Is Giant IFC safe?

Business

License

Is Giant IFC A Scam?

Introduction

Giant IFC is a forex broker that has recently emerged in the online trading landscape, offering services to traders worldwide. As the forex market continues to grow, it attracts both legitimate brokers and potential scams, making it crucial for traders to evaluate the credibility of firms like Giant IFC carefully. In this article, we will investigate whether Giant IFC is a safe choice for traders or if it raises red flags that suggest it may be a scam. Our assessment will be based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and overall risks associated with this broker.

Regulation and Legitimacy

One of the primary factors in determining the safety of any forex broker is its regulatory status. Regulation serves as a protective measure for traders, ensuring that brokers adhere to specific standards and practices. Unfortunately, Giant IFC is currently unregulated, which poses significant risks to potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

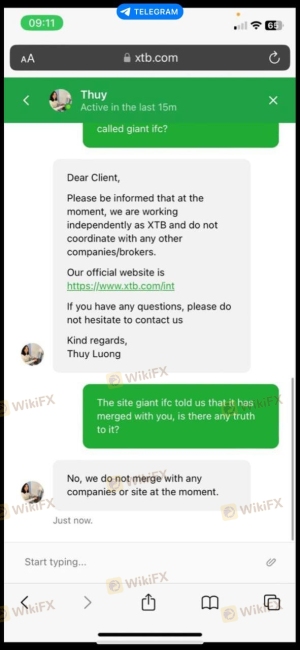

The absence of a valid regulatory license means that Giant IFC operates without the oversight of any recognized financial authority, which can lead to issues such as misappropriation of funds and lack of accountability. Furthermore, the Financial Conduct Authority (FCA) in the UK has issued warnings against Giant IFC, indicating that it may be providing financial services without authorization. This lack of regulation is a significant red flag for any trader considering whether Giant IFC is safe.

Company Background Investigation

Giant IFC's company background reveals a lack of transparency that is concerning. The broker claims to be operated by Giant International Finance Limited, but there is little information available regarding its history, ownership structure, or management team. The company was registered in March 2023, making it relatively new in the forex market, which increases the risks associated with trading with them.

The absence of detailed information about the management team raises questions about their expertise and qualifications. Without a robust leadership structure, it is difficult to assess whether the company can be trusted to manage client funds responsibly. The lack of transparency surrounding Giant IFC's operations further suggests that traders should exercise extreme caution when considering this broker.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Giant IFC presents an array of trading options, but the specifics of their fee structure remain unclear. Traders have reported various fees, but the exact nature of these charges is often undisclosed, which is a common tactic among less reputable brokers.

| Fee Type | Giant IFC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

The lack of clarity regarding trading costs is concerning, as it can lead to unexpected expenses that may erode traders' profits. Moreover, the absence of a transparent commission model and spread information raises questions about the broker's integrity. This ambiguity can create an environment where traders may feel misled, further reinforcing the idea that Giant IFC is not safe.

Client Fund Safety

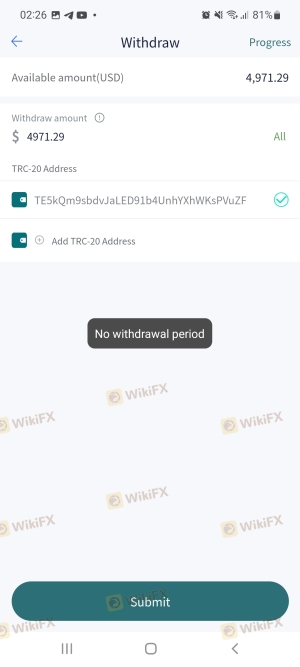

The safety of client funds is paramount when choosing a forex broker. Giant IFC's policies regarding fund safety are notably vague. There is no clear information regarding whether client funds are kept in segregated accounts or if they are covered by any investor protection schemes. The lack of such protections significantly increases the risk of loss should the broker face financial difficulties.

Historically, unregulated brokers like Giant IFC have been associated with fund misappropriation and other financial scandals. Traders should be aware that if they choose to engage with this broker, they may not have access to any recourse should issues arise, making it essential to consider whether Giant IFC is safe for managing their investments.

Customer Experience and Complaints

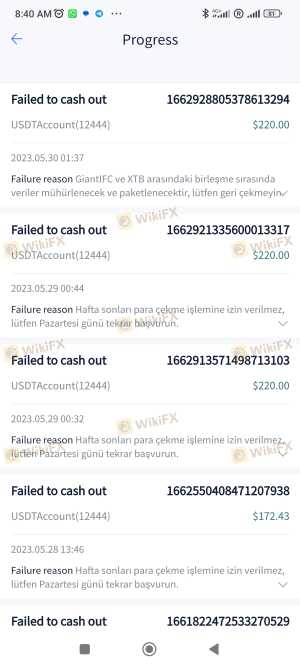

Customer feedback is a vital indicator of a broker's reliability. Unfortunately, reviews for Giant IFC paint a troubling picture. Many users have reported difficulties in withdrawing their funds, unexpected charges, and poor customer service. These complaints suggest a pattern of behavior that is characteristic of scam brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unexpected Charges | Medium | Inconsistent |

| Customer Service Complaints | High | Lacking |

For example, one trader reported being unable to withdraw their funds after several attempts, while another mentioned facing unexpected fees that were not disclosed during the account setup process. These issues not only highlight the potential risks of trading with Giant IFC but also raise concerns about the broker's commitment to customer satisfaction. Therefore, it is reasonable to conclude that Giant IFC is not safe for traders seeking a reliable trading experience.

Platform and Trade Execution

The performance of a trading platform is critical for successful trading. Giant IFC claims to offer a proprietary trading platform; however, users have reported issues related to stability and execution quality. There are concerns about slippage rates and the potential for rejected orders, which can severely impact trading outcomes.

Moreover, any signs of platform manipulation, such as sudden price changes or unresponsive trading interfaces, can be detrimental to traders. The lack of transparency regarding the platform's functionality adds another layer of risk, leading many to question if Giant IFC is truly safe for trading activities.

Risk Assessment

Engaging with Giant IFC comes with inherent risks that traders should carefully consider. The following risk assessment summarizes the critical areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases potential for fraud. |

| Fund Safety Risk | High | Lack of segregation and protection for client funds. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

| Platform Risk | Medium | Stability and execution quality are questionable. |

To mitigate these risks, traders should conduct thorough research, consider regulated alternatives, and never invest more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that Giant IFC is not safe for traders. The lack of regulation, transparency issues, poor customer feedback, and potential risks associated with fund safety all point to a concerning picture. Traders should exercise extreme caution and consider reputable, regulated brokers that offer the necessary protections for their investments.

For those seeking safer alternatives, brokers regulated by authorities such as the FCA or ASIC should be prioritized. These firms typically offer better security, transparency, and customer support, ensuring a more reliable trading experience. Ultimately, the goal is to safeguard investments and engage with brokers that prioritize the interests of their clients.

Is Giant IFC a scam, or is it legit?

The latest exposure and evaluation content of Giant IFC brokers.

Giant IFC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Giant IFC latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.