Finiko 2025 Review: Everything You Need to Know

Executive Summary

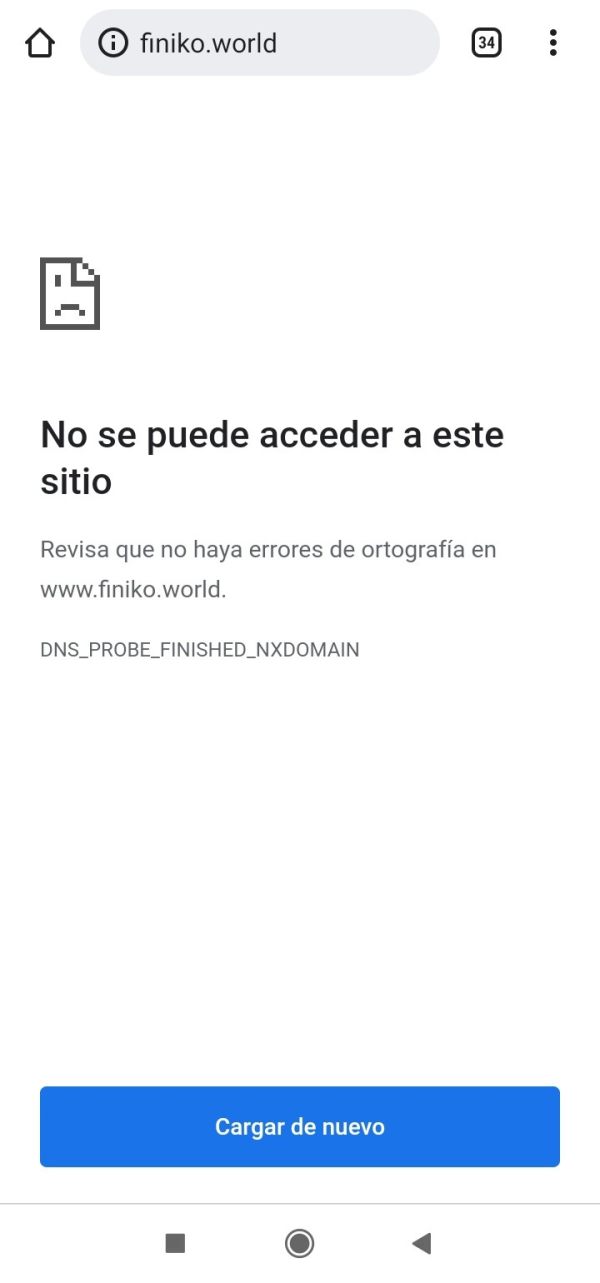

Finiko started in 2020 as a Russian-based trading platform. This finiko review shows troubling patterns that should make investors very careful about using this service. WikiFX gives Finiko an alarming score of just 1 out of 10, while Scam Detector assigns a trust score of 58, indicating moderate but questionable trustworthiness. Many user reviews highlight potential fraud, with lots of complaints about withdrawal issues and misleading investment promises.

The platform mainly targets investors who want passive income through automated trading systems. However, detailed analysis of user feedback and regulatory assessments suggests this broker operates with very little oversight and transparency. The lack of proper regulatory authorization, combined with growing negative user experiences, makes Finiko a high-risk investment option that goes against industry safety standards.

Important Notice

This evaluation uses information from multiple third-party sources and user feedback platforms. Finiko operates as a Russian entity with limited regulatory oversight, which creates risks for international clients. Our assessment uses data from WikiFX ratings, user review platforms, and industry analysis reports. Potential clients should know that regulatory protection may be minimal or non-existent, and geographical restrictions may apply depending on local financial regulations.

Rating Framework

Broker Overview

Finiko appeared in 2020 as a Russian-based online trading platform. The company positions itself as a provider of automated investment solutions for passive income generation. The company's business model focuses on attracting investors with promises of high returns through computer-based trading strategies. However, closer examination reveals concerning gaps in transparency and regulatory compliance that make it different from established brokers in the forex industry.

The platform's operational structure lacks the strong regulatory framework that legitimate forex brokers typically have. Unlike regulated entities that maintain clear licensing information and transparent business practices, Finiko operates in a regulatory gray area that offers minimal investor protection. This finiko review emphasizes the importance of understanding these fundamental differences when evaluating the broker against industry standards. The company's marketing approach focuses heavily on recruitment and referral systems, which often characterizes multi-level marketing schemes rather than traditional brokerage services.

Regulatory Status: Finiko operates as a Russian entity with questionable regulatory oversight. WikiFX assessments show poor regulatory compliance, with no clear authorization from recognized financial authorities. This lack of proper licensing represents a significant risk factor for potential clients.

Deposit and Withdrawal Methods: Specific information about available payment methods remains unclear in available documentation. The absence of transparent financial processes raises concerns about fund security and accessibility.

Minimum Deposit Requirements: Concrete minimum deposit information is not clearly specified in available materials. This indicates poor transparency in basic operational details.

Bonuses and Promotions: Available resources do not detail specific promotional offers or bonus structures. This suggests limited marketing transparency.

Tradeable Assets: The range of available trading instruments is not well documented in accessible materials. This is unusual for legitimate forex brokers who typically highlight their asset offerings.

Cost Structure: Detailed information about spreads, commissions, and fees is notably absent from available documentation. This makes cost comparison with other brokers impossible.

Leverage Ratios: Specific leverage offerings are not clearly stated in available materials.

Platform Options: Information about trading platform types and technological infrastructure remains undisclosed in accessible documentation.

This finiko review highlights the concerning lack of basic operational transparency that legitimate brokers typically provide to potential clients.

Account Conditions Analysis

The evaluation of Finiko's account conditions reveals significant transparency problems that make it different from reputable forex brokers. Available documentation fails to provide clear information about account types, their specific features, or associated benefits. This lack of clarity represents a fundamental weakness in the broker's operational transparency.

Minimum deposit requirements, a standard disclosure for legitimate brokers, remain unspecified in accessible materials. This absence of basic financial information makes it impossible for potential clients to make informed decisions about account opening. The account opening process itself lacks detailed documentation, with no clear explanation of verification procedures or required documentation.

Special account features, such as Islamic accounts for Sharia-compliant trading, are not mentioned in available resources. This omission suggests limited accommodation for diverse client needs. The absence of detailed account condition information in this finiko review reflects the broader transparency issues that characterize the platform's operations.

User feedback about account management experiences is limited, but available reports suggest dissatisfaction with account-related services. The lack of comprehensive account information, combined with negative user experiences, contributes to the low rating in this category.

Finiko's trading tools and educational resources present another area of significant concern for potential clients. Available documentation provides minimal information about the technological infrastructure supporting client trading activities. Unlike established brokers who typically showcase their platform capabilities and analytical tools, Finiko maintains limited transparency about its technological offerings.

Research and analysis resources, fundamental components of professional trading services, are not adequately documented in accessible materials. This absence suggests either limited analytical support or poor communication of available resources to potential clients. Educational materials, crucial for trader development, are similarly underdocumented.

Automated trading support, while implied in the platform's marketing materials, lacks detailed technical specifications or performance data. This gap in information makes it difficult for traders to assess the quality and reliability of automated systems. The platform's technological capabilities remain largely unverified through independent testing or user verification.

The limited availability of comprehensive tool information significantly impacts the user experience and trading effectiveness. Professional traders typically require robust analytical tools and educational resources, which appear to be either absent or inadequately communicated by Finiko.

Customer Service and Support Analysis

Customer service quality represents a critical component of broker evaluation, and Finiko's performance in this area shows mixed results based on available user feedback. While specific customer service channels and availability hours are not clearly documented, user reports suggest moderate service quality with room for significant improvement.

Response time information is not readily available in accessible documentation, which itself indicates poor communication standards. Professional brokers typically provide clear service level agreements and response time commitments. The absence of such information suggests less structured customer support operations.

Service quality assessments from user feedback indicate mediocre performance, with some clients reporting difficulties in obtaining timely assistance. However, the limited volume of detailed customer service reviews makes comprehensive assessment challenging. Multi-language support capabilities are not clearly specified, potentially limiting accessibility for international clients.

The customer service evaluation contributes to concerns about overall operational professionalism. While not the lowest-rated category, the moderate score reflects the gap between Finiko's service levels and industry standards established by regulated brokers.

Trading Experience Analysis

The trading experience evaluation reveals significant concerns based on available user feedback and platform assessment. User reports indicate various issues with platform functionality and trading execution, contributing to overall dissatisfaction with the trading environment. Unlike established brokers with proven track records, Finiko's trading infrastructure appears to face reliability challenges.

Platform stability and execution speed, critical factors for successful trading, receive negative feedback from users who have experienced the system. Order execution quality reports are limited but suggest potential issues with trade processing and fulfillment. The lack of comprehensive performance data makes it difficult to verify platform capabilities independently.

Mobile trading experience, increasingly important for modern traders, is not well-documented in available materials. Professional traders typically require robust mobile solutions, and the absence of clear mobile platform information represents a significant limitation. This finiko review emphasizes that trading environment quality significantly impacts user success and satisfaction.

The overall trading experience assessment reflects the combination of user dissatisfaction, limited transparency, and apparent technical limitations that distinguish Finiko from professional-grade trading platforms.

Trust and Security Analysis

Trust and security represent the most critical concerns in this Finiko evaluation. The broker's regulatory status presents significant red flags, with WikiFX assigning an extremely low score of 1 out of 10, indicating substantial regulatory compliance issues. The absence of clear licensing from recognized financial authorities creates an environment of minimal investor protection.

Fund security measures are not adequately documented or verified through independent sources. Legitimate brokers typically maintain segregated client accounts and provide clear information about fund protection mechanisms. Finiko's lack of transparency in this crucial area raises serious concerns about client asset safety.

Company transparency issues extend beyond regulatory compliance to include basic operational disclosures. The limited availability of comprehensive business information, combined with concerning user reports about withdrawal difficulties, suggests potential operational irregularities. Industry reputation assessments from multiple sources consistently highlight trust concerns.

The handling of negative incidents and user complaints appears inadequate based on available feedback. Professional brokers typically maintain robust dispute resolution mechanisms and transparent complaint handling procedures. The trust and security analysis reveals fundamental weaknesses that position Finiko as a high-risk option for potential investors.

User Experience Analysis

Overall user satisfaction with Finiko shows predominantly negative trends based on available feedback and review platforms. User reports consistently highlight various operational issues and dissatisfaction with service quality. The negative feedback patterns distinguish Finiko unfavorably from established brokers with positive user communities.

Interface design and platform usability information is limited in available documentation, making assessment of user experience quality challenging. However, the absence of positive user testimonials and the presence of multiple complaints suggest significant usability issues. Registration and verification processes are not clearly documented, indicating poor onboarding transparency.

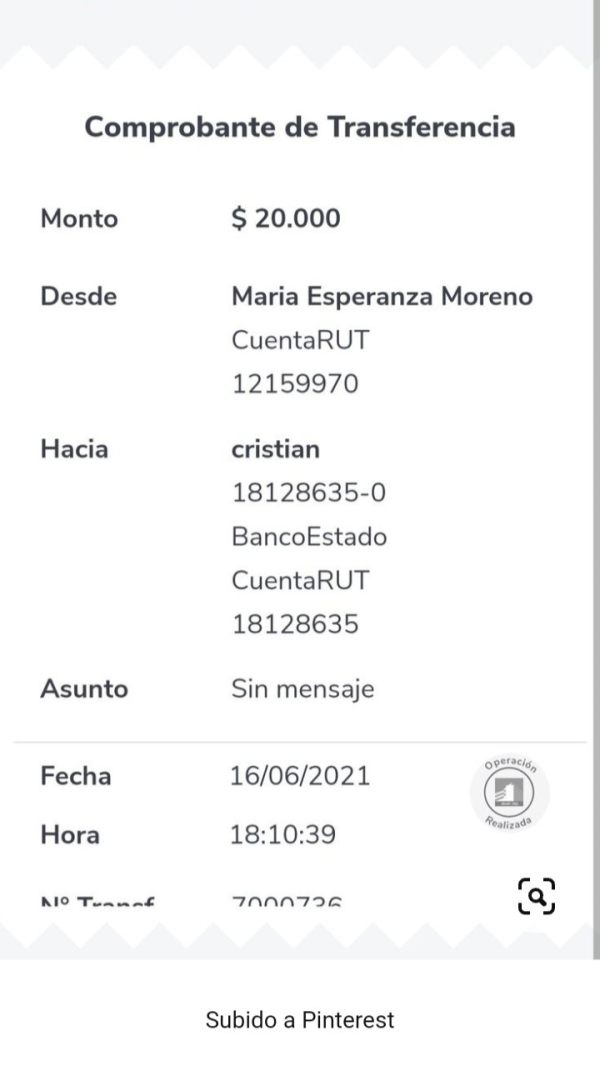

Fund management experiences receive particular criticism from users, with multiple reports of withdrawal difficulties and processing delays. These operational issues represent serious concerns for traders who require reliable access to their investments. Common user complaints center around platform functionality, customer service responsiveness, and financial transaction processing.

The user experience analysis reveals a pattern of dissatisfaction that extends across multiple operational areas. The lack of positive user feedback, combined with documented complaints, contributes to the low overall rating in this category.

Conclusion

This comprehensive finiko review reveals significant concerns that warrant serious caution from potential investors. The overall assessment indicates substantial risks associated with choosing Finiko as a trading partner. The combination of poor regulatory compliance, limited operational transparency, and negative user feedback creates an unfavorable risk profile.

The broker is not recommended for any category of traders, particularly beginners who require secure and regulated trading environments. Experienced traders seeking reliable platforms would similarly find better alternatives among properly regulated brokers. The primary disadvantages include extremely low trust ratings, regulatory compliance issues, and widespread user dissatisfaction, while identifiable advantages remain notably absent from available assessments.