MEVP Review 1

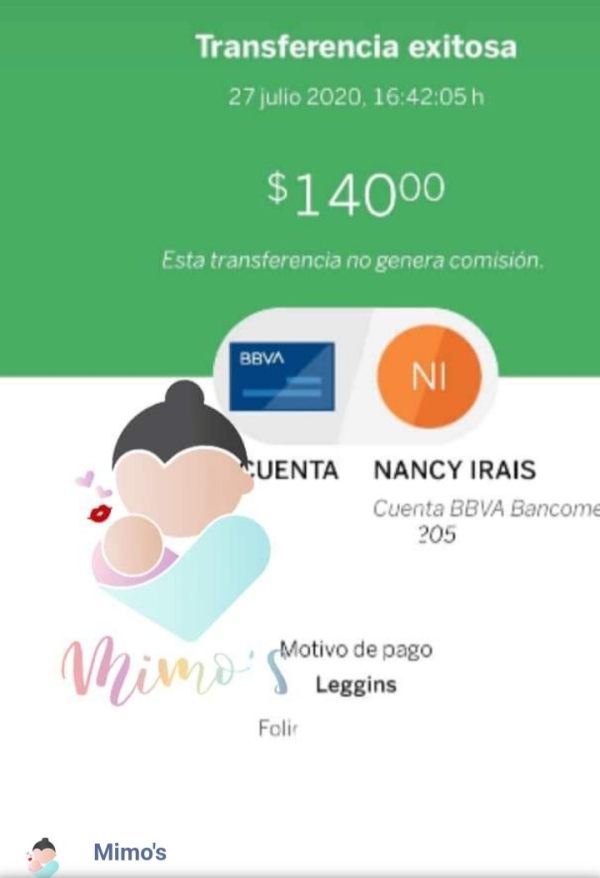

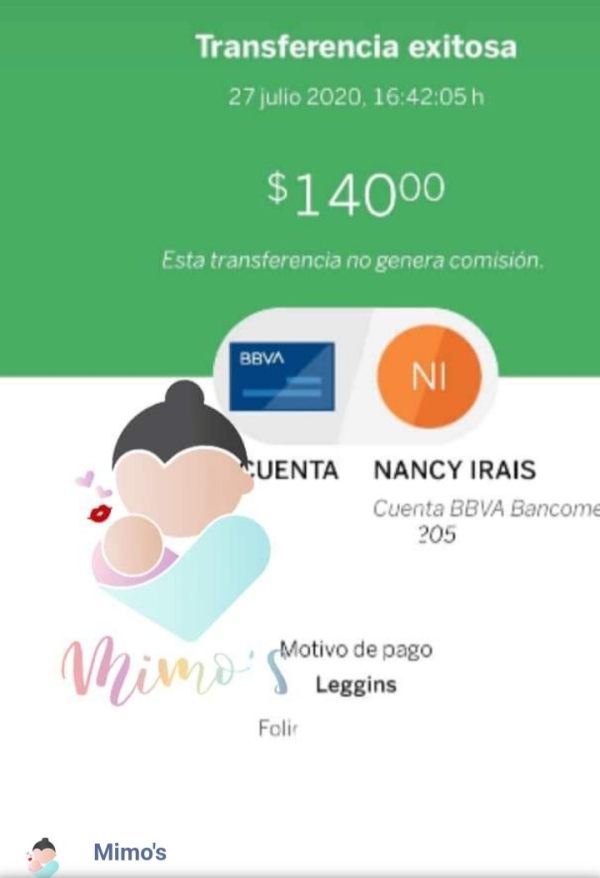

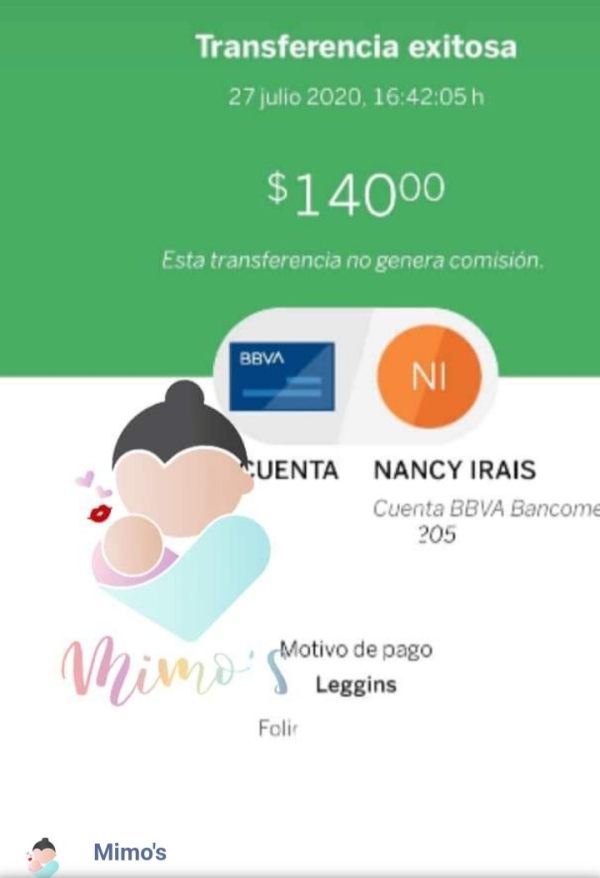

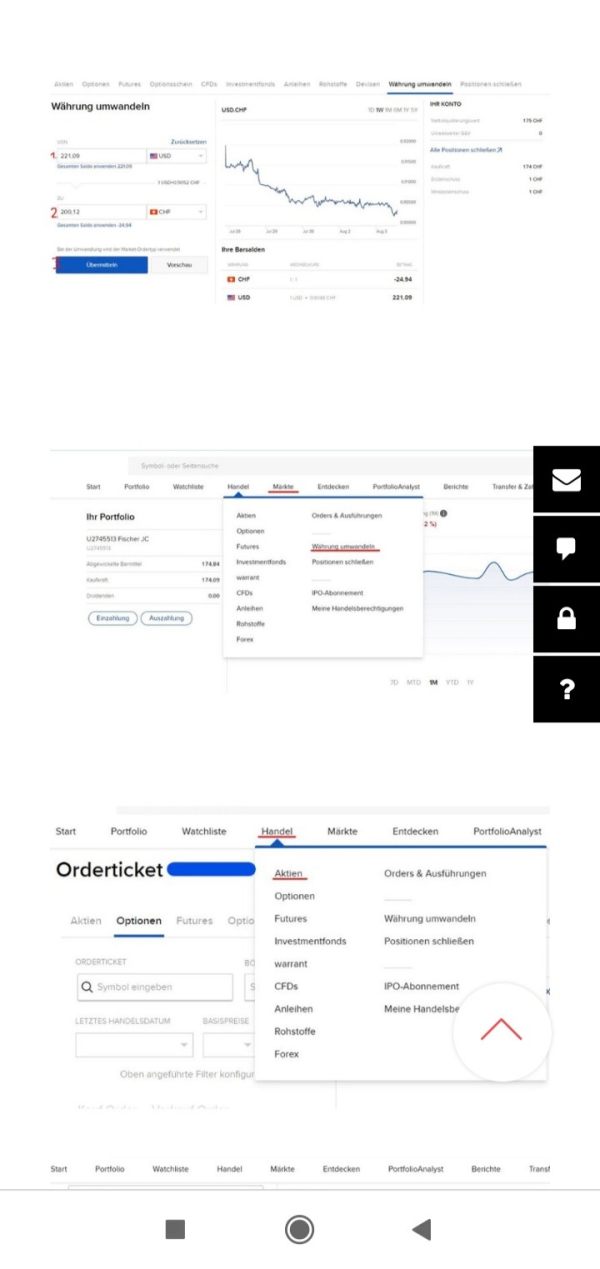

They tell you to deposit the money to them which was 140 in my case and then they tell you that the fact is not like that. It is false and absolutely no one gives you an answer

MEVP Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They tell you to deposit the money to them which was 140 in my case and then they tell you that the fact is not like that. It is false and absolutely no one gives you an answer

This Mevp review gives you a complete look at Middle East Venture Partners. MEVP is one of the biggest and most active venture capital firms in the MENA region. The firm has offices in Dubai, Beirut, Cairo, Bahrain, Riyadh, and Abu Dhabi, and it manages over USD 300 million in assets. MEVP puts money into early and growth-stage tech companies across the Middle East. The firm focuses mainly on GCC and Levant countries. MEVP has a strong market presence and knows the region well, but this review stays neutral because we don't have enough clear information about trading conditions, rules, and what users really think. The platform works best for investors who want to get into Middle Eastern markets and venture capital deals. However, potential users should check all available information carefully against what they need for their investments.

Regional Entity Differences: MEVP works in many Middle Eastern countries, and services change a lot between different offices because of local rules and market conditions. Users should check the specific terms that apply to their area before using any MEVP services.

Review Methodology: This review uses public information and limited user feedback only. The analysis doesn't include direct trading experience or full testing of all platform features. Potential users should do their own research and talk to financial advisors before making investment decisions.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 5/10 | Limited information available regarding specific account terms and conditions |

| Tools and Resources | 5/10 | Insufficient data on trading tools and analytical resources provided |

| Customer Service | 5/10 | No detailed information available about customer support quality and availability |

| Trading Experience | 5/10 | Lack of comprehensive data on platform performance and user experience |

| Trust and Security | 6/10 | Established presence in MENA region but limited regulatory transparency |

| User Experience | 5/10 | Insufficient user feedback and interface evaluation data available |

Company Background and Establishment

Middle East Venture Partners sees itself as a pioneer in MENA venture capital. MEVP is one of the region's most established investment firms. The company has offices in key Middle Eastern financial centers including Dubai, Beirut, Cairo, Bahrain, Riyadh, and Abu Dhabi. MEVP operates with a team of 11-50 employees and has built a following of over 38,000 professionals on professional networks. This shows strong industry recognition and market presence.

Business Model and Investment Focus

MEVP focuses on venture capital and private equity investments. The firm puts special emphasis on early and growth-stage innovative technology companies. MEVP clearly focuses on GCC and Levant countries and uses cross-border investment abilities to support talented entrepreneurs throughout the Middle East region. With more than USD 300 million in assets under management, MEVP has become one of the largest and most active venture capital firms in the MENA region. The company's investment portfolio includes technology-focused ventures, with notable involvement in AI-related projects such as AppliedAI, which operates from Abu Dhabi and develops AI solutions.

Regulatory Oversight: Specific regulatory information is not fully detailed in available materials. References to DFSA oversight suggest some level of regulatory compliance within the Dubai International Financial Centre framework.

Deposit and Withdrawal Methods: Detailed information about deposit and withdrawal procedures is not specified in available documentation. You need to contact the firm directly for specific terms and conditions.

Minimum Investment Requirements: Specific minimum investment amounts are not disclosed in public materials. These likely vary based on investment vehicle and investor type.

Promotional Offers: No specific bonus or promotional structures are mentioned in available information. This suggests a focus on institutional rather than retail promotional strategies.

Investment Assets: The firm focuses mainly on equity investments in technology companies. MEVP puts special emphasis on innovative startups and growth-stage enterprises in the Middle Eastern market.

Fee Structure: Detailed cost structures and fee schedules are not publicly disclosed. You need direct consultation for specific investment terms and management fees.

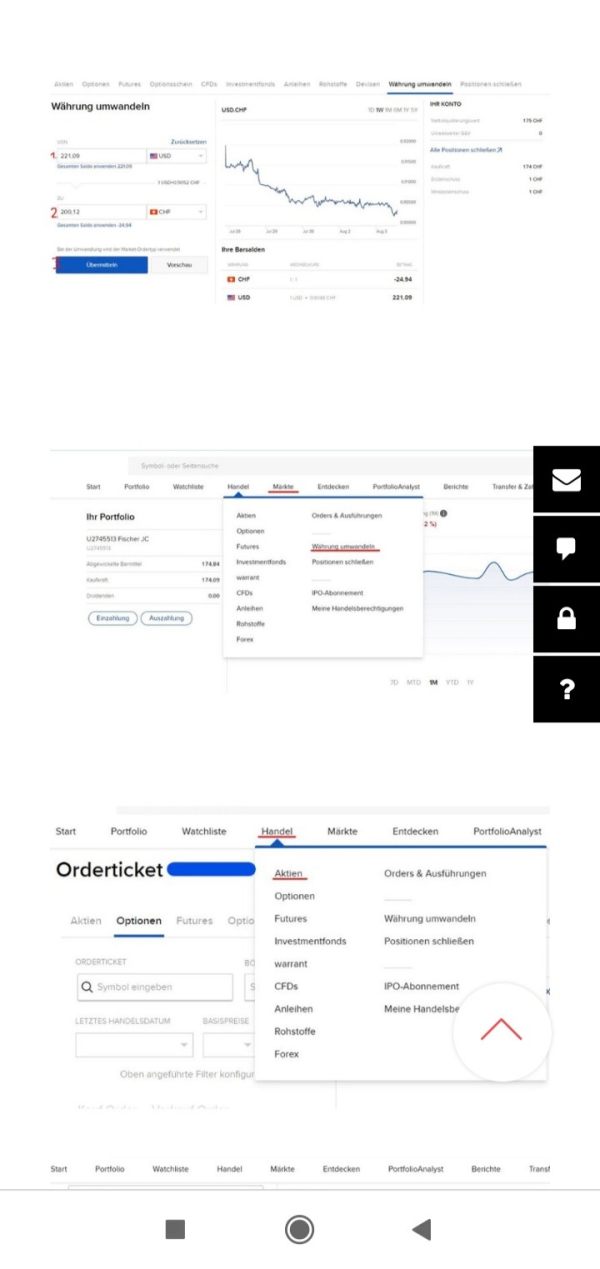

Leverage Options: Traditional trading leverage information doesn't apply since MEVP focuses on venture capital and private equity investments rather than leveraged trading products.

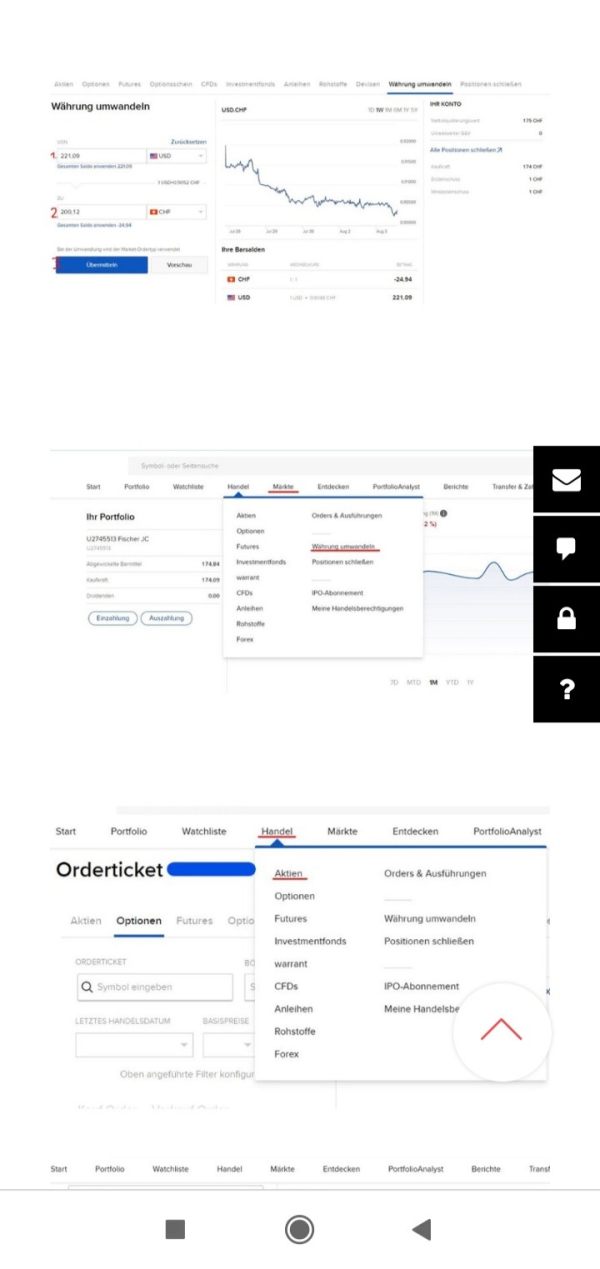

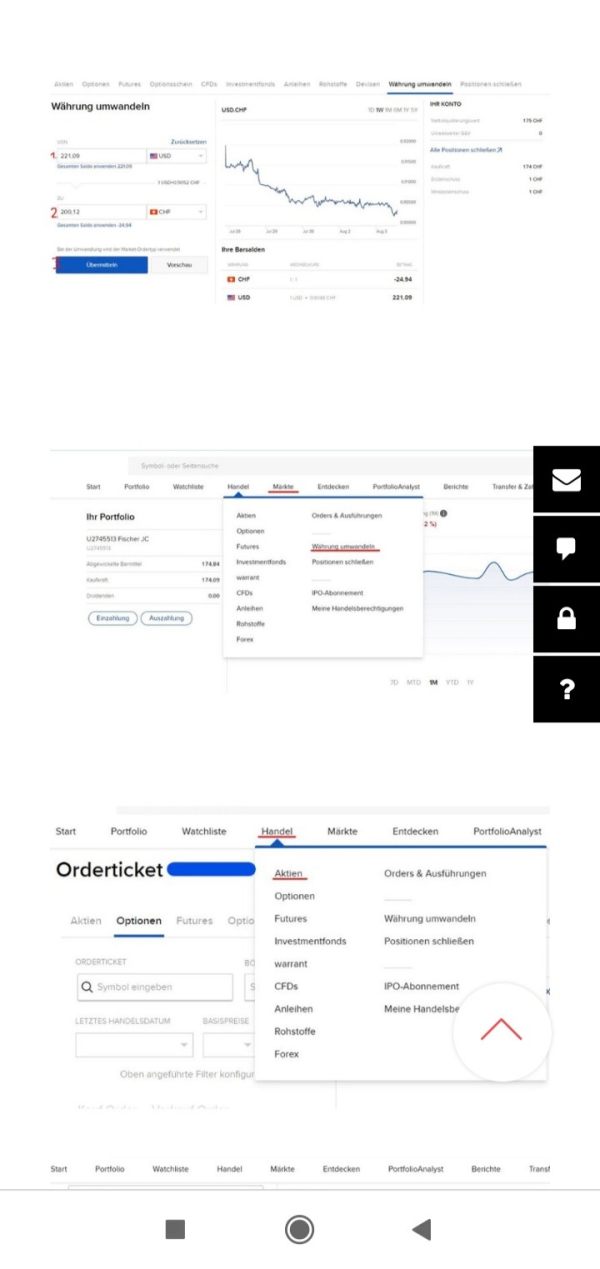

Platform Access: Specific trading platform information is not detailed in this Mevp review. The firm operates mainly as an investment management entity rather than a direct trading platform provider.

Geographic Restrictions: Operations focus mainly on the MENA region. Specific availability may vary by jurisdiction and investor type.

Language Support: Given the regional focus, support likely includes Arabic and English. However, specific language capabilities require direct confirmation.

The account conditions evaluation for MEVP presents big challenges because of limited public information about specific account structures and requirements. Traditional forex brokers usually offer standard account types with clear minimum deposit requirements and trading conditions, but MEVP operates as a venture capital firm with more complex investment structures. Available information shows that the firm manages over USD 300 million in assets, which means substantial institutional involvement, but specific details about individual investor account options remain unclear.

The firm's presence across multiple Middle Eastern countries may result in different account conditions depending on the specific office and local regulatory requirements. Potential investors should expect that account opening procedures likely involve comprehensive due diligence processes typical of institutional investment firms. The absence of detailed information about account types, whether focused on institutional investors, high-net-worth individuals, or retail participants, contributes to the moderate rating in this category. This Mevp review emphasizes the importance of direct consultation with the firm to understand specific account requirements and investment minimums applicable to individual circumstances.

MEVP's tools and resources evaluation faces limitations because of insufficient information about specific analytical tools, research capabilities, and investor resources provided by the firm. As a venture capital entity focusing on technology investments in the MENA region, the firm likely maintains sophisticated due diligence and market analysis capabilities, but these may not translate directly to retail trading tools commonly expected from forex brokers.

The firm's focus on early and growth-stage technology companies suggests access to specialized market research and industry analysis relevant to the Middle Eastern startup ecosystem. However, without detailed information about investor-facing tools, research reports, or analytical platforms, it becomes difficult to assess the quality and comprehensiveness of resources available to investors. The firm's established presence and substantial assets under management indicate professional-grade investment analysis capabilities, but the lack of transparency regarding specific tools and resources available to different investor categories limits the evaluation. Educational resources, market analysis, and investment guidance availability remain unclear based on publicly available information.

Customer service evaluation for MEVP encounters significant information gaps regarding support channels, response times, and service quality metrics. The firm's multi-jurisdictional presence across six Middle Eastern cities suggests potential for localized customer service, but specific details about support availability, communication channels, and response standards are not readily available in public documentation.

Given MEVP's institutional focus and venture capital business model, customer service likely operates differently from traditional retail forex brokers. The firm probably emphasizes relationship management and personalized advisory services rather than high-volume customer support. The firm's professional network following and established market presence suggest competent client relationship management, but without specific information about support hours, available languages, or communication methods, a comprehensive evaluation remains challenging. The absence of detailed customer service information, user testimonials regarding support quality, or published service standards contributes to the moderate rating in this category.

The trading experience assessment for MEVP requires careful consideration of the firm's venture capital focus rather than traditional trading platform operations. Unlike conventional forex brokers offering direct market access and trading platforms, MEVP operates as an investment management firm, which fundamentally alters the concept of "trading experience" for potential investors.

The firm's management of over USD 300 million in assets and focus on technology investments suggests sophisticated investment processes. However, these may not provide the immediate execution and platform stability typically associated with retail trading experiences. Investment decisions likely involve longer-term commitments and more complex due diligence processes rather than real-time trading capabilities. Without specific information about investor interfaces, investment reporting systems, or portfolio management tools, evaluating the user experience from an operational standpoint becomes challenging. This Mevp review notes that potential investors should adjust expectations based on the venture capital business model rather than anticipating traditional trading platform functionality.

Trust and security evaluation for MEVP benefits from the firm's established presence in the MENA region and substantial assets under management. These factors indicate a level of institutional credibility. The firm's operation across multiple jurisdictions and management of significant investment capital suggests adherence to relevant regulatory frameworks, though specific regulatory details remain limited in available documentation.

References to DFSA oversight provide some regulatory context, particularly given Dubai's role as a major financial center in the Middle East. However, comprehensive information about investor protection measures, fund segregation practices, and specific regulatory compliance standards is not readily available in public materials. The firm's established market presence, professional network engagement, and multi-jurisdictional operations suggest institutional legitimacy, but the absence of detailed regulatory information and transparency regarding security measures limits a complete trust assessment. Potential investors should conduct independent verification of regulatory status and security measures before committing funds.

User experience evaluation for MEVP faces significant limitations because of the absence of comprehensive user feedback, interface assessments, and detailed operational information. The firm's venture capital focus means that user experience differs substantially from traditional trading platforms. MEVP emphasizes investment processes, reporting, and relationship management rather than trading interface design and execution speed.

Available information does not provide insights into investor onboarding processes, documentation requirements, or ongoing communication and reporting standards. The firm's institutional focus suggests that user experience may be tailored toward sophisticated investors familiar with venture capital processes rather than retail users seeking intuitive trading interfaces. Without specific user testimonials, interface evaluations, or detailed operational procedures, assessing the overall user experience remains challenging. The moderate rating reflects the uncertainty surrounding user-facing operations and the need for direct evaluation of the firm's investor experience standards.

This Mevp review concludes with a neutral overall assessment based on available information about Middle East Venture Partners. MEVP shows substantial market presence in the MENA region with over USD 300 million in assets under management and strategic offices across key Middle Eastern financial centers, but the evaluation is limited by insufficient transparency regarding specific operational details, regulatory frameworks, and user experience standards. MEVP appears most suitable for investors specifically interested in Middle Eastern market exposure and venture capital opportunities. The firm works best for those comfortable with institutional investment processes and longer-term commitment structures. The firm's established presence and focus on technology investments represent potential advantages, while the lack of detailed operational transparency and limited user feedback constitute notable limitations for potential investors seeking comprehensive evaluation criteria.

FX Broker Capital Trading Markets Review