ICM Brokers Review 1

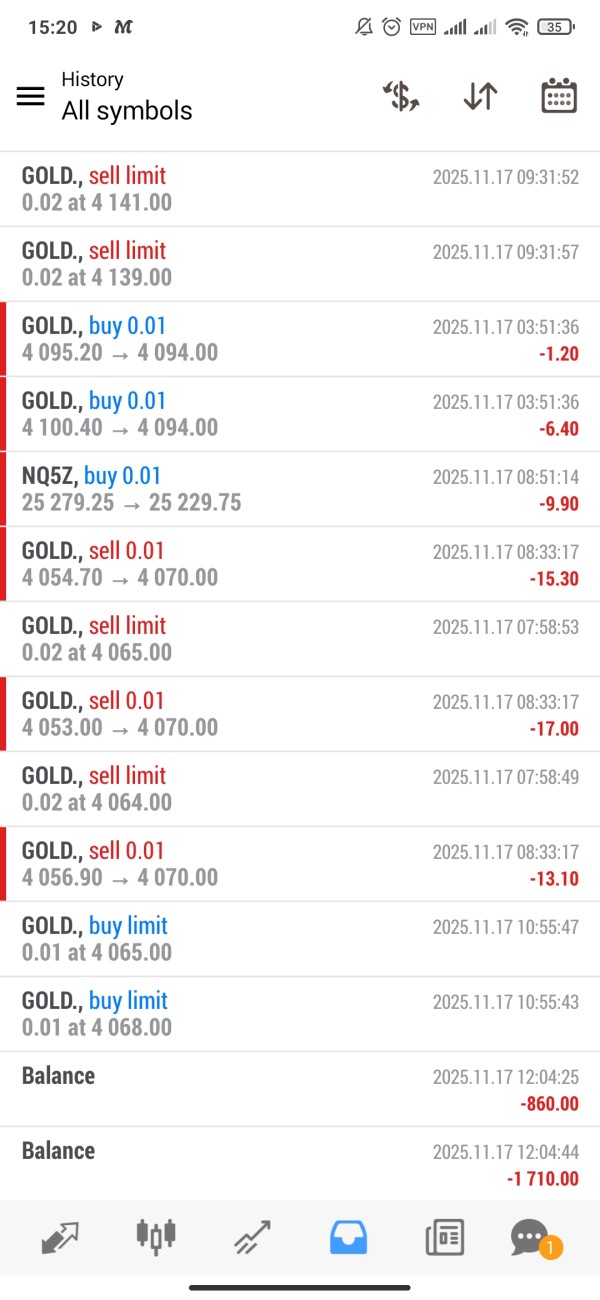

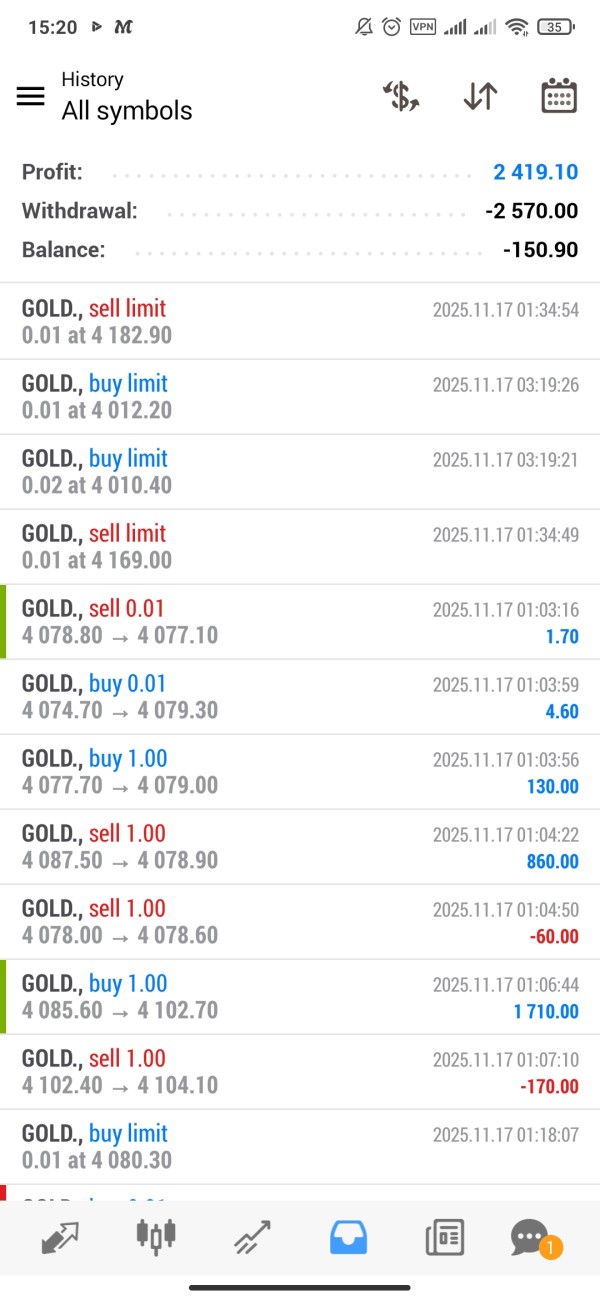

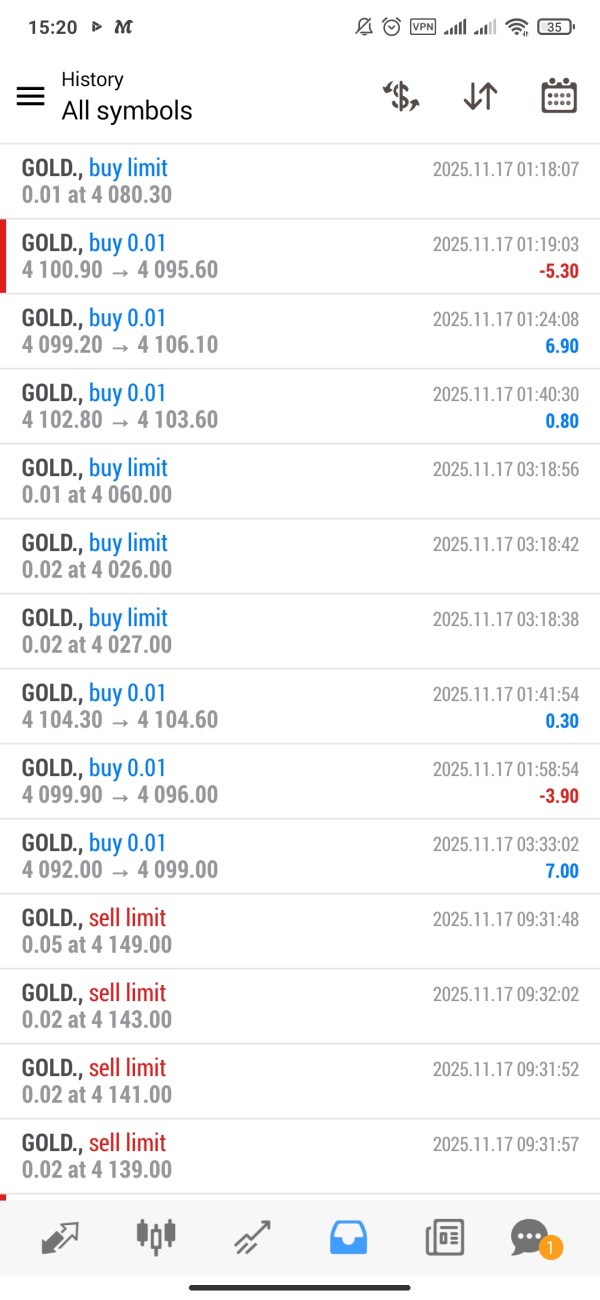

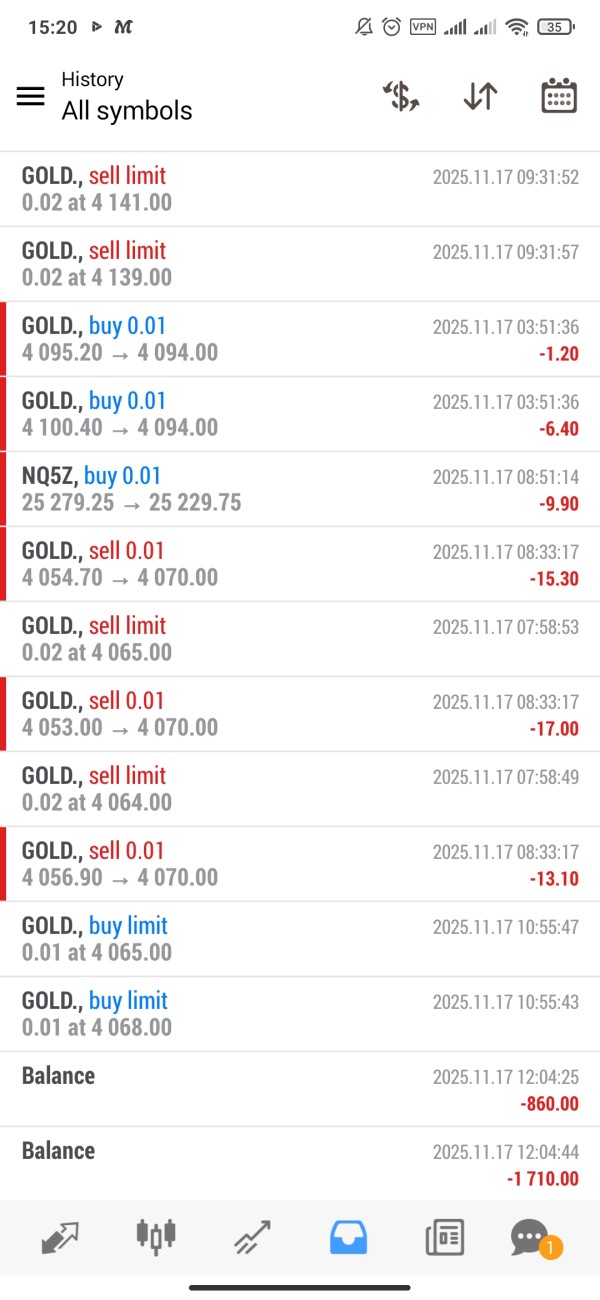

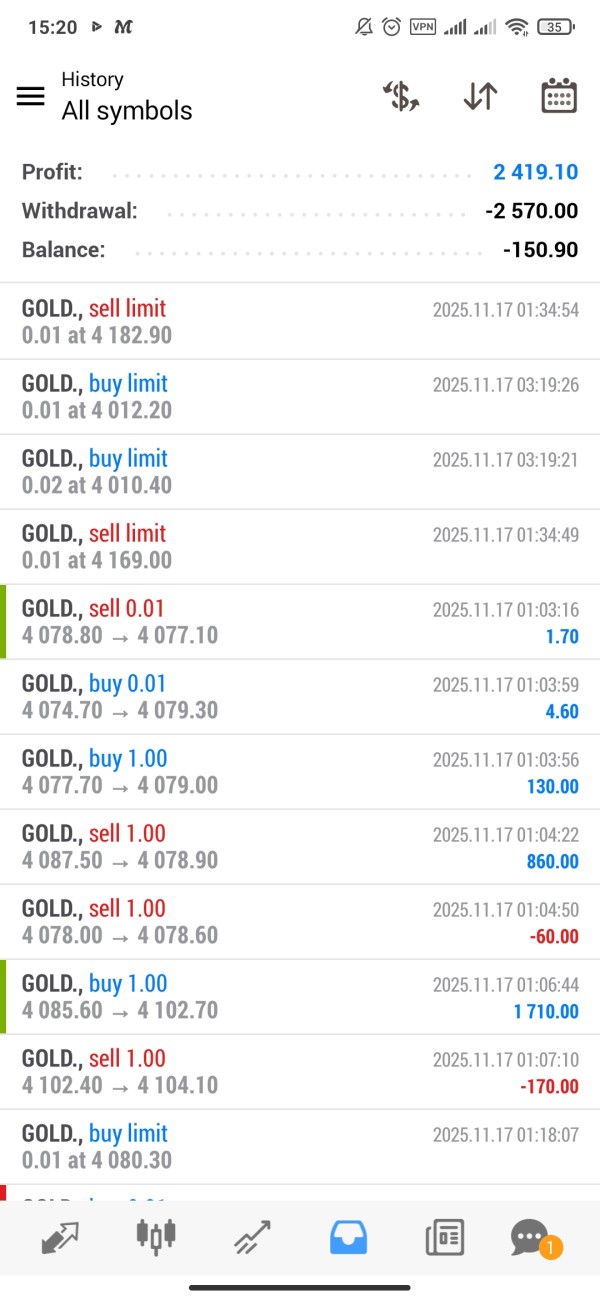

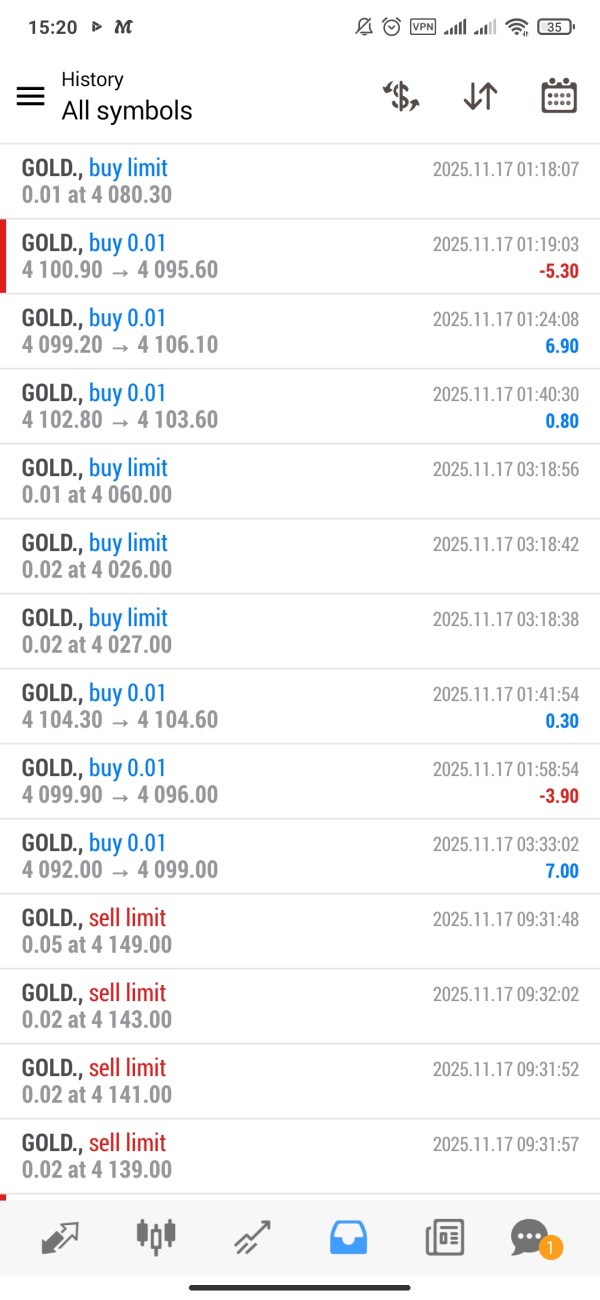

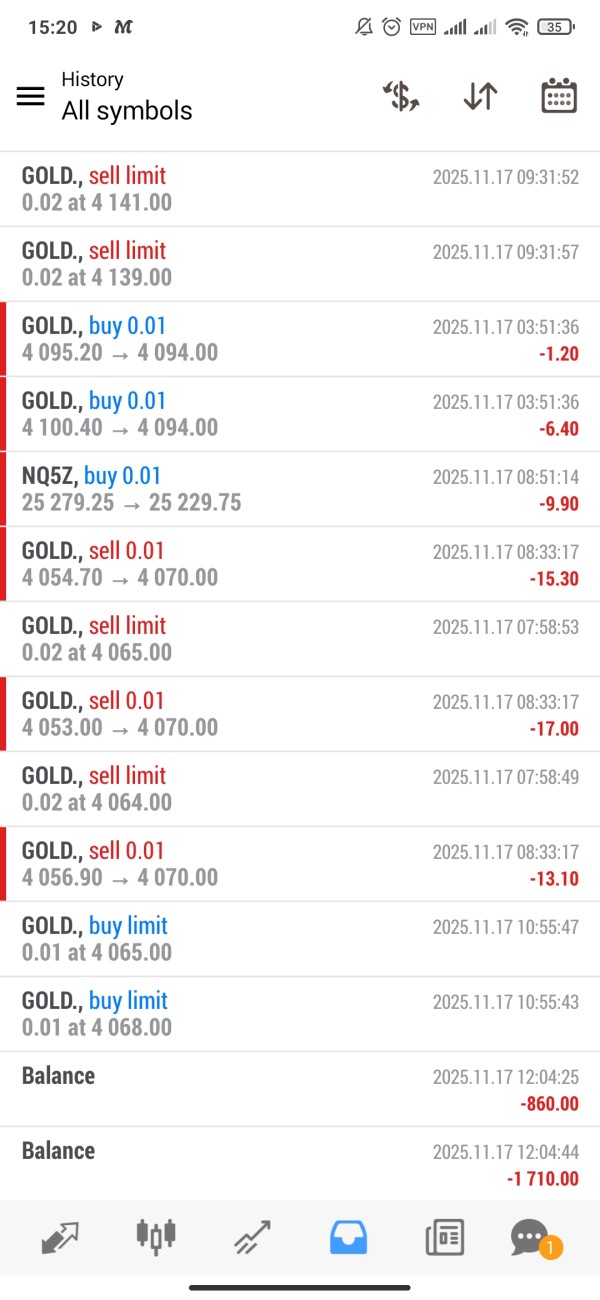

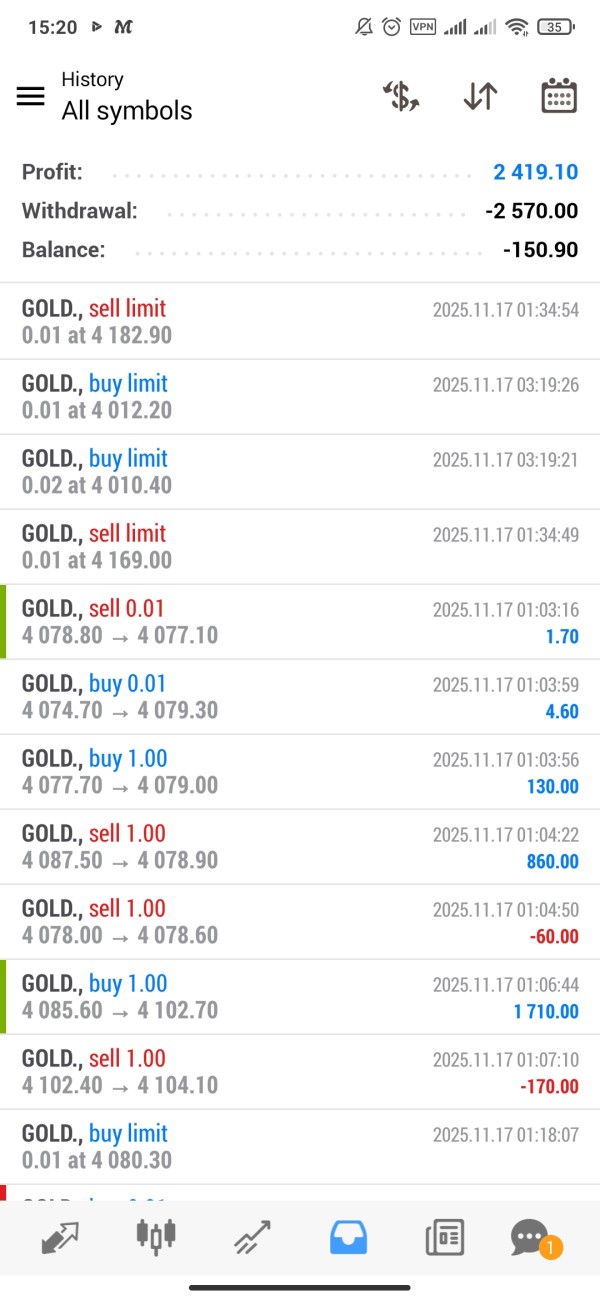

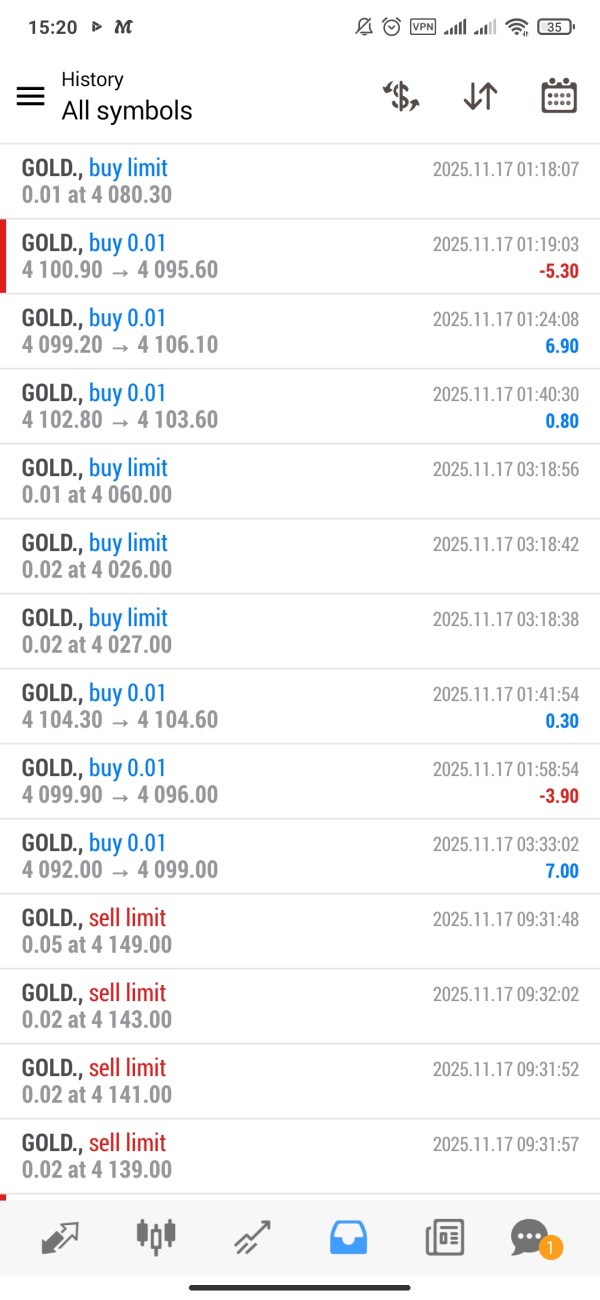

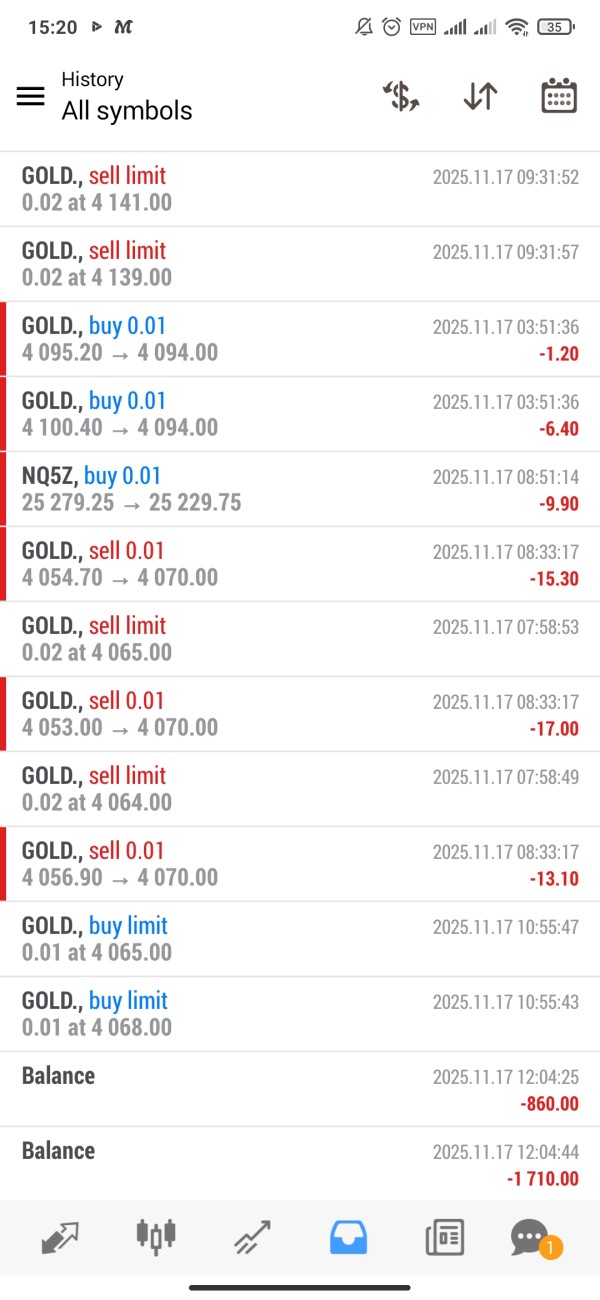

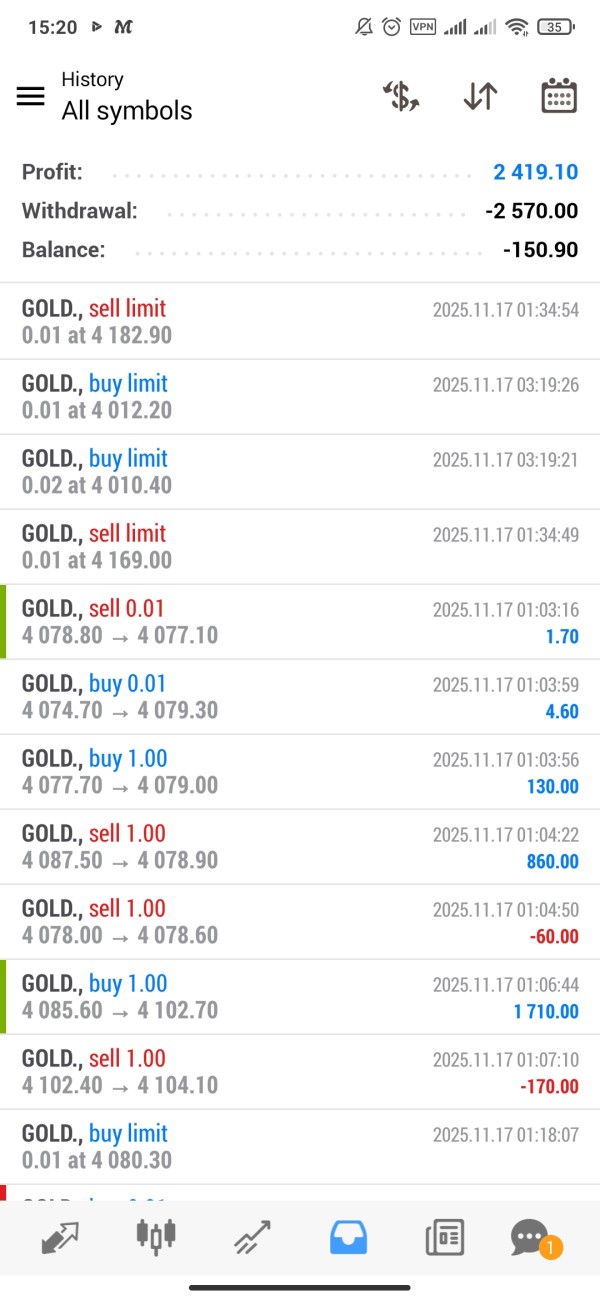

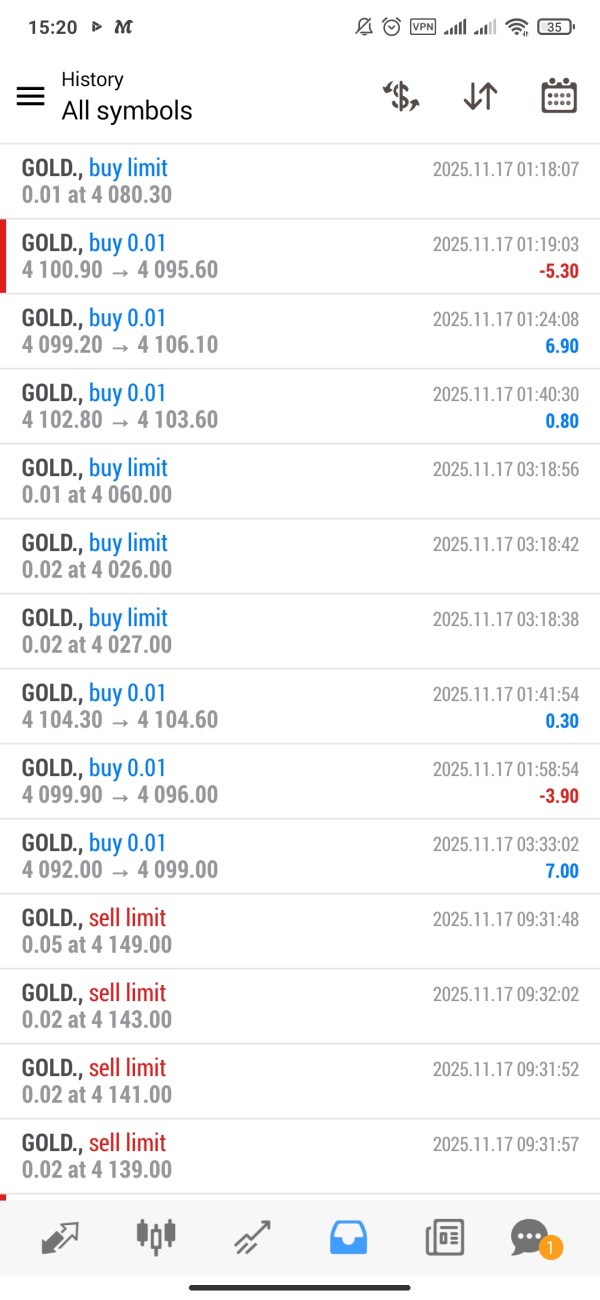

I have an account with ICM Broker. Last night, when the market opened, I traded about ten minutes after the market opened. I made some losses and some profits. They removed the profits without giving me an email or a reason.

ICM Brokers Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I have an account with ICM Broker. Last night, when the market opened, I traded about ten minutes after the market opened. I made some losses and some profits. They removed the profits without giving me an email or a reason.

ICM Brokers is a notable player in the forex brokerage industry. The company offers a comprehensive range of trading services designed to accommodate both novice and experienced traders who want to access global markets. ICM Brokers was established in 2009 and has its headquarters in the Marshall Islands. International Capital Markets Brokers LLC has positioned itself as a multi-asset broker supporting various financial instruments including forex, commodities, and indices through advanced technology platforms. This ICM Brokers review reveals that the platform provides advanced trading technology. The broker maintains generally positive user feedback across multiple review platforms, indicating strong customer satisfaction levels.

The broker's key strengths lie in its sophisticated trading infrastructure and diverse asset offerings. This makes it accessible to traders with varying experience levels and investment preferences who seek comprehensive market access. User evaluations indicate a predominantly positive reception. Some platforms show notably high satisfaction ratings that reflect the broker's commitment to service quality. However, transparency regarding specific regulatory oversight and detailed trading conditions remains limited in publicly available information. Potential clients should consider this factor when evaluating their options for forex and multi-asset trading.

ICM Brokers operates across multiple jurisdictions. Trading conditions may vary depending on your geographical location and applicable regulatory framework that governs financial services in your area. Different regional entities may offer varying services, account types, and regulatory protections. Prospective traders should verify the specific regulatory status and terms applicable to their region before opening an account with any international broker.

This evaluation is based on currently available information and publicly accessible data. The assessment presented here reflects factual information gathered from various sources. It does not constitute personal investment advice or recommendations for any specific trading decisions.

| Evaluation Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 5/10 | Limited publicly available information regarding specific spreads, commissions, minimum deposits, and leverage options |

| Tools and Resources | 8/10 | Advanced trading platform technology with multi-asset support demonstrates strong technical capabilities |

| Customer Service and Support | 5/10 | Insufficient detailed information available about customer service channels, response times, and support quality |

| Trading Experience | 7/10 | Generally positive user feedback indicates satisfactory trading environment, though specific performance metrics are limited |

| Trust and Regulation | 5/10 | Regulatory information not comprehensively detailed in available sources, impacting overall transparency assessment |

| User Experience | 8/10 | Strong user satisfaction ratings on multiple platforms, with some showing 100% positive feedback rates |

ICM Brokers emerged in the financial markets landscape in 2009. The company established its operations under the legal framework of the Marshall Islands as International Capital Markets Brokers LLC, building a foundation for international trading services. Over its operational history, ICM Brokers has developed a business model centered on delivering comprehensive trading services to a diverse client base. The company spans different geographical regions and serves traders with various experience levels from beginners to professionals.

The broker's operational framework encompasses foreign exchange trading alongside other significant financial markets. ICM Brokers includes commodities and indices in its comprehensive offering to provide diversified trading opportunities. The company has positioned itself to serve both retail and institutional clients through its advanced technological infrastructure that supports multiple asset classes. The platform supports multi-asset trading capabilities. This enables clients to diversify their portfolios across various market sectors including forex, commodities, and indices. While specific regulatory details are not extensively documented in available sources, the company operates within international financial services standards. ICM Brokers maintains its commitment to providing reliable trading environments for its global clientele across different time zones and market conditions.

Regulatory Oversight: Available information does not provide comprehensive details about specific regulatory authorities overseeing ICM Brokers' operations. Potential clients should investigate further based on their jurisdiction to ensure appropriate regulatory protection.

Deposit and Withdrawal Methods: Specific information regarding available payment methods, processing times, and associated fees is not detailed in current available sources. Traders should contact the broker directly for payment processing information.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in accessible documentation. This information requires direct inquiry with the broker's customer service team.

Promotional Offers: Current bonus structures, promotional campaigns, or special offers are not detailed in available information sources. Potential clients should check the broker's official website for current promotions.

Available Assets: ICM Brokers supports trading across multiple asset categories including foreign exchange pairs, commodity markets, and various indices. The platform provides traders with diversified investment opportunities across global markets.

Cost Structure: Detailed information about spreads, commission rates, overnight fees, and other trading costs is not comprehensively available in current sources. This requires direct inquiry with the broker for accurate pricing information.

Leverage Ratios: Specific leverage options and maximum ratios offered by the platform are not detailed in available documentation. Traders should verify leverage availability based on their jurisdiction and account type.

Platform Options: The broker provides advanced trading platform technology designed to support multi-asset trading. The platform includes sophisticated features for various trading strategies and market analysis tools.

Geographic Restrictions: Information about specific regional limitations or restricted territories is not detailed in current available sources. Potential clients should verify service availability in their region.

Customer Support Languages: Available language support options for customer service are not specified in accessible information. This ICM Brokers review highlights the need for potential clients to verify language support availability before opening accounts.

The evaluation of ICM Brokers' account conditions faces limitations due to insufficient publicly available information regarding specific account structures and terms. While the broker operates across multiple markets and serves diverse client segments, detailed information about account types remains unclear from current sources. Their distinctive features and associated benefits are not comprehensively documented in available materials. This lack of transparency affects potential clients' ability to make informed decisions about account selection based on their specific trading needs.

Minimum deposit requirements significantly impact accessibility for new traders. These requirements are not specified in available documentation, creating uncertainty for prospective clients who need to plan their initial investment. Similarly, the account opening process, verification procedures, and timeframes are not detailed in current sources. The availability of specialized account features remains unconfirmed in current sources. These include Islamic accounts for Sharia-compliant trading or managed account options for passive investors.

Without comprehensive account condition details, this ICM Brokers review cannot provide definitive guidance on the competitiveness of their offerings. Potential clients should directly contact the broker to obtain specific information about account types, minimum funding requirements, and associated terms. This direct communication is necessary before making commitment decisions about opening trading accounts.

ICM Brokers demonstrates strong performance in technological infrastructure and trading tools. The broker offers advanced platform capabilities that support multi-asset trading environments across various financial markets. The broker's commitment to providing sophisticated trading technology is evident in their platform offerings. These platforms accommodate various asset classes including forex, commodities, and indices within a unified trading environment that simplifies portfolio management.

The multi-asset support capability represents a significant strength for traders seeking diversification. This feature allows traders to diversify their portfolios and implement complex trading strategies across different market sectors. This comprehensive approach to asset coverage indicates the broker's understanding of modern trading requirements. The platform addresses portfolio management needs that today's traders demand from their brokers.

However, specific details about research resources, analytical tools, educational materials, and automated trading support are not extensively documented. The absence of detailed information about market analysis services, economic calendars, trading signals, or educational content limits the complete assessment. Advanced traders particularly value comprehensive analytical tools and market insights. These resources remain unspecified in current documentation, requiring direct inquiry with the broker.

The assessment of ICM Brokers' customer service capabilities is constrained by limited available information about support infrastructure. Service channels and response protocols are not comprehensively documented in current sources. Effective customer support is crucial for trading operations, particularly during market volatility or technical issues that require immediate attention. Yet specific details about ICM Brokers' support framework are not comprehensively documented in available materials.

Information about available communication channels is not detailed in current sources. These channels include live chat, telephone support, email assistance, or dedicated account management services that traders typically expect. Response time commitments, service availability hours, and escalation procedures remain unspecified in available documentation. This makes it difficult for potential clients to assess the adequacy of support services for their trading needs.

Multilingual support capabilities are essential for international brokers serving diverse client bases. These capabilities are not documented in available information sources, creating uncertainty for non-English speaking clients. The quality of technical support, trading assistance, and problem resolution processes cannot be evaluated based on current sources. Without user testimonials or service quality metrics, this aspect of the broker's operations remains largely unassessed. This ICM Brokers review acknowledges the need for more comprehensive support information.

User feedback indicates generally positive experiences with ICM Brokers' trading environment. This feedback suggests satisfactory platform performance and service delivery that meets client expectations across different market conditions. The positive user evaluations reflect well on the broker's ability to provide functional trading conditions. These conditions meet client expectations across different market scenarios and trading styles.

Platform stability and execution quality appear to meet user standards based on available feedback from various review sources. However, specific performance metrics such as execution speeds, slippage rates, or requote frequencies are not detailed in current sources. The trading environment seems to accommodate both novice and experienced traders effectively. This is indicated by the diverse user base and positive reception across different trader segments.

However, detailed technical performance data is not available for comprehensive assessment. This includes server uptime statistics, order execution analytics, and platform reliability metrics that serious traders consider important. Mobile trading capabilities are increasingly important for modern traders. These capabilities are not specifically addressed in current documentation, leaving questions about mobile platform functionality. The absence of detailed trading condition specifications limits the ability to provide definitive guidance about trading experience quality. This ICM Brokers review acknowledges positive user sentiment while noting the need for more detailed performance information.

The trust and regulatory assessment of ICM Brokers faces significant limitations due to insufficient detailed information. Regulatory oversight, licensing arrangements, and compliance frameworks are not comprehensively documented in available sources. While the broker operates as International Capital Markets Brokers LLC under Marshall Islands jurisdiction, specific regulatory authority oversight requires further investigation. License details are not comprehensively documented in available sources, creating uncertainty about regulatory compliance.

Client fund protection measures, segregation policies, and insurance arrangements are not detailed in current information sources. This creates uncertainty about asset security protocols that protect client investments from broker insolvency or other financial risks. Transparency regarding corporate governance, financial reporting, and regulatory compliance status remains limited in available documentation. This affects the overall trust assessment that potential clients can make based on publicly available information.

Industry reputation indicators are not available in current sources. These include regulatory actions, compliance history, or third-party certifications that would provide insight into the broker's regulatory standing. The absence of detailed regulatory information makes it challenging for potential clients to assess protection levels. Oversight applicable to their trading activities varies by jurisdiction and requires independent verification. Prospective traders should independently verify regulatory status and protection measures relevant to their jurisdiction. This verification should occur before engaging with the platform for live trading activities.

ICM Brokers demonstrates strong user satisfaction levels based on available feedback from multiple review platforms. Some review platforms indicate notably high positive ratings that reflect the broker's commitment to user satisfaction. The broker's ability to maintain positive user sentiment across different experience levels suggests effective service delivery. Platform functionality meets diverse trading needs from basic to advanced trading requirements.

The platform appears to successfully serve both novice and experienced traders simultaneously. This indicates user-friendly design combined with advanced functionality that doesn't compromise either user segment. This dual appeal suggests thoughtful interface development that balances accessibility with sophisticated trading capabilities. User feedback patterns indicate general satisfaction with the overall trading environment and service quality across different aspects of the platform.

However, specific details about user interface design, navigation efficiency, registration processes, and account management features are not extensively documented. Information about common user concerns, platform improvement initiatives, or user feedback integration processes is not available. These details would provide insight into the broker's commitment to continuous improvement and user experience enhancement. Despite these information gaps, the positive user feedback trends suggest that ICM Brokers maintains satisfactory user experience standards. The broker appears to meet expectations across its client base in various aspects of service delivery.

ICM Brokers presents itself as a capable international broker with positive user reception and multi-asset trading capabilities. The platform demonstrates strengths in technological infrastructure and maintains generally favorable user feedback across multiple review platforms. This indicates satisfactory service delivery across its operational framework and commitment to user satisfaction. The broker's ability to serve both novice and experienced traders suggests a well-designed platform. This platform balances accessibility with advanced functionality without compromising either user segment's needs.

However, this evaluation reveals significant information transparency limitations regarding regulatory oversight and detailed trading conditions. Specific service features and operational details are not comprehensively documented in publicly available sources. Potential clients should conduct thorough due diligence, particularly regarding regulatory protection applicable to their jurisdiction. Specific trading terms and conditions require direct verification with the broker before making account decisions. While user feedback trends are encouraging and suggest positive experiences, the absence of detailed operational information necessitates direct communication. Prospective clients should contact the broker directly for comprehensive evaluation of services and terms.

ICM Brokers appears suitable for traders seeking multi-asset capabilities with positive user community feedback and advanced trading technology. However, prospective clients should verify regulatory status, trading conditions, and service terms relevant to their specific requirements. This verification should occur before making account decisions to ensure the broker meets their individual trading needs and regulatory protection requirements.

FX Broker Capital Trading Markets Review