MEXO Finance 2025 Review: Everything You Need to Know

Executive Summary

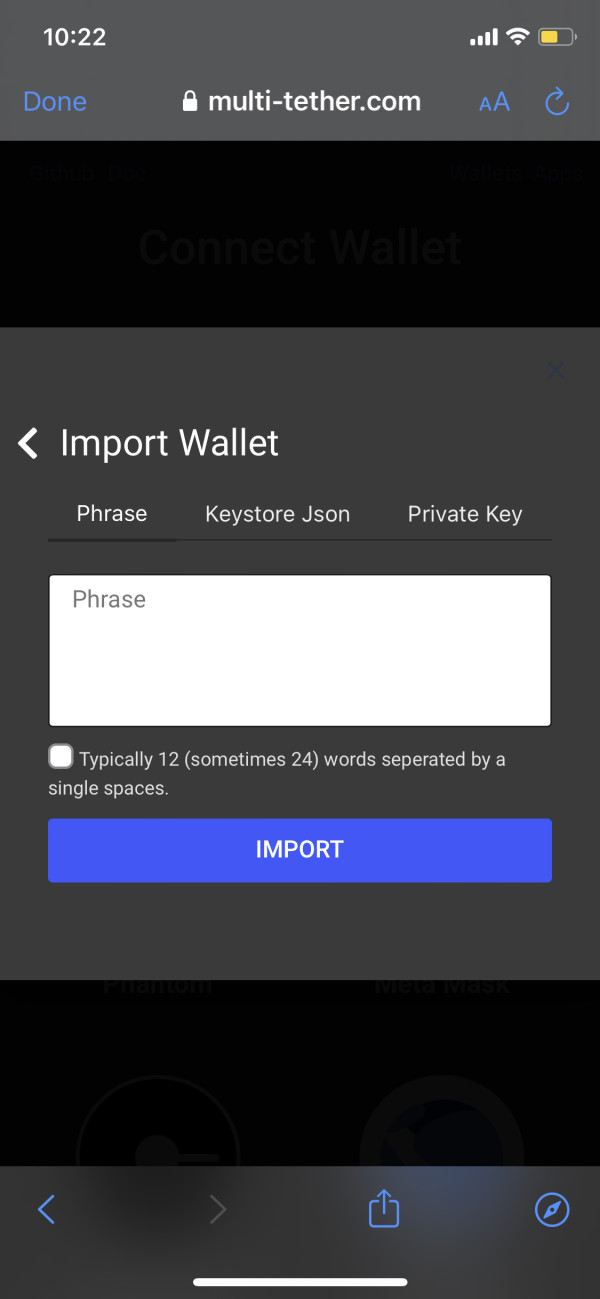

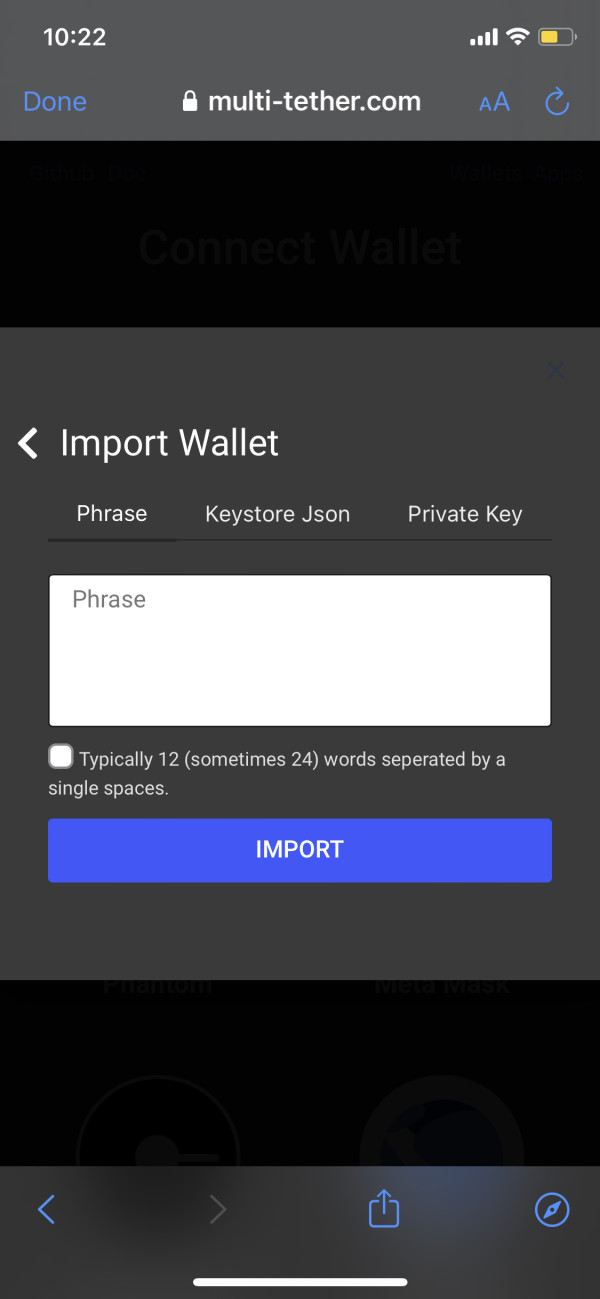

MEXO Finance presents itself as a Latin American cryptocurrency exchange and financial derivatives broker. This mexo finance review reveals significant concerns regarding its legitimacy and safety. The platform registered its domain on January 18, 2024, and claims to offer trading services across multiple asset classes including forex, stocks, futures, energy, precious metals, and cryptocurrencies. Our comprehensive analysis indicates that MEXO Finance operates without proper licensing. It faces serious questions about its regulatory compliance.

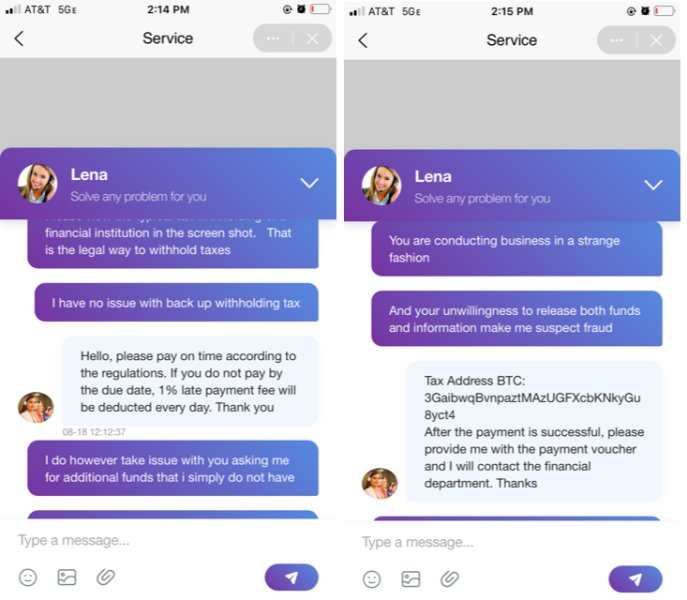

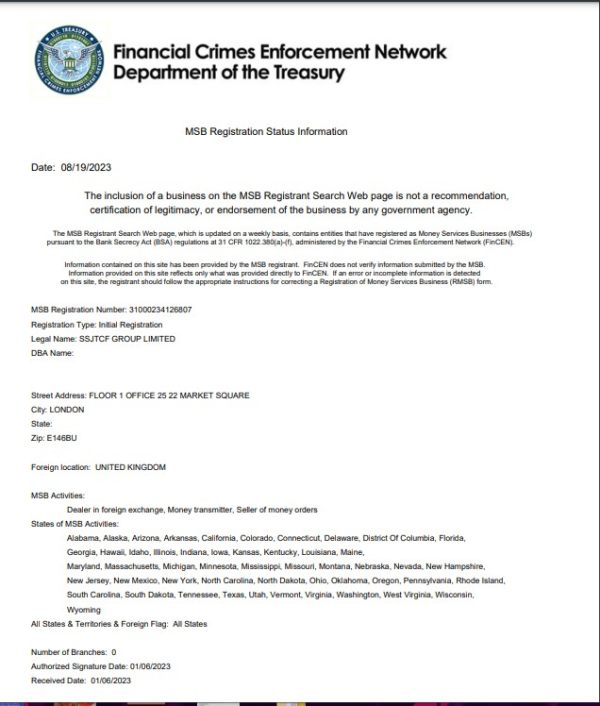

The broker positions itself as a centralized exchange supporting spot trading, futures, lending, and over-the-counter transactions. While it targets traders interested in cryptocurrency and financial derivatives, the lack of formal licensing and ongoing safety controversies make it unsuitable for most traders. According to available information, MEXO Finance claims registration with the Financial Crimes Enforcement Network in the United States. However, this does not constitute proper brokerage licensing. The platform's overall evaluation remains negative due to transparency issues, regulatory concerns, and questionable business practices that raise red flags for potential users.

Important Notice

This review is based on publicly available information and user feedback collected from various sources as of early 2025. MEXO Finance's regulatory status and operational legitimacy may vary across different jurisdictions. Traders should independently verify the broker's compliance with local regulations in their respective countries. The information presented here is for educational purposes only and should not be considered as financial advice. Given the significant regulatory concerns surrounding MEXO Finance, potential users are strongly advised to exercise extreme caution and consider regulated alternatives before engaging with this platform.

Rating Framework

Broker Overview

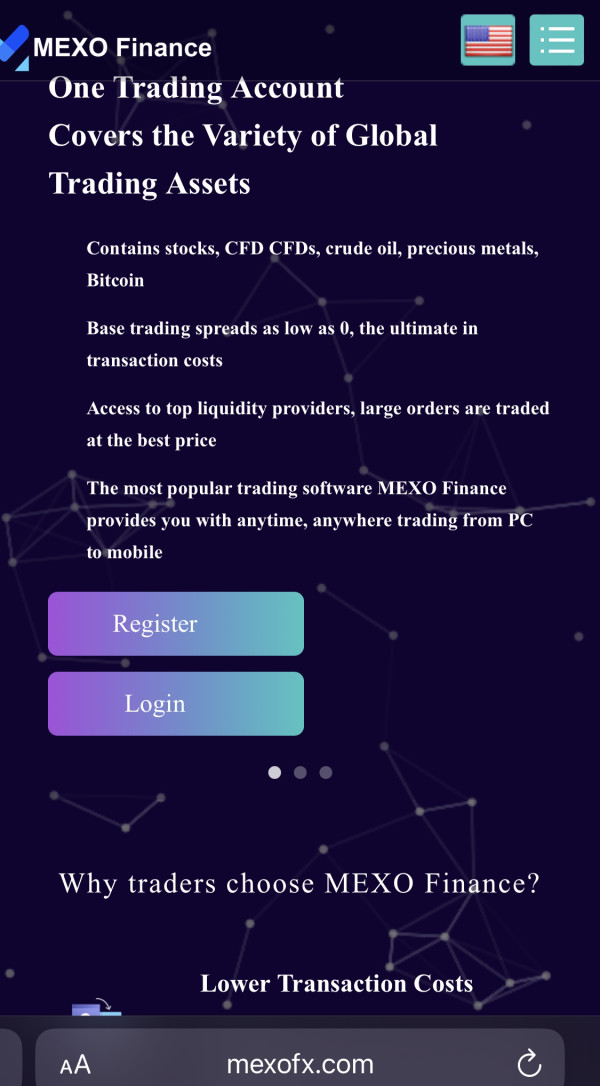

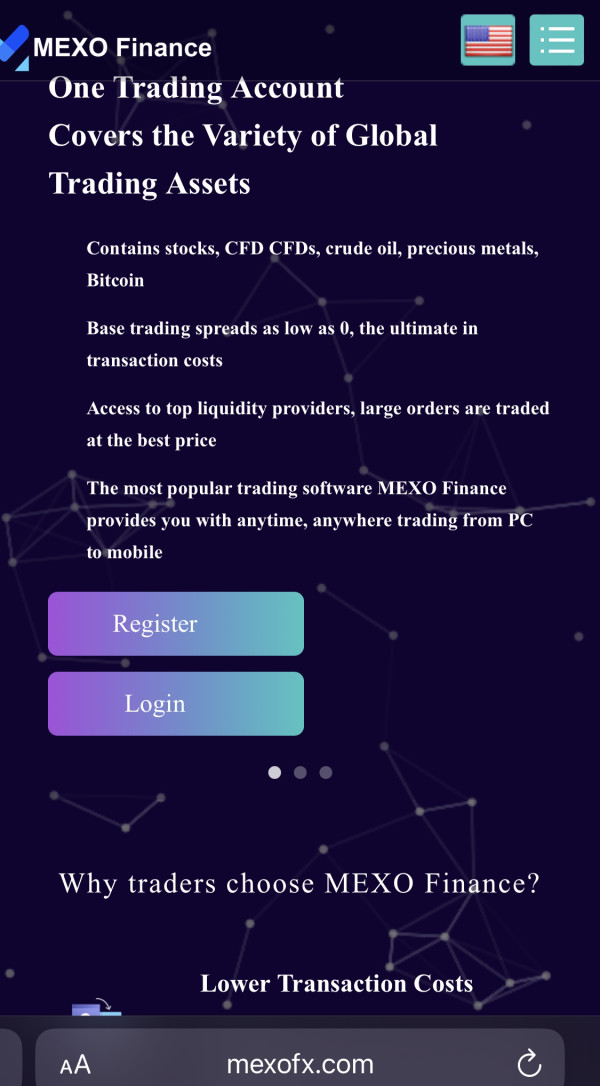

MEXO Finance emerged in the financial services landscape with its official website domain registered on January 18, 2024. The company positions itself as a Mexico City-based financial derivatives broker. The company operates as a centralized exchange claiming to facilitate various financial services including spot trading, futures contracts, lending services, and over-the-counter transactions. Despite its relatively recent establishment, MEXO Finance has attempted to establish itself in the competitive Latin American cryptocurrency and forex trading market.

The broker's business model centers around providing multi-asset trading services. It targets traders interested in diversified portfolio management across traditional and digital assets. According to available information, MEXO Finance claims to support trading in foreign exchange, equities, futures contracts, energy commodities, precious metals, and various cryptocurrencies. However, specific details about trading platforms, execution methods, and operational infrastructure remain largely undisclosed. This raises questions about the depth and quality of services offered.

From a regulatory perspective, this mexo finance review reveals concerning gaps in proper licensing and oversight. While the company claims association with the Financial Crimes Enforcement Network in the United States, this relationship does not constitute proper brokerage licensing or regulatory approval for financial services operations. The absence of clear regulatory authorization from recognized financial authorities represents a significant red flag for potential users considering the platform for their trading activities.

Regulatory Status: MEXO Finance claims monitoring by the Financial Crimes Enforcement Network in the United States. It critically lacks formal licensing from recognized financial regulatory authorities. This regulatory gap represents a fundamental concern for trader protection and legal recourse.

Deposit and Withdrawal Methods: Specific information regarding funding options, processing times, and associated fees has not been disclosed in available materials. This limits transparency about financial transactions.

Minimum Deposit Requirements: The broker has not publicly specified minimum deposit amounts for account opening or maintenance. This makes it difficult for potential traders to assess accessibility and entry barriers.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not available in current documentation. This suggests either absence of such programs or poor marketing transparency.

Tradeable Assets: MEXO Finance claims to offer access to foreign exchange pairs, stock indices, futures contracts, energy commodities, precious metals, and cryptocurrency markets. Specific instruments and market depth remain unspecified.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and withdrawal charges has not been disclosed. This prevents accurate cost analysis for potential users.

Leverage Ratios: The platform mentions offering leverage up to certain ratios. Specific maximum leverage levels and margin requirements have not been clearly communicated in this mexo finance review.

Platform Options: Trading platform specifications, software providers, and technological infrastructure details remain undisclosed in available documentation.

Geographic Restrictions: Information about service availability across different countries and jurisdictions has not been specified.

Customer Support Languages: Available support languages and communication channels have not been detailed in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis

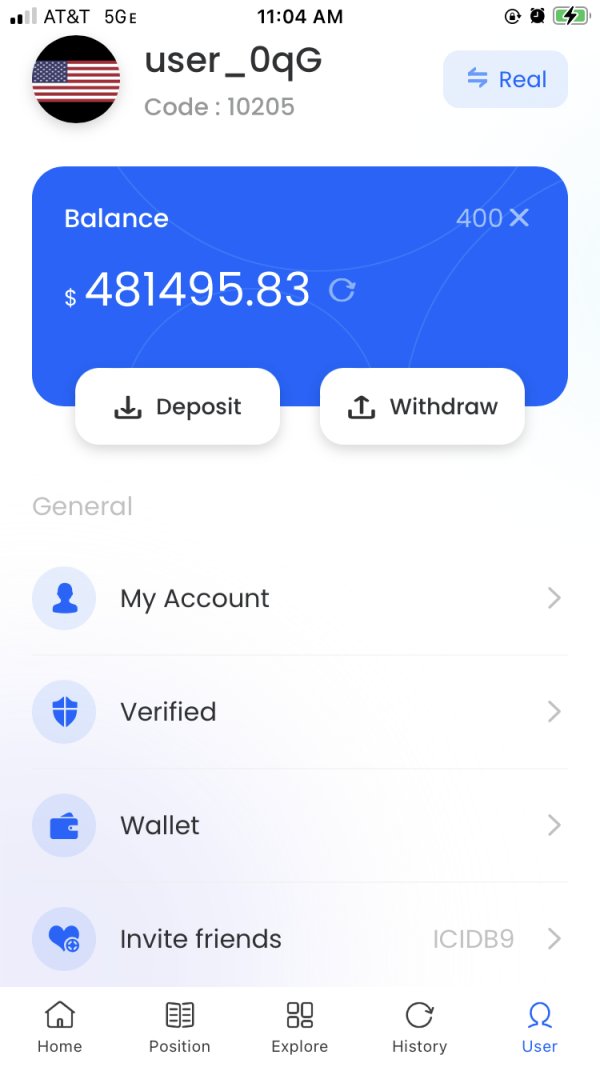

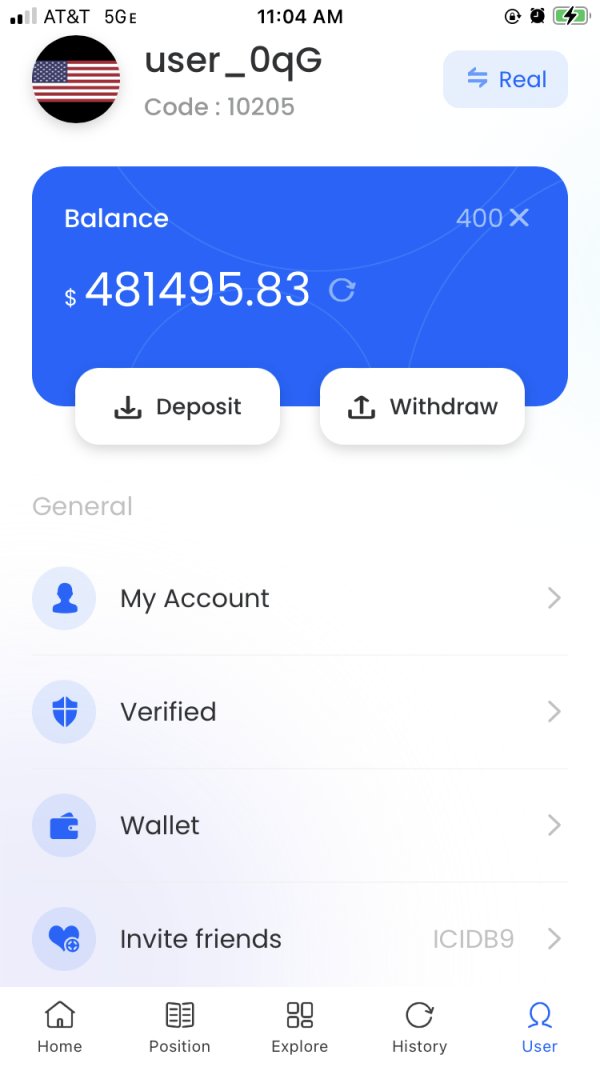

The account conditions offered by MEXO Finance present significant concerns for potential traders. The broker has failed to provide transparent information about account types, tier structures, or specific features that distinguish different account categories. This lack of clarity makes it impossible for traders to make informed decisions about which account might suit their trading needs and experience levels.

Minimum deposit requirements remain undisclosed. This prevents assessment of accessibility for retail traders with varying capital levels. The absence of clear information about account opening procedures, verification requirements, and documentation needed further complicates the onboarding process. Additionally, there is no mention of specialized account features such as Islamic accounts for Muslim traders, educational accounts for beginners, or professional accounts for experienced traders.

The scoring reflects these transparency issues and the fundamental risk associated with engaging with an unlicensed broker. Without proper regulatory oversight, account holders face significant risks regarding fund protection, dispute resolution, and legal recourse. The lack of detailed terms and conditions regarding account management, dormancy fees, and closure procedures adds to the overall negative assessment in this mexo finance review.

MEXO Finance's trading tools and resources receive a mediocre rating due to limited information availability and unclear service specifications. While the broker claims to offer multi-asset trading capabilities, specific details about trading tools, analytical resources, and educational materials remain largely unspecified. This lack of transparency makes it difficult to assess the actual quality and comprehensiveness of the platform's offerings.

The platform allegedly supports various asset classes including forex, stocks, futures, and cryptocurrencies. However, detailed information about market analysis tools, charting capabilities, technical indicators, and research resources is not readily available. Educational resources, which are crucial for trader development, have not been adequately described or demonstrated.

Furthermore, there is no clear information about automated trading support, API access for algorithmic trading, or integration with third-party trading tools. The absence of detailed specifications about mobile trading capabilities, real-time market data, and advanced order types further limits the platform's appeal to serious traders who require sophisticated trading environments.

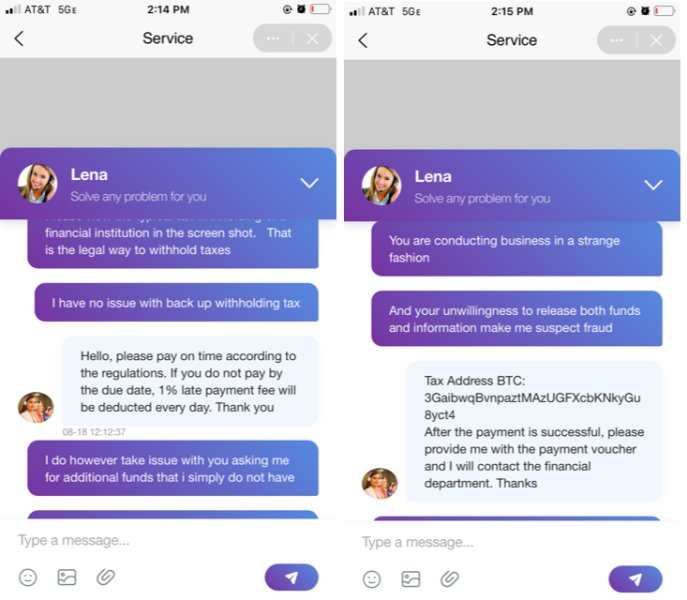

Customer Service and Support Analysis

Customer service evaluation for MEXO Finance is hampered by the lack of concrete information about support channels, availability, and service quality. The broker has not clearly communicated its customer support infrastructure. This includes available contact methods such as live chat, email support, phone assistance, or help desk systems.

Response time commitments, support availability hours, and multilingual support capabilities remain unspecified. This makes it impossible to assess the reliability and accessibility of customer assistance. Without proper regulatory oversight, users also lack protection through financial ombudsman services or regulatory complaint mechanisms that are typically available with licensed brokers.

The absence of user testimonials specifically addressing customer service experiences, combined with the overall legitimacy concerns surrounding the broker, contributes to the low rating. Potential users cannot rely on established support frameworks or regulatory protections that would typically be available through properly licensed financial service providers.

Trading Experience Analysis

The trading experience offered by MEXO Finance cannot be adequately assessed due to insufficient information about platform specifications, execution quality, and technological infrastructure. Without access to detailed platform demonstrations or comprehensive user feedback, it is impossible to evaluate critical aspects such as order execution speed, platform stability, and trading environment quality.

Key technical specifications including server uptime, latency rates, slippage statistics, and order fill rates have not been disclosed. The absence of information about trading platform providers, whether proprietary or third-party solutions, further complicates assessment of the trading environment's reliability and sophistication.

Mobile trading capabilities, cross-device synchronization, and platform customization options remain unspecified. The lack of detailed information about market depth, liquidity provision, and execution methods raises questions about the quality of trade execution that users might experience in this mexo finance review.

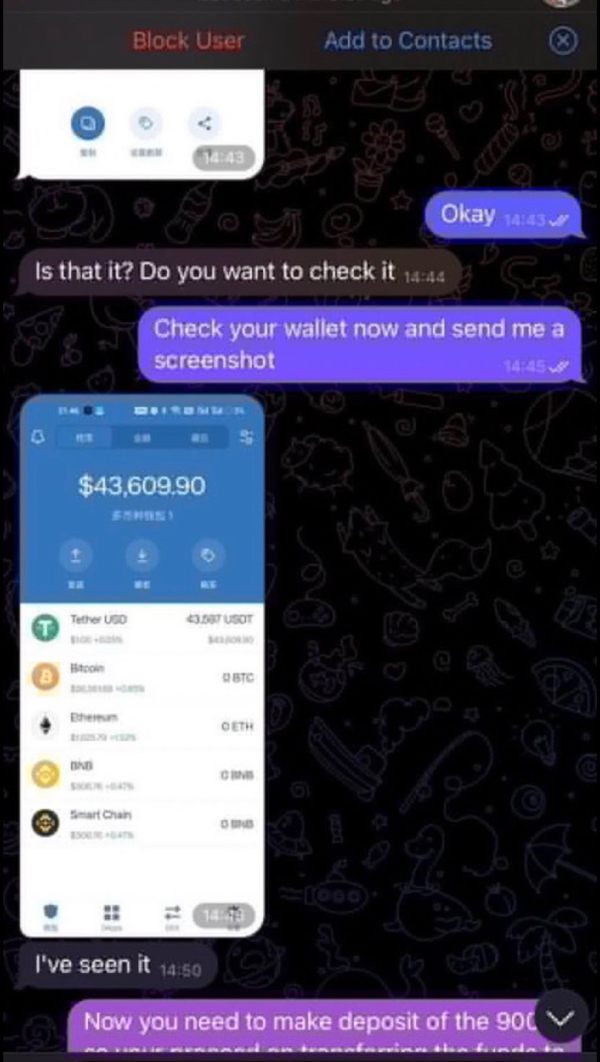

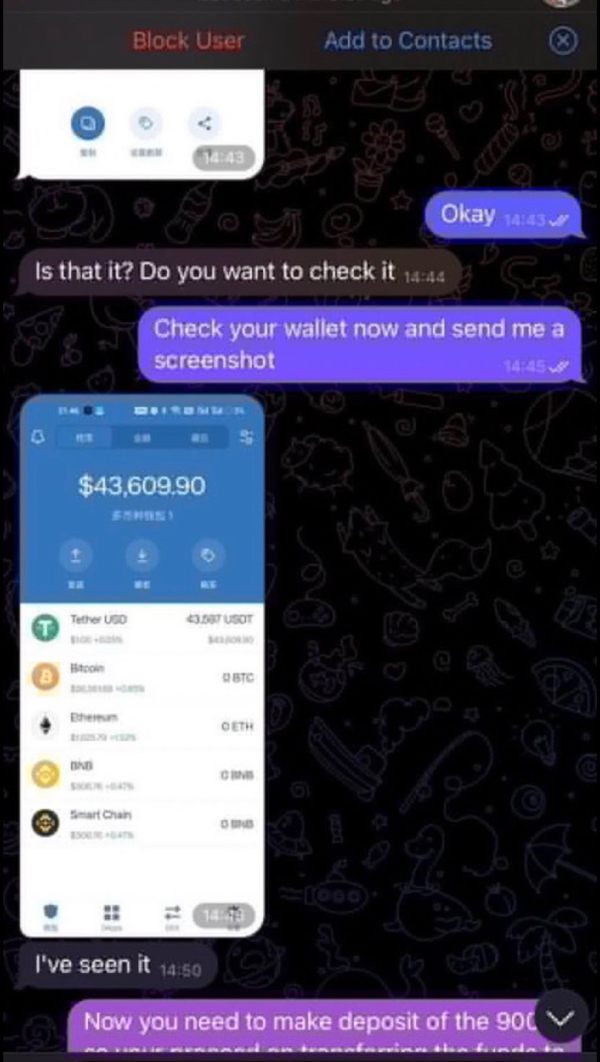

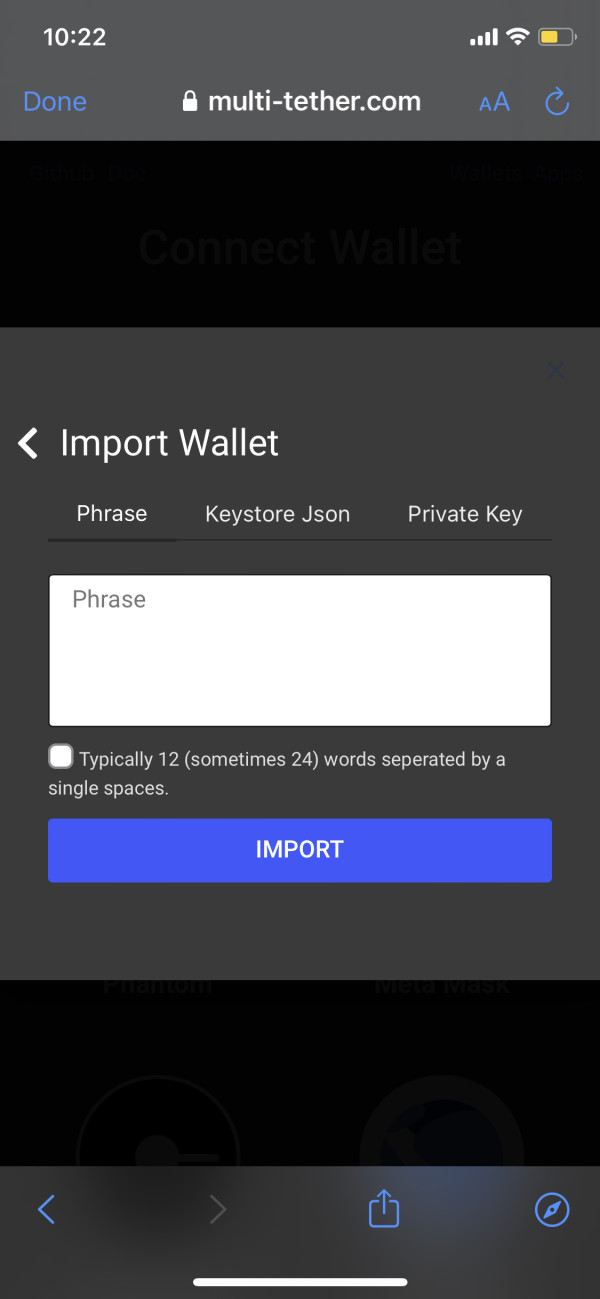

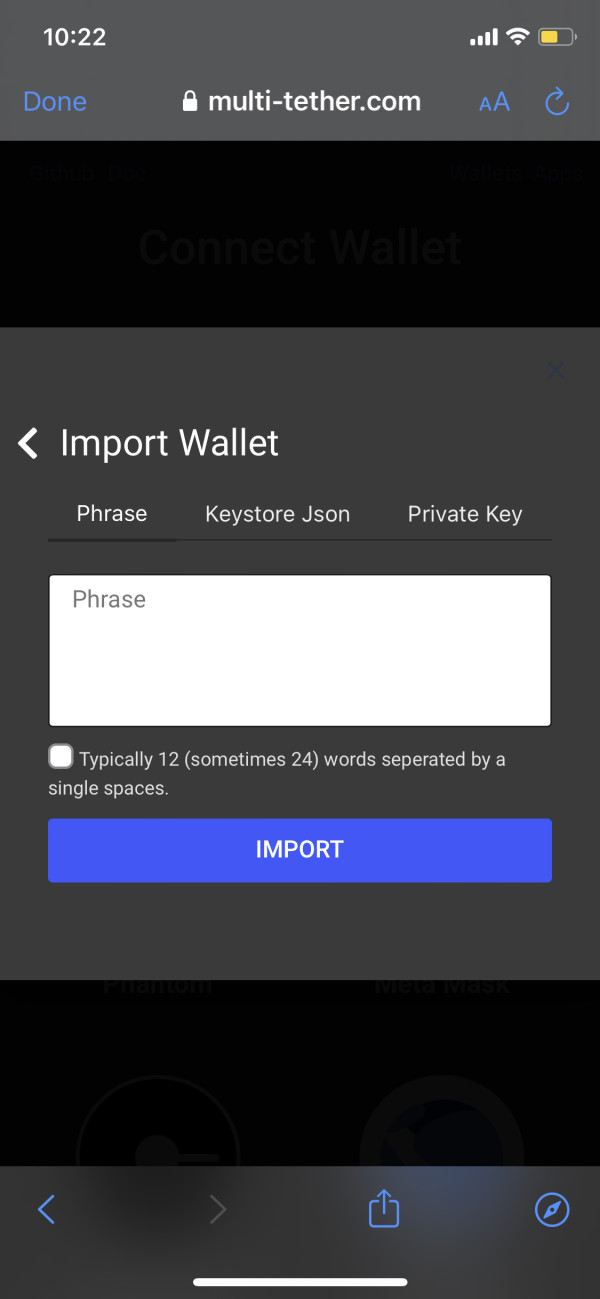

Trust and Safety Analysis

Trust and safety represent the most critical concerns regarding MEXO Finance, resulting in the lowest rating across all evaluation criteria. The broker's operation without proper licensing from recognized financial regulatory authorities creates fundamental risks for user funds and legal protection. While claiming association with FinCEN, this does not constitute proper brokerage licensing or provide the regulatory protections typically required for financial service providers.

The absence of clear information about fund segregation, client money protection, and deposit insurance creates significant safety concerns. Without regulatory oversight, users have limited recourse in case of disputes, platform failures, or fund access issues. The lack of transparency regarding company ownership, financial backing, and operational history further undermines trust.

Additionally, the broker has not provided clear information about security measures, data protection protocols, or cybersecurity infrastructure. The combination of regulatory concerns, transparency issues, and unresolved safety questions makes MEXO Finance unsuitable for traders seeking secure and reliable trading environments.

User Experience Analysis

User experience evaluation is limited by the absence of comprehensive user feedback and detailed platform demonstrations. The overall user journey, from account registration through active trading, remains poorly documented. This makes it difficult to assess the platform's usability and satisfaction levels.

Interface design quality, navigation ease, and platform intuitiveness cannot be properly evaluated without access to detailed user testimonials or platform trials. The registration and verification processes, which significantly impact initial user experience, have not been clearly described or streamlined according to available information.

The lack of detailed information about deposit and withdrawal experiences, platform reliability during market volatility, and customer support responsiveness contributes to the moderate rating. Potential users seeking comprehensive understanding of the platform's user experience would find insufficient information to make informed decisions about platform suitability for their trading needs.

Conclusion

This comprehensive mexo finance review reveals that MEXO Finance presents significant risks and concerns that outweigh any potential benefits for most traders. The broker's operation without proper licensing, combined with substantial transparency issues regarding services, costs, and operational procedures, makes it unsuitable for traders seeking secure and reliable trading environments.

While MEXO Finance may attract traders interested in cryptocurrency and financial derivatives trading, the fundamental regulatory and safety concerns make it inappropriate for serious trading activities. The lack of proper oversight, unclear fee structures, and absence of user protections create unacceptable risks for fund safety and trading security.

Potential users are strongly advised to consider properly regulated alternatives that offer transparent operations, clear regulatory oversight, and established customer protections. The combination of legitimacy questions, safety concerns, and operational transparency issues makes MEXO Finance a high-risk option that should be avoided in favor of licensed and regulated brokers operating under proper financial authority supervision.