Forex Traders 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive forex traders review evaluates leading brokers that have shown strong performance in regulatory compliance, competitive trading conditions, and platform innovation. The brokers we examined show robust regulatory frameworks under CFTC and NFA oversight, offer low fixed spreads, and provide diverse trading instruments suitable for both novice and professional traders. Key standout features include innovative risk management tools such as deal cancellation features, support for MetaTrader 4 alongside proprietary platforms, and comprehensive trading resources with multiple indicators and chart types.

The primary target audience consists of forex traders seeking reliable, well-regulated brokers and investors looking to diversify their trading portfolios across major and minor currency pairs, plus emerging asset classes like cryptocurrencies. According to ForexBrokers.com, these platforms have been evaluated based on 73 crucial criteria that determine success factors for forex traders. The regulatory environment, particularly in the US market, provides robust consumer protection through CFTC and NFA oversight, ensuring traders benefit from comprehensive safeguards against forex scams and fraudulent activities.

Important Considerations

Regional regulatory differences may significantly impact trading conditions and user experience across different jurisdictions. Brokers operating in multiple regions must comply with varying regulatory requirements, which can affect leverage limits, available instruments, and customer protection measures. US-based forex traders benefit from particularly stringent regulatory oversight, as brokers accepting US clients must register as Retail Foreign Exchange Dealers with the CFTC and maintain regulation under the NFA as Futures Commission Merchants.

This evaluation methodology is based on 73 key criteria crucial to forex trader success, as reported by industry analysis platforms. The assessment framework ensures objectivity and comprehensiveness by examining regulatory compliance, trading conditions, platform functionality, customer service quality, and overall user experience to provide traders with reliable decision-making information.

Rating Framework

Broker Overview

XTB, founded in 2004 and headquartered in Warsaw, Poland, has established itself as a preferred choice among cost-conscious forex traders. According to industry reports, XTB's strong regulatory framework and comprehensive customer service options solidify its position as a top choice for seasoned forex traders. The broker has built its reputation by focusing on competitive pricing structures and robust trading infrastructure that appeals to both retail and professional trading segments.

The company operates under a comprehensive business model that emphasizes forex trading services while expanding into additional asset classes. tastyfx represents another significant platform in this forex traders review, offering both proprietary trading solutions and MetaTrader 4 integration. The proprietary platform is particularly beneficial for beginner forex traders, featuring more intuitive and user-friendly interfaces compared to MT4's more complex environment, though MT4 remains the most popular choice among experienced forex traders.

Available trading assets include major and minor forex pairs, with cryptocurrency trading available through partnerships such as OANDA's collaboration with Paxos. The regulatory structure centers on CFTC and NFA oversight, providing US traders with robust consumer protections and ensuring compliance with strict financial industry standards.

Regulatory Jurisdictions: Primary regulation under CFTC and NFA ensures comprehensive trader protection and fund safety. Additional regulatory coverage may include CySEC, ASIC, SCB, and FSA Seychelles depending on the specific broker entity, providing multi-jurisdictional oversight for international operations.

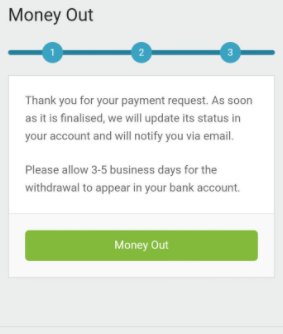

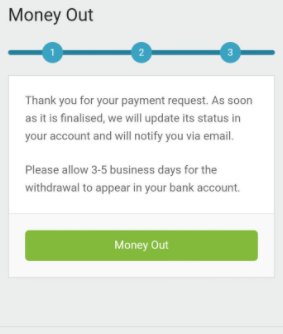

Funding Methods: Specific deposit and withdrawal options are not detailed in available sources, though industry-standard methods typically include bank transfers, credit cards, and electronic payment systems.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available sources and may vary by account type and regulatory jurisdiction.

Promotional Offerings: Current bonus and promotional structures are not detailed in available sources, though some brokers offer tiered loyalty programs that may benefit active traders.

Tradeable Assets: Major and minor forex pairs constitute the primary offering, with cryptocurrency trading available through strategic partnerships. Some platforms also provide access to additional instruments depending on regulatory permissions.

Cost Structure: Low fixed spreads are highlighted as a key competitive advantage, particularly for VIP account holders. Specific commission structures and additional fees are not detailed in available sources, though industry-leading fee schedules are mentioned for certain platforms.

Leverage Ratios: Specific leverage information is not provided in available sources, though US regulatory constraints typically limit retail forex leverage compared to international markets.

Platform Options: MetaTrader 4 support combined with proprietary platforms offers flexibility for different trader preferences and experience levels.

Geographic Restrictions: Specific regional limitations are not detailed in available sources beyond general regulatory compliance requirements.

Customer Support Languages: Multilingual support availability is not specified in available sources, though established brokers typically offer multiple language options.

This section of our forex traders review demonstrates the comprehensive nature of services available, though specific details may require direct broker consultation for complete information.

Account Conditions Analysis

The account structure evaluation reveals competitive offerings designed for various trader segments. Low fixed spreads represent a significant advantage, particularly for high-frequency traders and those managing larger position sizes. According to available sources, VIP account holders can access enhanced spread conditions, suggesting a tiered approach that rewards active trading volume or larger account balances.

Account opening processes are not specifically detailed in available sources, though established brokers typically maintain streamlined digital onboarding procedures. The absence of detailed minimum deposit requirements in available sources suggests these may vary by account type or promotional periods, requiring direct inquiry for current terms.

Special account features such as Islamic accounts or professional trader classifications are not mentioned in available sources. However, the regulatory framework under CFTC and NFA oversight ensures standardized consumer protections regardless of account type. The competitive spread environment indicates strong execution capabilities, though specific spread ranges and conditions during different market sessions require further investigation.

The account conditions framework appears designed to accommodate both cost-conscious traders and those requiring advanced trading tools, though this forex traders review notes that complete account specification details are not comprehensively available in current sources and may require direct broker consultation for full transparency.

The trading tools ecosystem demonstrates comprehensive coverage with multiple indicators, chart types, and timeframes available across supported platforms. MetaTrader 4 integration provides access to the industry-standard toolset that forex traders rely on for technical analysis and automated trading strategies. The platform offers extensive customization options and supports Expert Advisors for algorithmic trading approaches.

Proprietary platform offerings complement MT4 with more intuitive interfaces particularly suited for beginner forex traders. These platforms typically feature streamlined navigation and simplified order entry systems while maintaining access to essential trading tools. The combination approach allows traders to select platforms based on their experience level and specific trading requirements.

Research and analysis resources are not specifically detailed in available sources, though established brokers typically provide market commentary, economic calendars, and fundamental analysis. Educational resources and training materials are also not comprehensively covered in available sources, representing an area where direct broker evaluation would provide additional clarity.

Automated trading support through MT4 enables sophisticated strategy implementation, while innovative risk management tools like deal cancellation features provide unique hedging-like capabilities. The technological infrastructure appears robust, though specific performance metrics and tool reliability data are not detailed in current sources.

Customer Service and Support Analysis

Customer service evaluation is limited by available source information, though the mention of "wide range of customer service options" suggests comprehensive support infrastructure. Established brokers typically maintain multiple contact channels including phone, email, live chat, and potentially social media support, though specific channel availability is not detailed in current sources.

Response time benchmarks and service quality metrics are not provided in available sources, making objective assessment challenging. The regulatory environment under CFTC and NFA oversight typically requires brokers to maintain adequate customer service standards, providing baseline assurance for trader support needs.

Multilingual support capabilities are not specified in available sources, though international brokers commonly offer services in major trading languages. Service hours and availability during different market sessions also require direct verification as this information is not comprehensively covered in current sources.

Problem resolution processes and escalation procedures are not detailed in available sources. The regulatory framework provides ultimate recourse through CFTC and NFA complaint mechanisms, ensuring traders have access to formal dispute resolution when needed, though specific broker-level resolution processes require further investigation.

Trading Experience Analysis

Platform stability and execution quality represent critical factors for forex trading success, though specific performance metrics are not detailed in available sources. The support for both MT4 and proprietary platforms suggests robust technological infrastructure capable of handling diverse trading requirements and user preferences.

Order execution characteristics including slippage rates, requote frequency, and fill quality are not specifically addressed in available sources. However, mentions of "execution speeds of less than 40ms and zero requotes" for certain high-performance configurations indicate advanced execution capabilities for serious forex traders seeking institutional-grade performance.

Platform functionality completeness is evidenced by comprehensive charting tools and technical indicators across supported platforms. The range of available chart types and timeframes accommodates various trading styles from scalping to long-term position trading. Mobile trading experience details are not provided in available sources, though modern brokers typically maintain feature-rich mobile applications.

The trading environment benefits from low fixed spreads and innovative risk management tools, creating conditions favorable for both active and strategic trading approaches. This forex traders review notes that while technological capabilities appear strong, specific performance benchmarks and user experience metrics require direct evaluation for complete assessment.

Trust and Security Analysis

Regulatory credentials under CFTC and NFA oversight provide substantial credibility and ensure compliance with stringent US financial industry standards. This regulatory framework requires brokers to maintain segregated client funds, adequate capitalization, and transparent business practices that enhance overall trustworthiness for forex traders.

Fund security measures beyond basic regulatory requirements are not specifically detailed in available sources, though CFTC and NFA regulation mandates comprehensive client protection protocols. These typically include segregated account structures, regular financial reporting, and insurance coverage, though specific implementation details require direct broker verification.

Company transparency regarding ownership, financial condition, and business operations is ensured through regulatory reporting requirements, though specific transparency initiatives are not detailed in available sources. The established operational history since 2004 provides additional confidence in business stability and long-term viability.

Industry reputation and third-party recognition are not comprehensively covered in available sources, though the mention of being a "favorite broker among cost-conscious forex traders" suggests positive market positioning. Negative event handling and crisis management capabilities are not specifically addressed, representing areas where additional research would enhance this evaluation.

User Experience Analysis

Overall user satisfaction metrics are not provided in available sources, limiting objective assessment of trader contentment levels. However, the description of proprietary platforms as having "friendlier and more intuitive" interfaces suggests attention to user experience design, particularly for less experienced traders.

Interface design quality and usability are highlighted for proprietary platforms, with specific mention of improved accessibility for beginner forex traders. The availability of both simplified proprietary platforms and full-featured MT4 suggests a thoughtful approach to accommodating different user experience preferences and technical requirements.

Registration and account verification processes are not detailed in available sources, though regulatory compliance requirements ensure standardized identity verification and documentation procedures. Fund operation experiences including deposit and withdrawal processes are not specifically covered, requiring direct evaluation for complete user journey assessment.

Common user complaints and pain points are not identified in available sources, limiting understanding of potential friction areas. The target audience identification as "forex traders seeking reliable, well-regulated brokers and investors looking to diversify" suggests broad appeal across different trader segments, though specific user satisfaction data would strengthen this assessment.

Conclusion

This comprehensive forex traders review reveals brokers with strong regulatory foundations, competitive trading conditions, and robust platform offerings suitable for diverse trader requirements. The combination of CFTC and NFA oversight, low fixed spreads, and innovative risk management tools creates an attractive environment for both novice and experienced forex traders.

The evaluation recommends these platforms particularly for cost-conscious traders seeking reliable regulatory protection and those requiring flexible platform options. Beginners benefit from intuitive proprietary platforms, while experienced traders can leverage full MT4 functionality and advanced tools. The main strengths include strong regulatory compliance, competitive pricing, and comprehensive platform support, while limitations center on incomplete publicly available information regarding specific service details and user feedback metrics that would require direct broker evaluation for complete assessment.