Regarding the legitimacy of Glory Sky Group forex brokers, it provides HKGX, SFC and WikiBit, (also has a graphic survey regarding security).

Is Glory Sky Group safe?

Business

License

Is Glory Sky Group markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

東協發展有限公司

Effective Date: Change Record

2018-08-01Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.euniteddevelopment.comExpiration Time:

--Address of Licensed Institution:

香港灣仔灣仔道133號卓凌中心13樓13A室Phone Number of Licensed Institution:

39000303Licensed Institution Certified Documents:

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Nerico Brothers Limited

Effective Date:

2004-08-02Email Address of Licensed Institution:

pwan@nericobrothers.comSharing Status:

No SharingWebsite of Licensed Institution:

www.nericobrothers.comExpiration Time:

--Address of Licensed Institution:

Room 713, 7/F, Grand Millennium Plaza, 181 Queen's Road Central, Hong Kong, Hong KongPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Glory Sky Group Safe or Scam?

Introduction

Glory Sky Group is a Hong Kong-based forex broker that has positioned itself within the competitive landscape of the foreign exchange market since its establishment in 2017. As with any financial institution, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with a broker. This is particularly important in the forex market, where the risk of fraud and mismanagement can lead to significant financial losses. In this article, we will investigate the legitimacy and safety of Glory Sky Group using a structured evaluation framework that encompasses regulatory compliance, company background, trading conditions, customer safety, user experiences, platform performance, and an overall risk assessment.

Regulation and Legitimacy

The regulatory environment is a cornerstone of any broker's credibility. Glory Sky Group claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong and the Chinese Gold & Silver Exchange Society (CGSE). However, there are serious concerns regarding the authenticity of these claims, as many sources categorize them as “suspicious clones.” The table below summarizes the core regulatory information for Glory Sky Group:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | AGK 862 | Hong Kong | Suspicious Clone |

| CGSE | 191 | Hong Kong | Suspicious Clone |

The absence of a valid regulatory license raises significant red flags for potential investors. A broker‘s regulatory status is critical, as it indicates adherence to financial laws and protections for clients. In this case, the dubious nature of Glory Sky Group’s claimed licenses suggests a lack of regulatory oversight, which is a serious concern for traders considering their services. Furthermore, the brokers website has been reported as dysfunctional, further complicating the verification of its legitimacy and compliance history.

Company Background Investigation

Glory Sky Group was founded in 2017 and has since aimed to provide a range of financial services, including forex trading, securities, and investment management. However, the company's background raises questions about its transparency and operational history. The management team‘s qualifications and professional experience are crucial indicators of a broker’s reliability. Unfortunately, detailed information regarding the backgrounds of the executives at Glory Sky Group is scarce, which could imply a lack of transparency.

In terms of ownership structure, the company operates under the name "Glory Sky Global Markets Limited," but further details about its shareholders or corporate governance are not readily available. The limited information available may deter potential investors who prioritize transparency and accountability in their trading relationships. A broker that lacks clear disclosure of its ownership and management is often viewed with skepticism, particularly in an industry where trust is paramount.

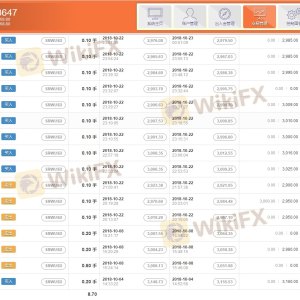

Trading Conditions Analysis

When evaluating a broker, understanding their trading conditions is essential. Glory Sky Group offers a variety of trading instruments, including forex, commodities, and precious metals. However, the specifics of their fee structure remain ambiguous, which could lead to unexpected costs for traders. Below is a comparison of key trading costs:

| Cost Type | Glory Sky Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Structure | Not Disclosed | Varies by broker |

| Overnight Interest Range | Not Disclosed | Varies by broker |

The lack of transparency in fee disclosures is concerning. Traders may find themselves facing hidden fees or unfavorable trading conditions that could impact their profitability. Moreover, the absence of a clearly defined commission model or spread rates raises questions about the broker's integrity. It is critical for traders to have a clear understanding of all potential costs associated with their trading activities to avoid unwarranted losses.

Customer Funds Security

The security of client funds is a paramount concern for any trader. Glory Sky Group claims to implement measures for fund safety, but specific details regarding fund segregation, investor protection, and negative balance protection are not readily available. A detailed analysis of these aspects is crucial:

- Fund Segregation: It is essential that client funds are kept separate from the broker's operational funds to ensure that they are not used for any other purposes.

- Investor Protection: Regulatory bodies often provide some form of compensation scheme for clients in the event of broker insolvency. The absence of such protection raises concerns.

- Negative Balance Protection: This policy ensures that clients cannot lose more than their deposited funds, a critical feature for risk management.

Without clear policies in these areas, potential investors face significant risks regarding the safety of their capital. Historical issues related to fund security or disputes involving client withdrawals have been reported, further exacerbating concerns about the broker's reliability.

Customer Experience and Complaints

Customer feedback serves as a vital indicator of a broker's performance and reliability. In the case of Glory Sky Group, user experiences have been mixed, with several complaints surfacing regarding withdrawal issues and overall service quality. The following table summarizes the main types of complaints:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Account Freezing | Medium | Lack of communication |

| Misleading Promotions | High | No resolution provided |

Typical complaints include difficulties in withdrawing funds and unresponsive customer service. One notable case involved a trader who reported being unable to access their funds after a series of successful trades, leading to frustration and financial loss. Such experiences highlight the importance of assessing a broker's customer service and responsiveness to issues.

Platform and Execution

The trading platform is a critical component of the trading experience. Glory Sky Group's platform has been described as unstable, with reports of slippage and order rejections. These issues can significantly affect trading outcomes, especially in a fast-paced market. Traders expect reliable execution without delays or manipulations, and any signs of platform instability can deter potential clients.

Risk Assessment

Engaging with Glory Sky Group presents several risks that traders should carefully consider. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unverified licenses and clones |

| Financial Risk | High | Lack of transparency in fees |

| Operational Risk | Medium | Platform instability and complaints |

To mitigate these risks, potential traders should conduct thorough research, seek regulated alternatives, and remain vigilant about the broker's practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that Glory Sky Group raises numerous red flags regarding its legitimacy and safety. The lack of verified regulatory oversight, coupled with customer complaints and unclear trading conditions, indicates that potential investors should approach this broker with caution. It is essential for traders to prioritize working with regulated and transparent brokers to ensure a safer trading experience.

For those considering entering the forex market, it is advisable to explore alternative brokers that are well-regulated and have a proven track record of reliability. Such brokers typically offer clear fee structures, robust customer service, and comprehensive fund protection policies, ensuring a more secure trading environment. Always remember to conduct thorough due diligence before making any financial commitments in the forex market.

Is Glory Sky Group a scam, or is it legit?

The latest exposure and evaluation content of Glory Sky Group brokers.

Glory Sky Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Glory Sky Group latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.