Vortex FX 2025 Review: Everything You Need to Know

Executive Summary

This Vortex FX review looks at a forex broker that has caught attention on many trading sites. Vortex FX shows up on Trustpilot, Myfxbook, and FXVerify as a platform that offers forex and CFD services to regular traders. The broker keeps an online presence on multiple review sites. However, detailed information about how they operate stays hard to find in public sources.

Review platform data shows that Vortex FX works in the busy forex brokerage world. They give traders access to currency markets and derivative tools. The broker seems to focus on serving individual traders who want forex trading chances, but we need to dig deeper to learn about account types, trading conditions, and rules.

Client feedback shows mixed experiences across the board. Some users point out good parts of the service while others worry about different operational issues. This review tries to give a fair assessment based on what we can find while admitting that complete data is hard to get.

Important Disclaimers

This Vortex FX review uses information from third-party review sites like Trustpilot, Myfxbook, and FXVerify as of July 2025. Readers should know that rules and operational details can change a lot across different areas where Vortex FX might work.

The evaluation method relies mostly on user-created content and public information. This might not show the complete operational picture of the broker. Potential clients should strongly verify all trading conditions, regulatory status, and service terms on their own before starting any trading activities.

Information gaps exist about specific regulatory oversight, detailed trading conditions, and complete service offerings.

Rating Framework

Broker Overview

Vortex FX works as a forex and CFD broker in the online trading space. Specific details about when they started and company background are not clearly shown in available sources. The broker keeps a digital presence on several review platforms and seems to offer trading services to retail clients who want exposure to foreign exchange markets and contract for difference instruments.

The broker's business model seems to follow the standard online forex brokerage approach. They help clients access currency markets and derivative products. Based on available platform information, Vortex FX places itself within the competitive retail trading sector, though detailed operational specifics about trading infrastructure, technology platforms, and service delivery mechanisms stay unclear in public documentation.

Review platform data shows the broker serves clients interested in forex trading and CFD instruments. This suggests a focus on the retail trading segment. However, complete information about regulatory oversight, company structure, licensing arrangements, and operational jurisdiction is not easy to find in the source materials examined for this Vortex FX review.

Regulatory Framework: Available sources do not give clear information about Vortex FX's regulatory status or oversight arrangements. This creates a big information gap for potential clients who want regulatory assurance.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and fees is not detailed in available source materials.

Minimum Deposit Requirements: Exact minimum deposit amounts and account funding limits are not specified in the reviewed sources.

Promotional Offerings: Details about welcome bonuses, trading incentives, or promotional programs are not clearly shown in available information.

Tradeable Assets: Based on platform references, Vortex FX seems to offer forex and CFD trading. Complete asset lists and market coverage details are not provided though.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in source materials.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation.

Platform Technology: Trading platform options and technological infrastructure details are not fully covered in reviewed sources.

Geographic Restrictions: Information about service availability and regional limits is not clearly specified.

Customer Support Languages: Multilingual support options and communication channels are not detailed in this Vortex FX review based on available sources.

Account Conditions Analysis

The account structure and conditions that Vortex FX offers stay mostly undocumented in available source materials. Standard industry practice suggests multiple account tiers with different features, but specific details about Vortex FX's account types, minimum balance requirements, and tier-specific benefits are not clearly outlined in reviewed platforms.

Account opening procedures and verification requirements are not detailed in available sources. This makes it hard to judge the onboarding experience for new clients. The lack of clear information about account features, special services, or premium offerings creates a big transparency gap that potential clients should think about.

Without specific documentation about Islamic accounts, professional trader accommodations, or institutional services, this Vortex FX review cannot give complete guidance on account suitability for different trader types. The lack of detailed account condition information suggests potential clients should ask the broker directly about specific terms and conditions.

Industry standards typically include various account protection measures and client fund segregation protocols. However, Vortex FX's specific arrangements in these areas are not clearly documented in available review platform information.

Trading tools and analytical resources represent crucial elements for trader success. Specific information about Vortex FX's offerings in this area is not fully documented in available sources. Standard forex brokers typically provide charting packages, technical indicators, and market analysis tools, but details about Vortex FX's specific technological offerings remain unclear.

Educational resources, market research, and trader development programs are not detailed in the reviewed source materials. The lack of information about webinars, tutorials, market commentary, or trading guides creates a big information gap for potential clients evaluating the broker's value proposition.

Automated trading support, including expert advisor compatibility and algorithmic trading infrastructure, is not specified in available documentation. This lack of clarity about technological capabilities may impact traders who rely on automated strategies or require advanced trading tools.

Third-party integrations, mobile trading capabilities, and platform customization options are not detailed in this assessment due to limited information availability in source materials.

Customer Service and Support Analysis

Customer service quality emerges as a mixed element in available user feedback. Review platforms show varied experiences among Vortex FX clients. Some users report satisfactory support interactions, while others indicate challenges in communication and problem resolution processes.

Response time consistency and support channel effectiveness seem to vary based on available user testimonials. The lack of specific information about support hours, available communication methods, and escalation procedures makes it hard to give a complete assessment of service reliability.

Multilingual support capabilities and regional service variations are not clearly documented. This potentially impacts international clients seeking assistance in their preferred languages. The lack of detailed support infrastructure information represents a consideration for traders who prioritize responsive customer service.

Problem resolution effectiveness and service quality consistency remain areas where user experiences show variation. This suggests potential inconsistencies in support delivery that prospective clients should consider when evaluating the broker.

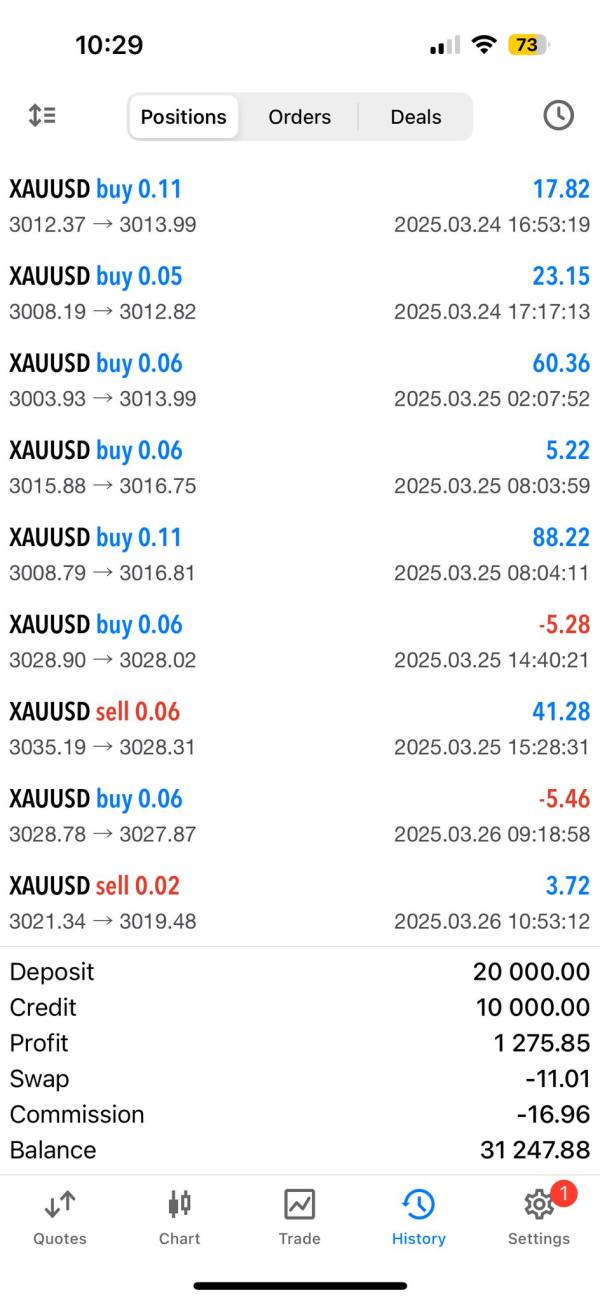

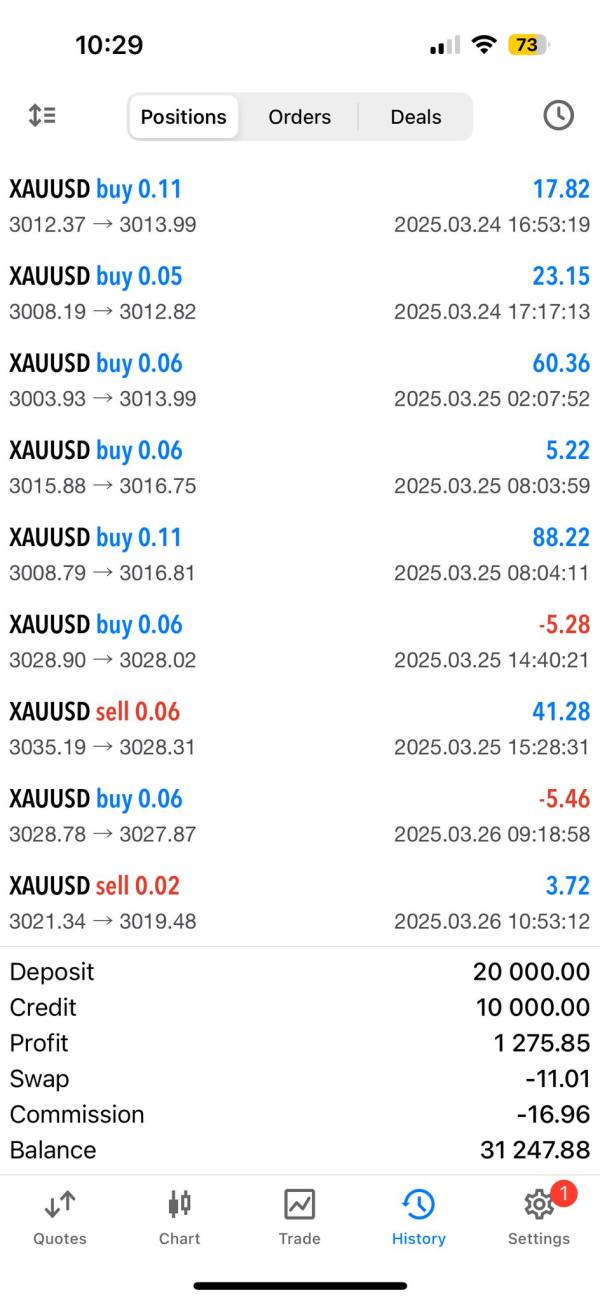

Trading Experience Evaluation

The overall trading experience with Vortex FX cannot be fully assessed due to limited specific user feedback and technical performance data in available sources. Standard trading experience factors including platform stability, execution speed, and order processing reliability are not detailed in reviewed materials.

Market access quality, including spread consistency and liquidity provision, is not specifically documented in available user feedback. The lack of detailed performance metrics makes it challenging to evaluate the broker's execution quality relative to industry standards.

Mobile trading functionality and cross-platform synchronization capabilities are not detailed in source materials. These represent important considerations for traders requiring flexible access to their accounts.

User interface design, platform navigation, and overall usability factors are not fully covered in available feedback. This makes it difficult to assess the Vortex FX review trading environment from a user experience perspective.

Trust and Security Assessment

Regulatory oversight and security arrangements represent critical factors for trader confidence. Specific information about Vortex FX's regulatory status is not clearly documented in available sources. The lack of clear regulatory information represents a big consideration for potential clients prioritizing regulatory protection.

Client fund protection measures, including segregation arrangements and compensation schemes, are not detailed in reviewed materials. Industry-standard security protocols and data protection measures are not specifically outlined, creating uncertainty about client asset protection.

Company transparency regarding ownership, financial standing, and operational history is limited in available public information. The lack of complete corporate disclosure may impact trader confidence in the broker's stability and reliability.

Third-party verification of business practices, independent audits, and industry certifications are not documented in available sources. These represent additional transparency considerations for potential clients.

User Experience Analysis

Overall user satisfaction indicators show mixed patterns based on available review platform data. Experiences vary significantly among different client segments. Interface usability and platform navigation effectiveness are not fully documented in available user feedback.

Account management processes, including registration, verification, and ongoing account maintenance, are not detailed in source materials. The efficiency of these operational elements impacts overall client satisfaction but cannot be thoroughly assessed based on available information.

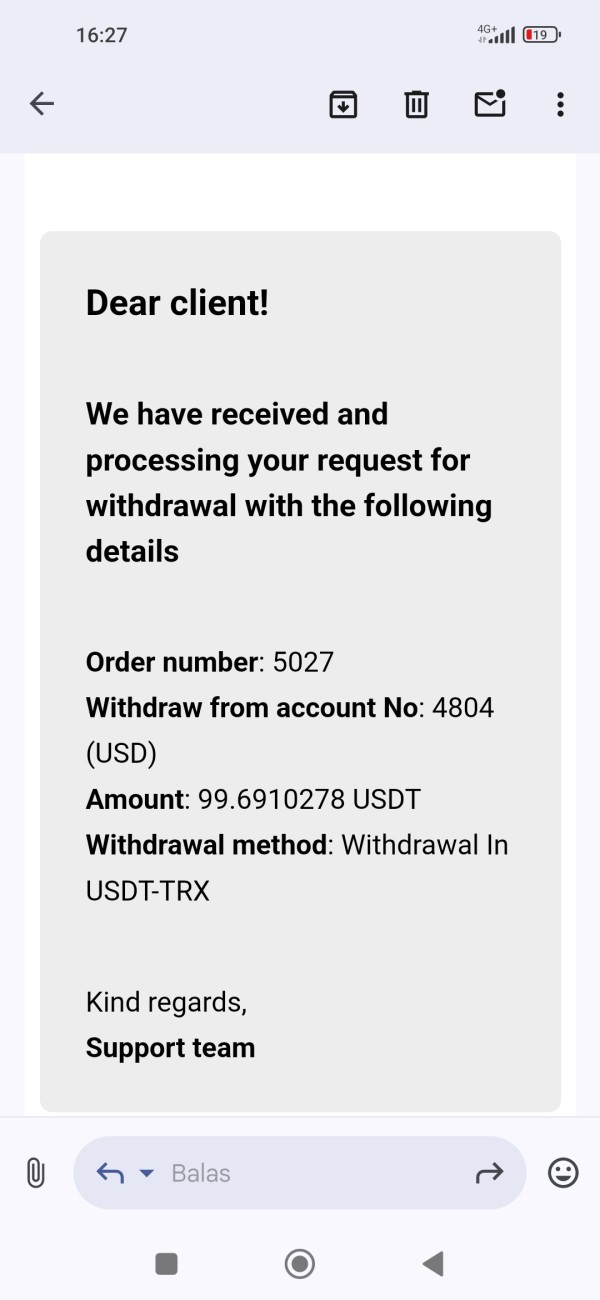

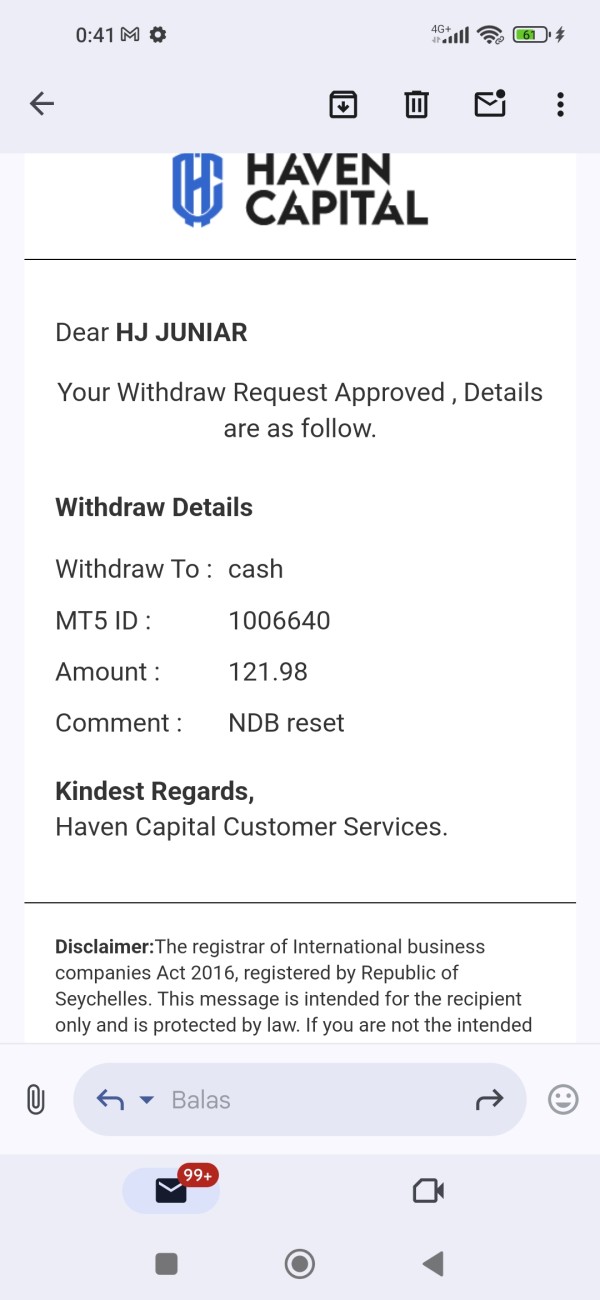

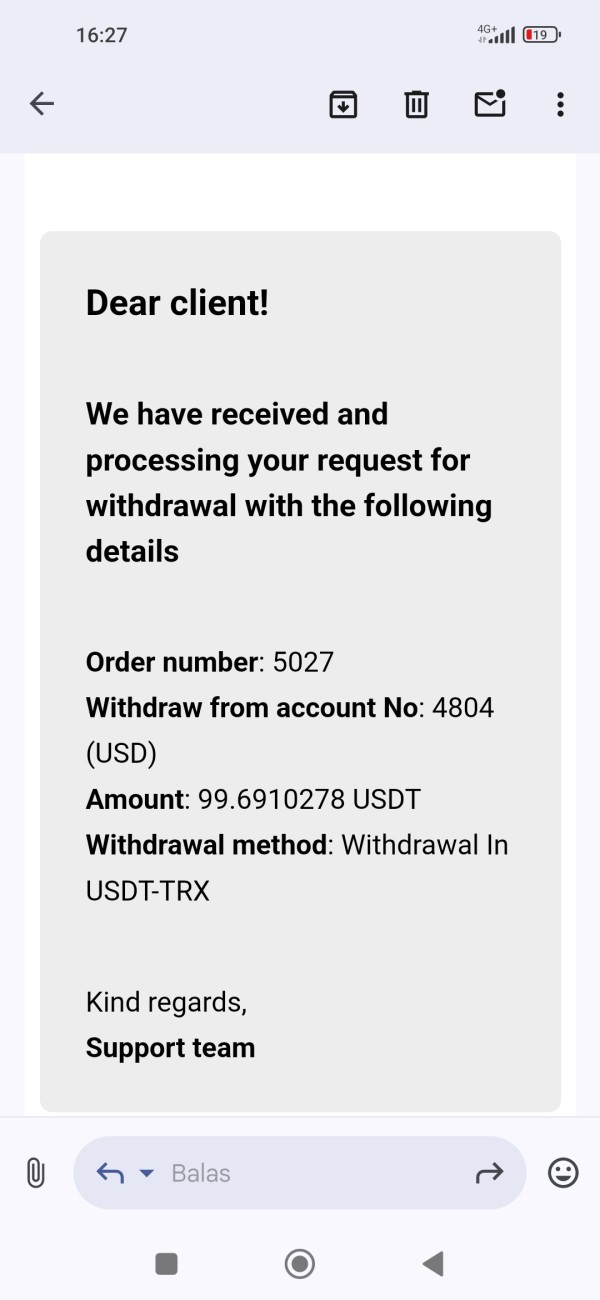

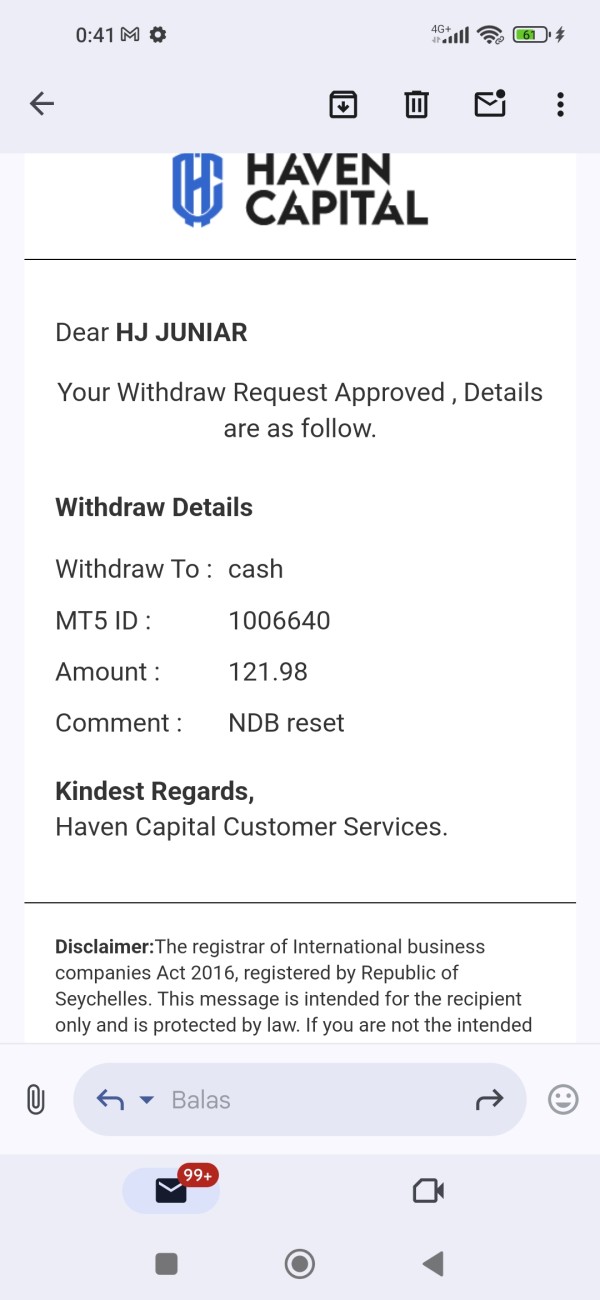

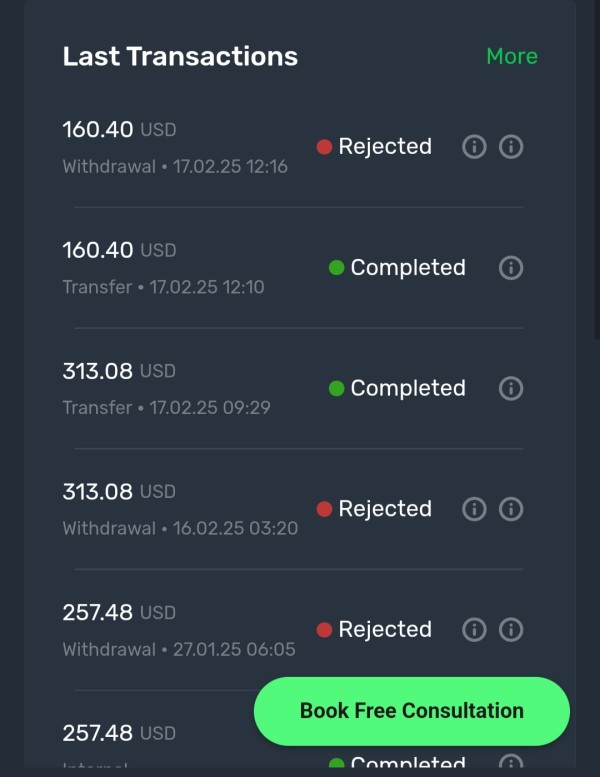

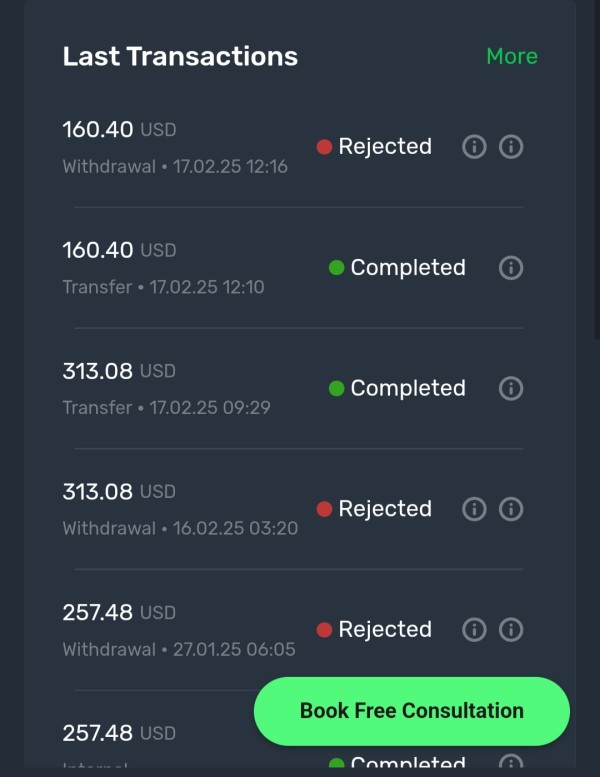

Funding and withdrawal experiences represent crucial user experience elements. Specific feedback about transaction processing, fees, and processing times is not fully documented in reviewed sources.

Common user concerns and frequent complaint patterns are not clearly identified in available feedback. This makes it difficult to highlight potential areas of improvement or recurring issues that prospective clients should consider.

Conclusion

This Vortex FX review reveals a broker operating in the competitive forex and CFD space with limited publicly available information about key operational aspects. While the broker maintains a presence across review platforms, significant information gaps exist regarding regulatory oversight, trading conditions, and comprehensive service offerings.

The mixed user feedback patterns suggest varied client experiences. Some positive elements balance against areas of concern. The lack of detailed regulatory information and complete operational transparency represents important considerations for potential clients prioritizing security and regulatory protection.

Vortex FX may suit traders willing to conduct extensive due diligence and seek direct clarification of terms and conditions. However, the limited publicly available information suggests that potential clients should exercise caution and thoroughly investigate all aspects of the broker's services before committing funds to trading activities.