Megafx 2025 Review: Everything You Need to Know

In the ever-evolving landscape of forex trading, Megafx emerges as a broker that raises significant concerns among potential investors. With a lack of regulation, high minimum deposit requirements, and questionable user experiences, this broker has garnered a reputation that warrants caution. Notably, the broker claims to offer a maximum leverage of 1:500, which, while attractive, comes with considerable risks.

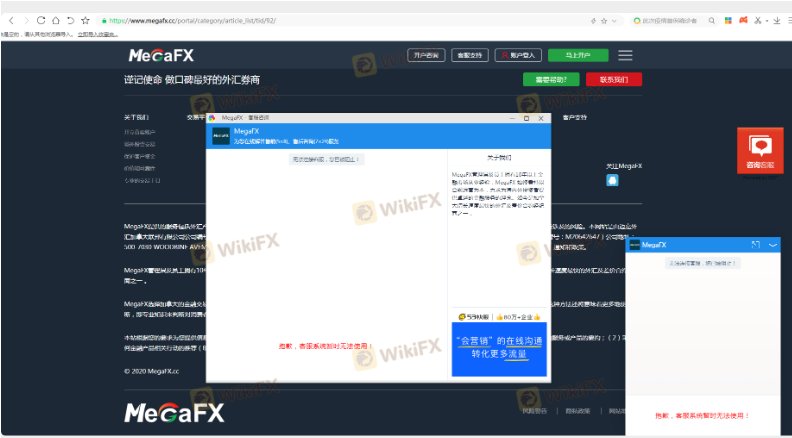

Attention: Its crucial to note that Megafx operates as a suspicious clone entity across different regions, which adds layers of complexity to its regulatory status. This review aims to provide a balanced perspective based on various sources, ensuring fairness and accuracy in assessing this broker's offerings.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user experiences, expert opinions, and factual data regarding the broker's operations.

Broker Overview

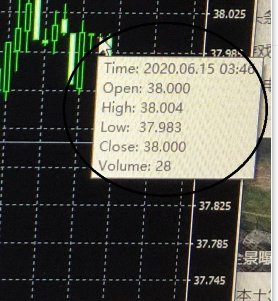

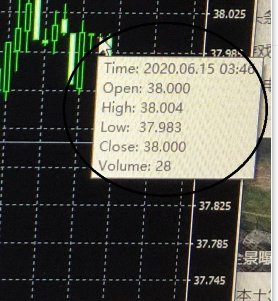

Established in 2019, Megafx is a Canadian-based forex broker that operates without valid regulatory oversight. The broker offers the widely recognized MetaTrader 4 (MT4) trading platform, which is popular for its user-friendly interface and robust analytical tools. Megafx claims to provide access to a variety of trading instruments, including forex, metals, indices, energies, and equities. However, the actual availability of these assets remains unverified due to the broker's lack of a functional trading platform and mixed reviews.

Detailed Section

Regulatory Regions: Megafx is registered in Canada but operates without any recognized regulatory authority oversight, which poses significant risks to traders. The absence of regulation means that clients lack the protections typically afforded by regulated brokers, such as segregated funds and dispute resolution mechanisms.

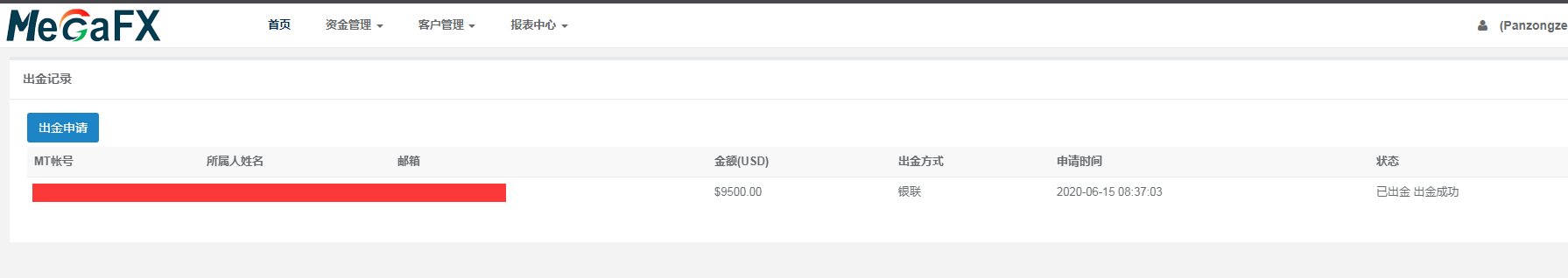

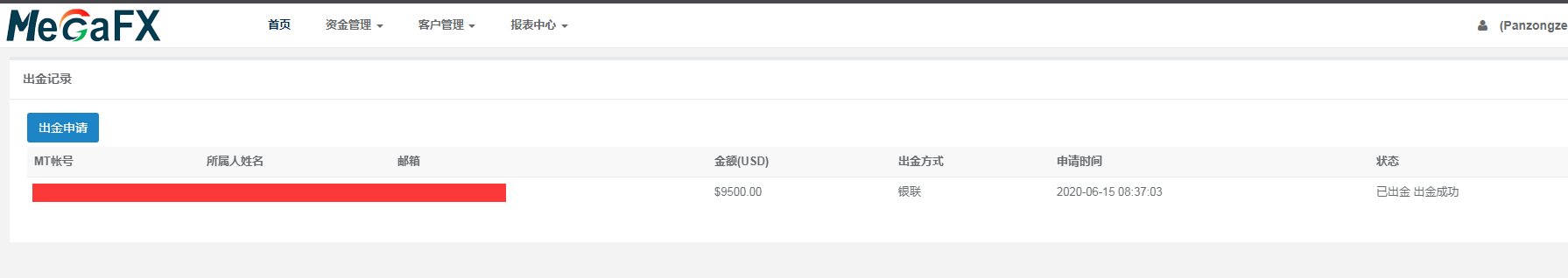

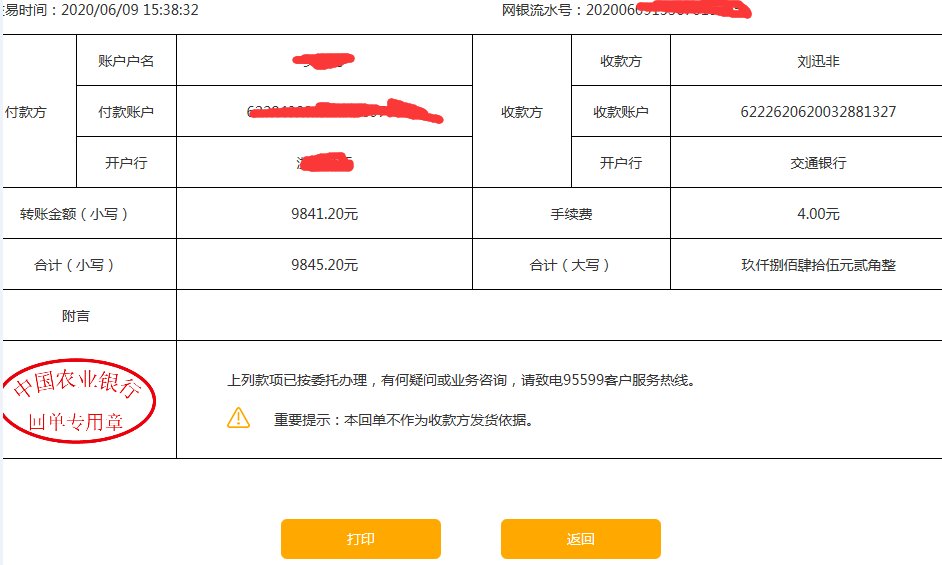

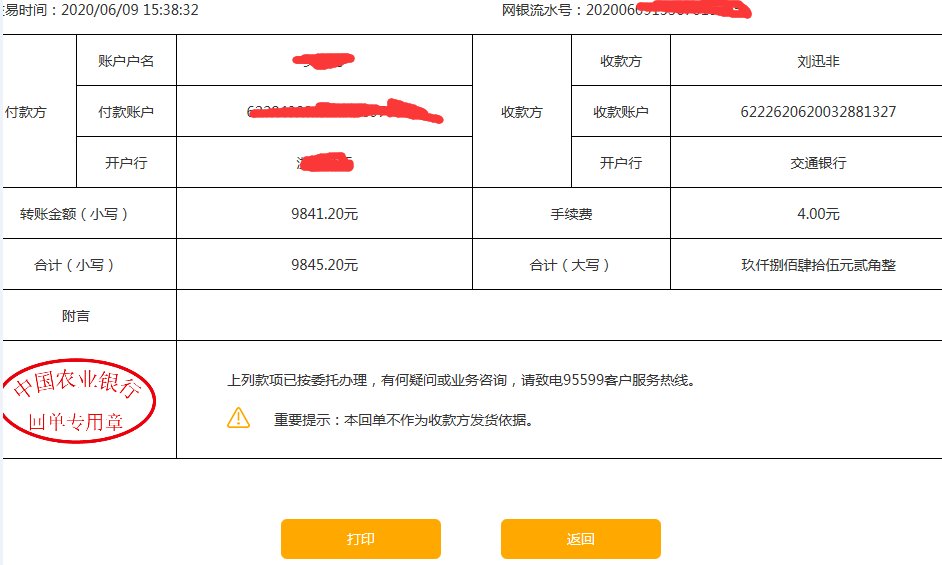

Deposit/Withdrawal Options: The broker offers various payment methods, including Visa/Mastercard, bank transfers, Skrill, Neteller, and Bitcoin. However, there is inconsistent information regarding the actual deposit methods, with some sources indicating Bitcoin as the primary option. The minimum deposit requirement is set at $500 for both standard and ECN accounts, which is relatively high compared to other brokers.

Bonuses/Promotions: There is limited information regarding any bonuses or promotions that Megafx may offer. This lack of transparency could deter potential clients looking for incentives to trade.

Tradable Asset Classes: Megafx claims to offer a diverse range of trading instruments. However, the lack of clarity regarding the actual availability and conditions of these assets raises skepticism. Traders should approach these claims with caution and verify the offerings through reliable sources.

Cost Structure: Information on spreads, fees, and commissions is sparse. While ECN accounts claim to have spreads starting from 0 pips, standard account spreads are not specified, leading to concerns about potential hidden costs.

Leverage: Megafx offers a high maximum leverage of 1:500, which may attract traders seeking to amplify their potential returns. However, high leverage also increases the risk of significant losses, particularly in the volatile forex market. Traders should have a solid risk management strategy in place when considering such leverage.

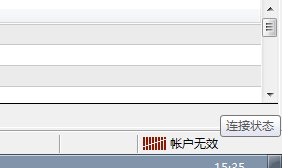

Allowed Trading Platforms: The broker exclusively provides the MetaTrader 4 platform, which is known for its extensive features, including automated trading through expert advisors. While MT4 is a positive aspect, the lack of additional platforms could limit trading flexibility for some users.

Restricted Regions: There is no specific information on regions where Megafx is restricted, but the unregulated nature of the broker suggests that it might not be compliant with various jurisdictions' trading laws.

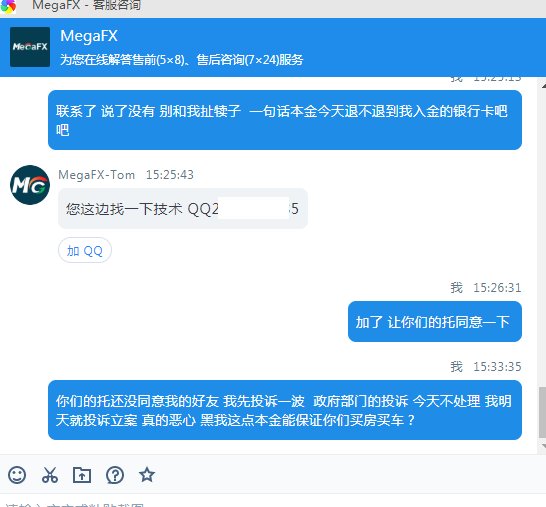

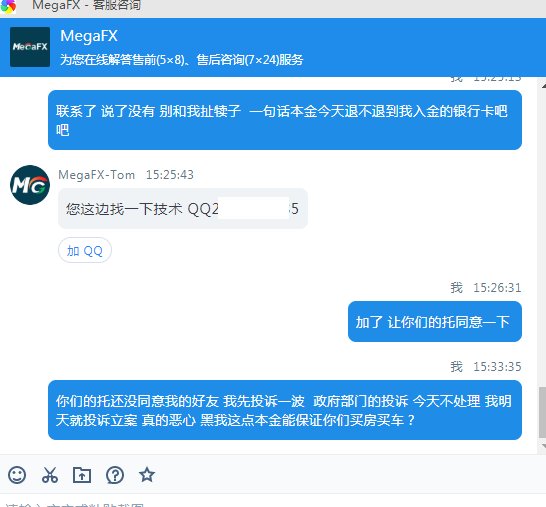

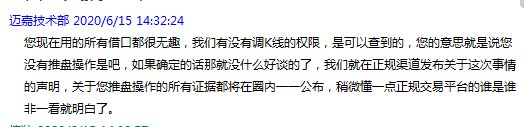

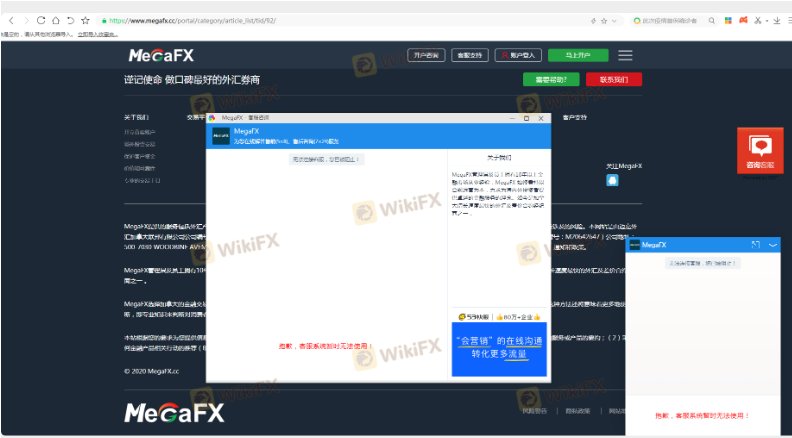

Available Customer Support Languages: Megafx provides customer support primarily through QQ and email, with no live chat or phone support options. This limited availability could hinder timely assistance for traders facing issues.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions (3/10): The high minimum deposit of $500 and lack of transparency regarding account types make Megafx less attractive to potential traders.

Tools and Resources (2/10): The absence of educational resources and limited trading tools significantly detracts from the overall offering, limiting traders' ability to enhance their skills.

Customer Service and Support (2/10): The reliance on QQ and email for support, without live chat or phone options, raises concerns about the responsiveness and effectiveness of customer service.

Trading Setup (4/10): While the MT4 platform is a solid choice, the lack of additional platforms and the unverified status of tradable assets hinder the trading experience.

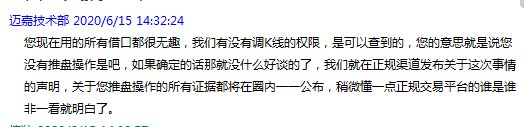

Trustworthiness (1/10): The absence of regulation and numerous reports of it being identified as a scam broker make Megafx a highly risky choice for traders.

User Experience (2/10): Mixed reviews and a lack of transparency contribute to a negative user experience, with many traders expressing skepticism about the broker's legitimacy.

In conclusion, the Megafx review indicates that this broker presents numerous red flags that potential investors should consider. With a lack of regulation, high minimum deposits, and unclear trading conditions, traders are strongly advised to seek more reputable and regulated alternatives to safeguard their investments.