Giant IFC 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive giant ifc review reveals significant concerns about this relatively new trading platform established in 2022. The platform shows serious problems that worry potential traders who want to use their services. With a WikiFX rating of just 1.36 out of 10, Giant IFC demonstrates substantial deficiencies across multiple operational areas.

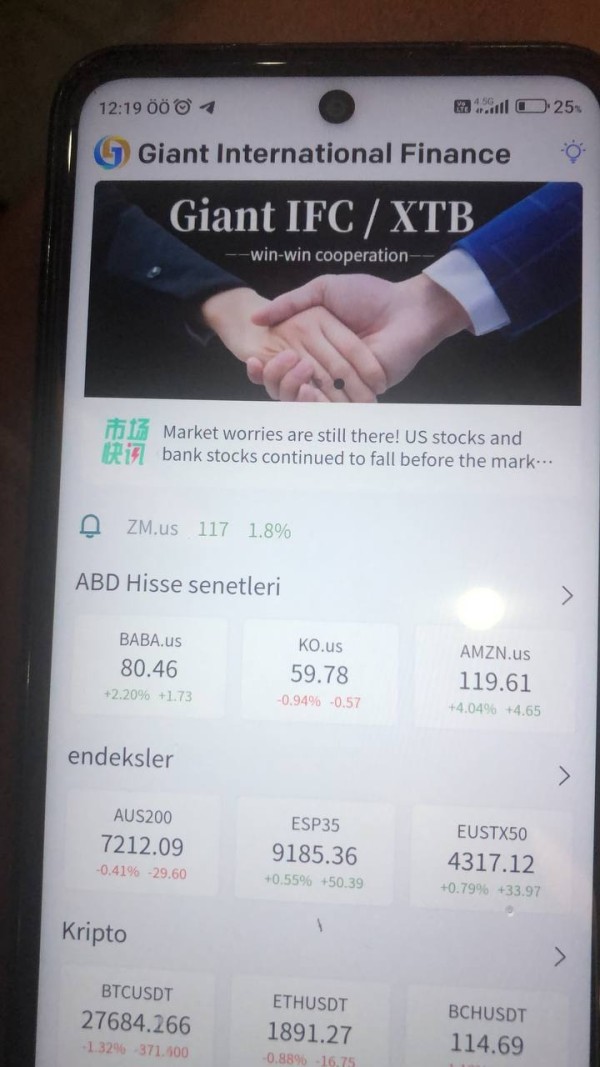

Giant IFC positions itself as a UK-based cryptocurrency-focused trading platform. The company offers multiple asset classes including forex, commodities, indices, stocks, and futures to attract different types of traders. However, the platform's lack of regulatory oversight raises serious questions about trader protection and fund security.

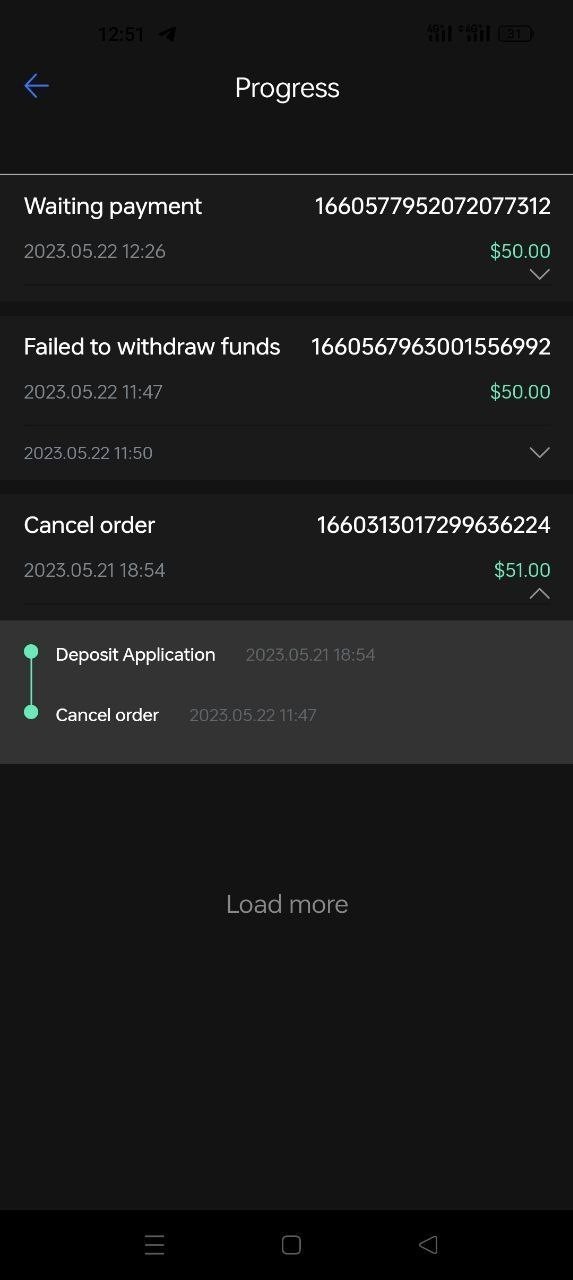

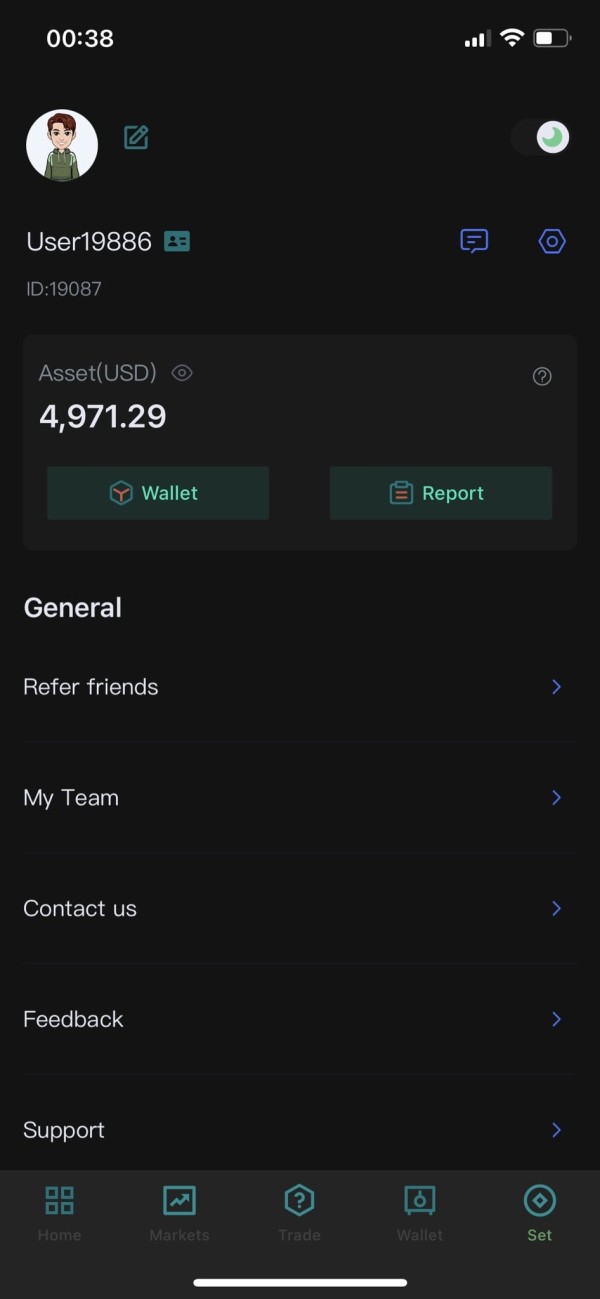

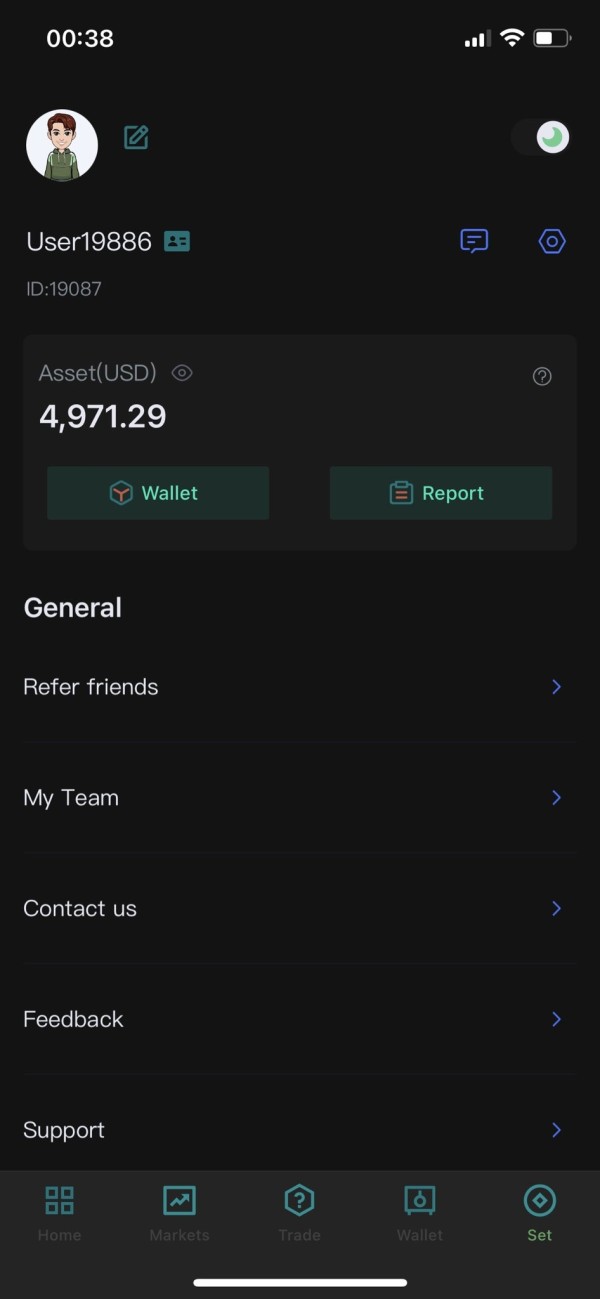

User feedback analysis shows a concerning pattern with 6 exposure reports and 6 user complaints recorded over the past three months. These negative reports significantly outweigh positive testimonials from satisfied customers. The platform appears to target traders interested in cryptocurrency-based trading activities.

The substantial risks associated with its unregulated status make it unsuitable for most retail traders. This giant ifc review strongly emphasizes the need for extreme caution when considering this platform for trading activities. Traders should carefully research all available options before making any financial commitments.

Important Notice

This evaluation is based on publicly available information and user feedback collected from various market analysis platforms. Traders should understand that regulatory requirements and platform features may vary significantly across different jurisdictions. The information presented reflects the platform's status as of 2025 and may be subject to change.

Our assessment methodology incorporates user testimonials, regulatory verification, platform feature analysis, and industry standard comparisons. This approach provides a comprehensive evaluation framework for potential users.

Rating Framework

Broker Overview

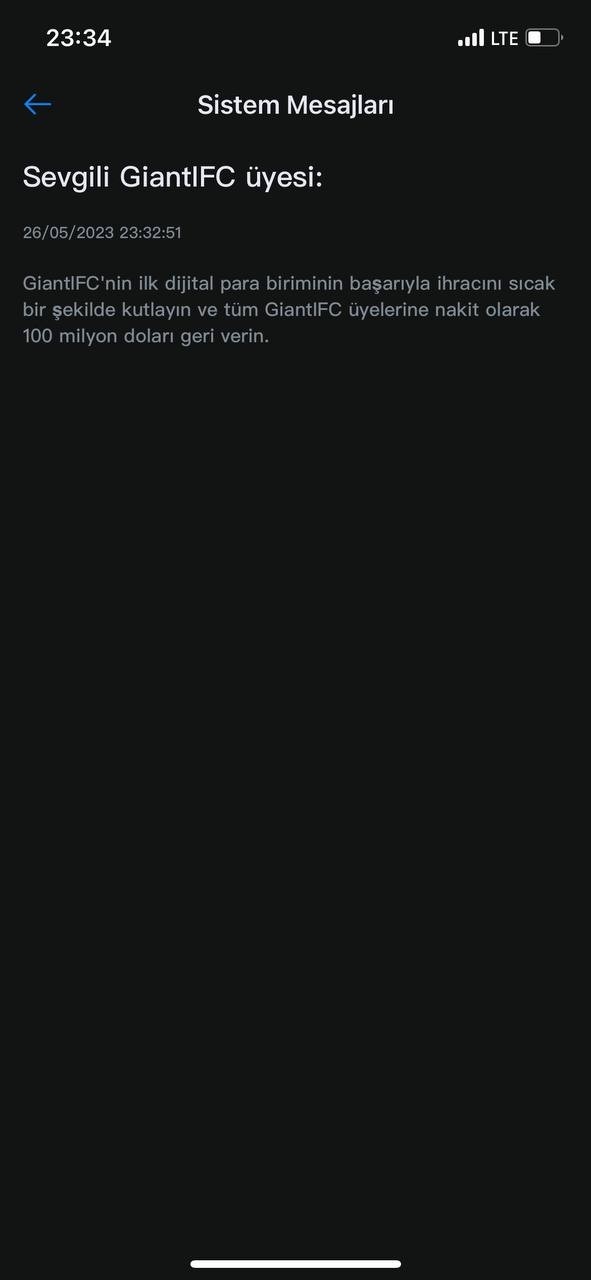

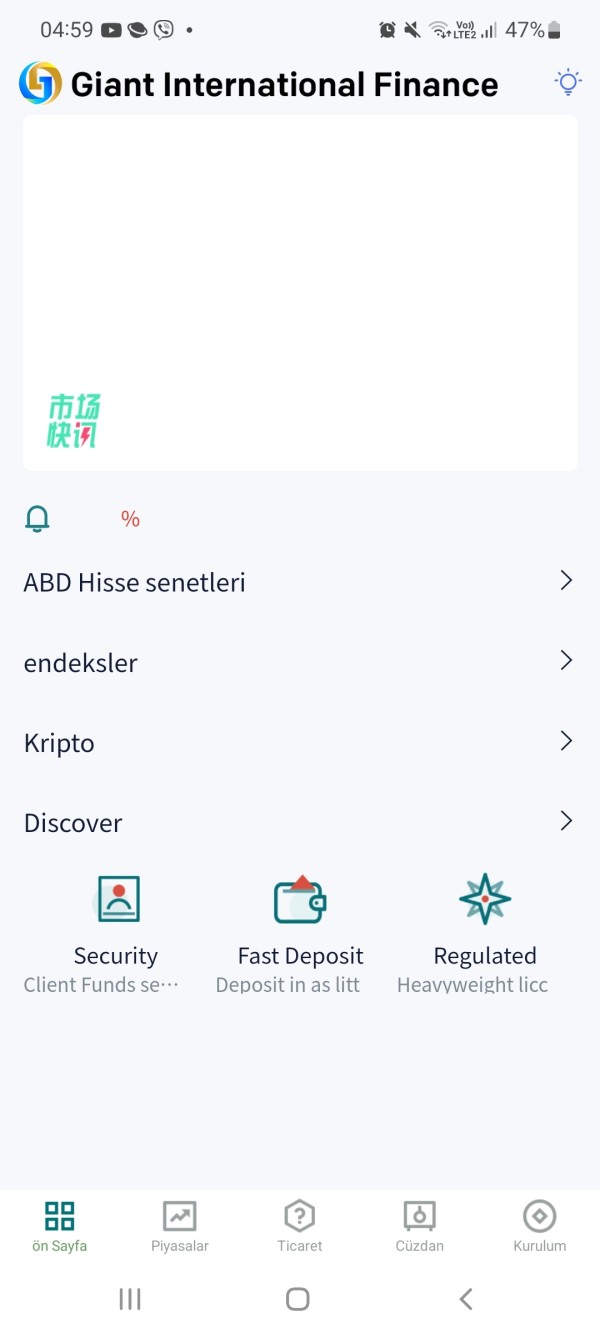

Giant IFC emerged in the trading landscape in 2022 as a UK-headquartered trading platform. The company focuses primarily on cryptocurrency-based financial services for modern traders. The platform positions itself as a modern trading solution, attempting to bridge traditional financial markets with emerging cryptocurrency technologies.

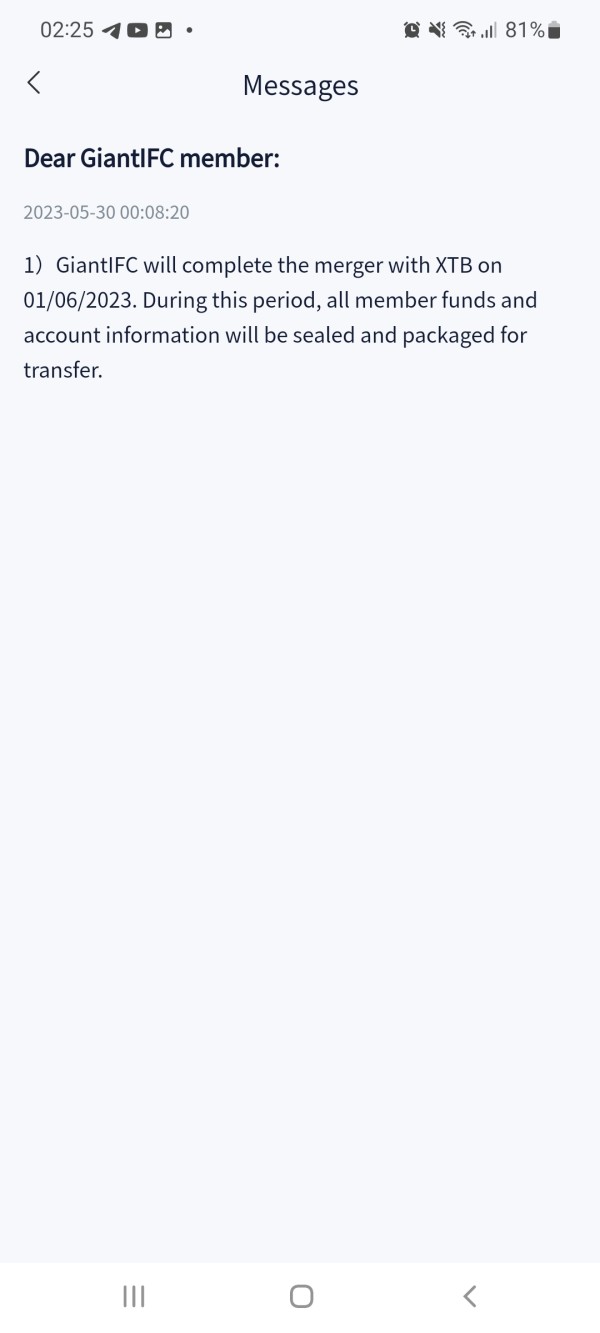

However, the platform's brief operational history and lack of established market presence raise immediate concerns. These factors create questions about its stability and long-term viability in the competitive trading market. The platform's business model centers around providing access to multiple financial instruments through what appears to be a cryptocurrency-integrated trading environment.

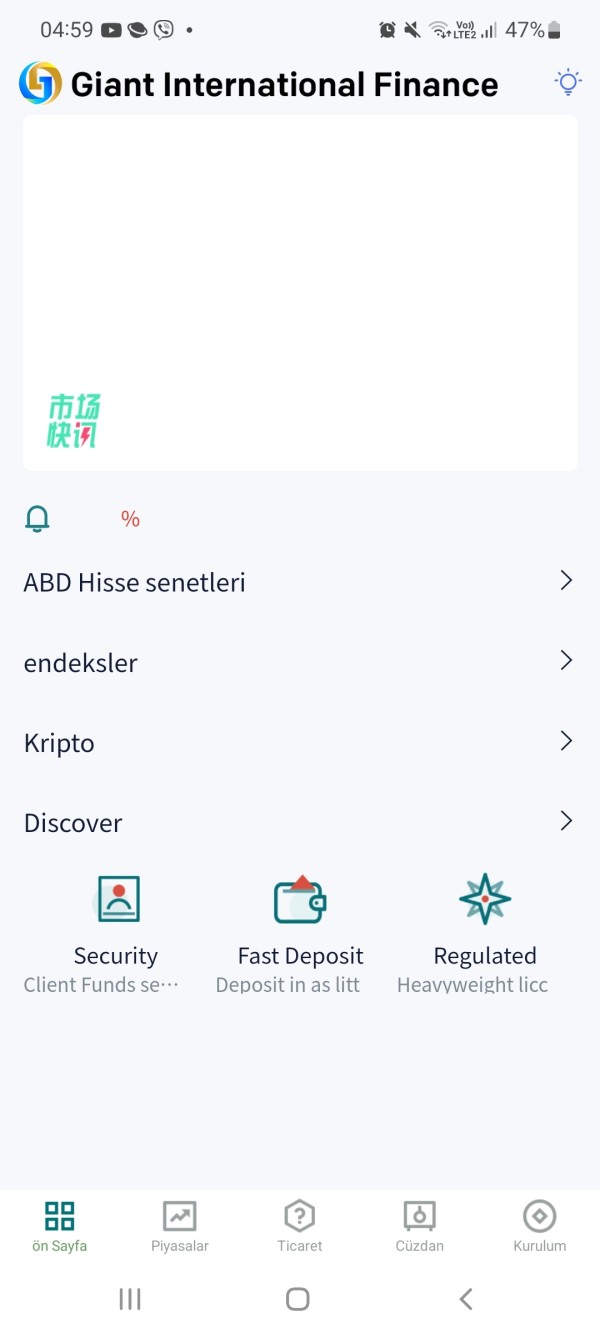

This approach targets traders seeking exposure to both traditional markets and digital assets through a single platform interface. Giant IFC offers trading access across five primary asset categories: foreign exchange pairs, commodities, major global indices, individual stocks, and futures contracts. However, the platform's operational framework lacks transparency regarding specific trading conditions, execution methods, and underlying liquidity providers.

The absence of clear regulatory oversight compounds these concerns, as traders cannot verify the platform's compliance with established financial service standards. This giant ifc review emphasizes that the platform's unregulated status represents a fundamental risk factor that potential users must carefully consider.

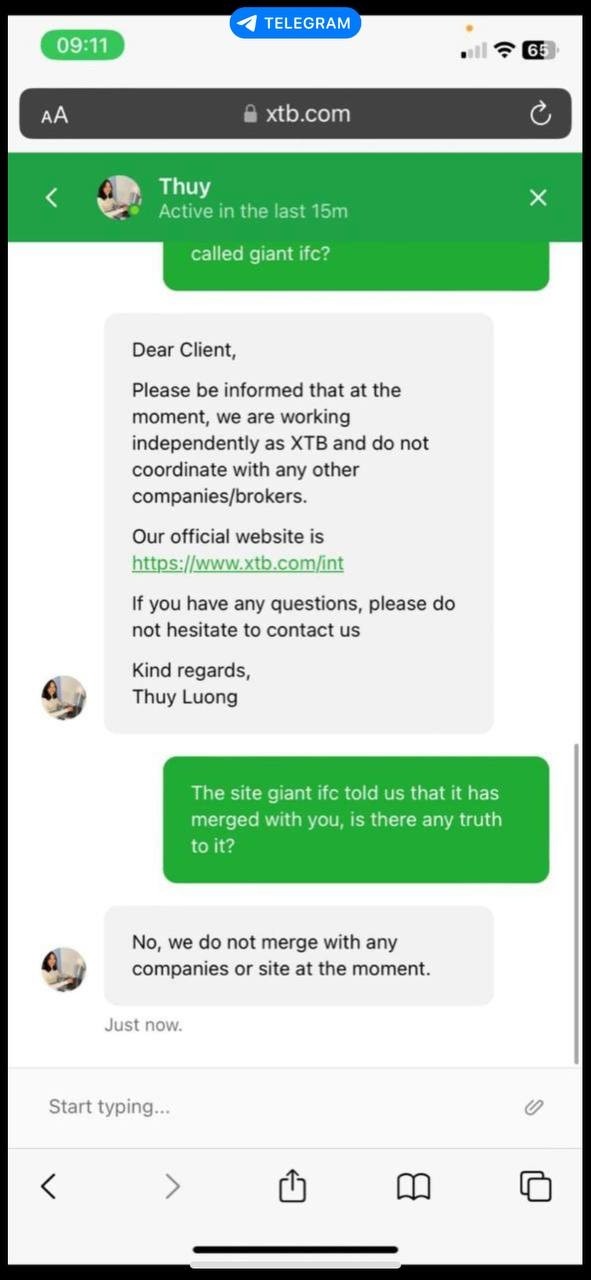

Regulatory Status: Available information indicates Giant IFC operates without recognized regulatory licenses or oversight from established financial authorities. This unregulated status presents significant risks for trader protection and fund security.

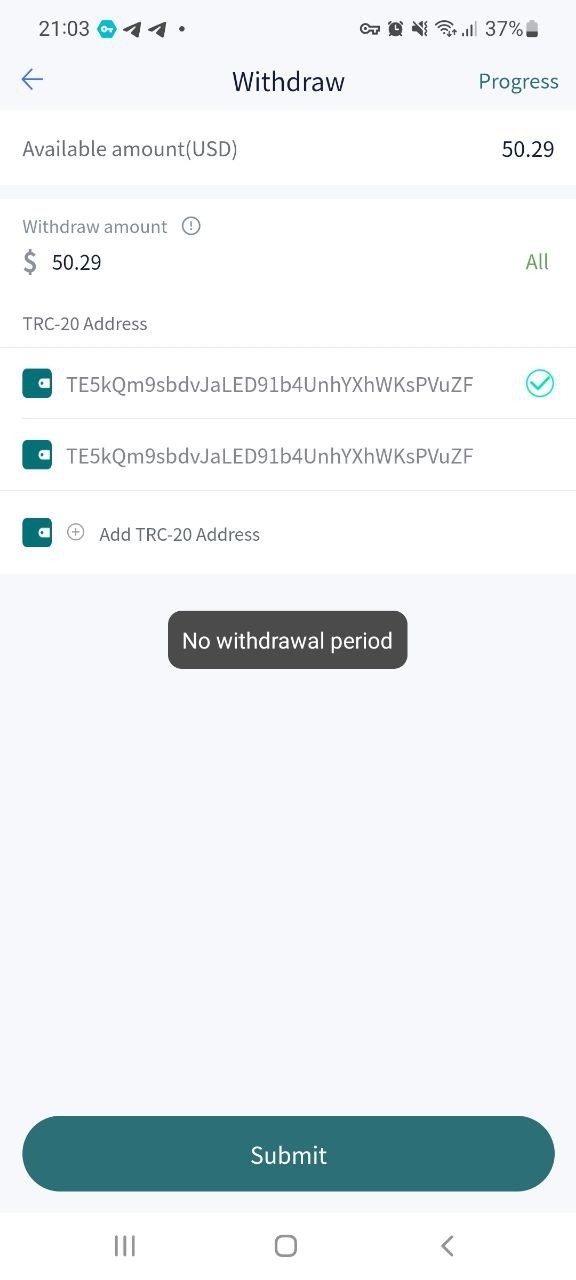

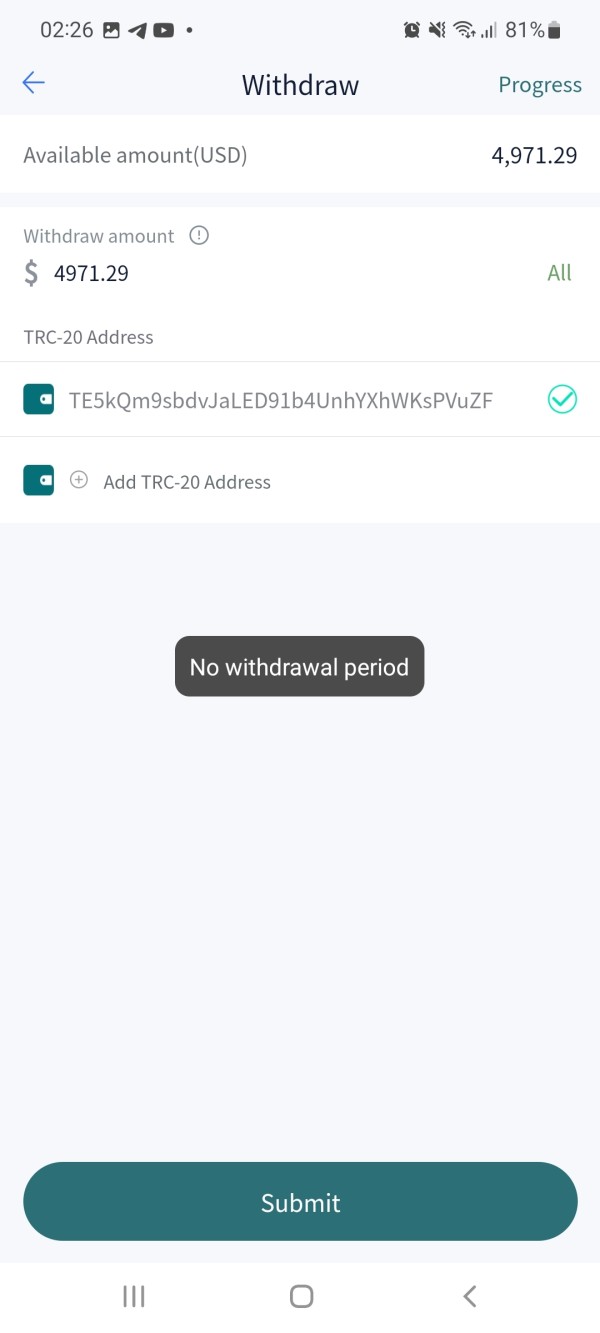

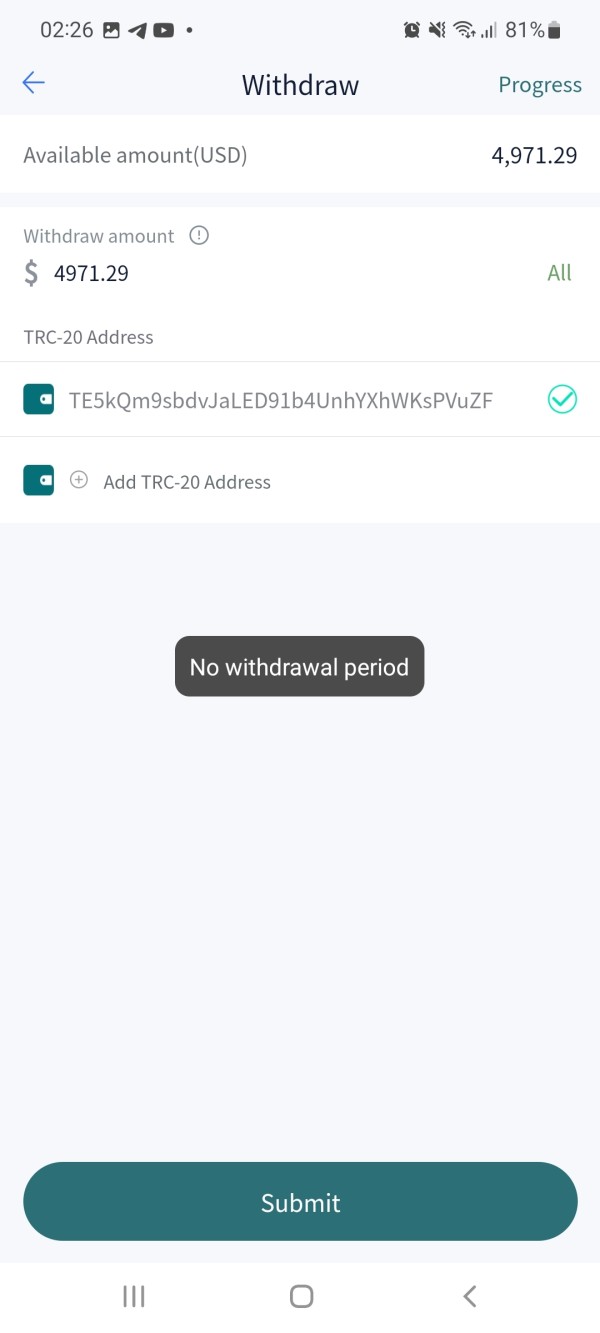

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not clearly disclosed. The platform has not provided transparent documentation about these essential trading functions.

Minimum Deposit Requirements: The platform has not published transparent information regarding minimum deposit amounts or account funding requirements. Different account types may have varying requirements that remain unclear to potential users.

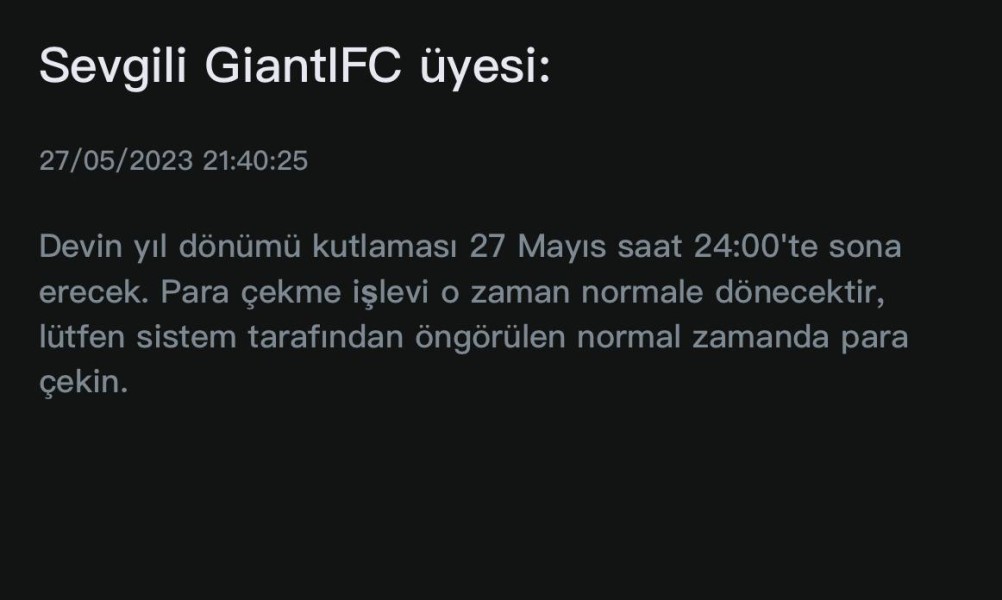

Promotional Offers: Details about bonuses, promotional campaigns, or special trading incentives are not readily available in current platform materials. This lack of information makes it difficult for traders to understand potential benefits.

Available Trading Assets: The platform advertises access to forex currency pairs, commodity markets, global stock indices, individual equity shares, and futures contracts. However, specific instrument counts and availability details remain unclear to potential users.

Fee Structure: Comprehensive information about spreads, commissions, overnight financing costs, and other trading-related charges is not transparently disclosed. This opacity makes cost comparison with regulated alternatives difficult for traders.

Leverage Options: Maximum leverage ratios and margin requirements across different asset classes are not clearly specified in available documentation. Traders cannot assess risk levels without this crucial information.

Trading Platforms: The specific trading software, mobile applications, or web-based platforms offered by Giant IFC are not detailed. Current promotional materials lack comprehensive technical specifications.

Geographic Restrictions: Information about service availability across different countries and jurisdictions is not clearly outlined. This creates uncertainty for international traders seeking platform access.

Customer Support Languages: Available customer service languages and support channels are not specified in accessible platform information. This giant ifc review highlights the concerning lack of transparency across these fundamental trading platform elements.

Detailed Rating Analysis

Account Conditions Analysis

Giant IFC's account structure represents one of the most problematic aspects highlighted in this giant ifc review. The platform provides minimal transparency regarding account types, opening requirements, or specific terms and conditions. Unlike established regulated brokers that clearly outline different account tiers with specific benefits and requirements, Giant IFC's approach lacks fundamental clarity.

Traders need comprehensive information to make informed decisions about their financial commitments. The absence of detailed information about minimum deposit requirements, account verification procedures, or special account features raises serious concerns. Professional trading platforms typically provide comprehensive account documentation, including detailed terms of service, trading agreements, and clear explanations of trader rights and responsibilities.

Without access to specific account opening procedures, potential traders cannot adequately assess whether the platform meets their needs. The platform should clearly outline individual trading requirements and risk tolerance levels for different account types. The lack of transparent account conditions also makes it impossible to compare Giant IFC's offerings with regulated alternatives.

Regulated brokers provide clear, legally binding account frameworks that protect trader interests. This opacity in account structure contributes significantly to the platform's low trust rating. The lack of transparency represents a fundamental barrier to establishing credible trader relationships.

Giant IFC's trading tools and educational resources present a mixed picture in this evaluation category. The platform earns a moderate rating primarily due to the diversity of available asset classes. The platform's offering of forex, commodities, indices, stocks, and futures provides traders with broad market exposure.

This diversity represents its primary strength in the tools and resources evaluation. However, the platform falls significantly short in providing detailed information about specific trading tools, analytical resources, or educational materials. Professional trading environments typically offer comprehensive charting packages, technical analysis tools, economic calendars, market research, and educational content.

These resources range from beginner tutorials to advanced trading strategies for different skill levels. The absence of detailed information about research capabilities, automated trading support, or third-party tool integration suggests limited technological infrastructure. Modern traders rely heavily on sophisticated analytical tools, real-time market data, and comprehensive research resources.

These tools are essential for making informed trading decisions in volatile markets. Without clear documentation of available tools and resources, traders cannot adequately assess whether the platform provides necessary technological foundation. This information gap represents a significant limitation for serious traders seeking comprehensive market analysis capabilities.

Customer Service and Support Analysis

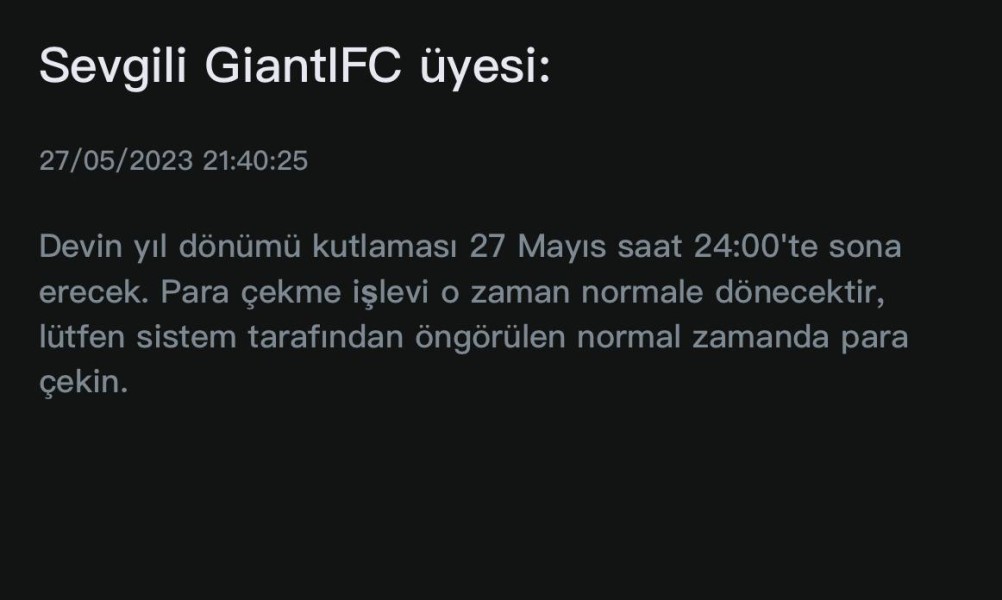

Customer service represents one of Giant IFC's weakest performance areas in this comprehensive evaluation. The platform shows concerning patterns emerging from user feedback and complaint data. The platform's customer support infrastructure appears inadequate for handling trader needs effectively.

This inadequacy is evidenced by the substantial number of unresolved complaints and negative user experiences. Professional trading platforms typically maintain multiple customer service channels including live chat, telephone support, email assistance, and comprehensive FAQ sections. They also provide multilingual support capabilities and maintain service availability during major market trading hours.

Service teams work across different time zones to accommodate global trading activities. The high volume of customer complaints relative to the platform's user base suggests systematic issues. These problems include support quality, response times, and problem resolution capabilities that fail to meet industry standards.

Effective customer service is crucial in trading environments where technical issues, account problems, or trading disputes require immediate attention. Quick resolution prevents potential financial losses and maintains trader confidence in platform operations. The pattern of unresolved complaints raises questions about the platform's commitment to customer satisfaction.

This poor performance also questions its ability to handle operational challenges effectively. This poor customer service performance significantly undermines trader confidence and contributes to the platform's low overall trust rating.

Trading Experience Analysis

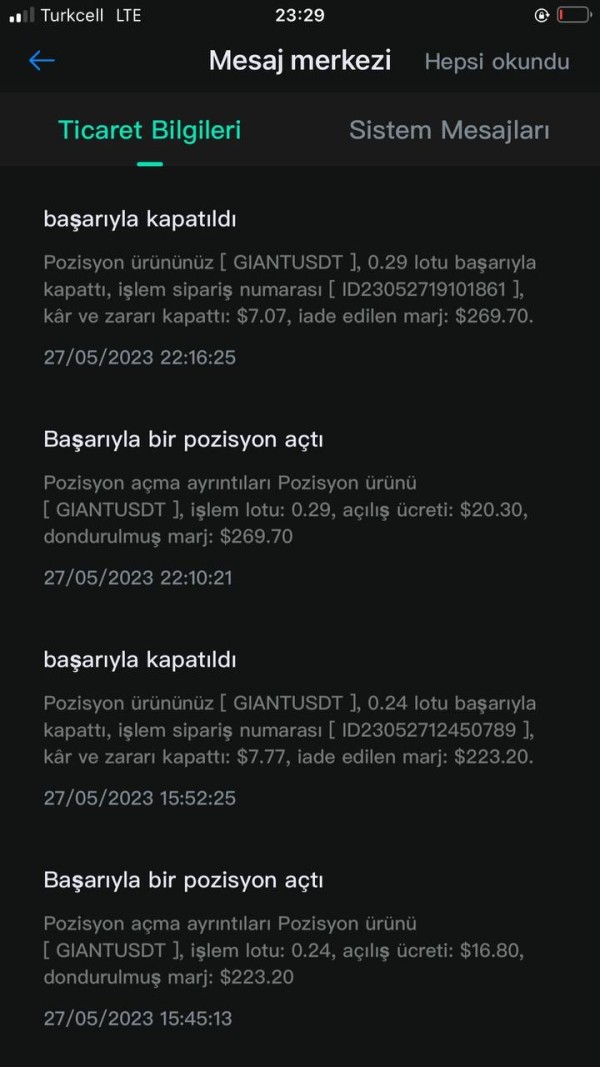

The trading experience offered by Giant IFC presents significant concerns that directly impact this giant ifc review's overall assessment. User feedback patterns suggest substantial issues with platform reliability, order execution quality, and overall trading environment stability. These factors are fundamental to successful trading operations and represent critical deficiencies in the platform's core functionality.

Professional trading platforms must provide consistent order execution, minimal slippage, competitive pricing, and stable platform performance. These requirements become especially important during volatile market conditions when traders need reliable access. The negative user feedback regarding Giant IFC's trading environment suggests the platform may struggle to meet basic operational requirements.

Platform stability issues can result in missed trading opportunities, execution delays, or inability to close positions during critical market movements. Such problems can lead to substantial financial losses and represent unacceptable risks for serious traders. The lack of detailed information about execution methods, liquidity providers, or platform infrastructure makes assessment impossible.

Traders cannot evaluate the quality of the trading environment before committing funds to the platform. This transparency deficit, combined with negative user experiences, creates a high-risk trading environment. The combination of these factors makes the platform unsuitable for most retail and professional traders.

Trust and Security Analysis

Trust and security represent Giant IFC's most critical weaknesses in this comprehensive evaluation framework. The platform earns the lowest possible rating due to fundamental security concerns that cannot be overlooked. The platform's complete absence of regulatory oversight from recognized financial authorities creates unacceptable risk levels.

Regulated brokers must comply with strict capital adequacy requirements, client fund segregation rules, and operational transparency standards. These regulatory frameworks protect trader interests and provide legal recourse when problems arise. They also ensure platforms maintain adequate financial resources to meet client obligations during market stress.

Giant IFC's unregulated status means traders have no regulatory protection for their deposited funds. Traders also lack oversight of the platform's financial stability and have no legal recourse through established financial ombudsman services. This creates an environment where trader funds are essentially unsecured and subject to complete loss.

The platform provides no legal protection for traders who experience problems with their accounts. The platform's lack of transparency regarding fund storage, insurance coverage, or financial auditing further compounds security concerns. Professional traders require assurance that their funds are protected through segregated accounts, insurance policies, and regular financial audits.

Independent third parties should conduct these audits to ensure transparency and accountability. The combination of no regulatory oversight and limited operational transparency creates an unacceptable risk profile. This risk level makes the platform unsuitable for serious trading activities.

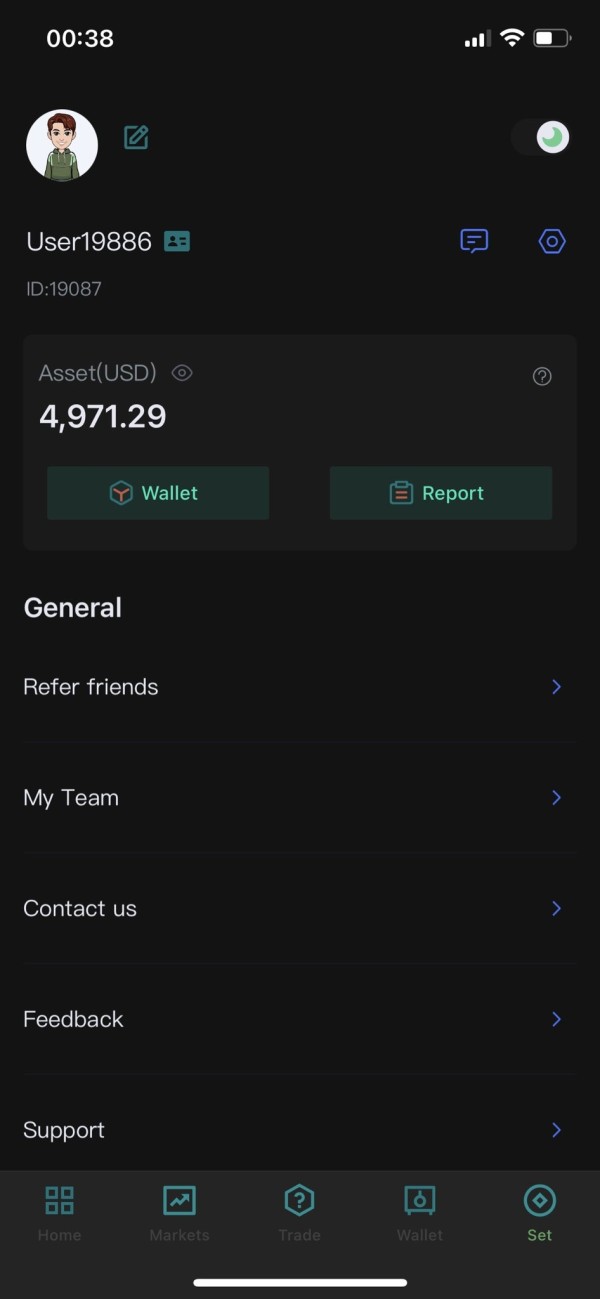

User Experience Analysis

User experience analysis reveals concerning patterns that significantly impact Giant IFC's overall platform assessment. The predominance of negative user feedback, combined with a high complaint-to-user ratio, suggests systematic issues. These problems affect platform usability, functionality, and overall trader satisfaction across multiple operational areas.

Modern trading platforms must provide intuitive interfaces, streamlined registration processes, efficient fund management capabilities, and responsive customer support. These features are essential for maintaining positive user experiences and building long-term customer relationships. The negative feedback patterns suggest Giant IFC struggles to meet these basic user experience standards.

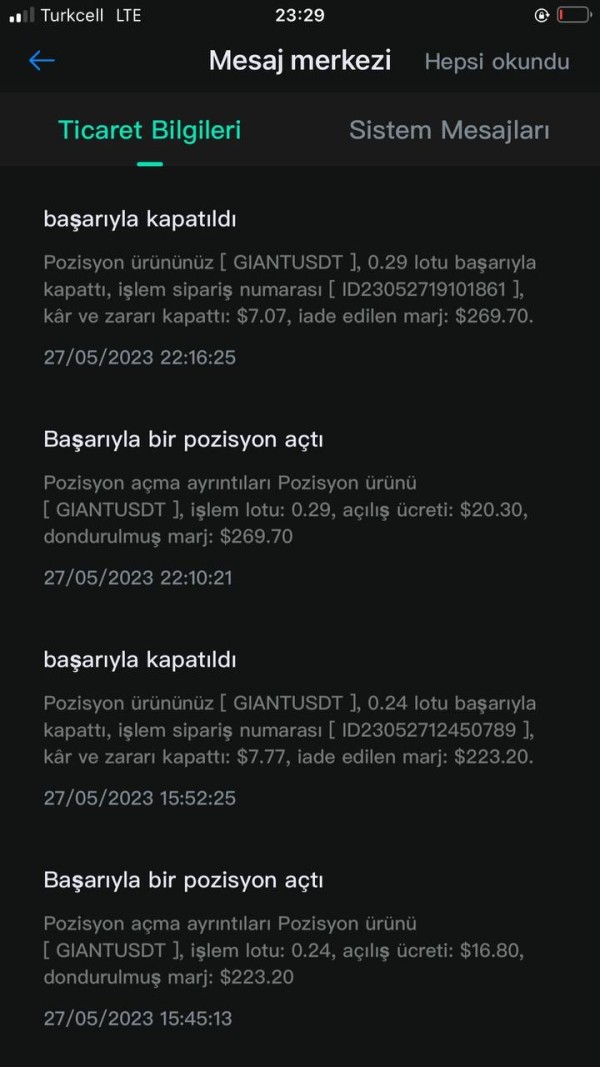

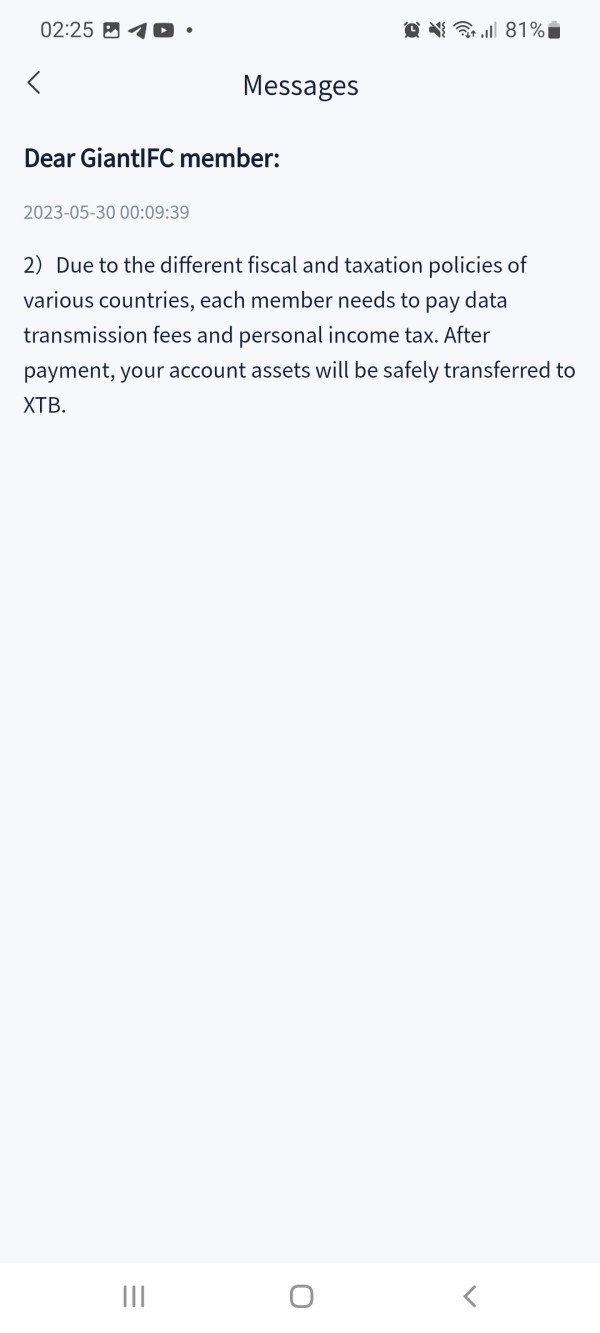

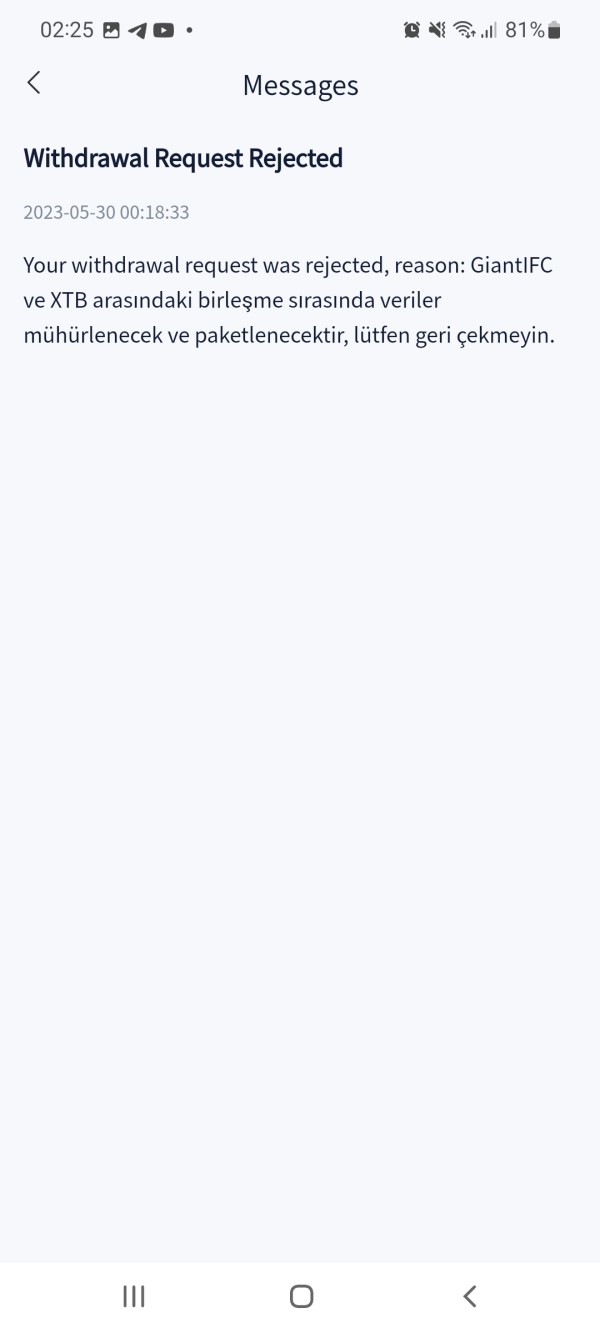

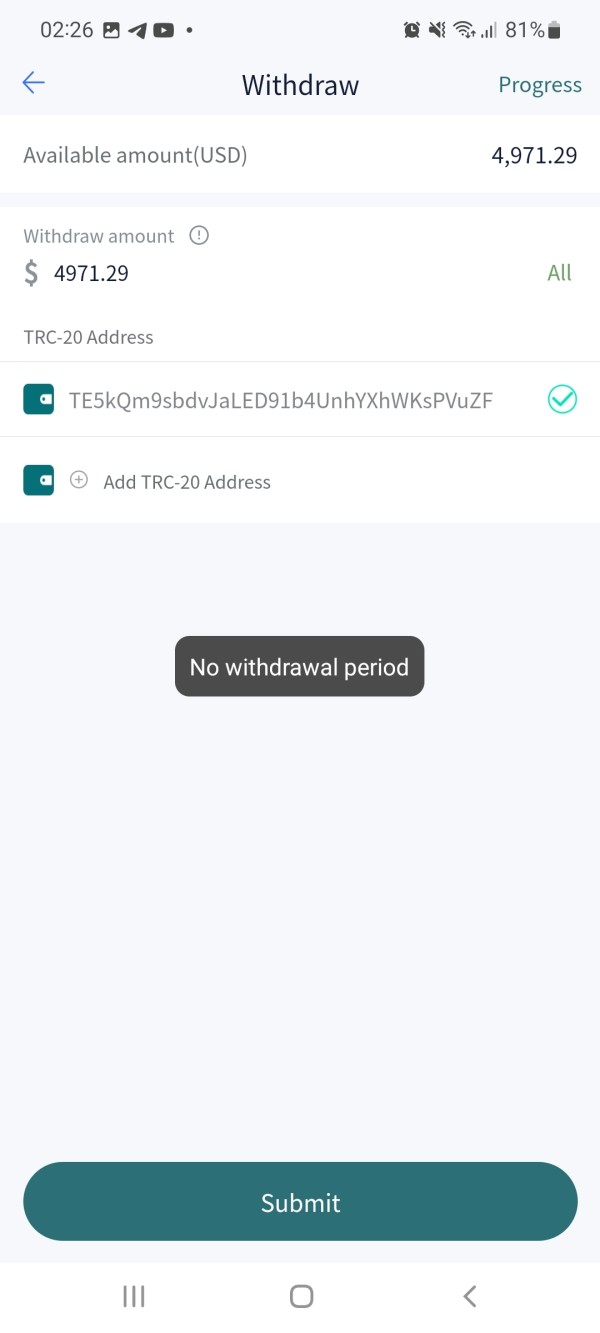

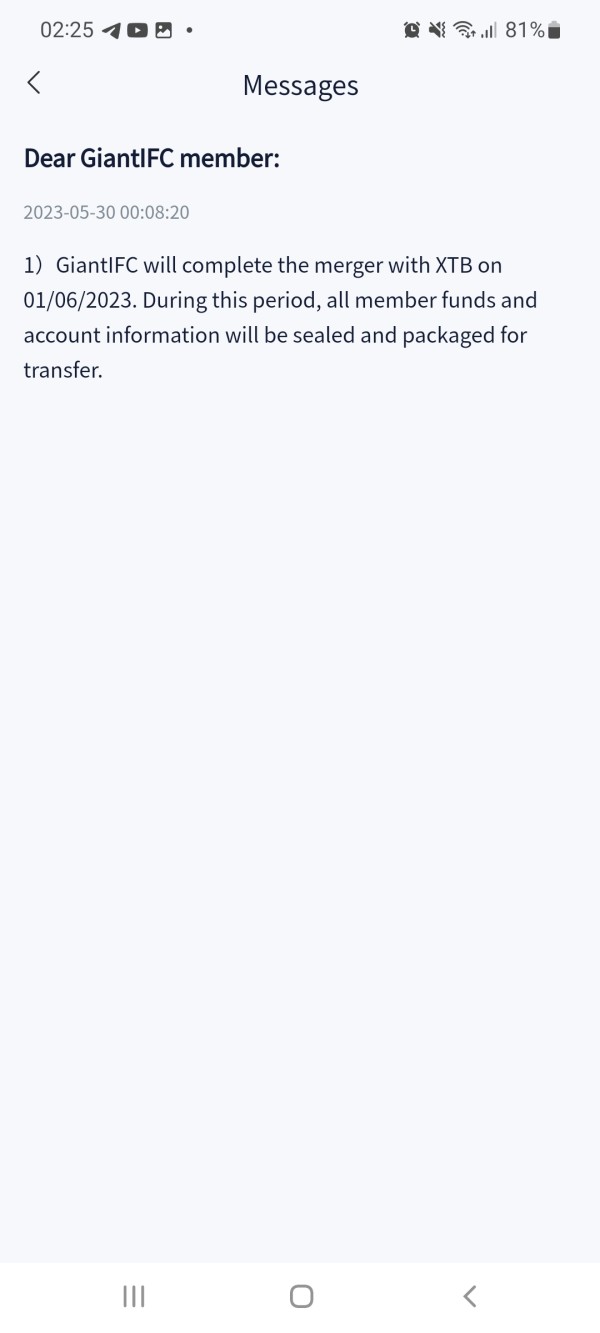

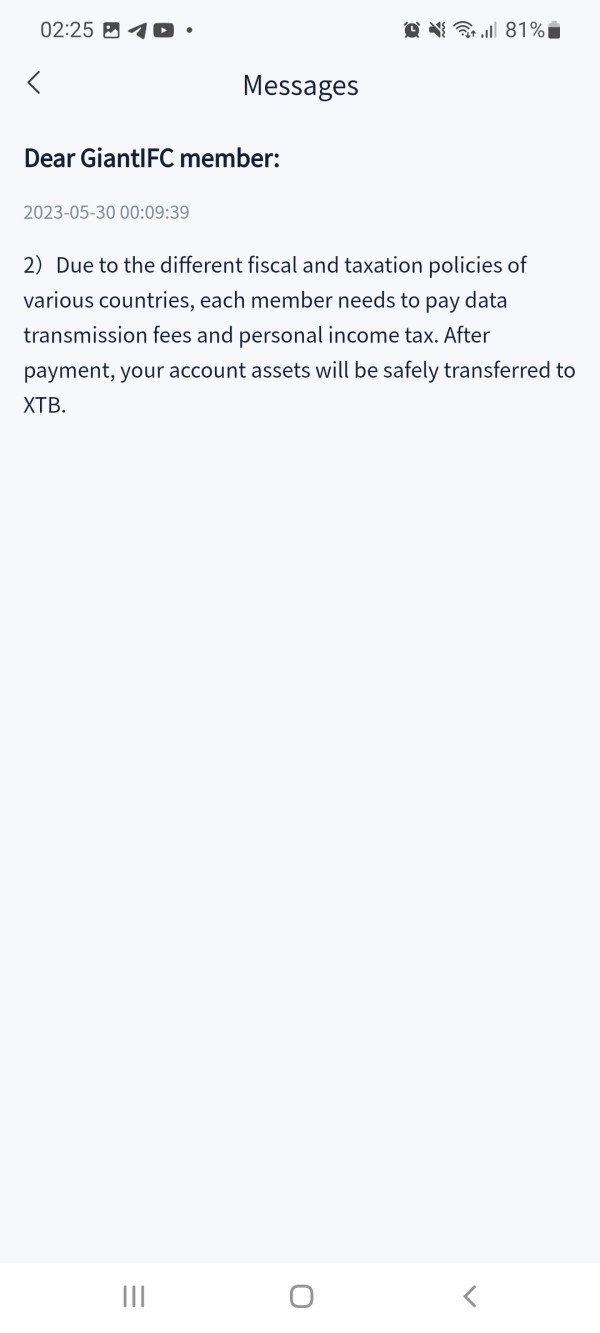

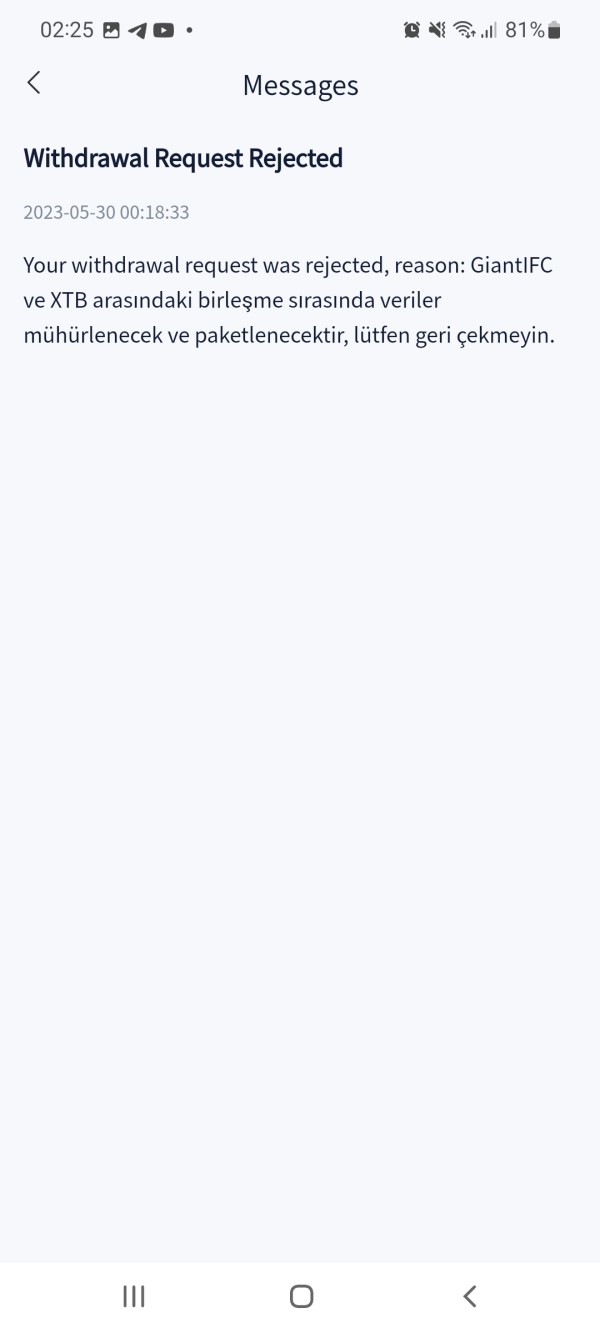

User complaints often focus on fundamental platform operations including account access issues, withdrawal problems, and trading platform functionality concerns. These types of operational problems indicate inadequate platform development and insufficient quality assurance processes. The high proportion of negative reviews relative to positive testimonials suggests that user dissatisfaction is not isolated to individual cases.

This pattern represents broader systemic issues with platform operations that affect multiple users. This pattern is particularly concerning for a platform seeking to establish credibility in the competitive trading platform market. Without significant improvements to user experience quality, Giant IFC is unlikely to attract or retain serious traders.

These traders have access to numerous regulated alternatives offering superior operational standards and better customer protection.

Conclusion

This comprehensive giant ifc review reveals a trading platform with fundamental deficiencies that make it unsuitable for most retail traders. The platform shows serious problems across multiple operational areas that create unacceptable risks. While Giant IFC offers access to multiple asset classes, the platform's lack of regulatory oversight, poor customer service performance, and concerning user feedback patterns create dangerous conditions.

These factors combine to form an unacceptable risk environment for serious trading activities. The platform may only be suitable for highly experienced traders with substantial risk tolerance who are specifically interested in cryptocurrency-integrated trading environments. Even these experienced traders must fully understand the implications of trading with unregulated platforms.

However, even experienced traders would benefit from choosing regulated alternatives that provide superior trader protections and operational transparency. Regulated platforms offer better security and legal protections for trader funds and activities. Giant IFC's primary advantages lie in its diverse asset offerings, but these benefits are significantly outweighed by security concerns.

The platform also suffers from operational transparency issues and poor user satisfaction ratings that characterize its current operational status.