JRFX Review 2

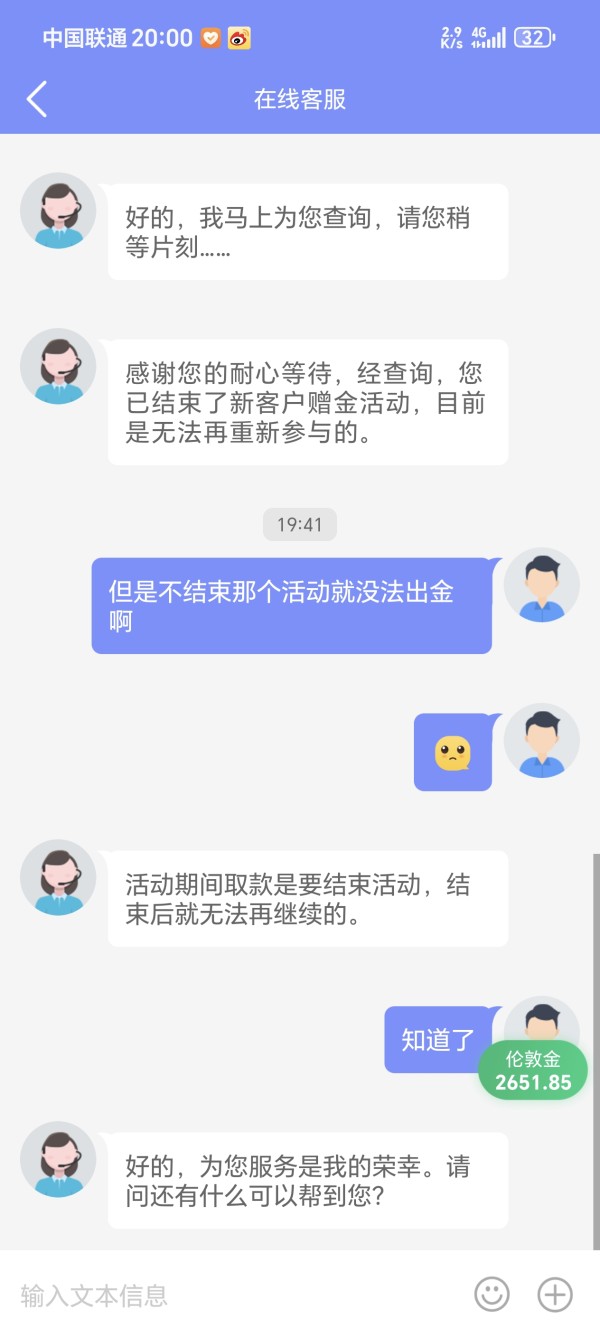

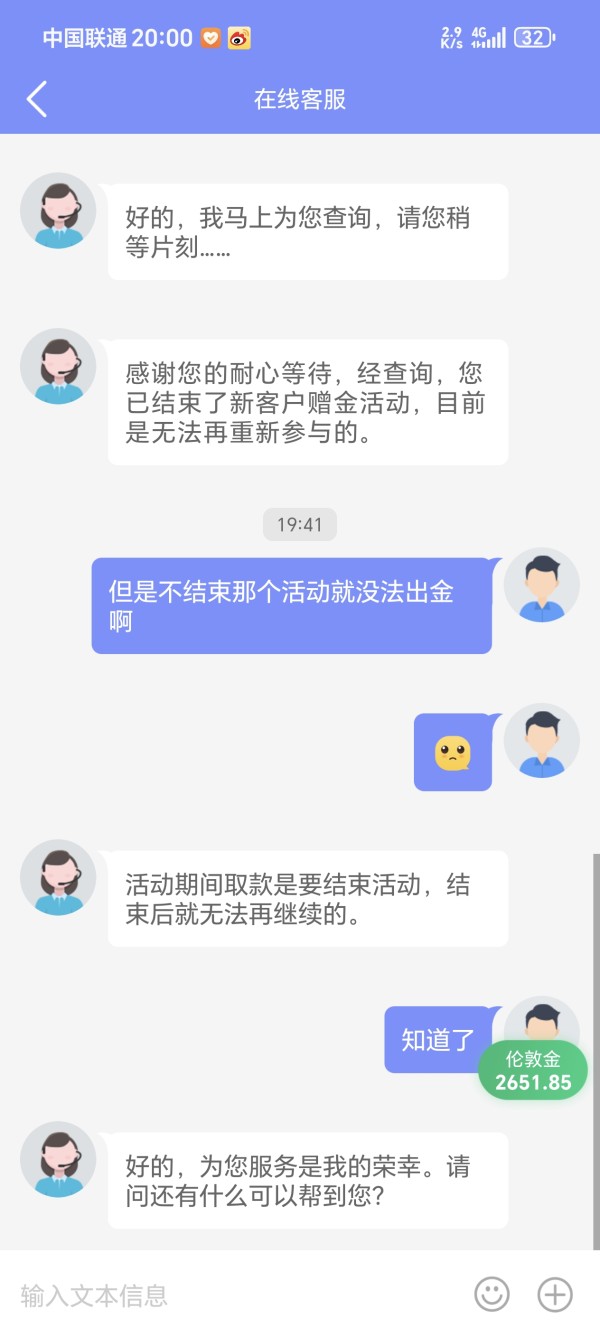

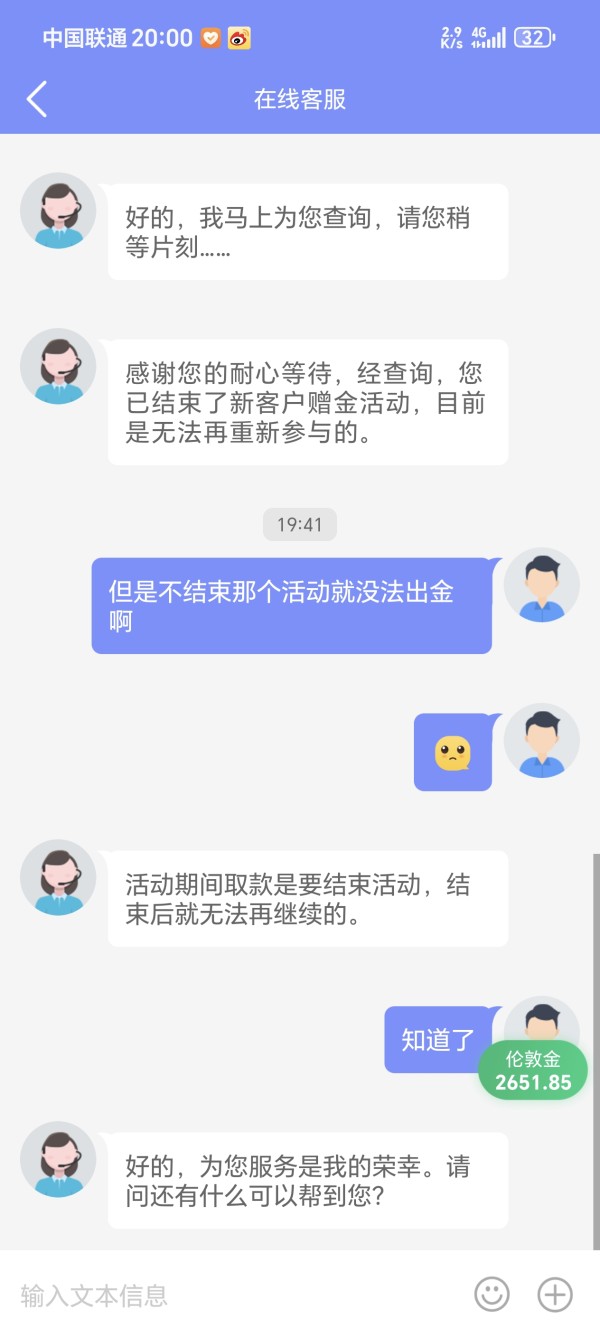

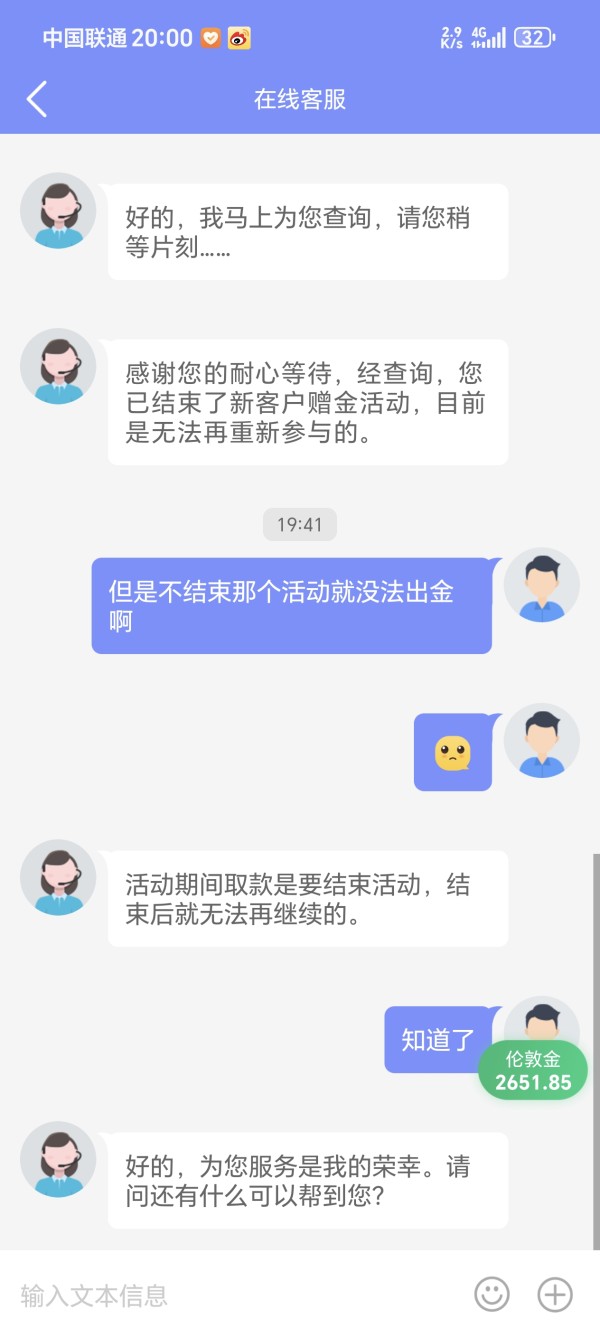

Inducing consumption, they offer a bonus upon entry, but do not allow withdrawals within two months.

Their proprietary app is great for checking in on the markets on the go. Handy little thing

JRFX Forex Broker provides real users with 1 positive reviews, * neutral reviews and 1 exposure review!

Inducing consumption, they offer a bonus upon entry, but do not allow withdrawals within two months.

Their proprietary app is great for checking in on the markets on the go. Handy little thing

Jrfx has been a topic of considerable discussion in the forex trading community, offering a platform for both novice and experienced traders since its inception in 2010. This review aims to provide a comprehensive analysis of the broker based on various user experiences and expert opinions, highlighting key features, advantages, and shortcomings of the Jrfx trading platform.

Note: It's important to consider that Jrfx operates under multiple regulatory entities across different regions, which can affect user experience and trust levels. This review aims to present a fair and accurate representation based on available data.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 5 |

| Tools and Resources | 6 |

| Customer Service & Support | 4 |

| Trading Setup | 5 |

| Trustworthiness | 4 |

| User Experience | 5 |

How We Rated the Broker: Ratings are derived from a synthesis of user experiences and expert assessments available in the sources.

Established in 2010, Jrfx is a forex and CFDs broker owned by Up Way Global Group, with its headquarters located in the British Virgin Islands. The broker provides access to the popular trading platform MetaTrader 4 (MT4) and its proprietary trading app, catering to a diverse range of trading styles. Available trading instruments include over 30 forex pairs, commodities, indices, and cryptocurrencies. Jrfx is regulated by the Financial Services Commission (FSC) of the British Virgin Islands, which, while offering some oversight, is generally considered less stringent compared to other regulatory bodies.

Jrfx operates under different regulatory frameworks, primarily the FSC in the British Virgin Islands. This jurisdiction is known for its lenient regulations, which raises concerns about the broker's reliability when compared to those regulated by more stringent authorities like the FCA or ASIC. According to ForexPeaceArmy, the lack of stringent oversight can lead to potential risks for traders.

Jrfx supports various funding methods, including bank wire transfers, credit cards, and popular e-wallets like Tether (USDT). The minimum deposit requirement is set at $100, which is relatively standard in the industry. However, users have reported delays in processing withdrawals, with some indicating that it takes longer than expected to receive funds, which could be a red flag for potential traders.

The broker offers various promotional bonuses, including a welcome bonus of $35 on the first deposit, which is relatively low compared to other brokers that offer more lucrative incentives. The lack of substantial promotions may deter some traders looking for value-added benefits. As noted in AllForexBonus, the promotional structure does not stand out in the competitive landscape of forex trading.

Jrfx's spreads are notably high, particularly for non-ECN accounts, with average spreads on major pairs like EUR/USD around 1.95 pips. This is significantly higher than the industry average, which typically hovers around 1 pip. The ECN account offers lower spreads starting from 0 pips but comes with a commission of $7, which can be considered high if not clarified whether it's round-trip or per trade. According to the ForexNewsNow, the high trading costs present a barrier for many traders.

Traders at Jrfx have access to a limited selection of assets, including 6 forex pairs, 4 commodities, and a handful of indices and stocks. The lack of variety in trading instruments may be a significant drawback for those looking to diversify their portfolios. As highlighted in the review on Forexing, the limited asset classes may restrict trading strategies and opportunities.

Customer support at Jrfx has received mixed reviews, primarily due to the absence of live chat options and limited support hours. Users have reported difficulties in reaching support for immediate assistance, which is a critical factor in the fast-paced trading environment. As mentioned in PediaFX, the lack of responsive support can be a significant disadvantage when traders face urgent issues.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 5 |

| Tools and Resources | 6 |

| Customer Service & Support | 4 |

| Trading Setup | 5 |

| Trustworthiness | 4 |

| User Experience | 5 |

Account Conditions: Jrfx offers several account types, but the high spreads and lack of clarity regarding account features are significant downsides. Users have expressed frustration over the difficulty in understanding the differences between account types.

Tools and Resources: The educational resources provided by Jrfx are basic, comprising articles and tutorials that may not be sufficient for beginners. More advanced traders might find the lack of comprehensive tools limiting.

Customer Service & Support: The absence of live chat and limited language support (primarily English) has led to poor ratings in this category. Users have highlighted the need for more accessible and responsive customer service.

Trading Setup: The trading experience is hampered by high costs and limited asset selection. While the MT4 platform is robust, the overall trading environment does not meet the expectations for competitive trading.

Trustworthiness: The regulatory framework under the FSC raises concerns about the broker's reliability. The lack of user feedback and reviews further complicates the trustworthiness assessment.

User Experience: Overall, the user experience is mixed, with some users appreciating the platform's usability while others express dissatisfaction with the trading costs and customer support.

In conclusion, while Jrfx offers a viable trading platform for some traders, the numerous red flags regarding costs, support, and regulatory oversight make it a less favorable choice for many. Potential users are encouraged to consider these factors carefully before committing to this broker.

FX Broker Capital Trading Markets Review