Regarding the legitimacy of Castle Rock FX forex brokers, it provides FCA and WikiBit, .

Is Castle Rock FX safe?

Business

License

Is Castle Rock FX markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Alchemy Prime Limited

Effective Date: Change Record

2014-08-05Email Address of Licensed Institution:

info@alchemyprime.uk, ricardo.dytz@alchemyprime.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.alchemyprime.ukExpiration Time:

--Address of Licensed Institution:

5th Floor 142 Central Street Clerkenwell London EC1V 8AR UNITED KINGDOMPhone Number of Licensed Institution:

+442070978794Licensed Institution Certified Documents:

Is Castle Rock FX Safe or Scam?

Introduction

Castle Rock FX is a forex broker that has recently garnered attention in the trading community. Operating primarily in the online forex market, it claims to offer a diverse range of trading instruments, including over 65 currency pairs, cryptocurrencies, and commodities. However, traders must exercise caution when evaluating brokers like Castle Rock FX, as the forex industry is rife with potential scams and unregulated entities. It is crucial for traders to conduct thorough research before entrusting their funds to any broker. This article aims to provide an objective analysis of Castle Rock FX, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation draws from various online reviews, regulatory databases, and customer feedback to form a comprehensive assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy and safety. Castle Rock FX operates under the ownership of CR Markets LLC, based in Saint Vincent and the Grenadines. Unfortunately, this location is known for its lax regulatory environment, which raises significant concerns about the safety of traders' funds. The following table summarizes the core regulatory information for Castle Rock FX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

As highlighted in the table, Castle Rock FX is not regulated by any major financial authority. This lack of oversight means that traders have little to no recourse in the event of disputes or issues with fund withdrawals. The absence of regulatory protection is a major red flag, as it indicates that the broker may not adhere to industry standards for transparency, safety, and client fund protection. Moreover, many reviews indicate that Castle Rock FX has a history of complaints from clients who have reported difficulties in withdrawing their funds, further suggesting that this broker may not be a safe choice for traders.

Company Background Investigation

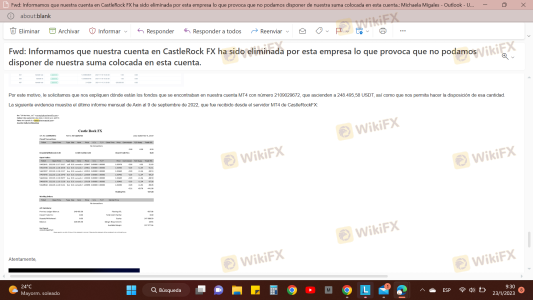

Castle Rock FX was established in 2020, and its ownership structure is listed under CR Markets LLC. The company claims to be associated with a UK-regulated entity, Alchemy Prime Limited, but investigations reveal that this connection is dubious at best. The Financial Conduct Authority (FCA) in the UK has issued warnings about cloned firms using legitimate firms' details to mislead potential clients. This lack of transparency regarding its ownership and regulatory affiliations raises concerns about the broker's credibility.

The management team behind Castle Rock FX is not well-documented, which adds to the opacity surrounding this broker. A reputable broker typically provides detailed information about its management team, including their professional backgrounds and experience in the financial sector. In contrast, Castle Rock FX lacks this transparency, making it difficult for potential clients to assess the broker's reliability and expertise.

Overall, the company's questionable regulatory status, combined with its lack of transparency and unclear ownership, raises significant concerns about whether Castle Rock FX is a safe option for traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is essential. Castle Rock FX claims to offer competitive trading conditions, with a minimum deposit requirement as low as $5 and leverage ratios reaching up to 1:1000. However, such high leverage can significantly increase risk, especially for inexperienced traders.

The following table summarizes the core trading costs associated with Castle Rock FX:

| Cost Type | Castle Rock FX | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.5 - 1 pip | 1 - 2 pips |

| Commission Structure | $5 per lot | $7 per lot |

| Overnight Interest Range | Variable | Variable |

While the spreads appear competitive, the low minimum deposit can be misleading. It is essential to consider that brokers with such low deposit thresholds may not have the financial stability or regulatory backing to ensure client safety. Furthermore, the commission structure may not be transparent, as many reviews indicate hidden fees that can impact overall trading costs.

Customer Funds Security

The security of customer funds is paramount when selecting a forex broker. Castle Rock FX does not provide sufficient information about its fund protection measures. The lack of segregated accounts, which separate client funds from the broker's operational funds, raises serious concerns about the safety of traders' investments. Moreover, there is no indication that Castle Rock FX participates in any investor compensation schemes, which are typically offered by regulated brokers to protect clients in case of insolvency.

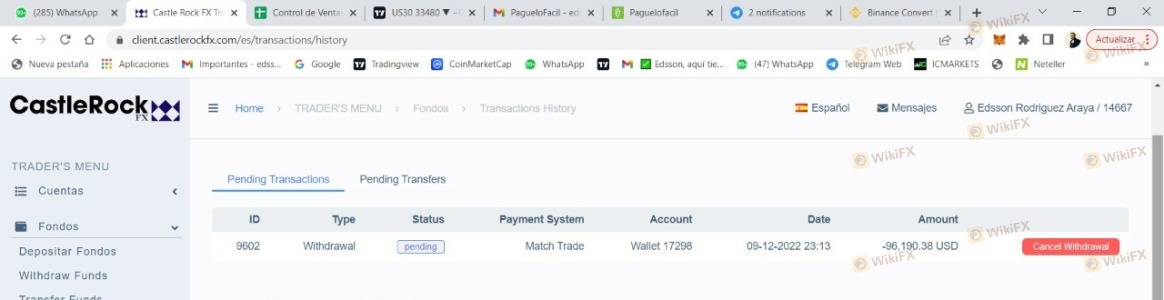

Historically, there have been reports of clients experiencing difficulties in withdrawing their funds from Castle Rock FX. Such incidents highlight the potential risks associated with trading with unregulated brokers. Without a robust framework for fund protection, traders may find themselves at risk of losing their investments.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. Reviews of Castle Rock FX reveal a pattern of complaints regarding withdrawal issues and unresponsive customer support. Many users have reported that their withdrawal requests were delayed or ignored, leading to frustration and financial losses. The following table outlines the main types of complaints received about Castle Rock FX:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Poor |

One notable case involved a client who requested a withdrawal of $10,000, only to be met with repeated delays and excuses from the customer support team. This experience underscores the potential risks associated with trading through Castle Rock FX and raises questions about the broker's commitment to customer service.

Platform and Trade Execution

The trading platform offered by Castle Rock FX is the widely used MetaTrader 4 (MT4), which is known for its user-friendly interface and robust trading features. However, reviews indicate that the platform may experience instability, particularly during high volatility periods. Users have reported instances of slippage and rejected orders, which can significantly impact trading performance. Such issues can be detrimental, especially for traders employing scalping or high-frequency trading strategies.

The lack of transparency regarding the broker's order execution practices is concerning. Traders should be wary of any signs of platform manipulation, as this can severely undermine their trading experience and profitability.

Risk Assessment

Using Castle Rock FX comes with a variety of risks that traders should carefully consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of investor protection and fund segregation. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

| Trading Platform Risk | Medium | Reports of slippage and execution issues. |

To mitigate these risks, traders should consider using regulated brokers with a proven track record of reliability and customer satisfaction. Additionally, it is advisable to only deposit funds that one can afford to lose, especially when trading with unregulated entities.

Conclusion and Recommendations

In conclusion, the analysis of Castle Rock FX raises significant concerns about its legitimacy and safety. The broker's lack of regulation, questionable company background, and numerous customer complaints suggest that it may not be a safe option for traders. Given the findings, it is prudent for potential clients to exercise extreme caution when considering Castle Rock FX.

For traders seeking a safer trading environment, it is recommended to explore reputable and regulated alternatives. Brokers like OANDA, IG, and Forex.com offer robust regulatory oversight and transparent trading conditions, making them more trustworthy options for forex trading. Ultimately, traders should prioritize safety and reliability when selecting a broker to protect their investments and ensure a positive trading experience.

Is Castle Rock FX a scam, or is it legit?

The latest exposure and evaluation content of Castle Rock FX brokers.

Castle Rock FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Castle Rock FX latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.