EssenceFX 2025 Review: Everything You Need to Know

Executive Summary

EssenceFX is a global online forex broker. It positions itself as a platform designed to help clients achieve maximum profits and secure withdrawals. However, this essencefx review reveals significant concerns within the trading community regarding the broker's legitimacy and operational practices. The platform offers trading services across forex markets, indices, and commodities. It targets both individual and institutional investors seeking forex trading and investment opportunities.

The broker provides access to popular trading platforms including MT4 and MT4 mobile platforms. It also offers a diverse range of tradeable assets comprising over 45 forex currency pairs, CFDs, commodities, indices, oil, gold, and silver. Despite these offerings, market sentiment surrounding EssenceFX remains predominantly negative. Multiple sources describe it as a suspicious investment trading scheme with potential scam characteristics.

The primary user base consists of individuals and institutional investors interested in forex trading and investment activities. However, prospective clients should exercise extreme caution given the widespread skepticism and negative reviews circulating within the trading community. These concerns focus on EssenceFX's business practices and reliability.

Important Notice

Users across different regions may face varying levels of legal protection and trading conditions. This is due to the absence of clear regulatory information in available sources. The regulatory framework governing EssenceFX operations remains unclear. This potentially exposes traders to different risk profiles depending on their geographical location.

This review is based on comprehensive analysis of user feedback, industry commentary, and publicly available information. Given the limited transparency surrounding EssenceFX's operations, prospective clients should conduct thorough due diligence before engaging with this broker. The evaluation methodology incorporates multiple data sources to provide a balanced assessment. This approach helps overcome information constraints.

Rating Framework

Broker Overview

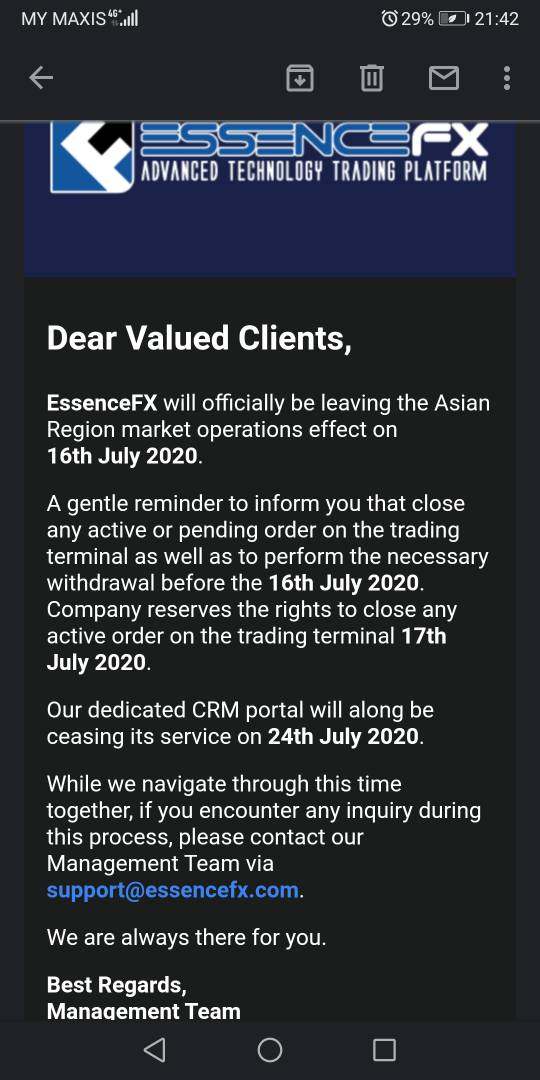

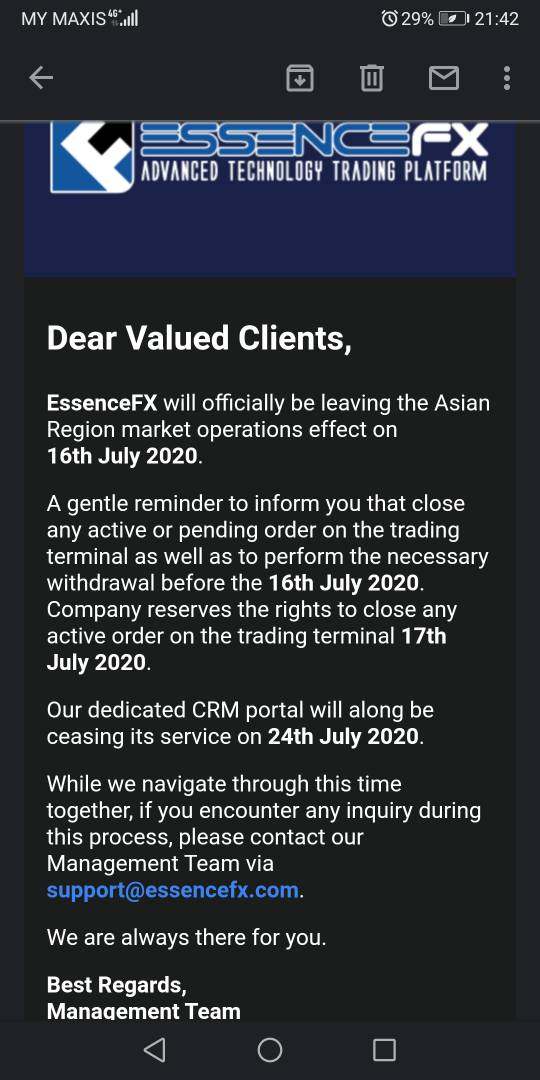

EssenceFX operates as a global online brokerage firm. It provides trading services across forex markets, indices, and commodities. The company's stated mission focuses on helping clients achieve maximum profits while ensuring secure withdrawal processes. However, the establishment date and detailed company background information are not specified in available sources. This raises questions about the broker's transparency and operational history.

The business model centers around online investment and trading platform services. It positions itself as a comprehensive solution for forex market participants. Despite these claims, the lack of detailed company information and regulatory transparency has contributed to widespread skepticism. The trading community expresses concerns regarding EssenceFX's legitimacy and long-term viability.

The broker supports trading through MT4 and MT4 mobile platforms. It offers access to an extensive range of financial instruments. The asset portfolio includes over 45 forex currency pairs, CFDs, commodities, indices, oil, gold, and silver. This provides traders with diverse investment opportunities across multiple market sectors. However, specific regulatory oversight information remains unavailable in current sources. This represents a significant concern for potential clients seeking regulated trading environments.

Regulatory Regions: Available information does not specify particular regulatory jurisdictions or oversight bodies governing EssenceFX operations. This represents a significant transparency gap.

Deposit and Withdrawal Methods: Specific payment methods, processing times, and associated fees for deposits and withdrawals are not detailed in available sources.

Minimum Deposit Requirements: Exact minimum deposit amounts and account funding requirements are not specified in current information.

Bonuses and Promotions: Details regarding promotional offers, welcome bonuses, or ongoing trading incentives are not mentioned in available sources.

Tradeable Assets: The platform offers access to over 45 forex currency pairs, CFDs, commodities, indices, oil, gold, and silver. This provides comprehensive market coverage across major asset classes.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not detailed in available sources.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in current information.

Platform Options: EssenceFX provides MT4 and MT4 mobile platforms for trading activities. This supports both desktop and mobile trading environments.

Geographic Restrictions: Specific regional limitations or restricted jurisdictions are not mentioned in available sources.

Customer Support Languages: Available language support for customer service is not detailed in current information.

This comprehensive essencefx review highlights significant information gaps. Potential clients should consider these when evaluating this broker.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of EssenceFX's account conditions faces significant limitations. This is due to insufficient information regarding account types, features, and specific terms. Available sources do not detail the variety of account categories offered. This makes it impossible to assess whether the broker provides different account tiers suited to various trader experience levels and capital requirements.

Minimum deposit requirements and their reasonableness cannot be evaluated. Specific amounts are not disclosed in available information. This lack of transparency regarding entry barriers represents a concern for potential clients. They seek to understand initial investment requirements and account accessibility.

The account opening process remains unspecified in current sources. This includes verification procedures, documentation requirements, and approval timelines. Additionally, information about special account features such as Islamic accounts, demo accounts, or institutional trading accounts is not available. This limits the ability to assess the broker's accommodation of diverse client needs.

Without detailed account condition information, this essencefx review cannot provide a comprehensive evaluation of this critical aspect. This highlights the need for greater transparency from the broker. They should provide more information regarding account offerings and terms.

EssenceFX demonstrates reasonable strength in platform offerings. It provides access to MT4 and MT4 mobile platforms, which are industry-standard trading solutions recognized for their reliability and functionality. The availability of mobile trading capabilities ensures that clients can manage positions and monitor markets while away from desktop environments.

The broker offers an extensive range of tradeable assets. These include over 45 forex currency pairs, CFDs, commodities, indices, oil, gold, and silver. This diverse asset selection provides traders with opportunities to diversify portfolios across multiple market sectors. It also allows them to implement various trading strategies.

However, specific information regarding research and analysis resources is not detailed in available sources. Market commentary, economic calendars, or technical analysis tools are also not mentioned. Educational resources such as webinars, tutorials, trading guides, or market analysis materials are not documented. This could limit the platform's value for developing traders.

Automated trading support is not specifically addressed in current information. This includes Expert Advisors compatibility and algorithmic trading features. While MT4 typically supports these functionalities, confirmation of their availability and any restrictions would enhance trader confidence. This would improve their perception of the platform's capabilities.

Customer Service and Support Analysis

The evaluation of EssenceFX's customer service capabilities is severely limited. This is due to the absence of specific information regarding support channels, availability, and service quality. Available sources do not detail whether the broker offers phone support, email assistance, live chat functionality, or other communication methods. These would be used for client assistance.

Response times for customer inquiries and the overall efficiency of problem resolution processes are not documented in current information. This lack of transparency regarding support responsiveness represents a significant concern. It affects traders who may require timely assistance during critical market periods or technical difficulties.

Service quality indicators cannot be assessed due to insufficient user feedback and documentation. These include staff expertise, problem-solving capabilities, and the professionalism of support interactions. The availability of multilingual support and the range of languages offered for customer assistance also remains unspecified.

Operating hours for customer support are not mentioned in available sources. This includes whether 24/5 or 24/7 assistance is available to accommodate global trading schedules. This information gap prevents traders from understanding when professional assistance will be accessible. They need to know this during their trading activities.

Trading Experience Analysis

The assessment of EssenceFX's trading experience is constrained by limited user feedback and technical performance data in available sources. Platform stability and execution speed cannot be adequately evaluated due to insufficient user testimonials and performance metrics. These are critical factors for successful trading outcomes.

Order execution quality is not documented in current information. This includes the frequency of slippage, requotes, and order rejection rates. These factors significantly impact trading profitability and user satisfaction. Their absence in available data represents a notable limitation for this evaluation.

While the platform offers MT4 functionality, specific details are not provided. These would include feature completeness, customization options, and advanced trading tools. The mobile trading experience through MT4 mobile platforms lacks detailed performance assessments. It also lacks user experience feedback.

Trading environment factors are not specified in available sources. These include spread stability, liquidity provision, and market depth information. Additionally, any unique trading features, order types, or execution models employed by EssenceFX remain undocumented. This limits the ability to assess the overall essencefx review trading experience comprehensively.

Trust and Reliability Analysis

EssenceFX faces significant credibility challenges based on available information and user sentiment. The absence of specific regulatory oversight details represents a major concern for traders seeking regulated trading environments. These traders want investor protection measures. No regulatory license numbers, governing bodies, or compliance frameworks are documented in current sources.

Fund safety measures are not detailed in available information. These would include segregated client accounts, deposit insurance, or third-party fund custody arrangements. This lack of transparency regarding client fund protection creates substantial risk concerns. It affects potential depositors significantly.

Company transparency issues extend beyond regulatory matters. They include limited disclosure of financial reports, management team information, and operational details. The absence of comprehensive company background information contributes to the overall skepticism. This surrounds EssenceFX's legitimacy.

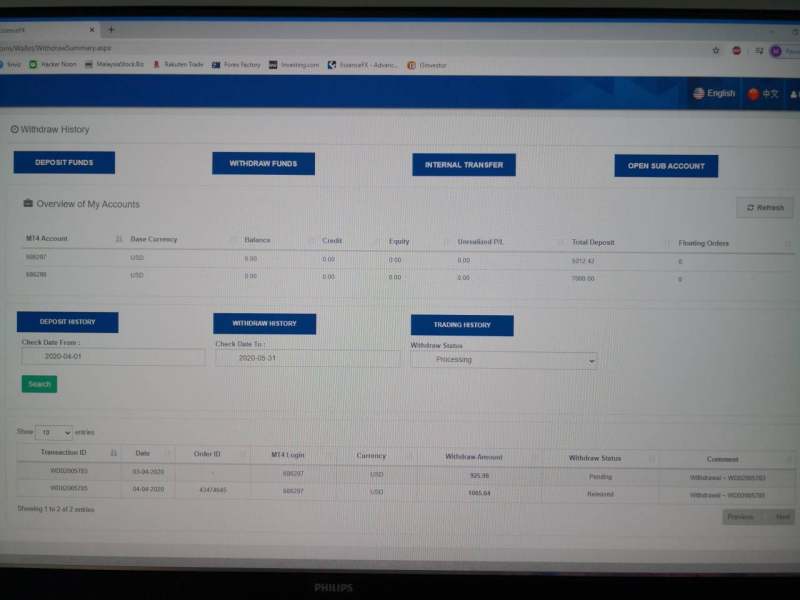

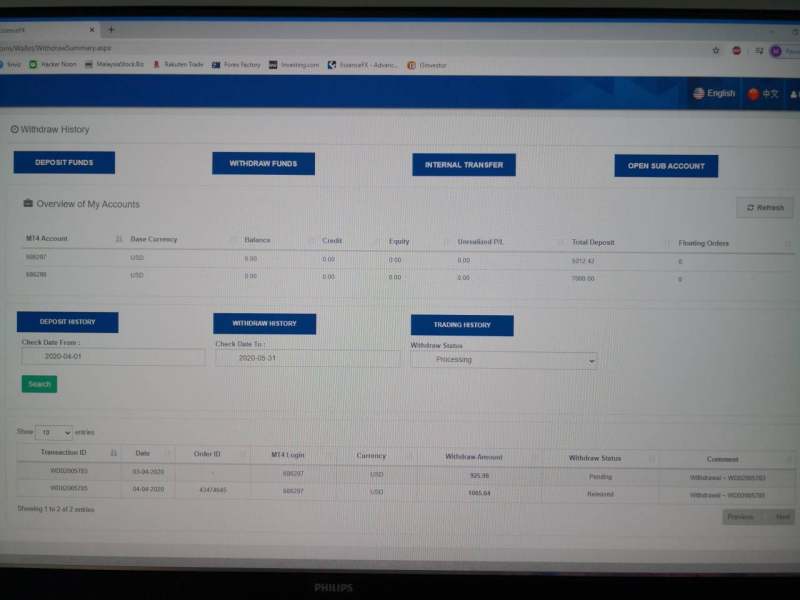

Industry reputation appears predominantly negative. Users widely express concerns about potential scam risks associated with EssenceFX operations. Available sources suggest that users have sought advice on recovering funds from the platform. This indicates problematic withdrawal experiences and potential fraudulent activities. These significantly impact the broker's trustworthiness assessment.

User Experience Analysis

The evaluation of overall user satisfaction with EssenceFX is limited by insufficient comprehensive user feedback in available sources. However, the predominant sentiment expressed in accessible information suggests significant concerns. These relate to the platform's legitimacy and operational practices.

Interface design and platform usability cannot be adequately assessed. This is due to limited user testimonials regarding navigation, functionality, and overall user-friendliness of the trading environment. The absence of detailed user interface reviews prevents comprehensive evaluation. It affects assessment of the platform's accessibility for traders of different experience levels.

Registration and account verification processes are not documented in current sources. This includes their efficiency and user-friendliness. Similarly, the convenience and speed of funding operations lack detailed user feedback for proper assessment. This includes deposit and withdrawal experiences.

The most prominent user concern identified relates to potential fraudulent activities. Available information suggests that users consider EssenceFX a possible scam operation. This negative sentiment significantly impacts the overall user experience assessment. It raises serious questions about the platform's suitability for legitimate trading activities.

Conclusion

This comprehensive essencefx review reveals a broker with mixed offerings and significant credibility concerns. While EssenceFX provides access to popular MT4 platforms and a diverse range of tradeable assets, the overwhelming negative sentiment creates substantial risk factors for prospective clients. The platform offers over 45 forex pairs and various CFDs, but potential scam allegations remain a major concern.

The broker may appeal to traders seeking diverse asset exposure and familiar trading platforms. However, the lack of regulatory transparency and widespread user skepticism make it unsuitable for risk-averse investors. The absence of clear regulatory oversight poses significant risks to client funds and trading security. Combined with negative user feedback regarding potential fraudulent activities, this suggests that EssenceFX represents a dangerous choice for traders.

Primary advantages include platform diversity and asset variety. Major disadvantages encompass regulatory information gaps, poor industry reputation, and serious trustworthiness concerns. Potential clients should exercise extreme caution and consider well-regulated alternatives. They should do this before engaging with EssenceFX for trading activities.