Gtcfx 2025 Review: Everything You Need to Know

Summary

This comprehensive Gtcfx review evaluates a London-based financial services provider that positions itself as a trusted broker offering global financial solutions. Based on available user feedback and market analysis, Gtcfx demonstrates a commitment to providing secure trading environments for forex and CFD markets. The broker has garnered attention from traders seeking reliable trading platforms. However, comprehensive regulatory information remains limited in public resources.

According to various review platforms, Gtcfx maintains a moderate to positive reputation among users, with feedback highlighting the platform's focus on security and customer service. The broker targets traders who prioritize safety and reliability in their trading experience, particularly those entering the forex market for the first time or seeking alternative trading solutions. While Gtcfx presents itself as a legitimate trading platform with headquarters in London, potential users should conduct thorough due diligence given the limited availability of detailed regulatory and operational information in public domains.

This review examines all available aspects of the broker's services to provide traders with a comprehensive understanding of what to expect.

Important Notice

This Gtcfx review is based on publicly available information and user feedback from various sources. As with any financial services provider, regulatory compliance and service offerings may vary significantly across different jurisdictions. Traders should verify current regulatory status and terms of service directly with the broker before making any investment decisions.

The evaluation methodology incorporates user testimonials, available company information, and industry standard assessment criteria. However, due to limited detailed operational data in public sources, some aspects of this review rely on general industry practices and user-reported experiences rather than verified company documentation.

Rating Framework

Broker Overview

Company Background and Establishment

Gtcfx operates as a financial services provider with reported headquarters in London, United Kingdom. The company positions itself within the competitive forex and CFD trading landscape, targeting traders who seek secure and reliable trading solutions. According to available information, the broker focuses on providing global financial services. However, specific establishment dates and founding details are not prominently disclosed in public resources.

The company's London-based operations suggest alignment with UK financial standards, though specific regulatory details require verification through official channels. Gtcfx appears to cater to both novice and experienced traders, emphasizing security and trustworthiness as core value propositions in its market positioning.

Business Model and Service Offerings

Based on available information, Gtcfx operates as a forex and CFD broker, providing access to various financial markets through online trading platforms. The broker's business model appears to focus on retail trading services. However, specific details about market-making versus STP execution models are not clearly outlined in public sources.

The company's service portfolio likely includes standard forex trading instruments, CFDs on various assets, and related trading tools. However, comprehensive details about asset classes, trading conditions, and platform specifications require direct verification with the broker, as public sources provide limited technical information about trading offerings.

Regulatory Framework

Specific regulatory information for Gtcfx is not comprehensively detailed in available public sources. While the company reports London headquarters, verification of FCA registration and compliance status requires direct confirmation through official regulatory databases.

Deposit and Withdrawal Methods

Available sources do not provide detailed information about supported payment methods, processing times, or associated fees for deposits and withdrawals. Prospective users should inquire directly about available banking options and transaction procedures.

Minimum Deposit Requirements

Specific minimum deposit amounts are not disclosed in publicly available information. Account opening requirements and initial funding thresholds should be confirmed directly with the broker.

Promotional Offers

Current bonus programs or promotional offers are not detailed in available sources. Traders interested in welcome bonuses or ongoing promotions should check directly with Gtcfx for current offerings.

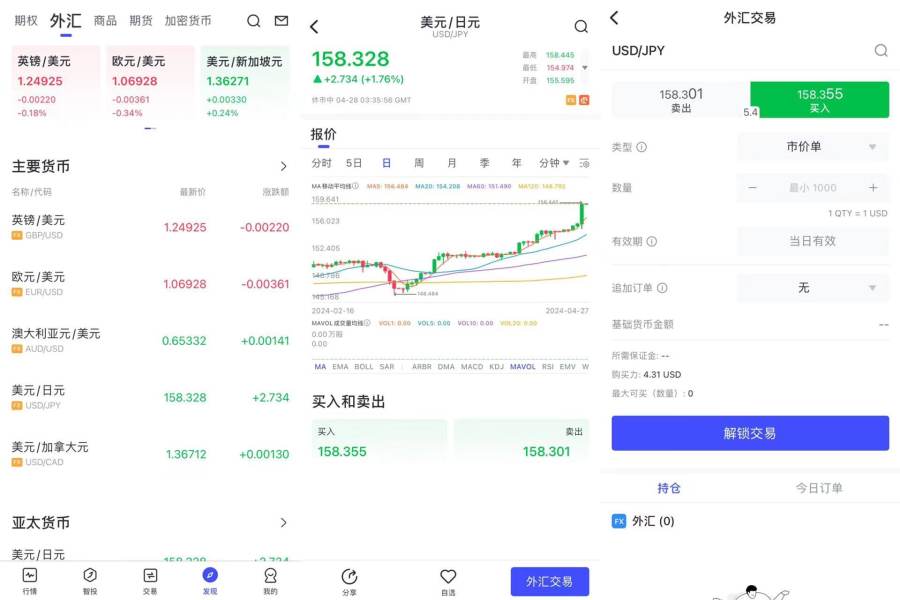

Available Trading Assets

While the broker appears to offer forex and CFD trading, specific instrument lists, including currency pairs, commodities, indices, and other available assets, are not comprehensively detailed in public sources.

Cost Structure and Fees

Detailed information about spreads, commissions, overnight fees, and other trading costs is not available in current public sources. This Gtcfx review recommends direct inquiry about all applicable fees before account opening.

Leverage Ratios

Specific leverage offerings are not detailed in available information. Given regulatory variations across jurisdictions, leverage availability likely depends on trader location and account type.

Trading Platforms

Platform specifications, including MetaTrader availability, proprietary platform features, and mobile trading options, are not comprehensively detailed in current public sources.

Geographic Restrictions

Specific information about restricted countries or regional limitations is not available in current sources.

Customer Support Languages

Available customer service languages are not specified in publicly accessible information.

Account Conditions Analysis

The assessment of account conditions for Gtcfx faces limitations due to insufficient detailed information in publicly available sources. Based on the company's London headquarters and positioning as a global financial services provider, the broker likely offers multiple account tiers to accommodate different trader profiles and investment levels.

Standard industry practice suggests that brokers of this type typically provide basic, standard, and premium account categories, each with varying minimum deposit requirements, spreads, and additional features. However, specific details about Gtcfx's account structure, including minimum opening deposits, account currencies, and tier-specific benefits, require direct verification with the broker. The account opening process likely involves standard KYC and AML procedures, particularly given the London-based operations.

Traders should expect identity verification, address confirmation, and financial background documentation as part of the onboarding process. Special account features, such as Islamic accounts for Sharia-compliant trading, VIP services for high-volume traders, or demo accounts for practice trading, are not specifically mentioned in available sources. This Gtcfx review recommends direct inquiry about specialized account options based on individual trading requirements.

The evaluation of trading tools and educational resources offered by Gtcfx is constrained by limited publicly available information. Based on industry standards for London-based brokers, the platform likely provides essential trading tools including basic charting capabilities, market analysis features, and standard order types.

Research and analytical resources typically expected from established brokers include daily market commentary, economic calendars, and technical analysis tools. However, specific details about Gtcfx's research department, analyst team, or proprietary market insights are not detailed in current public sources. Educational resources represent a crucial component for trader development, particularly for novice participants in forex markets.

While many brokers provide webinars, trading guides, video tutorials, and market education materials, specific information about Gtcfx's educational offerings is not comprehensively available in public sources. Automated trading support, including Expert Advisor compatibility, algorithmic trading features, and third-party signal integration, requires verification directly with the broker. The availability and sophistication of such tools often distinguish professional-grade platforms from basic retail offerings.

Customer Service and Support Analysis

Customer service evaluation for Gtcfx relies on limited publicly available information about support infrastructure and service quality. The broker's London headquarters suggests professional customer service standards. However, specific details about support channels, availability hours, and response times are not comprehensively documented in public sources.

Industry-standard customer support typically includes multiple communication channels such as live chat, email support, and telephone assistance. The quality of customer service often significantly impacts trader satisfaction, particularly during account issues, technical difficulties, or withdrawal processing concerns. Response time expectations vary among brokers, with professional services typically providing same-day email responses and immediate live chat availability during business hours.

However, specific service level commitments from Gtcfx are not detailed in available public information. Multilingual support capabilities are particularly important for global brokers, enabling effective communication with diverse trader populations. The extent of language support offered by Gtcfx requires direct verification, as this information is not specified in current public sources.

Trading Experience Analysis

The assessment of trading experience with Gtcfx faces significant limitations due to insufficient detailed platform information in publicly available sources. Trading experience encompasses platform stability, execution speed, order processing quality, and overall user interface design, all of which require hands-on evaluation or comprehensive user feedback.

Platform stability and execution speed represent critical factors for successful trading, particularly in volatile forex markets where milliseconds can impact profitability. Professional-grade platforms typically offer reliable uptime, fast order execution, and minimal slippage during normal market conditions. Order execution quality includes factors such as fill rates, requote frequency, and execution transparency.

These technical aspects significantly influence trader satisfaction and profitability, though specific performance metrics for Gtcfx are not available in current public sources. Mobile trading capabilities have become essential for modern traders who require platform access across devices. The availability and functionality of mobile applications, responsive web platforms, and synchronization across devices require direct verification with the broker.

This Gtcfx review emphasizes the importance of demo testing before live trading to evaluate platform performance, user interface design, and overall trading experience alignment with individual requirements.

Trust Rating Analysis

The trust assessment for Gtcfx yields a moderate rating of 6/10 based on available information and transparency limitations. This evaluation considers regulatory clarity, company transparency, and publicly available verification data.

The broker's reported London headquarters provides a foundation for regulatory expectations, as UK-based financial services typically operate under FCA oversight. However, specific regulatory registration details, license numbers, and compliance status verification are not readily available in public sources, which impacts the overall trust assessment. Company transparency regarding operational details, management information, and business practices appears limited based on publicly accessible resources.

Professional brokers typically provide comprehensive disclosure about company structure, regulatory compliance, and operational procedures to build trader confidence. Fund security measures, including segregated client accounts, deposit protection schemes, and third-party auditing, represent crucial trust factors for any financial services provider. Specific information about Gtcfx's client fund protection measures is not detailed in available sources.

Industry reputation and third-party evaluations contribute significantly to trust assessments. While some positive user feedback exists, the limited scope of publicly available reviews and professional assessments constrains comprehensive reputation evaluation.

User Experience Analysis

User experience evaluation for Gtcfx relies on limited available feedback and public information about platform usability and customer satisfaction. The overall user experience encompasses platform design, account management efficiency, customer service interactions, and the general ease of conducting trading activities.

Available user feedback suggests mixed experiences, with some traders reporting positive interactions while others express concerns about various aspects of the service. However, the limited volume and scope of publicly available reviews constrain comprehensive user satisfaction assessment. Interface design and platform usability significantly impact trader effectiveness and satisfaction.

Modern trading platforms should offer intuitive navigation, customizable layouts, and efficient order management capabilities. Specific details about Gtcfx's platform design and usability features require direct evaluation. Account registration and verification processes affect initial user experience and onboarding satisfaction.

Streamlined KYC procedures, clear documentation requirements, and efficient approval processes contribute to positive initial impressions. However, specific information about Gtcfx's onboarding experience is not detailed in public sources. Common user concerns in broker reviews typically include withdrawal processing times, customer service responsiveness, and platform technical issues.

The limited availability of comprehensive user feedback for Gtcfx constrains identification of recurring satisfaction or concern patterns.

Conclusion

This comprehensive Gtcfx review reveals a broker with London-based operations that positions itself as a trusted provider of global financial services. However, the evaluation is significantly constrained by limited publicly available information about key operational aspects, regulatory details, and comprehensive user feedback.

The broker appears suitable for traders who prioritize security and are comfortable conducting thorough due diligence before account opening. The London headquarters suggests professional operational standards. However, specific regulatory compliance verification remains essential for prospective users.

Key advantages include the professional positioning and London-based operations, which suggest alignment with established financial service standards. Primary limitations involve the lack of comprehensive public information about trading conditions, regulatory specifics, and detailed platform features, requiring direct broker consultation for complete service understanding.

Prospective traders should conduct independent verification of regulatory status, trading conditions, and service terms before making account opening decisions. This review recommends demo testing and direct communication with Gtcfx representatives to evaluate service alignment with individual trading requirements and expectations.