Cloud FX Trade Review 1

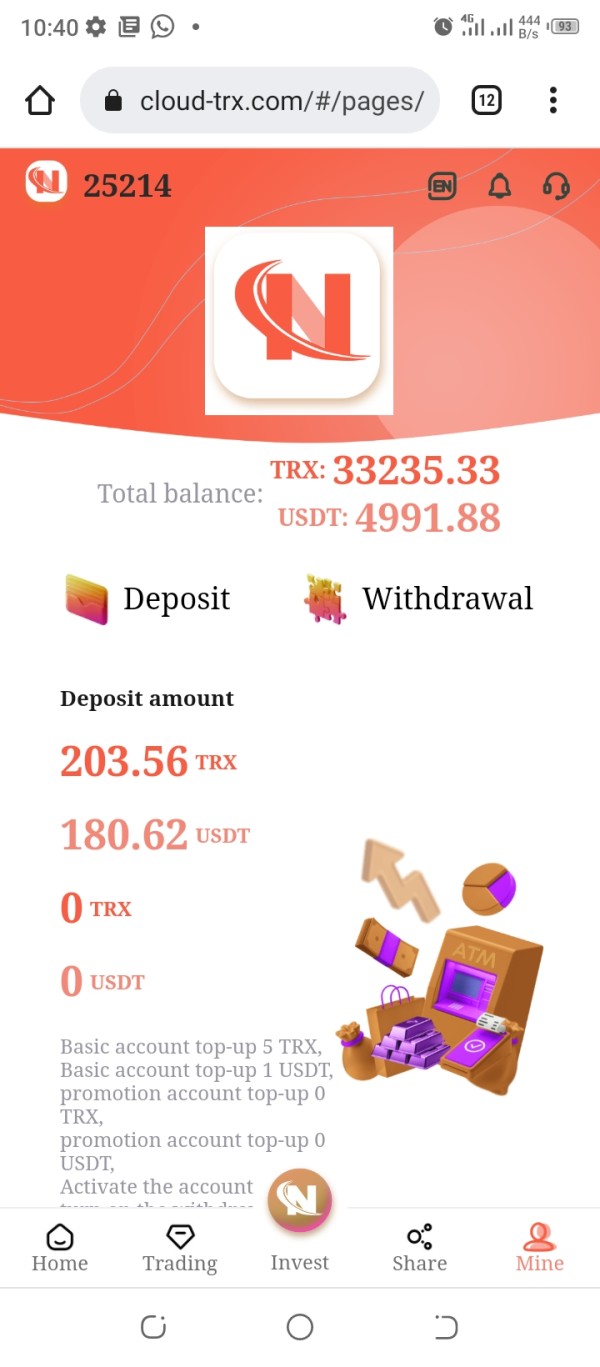

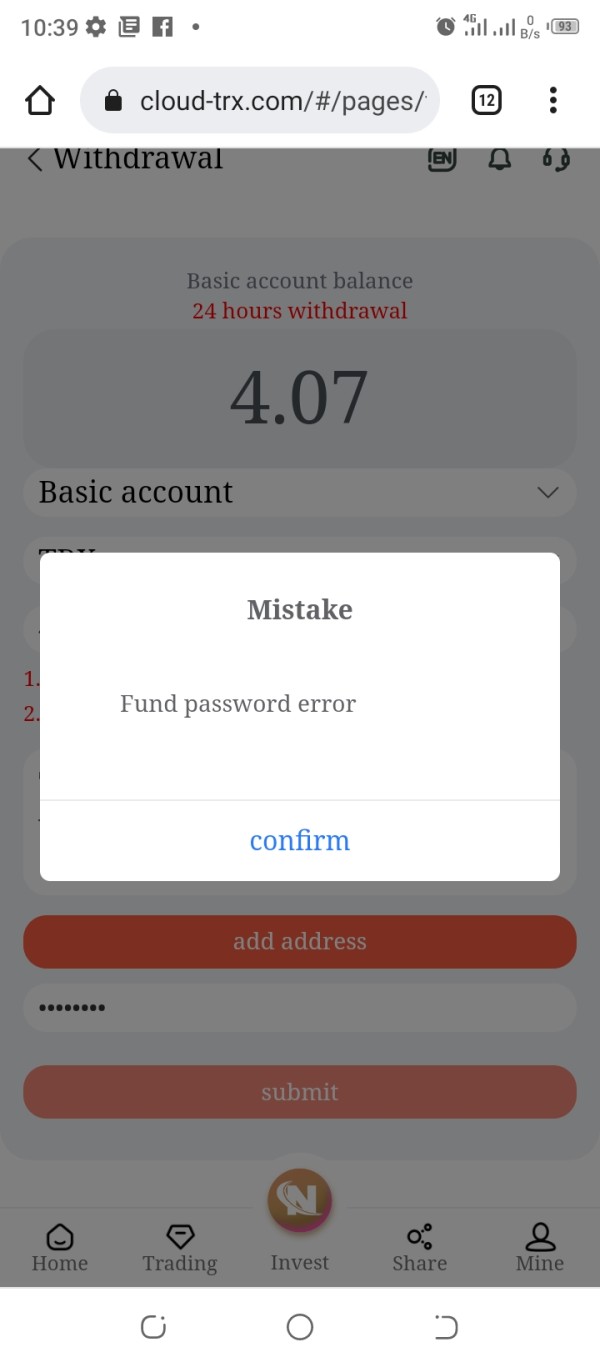

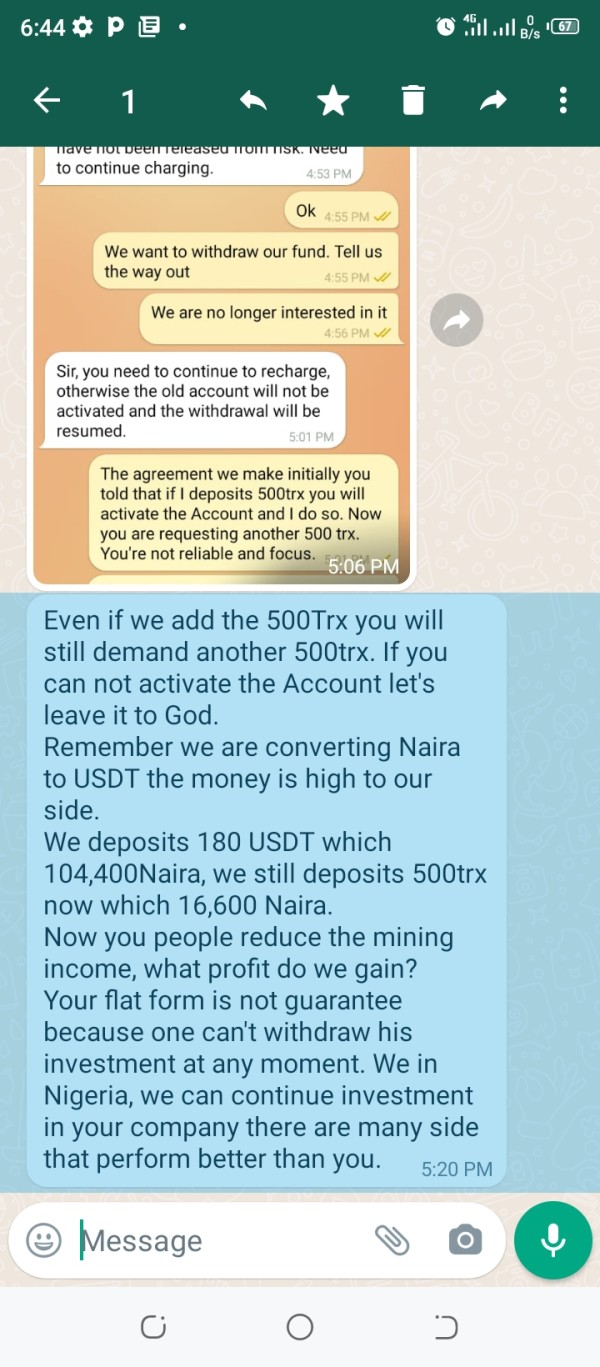

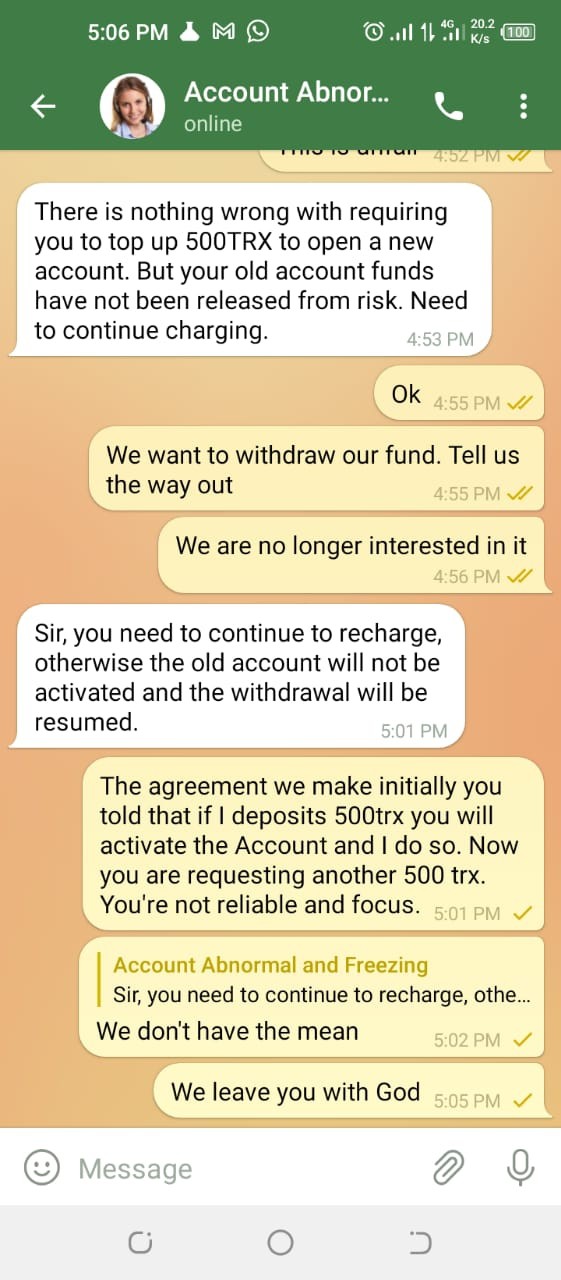

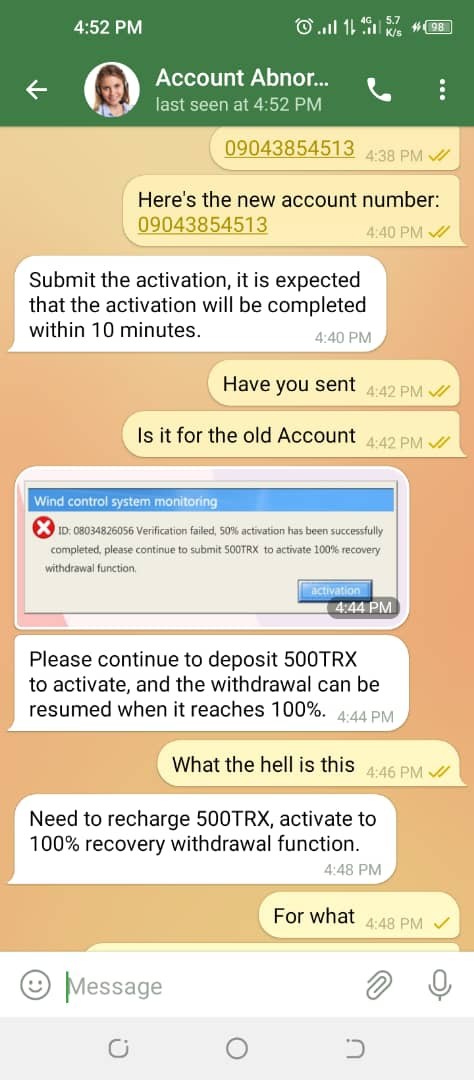

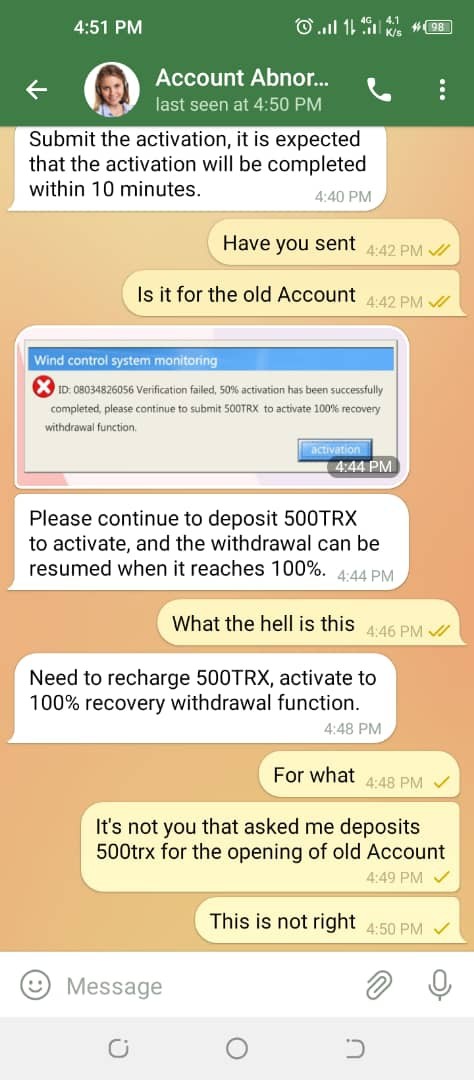

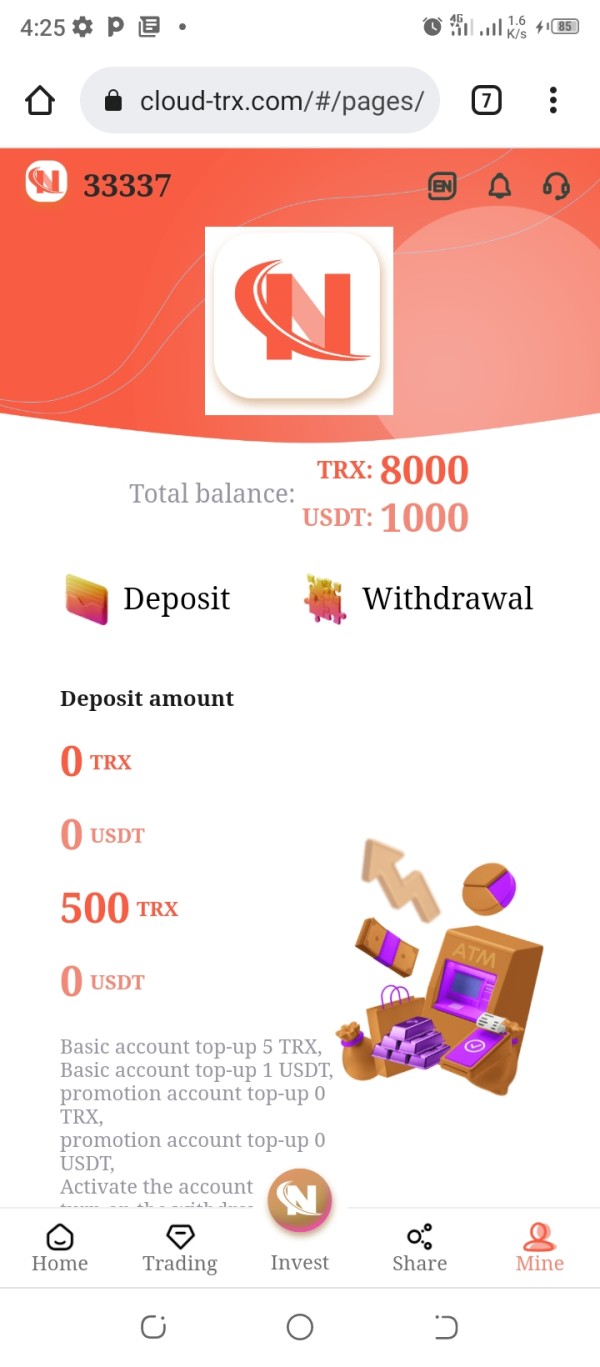

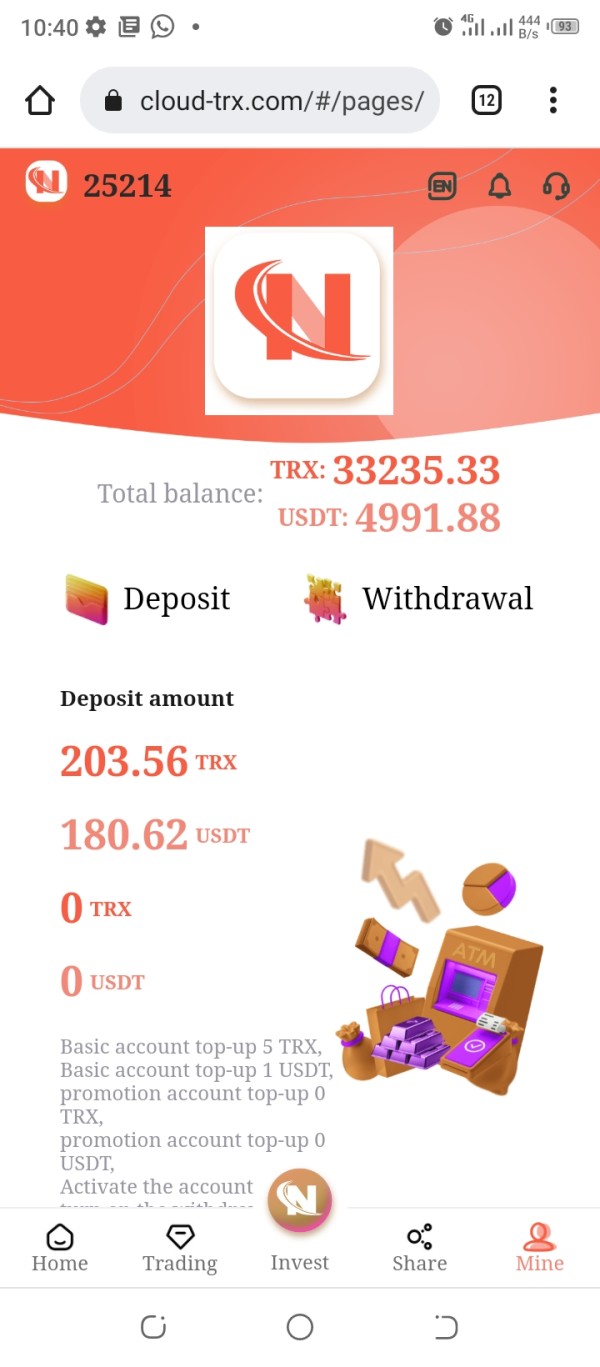

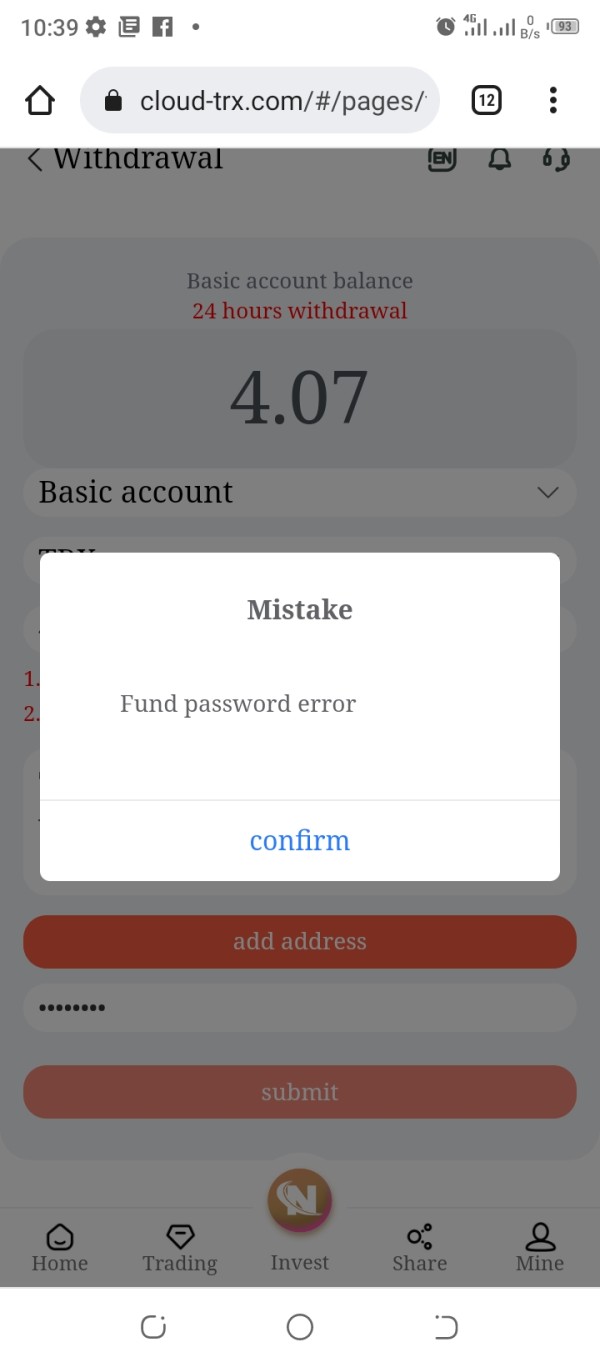

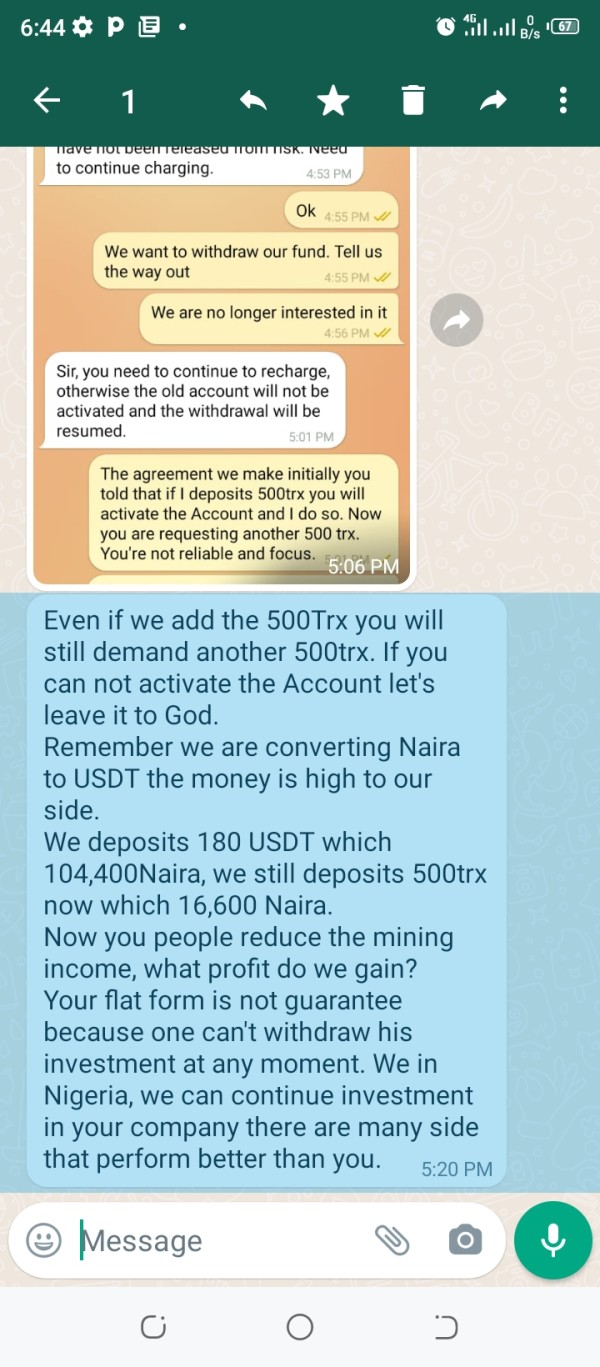

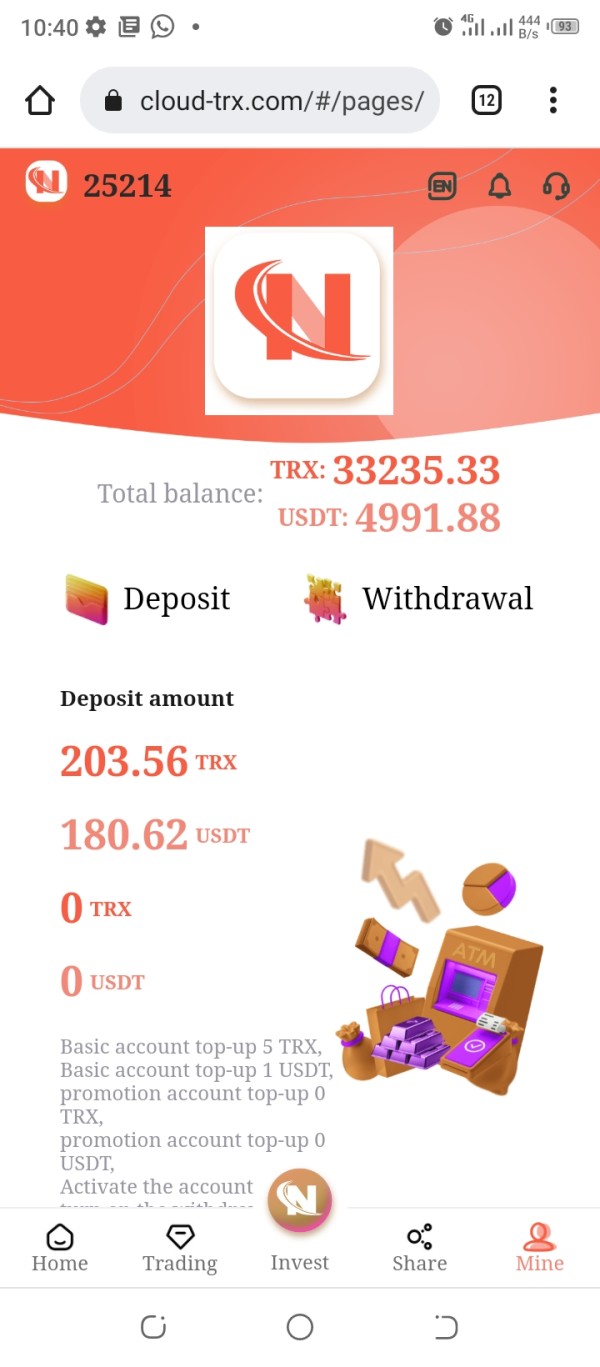

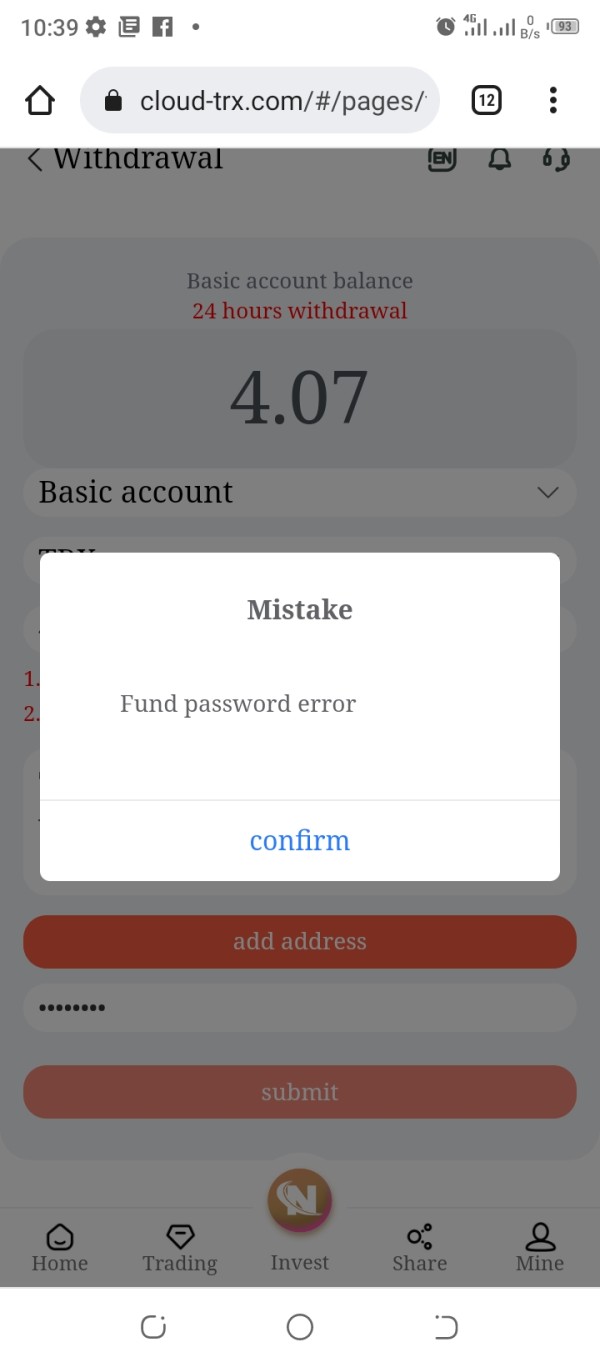

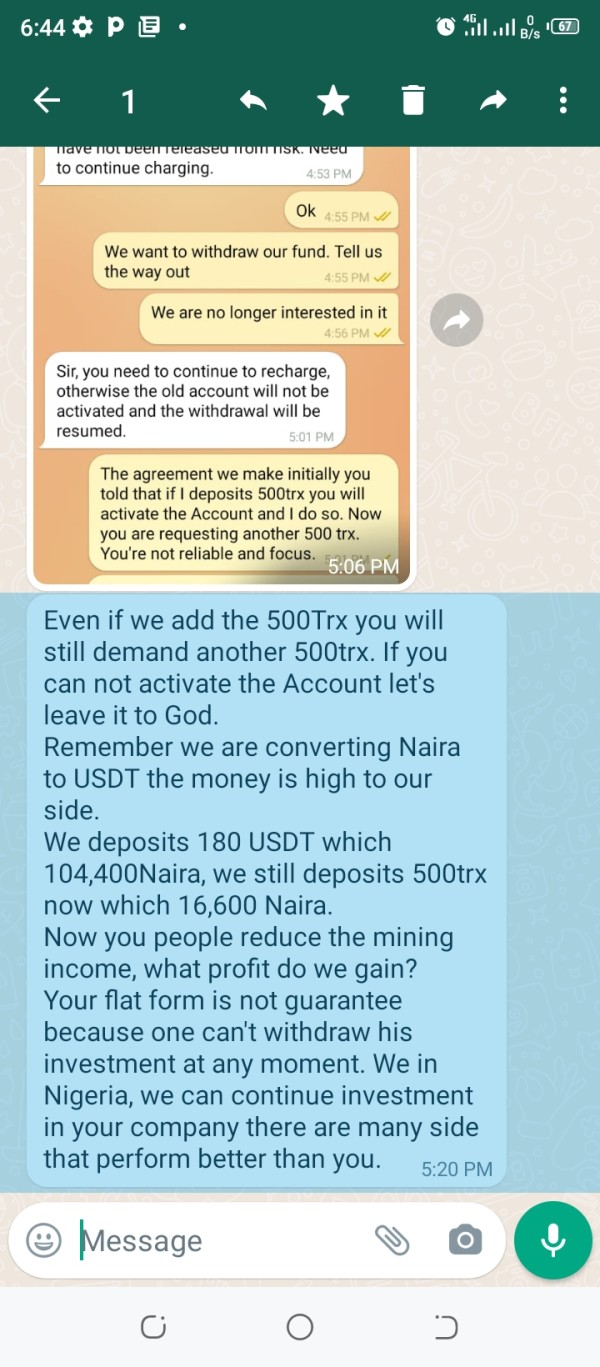

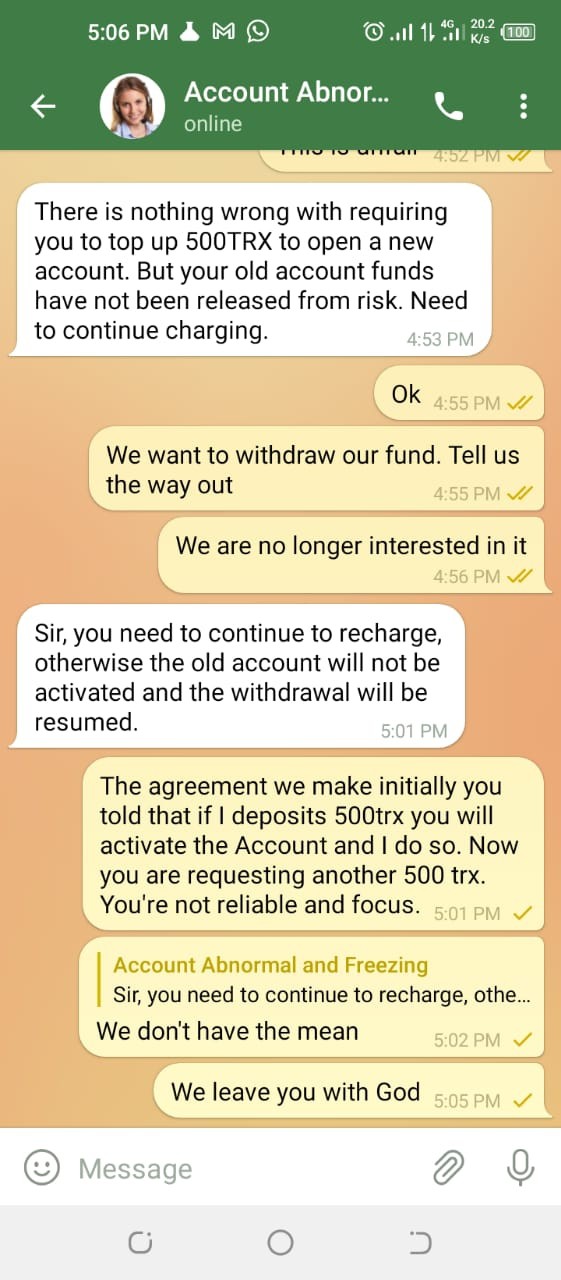

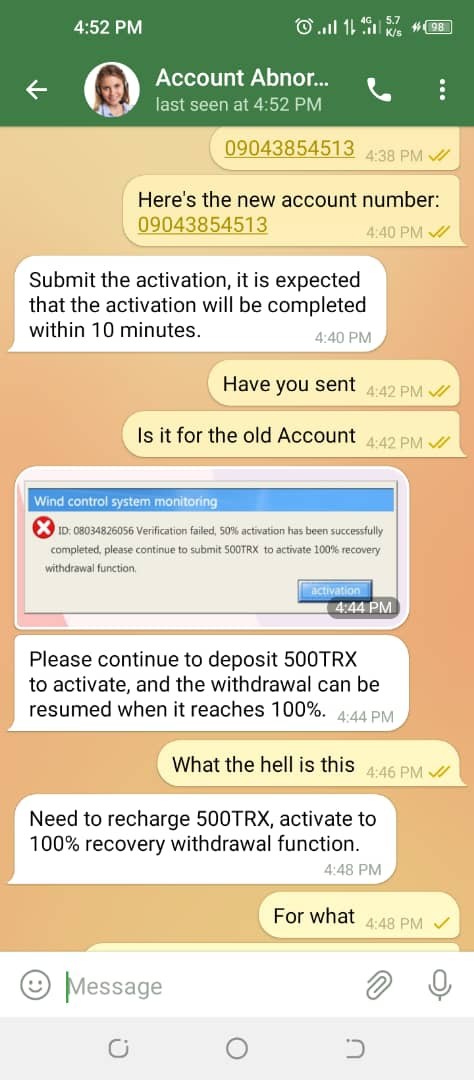

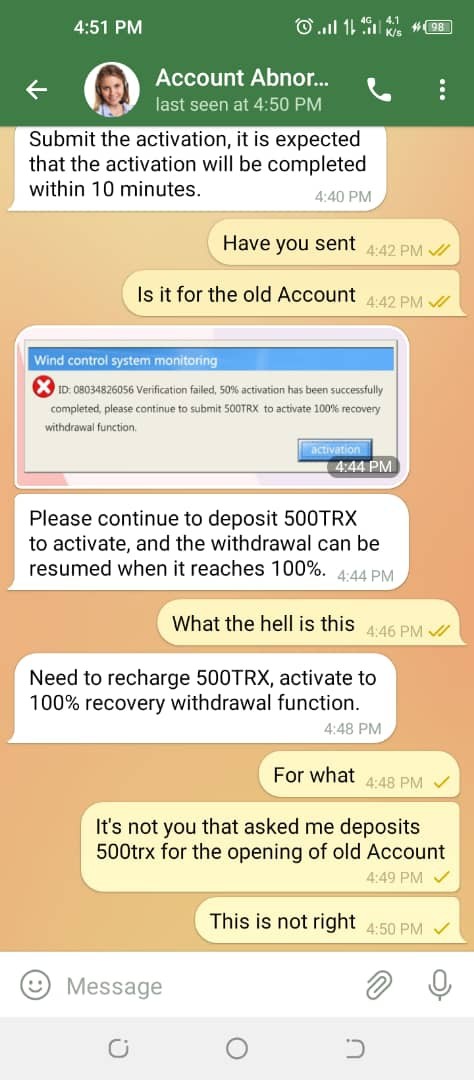

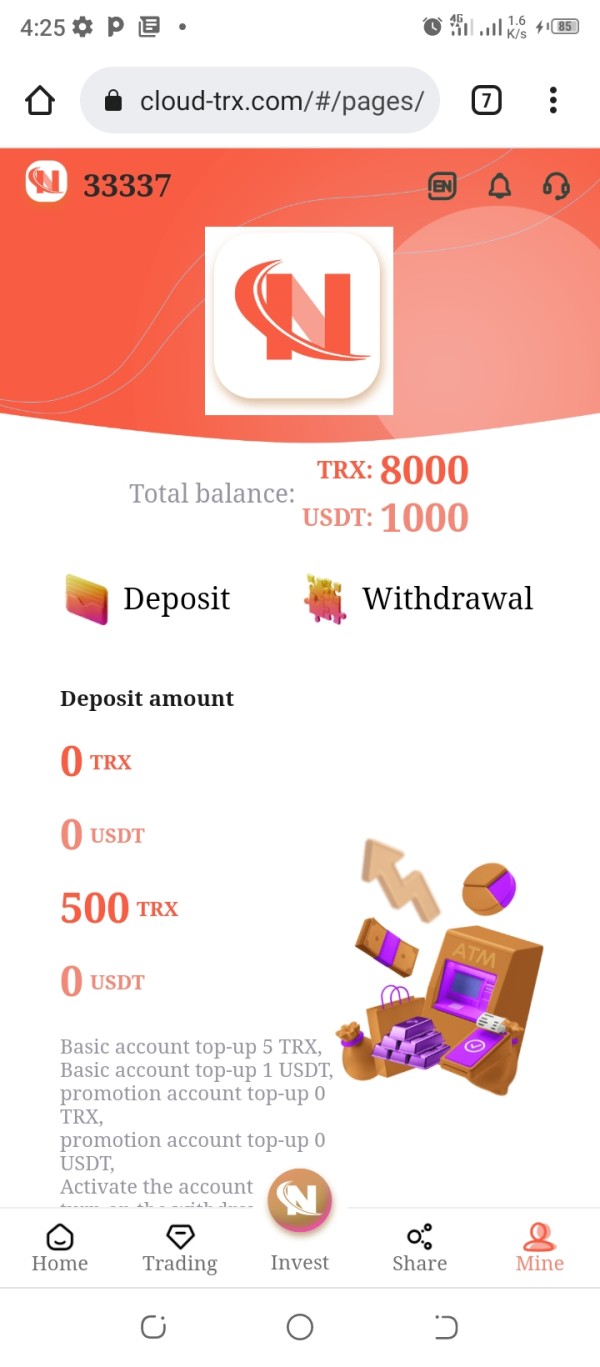

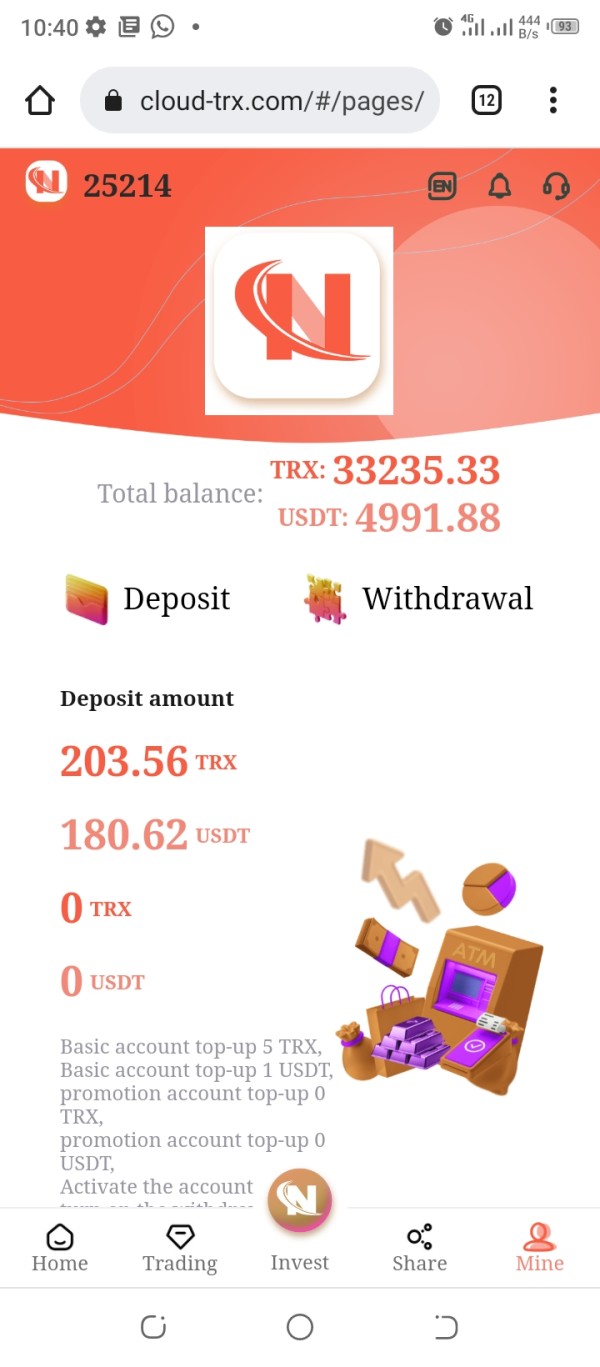

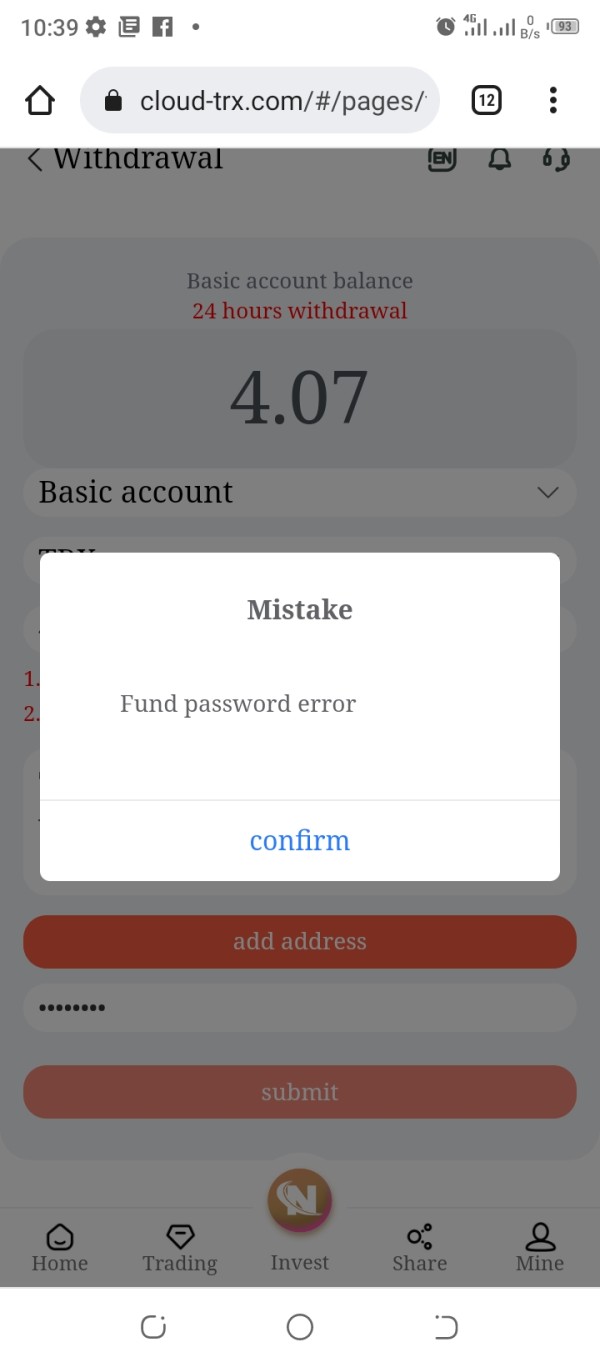

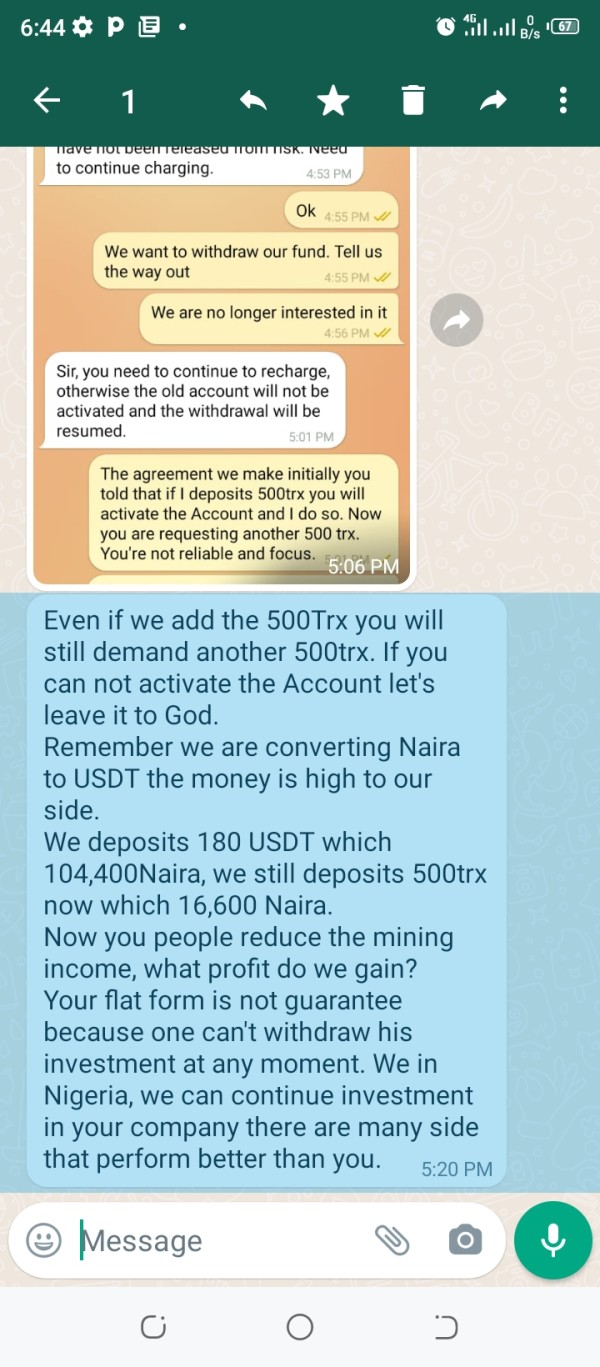

l have usdt180 and trx203 inside I complain hi say put another trx500 to upgrade my account all is losing

Cloud FX Trade Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

l have usdt180 and trx203 inside I complain hi say put another trx500 to upgrade my account all is losing

Cloud FX Trade presents itself as an online trading platform. However, our comprehensive cloud fx trade review reveals significant concerns about its legitimacy and safety that cannot be ignored. The broker operates under Cloud FX Trade LTD and has its headquarters in Reno, Nevada. It lacks proper regulatory oversight and has attracted numerous negative user reviews citing security and legitimacy issues that raise red flags. With a minimum deposit requirement of $200 USD and promises of weekly returns up to 50%, the platform appears to target inexperienced traders seeking high returns. The absence of regulatory protection, combined with substantial user concerns about the platform's authenticity, makes this broker extremely risky for any investor who values their money. The platform operates more as an investment scheme rather than a traditional forex broker. It offers investment plans instead of conventional trading accounts that most legitimate brokers provide. Given the lack of transparency, regulatory oversight, and overwhelmingly negative user feedback, we strongly advise potential clients to exercise extreme caution and consider regulated alternatives.

This cloud fx trade review is based on publicly available information and user feedback collected from various sources. Cloud FX Trade LTD operates from Nevada, United States, but lacks verification from major financial regulatory bodies that typically oversee legitimate brokers. The company's business model appears to focus on investment plans rather than traditional forex trading services. This raises additional concerns about its operational legitimacy that potential clients should carefully consider. Due to limited official documentation and transparency from the broker, some specific details regarding trading conditions, platform features, and regulatory status may not be available in the public domain. Readers should note that information about this broker is scarce. The lack of comprehensive data itself serves as a red flag that should not be ignored. This review aims to provide an objective assessment based on available evidence, but potential clients should conduct their own thorough research before making any financial commitments.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 3/10 | Minimum deposit of $200 USD available, but lacks detailed account type information and transparent terms |

| Tools and Resources | 2/10 | No evidence of comprehensive trading tools, research resources, or educational materials |

| Customer Service | 2/10 | Absence of detailed customer support information and negative user feedback regarding service quality |

| Trading Experience | 2/10 | User reports raise serious concerns about platform safety, legitimacy, and overall trading environment |

| Trustworthiness | 1/10 | Complete lack of regulatory oversight, potential fraud risks, and extremely low user confidence |

| User Experience | 2/10 | Overwhelmingly negative user feedback regarding platform legitimacy and security concerns |

Cloud FX Trade LTD operates as an online financial services provider based in Reno, Nevada, United States. The company presents itself as a trading platform but functions more like an investment scheme that offers structured investment plans rather than traditional forex trading accounts. The business model centers around promising high returns. It makes claims of up to 50% weekly profits, which immediately raises red flags for experienced traders familiar with realistic market expectations. The platform targets individuals seeking high-return investments. It particularly focuses on those who may be new to financial markets and less aware of typical industry standards and regulatory requirements.

The broker's operational structure differs significantly from conventional forex brokers. It does not appear to offer direct market access or traditional trading platforms that most legitimate brokers provide. Instead, Cloud FX Trade focuses on managed investment programs where clients deposit funds and expect returns based on the company's trading activities. This model lacks transparency regarding actual trading operations, risk management procedures, and fund allocation strategies that professional traders expect. The absence of detailed information about trading platforms, asset classes, and regulatory compliance creates substantial uncertainty about the broker's legitimacy and operational capabilities. Furthermore, the company's website and promotional materials provide minimal information about the management team, trading strategies, or regulatory status. These are typically standard disclosures for legitimate financial service providers that value transparency.

Regulatory Status: Available information does not indicate any regulatory oversight from major financial authorities such as the SEC, CFTC, or other recognized regulatory bodies. This absence of regulation represents a significant risk factor for potential clients who need protection.

Deposit and Withdrawal Methods: Specific information about payment methods, processing times, and withdrawal procedures is not detailed in available sources. This creates uncertainty about fund accessibility and transaction processes that clients should be aware of.

Minimum Deposit Requirements: The platform requires a minimum deposit of $200 USD to begin investing. This is positioned as accessible for entry-level investors but may be part of a strategy to attract inexperienced traders.

Promotional Offers: No specific information about bonuses, promotional campaigns, or special offers is available in the reviewed materials. However, the high return promises may serve as the primary attraction mechanism for new clients.

Available Assets: The specific range of tradeable instruments, asset classes, and investment options is not clearly documented in available sources. This raises questions about the actual trading opportunities provided to clients.

Cost Structure: Detailed information about spreads, commissions, fees, and other trading costs is not transparently provided. This makes it impossible for potential clients to assess the true cost of using the platform.

Leverage Options: No specific information about leverage ratios or margin requirements is available. This is concerning given that leverage disclosure is typically mandatory for legitimate brokers.

Platform Options: The specific trading platforms, software, or technological infrastructure used by the broker is not detailed in available documentation. This lack of information makes it difficult to assess the platform's capabilities.

Geographic Restrictions: Information about country-specific restrictions or availability limitations is not clearly specified in the reviewed materials. Potential clients should verify their eligibility before considering any investment.

Customer Support Languages: The range of supported languages for customer service is not documented in available sources. This could be problematic for international clients seeking support.

The account structure at Cloud FX Trade appears to be fundamentally different from traditional forex brokers. It focuses on investment plans rather than standard trading accounts that most legitimate brokers offer. The minimum deposit requirement of $200 USD may seem accessible, but this relatively low barrier to entry, combined with promises of extraordinary returns, is characteristic of investment schemes rather than legitimate trading platforms. Traditional forex brokers typically offer various account types with different features, spreads, and minimum deposits. Cloud FX Trade's approach lacks this conventional structure that professional traders expect.

The absence of detailed account terms, conditions, and features represents a significant transparency issue. Legitimate brokers provide comprehensive documentation about account types, including demo accounts, standard accounts, premium accounts, and their respective benefits that help clients make informed decisions. The lack of information about account opening procedures, verification requirements, and ongoing account management raises serious questions about the platform's operational legitimacy. This transparency gap makes it difficult for potential clients to understand what they are signing up for.

User feedback indicates substantial concerns about the safety and legitimacy of funds deposited with the platform. Unlike regulated brokers that provide client fund segregation and regulatory protection, Cloud FX Trade offers no such guarantees that clients can rely on. The investment plan structure means clients are essentially handing over funds to the company with promises of returns, rather than maintaining control over their trading activities. This fundamental difference in account structure significantly increases risk and reduces client protection compared to standard forex trading accounts offered by regulated brokers.

The available information suggests a significant lack of comprehensive trading tools and educational resources typically expected from legitimate forex brokers. Professional trading platforms usually provide advanced charting software, technical analysis tools, economic calendars, market research, and educational materials to support trader development and decision-making that serious traders require. Cloud FX Trade appears to offer none of these standard resources. This is concerning for clients seeking to develop their trading skills or conduct independent market analysis.

The absence of detailed information about trading platforms, analytical tools, or research capabilities indicates that the broker may not actually facilitate traditional trading activities. Instead, the investment plan model suggests that clients have little to no control over trading decisions or access to market analysis tools that would help them understand their investments. This lack of transparency and client empowerment is contrary to industry best practices where brokers typically provide extensive resources to help clients make informed trading decisions. The platform essentially asks clients to trust blindly without providing the tools needed for independent verification.

Educational resources are particularly important for the novice traders that Cloud FX Trade appears to target. Legitimate brokers invest heavily in educational content, webinars, tutorials, and training programs to help clients understand market dynamics and improve their trading skills over time. The apparent absence of such resources suggests that the platform is more interested in collecting deposits than in genuinely supporting client trading success. This lack of educational support, combined with promises of high returns without effort, is characteristic of investment schemes rather than legitimate trading platforms.

Information about customer service capabilities, support channels, and response times is notably absent from available documentation about Cloud FX Trade. Legitimate forex brokers typically provide multiple contact methods including phone support, email, live chat, and comprehensive FAQ sections that help clients resolve issues quickly. They also usually offer support in multiple languages and maintain extended hours to serve international clients across different time zones. The absence of such information raises questions about the platform's commitment to client support.

The lack of detailed customer service information is particularly concerning given the negative user feedback regarding the platform's legitimacy and safety. When clients have concerns about fund security or platform operations, responsive and professional customer support becomes crucial for maintaining trust and resolving issues. The absence of transparent support channels and contact information makes it difficult for potential issues to be resolved effectively. This creates additional risk for clients who may need assistance with their accounts or investments.

User feedback suggests poor service quality and inadequate response to client concerns about platform safety and fund security. This is especially problematic for an investment platform where clients entrust significant funds based on promised returns that may not materialize. Professional customer support should include dedicated account managers, technical support, and clear escalation procedures for resolving disputes or concerns. The apparent lack of robust customer service infrastructure raises additional red flags about the platform's commitment to client satisfaction and operational legitimacy.

The trading experience at Cloud FX Trade differs fundamentally from conventional forex trading. The platform operates on an investment plan model rather than providing direct market access that most traders expect. This means clients do not actually engage in trading activities themselves but instead rely on the company's claims about trading performance and returns. This lack of direct trading control significantly impacts the user experience and introduces substantial risks related to transparency and fund management.

User feedback consistently raises serious concerns about the platform's legitimacy, safety, and operational transparency. Unlike regulated brokers where clients can monitor their positions in real-time, access detailed trading history, and maintain control over their funds, Cloud FX Trade's model requires complete trust in the company's claimed trading activities that cannot be independently verified. This fundamental difference in trading experience eliminates many of the protections and controls that experienced traders expect from legitimate brokers. The passive nature of the investment means clients have no way to verify actual trading performance.

The absence of information about trading platforms, execution quality, spread competitiveness, and slippage rates makes it impossible to assess the actual trading environment. Professional traders typically evaluate brokers based on execution speed, order fill rates, spread stability, and platform reliability that directly impact their trading success. Since Cloud FX Trade operates as an investment scheme rather than a traditional broker, these standard performance metrics are not applicable. This itself represents a significant limitation for serious traders seeking professional trading conditions.

This cloud fx trade review reveals that the platform's approach to trading experience is fundamentally flawed from a professional trading perspective. It offers no real trading capabilities or market access to clients who want to develop their skills.

The trustworthiness assessment of Cloud FX Trade reveals multiple serious concerns that significantly impact its credibility as a financial service provider. The most critical issue is the complete absence of regulatory oversight from recognized financial authorities that normally protect clients. Legitimate forex brokers operate under strict regulatory frameworks that provide client protection, fund segregation, and operational transparency. The lack of regulatory registration or oversight eliminates these crucial protections and safeguards that clients need.

The company's transparency levels are extremely poor. It provides minimal information about management, operational procedures, financial reporting, or business practices that legitimate companies typically disclose. Professional financial service providers typically publish detailed information about their corporate structure, leadership team, financial statements, and operational policies. This transparency allows clients and regulators to assess the company's stability and legitimacy through independent verification. Cloud FX Trade's lack of such disclosure raises immediate red flags about its operational authenticity.

User feedback consistently questions the platform's legitimacy and raises concerns about potential fraudulent activities. The combination of unrealistic return promises, lack of regulatory oversight, and negative user experiences creates a pattern consistent with investment scams rather than legitimate financial services that clients can trust. The absence of third-party verification, regulatory compliance, or independent auditing further undermines the platform's credibility. These factors collectively indicate extremely high risk levels that make the platform unsuitable for serious investors seeking legitimate trading opportunities.

The overall user experience with Cloud FX Trade is characterized by significant concerns about platform legitimacy, fund security, and operational transparency. User satisfaction appears to be extremely low, with consistent reports questioning the safety of investments and the authenticity of the platform's operations that should alarm potential clients. This negative feedback pattern is particularly concerning for a financial service provider where trust and reliability are paramount. The lack of positive reviews or testimonials further reinforces these concerns.

The user interface and platform design information is not available in reviewed sources. This makes it impossible to assess the technical quality of the user experience that clients would encounter. However, the investment plan model means that users have limited interaction with trading interfaces or market data, as they are essentially passive investors rather than active traders. This simplified approach may appeal to complete beginners but eliminates the educational value and skill development opportunities that come with actual trading experience.

Common user complaints focus on concerns about fund security, platform legitimacy, and the unrealistic nature of promised returns. The target demographic appears to be inexperienced investors attracted by high return promises, but the lack of educational resources and transparent operations means these users are particularly vulnerable to potential losses that could be devastating. The platform's approach of targeting novice investors with promises of easy profits, combined with the lack of regulatory protection, creates an environment where users face significant risks without adequate safeguards or support systems. This predatory targeting of vulnerable populations is a major red flag.

This comprehensive cloud fx trade review reveals a platform that presents substantial risks and fails to meet the standards expected of legitimate forex brokers. Cloud FX Trade operates without regulatory oversight, lacks transparency in its operations, and has attracted significant negative user feedback regarding its legitimacy and safety that cannot be ignored. The platform's investment plan model, promising unrealistic returns of up to 50% weekly, is characteristic of investment schemes rather than professional trading services. These warning signs should be sufficient to deter any serious investor.

The broker is not suitable for any category of serious traders or investors, particularly beginners who may be attracted by the low minimum deposit and high return promises. The absence of regulatory protection, combined with poor transparency and negative user experiences, makes this platform extremely high-risk for anyone considering investment. The main disadvantage is the complete lack of regulatory oversight and operational transparency, while the only potential advantage is the low entry barrier of $200 minimum deposit. However, this itself may be designed to attract vulnerable investors.

We strongly recommend that potential clients avoid this platform and instead consider regulated brokers that provide proper client protections, transparent operations, and realistic trading conditions. The combination of regulatory absence, user concerns, and operational opacity makes Cloud FX Trade unsuitable for legitimate investment or trading activities that serious investors should pursue.

FX Broker Capital Trading Markets Review