Ebro 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive ebro review examines a unique entity in the financial services landscape. Ebro Foods, Inc. has earned significant customer satisfaction with 5-star ratings based on available information. This suggests strong performance in product quality and service delivery, though the trading-related aspects of Ebro present limited publicly available information. Such limited data makes this evaluation particularly challenging for traditional forex market analysis.

The most notable development in the Ebro ecosystem is Innoveo's launch of the eBro platform. This platform was specifically designed for small and medium-sized enterprise brokers. The digital solution promises rapid deployment and comprehensive customization capabilities, potentially positioning it as a significant player in the broker technology space. The platform uses no-code technology to deliver end-to-end digitization solutions. These solutions can be implemented within a week.

The primary target audience for Ebro-related services appears to be SME brokers seeking digital transformation solutions. Traditional forex trading information remains limited, but the technological infrastructure suggests potential for broader financial services applications. Customer feedback for Ebro Foods indicates strong satisfaction levels. However, specific trading-related testimonials are not readily available in current documentation.

Important Notice

Regional Entity Differences: This review acknowledges that information regarding specific regulatory frameworks and jurisdictional differences for Ebro's financial services operations is not comprehensively detailed in available sources. Potential users should verify regulatory compliance in their specific regions before engaging with any Ebro-related trading services.

Review Methodology: This evaluation is based on comprehensive analysis of available customer feedback, company background information, and technological platform capabilities. Due to limited specific trading-related data, some traditional forex broker evaluation metrics may not be fully applicable to this assessment.

Rating Framework

Broker Overview

Ebro Foods, Inc. was established in 1965 by founders Manny and Zenaida in Chicago, Illinois. They launched the El Ebro product line at that time. The company has built a reputation over nearly six decades, focusing primarily on food industry operations with demonstrated expertise in product formulation and quality management. According to available sources, the company has maintained its commitment to delivering "the highest quality products at the best value, through generations of experience."

The business model traditionally centered on food manufacturing and distribution. Recent technological developments suggest expansion into financial services technology. The company's long-standing presence in the market indicates stability and operational continuity. These factors could translate positively to financial services operations.

Recent developments include Innoveo's introduction of the eBro platform. This represents a significant technological advancement for SME brokers. This ebro review notes that the platform utilizes no-code Skye technology to provide comprehensive, scalable solutions for agency digitization. The platform promises rapid implementation timelines. Full digitization is possible within one week of deployment.

The technological infrastructure suggests a focus on customization and configurability. This addresses critical needs in the digital agency platform market. The approach indicates potential for serving diverse client requirements while maintaining operational efficiency and scalability across different market segments.

Regulatory Regions: Specific regulatory information for Ebro's financial services operations is not detailed in available documentation. Potential clients should independently verify regulatory compliance requirements.

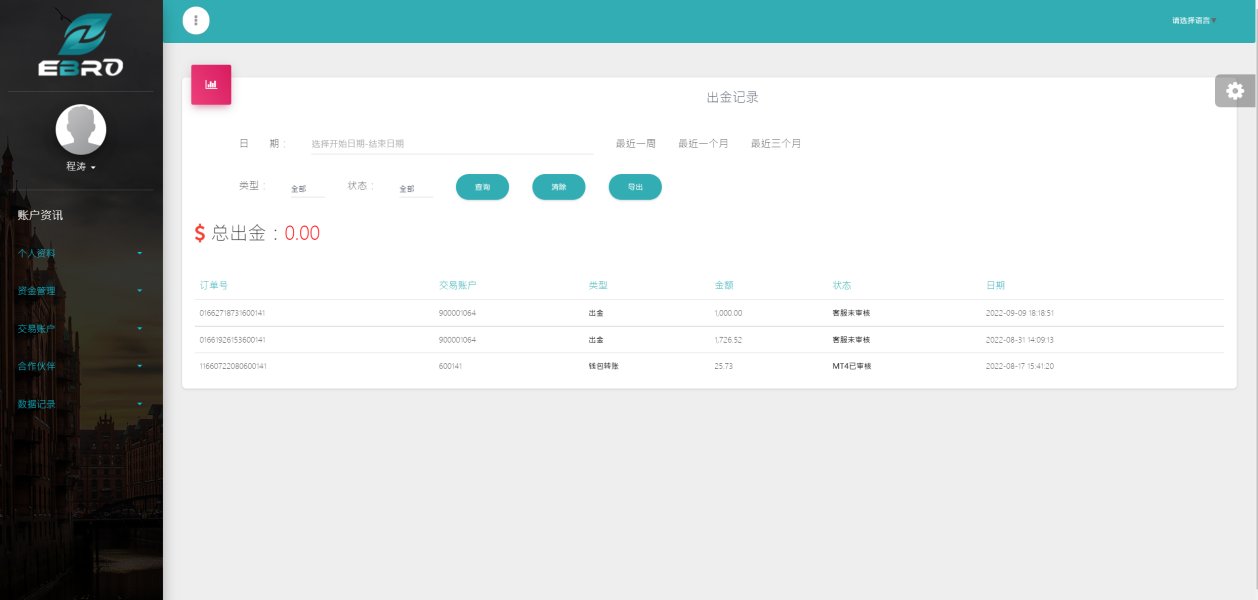

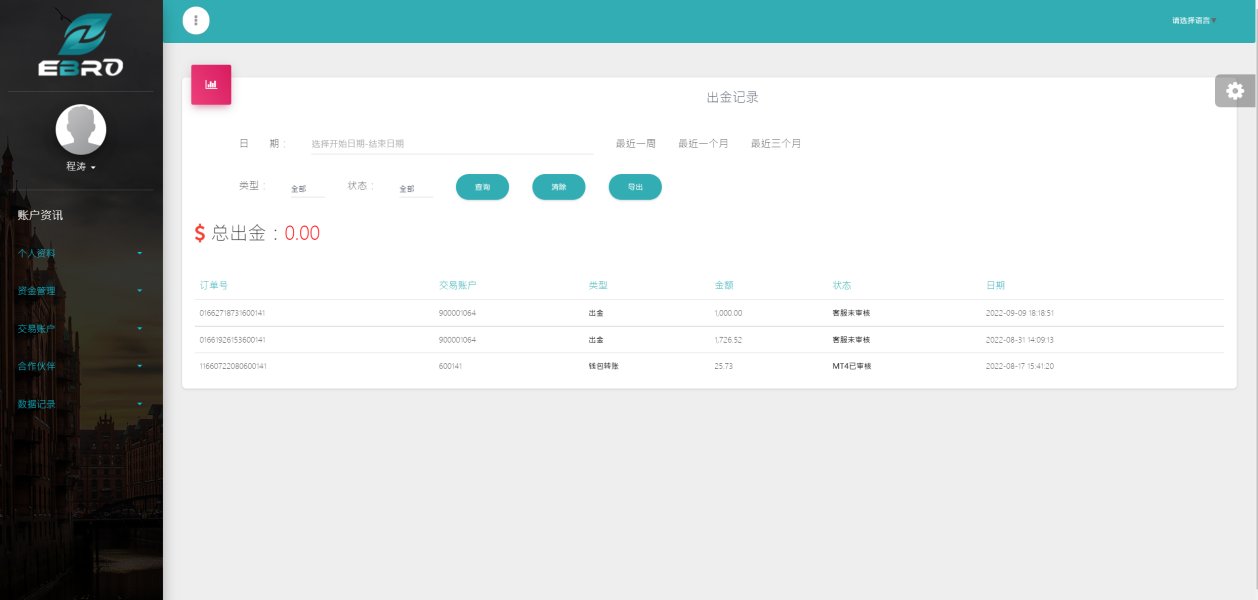

Deposit and Withdrawal Methods: Payment processing methods and financial transaction procedures are not specified in current available sources.

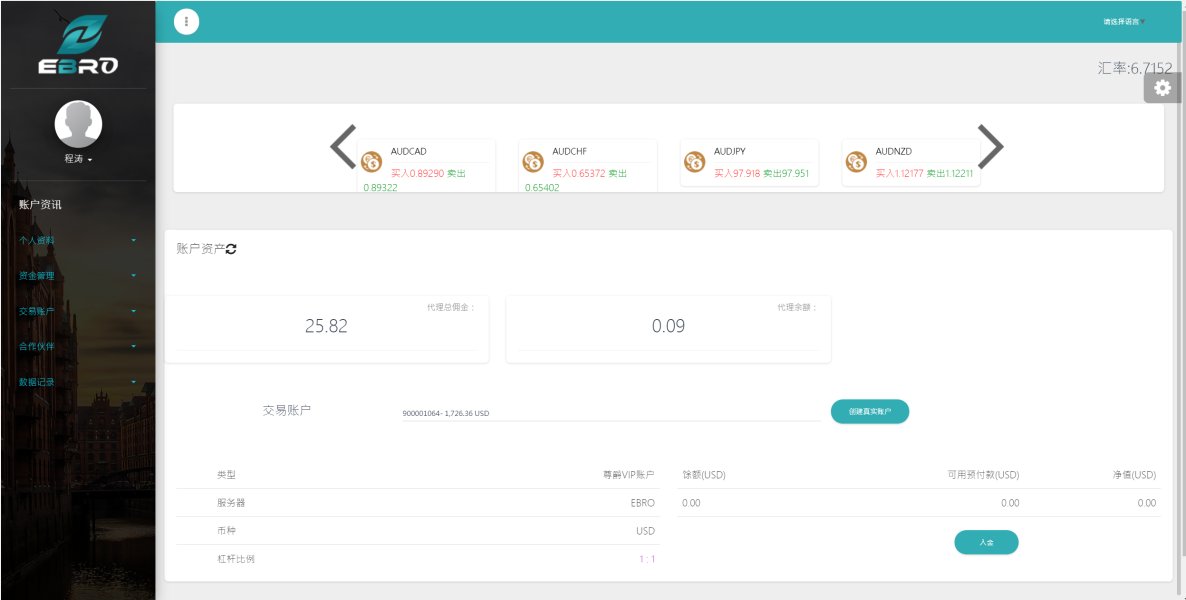

Minimum Deposit Requirements: Minimum deposit thresholds are not detailed in accessible documentation.

Bonuses and Promotions: Current promotional offerings and bonus structures are not outlined in available materials.

Tradeable Assets: Specific asset classes and trading instruments available through Ebro platforms are not detailed in current sources.

Cost Structure: Fee schedules, spread information, and commission structures are not comprehensively outlined in available documentation. This ebro review notes that cost transparency remains a significant information gap.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in current materials.

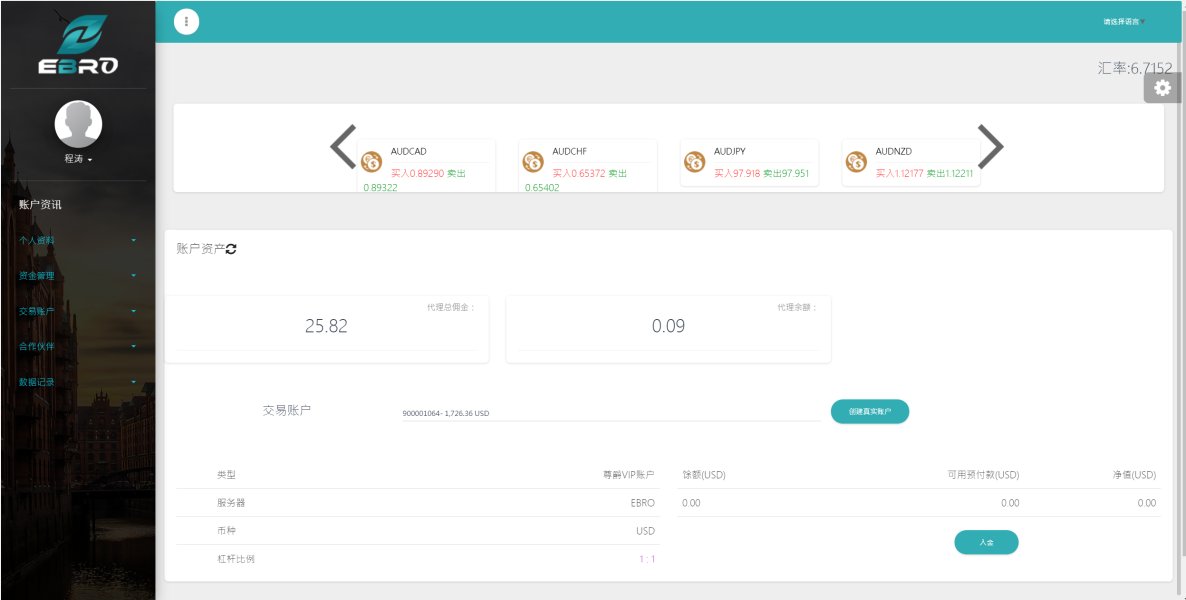

Platform Options: While the eBro technology platform is mentioned, specific trading platform details are not comprehensively covered in available sources.

Regional Restrictions: Geographic limitations and accessibility restrictions are not detailed in current documentation.

Customer Service Languages: Supported languages for customer service operations are not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for Ebro presents significant challenges due to limited available information in current documentation. Traditional forex broker account types, such as standard, premium, or VIP accounts, are not specifically outlined in accessible materials. This ebro review cannot provide definitive assessment of account tier structures or their respective benefits.

Minimum deposit requirements are not specified in available sources. These requirements typically serve as a primary differentiator between account types. This information gap prevents meaningful comparison with industry standards or competitor offerings. Account opening procedures and verification processes are similarly not detailed in current documentation.

Special account features are not mentioned in available materials. These include Islamic accounts for Sharia-compliant trading or institutional account options. The absence of this information significantly limits the ability to assess Ebro's accommodation of diverse client needs and religious requirements.

Without specific user feedback regarding account opening experiences or account management satisfaction, this evaluation cannot provide evidence-based assessment of account condition quality. User satisfaction levels in this critical area also cannot be determined.

The assessment of trading tools and resources available through Ebro platforms faces substantial limitations due to insufficient detailed information in current sources. Traditional trading tools such as technical analysis indicators, charting capabilities, or automated trading support are not specifically outlined in accessible documentation.

Research and analysis resources are not detailed in available sources. These typically include market commentary, economic calendars, and fundamental analysis materials. Educational resources are similarly not mentioned in current documentation. These include webinars, tutorials, or trading guides.

The eBro platform's technological capabilities suggest potential for comprehensive tool integration. This is given its no-code development framework and customization options. However, specific trading tool implementations are not detailed in available materials. This prevents definitive assessment of resource quality or comprehensiveness.

Without user testimonials or expert evaluations specific to trading tools and resources, this review cannot provide evidence-based analysis. Tool effectiveness and user satisfaction with available resources cannot be determined.

Customer Service and Support Analysis

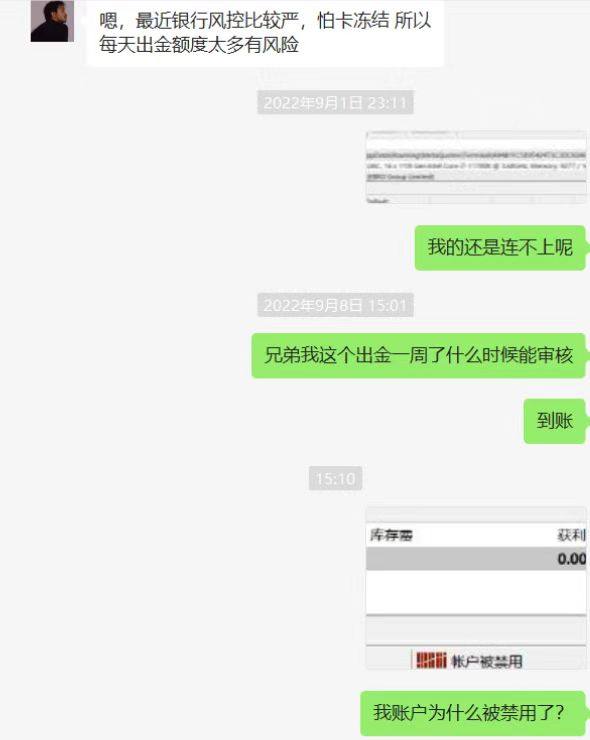

Customer service evaluation for Ebro's trading operations encounters significant information limitations in available documentation. Traditional customer support channels such as phone, email, live chat, or ticket systems are not specifically detailed for trading-related inquiries.

Response time commitments and service level agreements are not outlined in accessible materials. The quality of customer service interactions and problem resolution effectiveness cannot be assessed based on available information. Multi-language support capabilities are not specified in current sources. These capabilities are crucial for international trading operations.

Customer service availability hours and timezone coverage are not detailed in available documentation. This information gap prevents assessment of service accessibility for global trading activities across different time zones.

Without specific user feedback regarding customer service experiences or documented case studies of problem resolution, this evaluation cannot provide evidence-based assessment. Service quality and customer satisfaction levels cannot be determined.

Trading Experience Analysis

The evaluation of trading experience through Ebro platforms faces substantial challenges due to limited specific information in available sources. Platform stability and execution speed are not detailed in accessible documentation. These are critical factors for trading success.

Order execution quality is not provided in current materials. This includes fill rates and slippage statistics. Platform functionality completeness is not specifically outlined. This includes order types, risk management tools, or portfolio management features. This ebro review notes these significant information gaps.

Mobile trading experience and application capabilities are not detailed in available sources. The quality of mobile platform integration and feature parity with desktop platforms cannot be assessed based on current documentation.

Trading environment characteristics are not specified in accessible materials. These include server locations, execution methods, or liquidity provider relationships. Without user experience testimonials or technical performance data, definitive assessment of trading experience quality remains challenging.

Trust and Reliability Analysis

Trust and reliability assessment for Ebro encounters significant challenges due to limited regulatory and transparency information in available documentation. Specific regulatory licenses and oversight authorities are not detailed in accessible sources. This prevents verification of compliance status.

Fund safety measures are not outlined in current materials. These include segregated account policies, insurance coverage, or client fund protection protocols. Company transparency regarding ownership structure, financial statements, or operational procedures is not comprehensively detailed.

Industry reputation and third-party evaluations specific to trading operations are not readily available in current sources. Historical performance data and track record information are similarly limited in accessible documentation.

Without regulatory verification data or independent third-party assessments, this evaluation cannot provide definitive analysis. Trustworthiness and reliability metrics for trading operations cannot be determined.

User Experience Analysis

User experience evaluation for Ebro's trading platforms faces substantial information limitations in available documentation. Overall user satisfaction metrics and feedback specifically related to trading operations are not detailed in accessible sources.

Interface design quality and platform usability are not specifically outlined in current materials. Registration and account verification process efficiency cannot be assessed based on available information. Fund deposit and withdrawal experience quality is similarly not detailed.

Common user complaints or satisfaction highlights specific to trading operations are not documented in accessible sources. User demographic analysis and typical client profiles are not outlined in current materials.

Without comprehensive user feedback compilation or satisfaction surveys specific to trading operations, this evaluation cannot provide evidence-based assessment. User experience quality and areas for improvement cannot be determined.

Conclusion

This comprehensive evaluation reveals that while Ebro Foods demonstrates strong customer satisfaction in its traditional business operations, specific information regarding forex trading services remains limited in available documentation. The introduction of the eBro platform by Innoveo suggests potential for significant technological advancement in the SME broker market. However, detailed trading-specific features require further documentation.

Based on available information, Ebro appears most suitable for SME brokers seeking digital transformation solutions rather than individual retail traders. The technological infrastructure suggests capability for comprehensive platform development. However, specific trading conditions and user experiences require additional transparency for complete evaluation.

The primary advantage identified is the strong customer satisfaction history and technological innovation potential. The main limitation remains insufficient detailed information regarding specific trading operations, regulatory compliance, and user experience metrics.