Capital IM Limited 2025 Review: Everything You Need to Know

Executive Summary

This capital im limited review shows major concerns about this forex broker that claims to offer global financial services. Capital IM Limited says it is an established broker providing diverse trading instruments including forex, precious metals, crude oil, indices, and cryptocurrencies. However, our detailed analysis finds serious red flags that potential investors must consider.

The broker claims registration with the Financial Crimes Enforcement Network (FINCEN), yet no record exists in FINCEN's registration database. According to multiple sources, the platform has been flagged with scam warnings, and user reviews are mostly negative, citing fraudulent activities and significant risks. The Financial Conduct Authority (FCA) records also show no evidence supporting Capital IM Limited's legitimacy in the UK market.

Capital IM Limited appears to target traders with higher risk tolerance, offering multi-asset trading opportunities. However, the lack of regulatory oversight, combined with widespread negative user feedback and scam allegations, makes this broker unsuitable for most retail investors seeking secure trading environments.

Important Notice

Regional Entity Differences: Capital IM Limited lacks registration with major regulatory authorities, raising serious questions about its legal status across different jurisdictions. The broker's claimed FINCEN registration cannot be verified through official databases, and no supporting evidence exists in FCA records.

Review Methodology: This evaluation is based on user feedback, regulatory database searches, and available public information. Given the limited transparency from the broker itself, our analysis relies heavily on third-party sources and user experiences to provide an accurate assessment of the platform's credibility and safety.

Rating Framework

Broker Overview

Capital IM Limited positions itself as a global financial services provider. However, specific information about its establishment date and company background remains unclear in available documentation. The broker's business model appears to focus on multi-asset trading, targeting investors interested in diversified portfolio opportunities across various financial markets.

The platform claims to offer comprehensive trading services spanning multiple asset classes. According to available information, Capital IM Limited provides access to foreign exchange markets, precious metals trading, crude oil investments, major market indices, and cryptocurrency trading options. This diverse offering suggests an attempt to cater to traders seeking portfolio diversification across traditional and digital assets.

However, the broker's regulatory status raises immediate concerns. While Capital IM Limited claims registration with FINCEN, verification through official channels reveals no supporting documentation. Similarly, searches through the UK's Financial Conduct Authority database yield no evidence of legitimate registration or authorization. This capital im limited review emphasizes that regulatory compliance remains a critical factor in broker selection, and the absence of verifiable licensing presents significant risks for potential investors.

Regulatory Regions: Available documentation does not specify particular regulatory jurisdictions where Capital IM Limited operates legally. The claimed FINCEN registration lacks verification, and major regulatory bodies show no record of authorization.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in accessible sources. This raises transparency concerns about fund management procedures.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This indicates a lack of clear account opening requirements.

Bonus and Promotions: No specific information about promotional offers, welcome bonuses, or ongoing incentives is mentioned in available sources.

Tradeable Assets: Capital IM Limited offers multiple trading instruments including foreign exchange pairs, precious metals (likely gold and silver), crude oil contracts, major market indices, and various cryptocurrencies. This allows for diversified trading strategies across traditional and digital markets.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not transparently provided. This makes it difficult for potential clients to assess the true cost of trading.

Leverage Ratios: Specific leverage offerings and maximum ratios available to different account types are not detailed in accessible documentation.

Platform Options: Information about available trading platforms, whether proprietary or third-party solutions like MetaTrader, is not specified in available sources.

Geographic Restrictions: Specific countries or regions where services are restricted or unavailable are not clearly outlined in accessible documentation.

Customer Service Languages: Available customer support languages and communication options are not detailed in the information reviewed for this capital im limited review.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

Capital IM Limited's account conditions present significant transparency issues that contribute to its poor rating in this category. The broker fails to provide clear information about account types, their specific features, or the requirements for accessing different service levels. This lack of transparency immediately raises red flags for potential investors seeking detailed account information before committing funds.

The absence of clearly stated minimum deposit requirements makes it impossible for traders to understand the financial commitment needed to begin trading. Professional brokers typically provide detailed account specifications, including various account tiers with different minimum deposits, features, and benefits. Capital IM Limited's failure to provide this basic information suggests either poor business practices or deliberate hiding of terms.

Account opening procedures and verification requirements are not detailed in available sources. This creates uncertainty about the onboarding process. Legitimate brokers typically outline their Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, document requirements, and verification timelines. The absence of such information in this capital im limited review indicates potential compliance issues.

Special account features such as Islamic accounts for Muslim traders, professional account categories, or institutional trading options are not mentioned. This suggests either a limited service offering or inadequate disclosure of available account types, both of which negatively impact the overall account conditions assessment.

Capital IM Limited receives a moderate score for tools and resources primarily due to its claimed offering of diverse trading instruments across multiple asset classes. The broker provides access to forex markets, precious metals, crude oil, indices, and cryptocurrencies, which allows traders to implement various diversification strategies and explore different market opportunities.

However, the platform falls short in providing detailed information about research and analytical resources. Professional trading platforms typically offer market analysis, economic calendars, technical indicators, and expert commentary to support trader decision-making. The absence of specific information about these educational and analytical tools significantly limits the platform's value proposition.

Educational resources, which are crucial for trader development, are not detailed in available documentation. Reputable brokers typically provide webinars, tutorials, market guides, and educational content to help traders improve their skills and understanding of financial markets. The lack of transparent information about such resources suggests either their absence or poor communication of available offerings.

Automated trading support, including Expert Advisor compatibility or algorithmic trading tools, is not mentioned in available sources. Modern traders often rely on automated strategies, and the absence of information about such capabilities may limit the platform's appeal to sophisticated traders seeking advanced trading solutions.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of Capital IM Limited's most problematic areas. Multiple sources report poor customer support experiences, with users expressing frustration about unresponsive or inadequate assistance when encountering problems or seeking information. Available documentation does not specify customer service channels, such as live chat, email support, or telephone assistance.

Professional brokers typically provide multiple contact methods with clearly stated operating hours and expected response times. The absence of transparent customer service information raises concerns about the broker's commitment to client support. Response time expectations and service level agreements are not detailed, making it impossible for potential clients to understand what level of support they can expect.

Industry-standard practice includes providing estimated response times for different communication channels and priority levels for various types of inquiries. Multilingual support capabilities remain unclear, which could significantly impact international clients' ability to receive adequate assistance. Global brokers typically specify supported languages and regional support options to ensure effective communication with their diverse client base.

The negative user feedback pattern suggests systemic customer service issues rather than isolated incidents. This indicates potential structural problems in the broker's support infrastructure and staff training.

Trading Experience Analysis (Score: 4/10)

The trading experience evaluation for Capital IM Limited is hampered by limited technical information about platform capabilities, order execution quality, and overall trading environment. Available sources do not provide specific details about trading platforms used, whether proprietary solutions or established third-party platforms like MetaTrader 4 or 5.

Platform stability and execution speed, crucial factors for successful trading, are not documented in available sources. Professional traders require reliable platform performance, especially during volatile market conditions when rapid order execution can significantly impact trading outcomes. The absence of technical performance data or user testimonials about platform reliability raises concerns.

Order execution quality, including fill rates, slippage statistics, and rejection rates, is not transparently reported. Reputable brokers typically provide execution statistics or third-party audits of their trading environment to demonstrate fair and efficient order processing. The lack of such information makes it difficult to assess the actual trading conditions clients might experience.

Mobile trading capabilities and cross-device synchronization are not detailed, which is particularly important given the increasing reliance on mobile trading solutions. Modern traders expect seamless transitions between desktop and mobile platforms with synchronized account information and trading positions.

User feedback regarding trading experience is predominantly negative, with reports of problematic interactions and potential fraudulent activities. This capital im limited review emphasizes that negative user experiences significantly impact the overall trading environment assessment, regardless of claimed platform features.

Trust and Safety Analysis (Score: 1/10)

Capital IM Limited receives the lowest possible score for trust and safety due to multiple serious concerns about its legitimacy and regulatory compliance. The broker's claimed registration with the Financial Crimes Enforcement Network (FINCEN) cannot be verified through official database searches, immediately raising questions about the truthfulness of its regulatory claims.

The Financial Conduct Authority (FCA) records show no evidence supporting Capital IM Limited's legitimacy in the UK market. This is despite the broker's apparent targeting of international clients. Regulatory authorization is fundamental for broker credibility, and the absence of verifiable licensing from major financial authorities represents a critical safety concern.

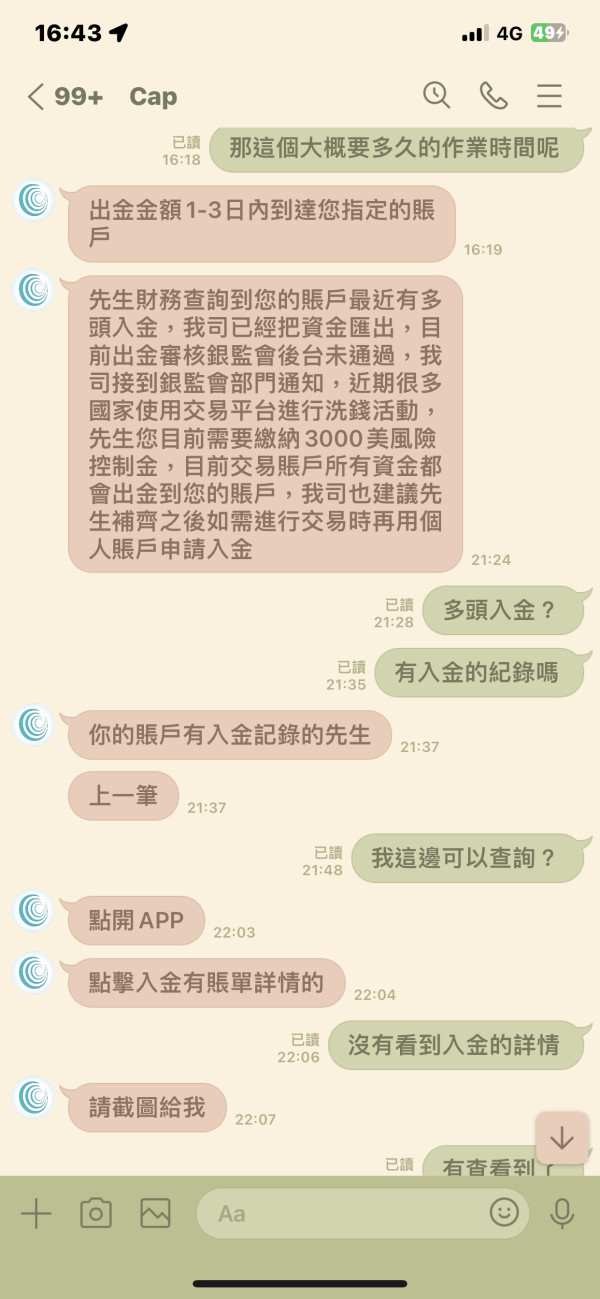

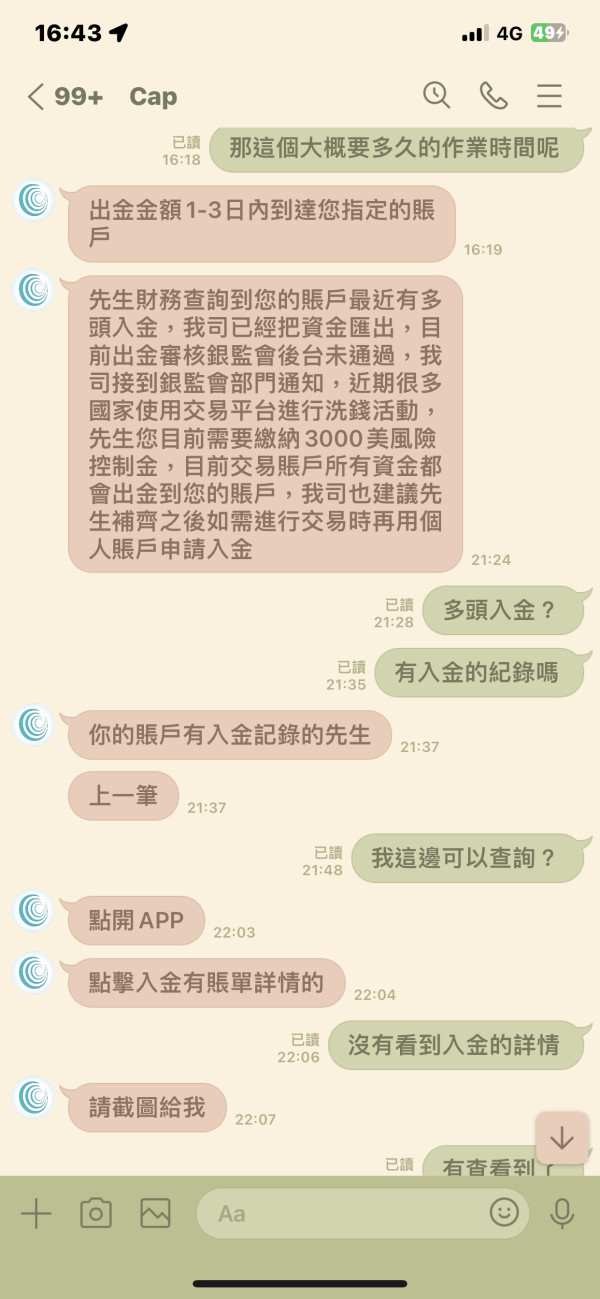

Multiple sources have flagged Capital IM Limited with "SCAM" status, indicating widespread industry concern about the broker's practices and legitimacy. Such warnings from various platforms and review sites suggest a pattern of problematic behavior that extends beyond isolated incidents or misunderstandings.

Fund safety measures, such as segregated client accounts, deposit insurance, or compensation schemes, are not detailed in available documentation. Legitimate brokers typically provide clear information about client fund protection measures and regulatory safeguards that protect investor deposits in case of broker insolvency or misconduct.

The combination of unverified regulatory claims, scam warnings, and lack of transparent safety measures creates an extremely high-risk environment for potential investors. This justifies the minimal trust and safety rating.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Capital IM Limited is extremely poor, with predominantly negative reviews and widespread reports of fraudulent activities. User feedback consistently highlights problematic experiences ranging from poor customer service to more serious allegations of deceptive practices and financial misconduct.

Interface design and platform usability information is not available in accessible sources. This makes it impossible to assess the technical user experience aspects such as navigation, feature accessibility, and overall design quality. Professional trading platforms typically prioritize user-friendly interfaces that facilitate efficient trading and account management.

Registration and account verification processes are not clearly documented, creating uncertainty about the ease and requirements for account opening. Streamlined onboarding processes are essential for positive user experiences, and the lack of clear information suggests potential complications in account establishment.

Fund operation experiences, including deposit and withdrawal processes, are not detailed in available sources. However, the negative user feedback pattern suggests potential issues with financial transactions and fund accessibility, which are critical components of the overall user experience.

Common user complaints center around fraudulent behavior and risk exposure, with multiple sources warning about potential scams and deceptive practices. The consistency of negative feedback across various platforms indicates systemic issues rather than isolated problems, significantly impacting the overall user experience assessment.

Conclusion

This comprehensive capital im limited review reveals significant concerns that make Capital IM Limited unsuitable for most traders seeking secure and reliable forex brokerage services. The broker's inability to provide verifiable regulatory credentials, combined with widespread scam warnings and predominantly negative user feedback, creates an extremely high-risk investment environment.

Capital IM Limited is not recommended for risk-averse traders or those seeking regulated, transparent trading environments. The lack of regulatory oversight, poor customer service reports, and fraudulent activity allegations make this broker inappropriate for serious investors prioritizing capital protection and regulatory compliance.

The main disadvantages include absence of regulatory support from major authorities, predominantly negative user reviews citing fraudulent activities, lack of transparency regarding trading conditions and costs, and poor customer service quality. While the broker offers diverse trading instruments across multiple asset classes, this single advantage is heavily outweighed by the numerous serious concerns identified in this analysis.

Potential investors are strongly advised to consider well-regulated alternatives with transparent business practices, verifiable licensing, and positive user feedback before committing funds to any trading platform.