DMI Review 1

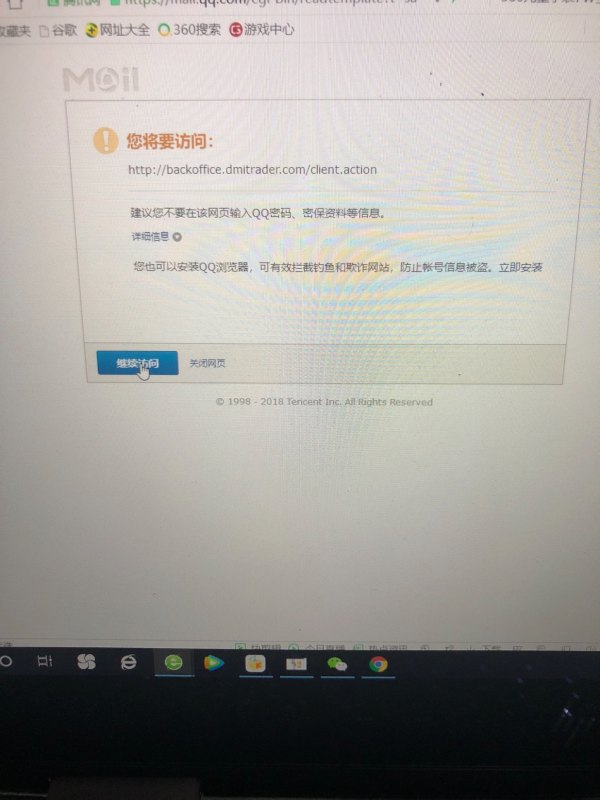

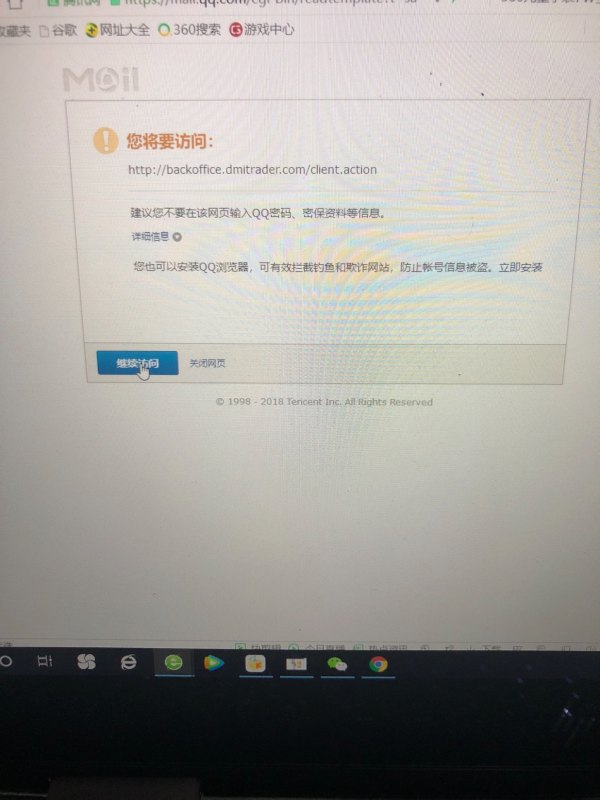

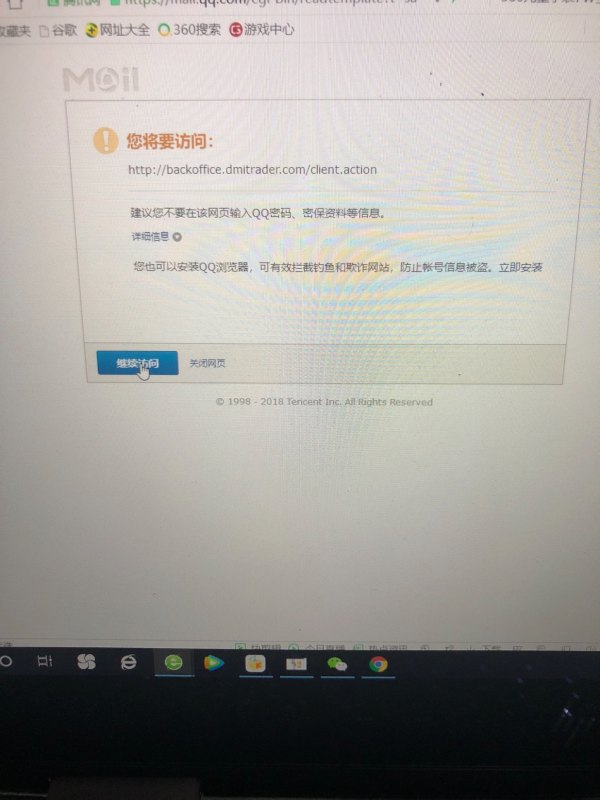

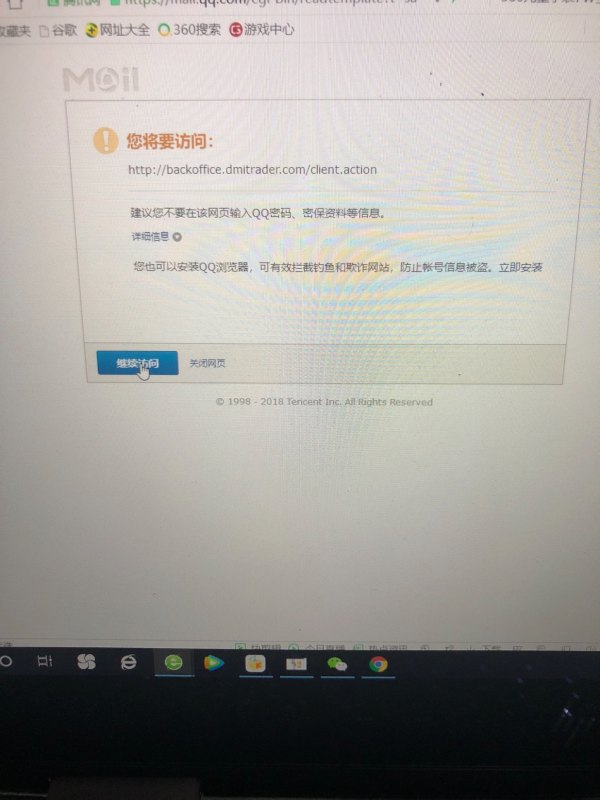

The back page can't be opened, the deposit can't be withdrawn. The customer service personnel are out of touch. The website is wrong, and the introducer is also lost, and the money can't be withdrawn.

DMI Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The back page can't be opened, the deposit can't be withdrawn. The customer service personnel are out of touch. The website is wrong, and the introducer is also lost, and the money can't be withdrawn.

This comprehensive dmi review reveals a concerning picture of a financial services entity struggling with fundamental operational challenges. Based on available data and user feedback, DMI presents significant red flags that potential clients should carefully consider. The organization shows particularly poor performance in employee satisfaction metrics, with staff ratings hitting rock bottom at just 1 out of 10. RepVue scores remain disappointingly low at 58 points.

Despite these challenges, DMI does offer some technical analysis capabilities, particularly through the Directional Movement Index indicator, which provides value for market trend analysis. However, this singular strength cannot compensate for the broader operational deficiencies evident across multiple service areas. The platform appears primarily targeted toward experienced traders and investors with strong technical analysis backgrounds. Even this demographic may find the overall service experience frustrating.

Given the limited positive feedback and substantial operational concerns, this dmi review suggests extreme caution for potential users considering DMI for their trading and investment needs.

Regional Entity Variations: DMI operations may vary significantly across different geographical regions, with potentially different regulatory standards and service offerings. The information presented in this review may not apply uniformly to all DMI entities worldwide.

Review Methodology: This evaluation is based on available employee feedback data, market analysis information, and limited public documentation. The assessment does not encompass all possible user experiences and should be considered alongside individual research and due diligence.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 2/10 | Poor |

| Tools and Resources | 5/10 | Average |

| Customer Service and Support | 3/10 | Poor |

| Trading Experience | 4/10 | Below Average |

| Trust and Reliability | 2/10 | Poor |

| User Experience | 3/10 | Poor |

DMI operates within a complex organizational structure that encompasses multiple entities and service offerings. According to available information, DMI Securities functions as a registered securities broker based in Dallas, Texas, positioning itself as an investment firm emphasizing strong ethics and core values. The organization seeks professionals with sales experience. This suggests a focus on client acquisition and business development activities.

The broader DMI ecosystem also includes the Design Management Institute, which provides research and resources related to design management practices. Additionally, there's the Data Management Interface, a specialized system developed at the Austin Information Technology Center for processing and storing data from VA Medical Centers and Clinics.

The company's business model appears to center around securities brokerage services. Specific details about trading platforms, asset offerings, and client service structures remain limited in available documentation. DMI Securities markets itself as serving experienced investors, particularly those interested in mortgage investments and seeking higher returns through portfolio building strategies. However, the lack of comprehensive publicly available information about core trading services raises questions about transparency and operational scope.

Regulatory Oversight: Specific regulatory information is not detailed in available materials, though DMI Securities is identified as a registered broker entity. The absence of clear regulatory disclosure represents a significant concern for potential clients.

Deposit and Withdrawal Methods: Available materials do not specify supported payment methods, processing times, or associated fees for fund transfers.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in accessible documentation.

Promotional Offerings: No information about bonuses, promotions, or special offers is available in current materials.

Tradeable Assets: While the platform appears to support forex and CFD trading, specific asset categories and availability are not comprehensively detailed in available resources.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not specified in accessible materials.

Leverage Options: Leverage ratios and margin requirements are not detailed in available documentation.

Platform Selection: Specific trading platform types, including whether MT4, MT5, or proprietary platforms are offered, is not mentioned in current materials.

Geographic Restrictions: Information about restricted countries or regional limitations is not specified in available resources.

Customer Support Languages: Supported languages for customer service are not detailed in accessible documentation.

This dmi review highlights significant information gaps that potential clients should address through direct inquiry before considering the platform.

The evaluation of DMI's account conditions reveals substantial information gaps that significantly impact the overall assessment. Available materials do not provide specific details about account types, their distinctive features, or the range of options available to different client categories. This lack of transparency regarding account structures represents a fundamental concern for potential users seeking to understand their options.

Minimum deposit requirements, a critical factor for trader decision-making, are not specified in accessible documentation. This absence of clear financial requirements makes it impossible for prospective clients to properly plan their investment approach or determine platform accessibility. Additionally, the account opening process, including verification procedures, documentation requirements, and approval timelines, remains undocumented in available materials.

Special account features that many traders consider essential, such as Islamic accounts for Sharia-compliant trading, professional account categories, or institutional service options, are not mentioned in current resources. The lack of detailed account condition information, combined with poor employee satisfaction ratings, suggests potential operational deficiencies that could impact the client onboarding experience.

Without comprehensive account information readily available, potential users face significant uncertainty about basic service parameters. This represents a substantial barrier to informed decision-making in this dmi review.

DMI's tools and resources present a mixed picture, with some technical capabilities offset by significant information gaps. The platform's connection to the Directional Movement Index indicator provides some value for technical analysis, offering traders a method for measuring price movement strength and direction across various securities including stocks, futures, and forex.

However, the broader range of trading tools typically expected from a modern brokerage platform remains unclear from available documentation. Essential resources such as advanced charting packages, comprehensive market analysis tools, economic calendars, and real-time news feeds are not detailed in accessible materials. This absence of information about fundamental trading infrastructure raises questions about platform completeness.

Educational resources, increasingly important for trader development, are not specified in current documentation. The availability of webinars, trading tutorials, market analysis training, or educational content libraries remains unknown. Similarly, automated trading support, including Expert Advisor compatibility, signal services, or algorithmic trading capabilities, is not addressed in available materials.

Research and analysis resources, critical for informed trading decisions, lack detailed description in accessible documentation. The absence of information about market research teams, analysis publications, or third-party research integration represents a significant gap in service transparency that impacts this evaluation.

Customer service and support represent critical weaknesses in DMI's service offering, as evidenced by extremely poor employee satisfaction ratings. With staff ratings at just 1 out of 10, internal operational challenges likely translate into subpar client service experiences. This concerning metric suggests fundamental problems with organizational culture and service delivery capabilities.

Available documentation does not specify customer service channels, availability hours, or response time commitments. The absence of clear information about support accessibility through phone, email, live chat, or other communication methods creates uncertainty about problem resolution capabilities. Additionally, service quality standards and performance metrics are not detailed in accessible materials.

Multi-language support capabilities remain unspecified, potentially limiting service accessibility for international clients. The geographic coverage of support services and timezone accommodation for global trading activities is not addressed in available documentation. Emergency support procedures and escalation processes for critical issues are similarly undocumented.

The combination of poor internal satisfaction ratings and limited public information about service standards suggests significant operational challenges that could severely impact client experiences. Problem resolution capabilities and case management procedures are not detailed, raising concerns about effective issue handling when problems arise.

The trading experience evaluation faces significant limitations due to sparse information about platform performance and functionality. Available materials do not provide specific details about platform stability, execution speeds, or system reliability metrics that traders typically require for informed platform selection.

Order execution quality, including slippage rates, requote frequency, and fill quality statistics, is not documented in accessible materials. These critical performance indicators directly impact trading profitability and user satisfaction, yet remain unspecified in current documentation. Additionally, platform functionality completeness, including charting tools, technical indicators, and analysis capabilities beyond the DMI indicator, lacks detailed description.

Mobile trading experience, increasingly important for modern traders, is not addressed in available documentation. The availability, functionality, and performance of mobile applications or responsive web platforms remain unclear. Trading environment factors such as spread stability, liquidity provision, and market depth information are similarly undocumented.

The absence of user feedback about actual trading experiences compounds these information gaps. Without documented user experiences regarding platform performance, execution quality, or trading environment satisfaction, this dmi review cannot provide comprehensive trading experience assessment based on real-world usage patterns.

Trust and reliability assessment reveals significant concerns about DMI's operational transparency and regulatory standing. Available materials do not provide specific regulatory authority information, license numbers, or compliance documentation that typically supports broker credibility. This absence of clear regulatory disclosure represents a fundamental trust issue for potential clients.

Financial security measures, including client fund segregation, deposit insurance coverage, and third-party custody arrangements, are not detailed in accessible documentation. These protections are essential for client confidence and regulatory compliance, yet remain unspecified in current materials. Company transparency regarding financial reporting, management structure, and operational oversight similarly lacks documentation.

Industry reputation indicators, such as awards, recognitions, or professional association memberships, are not mentioned in available materials. The handling of negative events, regulatory actions, or operational challenges is not addressed in accessible documentation. Additionally, third-party verification of business practices and service quality is not evidenced in current resources.

The combination of poor employee satisfaction ratings, limited regulatory disclosure, and absence of transparency indicators significantly undermines confidence in DMI's reliability as a financial services provider. These trust deficiencies represent substantial risk factors for potential clients.

User experience assessment reveals concerning patterns that align with poor internal satisfaction metrics. The employee rating of 1 out of 10 strongly suggests fundamental operational problems that inevitably impact client experiences. Such extremely low internal satisfaction typically correlates with service delivery issues, operational inefficiencies, and organizational dysfunction.

Interface design quality, navigation efficiency, and platform usability are not detailed in available documentation. The absence of information about user interface development, user experience testing, or platform optimization efforts raises questions about service quality priorities. Registration and verification processes, critical for first impressions, remain undocumented in accessible materials.

Fund management experience, including deposit and withdrawal procedures, processing efficiency, and fee transparency, lacks specific documentation. These operational aspects directly impact user satisfaction yet remain unspecified in current materials. Common user complaints, feedback patterns, and service improvement initiatives are similarly undocumented.

The target user demographic appears to focus on experienced traders and mortgage investment specialists, though specific user profiles and satisfaction metrics are not detailed. The absence of documented user feedback, testimonials, or case studies prevents comprehensive user experience evaluation based on actual client experiences.

This comprehensive dmi review reveals substantial concerns about DMI's operational capabilities and service quality. The extremely poor employee satisfaction ratings, combined with significant information gaps about fundamental service aspects, suggest serious operational challenges that potential clients should carefully consider.

While DMI offers some technical analysis capabilities through the Directional Movement Index indicator, this limited strength cannot compensate for broader operational deficiencies. The platform may have limited appeal for highly experienced traders specifically interested in technical analysis tools, but even this demographic would likely face frustration with overall service quality.

The combination of poor transparency, limited regulatory disclosure, and concerning internal satisfaction metrics makes DMI unsuitable for most trader categories, particularly beginners or those requiring comprehensive support services. Potential clients should exercise extreme caution and conduct thorough due diligence before considering DMI for their trading and investment needs.

FX Broker Capital Trading Markets Review