Paxton Trade 2025 Review: Everything You Need to Know

Executive Summary

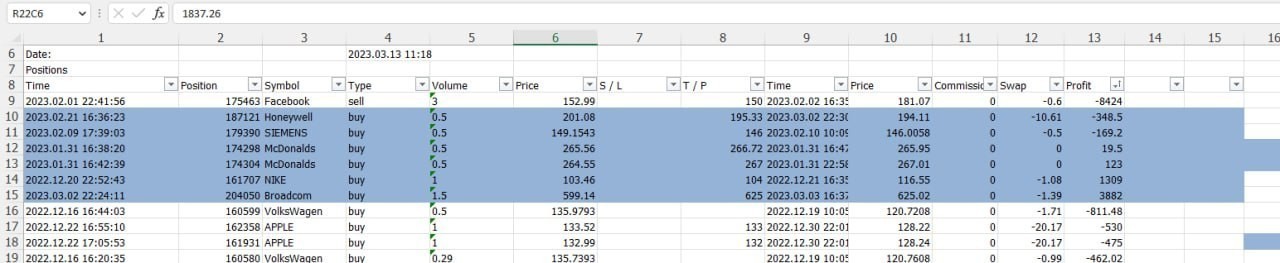

This Paxton Trade review looks at a controversial forex broker that has attracted significant attention within the trading community. Based on available information and user feedback, Paxton Trade presents itself as an international brokerage company headquartered in Mauritius, offering forex and CFD trading services to clients worldwide. However, many traders have raised serious concerns about the broker's legitimacy and how it operates.

The broker offers several notable features including leverage up to 500:1 and support for multiple financial instruments through the MetaTrader 4 platform. With a minimum deposit requirement of $100, Paxton Trade appears to target traders seeking high-leverage opportunities in the financial markets. However, the lack of clear regulatory information and mostly negative user reviews suggest potential risks that traders should carefully consider before investing.

The platform supports various asset classes including forex pairs, indices, stocks, commodities, and precious metals for trading. Despite these offerings, user feedback consistently highlights issues with customer service quality, platform stability, and overall trading experience that may disappoint users. This review aims to provide a comprehensive analysis to help traders make informed decisions about whether Paxton Trade aligns with their trading needs and risk tolerance levels.

Important Notice

Regional Entity Differences: Paxton Trade operates from Mauritius, and traders should be aware that regulatory frameworks may vary significantly across different jurisdictions. The absence of clear regulatory oversight in major financial centers may impact the level of trader protection available to clients. Users should carefully verify the regulatory status applicable to their region before engaging with this broker for any trading activities.

Review Methodology: This evaluation is based on available public information, user feedback, and industry reports from various sources. Given the limited transparency from the broker itself, some information may be incomplete or require verification from additional sources before making trading decisions.

Rating Overview

Broker Overview

Paxton Trade positions itself as an international forex and CFD broker, though specific details about its founding date and company history remain unclear from available sources. The company operates from Mauritius and claims to provide trading services to clients globally through online platforms. According to available information, the broker focuses on offering access to various financial markets through online trading platforms that support multiple asset classes.

The broker's business model centers around providing retail traders with access to foreign exchange markets and contracts for difference across multiple asset classes. Paxton Trade utilizes the widely recognized MetaTrader 4 platform as its primary trading interface, which suggests an attempt to provide familiar tools to traders who are already experienced with this software. The company offers leverage ratios up to 500:1, positioning itself toward traders seeking higher risk-reward opportunities in volatile markets. However, the lack of comprehensive information about the company's background and regulatory standing has contributed to skepticism within the trading community regarding its overall legitimacy and operational transparency standards.

Key Trading Details

Regulatory Status: Specific regulatory information is not detailed in available sources, which raises significant concerns about trader protection and oversight.

Deposit and Withdrawal Methods: Detailed information about funding options is not comprehensively available in current sources from the broker.

Minimum Deposit: The broker requires a minimum deposit of $100, which is relatively accessible for new traders starting their journey.

Bonuses and Promotions: Specific promotional offers are not detailed in available sources from the company.

Tradable Assets: The platform supports forex pairs, CFDs on indices, stocks, commodities, and precious metals, providing a diverse range of trading opportunities for users.

Cost Structure: Specific information about spreads and commission structures is not detailed in available sources from Paxton Trade.

Leverage Ratios: Maximum leverage of 500:1 is offered, which represents high-risk trading conditions that can amplify both profits and losses.

Platform Options: MetaTrader 4 serves as the primary trading platform for all client activities.

Geographic Restrictions: Specific regional limitations are not detailed in available sources from the broker.

Customer Support Languages: Language support details are not specified in available sources from the company.

This comprehensive Paxton Trade review reveals significant gaps in available information, which itself raises concerns about the broker's transparency with potential clients.

Detailed Analysis

Account Conditions Analysis

The account structure at Paxton Trade appears relatively straightforward, though detailed information about different account types and their specific features is not comprehensively available from official sources. The $100 minimum deposit requirement positions the broker as accessible to retail traders with modest starting capital, which compares favorably to some competitors requiring higher initial investments for account opening.

However, the lack of detailed information about account tiers, special features, or premium account benefits suggests limited sophistication in the broker's offering structure. User feedback indicates mixed experiences with account setup and management processes, with some traders reporting difficulties in account verification and funding procedures that can delay trading activities. The absence of information about Islamic accounts, professional trading accounts, or other specialized account types may limit the broker's appeal to diverse trader demographics seeking specific features.

Additionally, the lack of transparency regarding account terms and conditions has contributed to user skepticism about the overall account management experience. Based on available information and user feedback, the account conditions receive a moderate rating, primarily due to the reasonable minimum deposit requirement offset by concerns about transparency and user experience quality. This Paxton Trade review suggests that potential clients should seek additional clarification about account terms before proceeding with any deposits.

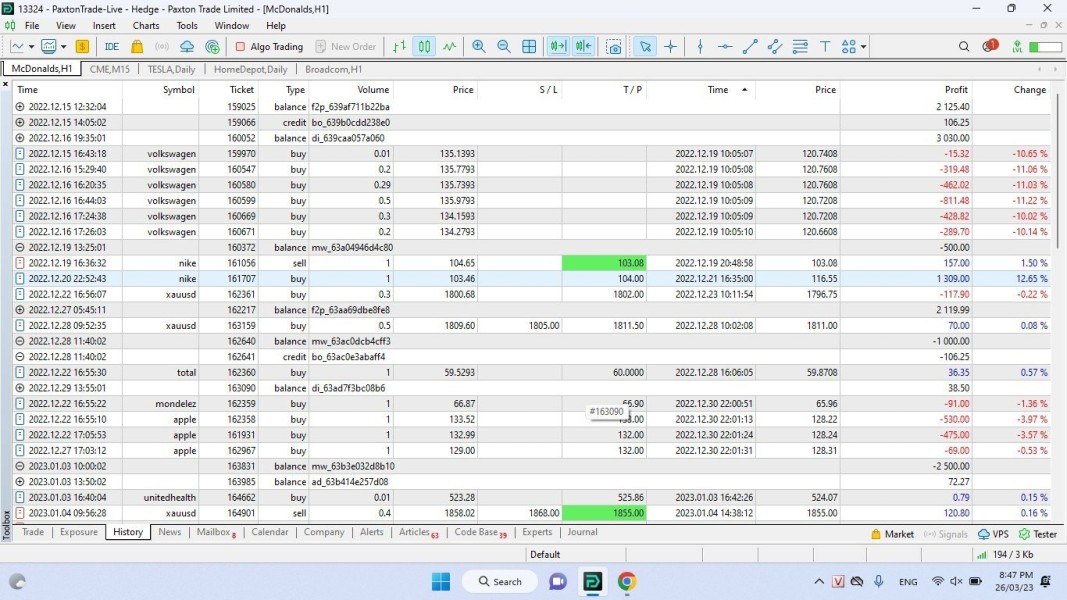

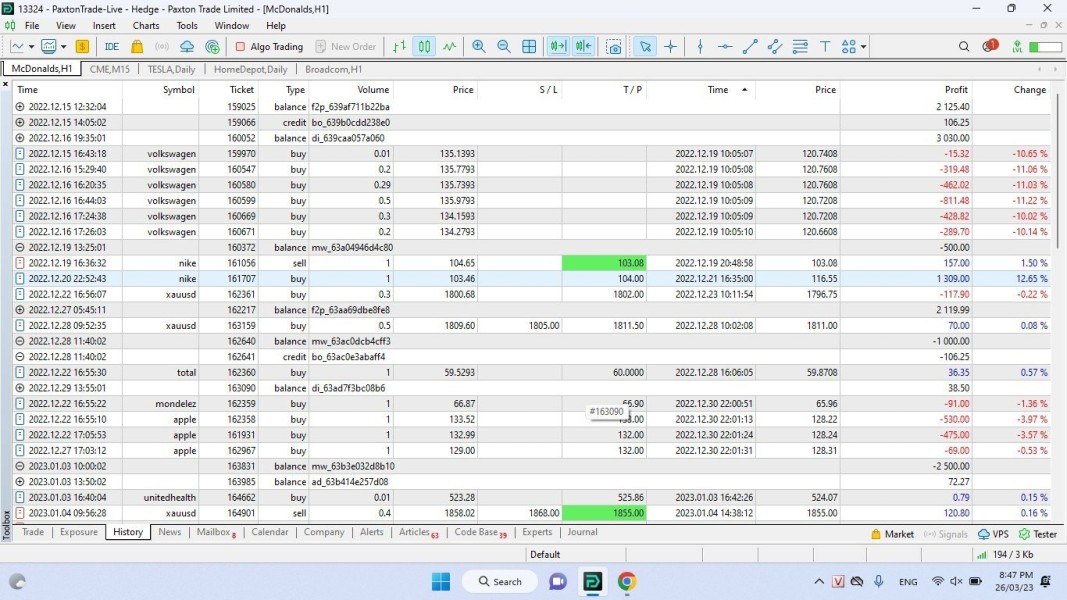

Paxton Trade utilizes MetaTrader 4 as its primary trading platform, which provides access to standard charting tools and technical analysis capabilities that most traders recognize. The MT4 platform offers familiar functionality including various timeframes, technical indicators, and basic automated trading support through Expert Advisors for strategy implementation.

The broker claims to support signal services and automated trading features, though specific details about the quality and reliability of these tools are not extensively documented. User feedback suggests that while the basic platform functionality operates adequately, advanced features and additional trading tools may be limited compared to more established brokers in the industry. Research and analysis resources appear to be minimal, with limited information available about market analysis, economic calendars, or educational materials that could help traders improve their skills.

This limitation may particularly impact newer traders who rely on broker-provided educational content and market insights to develop their trading skills. The absence of proprietary trading tools or advanced analytical resources suggests that Paxton Trade focuses on basic platform provision rather than comprehensive trading support for its clients. While the MT4 platform provides essential functionality, traders seeking sophisticated analytical tools or extensive educational resources may find the offering insufficient for their needs and trading goals.

Customer Service and Support Analysis

Customer service represents one of the most significant concerns highlighted in user feedback about Paxton Trade across multiple review platforms. Multiple reports indicate inconsistent response times and varying quality in customer support interactions that frustrate users seeking assistance.

Users have expressed frustration with difficulty reaching support representatives and receiving adequate assistance for their inquiries about trading or account issues. The specific channels available for customer support are not comprehensively detailed in available sources, though standard contact methods likely include email and potentially phone support during business hours. However, user experiences suggest that response times can be lengthy and resolution of issues may be inadequate for urgent trading concerns.

Language support capabilities are not clearly specified, which may pose challenges for international clients seeking assistance in their preferred languages. The lack of comprehensive support documentation or FAQ resources appears to compound customer service challenges for users trying to resolve issues independently. Several user reports indicate difficulties in resolving account-related issues, withdrawal concerns, and technical problems that impact their trading activities.

The overall customer service experience appears to fall short of industry standards, contributing to negative user sentiment about the broker. These service quality concerns represent a significant factor in the overall evaluation of Paxton Trade's suitability for traders who value responsive customer support when problems arise.

Trading Experience Analysis

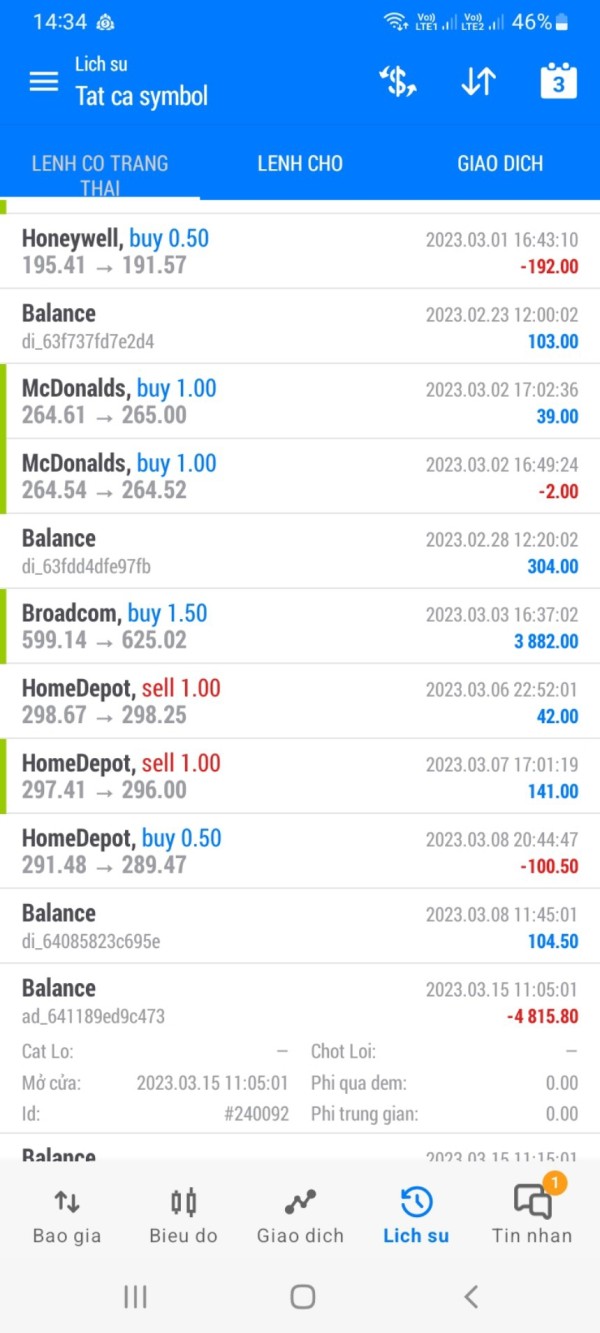

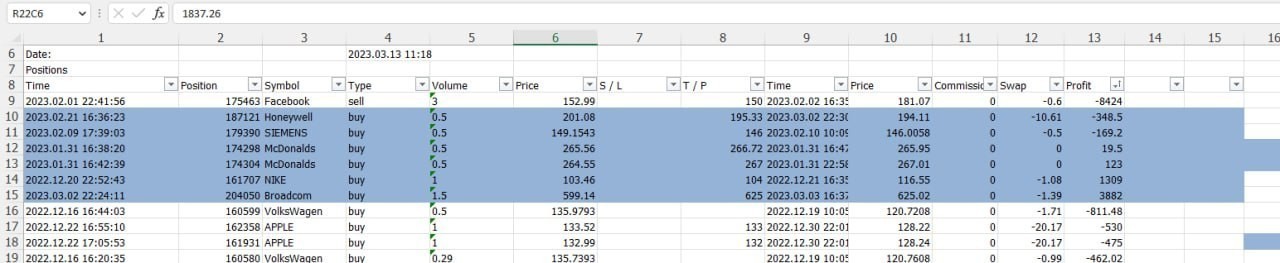

The trading experience at Paxton Trade centers around the MetaTrader 4 platform, which provides basic functionality for forex and CFD trading across multiple asset classes. However, user feedback reveals concerns about platform stability and execution quality that impact the overall trading environment for active traders.

Reports from users suggest occasional platform connectivity issues and concerns about order execution speed during volatile market conditions when quick trades are essential. While MT4 is generally considered a reliable platform, the broker's implementation and server quality appear to affect performance consistency in ways that may frustrate traders. The high leverage ratio of 500:1 may appeal to traders seeking amplified market exposure, though this also significantly increases risk levels that could lead to substantial losses.

Specific information about execution quality, slippage rates, and order fill statistics is not readily available, making it difficult to assess the true trading environment quality. Mobile trading capabilities through MT4 mobile applications are presumably available, though user feedback about mobile platform performance is limited in available reviews. The lack of detailed information about execution statistics, average spreads during different market conditions, and platform uptime percentages contributes to uncertainty about the overall trading experience quality.

This Paxton Trade review indicates that while basic trading functionality is available, concerns about reliability and execution quality may impact trader satisfaction, particularly for active traders requiring consistent platform performance.

Trust and Reliability Analysis

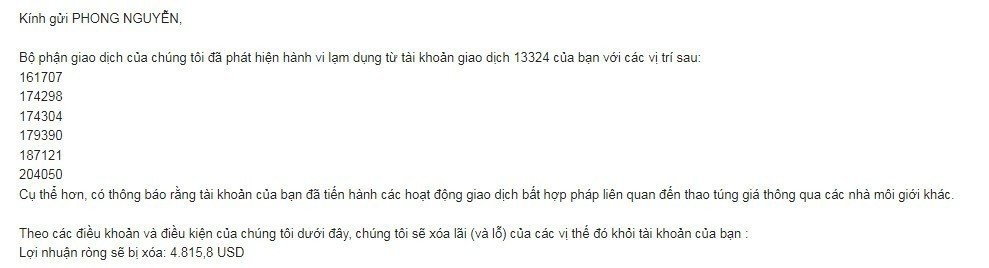

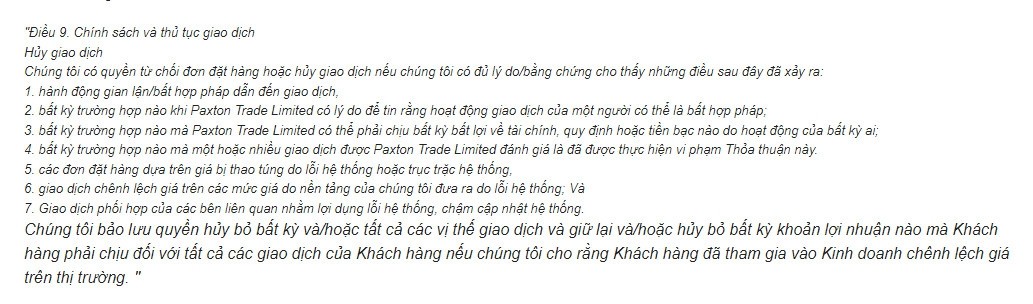

Trust and reliability represent the most significant concerns in this evaluation of Paxton Trade as a legitimate trading partner. The absence of clear regulatory oversight from major financial authorities raises fundamental questions about trader protection and fund security that should concern potential clients.

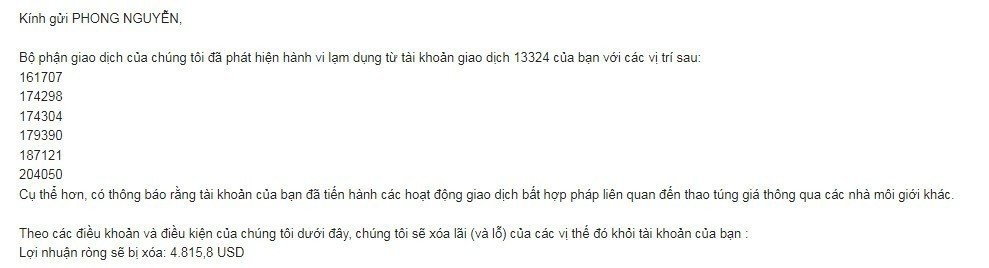

Without proper regulatory licensing, traders lack the safeguards typically provided by established financial regulators in major jurisdictions. User feedback consistently highlights concerns about the broker's legitimacy, with multiple reports questioning whether Paxton Trade operates as a legitimate brokerage or potentially represents fraudulent activity that could harm investors. These concerns are compounded by limited transparency about company ownership, financial backing, and operational procedures that legitimate brokers typically disclose.

The lack of information about client fund segregation, deposit protection schemes, or regulatory compliance measures further undermines confidence in the broker's reliability. Established brokers typically provide detailed information about fund security measures and regulatory compliance, while Paxton Trade's limited transparency in these areas raises red flags for potential clients. Industry reputation appears to be poor, with various online sources and user communities expressing skepticism about the broker's operations and business practices.

The combination of regulatory uncertainty, negative user feedback, and limited operational transparency creates a concerning profile from a trust perspective. These factors collectively suggest significant risks for potential clients, particularly regarding fund security and the broker's long-term operational viability in the competitive forex market.

User Experience Analysis

Overall user satisfaction with Paxton Trade appears to be notably poor based on available feedback and reviews from multiple sources. Users consistently report negative experiences across multiple aspects of the service, from initial account setup through ongoing trading activities and customer support interactions.

Interface design and usability receive mixed feedback, largely dependent on users' familiarity with the MT4 platform rather than broker-specific enhancements. The lack of proprietary platform features or user experience improvements suggests minimal investment in client-facing technology development that could differentiate the broker from competitors. Registration and verification processes reportedly present challenges for some users, with complaints about lengthy verification times and unclear documentation requirements that delay account activation.

These procedural issues contribute to frustration during the initial client onboarding experience when users are eager to start trading. Common user complaints center around customer service responsiveness, withdrawal difficulties, and concerns about fund security that affect their confidence in the broker. The prevalence of negative feedback across multiple review platforms suggests systemic issues rather than isolated incidents that might be expected with any financial service provider.

The user demographic appears to include traders attracted by high leverage offerings, though many subsequently report disappointment with the overall service quality. User retention appears to be poor, with many traders seeking alternative brokers after negative experiences that fail to meet their expectations. Based on available feedback, the user experience falls significantly below industry standards, with widespread dissatisfaction across multiple service areas contributing to poor overall ratings.

Conclusion

This comprehensive Paxton Trade review reveals a broker with significant concerns that potential traders should carefully consider before making any investment decisions. While the platform offers some attractive features such as high leverage ratios and access to multiple asset classes through the familiar MT4 platform, these benefits are overshadowed by substantial risks and limitations that could harm traders.

The most suitable users for Paxton Trade would be high-risk tolerance traders specifically seeking maximum leverage opportunities, though even this demographic should exercise extreme caution given the regulatory and reliability concerns identified in this analysis. The main advantages include the low $100 minimum deposit requirement, high leverage up to 500:1, and access to diverse financial instruments for trading various markets. However, these benefits are significantly outweighed by critical disadvantages including the absence of clear regulatory oversight, predominantly negative user feedback, poor customer service quality, and serious concerns about the broker's legitimacy and operational transparency standards.

Given the substantial risks identified in this evaluation, traders are strongly advised to consider well-regulated alternatives with established track records and positive user feedback before engaging with Paxton Trade for any trading activities.