Is SuperForex safe?

Business

License

Is SuperForex Safe or a Scam?

Introduction

SuperForex is a global online forex broker that has positioned itself as a player in the foreign exchange market since its establishment in 2013. Operating out of Belize, SuperForex provides a range of trading services, including forex, CFDs, and cryptocurrencies, to clients in over 150 countries. However, the nature of the forex market necessitates that traders exercise caution when selecting a broker, as the industry is rife with both reputable firms and potential scams. This article aims to provide an objective assessment of SuperForex, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk profile. The analysis is based on a comprehensive review of available information, including user feedback and regulatory data.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for ensuring its legitimacy and the safety of client funds. SuperForex is regulated by the International Financial Services Commission (IFSC) of Belize, which is considered an offshore regulatory authority. While the IFSC does provide some level of oversight, it is important to note that its regulations are not as stringent as those imposed by tier-1 regulators such as the FCA in the UK or ASIC in Australia. Below is a summary of SuperForex's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | 000160/344 | Belize | Verified |

The IFSC's oversight includes basic compliance checks, but it lacks the robust investor protection mechanisms found in more reputable jurisdictions. This raises concerns about the overall safety of trading with SuperForex. Historical compliance issues have been noted, with some sources indicating that the broker may not adhere strictly to the rules set forth by the IFSC, leading to potential risks for traders.

Company Background Investigation

SuperForex was founded in 2013 and is owned by Superfin Corp., a company registered in Belize. The broker's management team comprises individuals with varying backgrounds in finance and trading, though detailed information about their professional experience is limited. The company's transparency regarding its operations and ownership structure has been questioned, as it does not prominently disclose key information on its website. This lack of transparency can be a red flag for potential clients, as it raises doubts about the broker's accountability.

The broker has made efforts to establish a presence in the African market, particularly in countries like South Africa, Nigeria, and Kenya. However, the offshore nature of its operations and the associated regulatory leniency may lead to concerns about the broker's long-term viability and commitment to client safety.

Trading Conditions Analysis

When evaluating a forex broker, understanding the overall cost structure and trading conditions is essential. SuperForex offers various account types, including standard, ECN, and swap-free accounts, with a minimum deposit requirement as low as $1. However, the fee structure can be complex, with varying spreads and commissions depending on the account type. Below is a comparison of core trading costs:

| Fee Type | SuperForex | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2-3 pips | 1-1.5 pips |

| Commission Model | Variable, up to $21.50 per side | $5-10 per side |

| Overnight Interest Range | Varies by asset | Varies by broker |

The spreads offered by SuperForex are relatively high compared to industry standards, which could impact profitability, especially for active traders. Additionally, the commission structure may not be transparent, leading to potential misunderstandings about costs incurred during trading.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. SuperForex claims to implement several measures to protect client funds, including segregated accounts, which ensure that client money is kept separate from the broker's operational funds. This practice is crucial for safeguarding investments in the event of the broker facing financial difficulties.

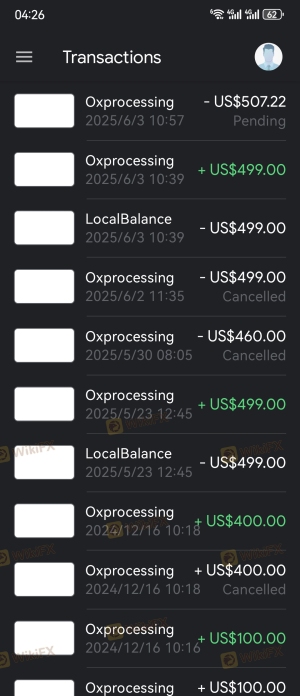

Moreover, SuperForex participates in the Investor Compensation Fund, which provides some level of protection for clients in case of insolvency. However, the absence of a robust negative balance protection policy raises concerns about the potential for clients to lose more than their initial investment. Historical issues reported by clients regarding fund withdrawals further exacerbate these concerns, indicating that while the broker may have some safety measures in place, they may not be sufficient to guarantee complete client protection.

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reputation. Reviews of SuperForex reveal a mixed bag of experiences, with some clients praising the broker for its customer service and user-friendly platform, while others report significant issues, particularly regarding fund withdrawals. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Management | Medium | Inconsistent support |

| Trading Conditions | Medium | Limited explanations |

Case studies from clients illustrate these issues. One user reported being unable to withdraw funds after reaching a profit threshold, while another experienced delays in account verification, leading to frustration. Such complaints highlight a potential pattern of operational inefficiencies that could deter potential clients from engaging with SuperForex.

Platform and Trade Execution

The trading platform offered by SuperForex is primarily MetaTrader 4 (MT4), a popular choice among traders for its functionality and ease of use. However, the performance of the platform has been scrutinized, particularly regarding order execution quality and slippage during volatile market conditions. Users have reported instances of delayed order execution and high slippage, which can significantly impact trading outcomes. There are also concerns about potential manipulation, with some traders alleging that profitable trades were closed without their consent.

Risk Assessment

Engaging with SuperForex presents several risks that potential traders should consider. The broker's offshore regulatory status, combined with reports of withdrawal issues and high spreads, contributes to a higher risk profile. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak oversight from IFSC |

| Financial Risk | Medium | Potential for fund access issues |

| Operational Risk | Medium | Complaints about service quality |

| Market Risk | High | High leverage increases volatility |

To mitigate these risks, traders are advised to start with a demo account, carefully review the broker's terms and conditions, and consider diversifying their investments across multiple platforms.

Conclusion and Recommendations

In conclusion, the evidence suggests that while SuperForex is a legitimate broker with regulatory oversight, its offshore status and mixed customer feedback warrant caution. The broker's high spreads, withdrawal issues, and lack of robust regulatory protections raise red flags for potential clients. Traders should approach SuperForex with a critical mindset, especially those new to forex trading. For those seeking more reliable alternatives, brokers regulated by tier-1 authorities such as the FCA or ASIC may offer a safer trading environment.

Is SuperForex a scam, or is it legit?

The latest exposure and evaluation content of SuperForex brokers.

SuperForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SuperForex latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.