Vatin 2025 Review: Everything You Need to Know

Summary

This vatin review looks at a cryptocurrency trading platform that worries many traders. Vatin started in 2022 and has its main office in China, but it operates as an unregulated cryptocurrency exchange that has received bad reviews from users and raised serious questions about whether it's safe and legitimate.

The platform mainly offers cryptocurrency trading services. These include Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Polkadot trading pairs. However, the lack of regulatory oversight and the platform's low trust score of 4 out of 10 on Scam Detector show major warning signs for people who might want to use it. The fact that it doesn't offer traditional forex or CFD trading options also makes it less appealing to regular retail traders.

Vatin seems to target cryptocurrency fans and traders who want to invest in digital assets. But since the platform isn't regulated and users don't like it, potential users should be very careful. The platform's short history, along with worrying trust scores, means that only people who are okay with high risks and have lots of cryptocurrency trading experience should think about using this platform, and even then, they should have serious concerns about fund safety and whether the platform works reliably.

Important Notice

Due to Vatin's unregulated status, users in different countries may face different levels of legal protection. Many regions offer little to no help if there are disputes or problems getting funds back. The lack of regulatory oversight means that standard investor protection systems that come with licensed brokers are not available.

This review uses information and user feedback from various sources. Since the platform itself doesn't share much information, some parts of the service are unclear, and potential users should do more research before thinking about using this platform.

Rating Framework

Broker Overview

Vatin appeared in the cryptocurrency trading world in 2022. It positioned itself as a digital asset exchange based in China. The platform's recent start happened at the same time as the broader growth of cryptocurrency trading platforms around the world, though it has failed to build the trust and regulatory compliance that good exchanges in this space have.

The company's business model focuses only on cryptocurrency trading services. This makes it different from traditional forex brokers that usually offer multiple types of assets including currency pairs, commodities, and indices. This narrow focus on digital assets shows the platform's attempt to make money from cryptocurrency market changes, though the lack of regulatory framework raises questions about operational standards and user protection rules.

Unlike established cryptocurrency exchanges that try to follow regulations in major countries, Vatin operates without oversight from recognized financial authorities. This vatin review must stress that the platform's unregulated status is a basic concern for potential users, as it lacks the consumer protection systems, financial safeguards, and operational transparency requirements that regulated companies must maintain.

The platform's Chinese headquarters location, along with its unregulated status, creates extra complexity for international users who may find limited legal help if there are disputes. The lack of clear information about trading platforms, whether they're proprietary or third-party solutions like MetaTrader, further shows the platform's lack of transparency in sharing essential service details to potential clients.

Regulatory Status: Available information shows no regulatory oversight from recognized financial authorities. This places Vatin in the category of unregulated cryptocurrency platforms that operate outside established financial supervision frameworks.

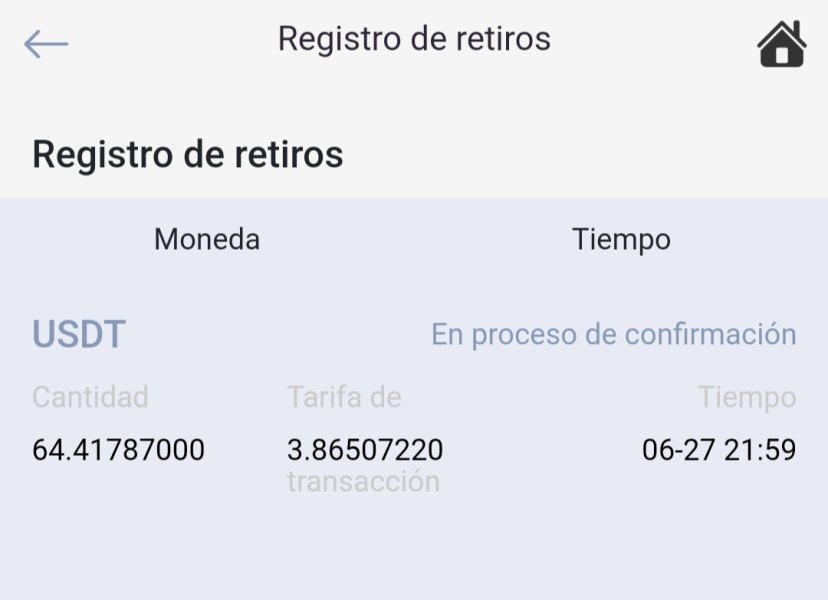

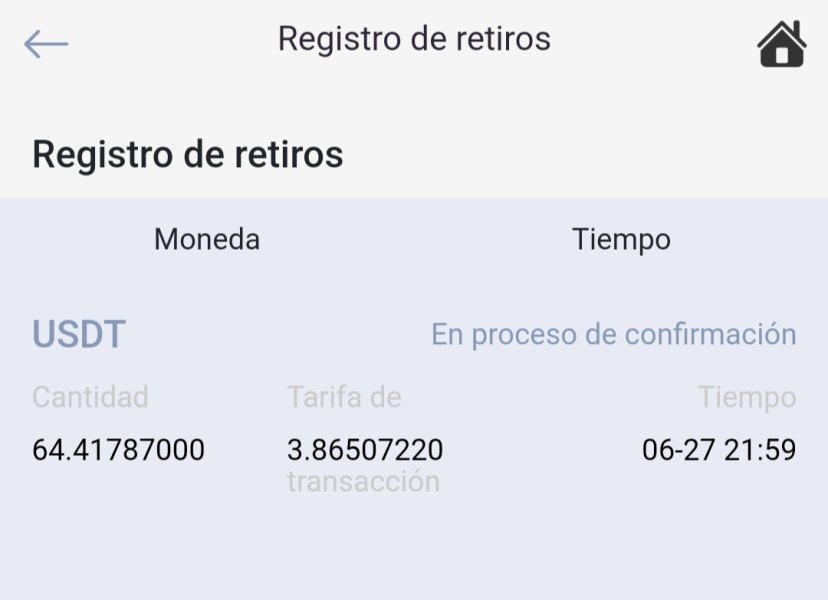

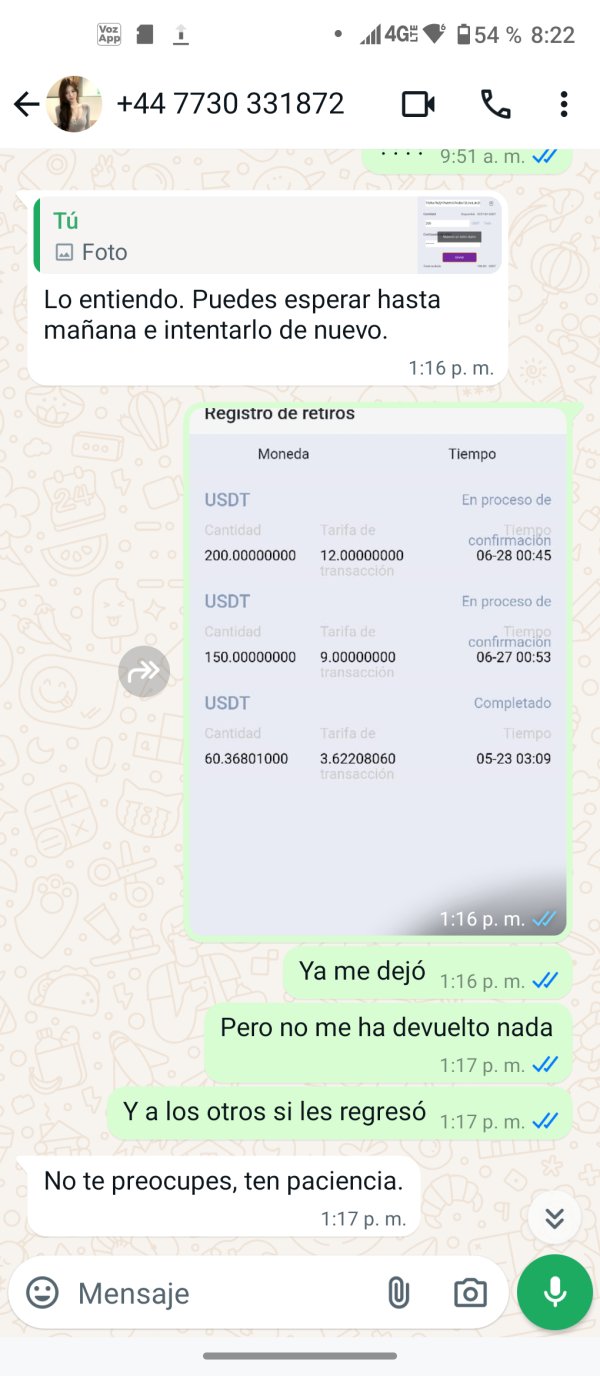

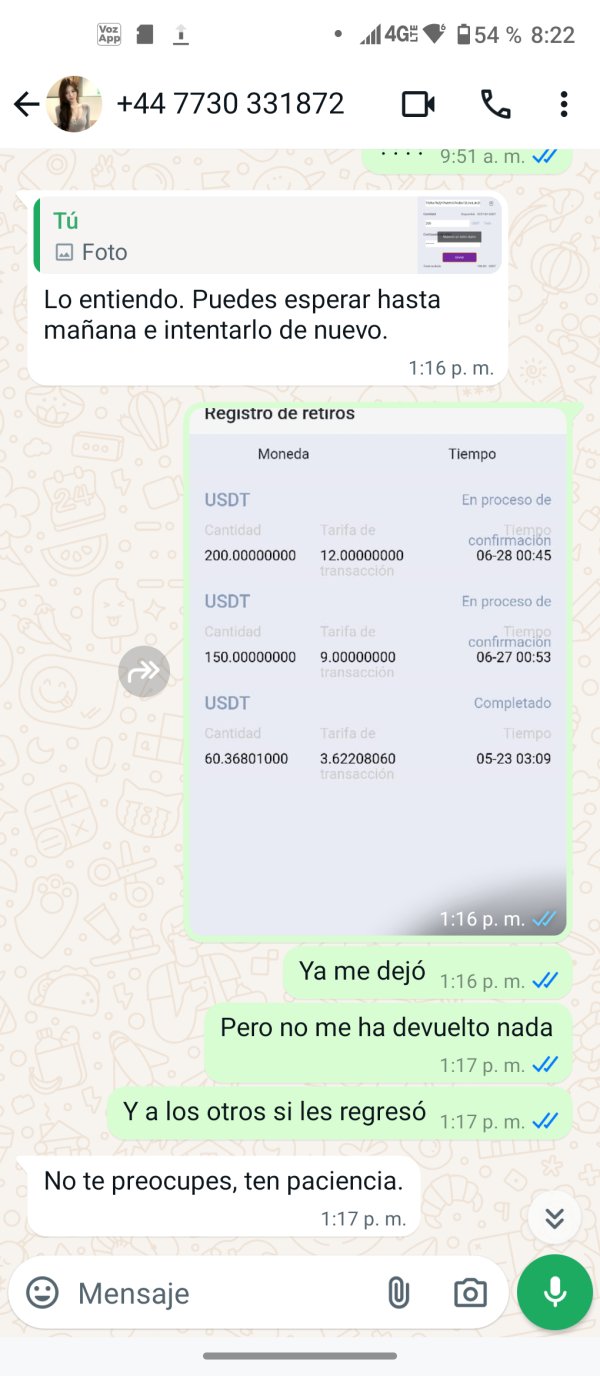

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and fees has not been detailed in available source materials. This represents a significant transparency gap for potential users.

Minimum Deposit Requirements: The platform's minimum deposit amounts and account funding requirements are not specified in accessible documentation. This makes it difficult for potential users to understand entry-level investment requirements.

Promotional Offers: No information about welcome bonuses, trading incentives, or promotional campaigns has been found in available materials. This suggests either absence of such programs or inadequate marketing transparency.

Tradeable Assets: The platform provides access to major cryptocurrency pairs including Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Polkadot. This selection covers primary digital assets but lacks the wide range offered by established cryptocurrency exchanges.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains unspecified in available documentation. This lack of fee transparency is a significant concern for cost-conscious traders trying to evaluate the platform's competitiveness.

Leverage Options: Leverage ratios and margin trading capabilities have not been detailed in source materials. This leaves potential users without essential information for risk management planning.

Platform Selection: The specific trading platforms, whether web-based, mobile applications, or desktop software, are not clearly identified in available information. This hinders users' ability to assess technological capabilities.

Geographic Restrictions: Regional availability and jurisdictional limitations are not specified in accessible materials.

Customer Support Languages: The range of supported languages for customer service interactions remains unspecified in available documentation.

This vatin review must note that the extensive information gaps represent a concerning pattern of limited transparency. Potential users should carefully consider this before engaging with the platform.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Vatin's account conditions faces significant limitations due to insufficient information in available source materials. Traditional cryptocurrency exchanges usually offer multiple account tiers with different features, minimum deposits, and trading privileges, but Vatin's account structure remains unclear.

Without detailed information about account types, potential users cannot assess whether the platform provides basic retail accounts, premium trading accounts, or institutional-level services. The absence of minimum deposit specifications makes it impossible to evaluate accessibility for different investor categories or compare competitive positioning against established cryptocurrency exchanges.

Account opening procedures, verification requirements, and documentation standards are not detailed in available materials. This information gap is particularly concerning given increasing regulatory focus on Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance in cryptocurrency trading. Good platforms usually provide clear guidance on identity verification, address confirmation, and source of funds documentation.

Special account features such as demo accounts for practice trading, Islamic-compliant accounts, or professional trader designations are not mentioned in accessible information. The lack of transparency about account conditions represents a basic weakness in the platform's communication strategy and raises questions about operational sophistication.

This vatin review cannot provide a meaningful account conditions rating due to insufficient available information. This highlights the platform's transparency problems that potential users should consider as a significant red flag when evaluating service quality and operational standards.

Vatin's trading tools and resources appear limited based on available information. The platform focuses mainly on basic cryptocurrency trading functionality. The platform offers access to major digital assets including Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Polkadot, but detailed information about trading tools, analytical resources, and educational materials is not readily available.

The absence of comprehensive tool descriptions raises concerns about the platform's technological sophistication compared to established cryptocurrency exchanges. These exchanges usually provide advanced charting capabilities, technical analysis indicators, order types, and market research resources. Professional traders generally require access to detailed market data, price alerts, portfolio management tools, and automated trading capabilities.

Research and analysis resources, which are essential for informed trading decisions, are not detailed in available materials. Good cryptocurrency platforms usually provide market analysis, news feeds, economic calendars, and educational content to support trader development and market understanding.

Educational resources, including tutorials, webinars, market guides, and trading strategies, appear to be absent or inadequately communicated. The lack of educational support is particularly concerning for a platform that may attract novice cryptocurrency traders who require guidance on market dynamics, risk management, and trading best practices.

Automated trading support, API access for algorithmic trading, and third-party integration capabilities are not mentioned in available information. These features have become standard expectations for serious cryptocurrency trading platforms, and their absence or lack of documentation suggests limited technological advancement.

The overall assessment indicates that Vatin's tools and resources may be insufficient for professional trading requirements. However, the limited available information makes comprehensive evaluation challenging.

Customer Service and Support Analysis

Customer service evaluation for Vatin faces significant challenges due to the absence of detailed support information in available materials. Quality customer support represents a critical component of cryptocurrency trading platforms, particularly given the technical complexity and 24/7 nature of digital asset markets.

Available information does not specify customer service channels such as live chat, email support, phone assistance, or support ticket systems. The absence of clear communication pathways raises concerns about users' ability to receive timely assistance for account issues, trading problems, or technical difficulties that may arise during cryptocurrency transactions.

Response time commitments, service level agreements, and support availability hours are not detailed in accessible documentation. Cryptocurrency markets operate continuously, and traders usually expect round-the-clock support availability to address urgent trading issues or account access problems that could result in financial losses.

Service quality metrics, customer satisfaction ratings, and support team expertise levels are not documented in available materials. Professional cryptocurrency platforms usually employ knowledgeable support staff who understand both technical platform functionality and broader cryptocurrency market dynamics.

Multilingual support capabilities, which are essential for international cryptocurrency platforms, are not specified in available information. The platform's Chinese headquarters suggests potential language limitations that could affect international user experience and support accessibility.

Without concrete information about customer service infrastructure, response capabilities, and support quality, potential users cannot assess whether Vatin provides adequate assistance for their trading needs. This information gap represents another transparency concern that undermines confidence in the platform's operational standards.

Trading Experience Analysis

The evaluation of Vatin's trading experience encounters substantial limitations due to insufficient technical and performance information in available source materials. Trading experience includes platform stability, execution speed, user interface design, and overall functionality that directly impacts trader success and satisfaction.

Platform stability and reliability information is not available in accessible documentation. This makes it impossible to assess system uptime, server performance during high-volume trading periods, or technical infrastructure strength. Cryptocurrency markets experience significant volatility that can generate intense trading activity, requiring platforms to maintain consistent performance under stress.

Order execution quality, including fill rates, slippage characteristics, and execution speed metrics, are not detailed in available materials. These factors critically impact trading profitability, particularly for active traders who rely on precise order execution during rapid market movements common in cryptocurrency trading.

Platform functionality completeness, including order types available, charting capabilities, portfolio management features, and market data quality, remains unspecified in accessible information. Professional traders usually require advanced order types such as stop-loss, take-profit, trailing stops, and conditional orders for effective risk management.

Mobile trading experience, which has become essential for cryptocurrency traders who need market access across multiple devices, is not documented in available materials. The absence of mobile platform information suggests potential limitations in trading accessibility and user convenience.

This vatin review cannot provide a comprehensive trading experience assessment due to limited available information. However, the lack of detailed platform specifications raises concerns about technological sophistication and user experience quality that potential traders should carefully consider.

Trust Level Analysis

Trust level analysis reveals significant concerns about Vatin's credibility and reliability as a cryptocurrency trading platform. The platform's unregulated status represents the most basic trust issue, as it operates without oversight from recognized financial authorities that usually ensure consumer protection, operational standards, and financial stability requirements.

Regulatory compliance absence means that Vatin does not follow standard financial industry safeguards including segregated client funds, capital adequacy requirements, regular auditing, or dispute resolution mechanisms. This regulatory gap exposes users to substantial risks including potential fund loss without legal recourse or regulatory intervention capabilities.

Fund security measures and client asset protection protocols are not detailed in available information. This creates uncertainty about how user deposits are safeguarded, whether funds are segregated from operational capital, and what security measures protect against unauthorized access or platform-related losses.

Company transparency regarding ownership structure, financial statements, operational procedures, and business practices appears limited based on available materials. Good cryptocurrency platforms usually provide comprehensive information about corporate governance, financial health, and operational transparency to build user confidence.

The Scam Detector trust score of 4 out of 10 represents a particularly concerning third-party assessment that suggests significant reliability concerns. Such low trust ratings usually indicate user complaints, operational issues, or other factors that undermine platform credibility within the cryptocurrency trading community.

Industry reputation and standing within the cryptocurrency exchange ecosystem appear questionable given the combination of unregulated status, limited operational transparency, and negative trust indicators. These factors collectively suggest substantial reliability risks for potential users.

User Experience Analysis

User experience assessment for Vatin faces considerable limitations due to insufficient feedback data and platform information in available source materials. Comprehensive user experience evaluation usually requires access to user testimonials, interface demonstrations, and detailed platform functionality descriptions that are not readily accessible for this platform.

Overall user satisfaction metrics and comprehensive feedback collections are not documented in available materials. This makes it difficult to assess whether existing users find the platform meets their cryptocurrency trading needs effectively. The absence of detailed user reviews or satisfaction surveys represents a significant information gap.

Interface design quality, navigation intuitiveness, and platform usability characteristics are not detailed in accessible documentation. Modern cryptocurrency platforms usually emphasize user-friendly design that accommodates both novice and experienced traders, but Vatin's interface quality cannot be assessed from available information.

Registration and account verification processes, which significantly impact initial user experience, are not described in available materials. Streamlined onboarding procedures with clear verification requirements usually enhance user satisfaction, while complex or unclear processes can create frustration and abandonment.

Fund management experience, including deposit convenience, withdrawal processing efficiency, and transaction transparency, remains unspecified in available documentation. Smooth financial operations represent a critical component of positive user experience in cryptocurrency trading platforms.

The Scam Detector low trust rating suggests potential negative user experiences, though specific complaint details or common user issues are not detailed in available materials. This negative indicator, combined with limited positive feedback availability, raises concerns about overall user satisfaction and platform reliability that potential users should carefully consider before engagement.

Conclusion

This vatin review reveals a cryptocurrency trading platform that presents substantial risks and concerns for potential users. Vatin's unregulated status, combined with limited transparency and negative trust indicators, suggests that the platform may not meet the safety and reliability standards expected from good cryptocurrency exchanges.

The platform may appeal to highly risk-tolerant cryptocurrency traders who prioritize access to digital assets over regulatory protection and operational transparency. However, the extensive information gaps, absence of regulatory oversight, and concerning trust metrics make Vatin unsuitable for most retail traders seeking secure and reliable cryptocurrency trading services.

The primary advantages include access to major cryptocurrency pairs and potential entry into digital asset trading. However, these benefits are significantly outweighed by substantial disadvantages including unregulated status, limited transparency, poor trust ratings, and insufficient information about critical operational aspects such as fund security, customer support, and platform reliability. Potential users should strongly consider established, regulated cryptocurrency exchanges that provide comprehensive consumer protection and operational transparency.