MCFX 2025 Review: Everything You Need to Know

Executive Summary

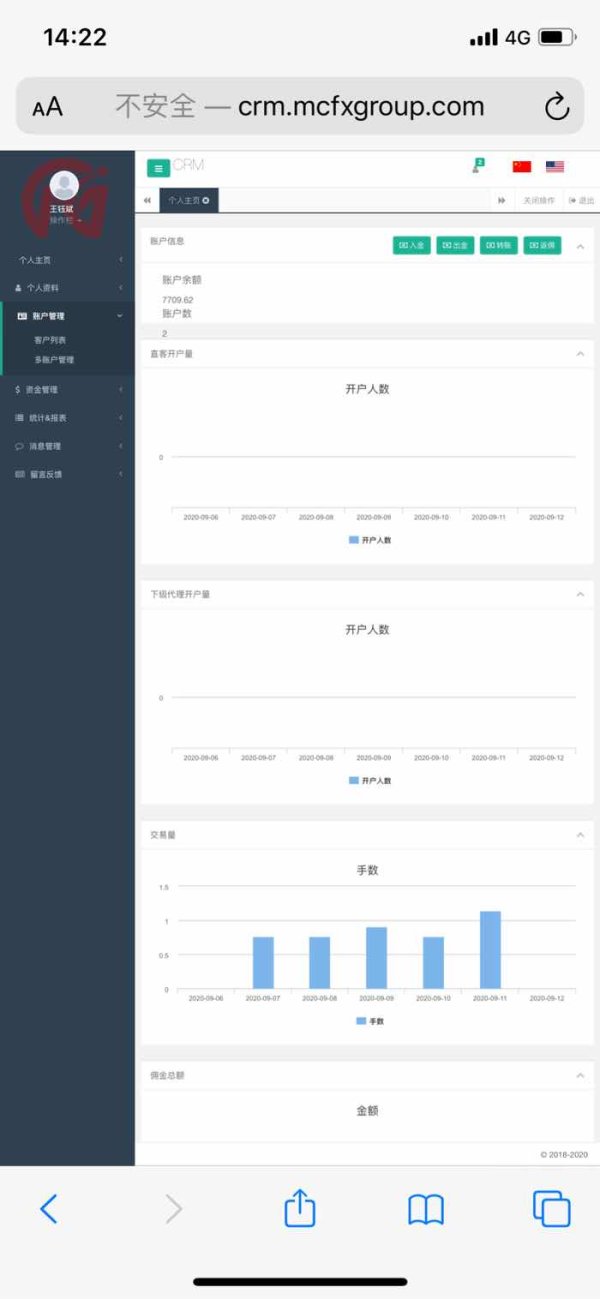

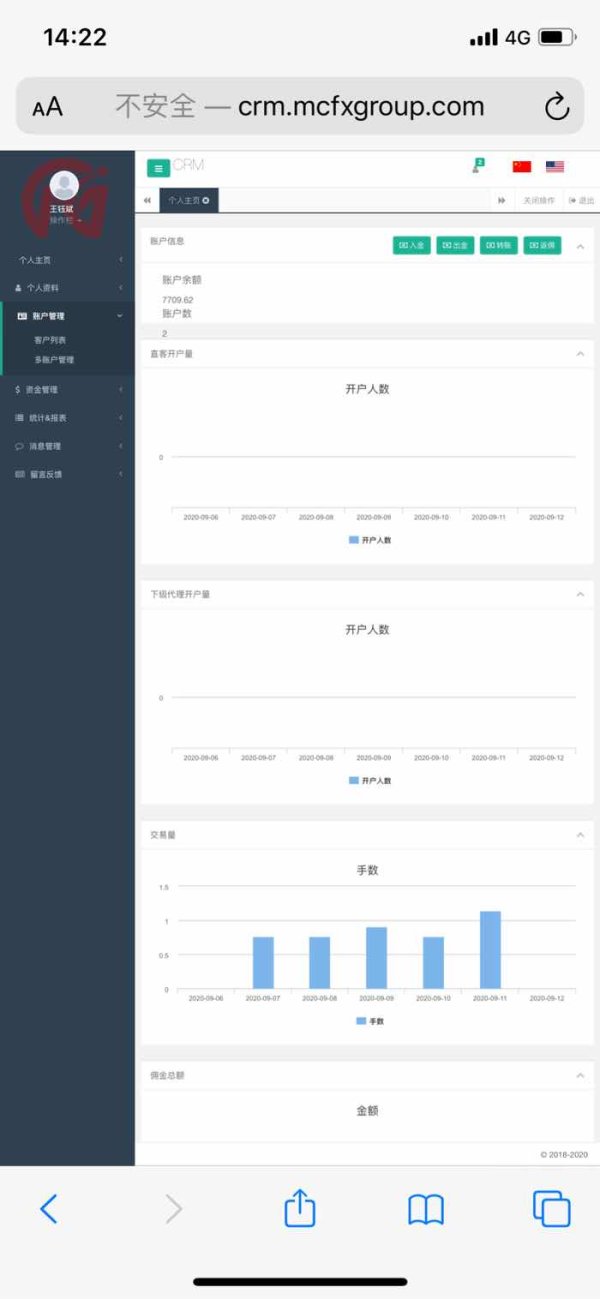

MCFX is a specialized trading platform. It was designed specifically for professional forex traders who want advanced charting capabilities and automated trading solutions. This mcfx review looks at a platform that positioned itself as a streamlined version of MultiCharts. The platform focused exclusively on forex market operations. The platform featured built-in data feeds for 30 major currency pairs, sophisticated analytical tools, and comprehensive order execution capabilities through its MCFX Pro version.

Based on available information, MCFX earned a trust score of 75. This indicates medium-high reliability within the forex trading community. The platform was particularly notable for combining data provision, advanced charting functionality, and trading execution in a single integrated environment. However, traders should be aware that MCFX operated without oversight from recognized financial regulatory authorities. This presents certain risk considerations that potential users must carefully evaluate before committing to the platform.

Important Notice

Regulatory Warning: MCFX operated without regulation from recognized financial institutions. This may present elevated risks for traders. This lack of regulatory oversight means that standard investor protections typically associated with licensed brokers may not be available to MCFX users.

Review Limitations: This evaluation is based on available platform information and technical specifications. Detailed user feedback, complaint resolution procedures, and comprehensive performance metrics were not extensively documented in available sources. This limits the depth of analysis in certain areas of this assessment.

Rating Framework

Broker Overview

MCFX established itself as a professional-grade forex trading platform. The company had an operational history spanning 5-10 years in the online trading sector. The company positioned itself as a technology-focused broker, developing proprietary solutions that catered specifically to experienced forex traders who required sophisticated analytical capabilities and automated trading functionality. The platform's core business model centered on providing comprehensive trading infrastructure that combined real-time data feeds, advanced charting tools, and execution capabilities in a unified environment.

The company's approach differed from traditional retail forex brokers by emphasizing professional-grade tools and streamlined functionality. MCFX developed its platform as a specialized version of MultiCharts software, adapting the technology specifically for forex market operations. This mcfx review reveals that the platform supported both demo and live trading environments. This enabled users to test strategies and refine their approach before committing real capital. The company's focus on automation and advanced analytics positioned it as a solution for traders who required more sophisticated tools than typical retail platforms provided.

Regulatory Status: MCFX operated without oversight from recognized financial regulatory authorities. This positioned it in the unregulated segment of the forex brokerage industry. This regulatory status requires traders to conduct enhanced due diligence and risk assessment.

Payment Methods: Specific deposit and withdrawal options were not detailed in available platform documentation. This requires direct inquiry with the company for comprehensive payment processing information.

Minimum Deposit Requirements: Initial funding requirements were not specified in accessible platform materials. This necessitates direct contact with MCFX representatives for account opening details.

Promotional Offers: Bonus structures and promotional campaigns were not outlined in available information sources. This suggests the platform focused primarily on technology provision rather than incentive-based marketing.

Trading Assets: The platform specialized exclusively in forex trading. It provided access to 30 major currency pairs through integrated data feeds and trading functionality.

Fee Structure: Detailed commission schedules, spread information, and additional charges were not comprehensively documented in available sources. This requires direct platform inquiry for complete cost analysis.

Leverage Options: Maximum leverage ratios and margin requirements were not specified in accessible documentation.

Platform Technology: MCFX utilized MetaTrader 4 as its primary trading interface. It was enhanced with proprietary analytical tools and automated trading capabilities.

Geographic Restrictions: Specific jurisdictional limitations were not detailed in available platform information.

Customer Support Languages: Multi-language support capabilities were not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis

This mcfx review encounters limitations in evaluating account conditions. This is due to insufficient detailed information in available sources. The platform appeared to offer both demonstration and live trading account options, enabling prospective users to evaluate functionality before committing real capital. However, specific account tier structures, minimum balance requirements, and account-specific features were not comprehensively documented.

The absence of detailed account condition information suggests that MCFX may have operated with simplified account structures. The platform focused primarily on platform functionality rather than complex tier-based offerings. Professional traders considering this platform would need to conduct direct inquiries to understand specific account opening requirements, funding minimums, and any special account features such as Islamic-compliant trading options.

Without comprehensive account condition details, potential users cannot fully assess the accessibility and suitability of MCFX account offerings. This affects their ability to evaluate the platform for their specific trading requirements and capital levels.

MCFX demonstrated strong capabilities in trading tools and analytical resources. The platform earned an 8/10 rating in this category. The platform's foundation on MetaTrader 4 technology provided users with a proven, stable trading environment enhanced by MCFX's proprietary analytical additions. The integration of real-time data feeds for 30 major currency pairs ensured that traders had access to current market information necessary for informed decision-making.

The platform's automated trading functionality represented a significant strength. It enabled users to implement systematic trading strategies without constant manual intervention. Advanced charting capabilities provided comprehensive technical analysis tools, supporting both discretionary and systematic trading approaches. The MCFX Pro version combined these analytical capabilities with direct order execution, creating a streamlined workflow for professional traders.

However, the absence of detailed information about educational resources, market research provision, and ongoing analytical support limits the complete assessment of the platform's resource offerings. Professional traders would benefit from understanding the full scope of analytical support and educational materials available through the platform.

Customer Service and Support Analysis

Customer service evaluation presents challenges in this mcfx review. This is due to limited available information about support structures and service quality. The platform's focus on professional traders suggests that support services were likely tailored to experienced users who required technical assistance rather than basic trading education.

Without specific information about support channels, response times, and service availability, potential users cannot adequately assess whether MCFX's customer service infrastructure meets their requirements. Professional trading platforms typically require responsive technical support, particularly for automated trading systems and platform integration issues.

The absence of documented user feedback about customer service quality further limits the ability to provide comprehensive assessment in this critical area. Traders considering MCFX would need to evaluate support quality through direct interaction during the account evaluation process.

Trading Experience Analysis

Platform performance and trading experience assessment proves challenging. This is due to limited specific information about execution quality, platform stability, and order processing efficiency. The foundation on MetaTrader 4 technology suggests a stable trading environment, given MT4's established track record in the forex trading industry.

The integration of automated trading capabilities and advanced analytical tools indicates that MCFX prioritized trading efficiency and system reliability. However, without specific performance metrics, execution speed data, or user experience feedback, this mcfx review cannot provide comprehensive assessment of actual trading experience quality.

Professional traders typically require detailed information about slippage rates, execution speeds, and platform uptime statistics. This helps them make informed platform selection decisions. The absence of such performance data in available sources represents a significant limitation for thorough platform evaluation.

Trust Score Analysis

MCFX received a trust score of 75. This indicates medium-high reliability within the forex trading community. However, this positive rating must be balanced against the platform's operation without regulatory oversight from recognized financial authorities. The absence of regulatory supervision means that standard investor protections and dispute resolution mechanisms may not be available to platform users.

The trust score suggests that the platform maintained operational stability and user satisfaction during its active period. However, the lack of regulatory backing presents inherent risks that traders must carefully consider. Professional traders often prioritize regulatory protection, particularly when deploying significant capital or automated trading systems.

The combination of positive trust scoring with regulatory absence creates a mixed risk profile. This requires individual trader assessment based on their specific risk tolerance and capital protection requirements.

User Experience Analysis

Comprehensive user experience evaluation faces limitations. This is due to insufficient detailed feedback and interface assessment information in available sources. The platform's focus on professional traders suggests that user experience design prioritized functionality and efficiency over simplified interfaces typical of retail trading platforms.

The integration of MetaTrader 4 with proprietary MCFX enhancements indicates an approach that balanced familiar interface elements with specialized functionality. However, without specific user feedback about interface design, registration processes, and overall platform usability, thorough user experience assessment remains incomplete.

Professional traders typically require efficient workflows, customizable interfaces, and reliable platform performance. The absence of detailed user experience documentation limits the ability to assess how effectively MCFX met these professional user requirements.

Conclusion

MCFX represented a specialized forex trading platform designed specifically for professional traders. The platform focused on traders seeking advanced analytical capabilities and automated trading functionality. The platform's strength lay in its sophisticated tool integration and focus on professional-grade trading infrastructure. However, this mcfx review identifies significant limitations in available information about key operational aspects including customer service, detailed trading conditions, and comprehensive user feedback.

The platform appears most suitable for experienced forex traders who prioritize advanced analytical tools and automated trading capabilities over regulatory protection and comprehensive support services. The trust score of 75 suggests operational reliability, but the absence of regulatory oversight requires careful risk assessment by potential users.

Traders considering MCFX should conduct thorough due diligence. This is particularly important regarding regulatory protection, customer service quality, and detailed trading conditions that were not comprehensively documented in available platform information.