Forexland 2025 Review: Everything You Need to Know

Summary: Forexland has garnered significant negative feedback from users and experts alike, primarily due to its unregulated status and lack of transparency. Key concerns include high minimum deposits, limited asset offerings, and a troubling reputation regarding fund withdrawals.

Note: Forexland operates under various names and claims to be registered in different jurisdictions, which can lead to confusion regarding its legitimacy. This review aims to provide a fair and accurate assessment based on multiple sources.

Rating Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user experiences, expert opinions, and factual data from various sources.

Broker Overview

Forexland, operating under the name of Nidex Limited, claims to provide online trading services from its registered address in Saint Vincent and the Grenadines. Established around 2021, Forexland primarily offers trading through a web platform and claims to support various asset classes, including forex and metals. However, it lacks a valid regulatory license, raising concerns about the safety of client funds.

Detailed Section

Regulated Geographic Areas/Regions

Forexland is registered in Saint Vincent and the Grenadines, a known offshore jurisdiction with minimal regulatory oversight. This lack of regulation poses a significant risk to traders, as there are no legal protections in place. According to the local financial authority, they do not license forex brokers, which adds to the red flags surrounding Forexland's operations.

Deposit/Withdrawal Currencies/Cryptocurrencies

Forexland accepts deposits primarily in fiat currencies and cryptocurrencies. However, the only payment methods mentioned include bank transfers and cryptocurrencies, which are often favored by unregulated brokers due to their anonymity and irreversibility.

Minimum Deposit

The minimum deposit required to open an account with Forexland is notably high at $500. This amount is significantly more than what many regulated brokers require, which can be as low as $100. This high entry barrier may deter many potential traders.

There is no substantial information available regarding bonuses or promotions offered by Forexland. The absence of such incentives further indicates a lack of competitive offerings compared to regulated brokers that often provide various promotions to attract new clients.

Tradable Asset Classes

Forexland claims to offer trading in forex and metals, but it does not provide a comprehensive range of assets like stocks, commodities, or cryptocurrencies. This limited selection is a disadvantage for traders seeking diversification in their portfolios.

Costs (Spreads, Fees, Commissions)

Forexland reportedly offers spreads starting from 1.8 pips, which is less competitive compared to many established brokers. Additionally, there are concerns about hidden fees, particularly since the broker does not specify withdrawal fees or conditions.

Leverage

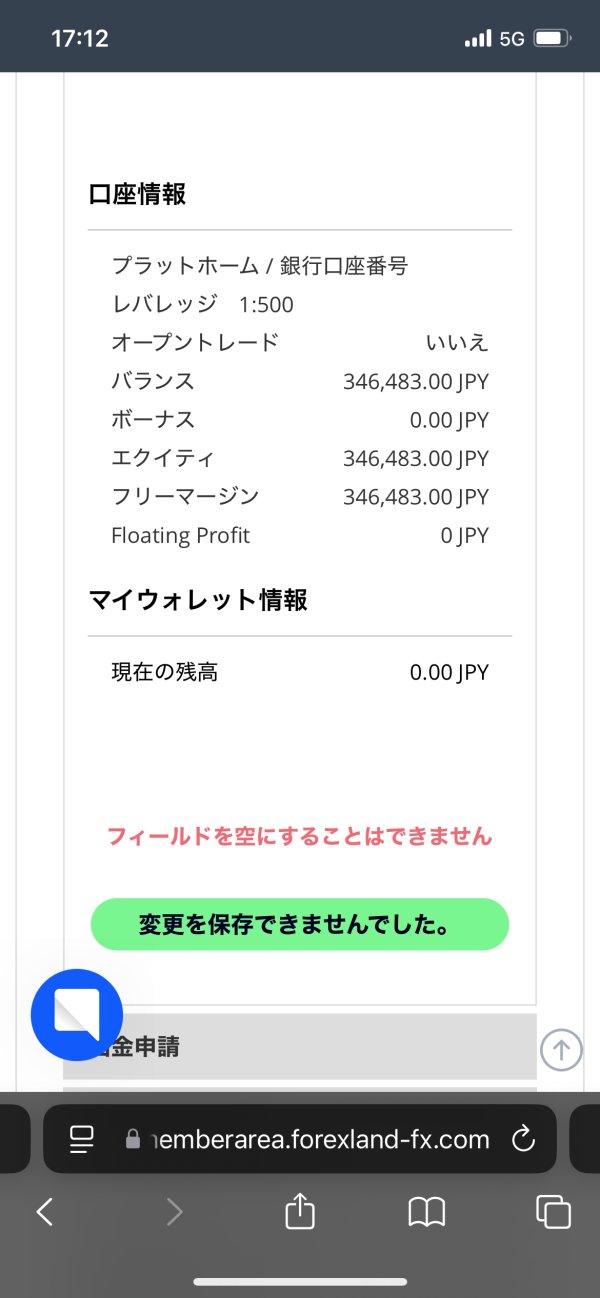

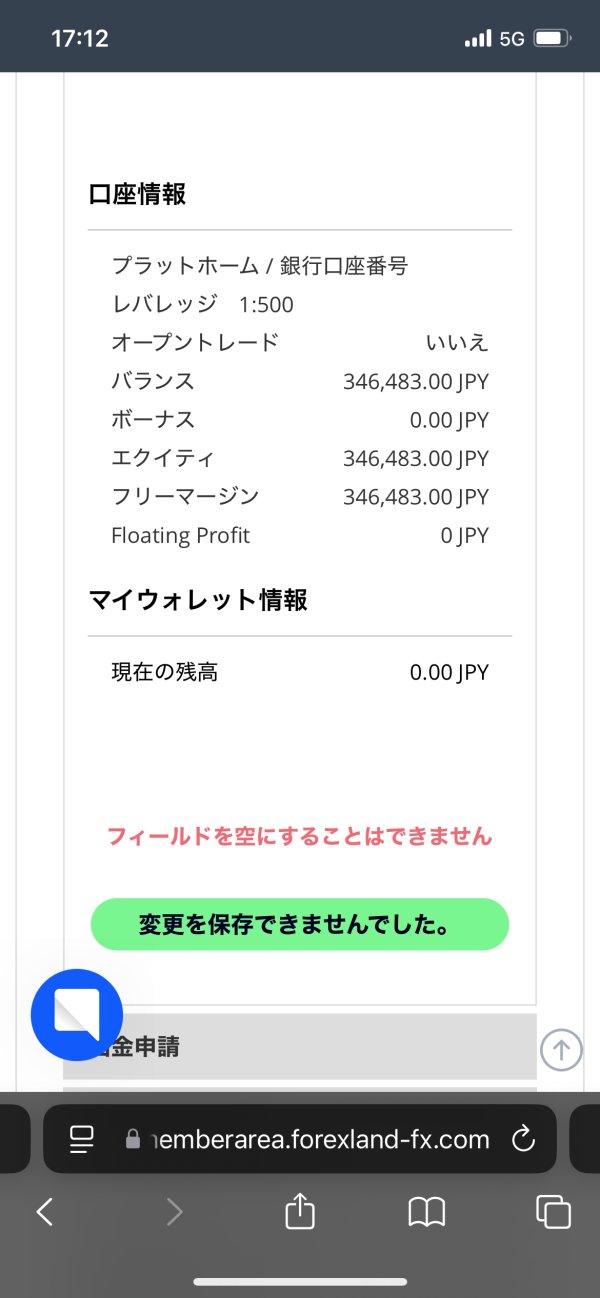

Forexland offers a high leverage of up to 1:500, which may seem attractive to some traders. However, high leverage also comes with increased risk, especially given the broker's unregulated status. This can lead to significant losses if not managed properly.

The broker provides access to a basic web trading platform but lacks advanced features found in popular platforms like MT4 or MT5. This limitation can hinder traders who rely on sophisticated tools for their trading strategies.

Restricted Areas

Forexland appears to target clients from various regions, including South Korea, Vietnam, and Japan, despite its unregulated status. This raises questions about its legitimacy and adherence to international trading standards.

Available Customer Support Languages

Forexland offers customer support primarily in English, but the quality of this support has been criticized. Many users report difficulties in contacting the support team and receiving timely assistance.

Repeated Rating Overview

Detailed Breakdown

-

Account Conditions (3/10): Forexland requires a minimum deposit of $500, which is high compared to many regulated brokers. The lack of diverse account types further limits options for traders.

Tools and Resources (4/10): The broker provides basic trading tools but lacks advanced features typically found in established platforms like MT4 or MT5, which are essential for serious traders.

Customer Service & Support (2/10): Users have reported poor experiences with customer support, citing slow response times and inadequate assistance. This raises concerns about the broker's reliability.

Trading Setup (3/10): The trading experience is hindered by the platform's limitations and the high leverage offered, which can lead to significant risks for traders.

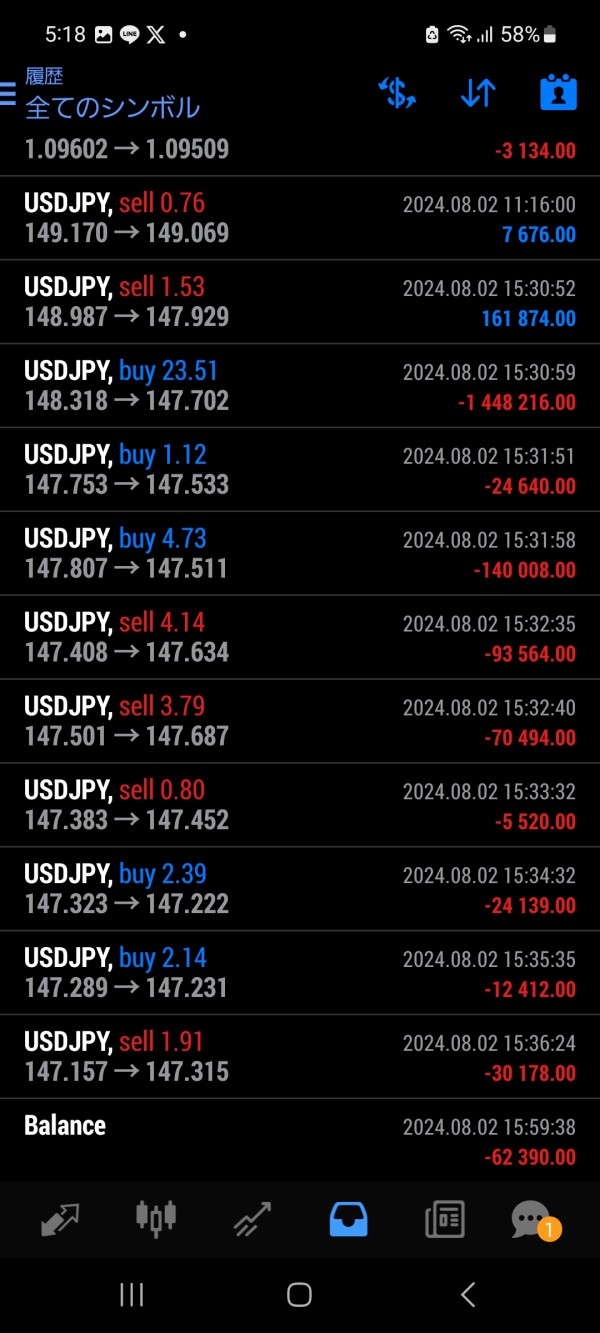

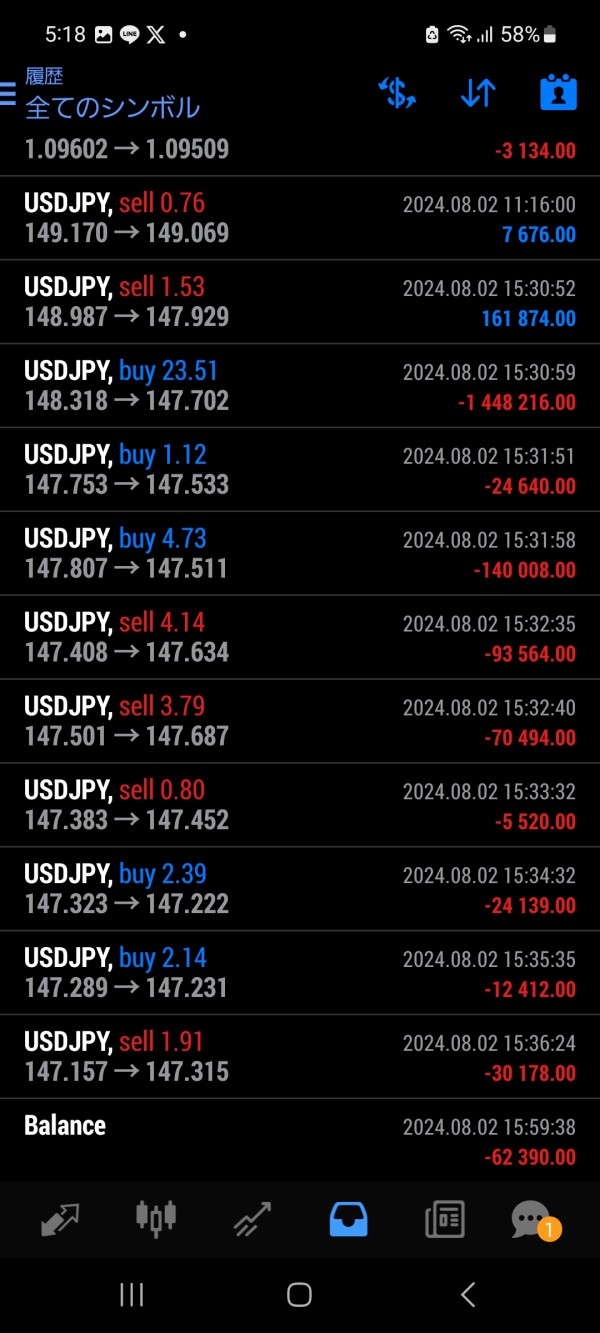

Trustworthiness (1/10): Forexland operates without any regulatory oversight, making it a risky choice for traders. Multiple sources indicate that it may be a scam, with numerous complaints about withdrawal issues.

User Experience (2/10): Overall user feedback is overwhelmingly negative, with many traders expressing dissatisfaction regarding their experiences and the broker's practices.

In conclusion, Forexland presents significant risks for potential traders due to its unregulated status and lack of transparency. Given the numerous red flags and negative user experiences, it is advisable to consider alternative, regulated brokers that offer better security and support.