century Group bullion Review 9

With single teacher: zhao yi WeChat ID: TLZ005500.Live broadcast or WeChat group. A man named zhao yi was pulled into a stock exchange WeChat group called zhaojiajun 164 in November .Later, it entered a studio called "stock market zhao jiajun".In addition to Mr. Zhao, he invited several lecturers to take turns explaining some stock practices.And boast about their past achievements.It was such encouraging effect.Later, zhao yi proposed to lead everyone to cooperate with listed companies to operate a stock and realize the plan of turning over (doubling) before the Spring Festival.Ask people to submit funds they can participate in.Then talk about the calculation of the capital is insufficient, to lead everyone to Hong Kong gold market to make money, to meet the operating stock capital gap.And instructs the group manager to provide the century gold industry account director (century gold industry WeChat customer service) contact information.And threatened not to open a gold speculation account will be expelled.Now come to think of it, this is a completely organized, premeditated, internal and external collusion of a hoax.After receiving the WeChat provided by the general manager, the account opening was completed on December 31, 2018.Acquire trading account 80031338.And in the century gold industry's website to download the MT5 trading system.After opening an account, according to the century gold industry customer service to provide a gold channel.Transfer the funds to the designated private account in China, and the platform will convert the funds into us dollars at the exchange rate of 1:6.8, and send an email to confirm the arrival of the funds in the account.Several times of total transfer into RMB through different accounts.664000 yuan.Fold the $97647.05

The adviser: Zhao Yi, the WeChat account: TLZ005500. the live stream studio or WeChat group. In last November, a person named Zhao Yi invited me via WeChat into a stock exchange group called "Zhao Jiajun 164". Later, I entered a live stream studio named"Stock Market Zhao Jiajun". He also invited several advisers to teach some stock operation methods by turns. They bragged about their past achievements, which had agitating effect. Later, Zhao Yi proposed to guide everyone to cooperate with a listed company to invest in a stock and realize the plan to double position before the Spring Festival. They asked everyone to report the money they could invest in. Then, after calculating the money, they said it wasn’t enough. So, they decided to guide everyone to make money in the Hong Kong gold market, so as to make up for the shortage. They instructed the group's general manager to provide us with the contact information of century Group bullion's director for opening accounts (the platform’s WeChat customer service supporter). They also threatened to remove the people who didn’t open accounts. Now when I calm down and think about it, finding that this is a scam that is organized, premeditated, and collusive inside and outside. After receiving the director’ contact information, I opened an account on December 31, 2018, and got the trading account 80031338. And I also downloaded the MT5 on the website. After opening an account, I transferred money to a designated domestic private account, according to the the channel provided by the platform. The platform converts the money into US dollars at an exchange rate of 1:6.8, and sent an email to confirm the money arrived at the account. It has been transferred a total of 664,000 yuan through several different accounts, approx US dollar 97647.05

Century Group Bullion’s adviser Yide invited me to join a QQ group. Every day, several advisers would gave lectures on stock trading. Later, a adviser said that he would guide everyone to invest in a stock, but there is a gap in the funds, so we need to make up the gap before I help you trade gold and double the money. I have deposited a total of RMB12.24 million. Advisers sometimes gave order recommendations while giving lessons online, and sometimes did through the assistant offline. At the beginning, I traded about 30% of the positions, and profited from quite a few orders. Before the release of 1.4 non-farm payroll data, the advisers let us buy in more than 50% of the positions. As a result, when the data were released, they were good news for shorts and all our orders were closed out. The advisers promised to help up take the losses back, and asked us to deposit more if we had money. Since the loss was serious at that time, I was panicked. So I accepted their advice and deposited again. However, the advisers’ advice caused losses in a row. Until 1.17, after the initial jobless claims data comes out, the data were good for shorts. They let everyone short 60% of positions. If I withdrew money then, I could earn a little. The advisers immediately let everyone buy in more than 60% of the positions and hold them overnight. As a result the quotations fall to the stop-loss position. We suffered heavy losses. I contacted with the platform from February 18, 2019. The platform asked s me to send emails, and I email them. But they have responded to the same emails for more than a month. They have not been dealing with your problem and have been delaying the time.

In late March this year someone on the Internet recommended me a so-called stock master Mirror. Mirror asked me to add Li on Wechat to learn how to trade stocks. I joined their stock lectures. There were Long, Zhao, Yi and Fang in the group. At first they did give some constructive advice. Later they held a stock contest and asked us to invest in century Group bullion and we should deposit at least 5 million RMB. They promised us a 45% profit and sent us many making-profit screenshots. I was induced. They urged me to invest, saying there would be a huge market trend to follow. I deposit 3 million and started to trade gold. They let us trade under their guidance. I lost tens of thousand dollars in the first try and earned a little in the second. Later they deliberately gave us wrong directions. I traded as they told me to do so. I lost all my 3 million.

Agent Long kun of Century Group bullion,by shifting lessons from stock investment skills to London gold investment,opened an account for me with my information,enabling me to suffer heavy losses.

Reveal of fraud in Jinye Century ! Internet era benefits the development of all things. However, online forex trading and stock trading are springing up.At present, there is an increasing number of frauds in the investment market. Investors enter the market in basically the same way, while they are induced by strangers in various ways.Who knows the lowdown on constant financial investment losses?I think a lot of investor have no idea of which platform is regular and how to profit? Browsing my posts,you must be victims cheated by fraud platform and made great losses.Finding the next broker again and again,leading to even a greater losses.Today I want to talk to you about how to distinguish the fraud platform! Revealing online financial fraud,I hope to help more investors! Exposed platform:Century group Jinye holdings co. LTD Teachers:Mingdao,Tianhong and master Qiaoxiao Trading products:forex,London gold and crude oil On 8th,May,I was pulled into a 30-person group by a stranger.I treated it as a fortune,while the nightmare was just beginning.The group owner was enthusiastic and recommended his master to us a few days later.He invited us into a 100-person or so group.And his master was indeed better than he was,each stock recommended by him...

I was pulled into a stock exchange group,in which the teacher taught lessons on stock,with other 4 teachers,namely,Long kun(Master),JIanguo Zhao(Mr.Six),Yi dao(Guoxin Wang) and future-teller(Fang hai).They taught us stock in the period of morning,noon and evening.To double the asset,he wanted us to get together.Then Mr.Six invited members of Jianguo in and set the profit goal of 600%,which was 400% set by the master before.Then we were divided into 10 groups to practice.With the guide of Mr.Six,our nightmare was beginning.We operated with 30% position at first, then 60 position,80% position and full position,and the result was obvious.Though having earned some money,we made a great loss(the fund and what we have earned).The members with 5 million,3 million and 1.5 million deposit showed their screenshots of profiting in the group.Saying that Mr. Six wasn’t in status,the master decided to take the group to operate.With profiting at first and making losses later,he told us that he wanted to adjust his status.He asked us to trade with full position and show him the real-time screenshot.Otherwise,he would remove you from the group.With full position and reverse order recommendation,what you earned was nothing.

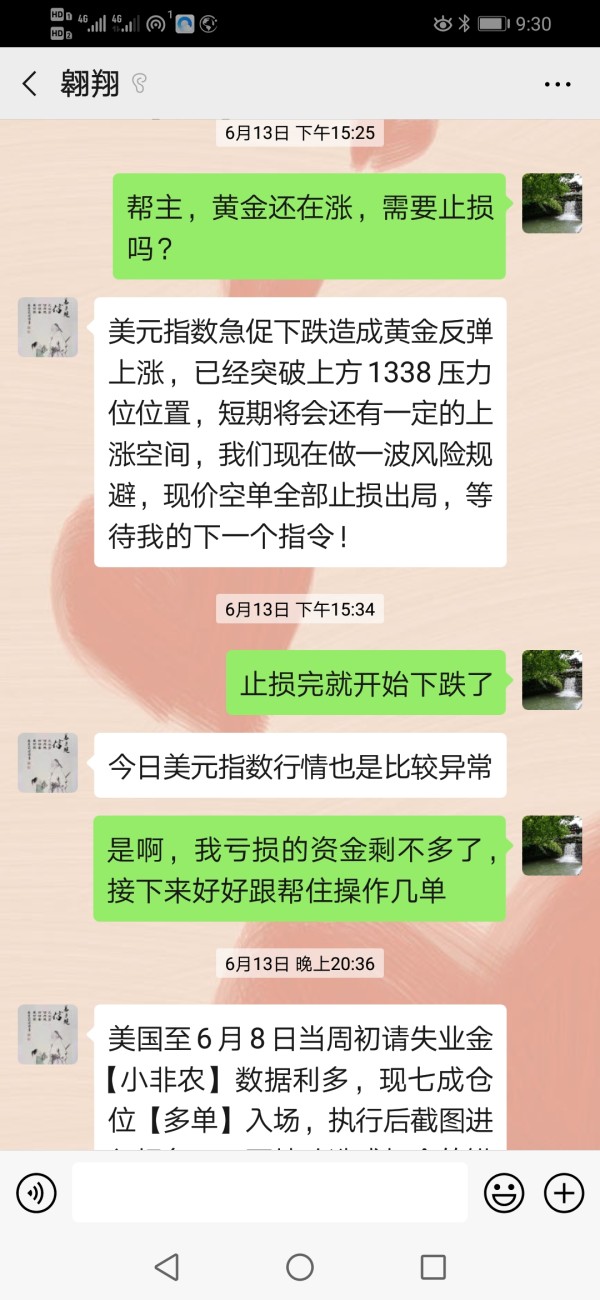

At the beginning of 2019, I added Aoxiang(Longkun) on the Internet.via WeChat. Later, they opened the network venue named Long Jiajun, and began to teach stock knowledge as well as tactics.They said that they would invest in one stock. But later they delayed the trading time, saying there are stock portfolios. Longkun and Liuye competed for the general commander, and they began to compete, investing London gold. Later, they said we would trade stock portfolios and need to make up for the shortage of the money. Liuye suggested to lead everyone to invest in London gold and earn 45% of the proceeds. He recommended the WeChat account of century Group bullion’s customer service personnel. On May 21, I began to contact the customer service supporter and deposited in the platform by three times with the first time 110,000, the second 40,000, the third 100,000. Long Kun and Liu Ye asked to deposit more money to earn back the capital. During trading, they said they had led the pioneers and teams to made orders and showed us how much profits they gained without loss. On May 27th, I followed their instructions and started to trade. I gained profits from small orders yet lost in big orders. On June 12, I suffered great losses from two orders. I told Long Kun that I would quit the London gold market. But he asked me to transfer the money to the stock market, giving me priority to open positions. On June 13th, I only withdrew 12025.12 yuan. century Group bullion’s commission fees are expensive. It takes 0.5 pip to buy in one lot, and it also requires 0.5 pip to sell out one lot. One lot requires commissions of 50 dollar, there are still rollovers. You will lost at least 150 dollars after trading one lot. The exchange rate for depositing money is 6.8 and that for withdrawing money is 6.55. Up to now, I have lost more than RMB230,000, which are my hard-earned money. This is a scam platform. I hope everyone can see this post and avoid being cheated.