Direct TT 2025 Review: Everything You Need to Know

Executive Summary

Direct TT operates under the full name Direct Trading Technologies, also known as GlobalDTT. The company presents itself as a global leader in the forex industry with operations spanning six countries. This direct tt review reveals a mixed picture of an offshore broker that has been in operation for 19 years. The broker offers multiple trading platforms including MetaTrader 4, MetaTrader 5, and Trading Station Web. Direct TT is regulated by the Vanuatu Financial Services Commission, which provides basic regulatory oversight. However, this may not offer the same level of protection as top-tier regulators.

The platform supports diverse asset classes. These include forex, CFDs, energy commodities, indices, precious metals, and cryptocurrencies like Bitcoin. Our analysis reveals significant concerns regarding transparency in trading conditions, account specifications, and limited user feedback. With a notably low user rating of 2.53, Direct TT appears to struggle with client satisfaction despite its claimed global presence and comprehensive service offerings.

This broker may appeal to traders seeking access to multiple trading platforms and diverse asset classes. However, potential clients should carefully consider the limited transparency and mixed reputation before committing funds.

Important Disclaimers

Direct TT operates across multiple jurisdictions. Traders should be aware that regulatory requirements and service offerings may vary significantly between different regions. The company's offshore regulatory status means that client protections may differ from those offered by brokers regulated in major financial centers.

This review is based on publicly available information and limited user feedback. Comprehensive user experiences and detailed trading conditions are not extensively documented. Therefore, potential clients should conduct additional due diligence before opening accounts.

Rating Framework

Broker Overview

Direct Trading Technologies is commonly referred to as Direct TT or GlobalDTT. The company established its presence in the forex market 19 years ago. It positions itself as a comprehensive trading solutions provider. The company claims to be a global leader in the forex industry, maintaining operations across six countries and serving an international client base.

According to available reports, Direct TT operates as an offshore broker. The company has been expanding its regulatory permissions to broaden its market reach. The broker's business model centers around providing access to multiple account types and supporting various trading instruments. These include forex pairs, contracts for difference, and emerging digital assets.

Recent developments indicate that the company has been actively seeking to expand its regulatory footprint. This suggests efforts to enhance its credibility and market access. Direct TT's platform offerings include industry-standard solutions such as MetaTrader 4 and MetaTrader 5, alongside proprietary options like Trading Station Web. The broker supports trading across multiple asset categories including traditional forex pairs, energy commodities, major indices, precious metals, and cryptocurrency products including Bitcoin.

Primary regulatory oversight comes from the Vanuatu Financial Services Commission. This provides basic regulatory framework though may not offer the comprehensive protection associated with tier-one financial regulators.

Regulatory Jurisdiction: Direct TT operates under regulation from the Vanuatu Financial Services Commission. This offshore regulatory framework provides basic oversight but may offer limited client protection compared to major financial centers.

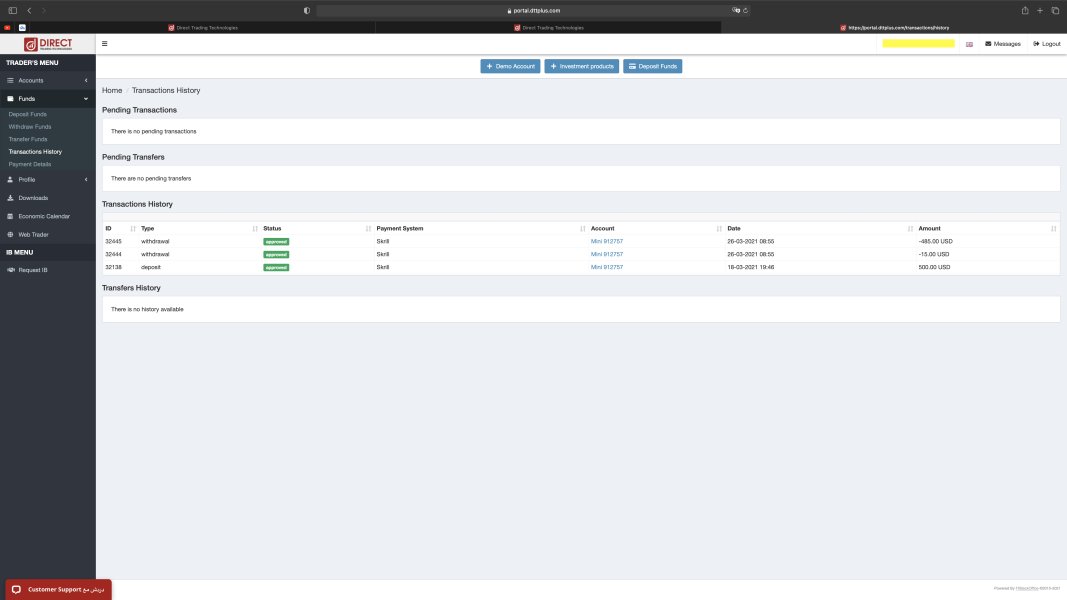

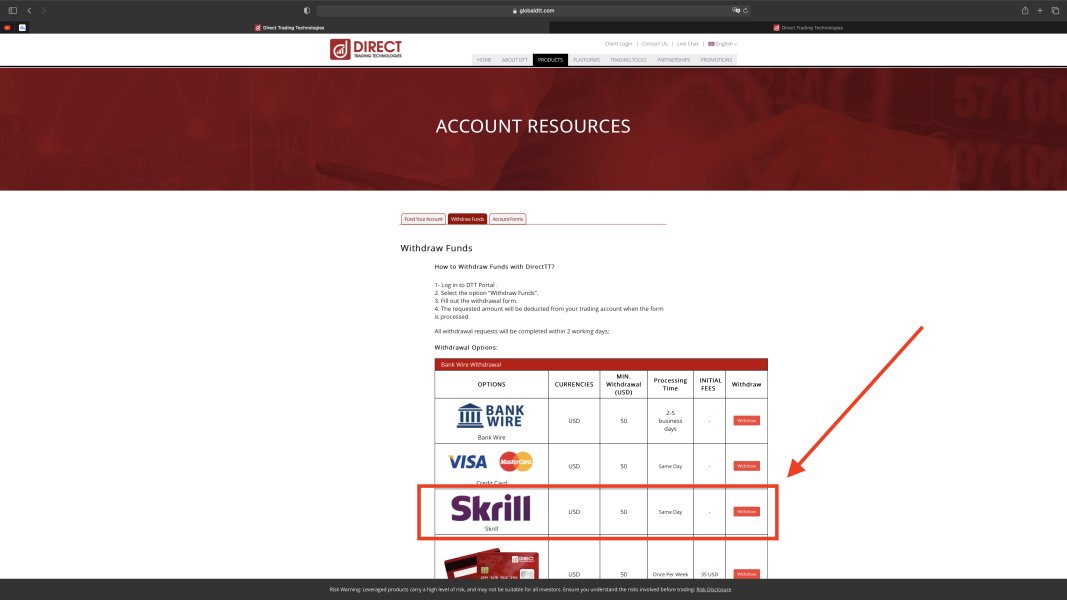

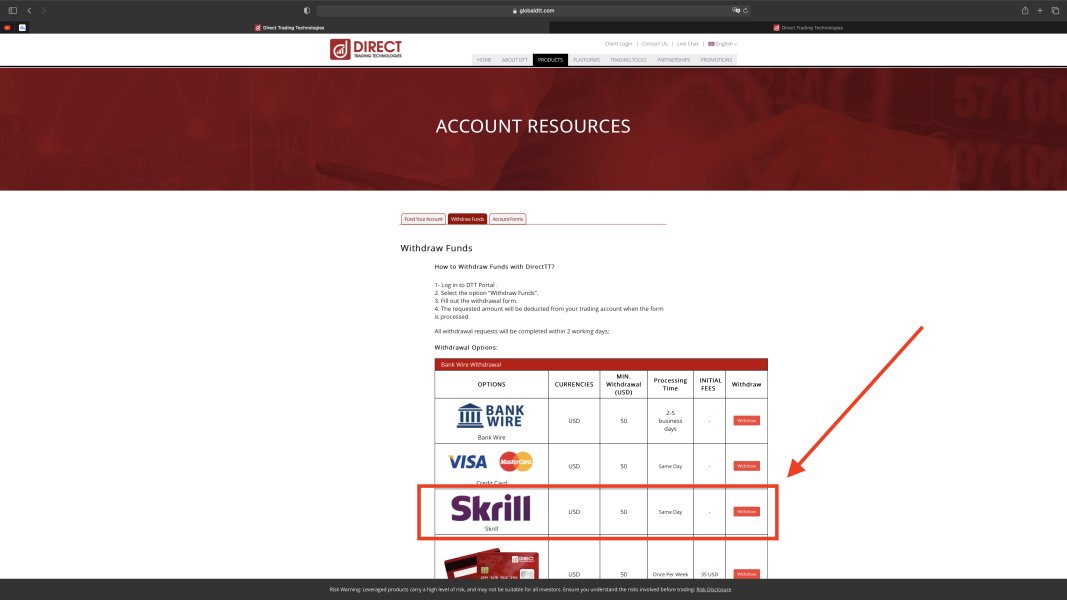

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available materials. This requires direct inquiry with the broker for comprehensive payment method information.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This indicates a need for potential clients to contact the broker directly for account opening requirements.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in available materials. This suggests limited or non-existent promotional programs.

Tradeable Assets: The platform supports a comprehensive range of trading instruments. These include major and minor forex pairs, energy commodities, stock indices, precious metals, and cryptocurrency products with Bitcoin being specifically mentioned as available for trading.

Cost Structure: Detailed information regarding spreads, commissions, and other trading costs is not readily available in public materials. This represents a significant transparency gap for potential clients in this direct tt review.

Leverage Ratios: Specific leverage offerings are not documented in available materials. This requires direct broker contact for leverage information.

Platform Options: Direct TT provides access to MetaTrader 4, MetaTrader 5, and Trading Station Web platforms. These offer clients multiple interface options for their trading activities.

Geographic Restrictions: Specific geographic limitations or restricted territories are not detailed in available documentation.

Customer Service Languages: Available customer service languages are not specified in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions evaluation for Direct TT reveals significant transparency issues. These impact the overall assessment. Available materials do not provide clear information about account types, their specific features, or the requirements for different account tiers. This lack of transparency makes it difficult for potential clients to make informed decisions about which account structure might best suit their trading needs.

Minimum deposit requirements remain unspecified across all available documentation. This creates uncertainty for traders attempting to budget for account opening. The absence of clear deposit thresholds suggests either very flexible requirements or a lack of standardized account structures. Additionally, the account opening process details are not readily available, potentially indicating a complex or non-standardized onboarding procedure.

Special account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions are not mentioned in available materials. This represents a significant gap for Muslim traders who require specific account configurations. The overall lack of detailed account information significantly undermines client confidence and represents a major weakness in this direct tt review.

Without clear account specifications, trading conditions, or opening procedures, potential clients face substantial uncertainty when considering Direct TT as their broker choice.

Direct TT demonstrates strength in its platform and tool offerings. The company provides access to multiple established trading platforms including MetaTrader 4, MetaTrader 5, and Trading Station Web. This variety allows traders to choose interfaces that match their experience levels and trading preferences. MT4 and MT5 are industry-standard platforms known for their reliability and extensive feature sets.

The broker supports a diverse range of trading instruments including traditional forex pairs, CFDs, energy commodities, indices, precious metals, and cryptocurrency products. This comprehensive asset coverage enables portfolio diversification and provides opportunities across multiple market sectors. The inclusion of cryptocurrency trading, specifically Bitcoin, demonstrates the broker's effort to stay current with evolving market demands.

However, specific research and analysis resources are not detailed in available materials. This potentially limits the analytical support available to traders. Educational resources, which are crucial for trader development, are also not mentioned in accessible documentation. The absence of information regarding automated trading support, expert advisors, or algorithmic trading capabilities represents another potential limitation.

While the platform variety and asset diversity are positive aspects, the lack of detailed information about additional trading tools, research resources, and educational materials prevents a higher rating in this category.

Customer Service and Support Analysis (4/10)

The customer service evaluation for Direct TT is hampered by limited available information about support channels, response times, and service quality. Available materials do not specify the customer service channels offered. These could include phone, email, live chat, or other communication methods. This lack of clarity about contact options creates uncertainty for potential clients who need to understand how they can reach support when needed.

Response time expectations are not documented. This makes it impossible to assess whether the broker provides timely support during trading hours or emergency situations. Service quality assessments from actual users are notably absent from available materials, preventing any meaningful evaluation of support effectiveness or problem resolution capabilities.

Multi-language support availability is not specified. This could be problematic for the broker's claimed international presence across six countries. Additionally, customer service hours and timezone coverage are not detailed, raising questions about support availability for global clients trading across different time zones.

The absence of user feedback regarding customer service experiences represents a significant information gap. Without testimonials, complaints, or service quality reports, potential clients cannot gauge the reliability and effectiveness of Direct TT's support infrastructure.

Trading Experience Analysis (5/10)

The trading experience assessment for Direct TT is complicated by limited specific feedback about platform performance, execution quality, and overall user satisfaction. The broker offers multiple established platforms including MT4 and MT5, which are known for their stability. However, specific performance data regarding Direct TT's implementation is not available in accessible materials.

Order execution quality, including execution speed, slippage rates, and fill quality, is not documented in available user feedback or broker specifications. This information gap makes it difficult to assess whether the broker provides competitive execution standards expected by active traders. Platform functionality completeness, while likely comprehensive given the MT4/MT5 offerings, lacks specific user verification or detailed feature descriptions.

Mobile trading experience details are not provided. This is concerning since mobile trading is crucial for modern traders who need platform access while away from desktop computers. The overall trading environment assessment is further complicated by the notably low user rating of 2.53, which suggests significant user satisfaction issues though specific complaints are not detailed.

This direct tt review finds that while the platform selection appears solid, the lack of specific performance feedback and the concerning user rating create uncertainty about the actual trading experience quality.

Trust and Reliability Analysis (6/10)

Direct TT's trust and reliability assessment centers primarily on its regulatory status under the Vanuatu Financial Services Commission. While this provides basic regulatory oversight, Vanuatu is considered an offshore jurisdiction. It may not offer the same level of client protection as major financial centers like the UK, Australia, or the European Union.

The broker's claim to be a "global leader in the forex industry" with 19 years of operation suggests some level of market experience and stability. Recent reports indicate that Direct TT has been expanding its regulatory permissions. This could be viewed as an effort to enhance its regulatory standing and market credibility.

However, specific fund safety measures such as segregated client accounts, investor compensation schemes, or insurance coverage are not detailed in available materials. This represents a significant transparency gap regarding client fund protection. Company transparency is limited, with minimal disclosure about company structure, financial backing, or operational procedures.

The absence of detailed information about negative event handling, regulatory actions, or complaint resolution procedures further impacts the trust assessment. While the basic regulatory framework provides some oversight, the limited transparency and offshore regulatory status prevent a higher trust rating.

User Experience Analysis (4/10)

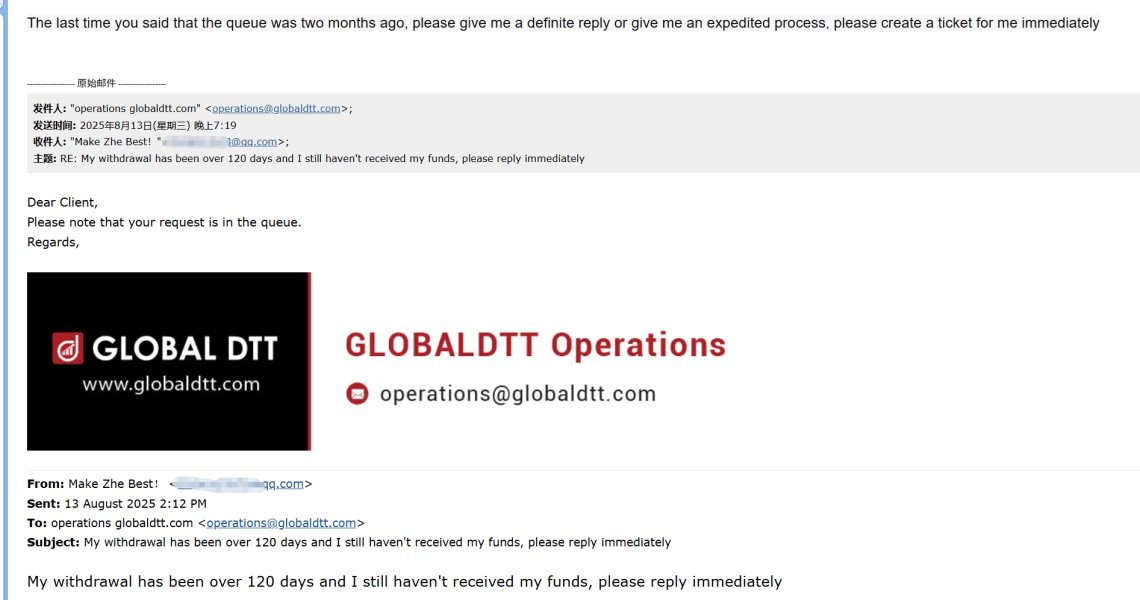

The user experience evaluation reveals concerning indicators. Most notably, the low user rating of 2.53 suggests significant satisfaction issues among Direct TT clients. This rating indicates that users have experienced problems with various aspects of the broker's services, though specific complaints and issues are not detailed in available materials.

Interface design and usability assessments are not available in accessible documentation. This makes it difficult to evaluate how user-friendly the broker's platforms and websites are for both novice and experienced traders. The registration and verification process details are not provided, creating uncertainty about the ease and speed of account opening procedures.

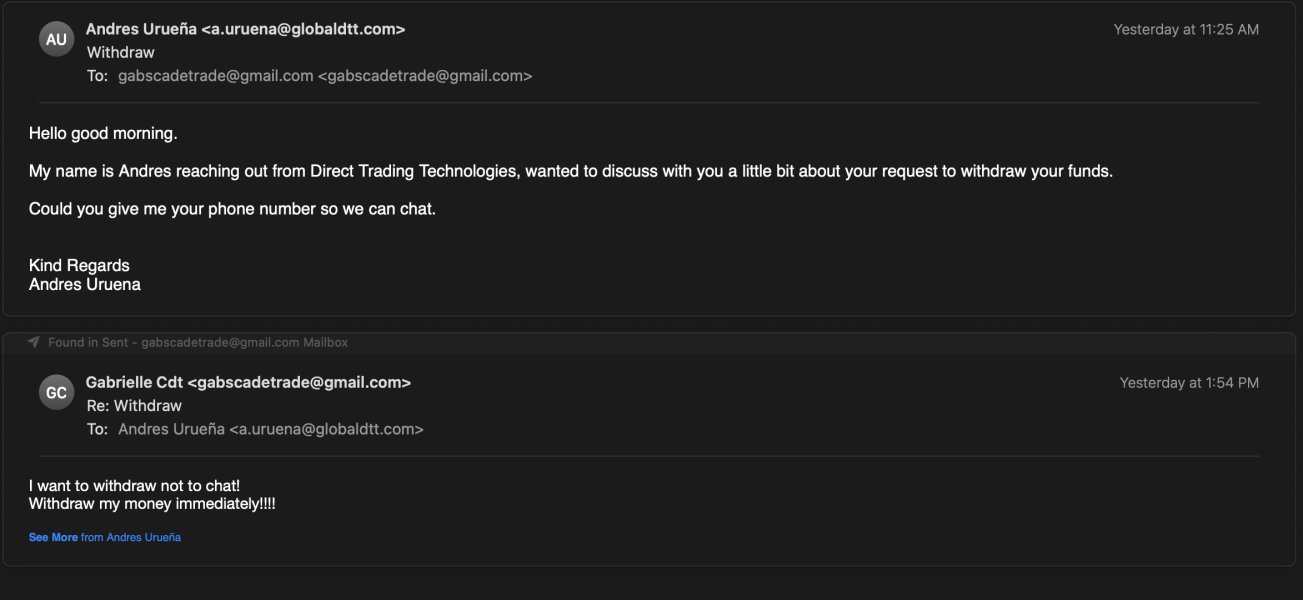

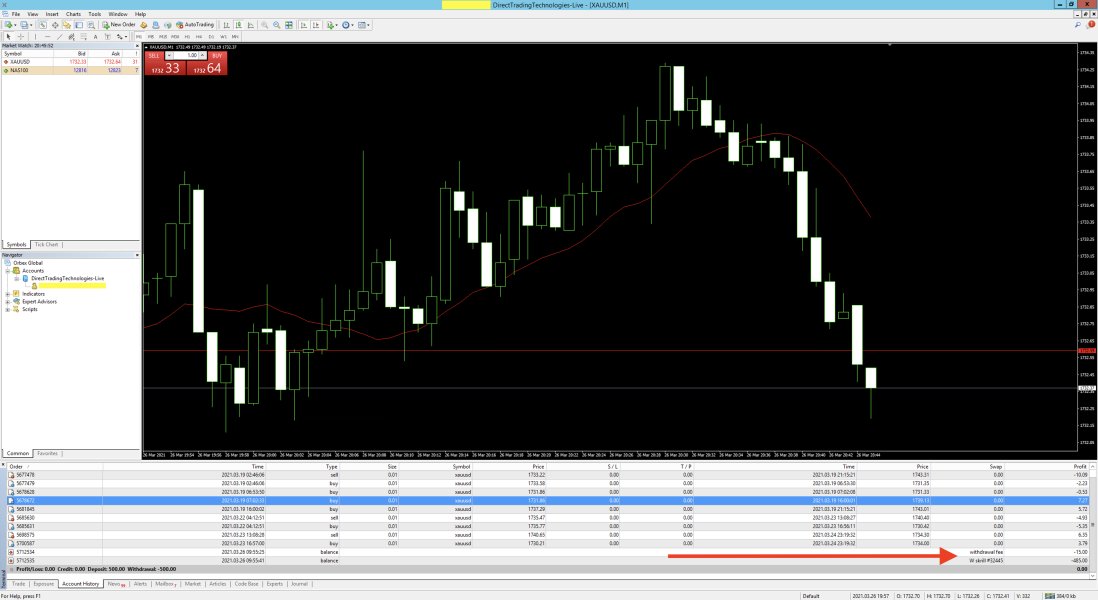

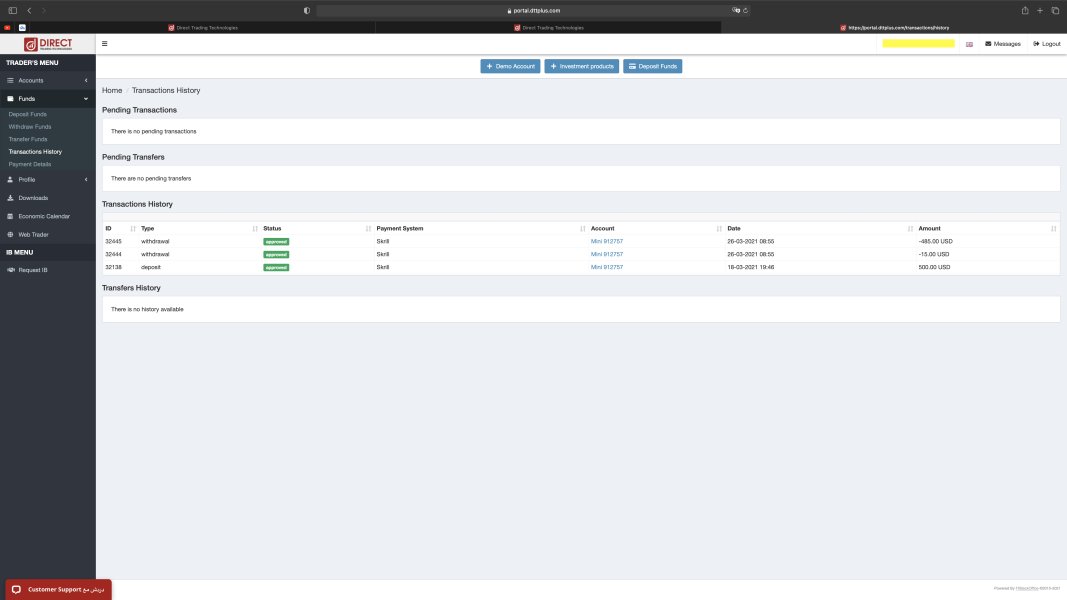

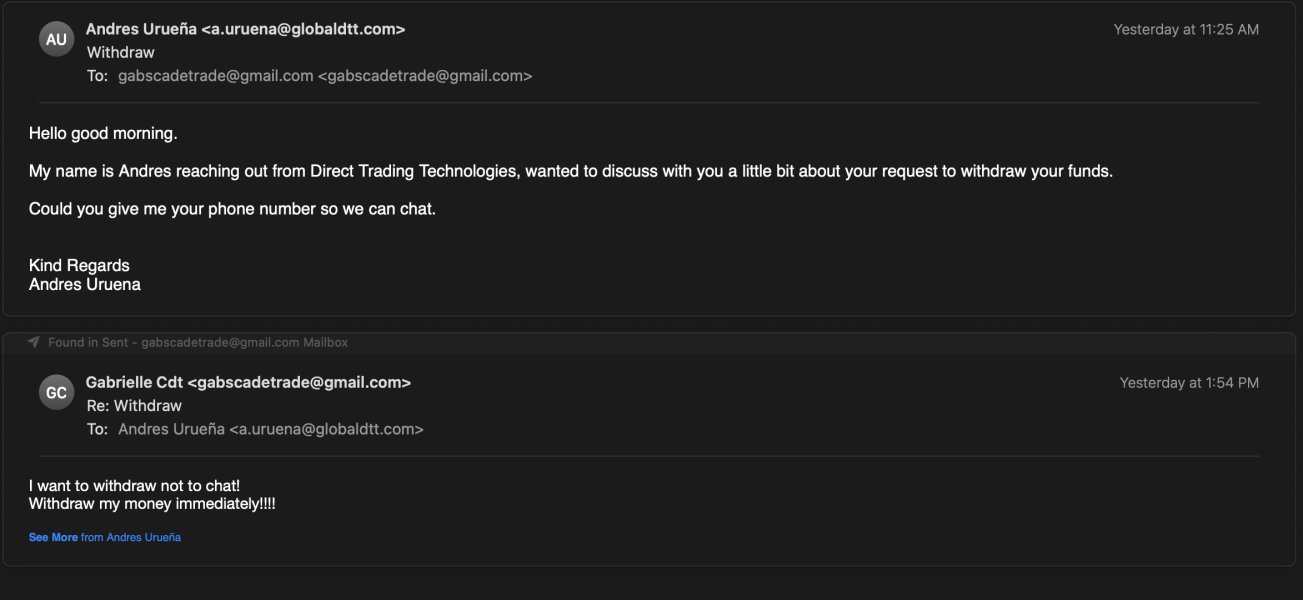

Fund operation experiences, including deposit and withdrawal processes, processing times, and associated fees, are not documented in available user feedback. This represents a crucial information gap since fund operations significantly impact overall user satisfaction. Common user complaints and recurring issues are not specified in accessible materials, preventing identification of systematic problems.

The absence of detailed user feedback makes it impossible to develop clear user profiles or understand which types of traders might be most satisfied with Direct TT's services. Without comprehensive user experience data, potential clients cannot adequately assess whether this broker would meet their specific needs and expectations.

Conclusion

This comprehensive direct tt review reveals a broker with mixed strengths and significant transparency concerns. Direct TT demonstrates competence in platform variety and asset diversity. The broker offers established trading platforms like MT4 and MT5 alongside access to multiple asset classes including forex, CFDs, and cryptocurrencies. The broker's 19-year operational history and claimed global presence across six countries suggest some level of market experience.

However, substantial weaknesses in transparency, particularly regarding account conditions, trading costs, and customer service specifications, significantly impact the overall assessment. The notably low user rating of 2.53 raises serious concerns about client satisfaction and service quality. The offshore regulatory status under Vanuatu's VFSC provides only basic oversight compared to major financial regulators.

Direct TT may appeal to traders seeking platform variety and diverse trading instruments. However, the lack of transparent pricing, unclear account conditions, and concerning user feedback suggest that potential clients should exercise considerable caution. Traders considering this broker should conduct thorough due diligence and carefully evaluate whether the limited transparency aligns with their risk tolerance and trading requirements.