Glory Sky Group 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Glory Sky Group review reveals significant concerns that potential traders should carefully consider before engaging with this broker. Glory Sky Group was established in 2017. The company has its headquarters in Hong Kong and presents itself as a multi-asset trading platform offering services across securities, foreign exchange, futures, and precious metals trading. Glory Sky Group targets a diverse clientele including retail customers, corporate clients, funds, and financial institutions throughout the Asia Pacific region.

However, our analysis uncovers troubling patterns in user feedback and industry ratings that paint a concerning picture. Glory Sky Group has a WikiFX Score of merely 1 out of 10. The broker also has a user rating of C, which means it faces substantial credibility challenges. Multiple user complaints have surfaced regarding alleged fraudulent practices and persistent withdrawal issues, creating serious red flags for potential investors. The negative customer feedback consistently highlights problems with fund accessibility and questionable business practices. These issues significantly impact the overall trading experience and user confidence in the platform.

Important Notice

This Glory Sky Group review is based on comprehensive analysis of available user feedback, industry ratings, and publicly accessible information. Readers should note that regulatory information for this broker remains unclear in available materials. This may indicate potential compliance concerns or varying regulatory status across different jurisdictions. The evaluation presented here reflects the current state of available data and user experiences as reported through various industry sources and review platforms. Prospective traders are strongly advised to conduct their own due diligence and verify regulatory status before making any investment decisions with this broker.

Rating Framework

Broker Overview

Glory Sky Group entered the financial services market in 2017. The company positioned itself as a comprehensive investment services provider based in Hong Kong. Glory Sky Group's business model encompasses both traditional and online investment solutions, targeting a broad spectrum of clients across the Asia Pacific region. Their stated mission involves serving retail customers, corporate clients, investment funds, and financial institutions through a multi-faceted approach to trading and investment services. The broker's establishment in Hong Kong suggests an intention to leverage the region's financial hub status. However, specific regulatory compliance details remain unclear in available documentation.

The platform's service portfolio spans multiple asset categories, including foreign exchange trading, securities, futures contracts, and precious metals investments. This diversified offering positions Glory Sky Group as a one-stop solution for various investment needs. However, the lack of detailed information about specific trading platforms, technological infrastructure, and regulatory oversight raises questions about the depth and quality of their service delivery. The absence of clear regulatory information in this Glory Sky Group review is particularly concerning given the importance of proper oversight in the financial services industry. This is especially true for brokers handling client funds across multiple asset classes.

Regulatory Status: Available materials do not provide specific information about regulatory authorities overseeing Glory Sky Group's operations. This represents a significant concern for potential clients seeking properly regulated trading environments.

Deposit and Withdrawal Methods: Specific information about available funding methods and withdrawal processes is not detailed in current materials. However, user complaints suggest significant issues with fund withdrawal procedures.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This makes it difficult for potential traders to assess entry barriers.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in accessible materials. This limits insight into potential incentives for new clients.

Tradeable Assets: The platform offers access to foreign exchange markets, securities trading, futures contracts, and precious metals investments. This provides a relatively diverse range of trading opportunities across different asset classes.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs is not available in current materials. This makes it challenging to assess the competitiveness of their pricing structure.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in available documentation. This is crucial information for risk assessment.

Platform Options: Details about specific trading platforms, software options, and technological features are not provided in accessible materials.

Geographic Restrictions: Information about regional limitations or restricted jurisdictions is not specified in current documentation.

Customer Support Languages: The platform provides support in English. However, the extent of multilingual support capabilities remains unclear.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of Glory Sky Group's account conditions faces significant limitations due to the absence of detailed information in available materials. This Glory Sky Group review cannot provide comprehensive analysis of account types, tier structures, or specific features that different account categories might offer. The lack of transparency regarding minimum deposit requirements, account opening procedures, and special account features such as Islamic accounts creates substantial uncertainty for potential traders seeking to understand their options.

Without access to detailed account specifications, traders cannot effectively compare Glory Sky Group's offerings against industry standards or competitor products. The absence of information about account benefits, restrictions, or special features makes it impossible to determine whether the broker provides competitive account conditions. This information gap represents a significant red flag. Reputable brokers typically provide clear, detailed account information to help clients make informed decisions about their trading arrangements.

Glory Sky Group's tools and resources evaluation reveals mixed results based on available information. While the broker offers access to multiple asset classes including foreign exchange, securities, futures, and precious metals, the quality and sophistication of their trading tools remain unclear. The platform's multi-asset approach suggests potential for comprehensive trading resources. However, specific details about analytical tools, charting capabilities, research resources, and educational materials are not available in current documentation.

The absence of information about automated trading support, third-party integrations, or advanced trading features limits the ability to assess the platform's technological capabilities. Professional traders and institutions typically require sophisticated tools for market analysis, risk management, and trade execution. However, this Glory Sky Group review cannot verify whether such resources are adequately provided. The lack of detailed tool specifications raises questions about the platform's ability to serve experienced traders effectively.

Customer Service and Support Analysis

Customer service represents a critical weakness for Glory Sky Group based on available user feedback and complaints. Multiple reports indicate significant issues with service responsiveness, problem resolution capabilities, and overall support quality. Users have reported difficulties in reaching customer service representatives and receiving adequate assistance with account-related issues. This is particularly concerning for withdrawal requests and dispute resolution.

The negative feedback pattern suggests systemic issues within the customer support infrastructure that could significantly impact user experience. While the platform offers English language support, the effectiveness of this service appears compromised based on user reports. The combination of poor responsiveness and inadequate problem-solving capabilities creates substantial concerns about the broker's commitment to client service and support quality.

Trading Experience Analysis

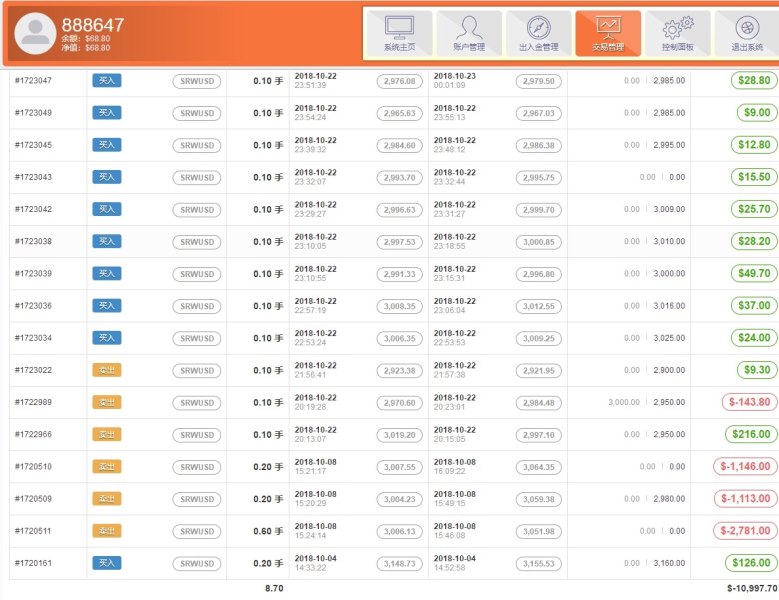

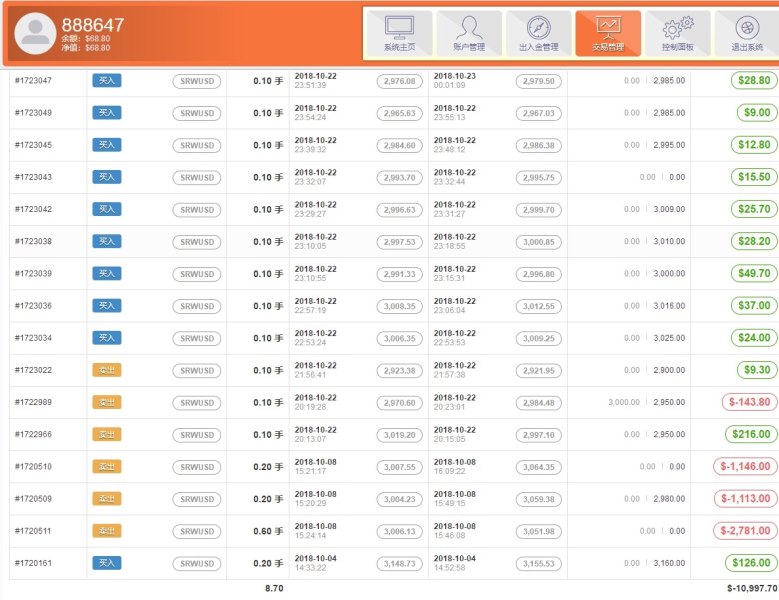

The trading experience evaluation for Glory Sky Group reveals significant concerns based on user feedback and reported issues. Multiple complaints regarding withdrawal difficulties suggest fundamental problems with the platform's operational processes that directly impact trader satisfaction. Users have reported challenges accessing their funds. This represents one of the most serious issues a trading platform can face, as it directly affects trader confidence and financial security.

Platform stability, order execution quality, and overall trading environment appear to suffer from operational deficiencies based on available feedback. The lack of detailed information about trading platform features, mobile applications, and technological infrastructure further compounds concerns about the overall trading experience. This Glory Sky Group review indicates that traders may face significant challenges in executing their trading strategies effectively and accessing their funds when needed.

Trustworthiness Analysis

Glory Sky Group's trustworthiness rating reflects serious concerns highlighted by industry evaluations and user experiences. The WikiFX Score of 1 out of 10 represents an extremely poor industry assessment that raises significant red flags about the broker's credibility and operational integrity. This exceptionally low rating suggests fundamental issues with the broker's business practices, regulatory compliance, or operational standards. Industry experts consider these issues highly problematic.

User complaints involving alleged fraudulent practices and withdrawal issues further compound trustworthiness concerns. The absence of clear regulatory information in available materials adds another layer of uncertainty about the broker's compliance status and oversight mechanisms. Without proper regulatory supervision and transparent business practices, traders face elevated risks when engaging with this platform. The combination of poor industry ratings and serious user complaints creates a concerning picture regarding the broker's reliability and integrity.

User Experience Analysis

Overall user satisfaction with Glory Sky Group appears predominantly negative based on available feedback and ratings. The C-grade user rating reflects widespread dissatisfaction with various aspects of the platform's services. This includes everything from customer support quality to fund accessibility issues. Users have consistently reported problems with withdrawal processes. This suggests systemic issues that significantly impact the overall user experience and satisfaction levels.

The concentration of negative feedback around critical operational areas such as fund withdrawals and customer service indicates fundamental problems with the platform's user-centric approach. These issues particularly affect traders who prioritize reliable fund access and responsive support services. The pattern of complaints suggests that Glory Sky Group may not adequately address user concerns or provide satisfactory solutions to operational problems. This results in diminished user confidence and satisfaction.

Conclusion

This comprehensive Glory Sky Group review reveals substantial concerns that overshadow any potential benefits the broker might offer. While the platform provides access to diverse asset classes including forex, securities, futures, and precious metals, the negative user feedback, extremely poor industry ratings, and withdrawal-related complaints create significant red flags for potential traders. The WikiFX Score of 1 out of 10 and multiple fraud allegations represent serious credibility issues. These cannot be overlooked.

The broker is not recommended for traders who prioritize security, regulatory compliance, and reliable fund access. The absence of clear regulatory information, combined with persistent user complaints about withdrawal difficulties and poor customer service, suggests substantial operational deficiencies. These could put trader funds and interests at risk.