DTCC Review 1

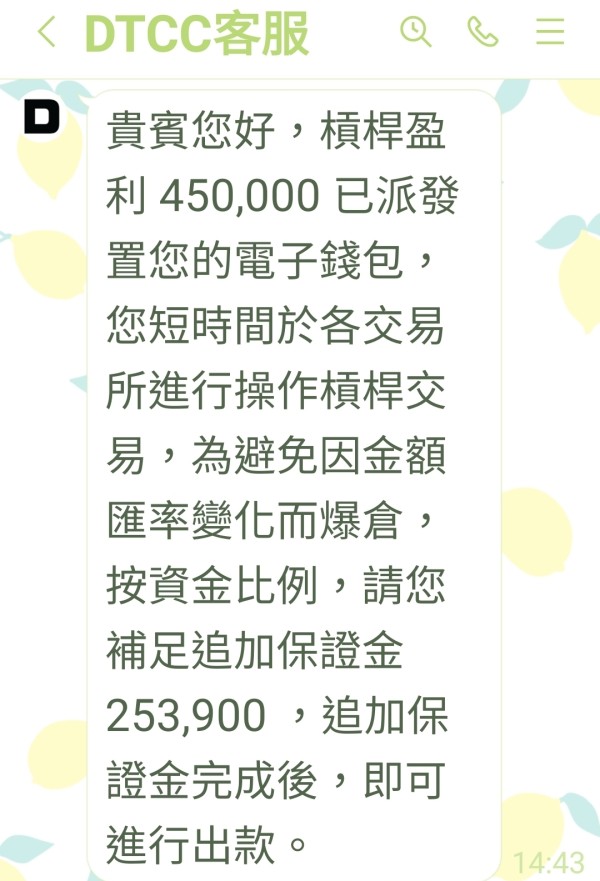

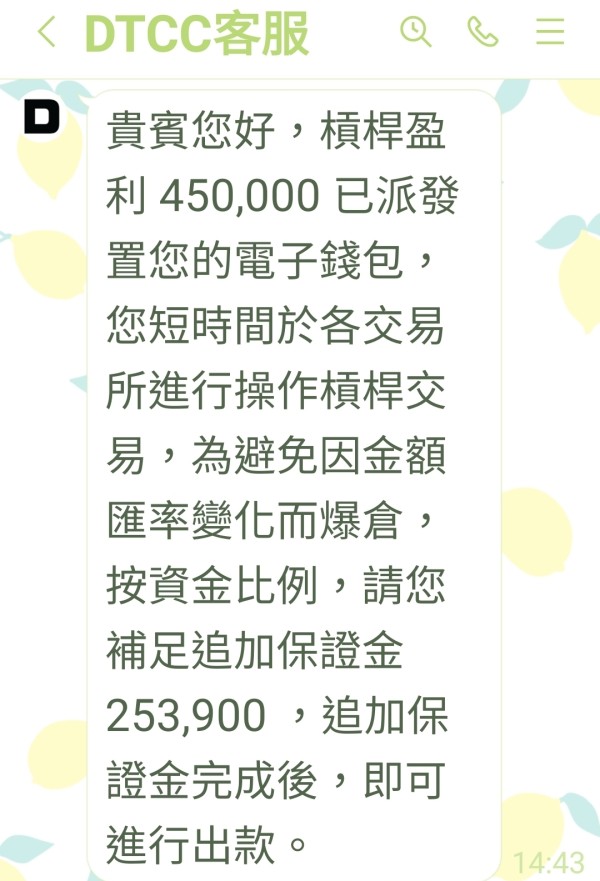

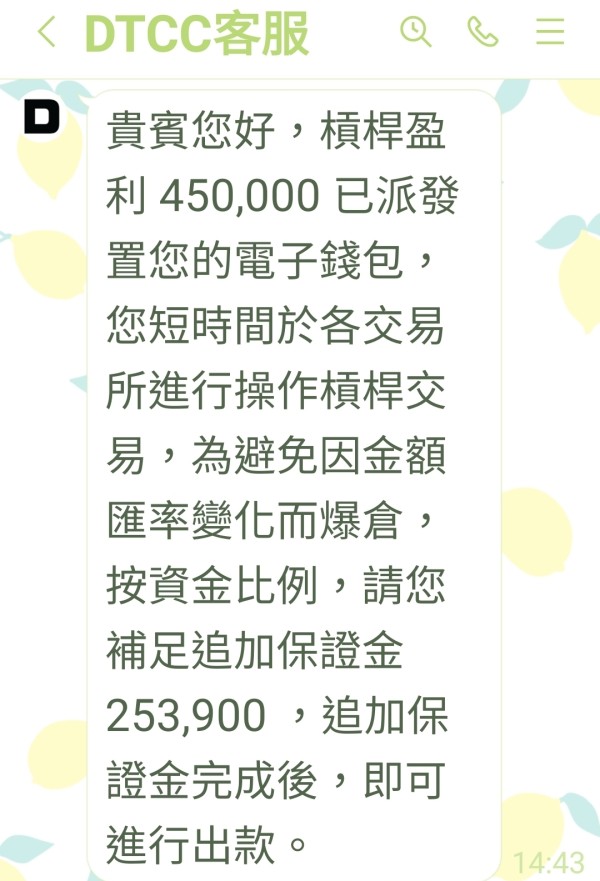

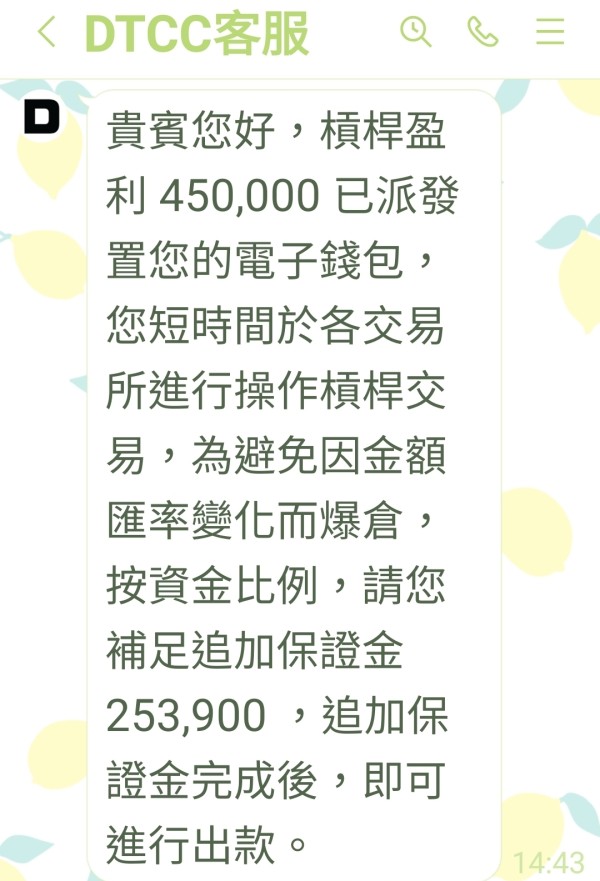

I invested a total of 25,000 and said that I made a profit of 860,000, but when I wanted to withdraw, It was required to pay a liquidation margin fee which was 260,000

DTCC Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I invested a total of 25,000 and said that I made a profit of 860,000, but when I wanted to withdraw, It was required to pay a liquidation margin fee which was 260,000

The Depository Trust & Clearing Corporation stands as a unique entity in the financial services landscape. It operates primarily as a clearing and settlement infrastructure provider rather than a traditional retail forex broker. This dtcc review examines the company's role in financial markets and its services for institutional and individual investors. DTCC was established in 1999 as a holding company for DTC and NSCC, and it has positioned itself as a critical infrastructure provider for the financial industry. The company offers clearing services, settlement and asset services, wealth management solutions, and derivatives services.

DTCC operates as a private holding company in the finance industry. It focuses on post-trade services rather than direct retail trading. The company's primary function involves facilitating the clearing and settlement of securities transactions. This makes it more of a behind-the-scenes infrastructure provider than a consumer-facing brokerage platform. This positioning creates a unique evaluation scenario, as traditional retail trading metrics may not directly apply to DTCC's business model.

The target audience for DTCC's services primarily consists of institutional investors, broker-dealers, and financial institutions. These clients require clearing and settlement services. Individual retail traders seeking traditional forex trading platforms may find DTCC's offerings less relevant to their immediate needs. The company operates at the institutional level of financial market infrastructure.

This dtcc review focuses on The Depository Trust & Clearing Corporation as a financial services infrastructure provider. It does not focus on DTCC as a traditional retail forex broker. Potential users should understand that DTCC primarily serves institutional clients and operates clearing and settlement services for the broader financial industry. The company's regulatory framework and operational structure differ significantly from typical retail forex brokers. It functions as essential market infrastructure rather than a direct trading platform.

The evaluation methodology for this review incorporates available public information about DTCC's business operations. It also includes industry positioning and institutional role information. Due to the specialized nature of DTCC's services, traditional retail trading metrics such as spreads, leverage ratios, and retail customer support may not be directly applicable or available for assessment.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Information not applicable for institutional infrastructure provider |

| Tools and Resources | N/A | Specific trading tools information not detailed in available materials |

| Customer Service and Support | 6/10 | Limited information available on client support for institutional services |

| Trading Experience | N/A | DTCC operates clearing services rather than direct trading platforms |

| Trust and Reliability | 7/10 | Established infrastructure provider with significant industry role since 1999 |

| User Experience | N/A | Institutional focus limits traditional user experience evaluation |

The Depository Trust & Clearing Corporation represents a fundamental component of financial market infrastructure. It was established in 1999 as a private holding company consolidating the operations of two critical financial institutions: the Depository Trust Company and the National Securities Clearing Corporation. DTCC's primary business model centers on providing essential post-trade services including clearing, settlement, asset services, and risk management solutions for the financial industry.

The company's operational framework encompasses multiple service categories designed to support institutional market participants. DTCC provides clearing services that facilitate the processing of trades between market participants. It also offers settlement and asset services that ensure the proper transfer of securities and funds, wealth management services for institutional clients, and derivatives services supporting complex financial instruments. This comprehensive service portfolio positions DTCC as a critical infrastructure provider rather than a direct market access provider for retail traders.

DTCC's role in the financial ecosystem involves serving as an intermediary that reduces counterparty risk and operational complexity. The company operates behind the scenes of most securities transactions, providing the infrastructure that enables efficient and secure trade settlement. This positioning means that while individual retail traders may not interact directly with DTCC, their trades likely benefit from the infrastructure and risk management services the company provides to the broader financial system.

The regulatory environment and oversight structure for DTCC differs from traditional retail forex brokers. The company operates under frameworks designed for financial market infrastructure providers. Specific regulatory details and oversight mechanisms were not detailed in available materials, reflecting the specialized nature of DTCC's institutional focus and infrastructure role.

Available materials do not specify detailed regulatory oversight information for DTCC's operations. As a financial market infrastructure provider, the company likely operates under specialized regulatory frameworks. These frameworks differ from retail forex broker oversight.

Specific information regarding deposit and withdrawal methods is not detailed in available materials. This reflects DTCC's institutional focus rather than retail client services.

Minimum deposit requirements are not specified in available materials. This is consistent with DTCC's role as an institutional infrastructure provider rather than a retail trading platform.

No information regarding bonuses or promotional offers is available. This aligns with DTCC's institutional service model rather than retail client acquisition strategies.

DTCC provides clearing and settlement services across multiple asset classes. However, specific details about directly tradeable assets through DTCC platforms are not detailed in available materials.

Specific information about fees, spreads, or commission structures is not detailed in available materials. According to industry information, clearing corporations may earn clearing fees. However, specific DTCC fee structures are not publicly detailed.

Leverage ratio information is not applicable or detailed in available materials. This reflects DTCC's infrastructure role rather than direct trading services.

Available materials do not detail specific trading platform options. DTCC's services focus on clearing and settlement infrastructure rather than direct trading interfaces.

This dtcc review highlights the unique positioning of DTCC within the financial services industry. It operates as essential infrastructure rather than a traditional retail trading platform.

The evaluation of account conditions for DTCC requires understanding that the company operates as a financial infrastructure provider. It does not operate as a traditional retail broker offering individual trading accounts. Available materials do not detail specific account types, minimum deposit requirements, or account opening procedures that would typically be associated with retail forex brokers. This absence of traditional account information reflects DTCC's institutional focus and its role as a clearing and settlement service provider.

DTCC's client base primarily consists of institutional market participants. These include broker-dealers, banks, and other financial institutions that require clearing and settlement services. The "account" relationships in this context involve institutional service agreements rather than individual trading accounts. These institutional arrangements likely involve complex onboarding procedures, regulatory compliance requirements, and service level agreements tailored to each institution's specific needs.

The company's operational model suggests that individual retail traders would not directly open accounts with DTCC. Their services are embedded within the infrastructure used by retail brokers and financial institutions. This institutional focus means that traditional account condition metrics such as account minimums, account types, and retail-focused features are not applicable to DTCC's business model.

For institutions seeking DTCC's services, the "account conditions" would likely involve comprehensive due diligence processes. They would also include regulatory compliance verification and technical integration requirements. However, specific details about these institutional onboarding processes are not detailed in available materials, reflecting the specialized and private nature of institutional financial infrastructure relationships.

This dtcc review emphasizes that potential clients should understand DTCC's institutional focus when considering their services. Traditional retail account features and conditions are not part of the company's service offering.

DTCC's tools and resources portfolio centers on institutional-grade infrastructure solutions. It does not focus on traditional retail trading tools. Available materials indicate that the company provides clearing services, settlement and asset services, wealth management services, and derivatives services. This suggests a comprehensive suite of institutional tools designed for financial market operations.

The company's infrastructure includes systems for trade processing, risk management, and settlement operations that serve the broader financial industry. According to available information, DTCC operates services such as the Cost Basis Reporting Service and ComposerX™ Factory. These services indicate specialized tools designed for institutional compliance and operational efficiency. These tools focus on post-trade processing and regulatory compliance rather than pre-trade analysis or retail trading support.

Educational resources and research tools, commonly associated with retail forex brokers, are not detailed in available materials. This absence reflects DTCC's institutional focus, where clients typically possess sophisticated financial expertise and require operational tools rather than educational content. The company's resources likely emphasize technical documentation, compliance guidance, and operational support materials tailored to institutional users.

Automated trading support, in the traditional retail sense, is not applicable to DTCC's business model. Instead, the company provides automated clearing and settlement infrastructure that enables efficient processing of large volumes of institutional trades. This automation focuses on post-trade processing efficiency rather than trading strategy execution.

The specialized nature of DTCC's tools means that individual retail traders would not directly access or utilize these resources. They are designed for institutional infrastructure requirements rather than individual trading needs.

Customer service and support evaluation for DTCC must consider the company's institutional client base and infrastructure role. Available materials do not detail specific customer service channels, response times, or support availability that would typically be assessed for retail forex brokers. This information gap reflects the specialized nature of institutional relationships, where support structures are often customized and confidential.

Institutional clients of DTCC likely receive dedicated account management and technical support tailored to their specific operational requirements. The support model for financial infrastructure providers typically involves relationship managers, technical specialists, and compliance experts rather than general customer service representatives. These support structures focus on operational continuity, technical integration, and regulatory compliance rather than trading assistance.

Response time expectations for institutional infrastructure services differ significantly from retail customer service standards. Critical infrastructure issues likely receive immediate attention through dedicated support channels. Routine inquiries may follow structured communication protocols. However, specific service level agreements and response time commitments are not detailed in available materials.

Multi-language support and extended service hours, common considerations for retail brokers, may be less relevant for DTCC's institutional focus. The company's client base likely consists primarily of sophisticated financial institutions with established communication preferences and technical capabilities.

The absence of detailed customer service information in available materials reflects the private and specialized nature of institutional financial infrastructure relationships. Support arrangements are typically governed by confidential service agreements rather than public service standards.

Evaluating trading experience for DTCC requires understanding that the company does not operate traditional trading platforms for retail or institutional clients. Instead, DTCC provides the clearing and settlement infrastructure that enables trading conducted through other platforms and brokers. This fundamental difference means that traditional trading experience metrics such as platform stability, order execution quality, and trading interface functionality are not directly applicable to DTCC's services.

The "trading experience" in DTCC's context involves the efficiency and reliability of post-trade processing. It does not involve the execution of trades themselves. The company's infrastructure supports the clearing and settlement of trades executed elsewhere, ensuring that securities and funds are properly transferred between counterparties. This behind-the-scenes role means that while DTCC's services impact the overall trading ecosystem, they do not directly affect the trading interface or execution experience that traders encounter.

Platform stability for DTCC involves maintaining the critical infrastructure that processes large volumes of post-trade transactions. Any disruption to DTCC's systems could impact the broader financial market's ability to settle trades efficiently. However, specific performance metrics or stability data are not detailed in available materials, reflecting the confidential nature of infrastructure operations.

Mobile trading experience is not applicable to DTCC's business model. The company does not provide direct trading interfaces. Instead, DTCC's services operate through institutional connections and automated systems that support the broader trading ecosystem without requiring direct trader interaction.

This dtcc review emphasizes that DTCC's role enhances the overall trading ecosystem's efficiency and security. It does not provide direct trading experiences for individual market participants.

DTCC's trust and reliability assessment centers on its role as critical financial market infrastructure. It does not focus on traditional broker reliability metrics. Established in 1999 as a holding company for institutions dating back to 1973 and 1976, DTCC has demonstrated long-term stability and industry acceptance as essential market infrastructure. This historical presence suggests institutional confidence in the company's operational capabilities and risk management.

The company's position as a private holding company in the finance industry indicates a business model focused on infrastructure provision. It does not focus on speculative trading activities. This positioning typically involves conservative risk management approaches and robust operational controls designed to maintain system stability and client confidence. However, specific details about capital adequacy, insurance coverage, or risk management frameworks are not detailed in available materials.

Regulatory oversight for financial market infrastructure providers typically involves specialized frameworks designed to ensure operational resilience and systemic stability. While specific regulatory details are not provided in available materials, DTCC's continued operation and industry acceptance suggest compliance with applicable oversight requirements.

The absence of detailed transparency information reflects the institutional nature of DTCC's operations. Disclosure requirements and transparency standards may differ from retail-focused financial service providers. Institutional clients typically have access to detailed operational and financial information through private channels rather than public disclosure.

Industry reputation appears solid based on DTCC's continued role as essential market infrastructure. However, specific industry rankings or reputation metrics are not detailed in available materials. The company's longevity and continued operation suggest positive industry perception and institutional confidence.

User experience evaluation for DTCC requires understanding that the company's "users" are primarily institutional clients. They are not individual retail traders. The user experience in this context involves institutional operational efficiency, system integration capabilities, and service reliability rather than traditional trading platform usability or customer interface design.

Institutional satisfaction with DTCC's services would typically be measured through operational metrics such as settlement efficiency, system uptime, and integration effectiveness. It would not be measured through user interface satisfaction or ease of use. These metrics are generally confidential and specific to individual institutional relationships, making public assessment challenging.

Registration and verification processes for DTCC's services likely involve comprehensive institutional onboarding procedures. These include regulatory compliance verification, technical integration requirements, and operational readiness assessments. These processes are designed for institutional capabilities rather than individual user convenience, reflecting the specialized nature of financial infrastructure services.

Fund operation experience in DTCC's context involves the settlement and custody of institutional assets. It does not involve individual account funding. The company's role in facilitating the transfer of securities and funds between institutional counterparties represents a critical but largely invisible component of the overall trading ecosystem.

Common user complaints or satisfaction metrics are not detailed in available materials. This is typical for institutional infrastructure providers where client feedback is generally handled through private channels and confidential service agreements. The specialized nature of DTCC's services means that user experience considerations differ significantly from retail trading platforms.

This dtcc review reveals that The Depository Trust & Clearing Corporation operates as essential financial market infrastructure. It does not operate as a traditional retail forex broker. The company's role as a clearing and settlement service provider positions it as a critical but largely invisible component of the financial ecosystem. It serves institutional clients rather than individual retail traders.

DTCC's strengths include its established position as market infrastructure, long operational history dating back to 1999, and comprehensive service portfolio covering clearing, settlement, and asset services. However, the company's institutional focus means that traditional retail trading considerations such as spreads, leverage, customer support, and trading platforms are not applicable to its business model.

The company appears most suitable for institutional clients requiring clearing and settlement services. These include broker-dealers, banks, and other financial institutions. Individual retail traders seeking direct market access would need to look to traditional forex brokers that utilize DTCC's infrastructure rather than seeking direct services from DTCC itself. Understanding this fundamental distinction is crucial for properly evaluating DTCC's role and relevance in the broader financial services landscape.

FX Broker Capital Trading Markets Review