Superforex 2025 Review: Everything You Need to Know

Superforex, a broker established in 2013, has garnered mixed feedback from the trading community. While some users appreciate its low minimum deposit and diverse account types, others raise concerns about withdrawal issues and regulatory status. This review synthesizes insights from various sources to provide a comprehensive overview of Superforex, highlighting its key features, advantages, and drawbacks.

Note: It is important to consider that Superforex operates under different entities across regions, which may affect the overall trading experience. The review methodology aims for fairness and accuracy, taking into account various user experiences and expert analyses.

Ratings Overview

We rate brokers based on user feedback, expert analysis, and factual data.

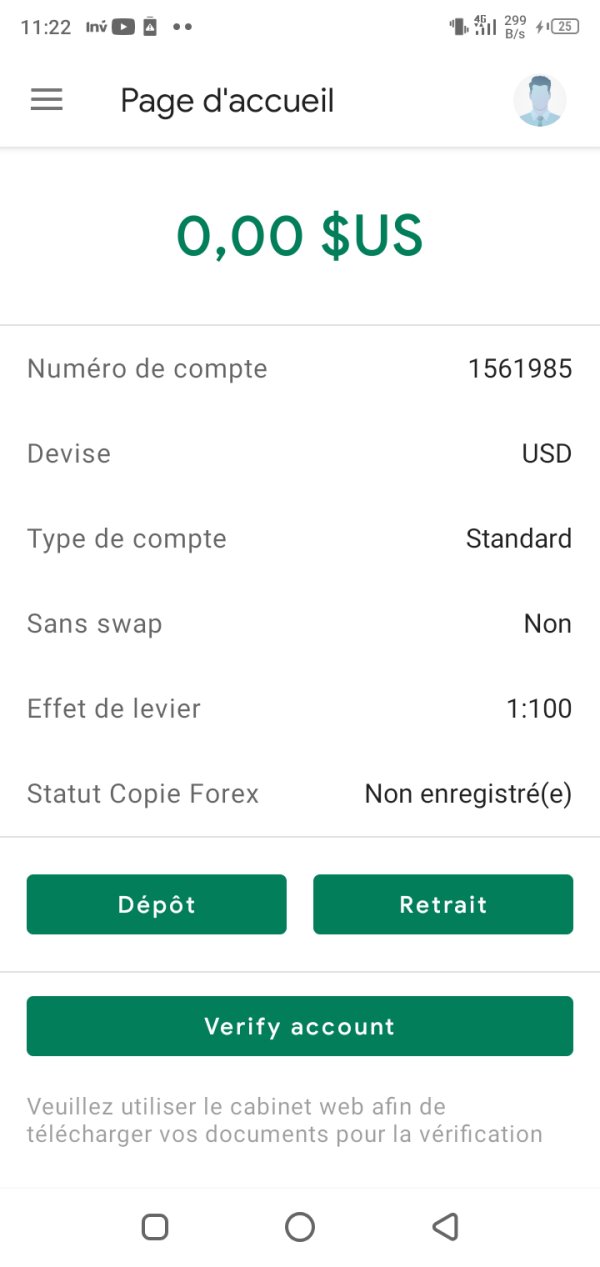

Broker Overview

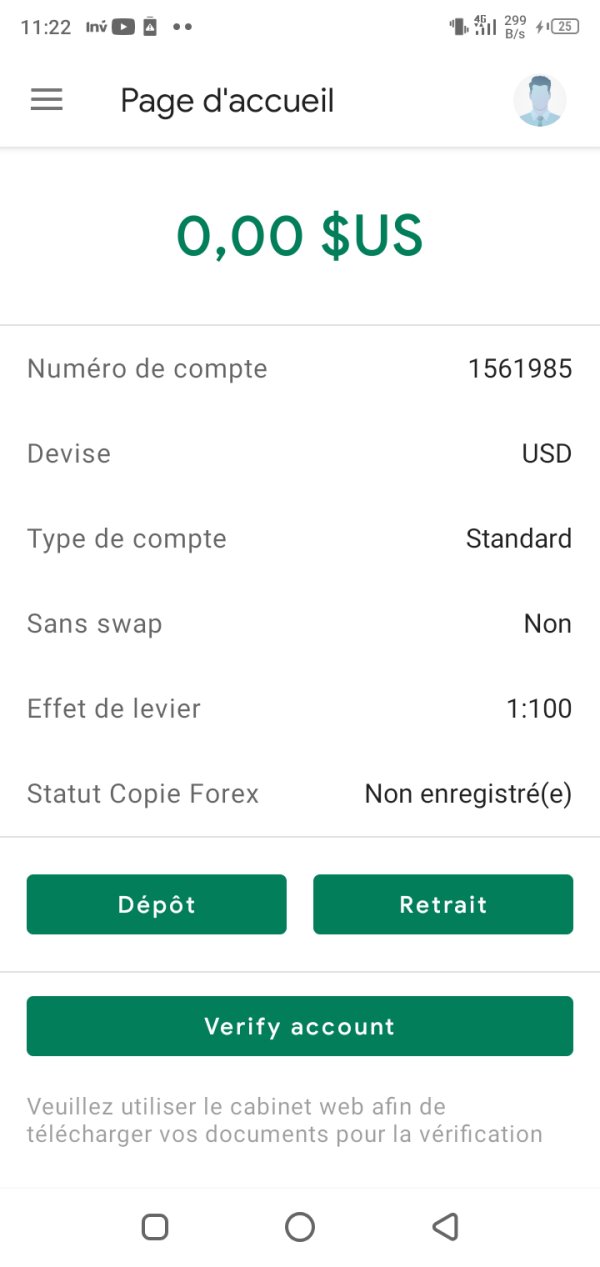

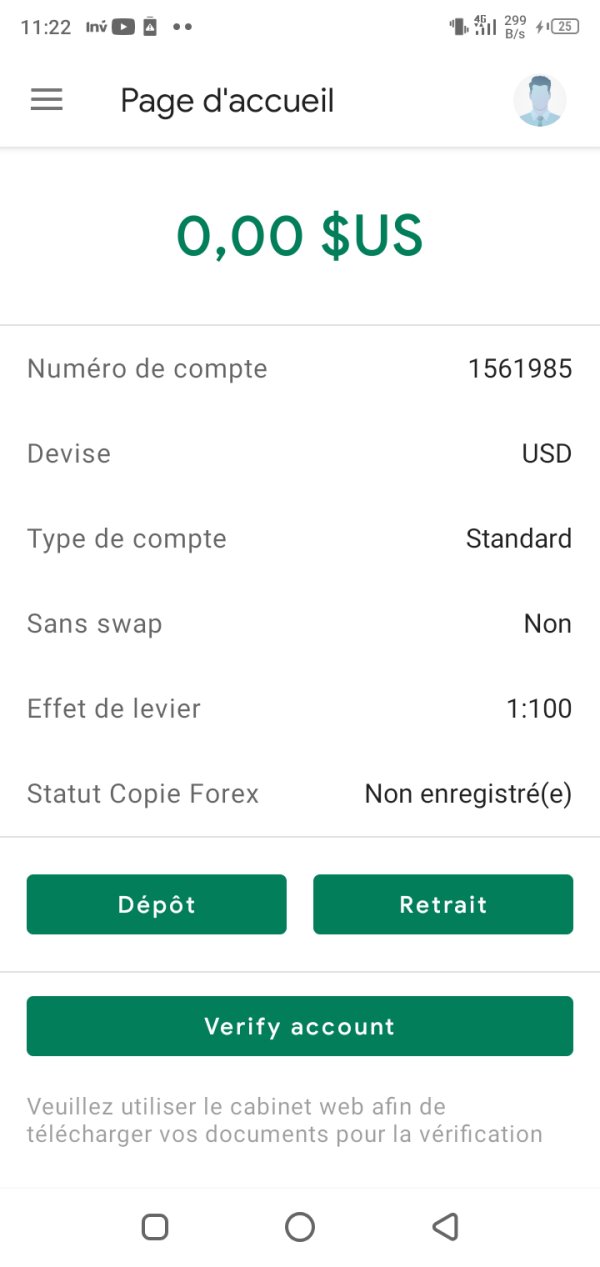

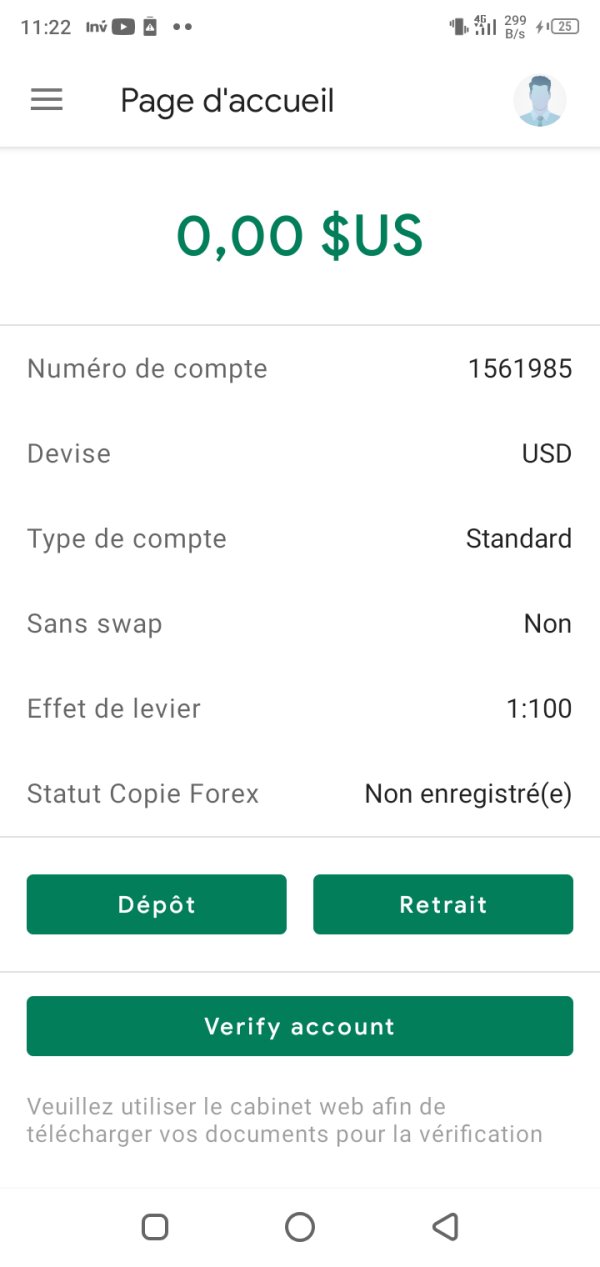

Superforex is regulated by the International Financial Services Commission (IFSC) in Belize. Although the IFSC is not regarded as a top-tier regulator, it provides a level of oversight. The broker offers trading on the popular MetaTrader 4 (MT4) platform, catering to a variety of asset classes, including forex, commodities, cryptocurrencies, and stocks. Superforex is accessible to traders in over 150 countries and provides a range of account types with varying leverage options.

Detailed Insights

Regulated Geographic Areas/Regions

Superforex operates primarily in regions where the IFSC is the regulatory authority. However, it is important to note that traders from the United States and Ukraine are restricted from opening accounts with Superforex. This geographic limitation may impact the brokers accessibility for some traders.

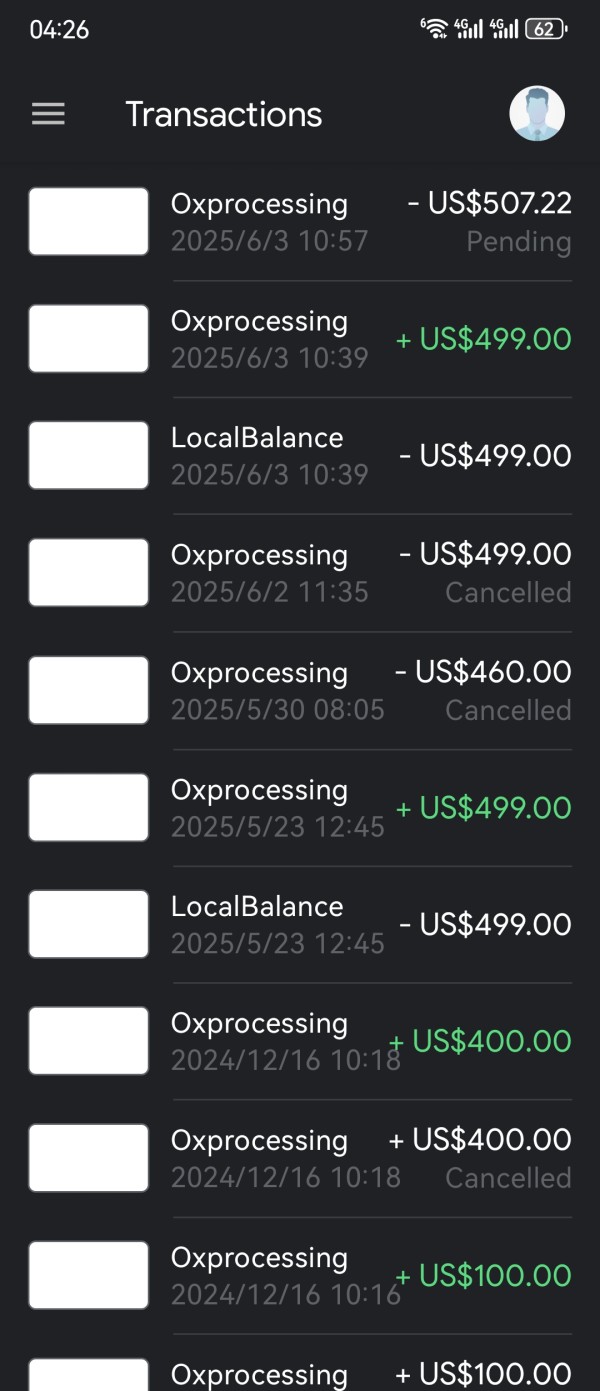

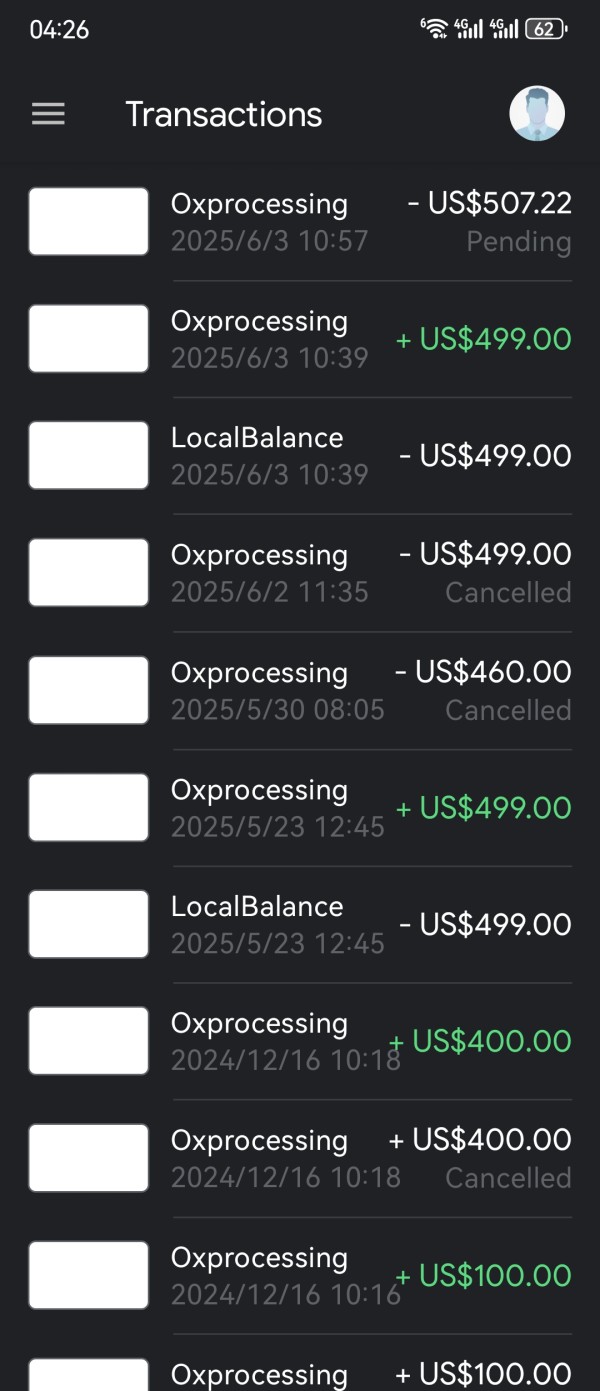

Deposit/Withdrawal Currencies/Cryptocurrencies

Superforex allows transactions in multiple currencies, including USD, EUR, and GBP. It also supports various cryptocurrencies for deposits and withdrawals, enhancing flexibility for users who prefer digital currencies. The minimum deposit requirement is notably low, set at just $1, which makes it appealing for new traders.

Bonuses/Promotions

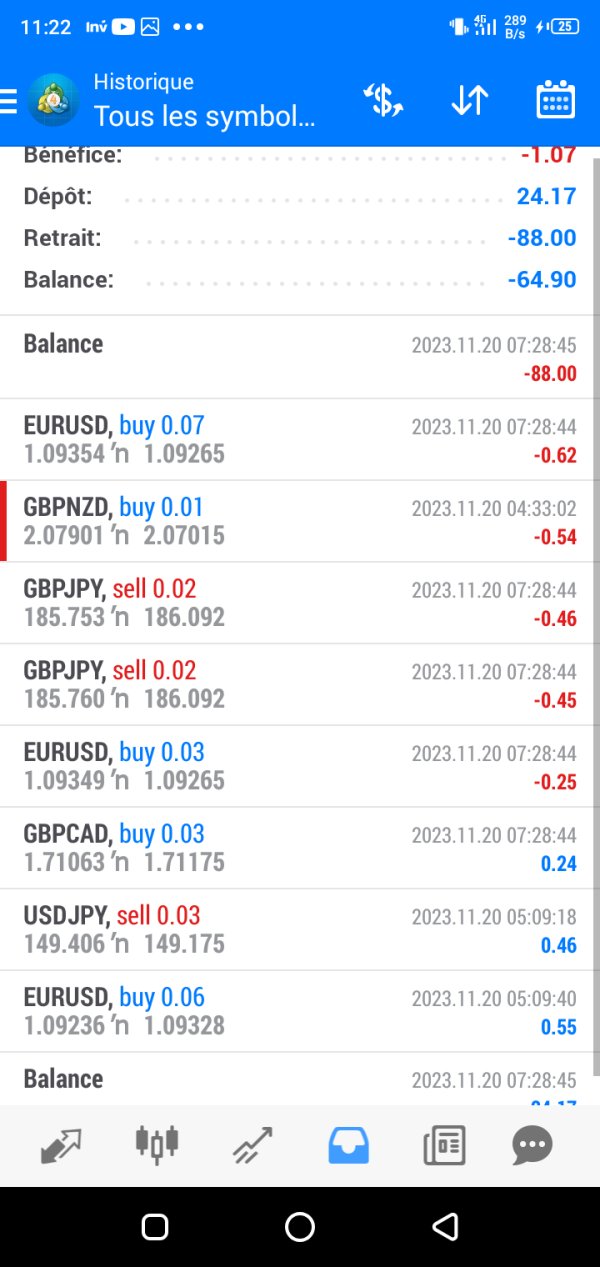

Superforex offers an array of bonuses, including a no-deposit bonus, welcome bonuses, and promotional offers that can significantly enhance a trader's initial capital. However, some users have reported that the terms associated with these bonuses can be restrictive, particularly when it comes to withdrawing funds after meeting the trading volume requirements.

Tradeable Asset Classes

The broker provides access to over 2,300 trading instruments across various asset classes, including more than 100 currency pairs, commodities like gold and oil, and popular cryptocurrencies such as Bitcoin and Ethereum. This vast selection allows traders to diversify their portfolios effectively.

Costs (Spreads, Fees, Commissions)

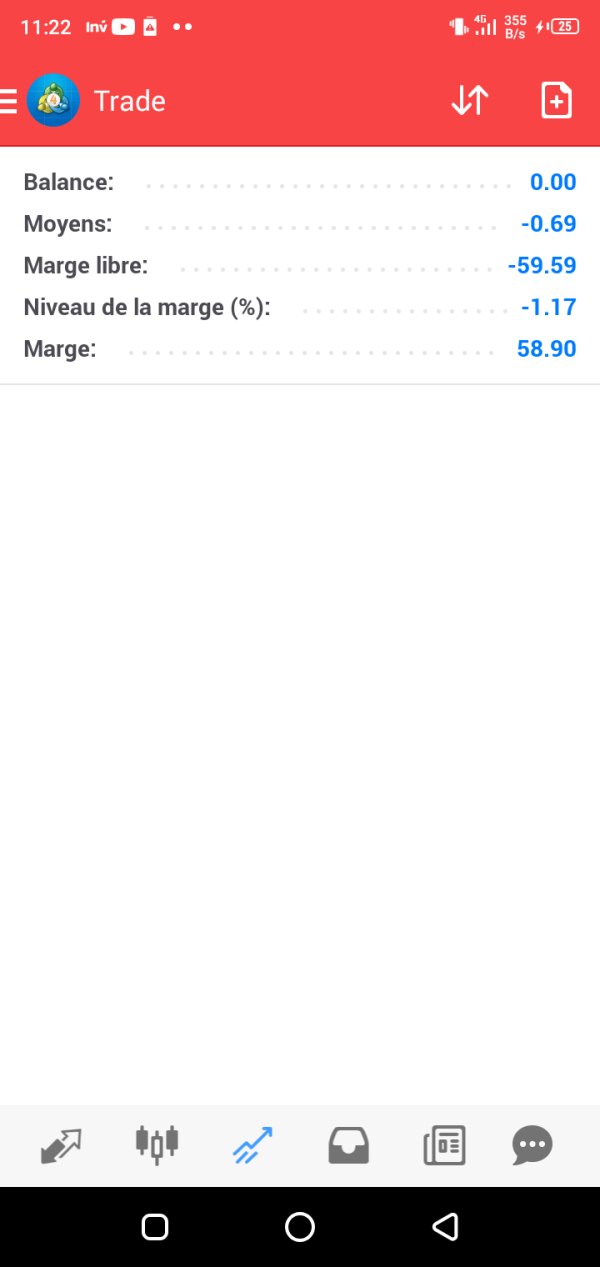

Superforex offers competitive spreads, starting from 0 pips on certain accounts. However, users have reported that the spreads can widen significantly during periods of high volatility. The broker does not charge commissions on most accounts, but withdrawal fees can range from 0.5% to 5%, depending on the method used.

Leverage

The leverage offered by Superforex is quite high, reaching up to 1:3000 for certain accounts. While this can amplify potential profits, it also increases risk, particularly for inexperienced traders. Users are advised to implement robust risk management strategies when trading under such conditions.

Allowed Trading Platforms

Currently, Superforex only supports the MT4 platform, which is widely recognized for its user-friendly interface and extensive analytical tools. The absence of alternatives like MT5 may limit options for traders seeking more advanced features.

Restricted Regions

As mentioned, traders from the United States and Ukraine are not permitted to open accounts with Superforex. This limitation may affect the broker's reputation and accessibility in these regions.

Available Customer Service Languages

Superforex provides customer support in multiple languages, including English and Russian. However, users have expressed mixed feelings about the quality of customer service, with some reporting delays and unsatisfactory responses to inquiries.

Repeat Ratings Overview

Detailed Breakdown

-

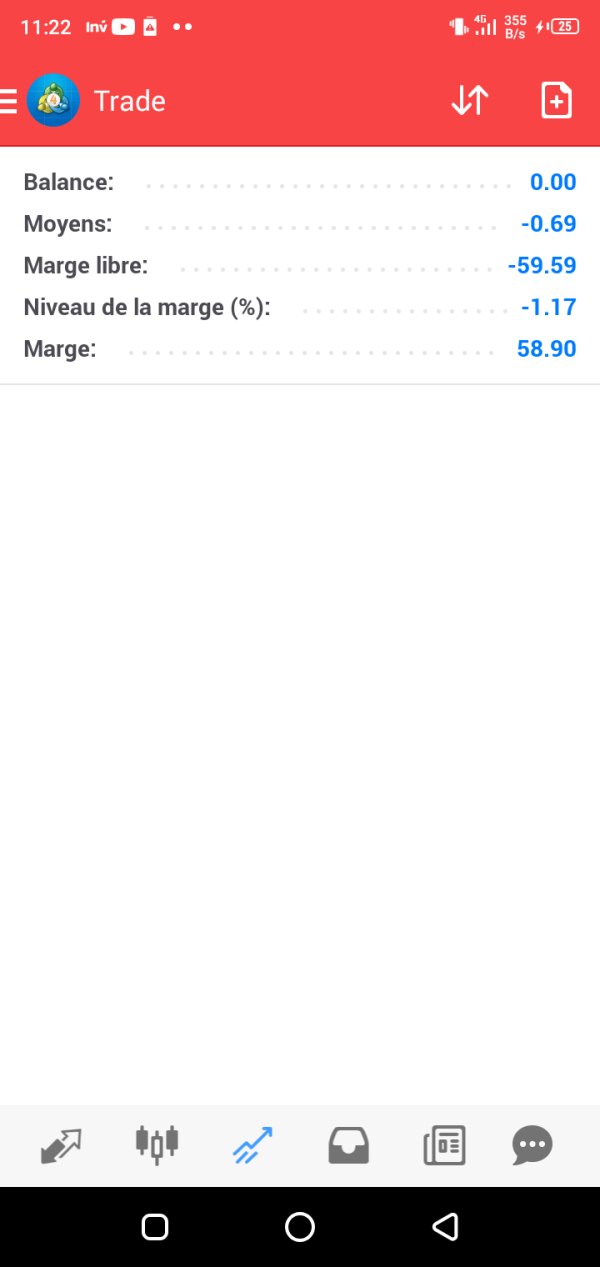

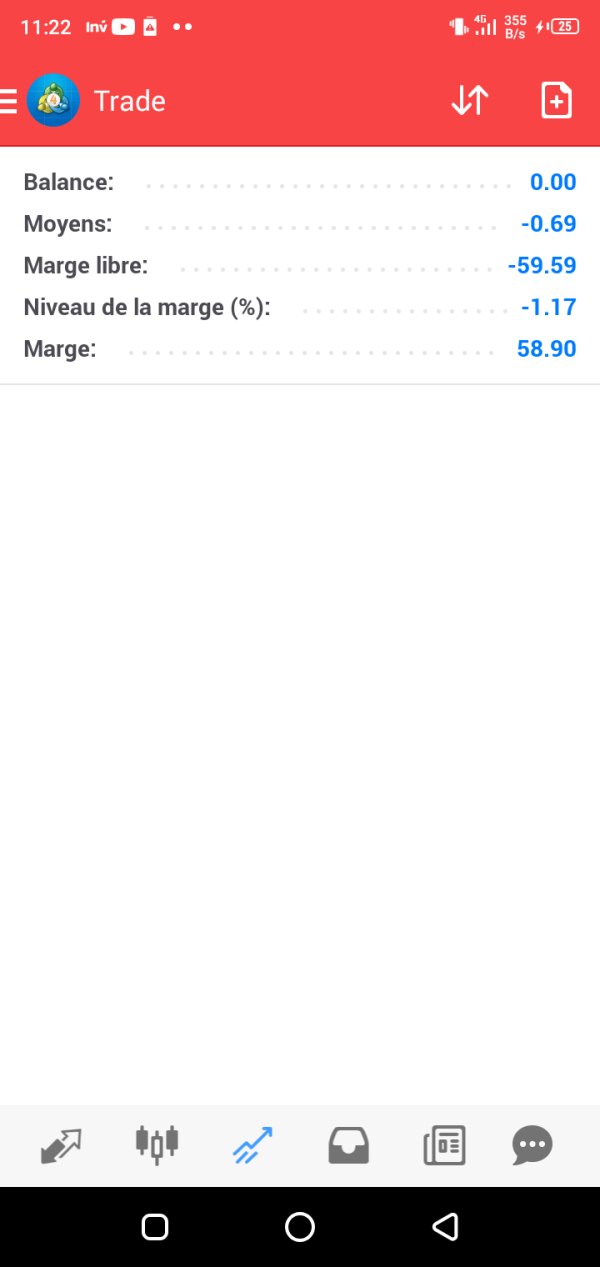

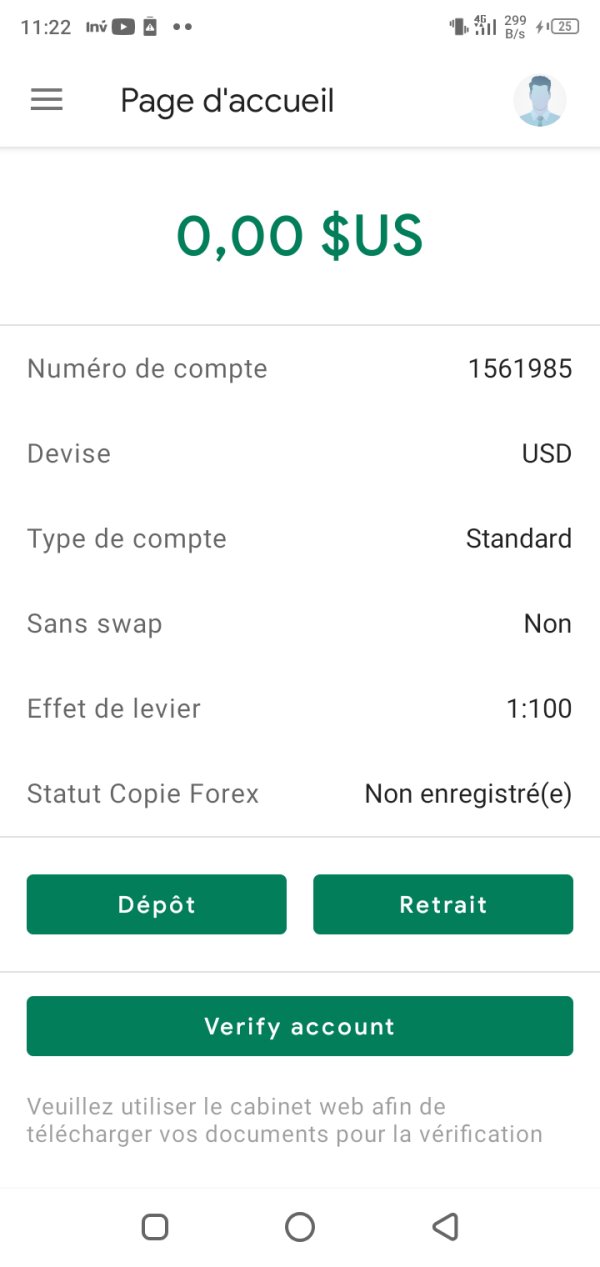

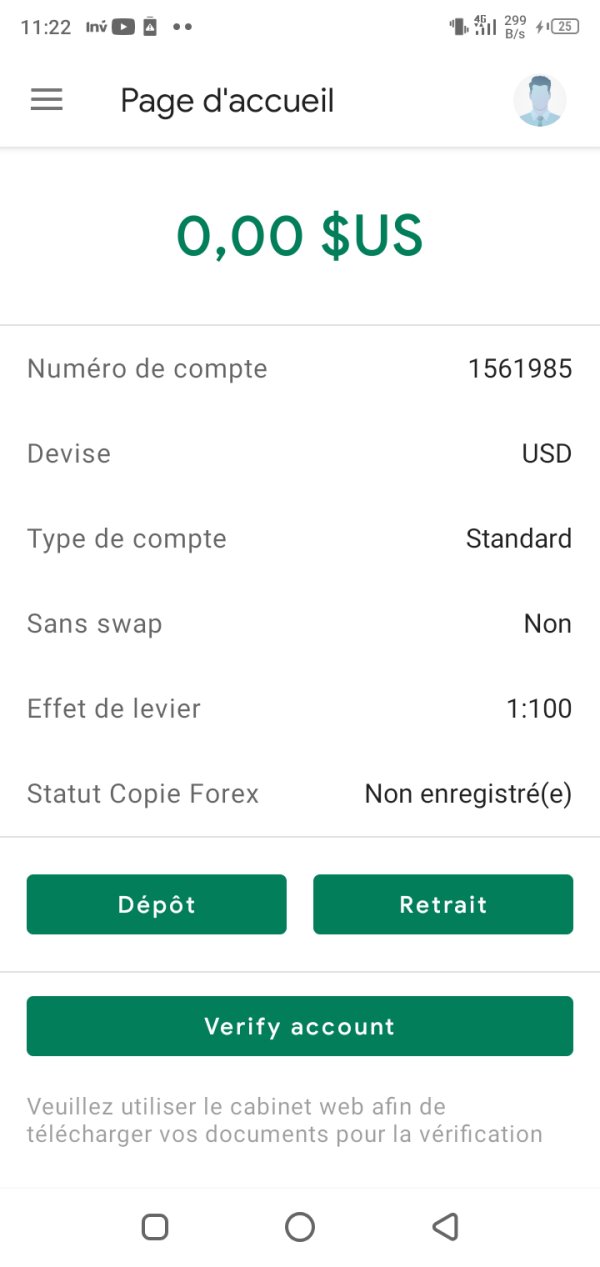

Account Conditions (7.5/10): Superforex offers a variety of account types, including standard, STP, and ECN accounts, with low minimum deposits. However, the high leverage can pose risks.

Tools and Resources (6.0/10): The educational resources available are decent but could be improved. While there are some webinars and articles, they may not suffice for all traders.

Customer Service and Support (5.5/10): Customer service is available in multiple languages, but user reviews indicate inconsistencies in response times and effectiveness.

Trading Experience (6.5/10): The trading experience on the MT4 platform is generally positive, though some users report issues with execution speed and slippage during volatile market conditions.

Trustworthiness (4.0/10): The IFSC regulation is a concern for many traders, as it does not offer the same level of protection as higher-tier regulators. User reviews also highlight issues with withdrawals.

User Experience (5.5/10): Overall user experience is mixed, with some traders reporting satisfaction with the platform and others expressing frustration over withdrawal issues and customer service.

In conclusion, the Superforex review indicates that while the broker offers attractive features such as low minimum deposits and a wide range of trading instruments, potential users should be cautious due to regulatory concerns and mixed user experiences. It is advisable to conduct thorough research and consider all factors before deciding to trade with Superforex.