Is Cryptocdf safe?

Business

License

Is Cryptocdf Safe or Scam?

Introduction

Cryptocdf is an online brokerage that positions itself within the forex and cryptocurrency trading markets. With the rise of digital currencies and the increasing interest in forex trading, platforms like Cryptocdf have emerged, promising lucrative opportunities for traders. However, the influx of such platforms has also raised concerns about their legitimacy. Traders must exercise caution and conduct thorough evaluations before engaging with any broker to avoid potential scams. This article aims to investigate whether Cryptocdf is safe or a scam by analyzing its regulatory status, company background, trading conditions, customer experience, and overall risks. The investigation is based on a review of various credible sources, including user feedback, regulatory databases, and expert analyses.

Regulation and Legitimacy

Regulation is a critical factor in determining a broker's credibility. A legitimate broker should operate under the oversight of recognized financial authorities, which helps ensure compliance with industry standards and protects traders' interests. Unfortunately, Cryptocdf appears to lack any regulatory oversight. According to multiple sources, it is not registered with key regulatory bodies such as the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA) in the United States. The absence of regulation raises significant concerns about the safety of funds and the broker's operational transparency.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The lack of a regulatory framework means that traders have limited recourse in the event of disputes or financial losses. Furthermore, unregulated brokers often operate in jurisdictions with lax oversight, making it easier for them to engage in potentially fraudulent activities. As such, the absence of regulation is a significant red flag when assessing whether Cryptocdf is safe.

Company Background Investigation

Understanding the company behind a trading platform is essential for evaluating its trustworthiness. Cryptocdf presents itself as a broker based in California, USA. However, the information available about its ownership and management team is scant. Reliable brokers usually provide detailed information about their founders and key personnel, including their qualifications and industry experience.

The lack of transparency regarding Cryptocdf's ownership structure raises questions about its legitimacy. A broker that hides its ownership details may be attempting to evade accountability, making it difficult for traders to know who is managing their funds. Furthermore, the absence of a clear corporate history and established reputation in the industry is concerning. Without this information, it is challenging to ascertain whether Cryptocdf has a history of compliance or any previous regulatory issues.

Trading Conditions Analysis

Assessing a broker's trading conditions is vital for understanding the costs associated with trading. Cryptocdf claims to offer various trading instruments, including forex, stocks, and cryptocurrencies. However, the details regarding its fee structure are not clearly outlined, which can lead to hidden costs for traders.

| Fee Type | Cryptocdf | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2% |

The absence of specific information about spreads and commissions makes it challenging to evaluate whether Cryptocdf's trading conditions are competitive. Furthermore, reports indicate that the broker accepts only cryptocurrency payments, which may pose additional risks for traders, as cryptocurrency transactions are often irreversible.

Customer Funds Safety

The safety of customer funds is paramount when evaluating any brokerage. Cryptocdf's lack of regulatory oversight raises concerns about its fund safety measures. A reputable broker typically segregates client funds from its operational funds to protect them in case of insolvency. However, sources indicate that Cryptocdf does not provide clear information on how it handles client funds, which could expose traders to significant risks.

Additionally, there are no indications that Cryptocdf offers negative balance protection, a critical feature that prevents traders from losing more than their initial investment. The absence of these safety measures suggests that trading with Cryptocdf may not be safe, as traders could potentially face substantial financial losses without any protection.

Customer Experience and Complaints

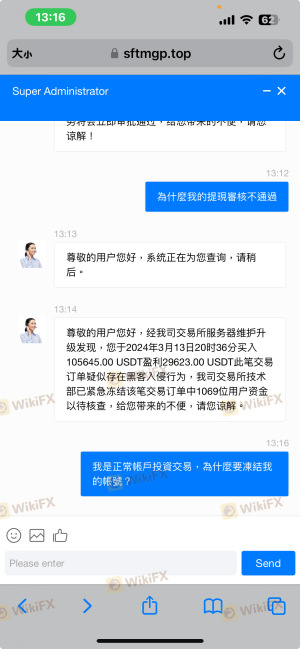

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Cryptocdf reveal a mix of experiences, with many users expressing dissatisfaction with the platform. Common complaints include difficulties with withdrawals, lack of customer support, and issues with account verification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Issues | Medium | Poor |

| Account Verification | High | Poor |

For instance, several users have reported being unable to withdraw their funds, with some alleging that the broker imposes excessive withdrawal fees or delays. These complaints indicate a pattern of poor customer service and operational inefficiencies, which further question whether Cryptocdf is safe for trading.

Platform and Execution

The trading platform's performance is another essential aspect to consider. Cryptocdf offers a web-based trading platform that lacks the industry-standard MetaTrader 4 or 5. Users have reported issues with platform stability, order execution speed, and slippage. Additionally, the absence of advanced trading tools and features may hinder traders' ability to execute their strategies effectively.

The lack of transparency regarding order execution quality and any potential signs of platform manipulation raises further concerns about Cryptocdf's reliability. A broker that does not provide robust trading infrastructure may not be safe for traders looking to make informed and timely decisions.

Risk Assessment

When evaluating the overall risk of trading with Cryptocdf, several factors come into play. The absence of regulation, poor customer feedback, and questionable trading conditions contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund safety measures |

| Customer Service Risk | Medium | Poor response to customer complaints |

Given these risks, traders should exercise extreme caution when considering Cryptocdf as a trading platform. It is advisable to seek alternatives with better regulatory oversight and customer reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that Cryptocdf is not a safe trading platform. The lack of regulatory oversight, poor customer experiences, and questionable trading conditions indicate that traders should be wary of engaging with this broker. For those looking to trade forex or cryptocurrencies, it is recommended to consider more reputable alternatives that offer robust regulatory protections, transparent fees, and reliable customer support.

Ultimately, conducting thorough research and choosing a well-regulated broker is crucial for ensuring a safe and successful trading experience.

Is Cryptocdf a scam, or is it legit?

The latest exposure and evaluation content of Cryptocdf brokers.

Cryptocdf Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cryptocdf latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.