MCCM 2025 Review: Everything You Need to Know

Executive Summary

MCCM Markets is a new forex broker that started in 2020. The company operates from the Bahamas as an unregulated financial services company. This mccm review gives traders a complete analysis of what this broker offers and the risks that come with it. MCCM provides access to the popular MetaTrader 5 platform and supports multiple trading instruments including forex, indices, and cryptocurrencies, but the lack of regulatory oversight creates major concerns for potential clients.

The broker serves traders who want to trade forex, cryptocurrency, and other financial products. It mainly targets those with higher risk tolerance who feel comfortable trading with unregulated companies. MCCM's platform supports trading in precious metals and commodities alongside traditional forex pairs, which offers some variety in trading opportunities. However, the lack of regulatory protection means traders must be very careful when thinking about using this broker for their trading activities.

The forex industry is very competitive and has many well-regulated alternatives available. Traders should carefully compare the risks against any potential benefits before choosing MCCM Markets as their trading partner.

Important Notice

Regulatory Disclaimer: MCCM Markets operates as an unregulated financial services company based in the Bahamas. Traders in different areas should know that trading with unregulated brokers carries major risks, including potential loss of funds without access to regulatory protection or compensation programs. The lack of oversight means there are no guarantees about fund separation, fair trading practices, or ways to resolve disputes.

Review Methodology: This evaluation uses publicly available information and user feedback found online. We have not directly verified all services and features mentioned, and traders should do their own research before making any trading decisions.

Rating Framework

Broker Overview

Company Background and Establishment

MCCM Markets entered the forex trading scene in 2020. The company positions itself as a financial services provider based in the Bahamas. As a new player in the forex industry, the company focuses on providing online trading services for various financial instruments. The broker's business model centers around offering access to global financial markets through electronic trading platforms, and it specifically targets individual retail traders who want exposure to multiple asset classes.

MCCM has tried to build a presence in the competitive forex market by offering popular trading platforms and a range of financial instruments. However, the company's choice to operate without regulatory oversight from major financial authorities raises questions about its long-term sustainability and commitment to trader protection.

Trading Platform and Asset Coverage

The broker provides access to the well-established MetaTrader 5 platform. This platform is widely recognized in the trading community for its advanced features and analytical capabilities. This platform choice shows MCCM's understanding of trader preferences for reliable and feature-rich trading environments. The asset coverage includes traditional forex currency pairs, stock indices, cryptocurrencies, precious metals, and various commodities, which offers traders diversification opportunities across multiple market sectors.

The inclusion of cryptocurrency trading alongside traditional forex instruments shows the broker's attempt to meet modern trading preferences. However, the lack of specific information about trading conditions, spreads, and execution quality makes it hard to assess the true value that MCCM Markets offers.

Regulatory Status and Jurisdiction

MCCM Markets operates from the Bahamas without regulation from recognized financial authorities. This unregulated status means the broker is not subject to the strict oversight, capital requirements, and client protection measures that major regulatory bodies like the FCA, CySEC, or ASIC typically enforce.

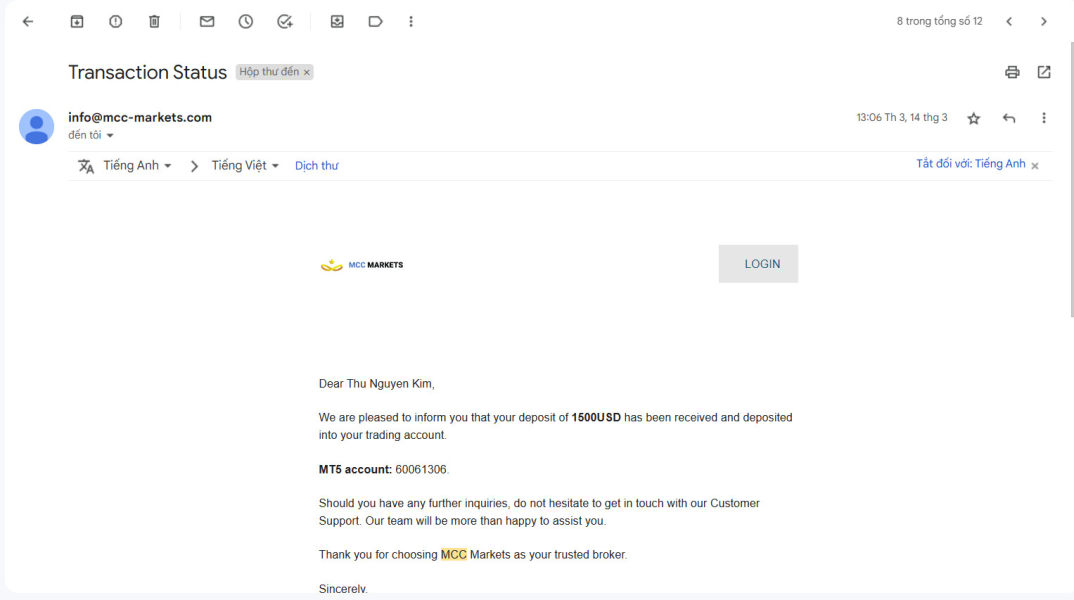

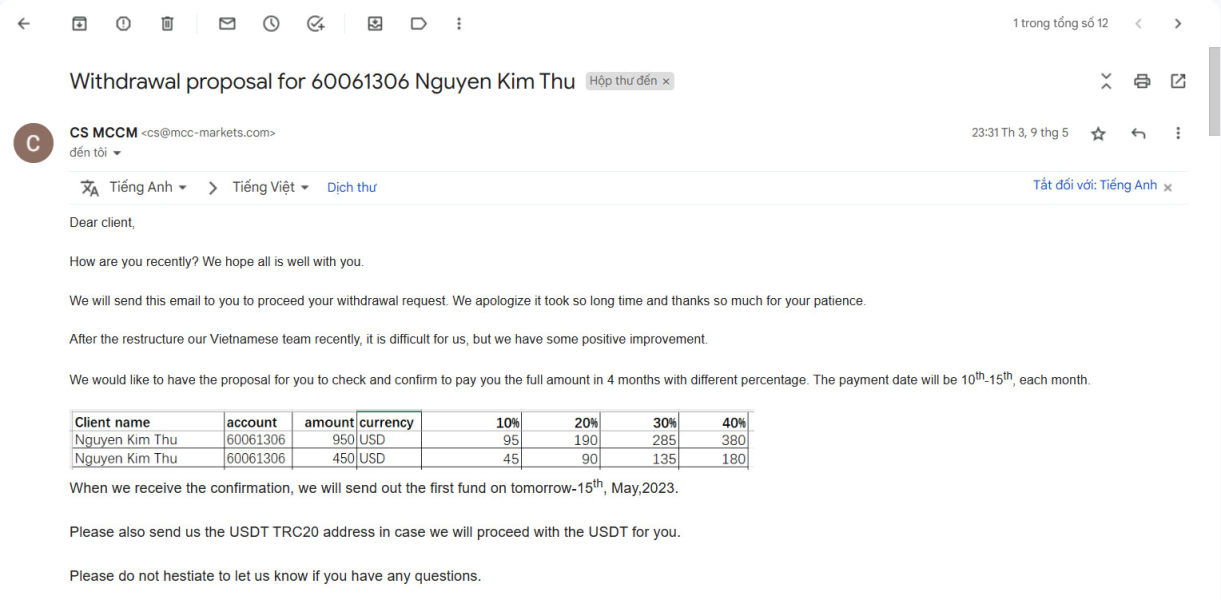

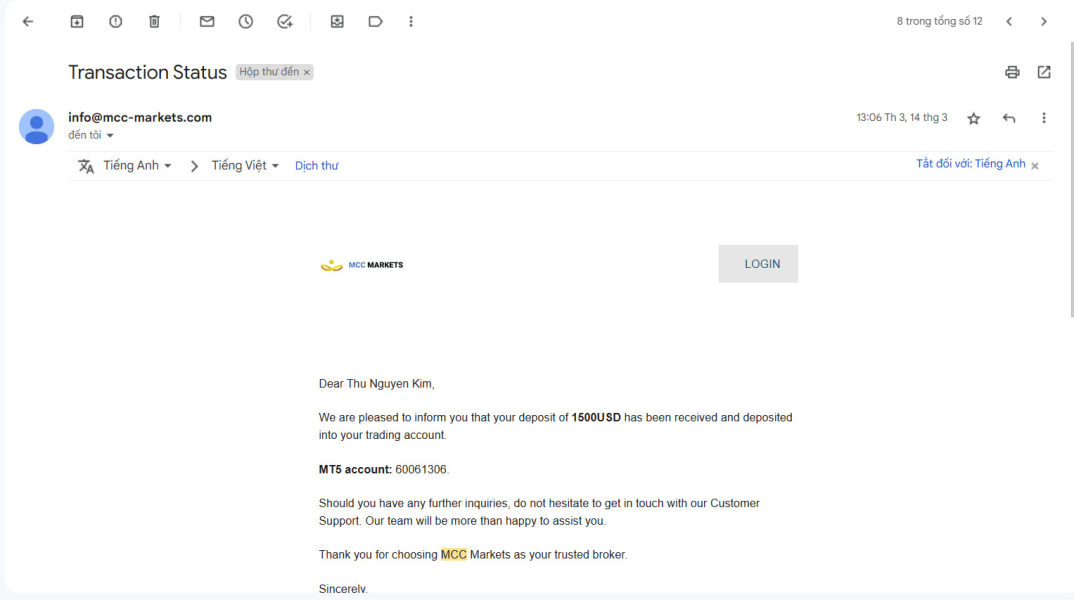

Payment Methods and Banking

Specific information about deposit and withdrawal methods has not been detailed in available sources. This lack of transparency about banking options and payment processing represents a major information gap for potential clients.

Minimum Deposit Requirements

The minimum deposit requirements for opening an account with MCCM Markets are not specified in current available information. This makes it difficult for traders to plan their initial investment.

Promotional Offers and Bonuses

Details about any promotional offers, welcome bonuses, or ongoing incentive programs are not available in the current information sources.

Tradeable Assets and Instruments

MCCM supports trading across multiple asset classes including forex currency pairs, stock indices, cryptocurrencies, precious metals such as gold and silver, and various commodity markets. This diverse offering allows traders to diversify their portfolios across different market sectors.

Cost Structure and Fees

Specific information about spreads, commissions, overnight financing costs, and other trading fees has not been detailed in available sources. This represents a major transparency concern.

Leverage and Margin Requirements

Current information does not specify the maximum leverage ratios or margin requirements that MCCM Markets offers.

Platform Options

The broker provides access to MetaTrader 5. This is a sophisticated trading platform known for its advanced charting capabilities, technical analysis tools, and automated trading features.

Geographic Restrictions

Specific information about geographic restrictions or prohibited areas is not detailed in available sources.

Customer Support Languages

Details about supported languages for customer service are not available in current information sources.

This mccm review highlights the major information gaps that potential traders face when evaluating this broker.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of MCCM Markets' account conditions is severely limited by the lack of detailed information in available sources. Typically, a complete assessment would examine various account types, minimum deposit requirements, account opening procedures, and special features such as Islamic accounts for Muslim traders. However, this mccm review cannot provide specific details about these important elements because there is not enough publicly available information.

The absence of clear account condition details represents a major red flag for potential traders. Established and reputable brokers typically provide complete information about their account offerings, including detailed fee structures, minimum balance requirements, and account benefits. The lack of transparency in this area suggests either poor marketing communication or a deliberate attempt to hide potentially unfavorable terms.

Without access to specific account information, traders cannot make informed decisions about whether MCCM's offerings match their trading capital, risk tolerance, and trading strategy requirements. This information gap greatly impacts the broker's credibility and makes it difficult for potential clients to evaluate the true cost of trading with MCCM Markets.

MCCM Markets shows some strength in its platform and instrument offerings by providing access to MetaTrader 5. This is one of the most respected trading platforms in the industry. MetaTrader 5 offers advanced charting capabilities, multiple timeframes, extensive technical analysis tools, and support for automated trading through Expert Advisors. The platform's multi-asset support works well with MCCM's diverse instrument offering.

The broker's asset coverage spans forex, indices, cryptocurrencies, precious metals, and commodities. This provides traders with opportunities to diversify their portfolios across different market sectors. This multi-asset approach can be particularly valuable for traders who want to take advantage of various market conditions and economic cycles.

However, specific information about additional research resources, market analysis, educational materials, or proprietary trading tools is not available in current sources. Many established brokers provide daily market analysis, economic calendars, trading signals, and educational resources to support their clients' trading activities. The absence of detailed information about such resources in this mccm review suggests either limited offerings or poor communication of available services.

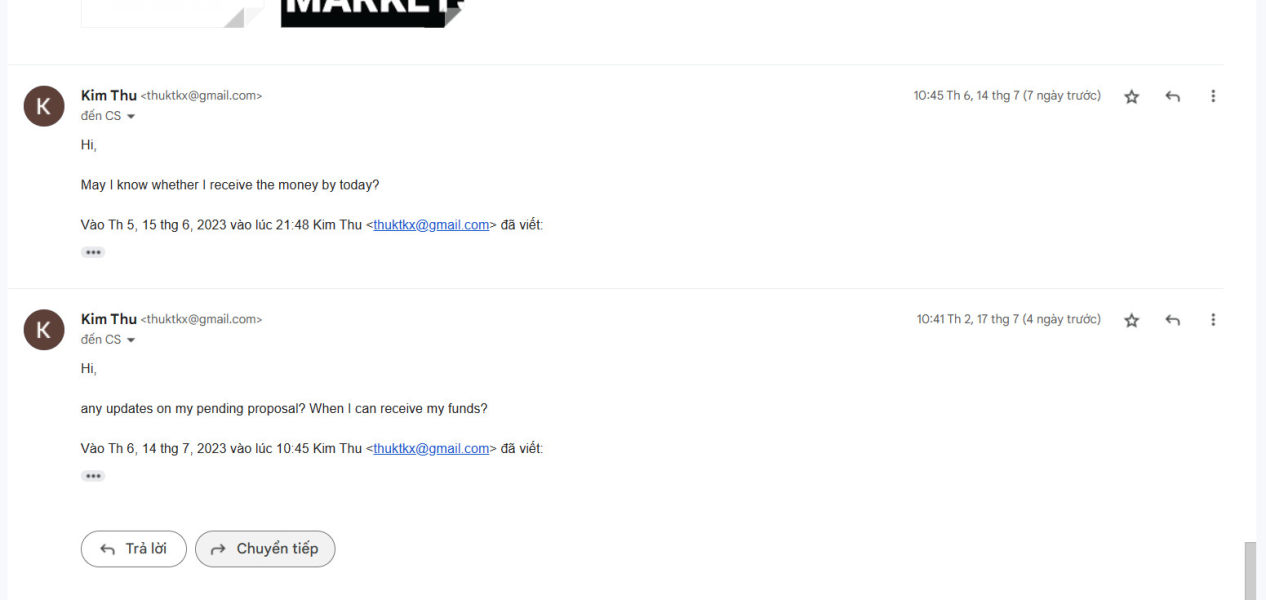

Customer Service and Support Analysis

The assessment of MCCM Markets' customer service capabilities is greatly limited by the absence of detailed information about support channels, availability, and service quality. Professional forex brokers typically offer multiple contact methods including phone, email, live chat, and sometimes social media support, with clearly defined operating hours and multilingual capabilities.

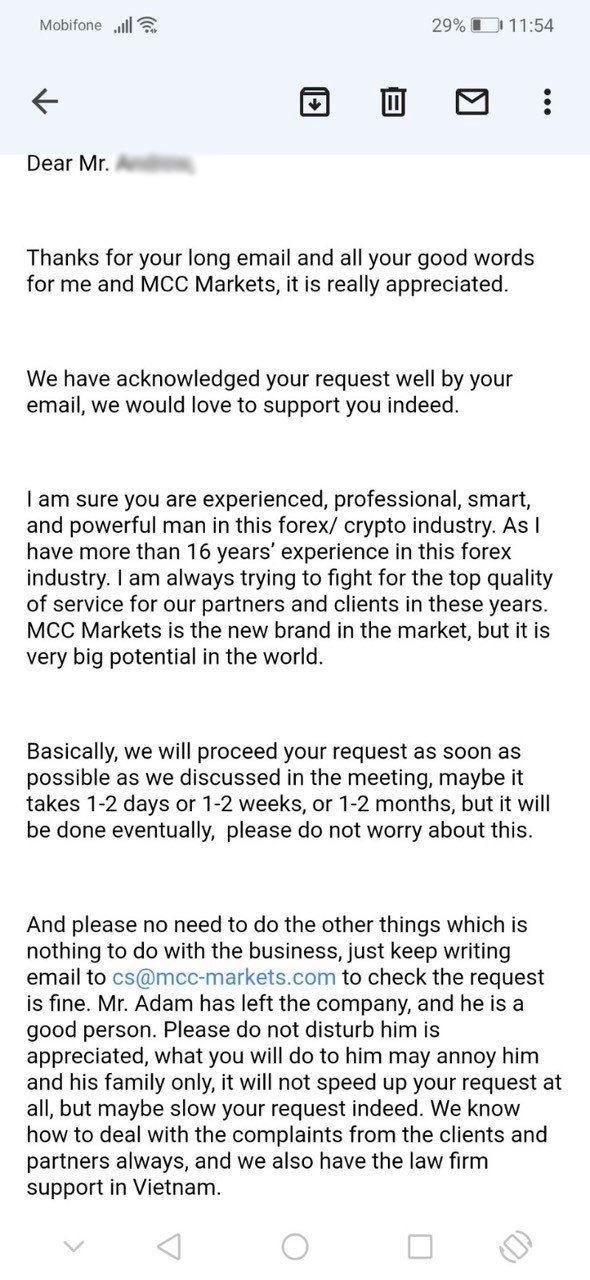

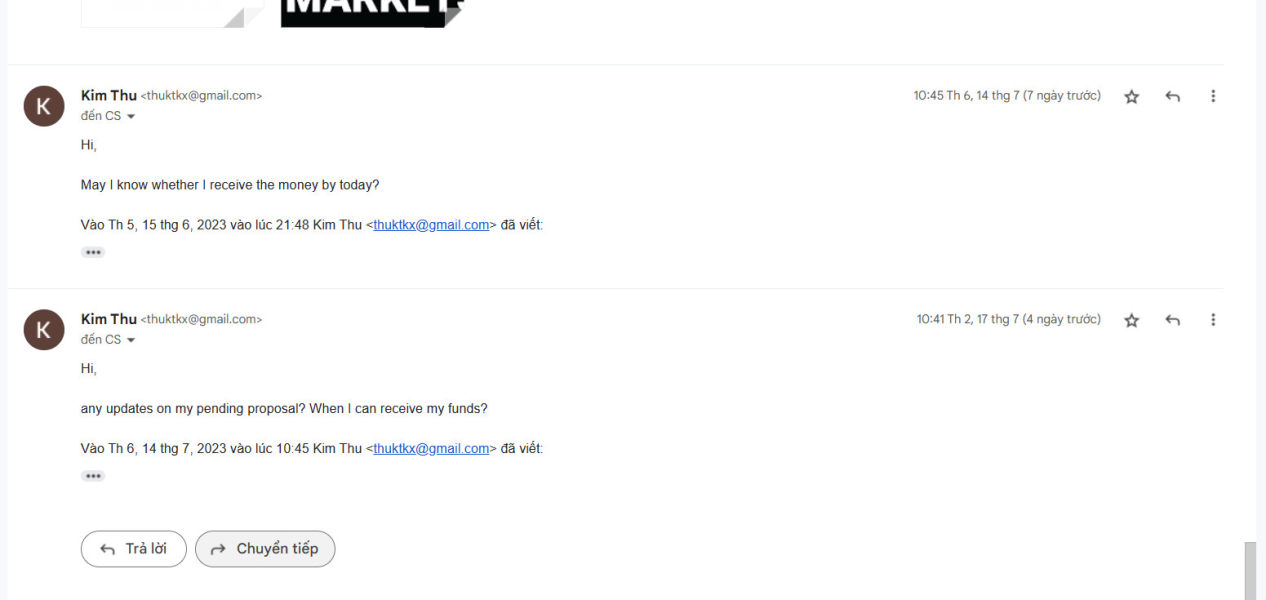

Without specific information about customer service offerings, potential traders cannot evaluate whether MCCM provides adequate support for their needs. This is particularly concerning given the broker's unregulated status, as quality customer service becomes even more critical when regulatory protection is absent.

The lack of transparency about customer support represents a major concern for traders who may need help with platform issues, account problems, or dispute resolution. Established brokers typically provide detailed information about their support infrastructure, including response time commitments and available languages, to build confidence among potential clients.

The absence of user feedback or testimonials about customer service quality in available sources further complicates the evaluation process. This leaves potential traders without insight into the actual support experience they might expect from MCCM Markets.

Trading Experience Analysis

Evaluating the actual trading experience with MCCM Markets proves challenging because of limited user feedback and technical performance data in available sources. A complete trading experience assessment would typically examine platform stability, execution speed, slippage rates, order rejection frequencies, and overall system reliability during various market conditions.

The choice to offer MetaTrader 5 suggests an understanding of trader preferences for reliable and feature-rich platforms. However, the quality of trade execution, server stability, and platform performance ultimately depends on the broker's technical infrastructure and execution policies, and specific information about these factors is not available.

Mobile trading capabilities are an essential feature for modern traders, but they are not specifically detailed in current sources. Most professional brokers provide complete mobile solutions that allow traders to manage positions, analyze markets, and execute trades from smartphones and tablets.

This mccm review cannot provide specific insights into the actual trading environment quality, including factors such as requotes, execution delays, or platform downtime, because there is insufficient user feedback and performance data in available sources. This lack of transparency makes it difficult for potential traders to assess whether MCCM can provide the reliable trading environment necessary for successful forex trading.

Trust and Reliability Analysis

The trust and reliability assessment of MCCM Markets reveals major concerns primarily stemming from its unregulated status. Operating without oversight from recognized financial authorities means the broker is not subject to the capital adequacy requirements, fund segregation mandates, and operational standards that regulated brokers must maintain.

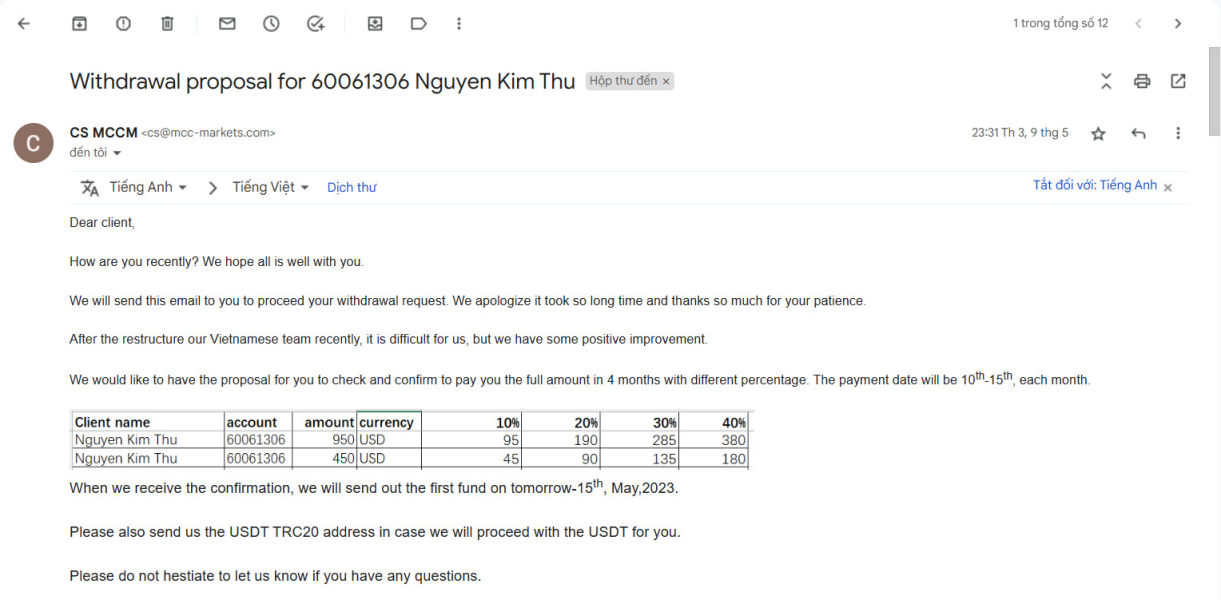

Unregulated status carries inherent risks including potential issues with fund security, lack of investor compensation schemes, and limited recourse in case of disputes. Traders considering MCCM should be aware that their funds may not be protected by the segregated account requirements and insurance coverage that financial regulators typically mandate.

The absence of detailed information about the company's financial backing, operational history, and transparency measures further complicates the trust assessment. Established brokers typically provide complete information about their corporate structure, financial statements, and operational procedures to build confidence among potential clients.

Without access to independent third-party evaluations, regulatory reports, or comprehensive user feedback, this mccm review cannot provide definitive insights into the broker's actual reliability and trustworthiness. The combination of unregulated status and limited transparency represents a major risk factor that traders must carefully consider.

User Experience Analysis

The evaluation of overall user experience with MCCM Markets is severely limited by the absence of comprehensive user feedback and detailed interface information in available sources. A thorough user experience assessment would typically examine website design, account opening procedures, platform usability, and overall satisfaction levels reported by actual users.

The registration and verification processes are crucial elements of the initial user experience, but they are not detailed in current information sources. Professional brokers typically provide clear information about required documentation, verification timeframes, and account activation procedures to set appropriate expectations for new clients.

Fund management experience, including deposit and withdrawal procedures, processing times, and associated fees, cannot be evaluated because of insufficient available information. These operational aspects greatly impact overall user satisfaction and are critical factors in broker selection decisions.

The absence of user testimonials, satisfaction surveys, or independent user experience evaluations makes it impossible to provide meaningful insights into the actual client experience with MCCM Markets. This lack of feedback represents a major information gap that potential traders should consider when evaluating their options in the competitive forex broker market.

Conclusion

This comprehensive mccm review reveals a broker with limited transparency and major information gaps that raise concerns for potential traders. While MCCM Markets offers access to the reputable MetaTrader 5 platform and supports trading across multiple asset classes including forex, cryptocurrencies, and commodities, the lack of regulatory oversight and insufficient publicly available information about key operational aspects represent substantial red flags.

The broker may appeal to traders specifically interested in cryptocurrency and forex trading who are comfortable with higher risk levels associated with unregulated entities. However, the absence of detailed information about account conditions, customer service quality, and actual user experiences makes it difficult to recommend MCCM Markets over established, regulated alternatives.

The primary advantages include multi-asset trading capabilities and access to a professional trading platform, while major disadvantages include the unregulated status, lack of transparency regarding fees and conditions, and insufficient information about customer protection measures. Traders considering MCCM Markets should conduct thorough research and carefully weigh these risks against their trading objectives and risk tolerance levels.