Castle Rock FX 2025 Review: Everything You Need to Know

Executive Summary

Castle Rock FX works as an unregulated STP forex broker. The company offers high-leverage opportunities with maximum leverage reaching 1:500. This castle rock fx review shows a platform that uses the MT4 trading system and gives access to multiple financial derivatives including currency pairs, cryptocurrencies, precious metals, and energy commodities. The broker's fully digital account opening process helps streamline user onboarding for active traders.

Castle Rock FX positions itself as an offshore broker targeting traders who want diverse trading opportunities over regulatory oversight. The platform supports various asset classes through its MT4 infrastructure, though specific details about spreads, commissions, and minimum deposit requirements stay hidden in publicly available materials. The broker's English-only customer support and lack of mobile platform compatibility may limit its appeal to certain trader groups.

The primary user base consists of active traders comfortable with higher-risk trading environments who value leverage flexibility and asset diversity over regulatory protection. However, potential clients should carefully consider the risks of trading with an unregulated entity before proceeding.

Important Notice

Due to Castle Rock FX's unregulated status, traders must check the broker's compliance with local regulations in their jurisdictions. Regulatory requirements vary significantly across different countries, and what may be acceptable in one region could violate financial regulations in another. This is particularly important for traders in jurisdictions with strict financial oversight.

This review uses publicly available information and user feedback accessible at the time of writing. Information may become outdated as broker policies and offerings evolve. Readers should verify current terms and conditions directly with Castle Rock FX before making any trading decisions.

Rating Framework

Broker Overview

Castle Rock FX was established in 2020. The company operates from Saint Vincent and the Grenadines as an unregulated forex broker. The company positions itself as an offshore trading solution using the STP business model. This approach typically means that client orders are passed directly to liquidity providers without dealer intervention, though the specific execution details have not been publicly verified due to the broker's unregulated status.

The broker targets investors seeking flexible trading conditions without the constraints often associated with heavily regulated environments. Castle Rock FX markets itself as an offshore broker, which typically appeals to traders comfortable with assuming additional regulatory risks in exchange for potentially more liberal trading terms.

The platform's core offering centers around the MetaTrader 4 trading platform. Castle Rock FX provides access to various asset categories including major and minor currency pairs, cryptocurrency trading opportunities, precious metals such as gold and silver, energy commodities, and other financial derivatives. However, this castle rock fx review notes that specific details about the exact number of tradeable instruments and their respective trading conditions remain hidden in available public materials.

Regulatory Status: Available information shows that Castle Rock FX operates without oversight from major financial regulatory bodies. This unregulated status means the broker is not subject to the capital requirements, client fund protection measures, or operational standards typically mandated by established financial authorities.

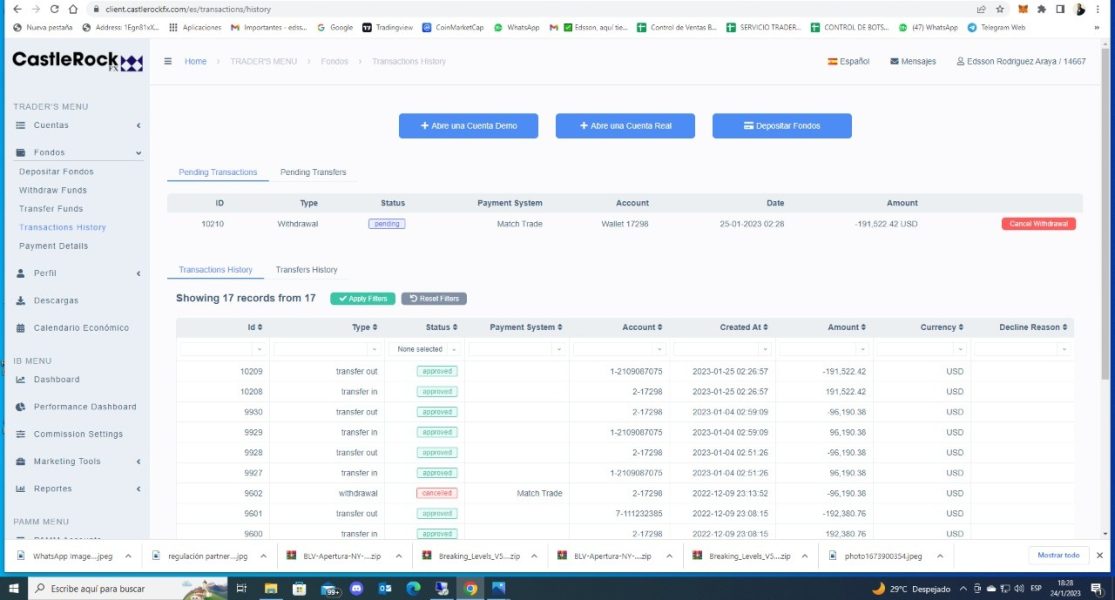

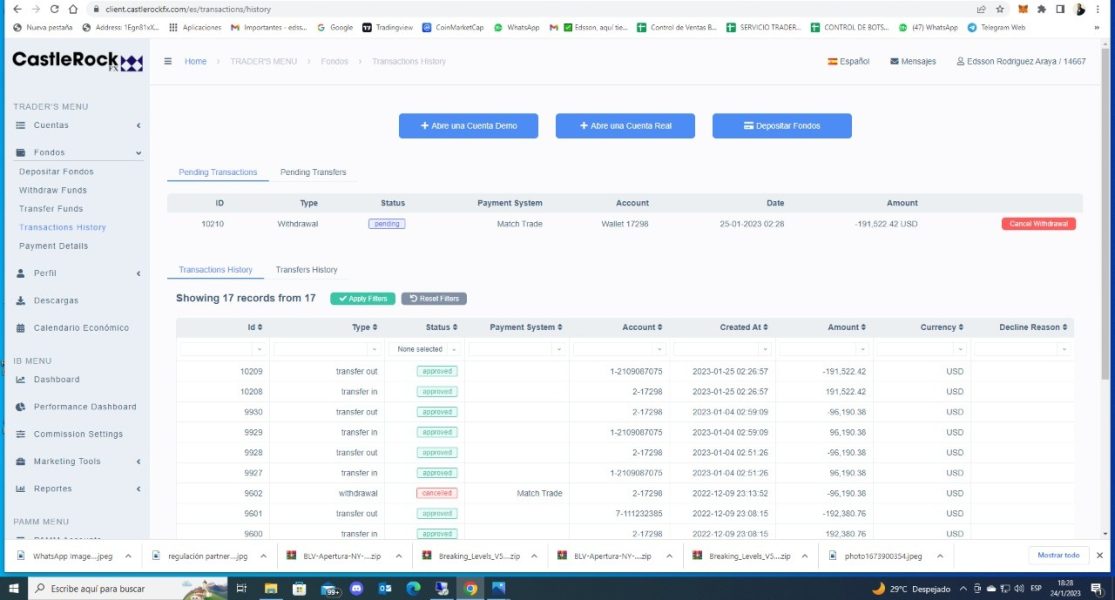

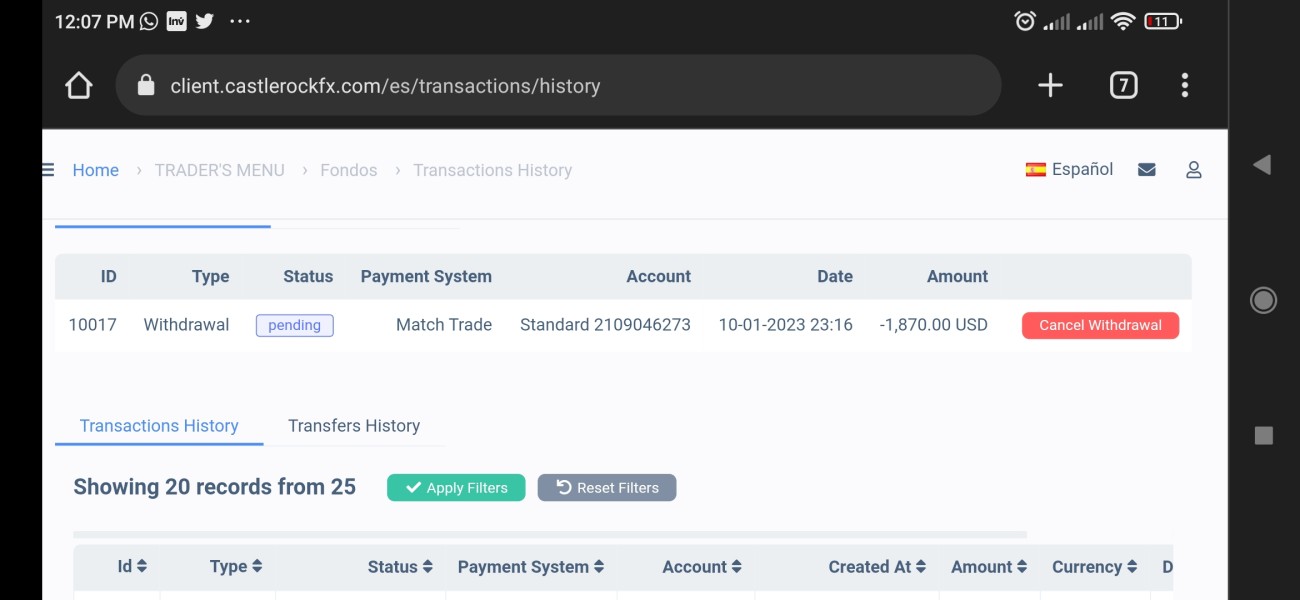

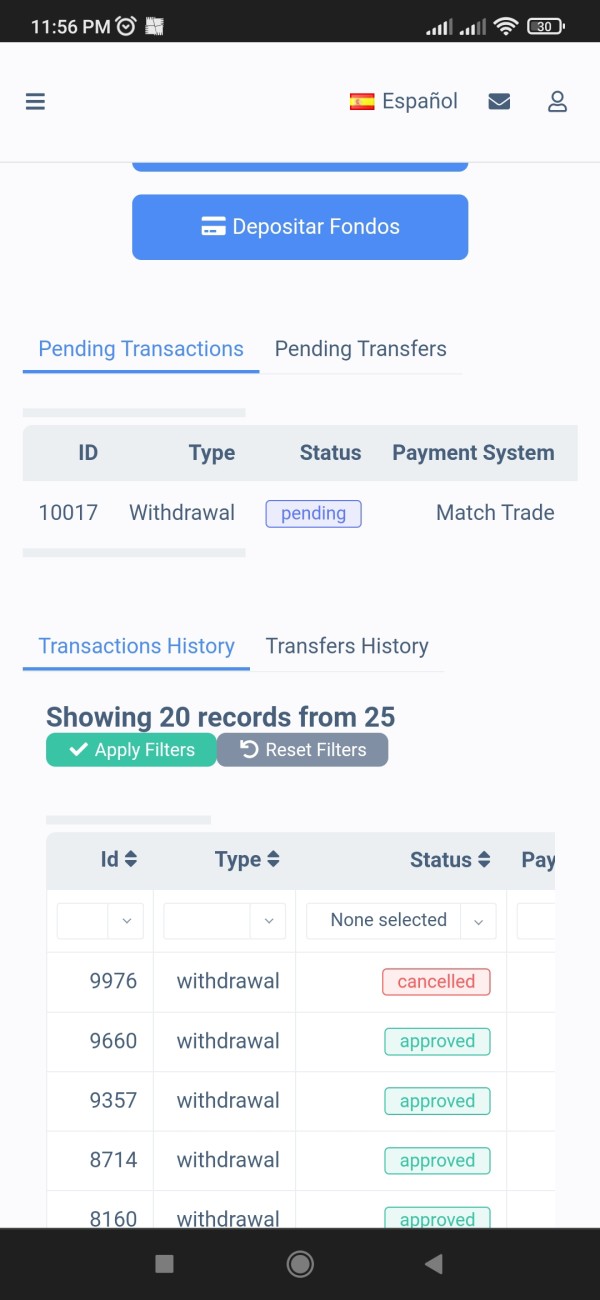

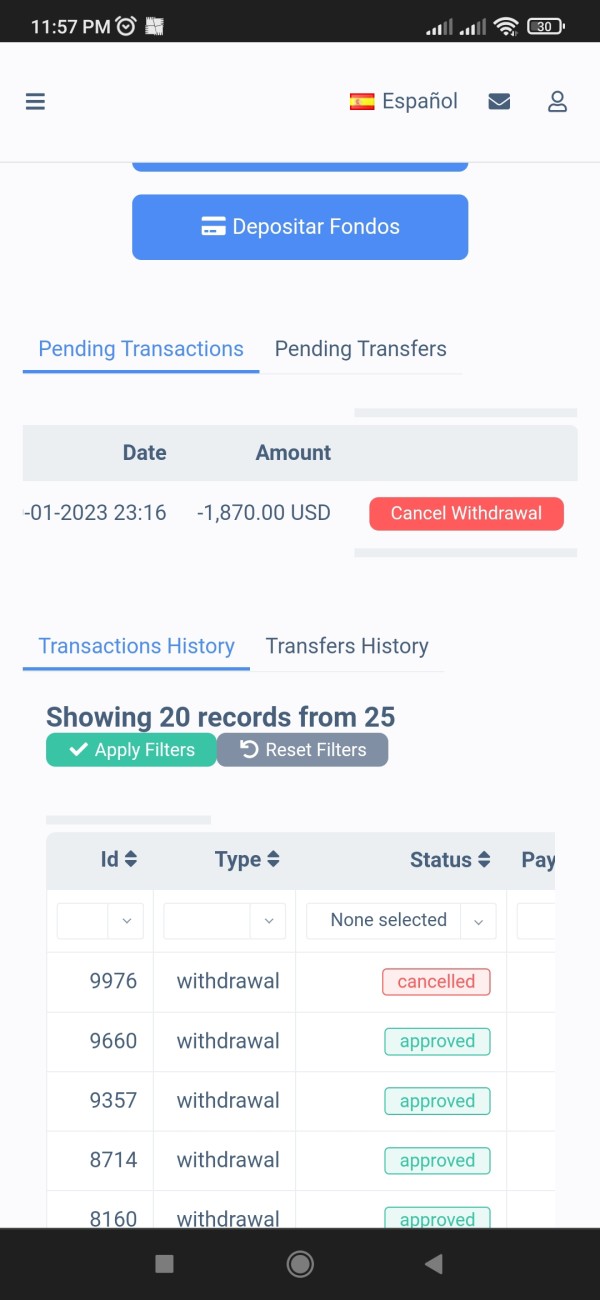

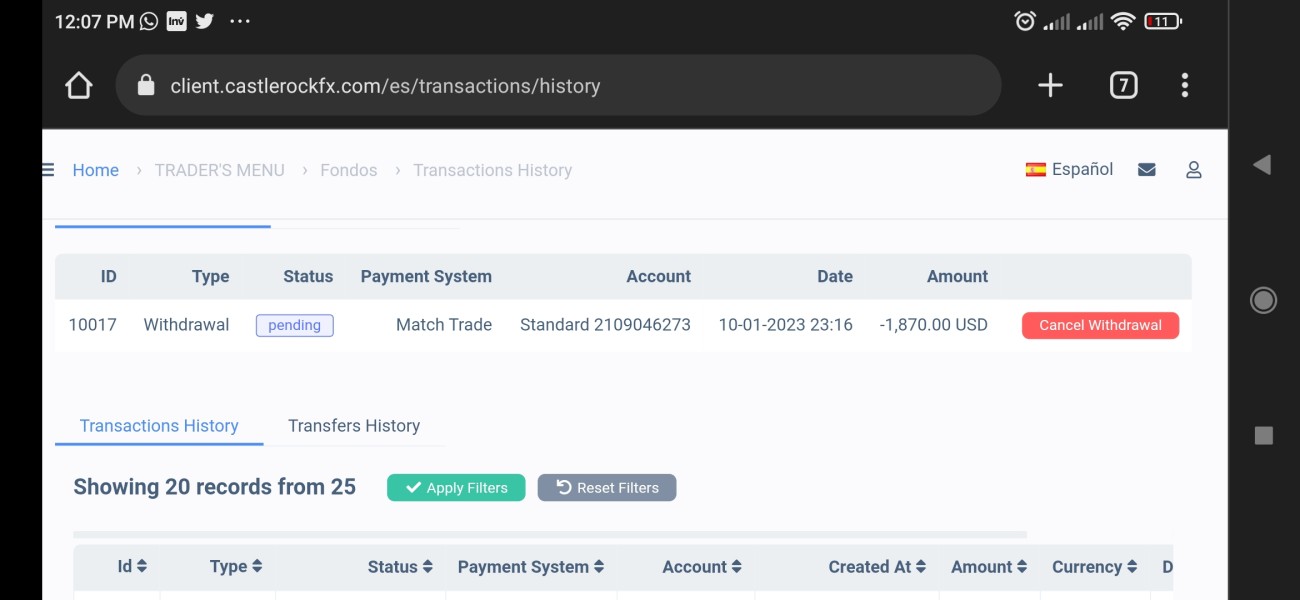

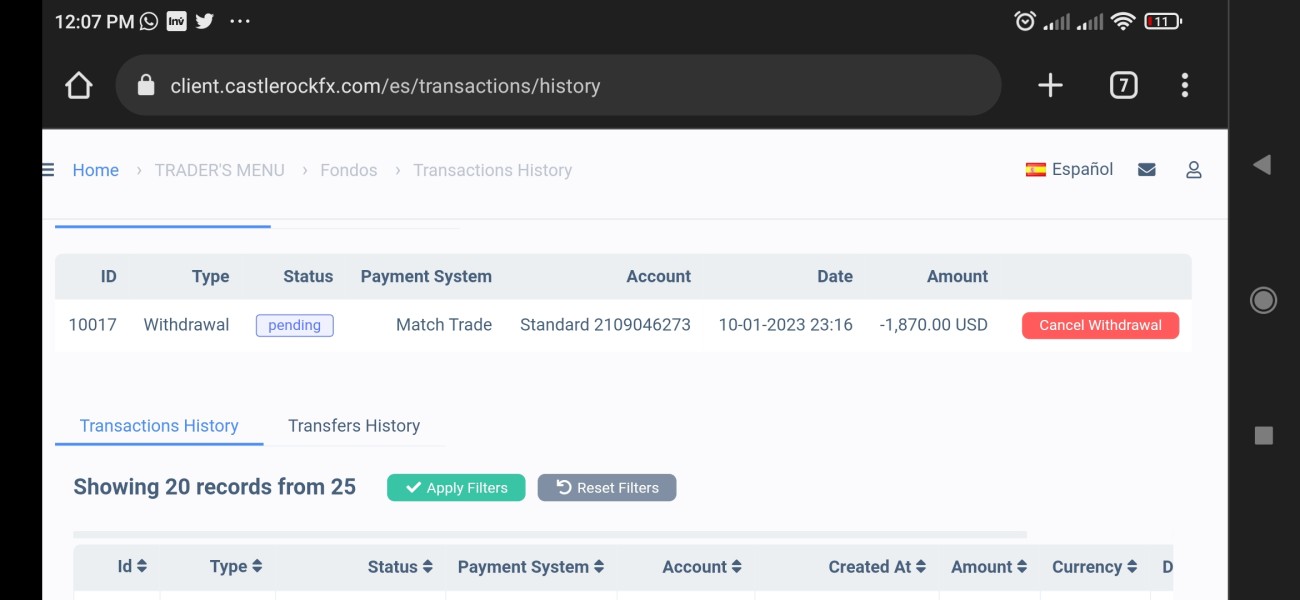

Deposit and Withdrawal Methods: Specific information about supported payment methods for deposits and withdrawals has not been detailed in available public sources. Prospective clients would need to contact the broker directly to understand available funding options.

Minimum Deposit Requirements: The minimum initial deposit amount required to open an account with Castle Rock FX has not been specified in publicly accessible materials.

Promotional Offers: No specific information about welcome bonuses, trading incentives, or promotional campaigns has been identified in available sources.

Tradeable Assets: The broker supports multiple asset classes including foreign exchange currency pairs, cryptocurrency trading, precious metals trading, energy commodity trading, and various other financial derivatives. However, the exact number of instruments in each category remains unspecified.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs has not been disclosed in available public materials. This lack of transparency about pricing makes it difficult for potential clients to accurately assess trading costs.

Leverage Ratios: Castle Rock FX offers maximum leverage of 1:500. This represents a relatively high leverage offering compared to regulated brokers in major jurisdictions where leverage is often capped at lower levels.

Platform Options: The primary trading platform is MetaTrader 4. However, available information suggests limited support for iOS, Android, MacOS, and web-based trading interfaces, which may restrict trading flexibility for mobile users.

Geographic Restrictions: Specific information about countries or regions where Castle Rock FX services are restricted has not been detailed in available sources.

Customer Support Languages: Customer service is provided in English only. This may limit accessibility for non-English speaking traders.

This castle rock fx review emphasizes that the limited public disclosure of key trading details represents a significant information gap for potential clients seeking to make informed decisions.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions at Castle Rock FX present a mixed picture for potential traders. While the broker offers attractive high leverage up to 1:500, which significantly exceeds the leverage limits imposed by major regulated jurisdictions, the lack of transparency about account types and their specific features creates uncertainty for prospective clients.

The fully digital account opening process represents a modern approach to client onboarding. This potentially reduces the time and paperwork traditionally associated with broker registration. However, without clear information about minimum deposit requirements, account tiers, or specific features available to different account types, traders cannot adequately assess whether the broker's offerings align with their capital availability and trading objectives.

The absence of detailed account specifications in publicly available materials raises questions about the broker's commitment to transparency. Regulated brokers typically provide comprehensive account information including minimum deposits, maximum position sizes, margin requirements, and any account-specific benefits or restrictions. This information gap in our castle rock fx review reflects a broader pattern of limited disclosure that characterizes unregulated brokers.

Without information about account protection measures such as negative balance protection or segregated client funds, traders cannot assess the safety features built into the account structure. This lack of clarity may deter risk-conscious traders who prioritize capital protection alongside trading opportunities.

Castle Rock FX demonstrates strength in asset diversity by offering multiple financial derivatives including currency pairs, cryptocurrencies, precious metals, and energy commodities. This broad range of tradeable instruments potentially allows traders to diversify their portfolios and capitalize on opportunities across different market sectors.

However, the quality and depth of trading tools remain unclear due to limited public information. While the MT4 platform provides standard charting capabilities, technical indicators, and automated trading support, the broker has not disclosed whether additional analytical tools, market research, or trading resources are available to clients.

The absence of information about research and analysis resources represents a significant limitation. Professional traders often rely on market commentary, economic calendars, sentiment indicators, and fundamental analysis to inform their trading decisions. Without clarity on whether Castle Rock FX provides such resources, traders may need to source analytical support from third-party providers.

Educational resources, which are increasingly important for broker differentiation, have not been mentioned in available materials. Many brokers provide webinars, trading guides, video tutorials, and market analysis to support client development. The lack of information about educational offerings suggests this may not be a priority for Castle Rock FX.

Automated trading support through MT4 Expert Advisors is likely available given the platform choice. However, specific policies about EA usage, VPS services, or algorithmic trading support have not been detailed.

Customer Service and Support Analysis

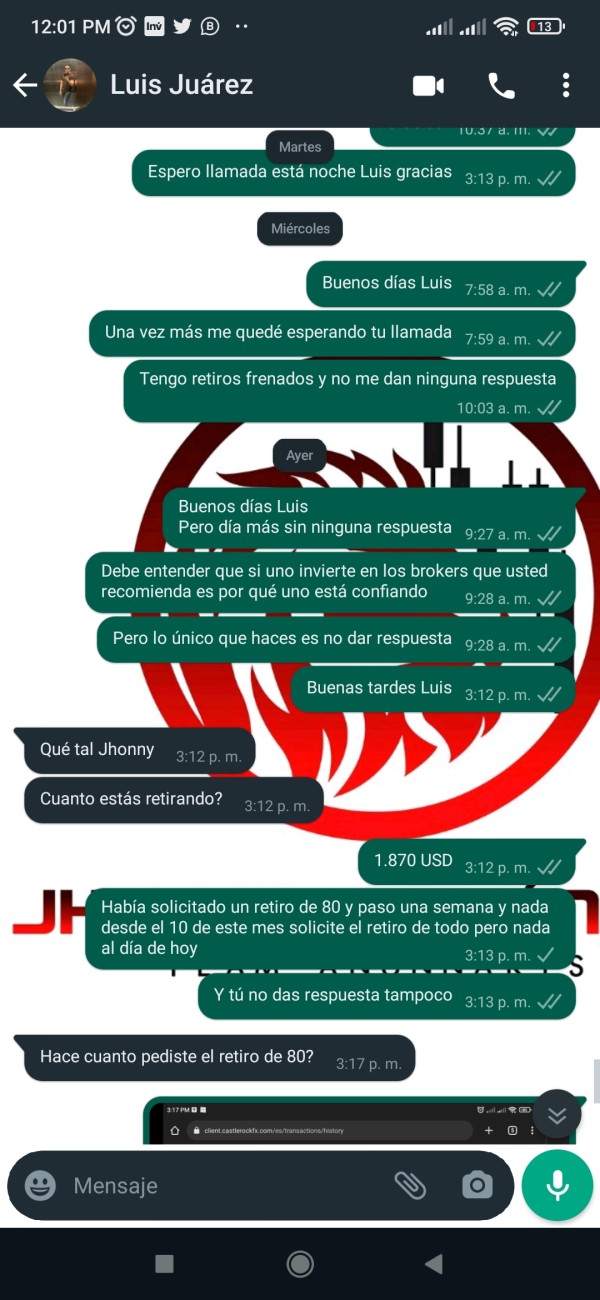

Customer service represents a notable weakness in Castle Rock FX's offering based on available information. The limitation to English-only support significantly restricts the broker's accessibility to international traders who may prefer customer service in their native languages. This linguistic limitation may particularly impact traders from non-English speaking regions where forex trading is popular.

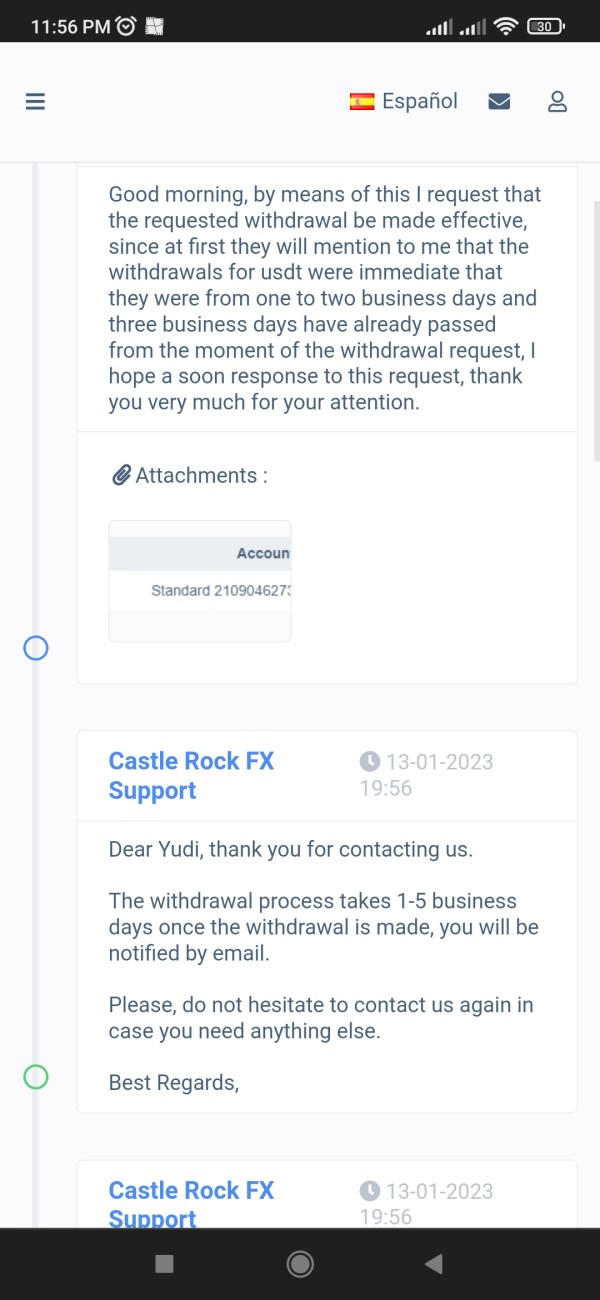

The specific customer service channels available to clients remain unclear from publicly accessible information. Modern brokers typically offer multiple contact methods including live chat, email support, telephone assistance, and sometimes social media channels. Without clarity on available communication methods, potential clients cannot assess the convenience and accessibility of customer support.

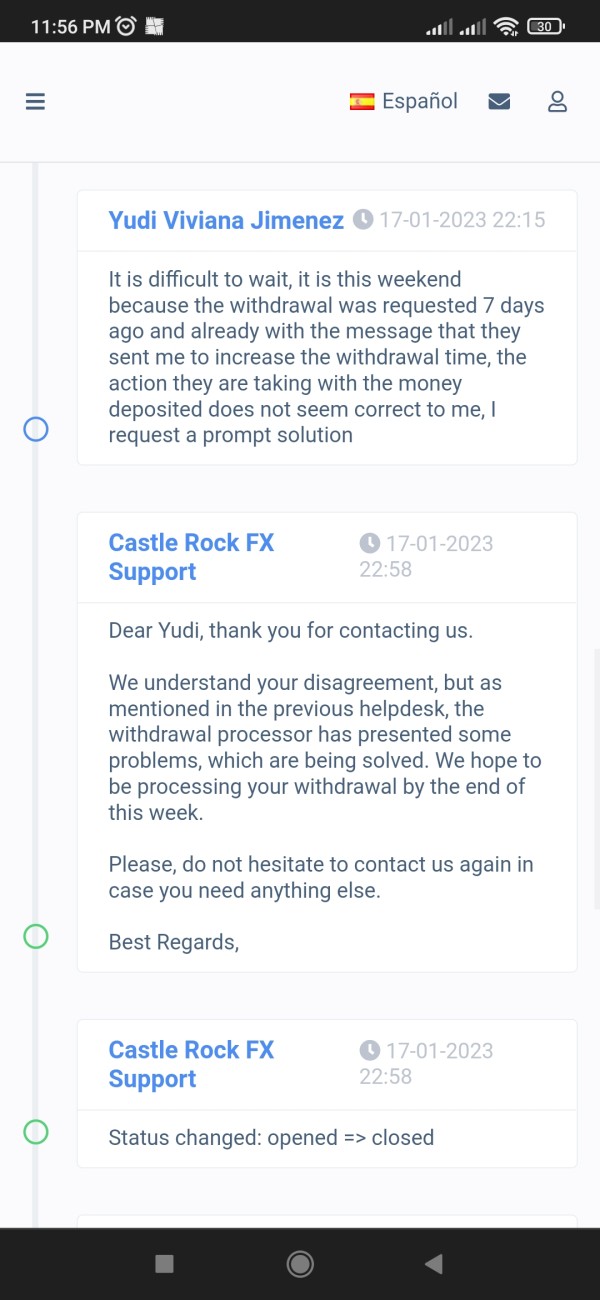

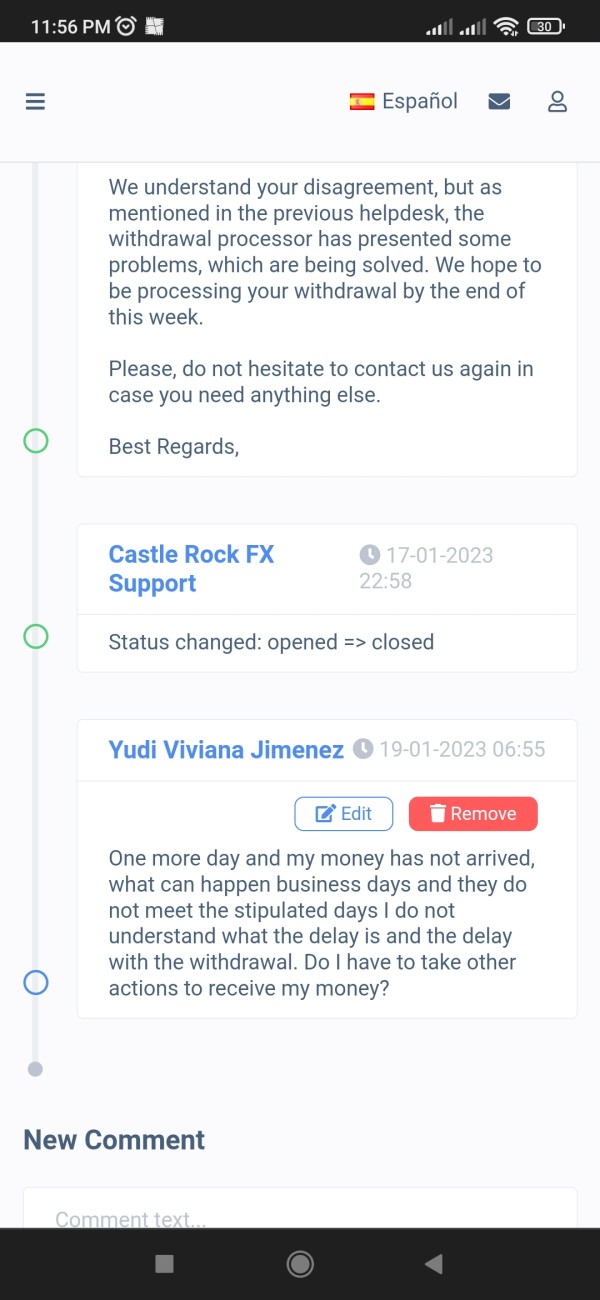

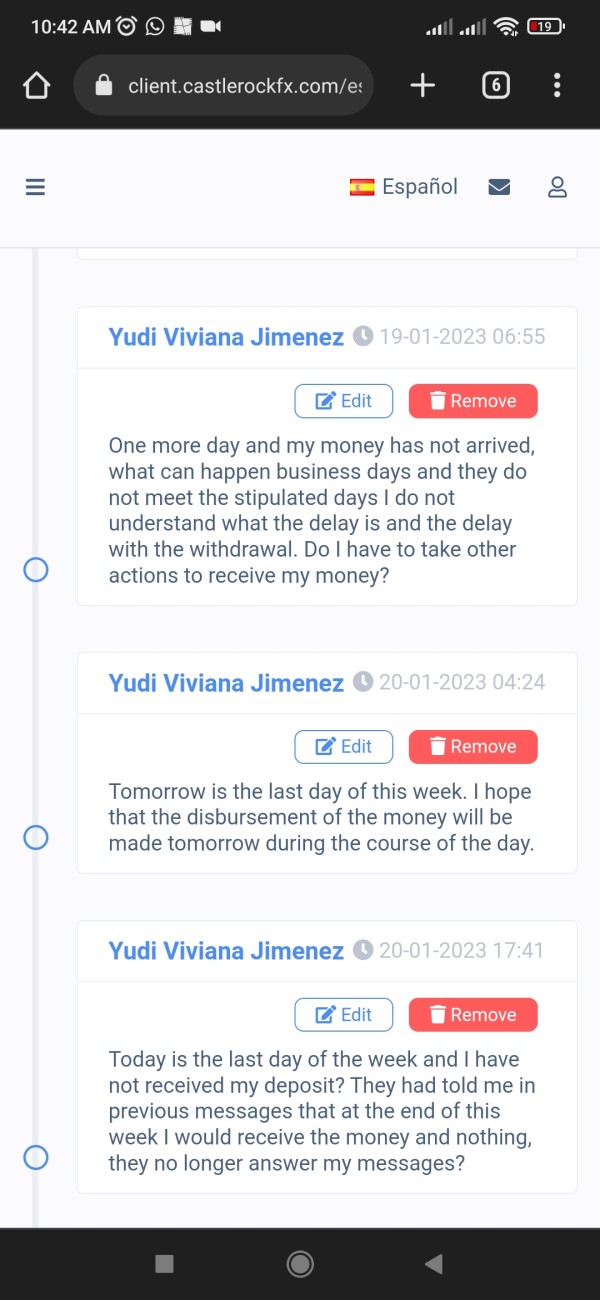

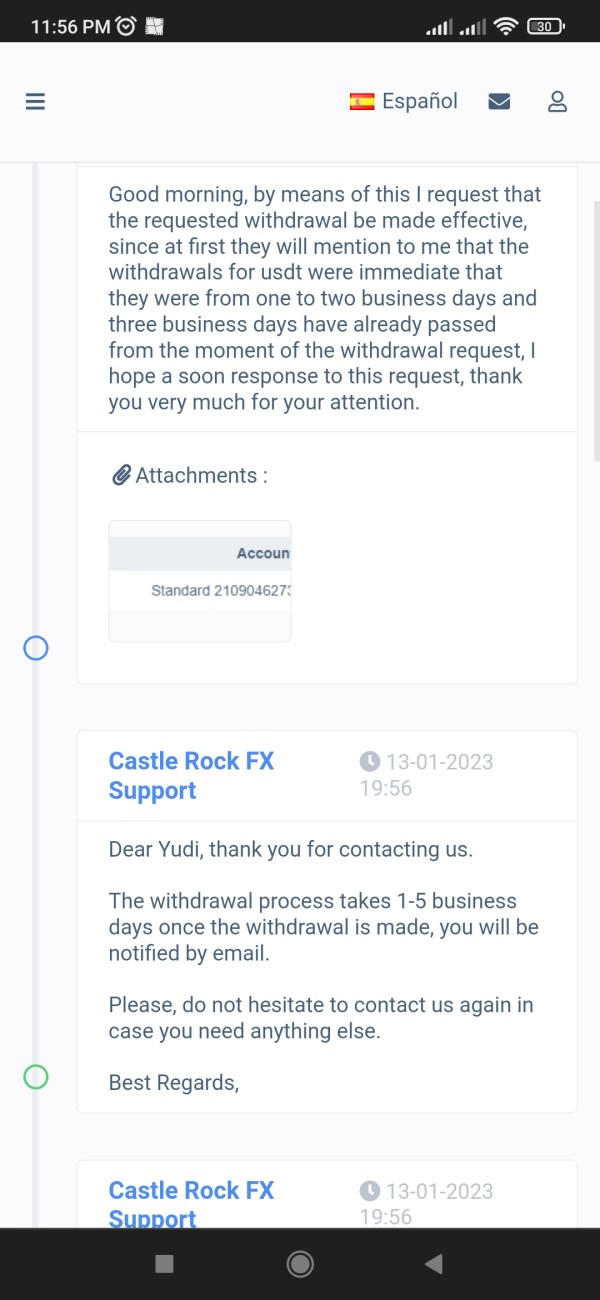

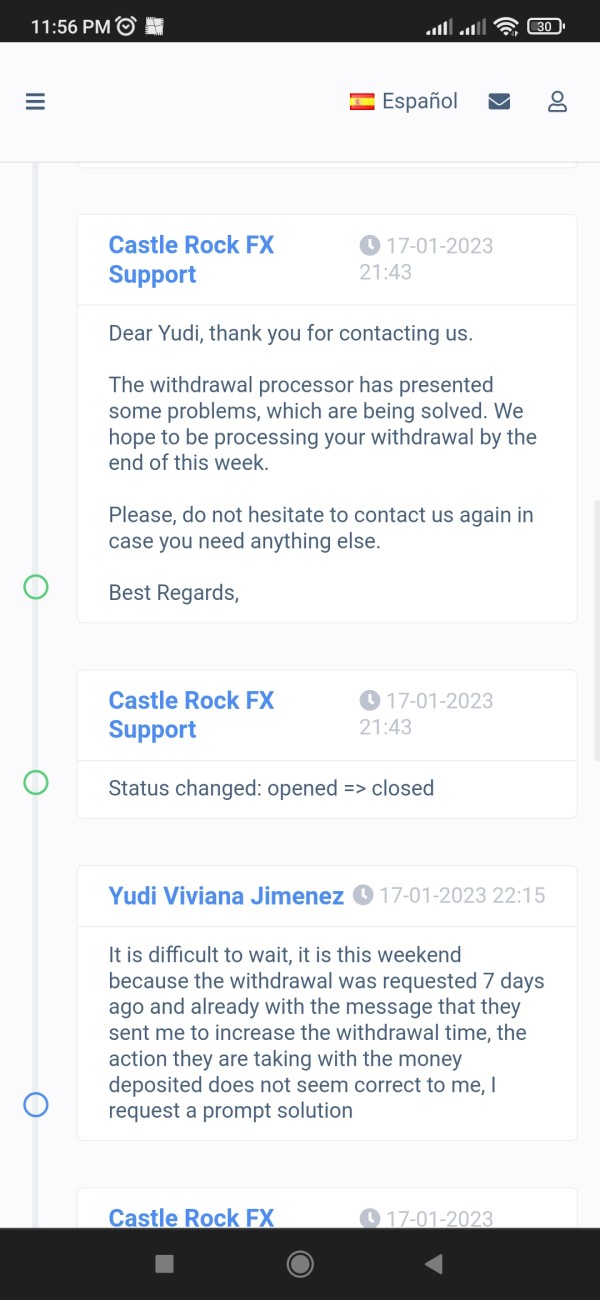

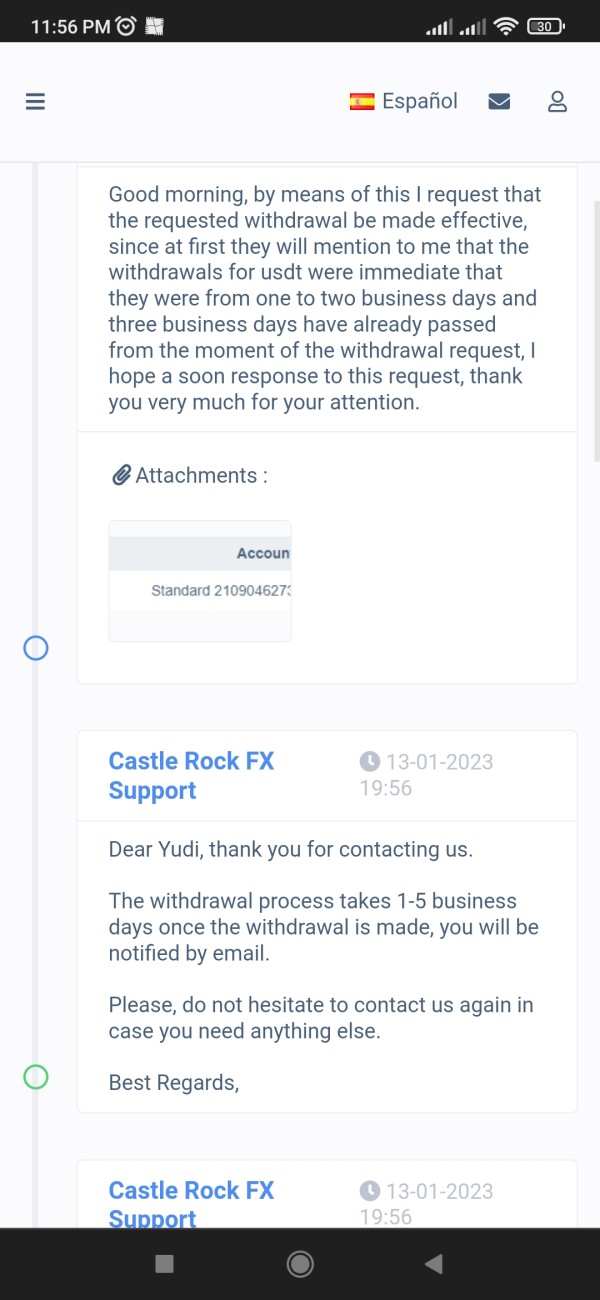

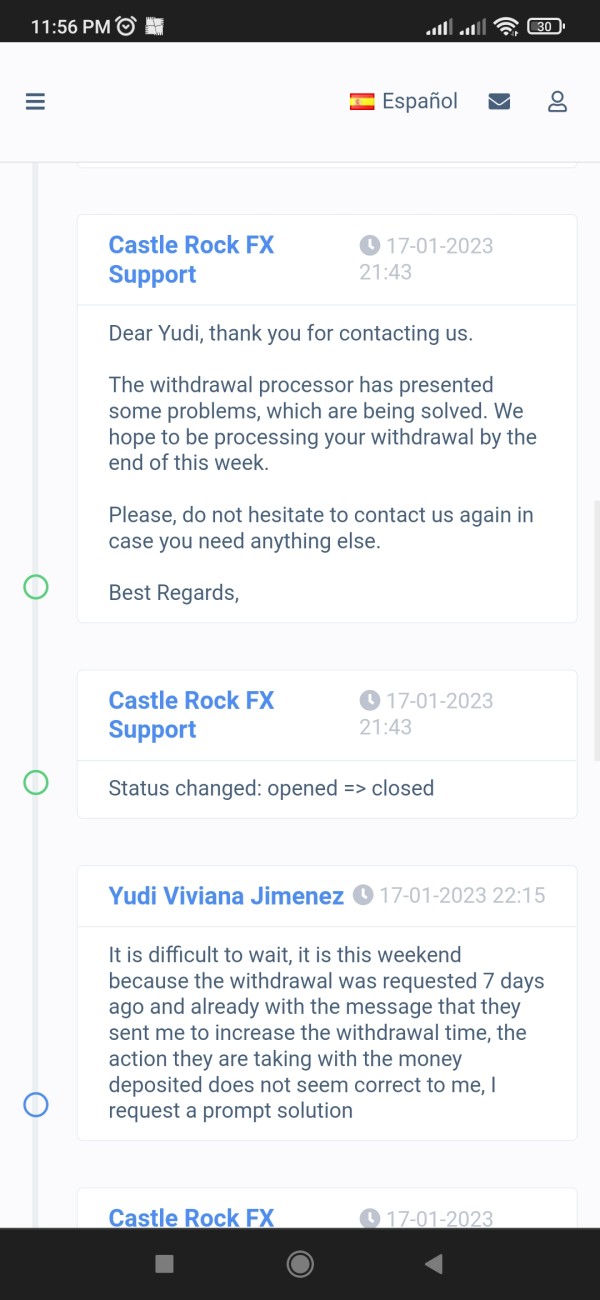

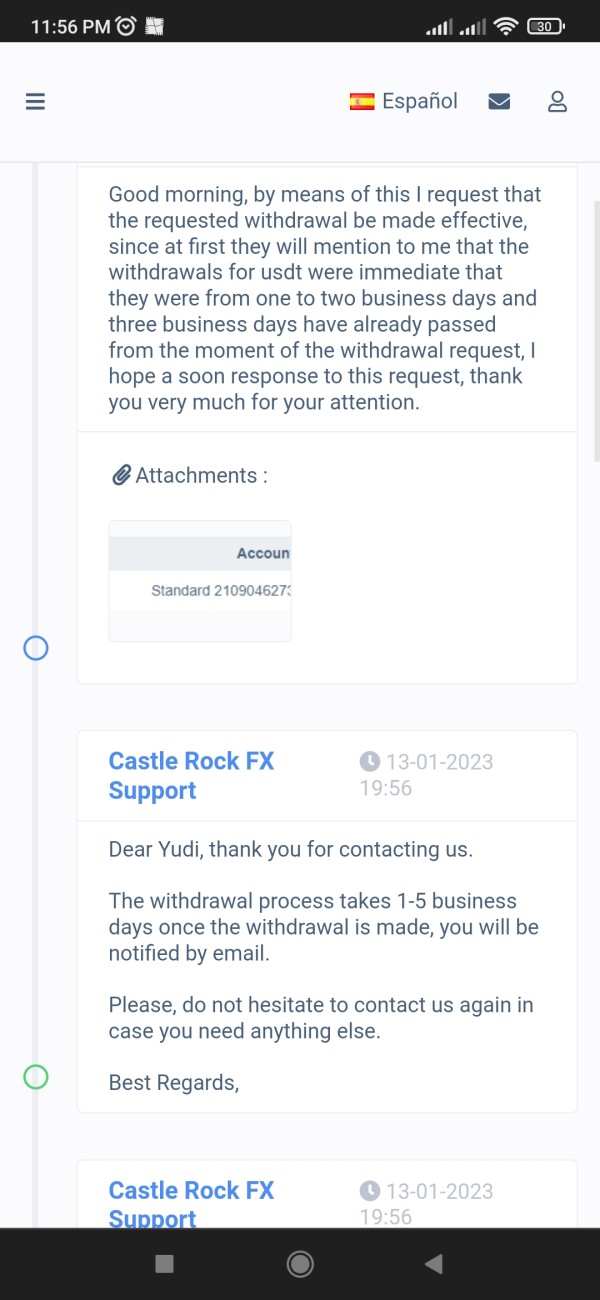

Response times and service quality metrics have not been disclosed. This makes it impossible to evaluate the efficiency of customer service operations. Traders often prioritize quick resolution of account, technical, or trading-related issues, particularly when dealing with time-sensitive market situations.

The absence of 24/7 support information is particularly concerning for forex traders who operate across global time zones. Foreign exchange markets operate continuously during weekdays, and traders may require assistance outside standard business hours. Without clear information about support availability, traders cannot rely on timely assistance when needed.

No information about dedicated account management, VIP support tiers, or specialized assistance for high-volume traders has been identified. This suggests a potentially standardized approach to customer service regardless of client value or trading volume.

Trading Experience Analysis

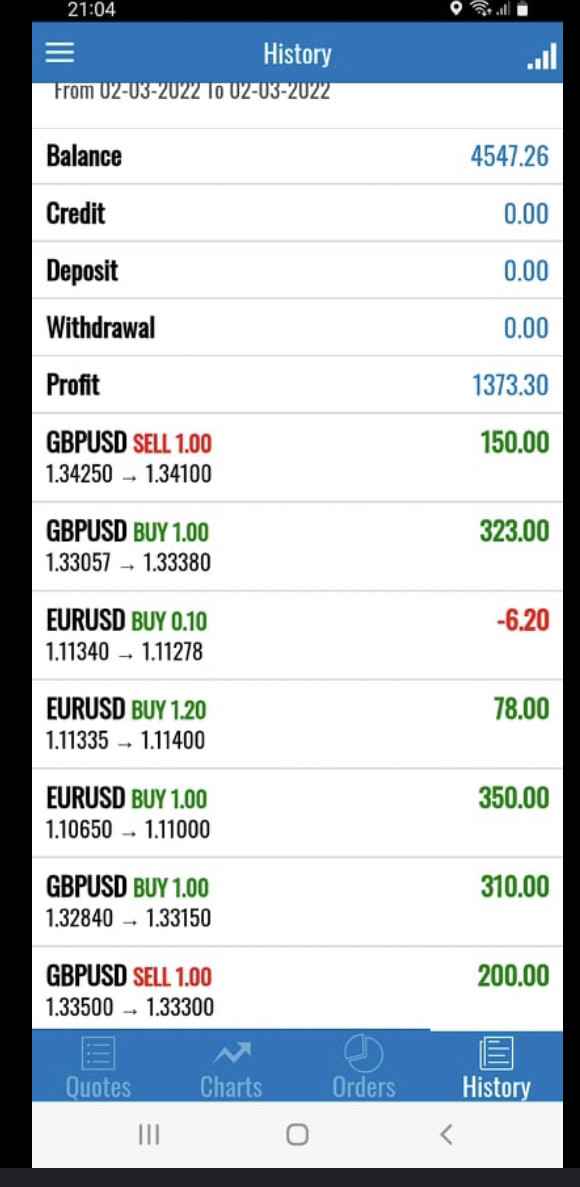

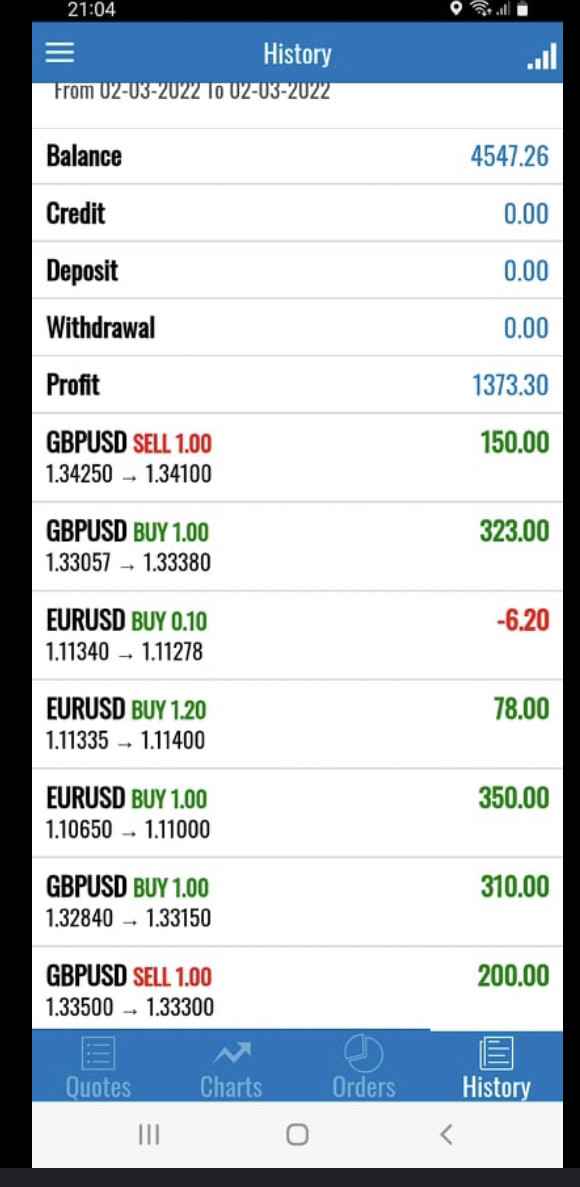

The trading experience at Castle Rock FX centers around the MetaTrader 4 platform. This provides a solid foundation for forex and CFD trading. MT4's widespread adoption in the industry means many traders are familiar with its interface, charting capabilities, and order management features. The platform's stability and functionality are generally well-regarded, though specific performance metrics for Castle Rock FX's MT4 implementation have not been provided.

However, the apparent lack of mobile platform support significantly impacts the overall trading experience in today's mobile-first environment. Many traders rely on smartphone and tablet applications to monitor positions, execute trades, and manage risk while away from desktop computers. This castle rock fx review identifies the limited mobile accessibility as a substantial drawback for active traders.

Order execution quality information has not been disclosed. This leaves traders without insight into execution speeds, slippage rates, or requote frequency. These factors significantly impact trading profitability, particularly for scalpers and high-frequency traders who rely on precise order execution.

The trading environment's competitiveness cannot be assessed without information about spreads, commission structures, or execution statistics. While the STP business model suggests orders are passed to liquidity providers, the quality of those relationships and their impact on client execution remain unclear.

Platform customization options, while likely available through MT4's standard features, have not been specifically detailed. Advanced traders often require specialized indicators, custom Expert Advisors, or specific charting configurations that may or may not be supported.

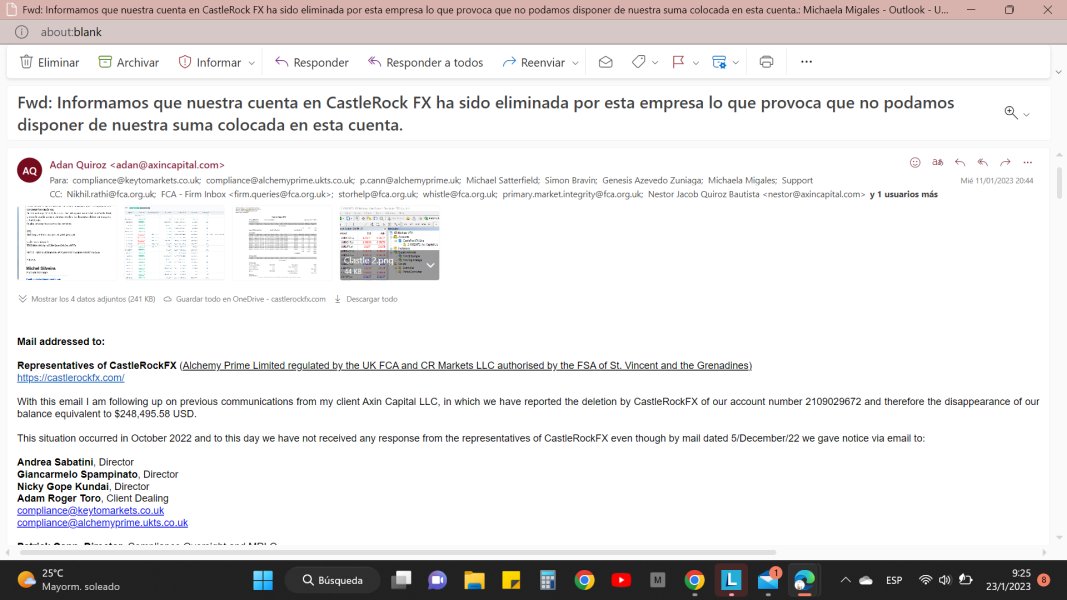

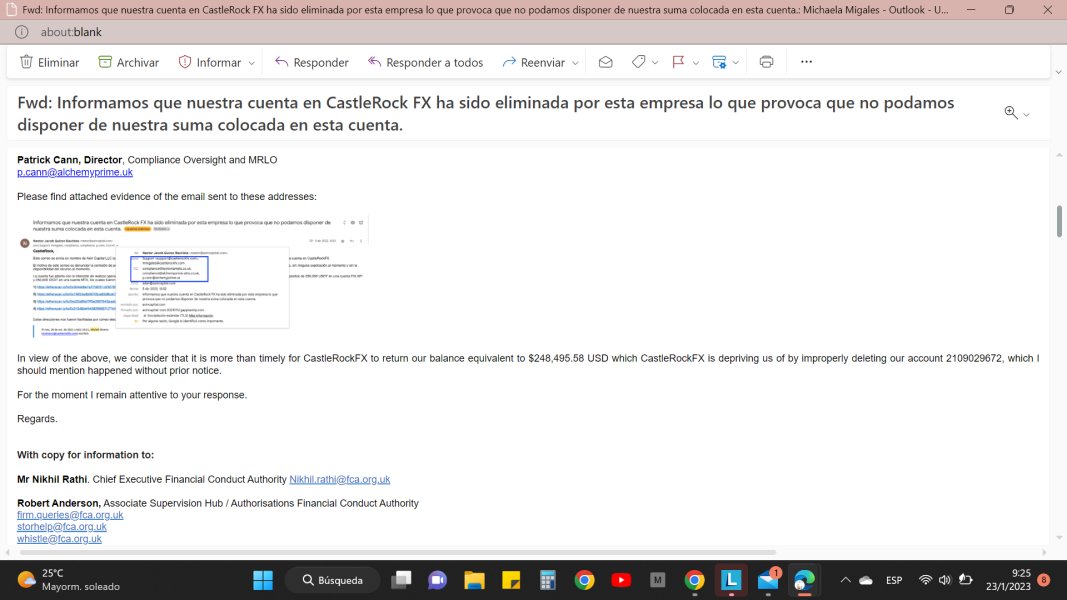

Trust and Safety Analysis

Trust and safety represent the most significant concerns in this Castle Rock FX evaluation. The broker's unregulated status fundamentally impacts client protection and recourse options. Without oversight from established financial regulatory bodies, traders lack the safety nets typically provided by regulatory frameworks including compensation schemes, segregated client funds requirements, and standardized operational procedures.

The absence of regulatory oversight means Castle Rock FX is not subject to capital adequacy requirements that regulated brokers must maintain. These requirements ensure brokers have sufficient financial resources to meet client obligations even during adverse market conditions or operational difficulties.

Client fund protection measures have not been detailed in available information. Regulated brokers typically segregate client deposits from operational funds and may provide additional protection through investor compensation schemes. Without such protections, client funds may be at greater risk in the event of broker financial difficulties.

The company's transparency about ownership, financial statements, or operational details appears limited based on publicly available information. Established brokers often provide detailed company information, regulatory disclosures, and financial reporting to build client confidence.

No information about independent audits, third-party verification of trading conditions, or external oversight has been identified. These elements typically contribute to broker credibility and client confidence in the legitimacy of trading operations.

The offshore jurisdiction of Saint Vincent and the Grenadines, while legal for broker operations, provides limited regulatory oversight compared to major financial centers with comprehensive broker regulation frameworks.

User Experience Analysis

The user experience at Castle Rock FX shows both positive and negative elements based on available information. The fully digital account opening process represents a modern approach that likely reduces onboarding time and paperwork requirements compared to traditional broker registration procedures.

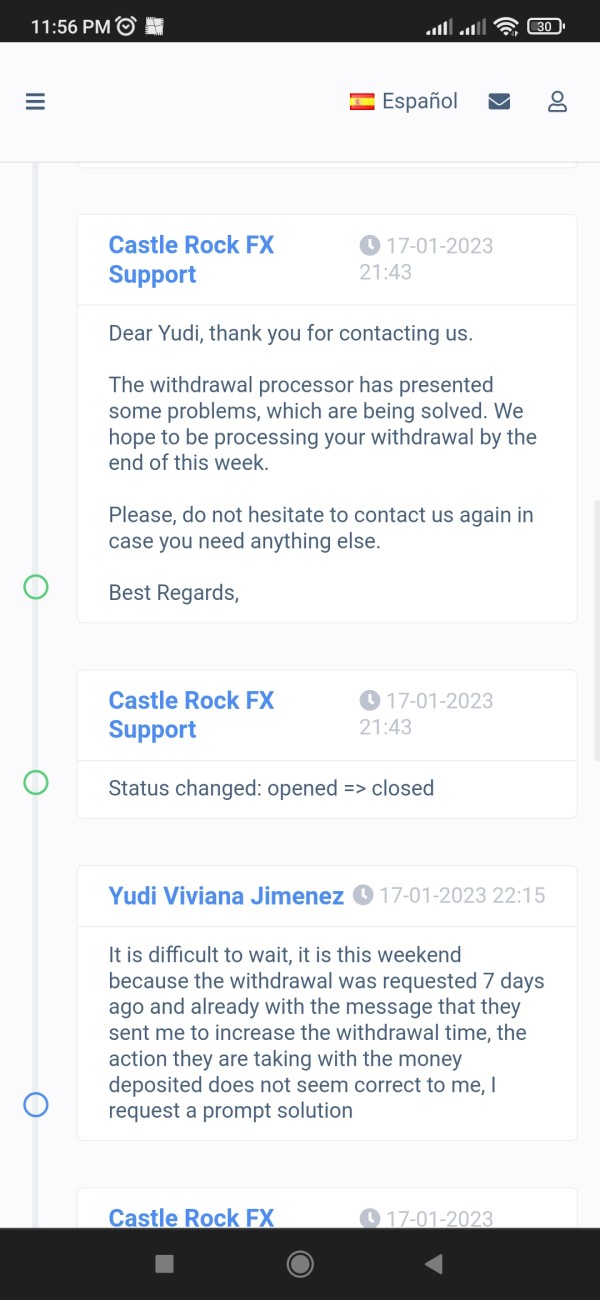

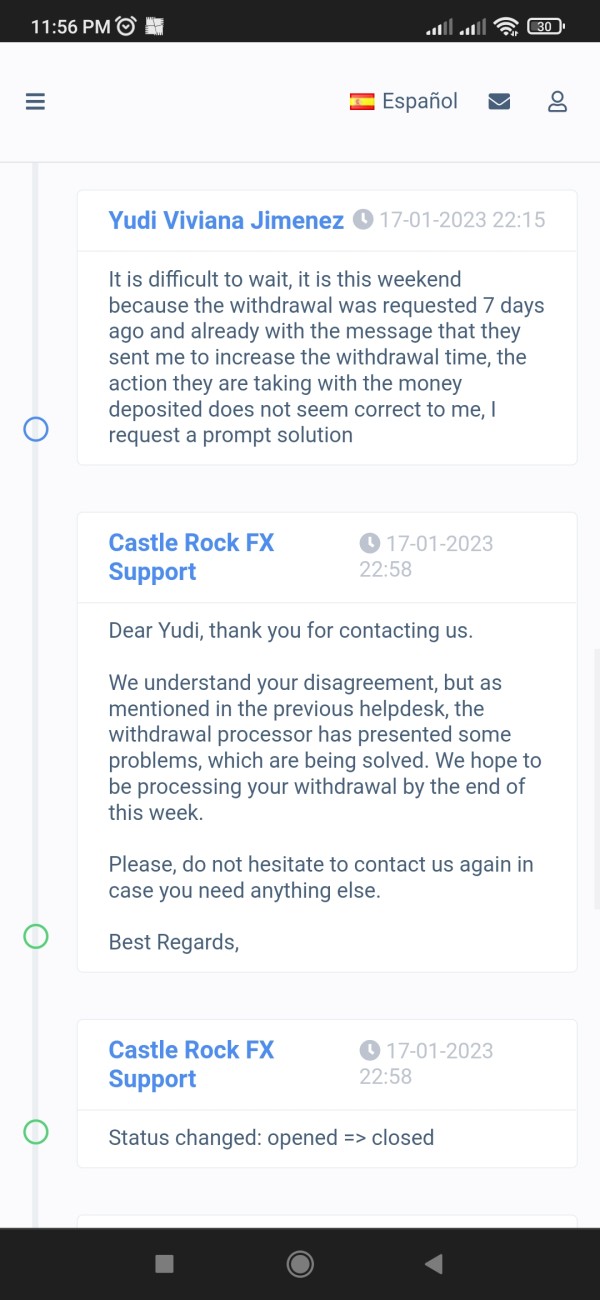

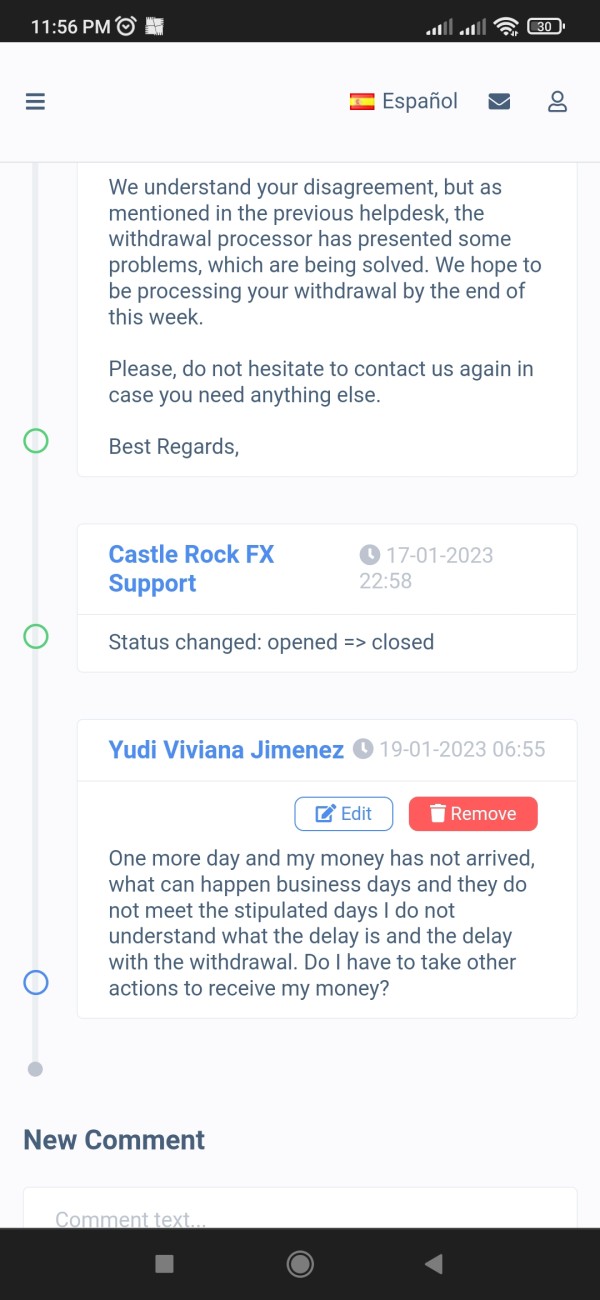

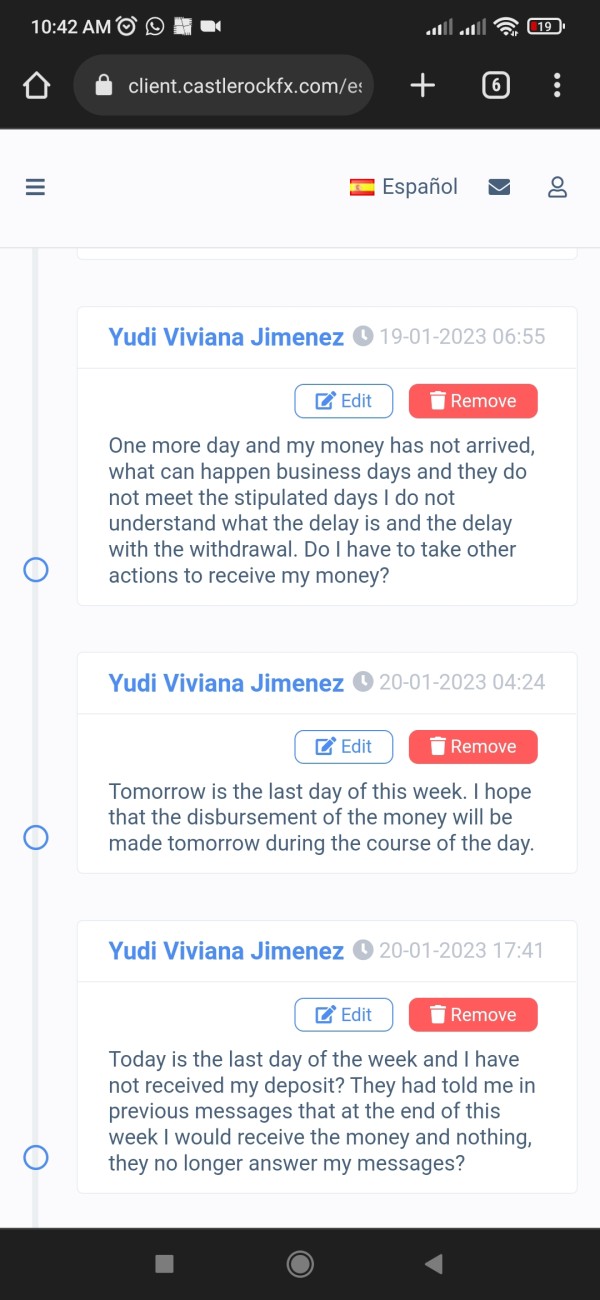

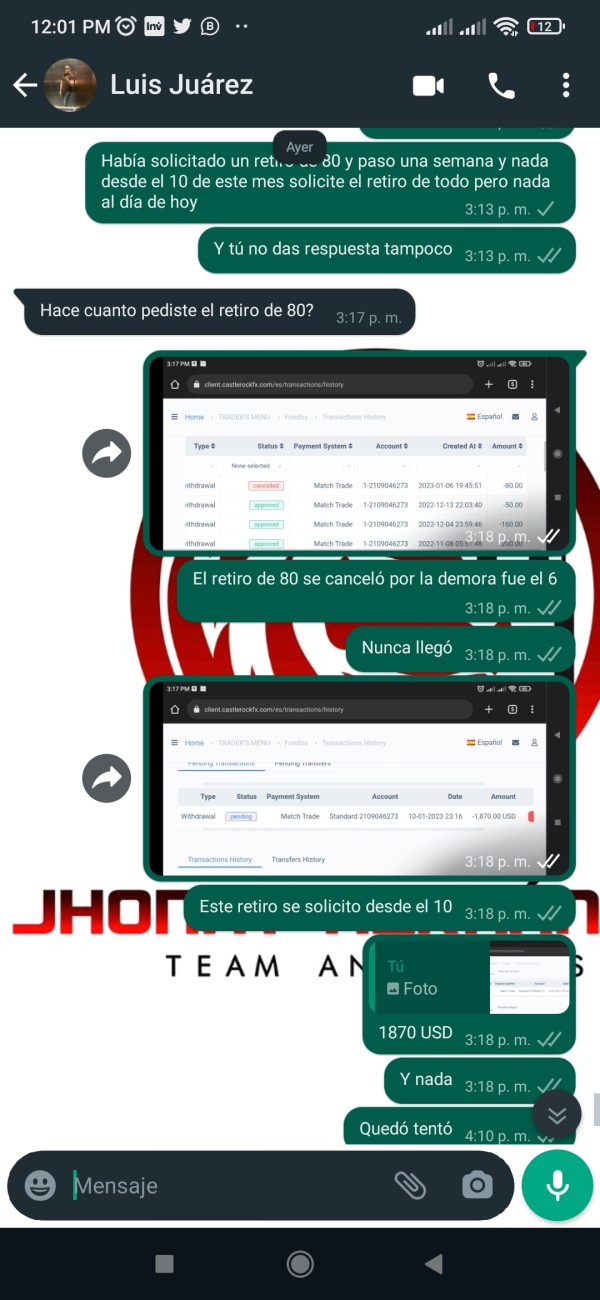

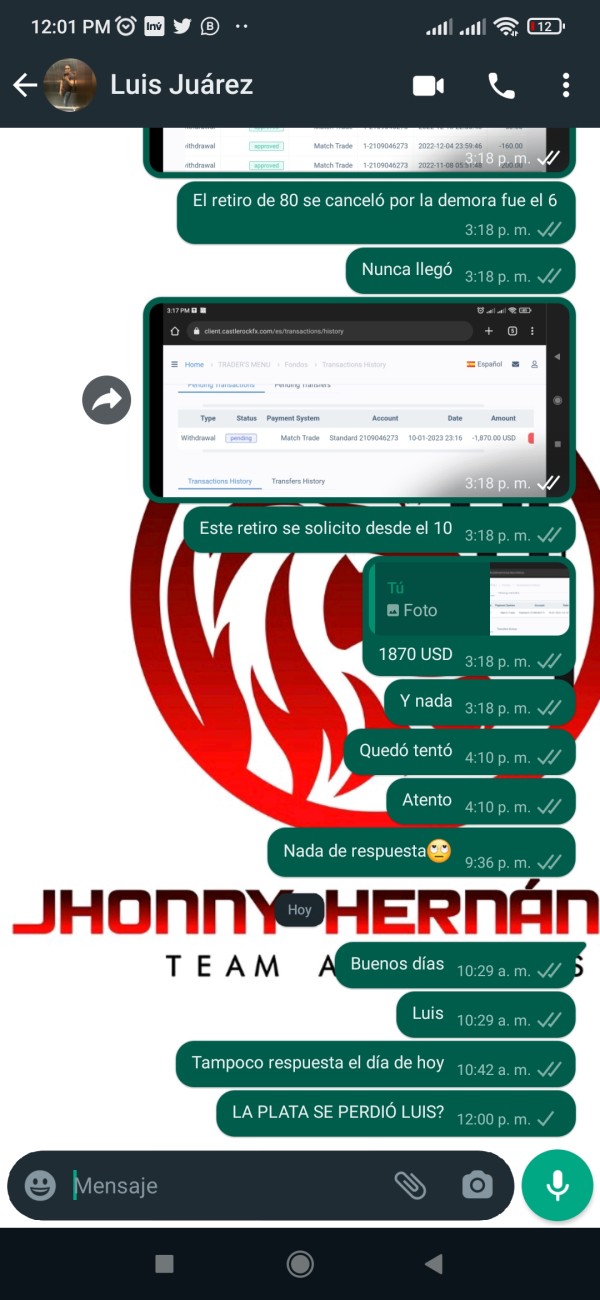

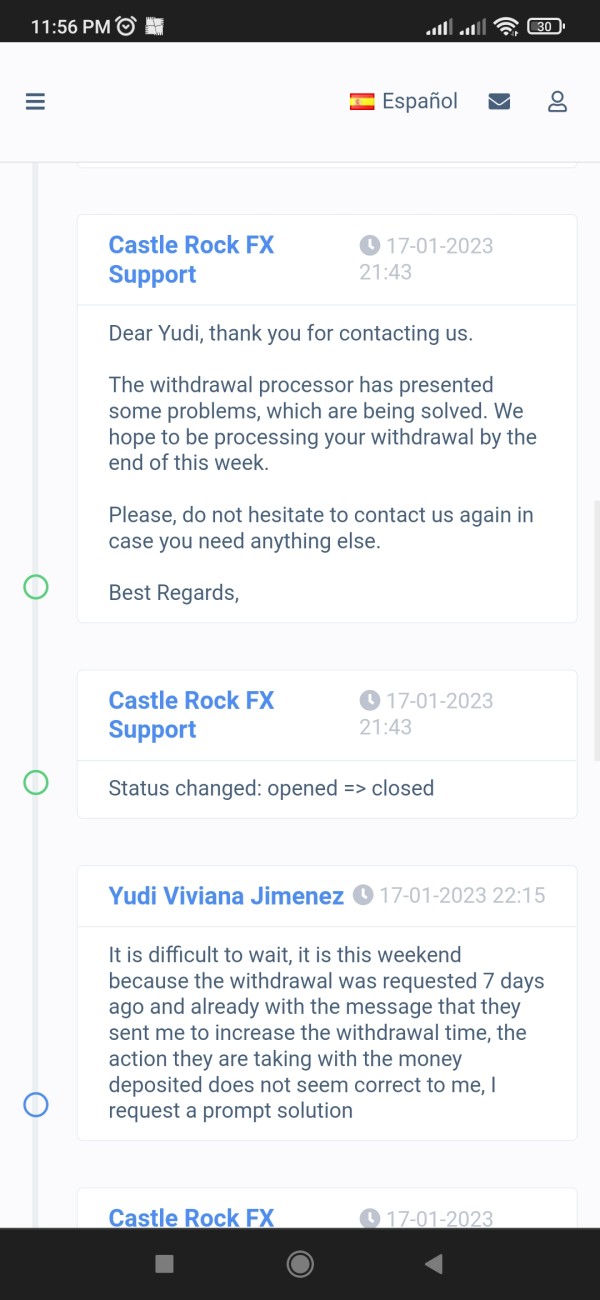

However, overall user satisfaction metrics and feedback have not been extensively documented in publicly available sources. User reviews and testimonials, which typically provide insight into real-world trading experiences, appear limited for Castle Rock FX.

Interface design and platform usability depend largely on the MT4 implementation. This generally provides a functional if somewhat dated user experience. While MT4 is powerful and feature-rich, its interface design reflects older software paradigms that may feel less intuitive compared to newer trading platforms.

The registration and verification process benefits from digital automation, though specific requirements, documentation needs, and approval timeframes have not been detailed. Modern traders often expect streamlined onboarding with minimal friction and quick account activation.

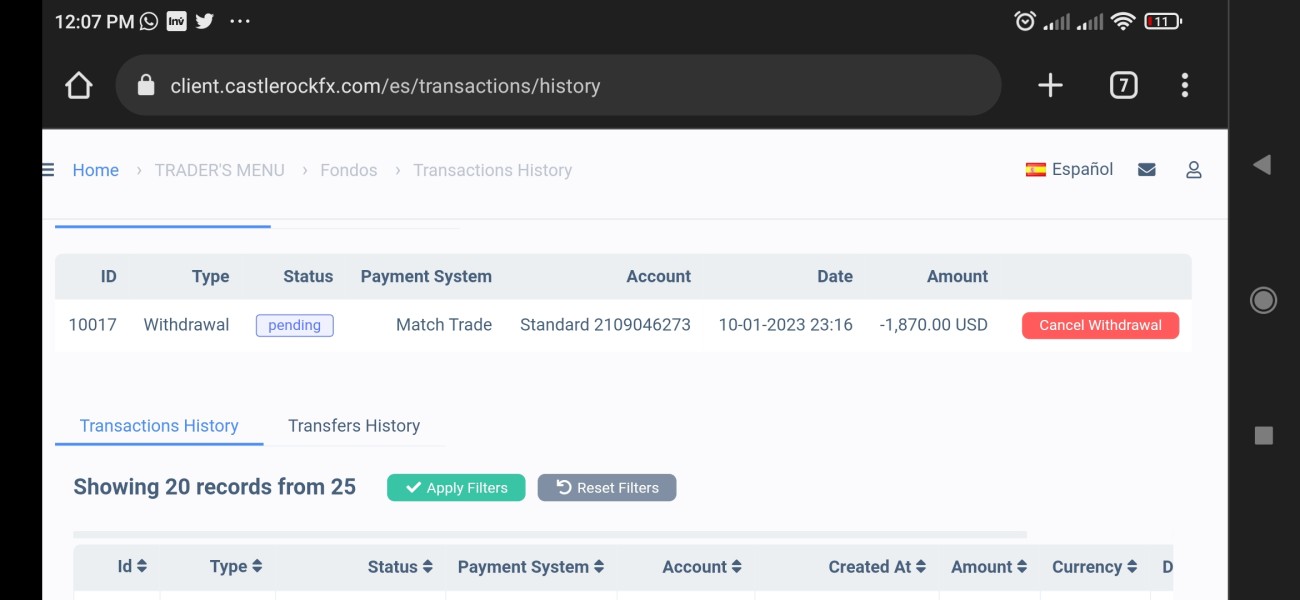

Fund management experience remains unclear due to limited information about deposit and withdrawal processes, processing times, and available payment methods. Efficient fund management significantly impacts overall user satisfaction, particularly for active traders who frequently move capital.

The target user profile appears to focus on active traders comfortable with higher-risk trading environments who prioritize leverage and asset diversity over regulatory protection. This positioning may appeal to experienced traders but could deter newcomers who value comprehensive support and regulatory oversight.

Conclusion

Castle Rock FX presents a mixed proposition for forex and derivatives traders in 2025. As an unregulated offshore broker, it offers attractive features including high leverage up to 1:500 and access to diverse financial instruments including cryptocurrencies, precious metals, and energy commodities through the established MT4 platform.

However, significant concerns about transparency, regulatory protection, and customer support limit its appeal to risk-conscious traders. The broker's English-only support, limited mobile platform compatibility, and lack of detailed pricing information create barriers for many potential clients.

Castle Rock FX appears most suitable for experienced traders who prioritize high leverage and asset diversity over regulatory oversight and comprehensive customer support. However, the substantial risks associated with unregulated brokers, including limited fund protection and recourse options, require careful consideration by any potential client.

Traders considering Castle Rock FX should thoroughly evaluate their risk tolerance, regulatory preferences, and support requirements before proceeding. The limited transparency and unregulated status make this broker unsuitable for novice traders or those prioritizing capital protection and regulatory oversight.