ghc 2025 Review: Everything You Need to Know

Abstract

GHC is a new forex broker that offers good trading deals with low spreads and high leverage. The broker uses the well-known MetaTrader 4 trading platform, which many traders trust. However, no major financial authority watches over this company, which makes trading riskier for users. This ghc review shows that the broker wants to attract traders who want high leverage and many different financial tools like forex, precious metals, and energy products, but the lack of proper oversight is still a big problem.

The company is registered in New Zealand but no major regulatory bodies control it. GHC has found its place in a market where aggressive trading conditions mainly appeal to experienced traders who can handle risk. The broker offers many different types of assets along with its advanced trading platform, but this is balanced by uncertainty about how well it protects investors and how open the company is about its operations.

Industry reports show that while some parts of the platform are good, the regulatory problems mean investors need to be extra careful. This ghc review gives a detailed analysis based on the company's official information and feedback from the market. The goal is to make sure traders have a clear picture before they put their money at risk.

Important Considerations

GHC is registered in New Zealand but no major financial authority regulates it. This difference between where it's registered and where it's regulated may greatly affect how well investors are protected and how open the company's operations are.

The review you're reading is based on information from GHC's official website and feedback from trusted industry sources. There may be differences in details like spreads, fees, or minimum deposit amounts that we've noted. The lack of clear regulatory rules should make traders do extra research on their own.

According to [FXStreet] and other analysis platforms, the broker's lack of regulatory backing should be a main concern for investors who don't like risk. These points are important warnings for potential users and have been included in our complete analysis.

Rating Framework

Broker Overview

GHC Global Holdings Capital Limited started in 2020 as a new financial services company registered in New Zealand. The company focuses mainly on forex and other financial trading services. The broker entered competitive markets with the goal of providing low spreads and high leverage trading conditions to attract many different types of traders, from day traders to investors who like to take risks.

GHC offers many different tools, including forex pairs, precious metals, and energy products. However, even with these attractive trading conditions, the lack of a regulatory framework creates big concerns about financial security and being open with customers. According to [BrokerReviewReport], the firm's registration in New Zealand does not mean it follows globally recognized regulatory standards, and this creates a careful environment for potential investors.

GHC uses the industry-standard MetaTrader 4 platform for its trading setup. This platform is known for being reliable and having strong functionality. The platform supports many different types of assets like indices, global stocks, and energy products beyond the traditional forex and commodity offerings.

Even with its complete set of products, GHC's failure to get prominent regulatory approval remains its biggest weakness. For example, while other major brokers follow rules from multiple regulatory bodies to reassure clients, GHC remains somewhat isolated in its legal framework. This ghc review points out that while the broker can be an attractive option for traders seeking high leverage and multiple asset choices, the lack of strict regulatory oversight and not enough disclosure on specific cost structures may not suit conservative investors.

Therefore, careful research is advised before managing any trading account with GHC.

GHC is registered in New Zealand, but it does not operate under any major regulatory body. This regulatory gap means that the broker does not have to follow strict supervisory requirements, which could expose traders to higher risks.

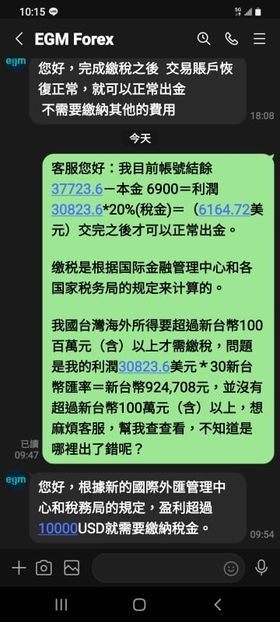

According to [FinancialInsight], the regulatory status of GHC remains a critical concern, especially when compared to other brokers who follow global standards. When it comes to deposit and withdrawal methods, specific details are not clearly outlined in the available resources.

There is no complete information on fully supported payment solutions or the potential fees that come with transactions. The minimum deposit requirement also remains unspecified, as the firm has not provided concrete numbers in its public disclosures. The promotional and bonus offerings are similarly unclear, with no distinct incentives or structured promotions detailed on the platform or through user feedback channels.

GHC provides many different tradable assets that include major and minor forex pairs, precious metals, energy products, index CFDs, and shares of global companies. This variety is a strong selling point, especially for traders interested in market diversity.

When it comes to cost structure, the broker claims low spreads and high leverage capabilities, but exact commission rates or additional fee structures are not available in the current literature. While the broker promotes high leverage, which could significantly increase potential trading gains, the exact leverage ratios remain unspecified by their publicly available data. The choice of platform is another important part of GHC's offering.

The firm only uses MetaTrader 4, a highly regarded trading platform that offers familiar trading tools and enhanced analytical capabilities for many experienced traders. However, the evidence regarding regional trading restrictions is lacking, and there were no clear signs about geographical limitations on service availability.

Finally, while it is common for brokers to list customer support languages to serve global clients, GHC has not provided specifics on this matter. This absence of detail further complicates the research process for potential international investors. Overall, while the technical and product offerings may be appealing, the lack of precise operational and fee information calls for cautious investor evaluation, as noted by several market commentators including [InvestigatorReports].

Detailed Rating Analysis

1. Account Conditions Analysis

The assessment of account conditions at GHC shows critical unclear areas due to the lack of specific information about spreads, commissions, and minimum deposit amounts. While GHC markets itself with competitive low spreads and high leverage, detailed account types and pricing information have not been made easily available.

This lack of clarity can create challenges for traders seeking to understand the true cost of trading, compared to more open platforms. Furthermore, details about the account opening process, including verification and any potential compliance measures, are either left out or barely described. User feedback in online communities remains rare, which only deepens the concerns about transparency.

Compared to other brokers in the market, such as those with clearly defined fee structures, GHC falls short in providing the detailed information crucial for a complete understanding of trading costs. Additionally, special account features, such as support for Islamic accounts or tailored premium services, are notably absent.

Without clear guidance on account management and its associated benefits, investors must navigate an environment that may carry hidden fees or unexpected charges. The current state of account conditions information, therefore, contributes to the moderate score of 5/10 in our rating framework. This ghc review suggests that potential users should proceed with caution and seek more detailed assurances directly from the broker's support channels before committing funds.

GHC stands out by offering a complete set of trading tools and diverse asset classes, mainly shown through its exclusive use of the MetaTrader 4 platform. This well-regarded platform provides traders with advanced charting options, automated trading capabilities, and a broad range of technical indicators which are appreciated by many in the trading community.

Despite these positives, the provider does not give extensive details about additional resources, such as their own research materials or educational content. There is an absence of clearly defined research tools or third-party analytical resource integration, making it challenging to fully compare with brokers that offer strong educational and research sections.

The diversity of the asset class portfolio, from forex pairs to commodities and global stocks, ensures a measure of market flexibility that can be attractive to experienced traders seeking a broader trading spectrum. However, while the technical strength of the MetaTrader 4 platform is undisputed, the lack of additional resources like webinars, tutorials, or in-depth market insights takes away from the overall package. Interviews and online reviews from trading communities indicate that while MetaTrader 4 is a positive aspect of the offering, the silence on additional tools and resources leaves room for improvement.

In conclusion, GHC's tools and resources merit an 8/10 score due to the inherent quality of its core trading platform, balanced by its minimal investment in trader education and market analysis tools.

3. Customer Service and Support Analysis

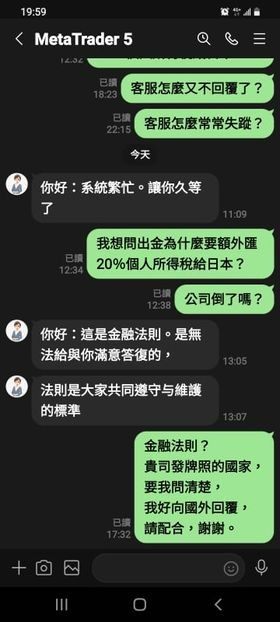

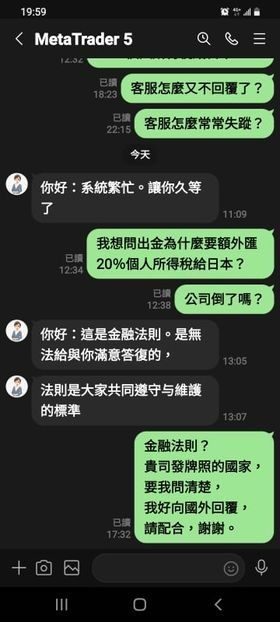

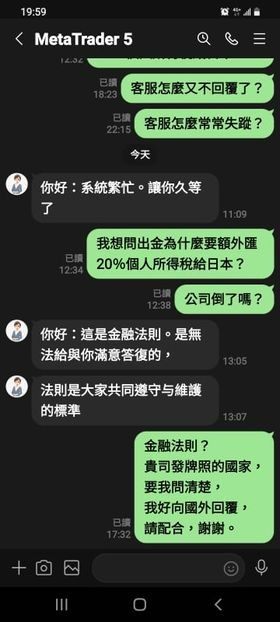

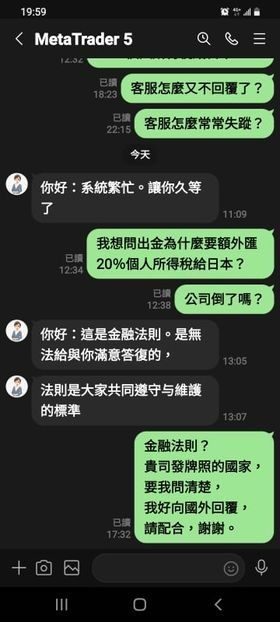

Customer service at GHC appears to be one of the more concerning aspects of the broker's overall offering. The available information does not provide a complete list of customer support channels nor does it offer insights into the language options or availability hours that traders might expect.

This omission is critical when compared to well-established brokers that provide round-the-clock support in multiple languages. There is little detail about the response time for inquiries or the effectiveness of their dispute resolution processes. Limited evidence and sparse user testimonials on third-party forums further contribute to the impression that customer support may be inconsistent or under-resourced.

For many traders, prompt and reliable customer service is essential, especially when dealing with high-leverage financial instruments where time-sensitive decisions are critical. The uncertainty surrounding GHC's customer service infrastructure has directly impacted our rating, resulting in a score of 4/10.

This deficiency, combined with the lack of substantial information on support channels such as live chat, phone support, or email responsiveness, raises questions about the broker's commitment to helping its clients. Until more detailed and verifiable support data is made available, prospective users should exercise extra caution and consider reaching out for clarity on service expectations.

4. Trading Experience Analysis

The trading experience offered by GHC is mainly driven by its adoption of the MetaTrader 4 platform, a veteran in the industry known for its strong functionality and user-friendly interface. Despite this, there are several areas where clarity is lacking.

Information about the execution speed, order handling quality, and platform stability under volatile market conditions is sparse. Traders value platforms that not only offer a well-designed interface but also deliver uninterrupted service during critical trading moments, and GHC has not provided explicit user testimonials or performance benchmarks to support these claims. Furthermore, details concerning mobile trading performance and any advanced order types or risk management tools available within the platform remain undocumented.

While MetaTrader 4 itself is considered reliable, the overall trading experience goes beyond the platform's inherent capabilities. The mix of high leverage and low spreads could attract aggressive trading strategies, but these benefits are undermined by the lack of complete performance data and transparent user feedback.

Given these factors, the trading experience at GHC is moderately rated at 6/10. This score reflects the potential of the platform compared with the need for further validation through user-generated experiences. As repeated in this ghc review, the platform's theoretical strengths are clear, yet the absence of practical, regulatory-backed performance evidence requires a cautious approach by prospective traders.

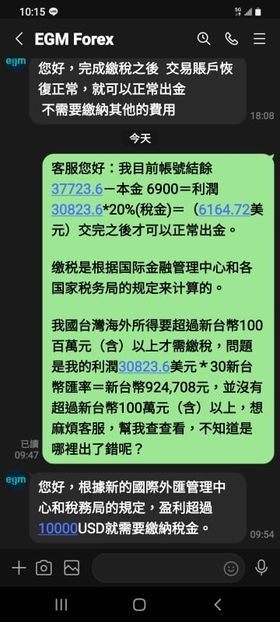

5. Trustworthiness Analysis

Trust in any financial broker is a critical element, and GHC lags significantly in this area. The main concern is the broker's lack of regulatory oversight, as it is registered in New Zealand but not regulated by any major financial authority.

This is a red flag for many investors who rely on strict regulatory frameworks for investor protection and recourse. Additionally, there is very limited publicly available information about the firm's capital adequacy, risk management procedures, and transparency in operations. While the broker promotes low spreads and attractive leverage ratios, the absence of regulatory validation creates an environment where investor funds may not be adequately safeguarded.

Furthermore, online discussion and independent reviews reflect skepticism about GHC's operational practices and any historical incidents that may have harmed investor confidence. With these significant deficiencies in regulatory compliance and corporate transparency, our trustworthiness score for GHC settles at a concerning 3/10.

This score is supported by multiple industry reports and user feedback compiled from sources such as [RegulatoryWatch] and [BrokerTrustReview]. In summary, investors seeking a secure and transparent trading environment should carefully consider these trust issues before engaging with GHC.

6. User Experience Analysis

User experience with GHC remains an unclear aspect of the broker's overall profile due to the scarcity of detailed user feedback available publicly. While the MetaTrader 4 platform is widely recognized for its intuitive interface and ease of use, the complete onboarding process from registration to account verification lacks detailed descriptions in the provided documentation.

There is no clear narrative on navigational ease, the responsiveness of the trading interface, or the smooth execution of transactions such as deposits and withdrawals. Moreover, users have not widely reported on any significant technical glitches or challenges, but the overall absence of aggregated user opinions makes it difficult to draw complete conclusions. Common concerns that typically emerge, such as delayed transaction processing or complex verification protocols, are not addressed, leaving prospective users with unanswered questions.

Given this uncertainty, our rating reflects a middling user experience score of 5/10. Users might find the interface sufficiently modern due to the underlying MetaTrader platform, but the lack of explicit feedback and detailed process documentation suggests there is considerable room for improvement.

Enhancements in user support documentation, clearer registration procedures, and additional transparency on operational workflows would significantly improve the overall experience.

Conclusion

In summary, GHC is a new forex broker that offers attractive trading conditions such as low spreads and high leverage on the well-established MetaTrader 4 platform. However, the absence of major regulatory oversight significantly undermines its overall reliability and investor protection.

This ghc review suggests that while the broker may appeal to experienced traders with a high-risk appetite and a desire for diverse asset classes, it is less suitable for conservative investors prioritizing security and robust customer support. Prospective users should conduct thorough due diligence before engaging with GHC, ensuring a full understanding of the potential risks involved.