Cryptocdf 2025 Review: Everything You Need to Know

Executive Summary

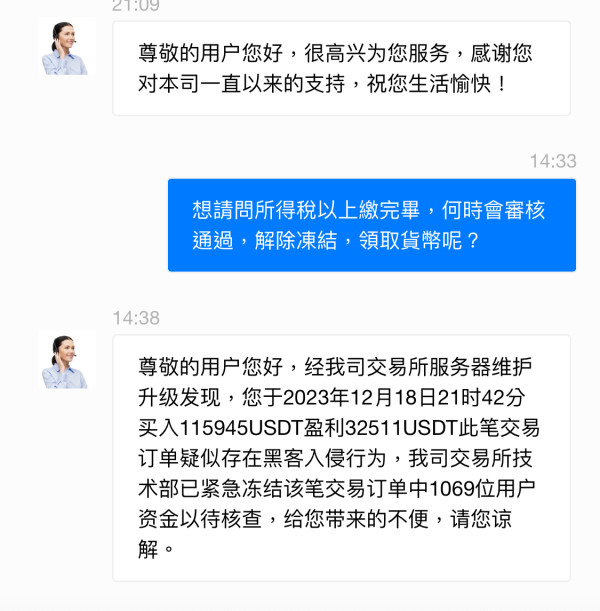

This cryptocdf review shows big concerns about the broker's safety for traders. Cryptocdf works as a cryptocurrency CFD trading platform, but many red flags suggest traders should be very careful. The platform has a bad user rating of only 25%. Many people complain about fraud and bad business practices.

This broker focuses on cryptocurrency CFD trading, but important details about trading conditions and rules are missing from public records. The lack of real regulatory information, plus reports of scam activities, makes Cryptocdf a high-risk choice for traders. The main users seem to be cryptocurrency fans who want CFD trading opportunities.

Even experienced traders should avoid this platform because of safety concerns. The platform lacks clear regulatory oversight, transparent fee structures, and reliable customer support. This creates an environment where trader funds and personal information face big risks.

Important Notice

Cryptocdf operates across multiple countries without providing specific regulatory information or licensing details. This lack of transparency about regulatory compliance creates uncertainty about trader protections and fund security across different regions.

This evaluation uses comprehensive analysis of available user feedback, market information, and publicly accessible data about the broker's operations. Due to limited official documentation from the broker itself, this review relies heavily on third-party sources and user experiences to provide an accurate assessment of the platform's services and reliability. The broker does not provide enough official information for a complete analysis.

Rating Framework

Broker Overview

Cryptocdf presents itself as a cryptocurrency CFD trading platform. Basic information about the company's establishment date, founding background, and corporate structure remains hidden in available documentation. The broker's main business model focuses only on cryptocurrency contract for difference trading.

The company targets traders interested in speculating on digital asset price movements without owning the actual cryptocurrencies. The company's operational history and track record are missing from public records. This raises questions about its longevity and stability in the competitive online trading market.

Without clear information about the broker's founding team, headquarters location, or business registration details, potential clients face big uncertainty about the platform's legitimacy and operational capacity. Cryptocdf fails to provide essential information about its trading platform technology, regulatory licensing, or financial oversight. The broker's website and promotional materials do not specify which trading platforms are available.

They don't say whether proprietary or third-party solutions are used, or what regulatory protections exist for client funds. This cryptocdf review finds that the absence of such basic operational details creates big concerns about the broker's transparency and commitment to industry standards.

Regulatory Jurisdiction: Available information does not specify any regulatory authorities overseeing Cryptocdf's operations. The broker's regulatory status is currently classified as fraudulent or unregulated.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and withdrawal procedures is not provided in available documentation.

Minimum Deposit Requirements: The minimum initial deposit amount required to open trading accounts remains unspecified in accessible materials.

Bonus and Promotional Offers: No information about welcome bonuses, promotional campaigns, or trading incentives is documented.

Tradeable Assets: The platform focuses on cryptocurrency CFD trading. The specific range of available digital assets is not detailed.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs is not disclosed in available sources.

Leverage Options: Maximum leverage ratios and margin requirements for different asset classes are not specified.

Platform Selection: Information about available trading platforms, mobile applications, and trading software is not provided.

Geographic Restrictions: Specific countries or regions where services are restricted or prohibited are not documented.

Customer Support Languages: Available customer service languages and communication channels are not specified in accessible materials.

This cryptocdf review highlights the concerning lack of transparency regarding essential trading conditions and operational details. Legitimate brokers typically provide this information to potential clients.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Cryptocdf's account conditions reveals a complete absence of essential information that traders need to make informed decisions. Available documentation does not specify the types of trading accounts offered. It doesn't say whether multiple account tiers exist, or what features distinguish different account categories.

This lack of transparency regarding account structures represents a big red flag for potential clients seeking to understand their trading options. Minimum deposit requirements, which serve as a basic consideration for trader accessibility, remain completely undisclosed. Without this basic information, traders cannot determine whether the platform aligns with their financial capacity or trading goals.

The absence of information about account opening procedures, verification requirements, and approval timeframes creates uncertainty about the onboarding process. Special account features that many legitimate brokers offer are not mentioned in any available documentation. These include Islamic accounts for Muslim traders, demo accounts for practice, or managed accounts for less experienced traders.

The platform also fails to provide information about account maintenance fees, inactivity charges, or minimum trading activity requirements that could impact long-term account viability. User feedback regarding account conditions is notably absent from available sources. This prevents potential clients from understanding real-world experiences with account management, funding processes, or account-related customer service.

This cryptocdf review finds that the complete lack of account condition transparency severely undermines the platform's credibility. Potential clients should seek more transparent alternatives.

The assessment of trading tools and resources available through Cryptocdf reveals a concerning void in essential trading infrastructure. Available information does not document any proprietary or third-party trading tools, technical analysis software, or market research resources. These tools would typically support informed trading decisions.

This absence of analytical tools severely limits traders' ability to conduct thorough market analysis and develop effective trading strategies. Educational resources, which legitimate brokers commonly provide to support trader development, appear to be entirely absent from Cryptocdf's offerings. No documentation exists regarding trading tutorials, market analysis guides, webinars, or educational content that could help traders improve their skills and understanding of cryptocurrency markets.

This lack of educational support particularly disadvantages novice traders who require guidance to navigate complex financial markets safely. Research and market analysis capabilities are not mentioned in any available materials. These include economic calendars, market news feeds, expert analysis, or fundamental research reports.

Without access to current market information and professional analysis, traders must rely entirely on external sources for market insights. This potentially places them at a big disadvantage in fast-moving cryptocurrency markets. Automated trading support, including expert advisors, copy trading features, or algorithmic trading capabilities, is not documented.

Modern traders increasingly rely on automation to execute strategies efficiently. The absence of such features suggests the platform may lack sophisticated trading infrastructure that competitive brokers typically provide.

Customer Service and Support Analysis

The evaluation of Cryptocdf's customer service capabilities reveals a complete absence of documented support infrastructure. This raises serious concerns about the platform's commitment to client assistance. Available information does not specify customer service channels.

It doesn't say whether support is available through phone, email, live chat, or other communication methods. This lack of clear support channels creates uncertainty about how traders can seek assistance when facing account issues or trading problems. Response time commitments, service level agreements, and support availability hours are not documented in any accessible materials.

Without understanding when support is available or how quickly issues are typically resolved, traders cannot assess whether the platform can provide adequate assistance during critical trading situations. They also can't determine if help is available during technical emergencies that require immediate attention. Service quality indicators are notably absent from available documentation.

These include customer satisfaction ratings, support team qualifications, or problem resolution success rates. The lack of quality metrics prevents potential clients from evaluating whether the support team possesses the expertise and resources necessary to address complex trading or technical issues effectively. Multilingual support capabilities, which are essential for international trading platforms, are not specified in available materials.

Without clear information about supported languages or regional support teams, non-English speaking traders face uncertainty about their ability to receive assistance in their preferred language. This potentially creates barriers to effective problem resolution.

Trading Experience Analysis

The analysis of Cryptocdf's trading experience reveals big gaps in essential platform information that directly impact trader success and satisfaction. Available documentation does not provide details about platform stability, server uptime, or technical reliability measures. These ensure consistent trading access during volatile market conditions.

Without this basic infrastructure information, traders cannot assess whether the platform can support their trading activities reliably. Order execution quality remains completely undocumented. This includes execution speed, slippage rates, and fill quality statistics.

These factors critically impact trading profitability, particularly in fast-moving cryptocurrency markets where price gaps and execution delays can significantly affect trade outcomes. The absence of execution quality data prevents traders from understanding how their orders will be processed. It also prevents them from knowing whether the platform can deliver competitive execution standards.

Platform functionality completeness is not described in accessible materials. This includes available order types, charting capabilities, technical indicators, and trading interface features. Modern traders require sophisticated platform features to implement complex trading strategies effectively.

The lack of functionality documentation suggests the platform may not meet contemporary trading requirements. Mobile trading capabilities, which are essential for traders who need market access while away from desktop computers, are not documented. Without information about mobile applications, responsive web platforms, or mobile-specific features, traders cannot determine whether the platform supports their mobility requirements.

This cryptocdf review finds that the complete absence of trading experience documentation creates big uncertainty about the platform's ability to deliver satisfactory trading conditions for serious market participants.

Trust and Security Analysis

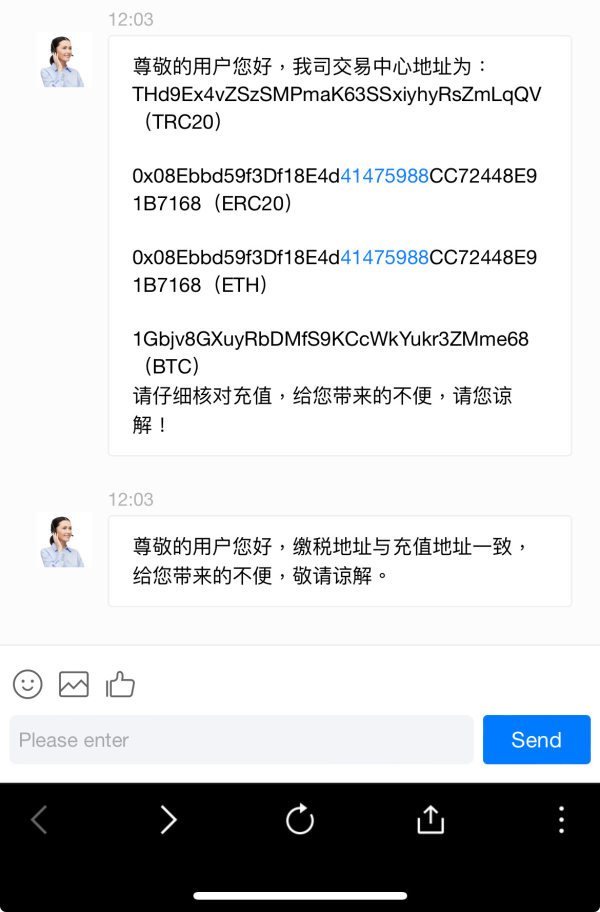

The trust and security evaluation of Cryptocdf reveals critical deficiencies that pose big risks to potential clients. The broker's regulatory status is documented as fraudulent. No legitimate regulatory oversight exists from recognized financial authorities.

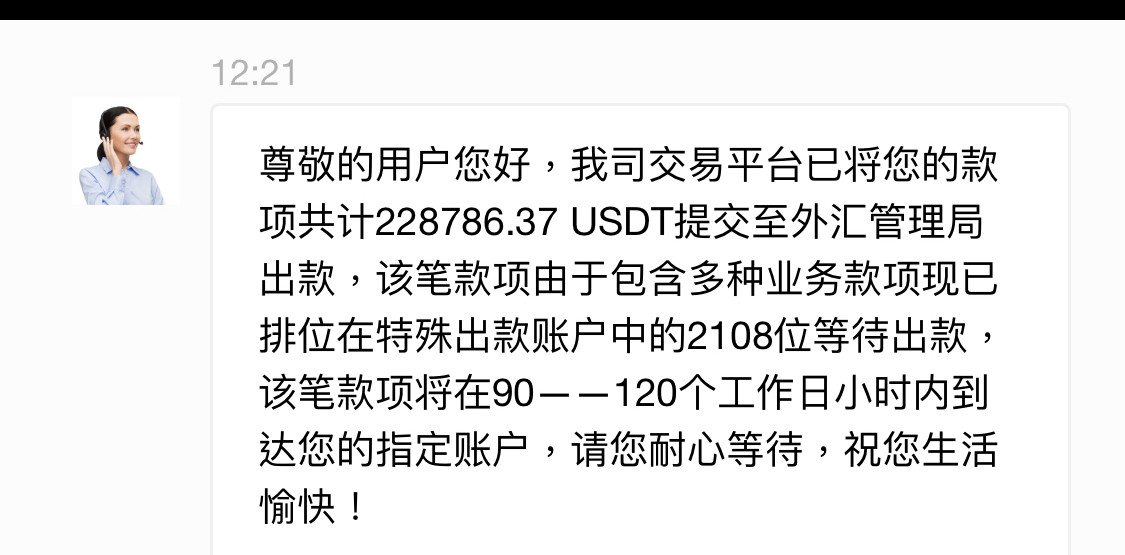

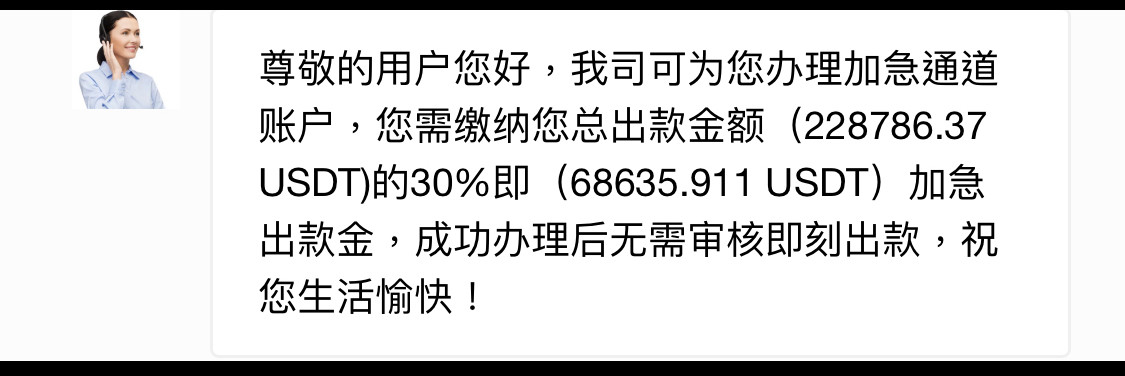

This absence of regulatory compliance means traders lack essential protections typically provided by licensed financial institutions. These protections include segregated fund storage, compensation schemes, and regulatory dispute resolution mechanisms. Fund security measures are not documented in available materials.

These include client money segregation, bank account protections, and insurance coverage. Without clear information about how client funds are protected and stored, traders face big risks regarding the safety of their deposits and trading capital. The lack of transparency about financial safeguards represents a major red flag for any trading platform.

Company transparency regarding ownership structure, business registration, physical address, and corporate governance is notably absent. Legitimate brokers typically provide comprehensive company information to demonstrate accountability and regulatory compliance. The absence of such transparency suggests potential clients cannot verify the platform's legitimacy or hold the company accountable for its actions.

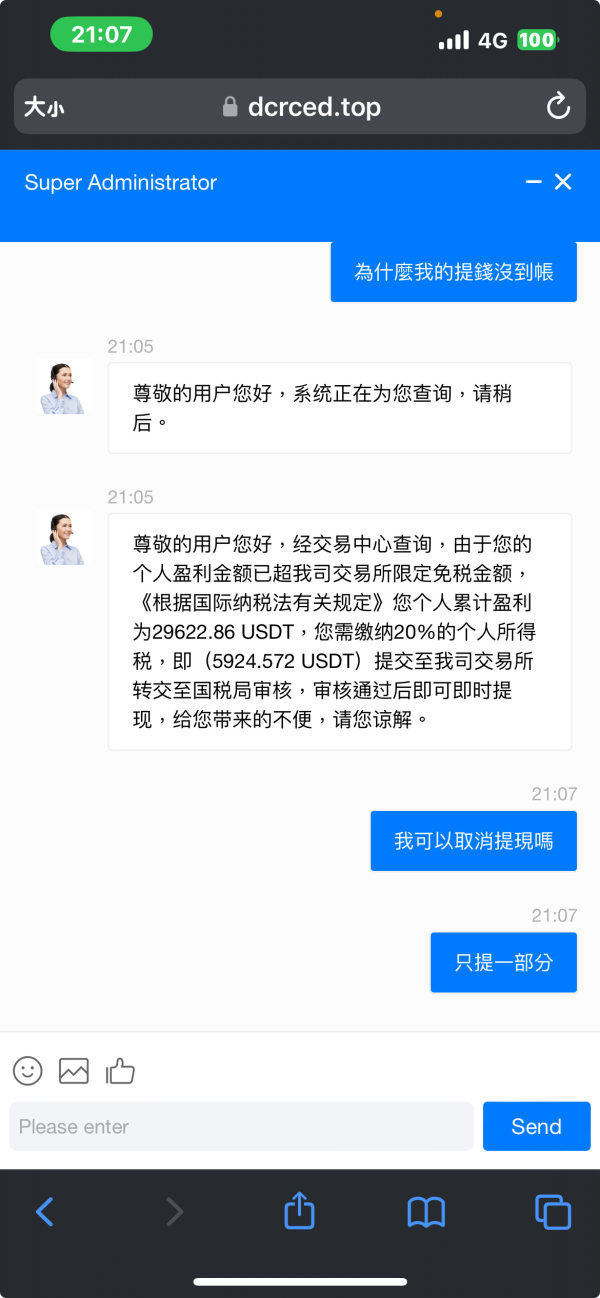

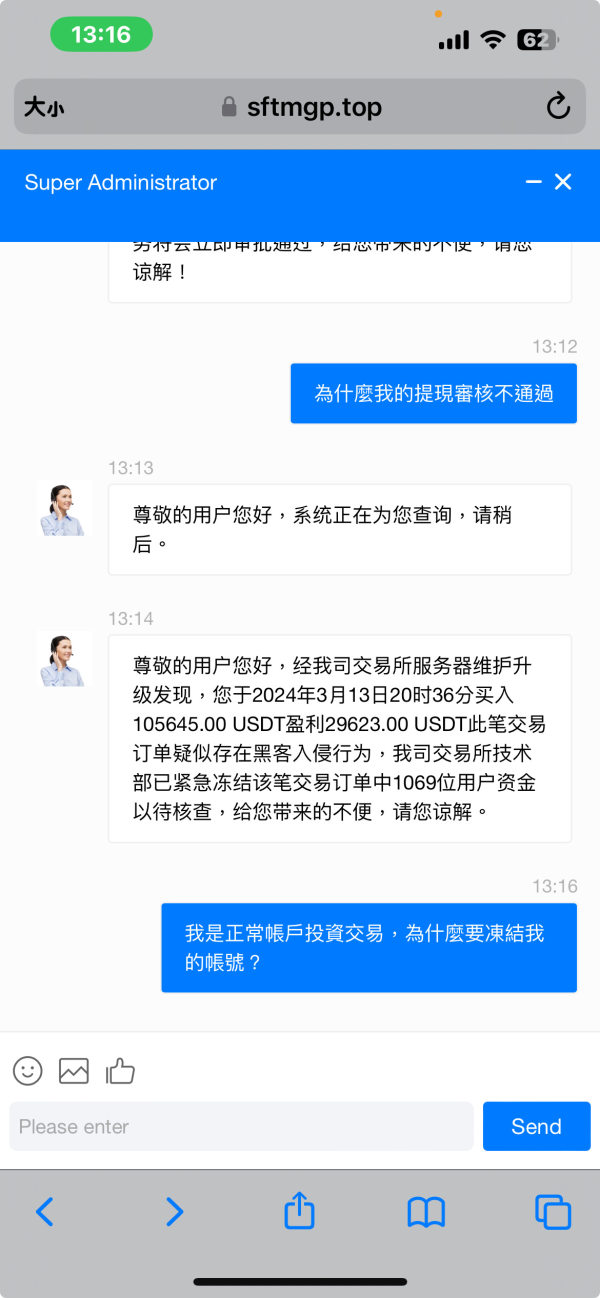

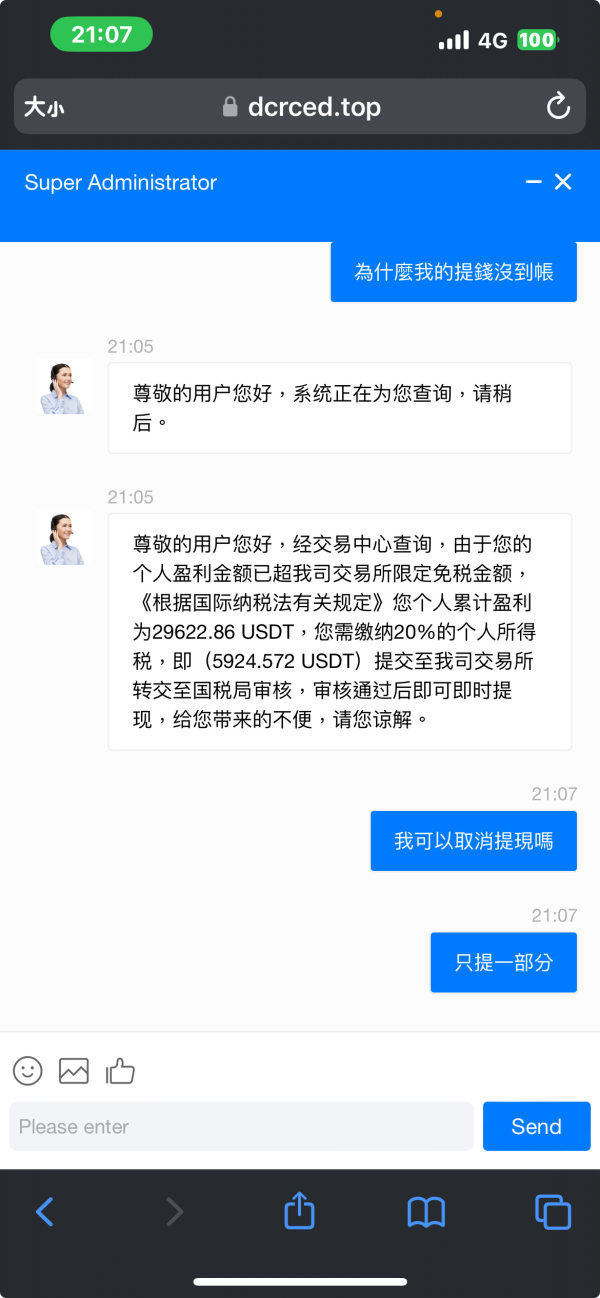

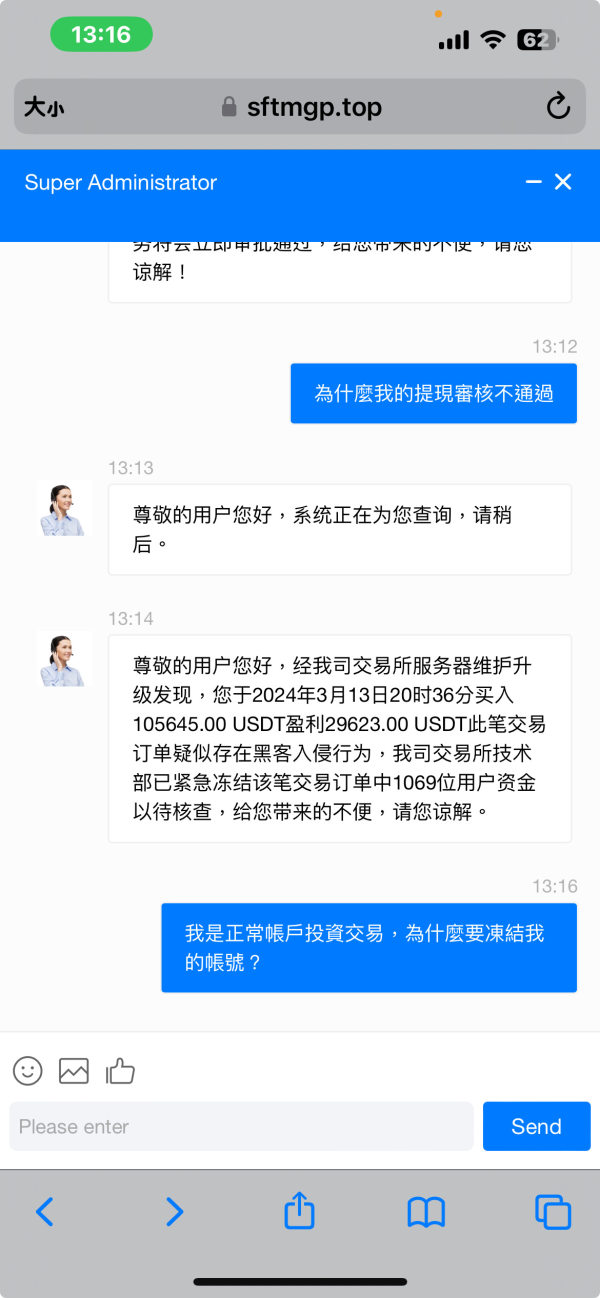

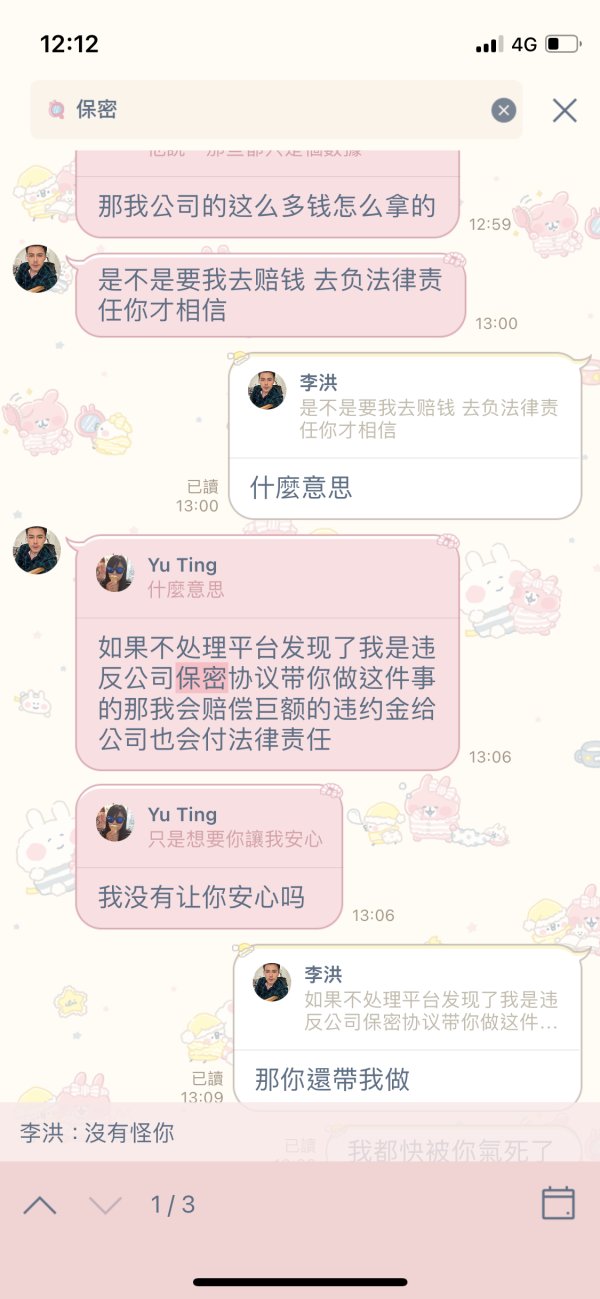

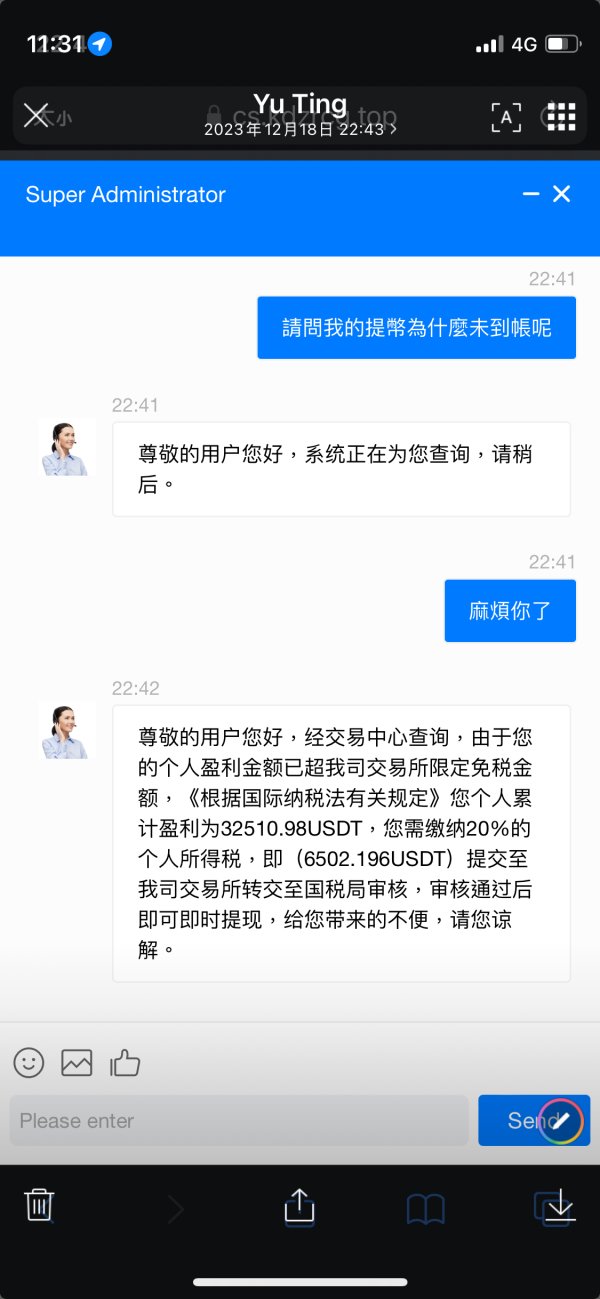

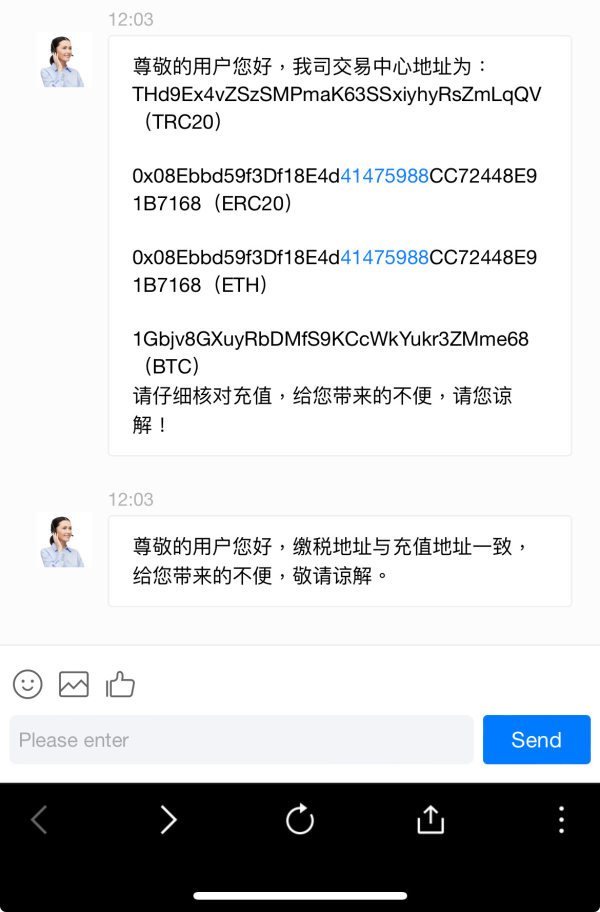

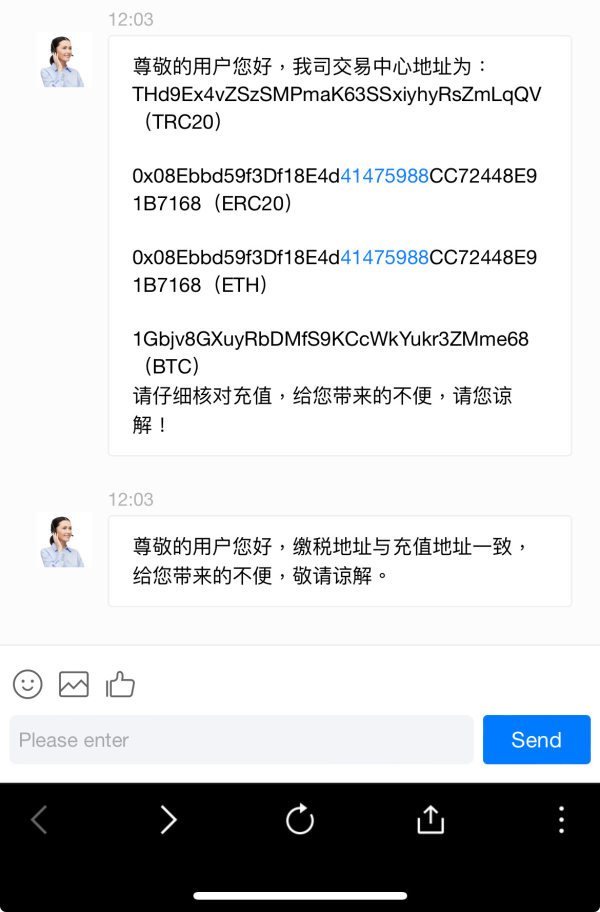

Industry reputation and third-party evaluations consistently highlight concerns about the platform's legitimacy and business practices. Reports of fraudulent activities and user complaints about security issues create a pattern of negative feedback. This reinforces concerns about the platform's trustworthiness.

The documented scam status and user security complaints provide clear evidence that potential clients should exercise extreme caution when considering this platform.

User Experience Analysis

The comprehensive analysis of user experience with Cryptocdf reveals consistently poor satisfaction levels and big user concerns. Available user ratings show only 25% satisfaction. This indicates that the vast majority of users who have interacted with the platform report negative experiences.

This extremely low satisfaction rate suggests fundamental problems with the platform's service delivery and user support capabilities. Interface design and usability information is not provided in available documentation. This prevents assessment of the platform's ease of use and navigation efficiency.

User-friendly design is crucial for effective trading. The absence of interface information, combined with poor user ratings, suggests the platform may lack intuitive design elements that facilitate smooth trading experiences. Registration and verification processes are not documented.

This creates uncertainty about account opening procedures and identity verification requirements. Streamlined onboarding processes are essential for positive initial user experiences. The lack of clear process information may contribute to user frustration and abandonment during account setup.

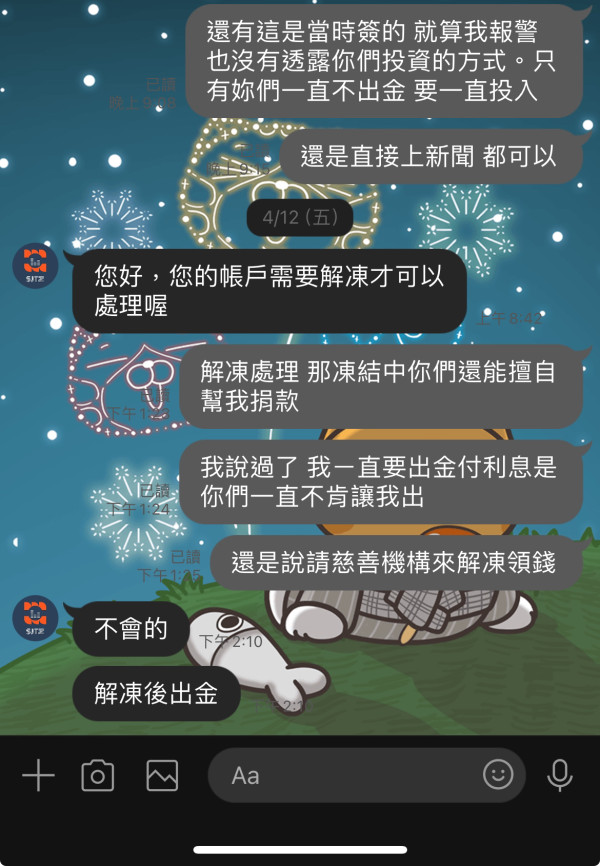

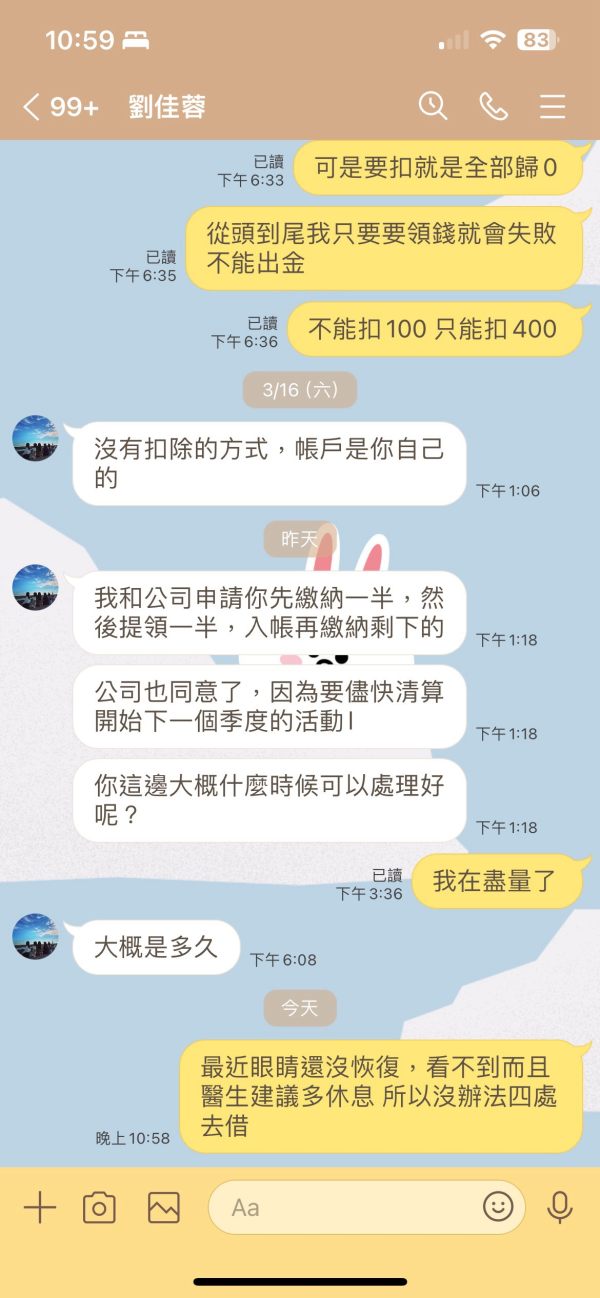

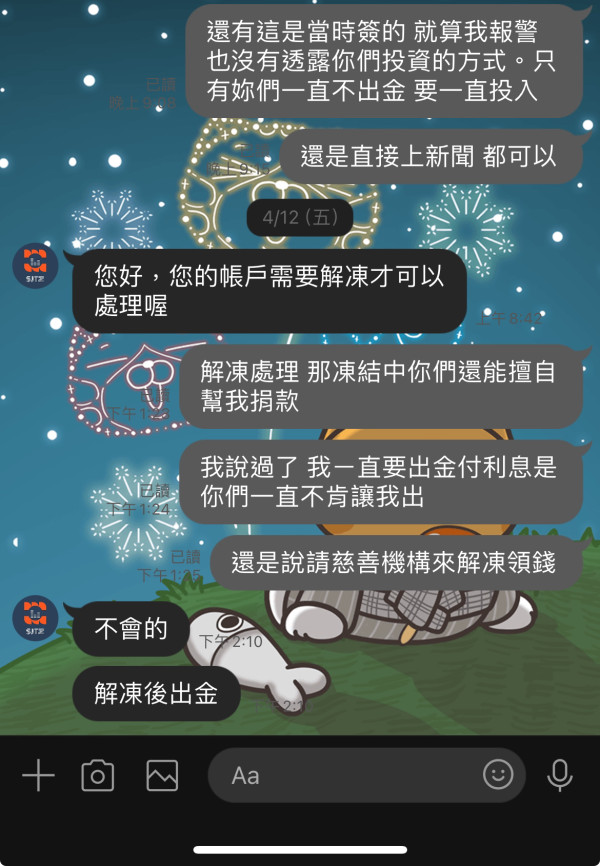

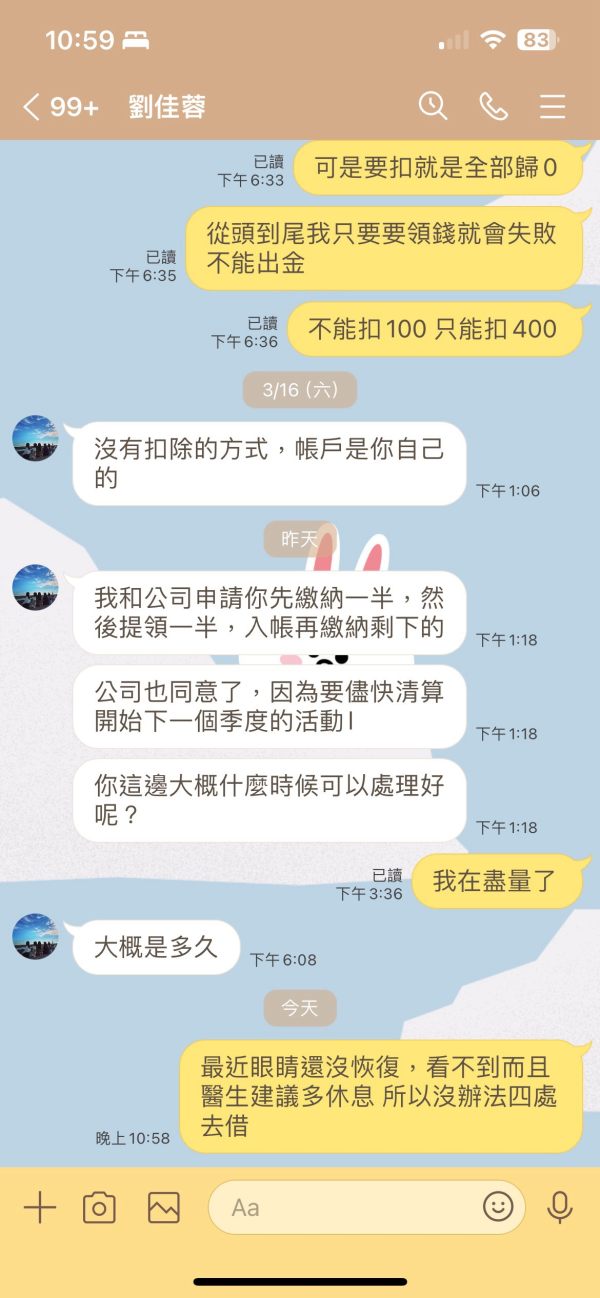

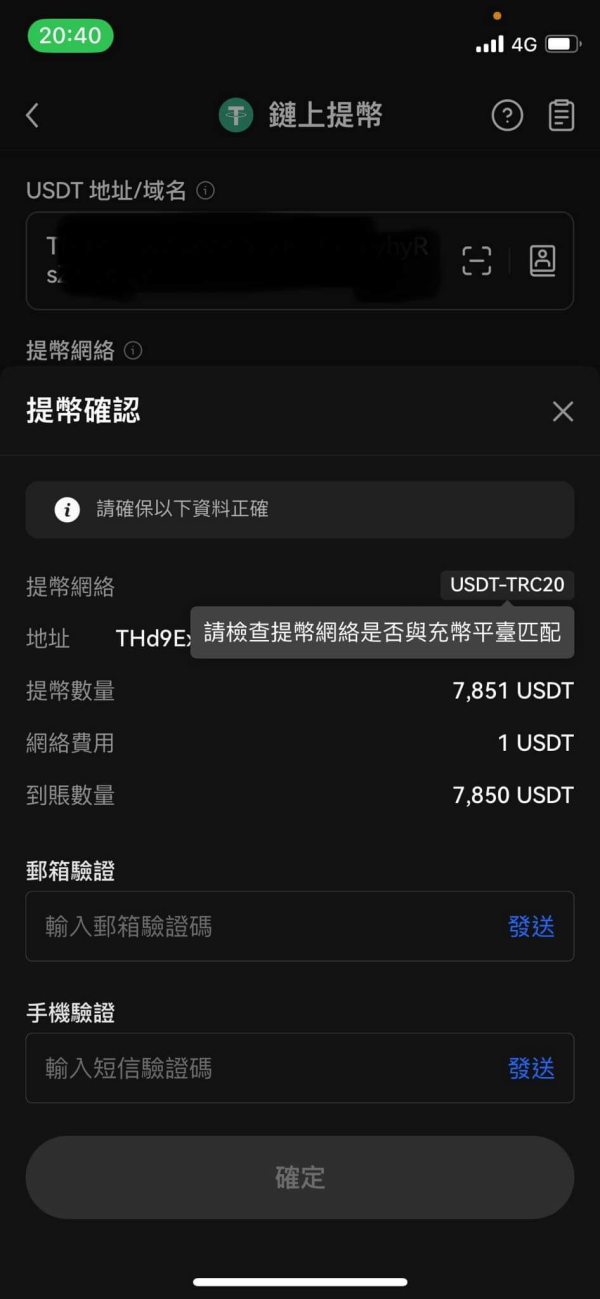

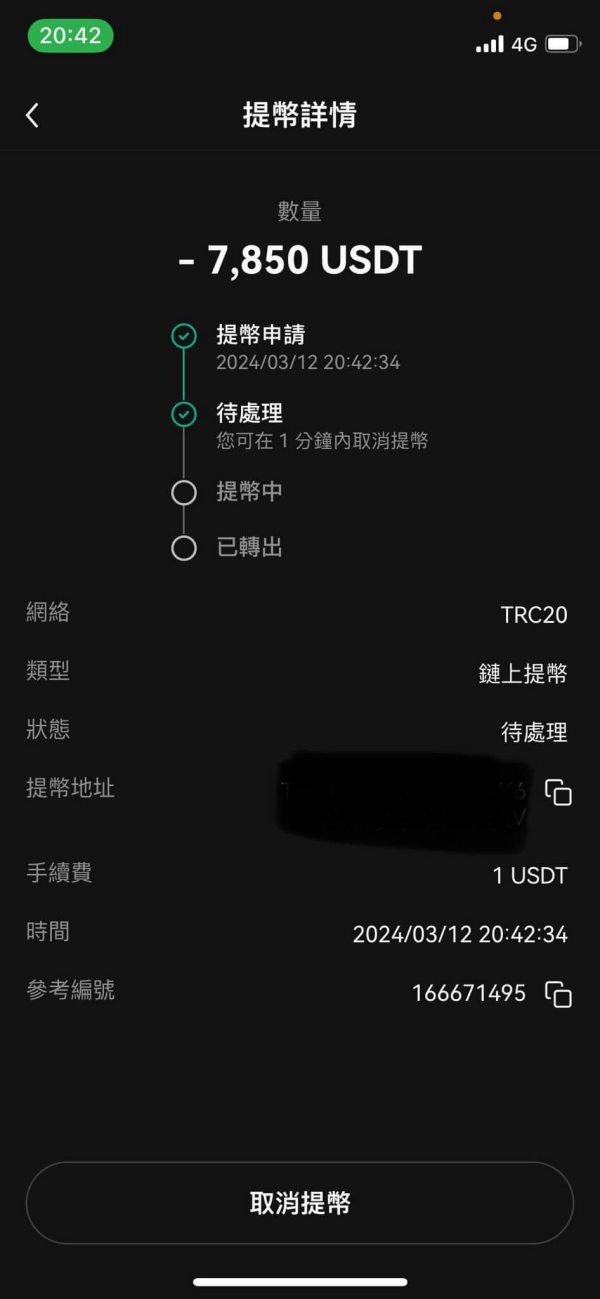

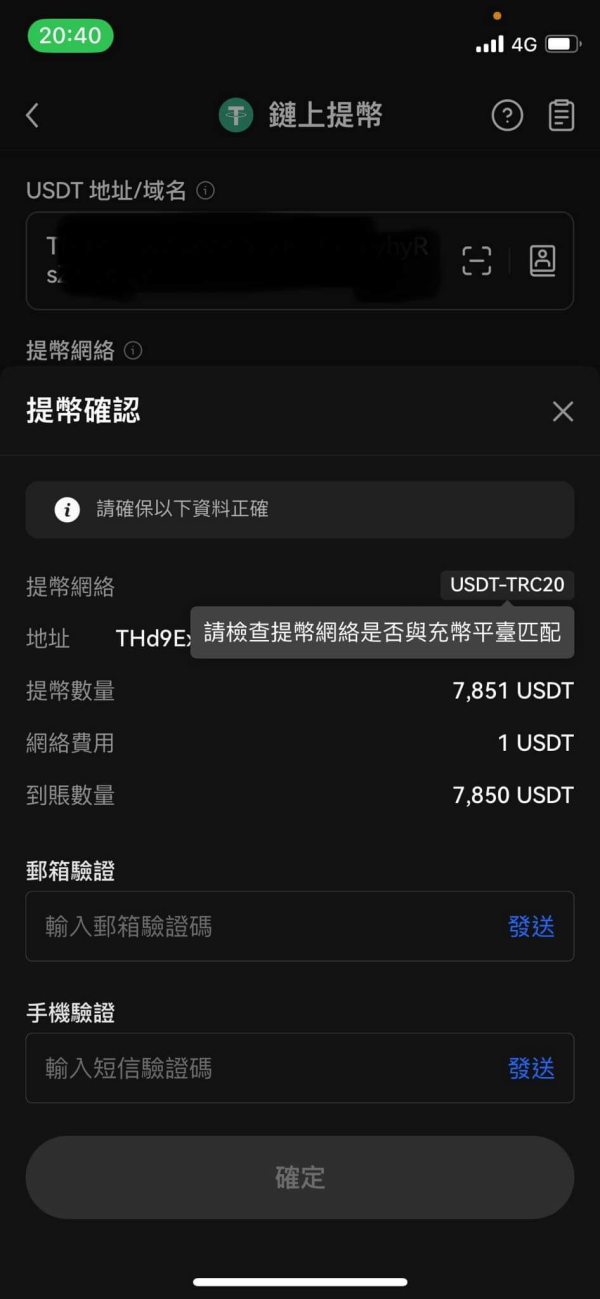

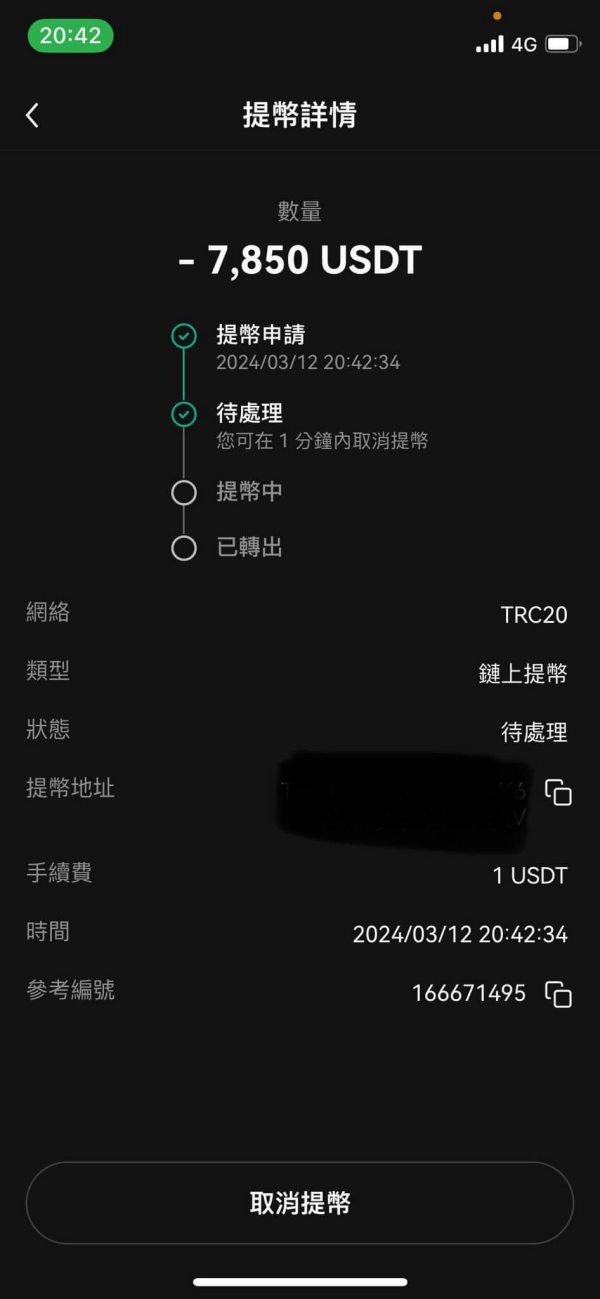

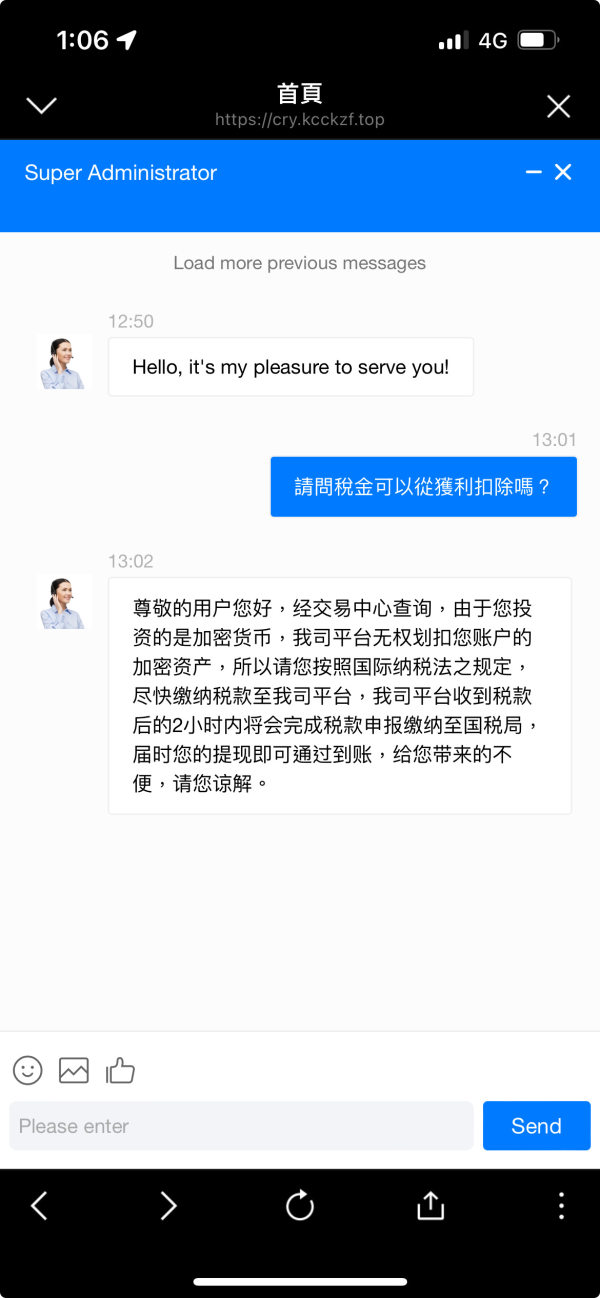

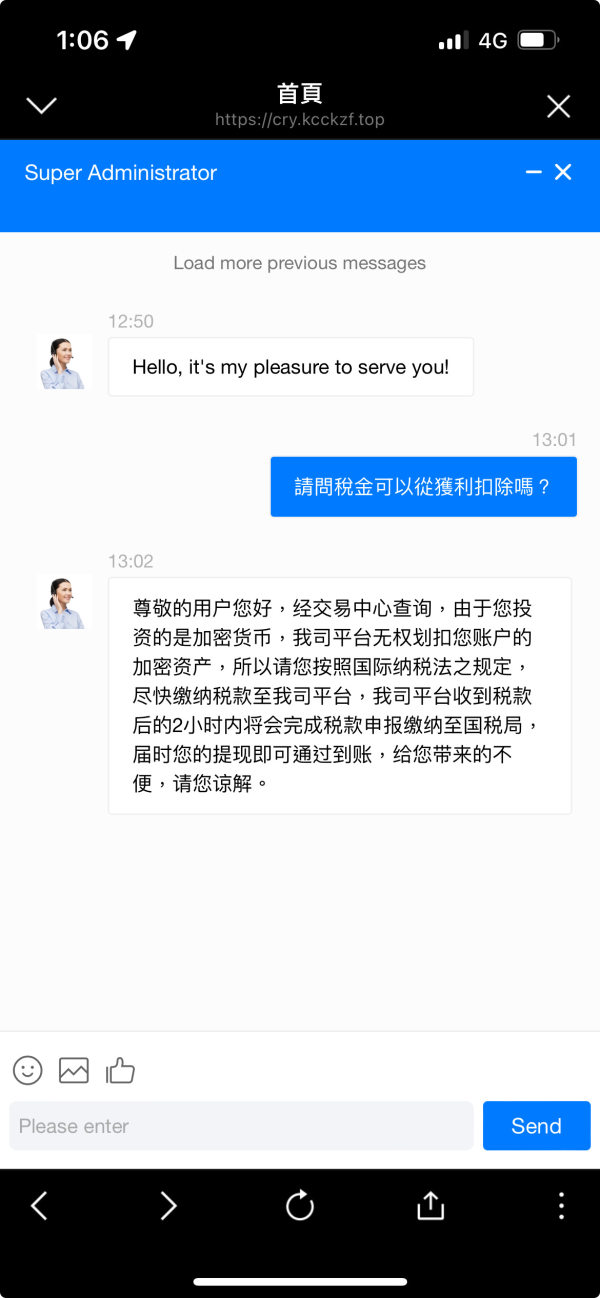

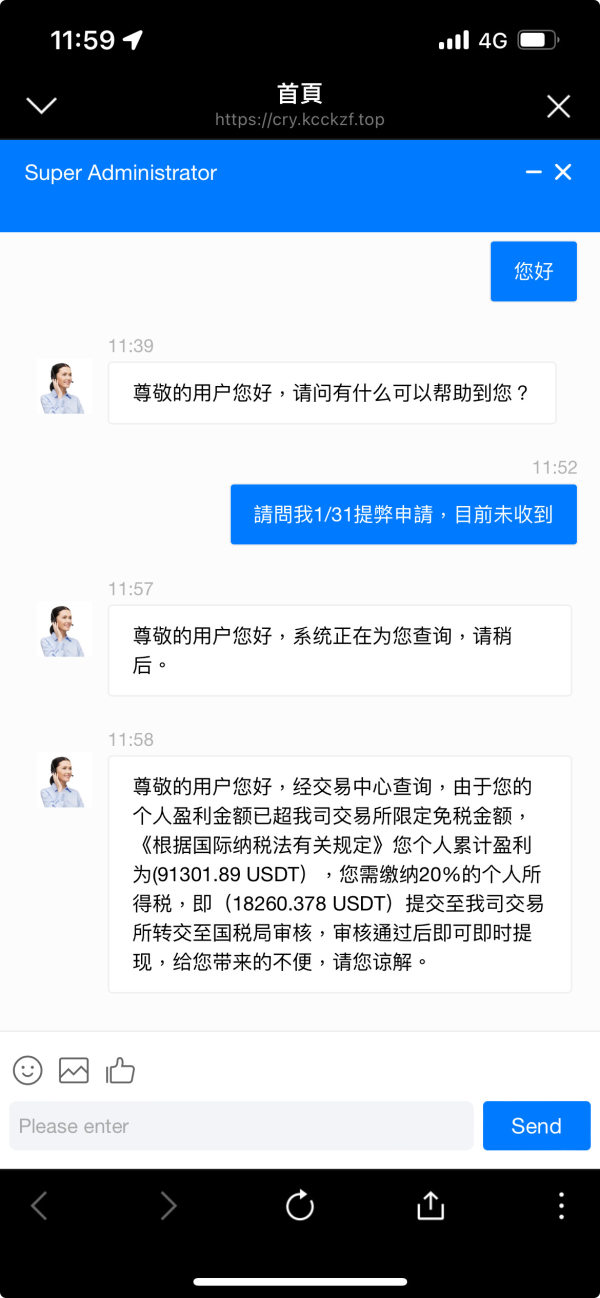

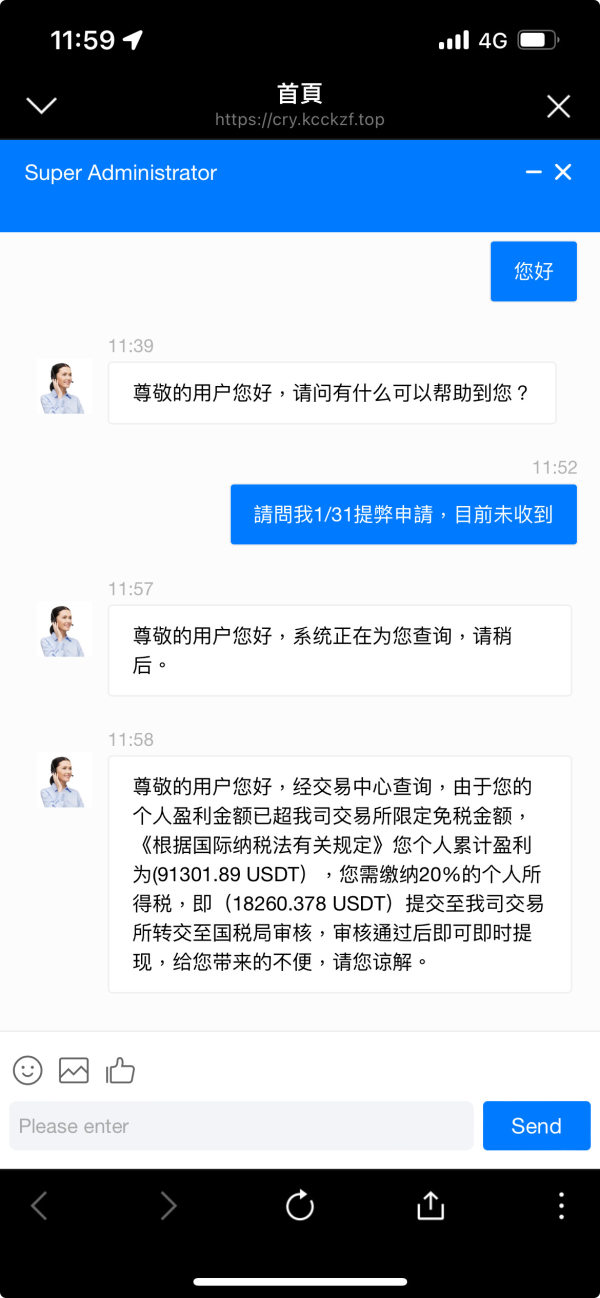

Funding and withdrawal experiences, which significantly impact overall user satisfaction, are not detailed in available sources. However, the presence of fraud complaints and security concerns suggests users may have encountered difficulties with financial transactions. These potentially include delayed withdrawals or unauthorized account access that would severely impact user confidence.

Common user complaints center around fraud allegations and security concerns. This indicates systematic problems with the platform's operations and client treatment. The pattern of negative feedback suggests users have experienced issues that go beyond minor service inconveniences.

These issues include potential financial losses and security breaches that fundamentally undermine platform trustworthiness.

Conclusion

This comprehensive cryptocdf review concludes that the platform presents unacceptable risks for traders of all experience levels. The broker's documented fraudulent status creates a dangerous environment for anyone considering cryptocurrency CFD trading through this platform. The extremely poor user satisfaction ratings and complete lack of regulatory oversight add to these concerns.

The evaluation reveals systematic deficiencies across all critical areas. These include account transparency, trading tools, customer support, platform reliability, security measures, and user experience. No user demographic can be safely recommended to use this platform given the documented risks and absence of essential trader protections.

The primary recommendation for anyone considering cryptocurrency CFD trading is to seek well-regulated, transparent alternatives with established track records of client protection and service quality. The risks associated with Cryptocdf far outweigh any potential benefits. This makes it unsuitable for serious trading activities.