BTIG 2025 Review: Everything You Need to Know

Executive Summary

BTIG is a global financial services firm. The company has built a strong position in institutional trading and investment banking services. This btig review shows a company that works across 14 cities in North America, Europe, Asia, and Australia. BTIG serves mainly institutional investors and high-net-worth clients. The firm employs over 500 people worldwide and focuses on multi-asset class execution, investment banking, research, and related brokerage services.

The firm has won industry awards. BTIG was named Hedgeweek's Best Prime Broker and received recognition for capital introduction services. However, employee feedback data shows BTIG has a moderate overall rating of 3 out of 5 stars. Only 45% of employees would recommend the company, and 45% feel positive about the company's future.

BTIG offers many core services including global sales, portfolio management, electronic and outsource trading, transition management, investment banking, prime brokerage, capital introduction, corporate access, research and strategy, and commission management. The firm wants to be a trusted partner for institutional and corporate clients who need personalized service and expertise throughout the investment process.

Important Notice

This review uses publicly available information and employee feedback data. BTIG operates in multiple countries, so regulatory rules, service terms, and operating conditions may differ greatly by region. Potential clients should check regulatory status and service availability in their area before using BTIG's services.

This review's evaluation method relies on anonymous employee reviews, industry reports, and publicly shared company information. Specific trading conditions, regulatory compliance details, and client service metrics were not available in the source materials reviewed for this analysis.

Rating Framework

Broker Overview

BTIG is a global financial services firm that focuses mainly on institutional trading, investment banking, research, and related brokerage services. The company has become a major player in the institutional finance space by using expertise across multiple asset classes and geographic regions. Company information shows that BTIG's professionals work to help maximize results for institutional and corporate clients through personalized execution and comprehensive financial insights.

The firm's business model centers on providing advanced financial services to institutional clients. This includes investment banking services, global sales operations, portfolio management, electronic and outsource trading capabilities, and transition management. BTIG also offers prime brokerage services, capital introduction, corporate access, research and strategy services, and commission management solutions.

The reviewed materials did not include specific founding details, but BTIG has grown to operate across 14 cities spanning North America, Europe, Asia, and Australia. The company employs over 500 professionals who service clients at every stage of the investment lifecycle. This btig review shows that the firm has built its reputation on providing expertise and insights to institutional investors seeking comprehensive financial services across global markets.

Regulatory Coverage: The reviewed source materials did not detail specific regulatory information, though the firm operates across multiple international jurisdictions.

Deposit and Withdrawal Methods: The reviewed materials did not include specific information about funding methods.

Minimum Deposit Requirements: Available documentation did not specify minimum deposit thresholds.

Promotions and Bonuses: The reviewed source materials did not mention specific promotional offerings.

Tradable Assets: BTIG offers multi-asset class execution services, but available information did not detail specific asset categories and instruments.

Cost Structure: The reviewed materials did not include detailed fee schedules and commission structures for this btig review.

Leverage Ratios: Available source materials did not mention specific leverage offerings.

Platform Options: Reviewed documentation did not include trading platform specifications and technology details.

Geographic Restrictions: BTIG operates globally, but available materials did not detail specific regional limitations.

Customer Service Languages: Reviewed sources did not specify language support information.

Detailed Rating Analysis

Account Conditions Analysis

The available source materials did not detail the specific account conditions offered by BTIG. As an institutional-focused financial services firm, BTIG likely offers account structures tailored to institutional investors and high-net-worth clients rather than retail trading accounts. The firm's emphasis on serving institutional and corporate clients suggests that account opening procedures and minimum requirements would be designed for sophisticated investors.

It's difficult to provide a comprehensive assessment of BTIG's account conditions without specific information about account types, minimum deposits, or special account features. The institutional focus implies that account structures would be customized based on client needs and regulatory requirements across different jurisdictions.

BTIG's global operations across 14 cities and multiple regulatory environments mean that account conditions likely vary by region and client type. This btig review cannot provide specific details about Islamic accounts, account opening processes, or minimum balance requirements due to the lack of available information in reviewed materials.

BTIG's tools and resources appear to center around institutional-grade research and strategy services. The reviewed materials did not include specific details about trading tools and analytical resources. The firm emphasizes research and strategy as core capabilities, suggesting that clients have access to professional-grade analytical resources.

The company's focus on multi-asset class execution implies sophisticated trading tools and execution capabilities. Available information did not detail specific platform features and automated trading support. BTIG's emphasis on electronic and outsource trading suggests technological capabilities designed for institutional clients.

Educational resources and research materials likely cater to the institutional client base rather than retail trader education. The firm's corporate access and research capabilities suggest that clients receive professional-grade market insights and analysis. The reviewed source materials did not include specific details about these resources.

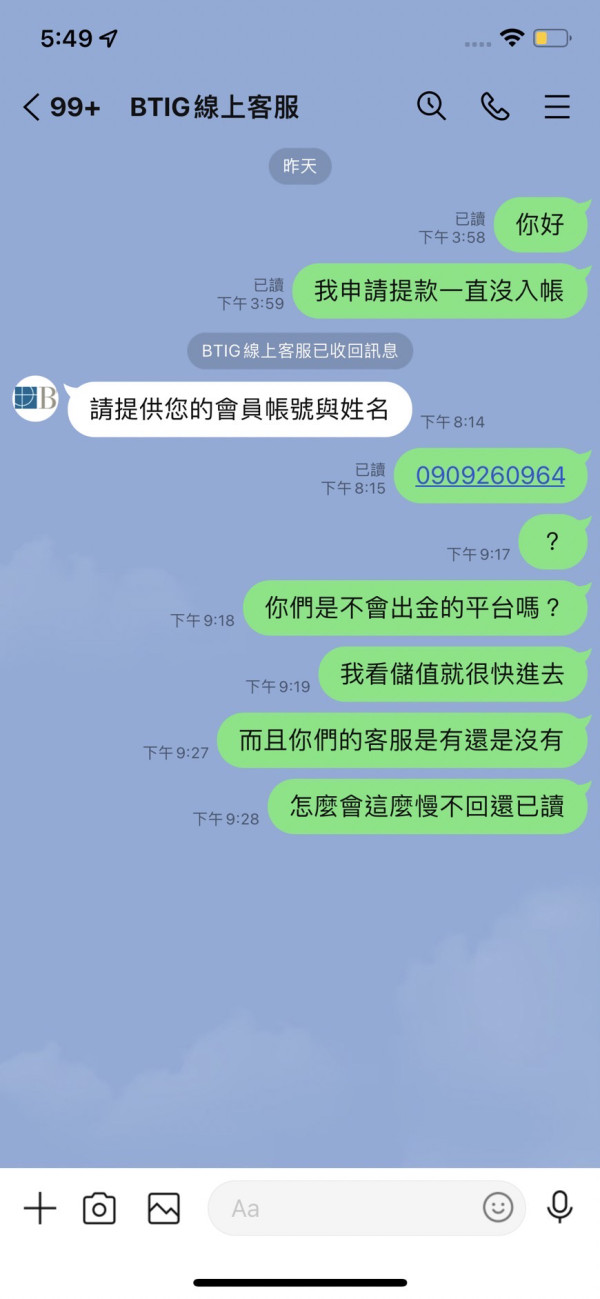

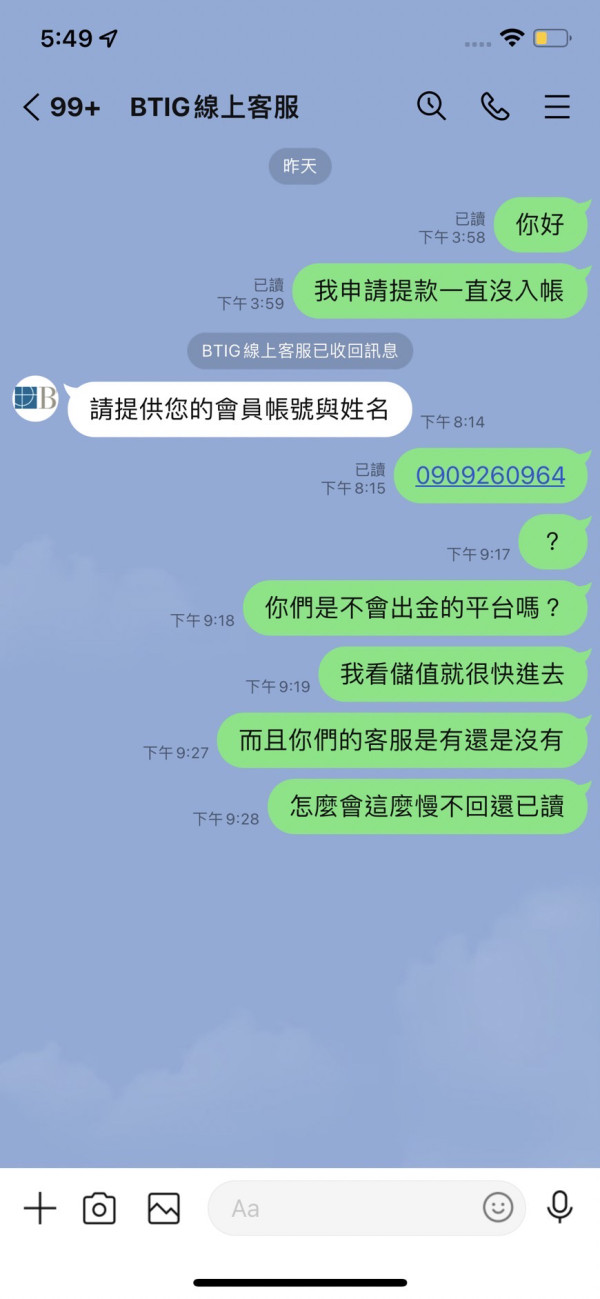

Customer Service and Support Analysis

The available source materials did not specifically detail customer service information for BTIG. As an institutional-focused firm operating across multiple global locations, BTIG likely provides dedicated relationship management and support services tailored to institutional clients' needs.

The firm's global presence across 14 cities in North America, Europe, Asia, and Australia suggests multi-regional support capabilities. Reviewed materials did not detail specific service channels, response times, and language support.

Customer support would likely involve dedicated relationship managers and specialized support teams rather than general retail customer service, given the institutional focus and global operations. However, a detailed assessment of BTIG's customer service capabilities cannot be provided in this review without specific information about service availability, response times, or support quality metrics.

Trading Experience Analysis

The trading experience offered by BTIG appears to focus on institutional-grade execution and multi-asset class capabilities. The reviewed materials did not include specific platform details. The firm emphasizes electronic and outsource trading as core capabilities, suggesting sophisticated execution technology designed for institutional clients.

BTIG's focus on global sales and portfolio services implies comprehensive trading capabilities across multiple markets and asset classes. The firm's emphasis on personalized execution suggests that trading experience is tailored to individual institutional client needs rather than standardized retail trading platforms.

This btig review cannot provide detailed insights into the technical aspects of BTIG's trading experience without specific information about platform stability, execution speeds, order types, or mobile trading capabilities. The institutional focus suggests that trading tools and execution capabilities would be designed for professional investors rather than retail traders.

Trust and Reliability Analysis

BTIG has demonstrated industry recognition through awards including Hedgeweek's Best Prime Broker designation. This provides some indication of industry standing and reliability. The firm has also received recognition as "Best Capital Introduction Provider," suggesting acknowledged expertise in specific service areas.

The company's global operations across multiple regulated jurisdictions implies compliance with various regulatory frameworks. Available source materials did not detail specific regulatory authorizations. BTIG's institutional focus and industry recognition suggest a level of professional standing within the financial services industry.

However, employee feedback indicates mixed sentiment, with only 45% of employees willing to recommend the company and 45% expressing positive views about the company's prospects. Industry awards provide some validation of service quality, but the moderate employee satisfaction ratings suggest areas for potential improvement in organizational culture and operations.

User Experience Analysis

User experience at BTIG appears to be mixed based on available feedback data. The overall employee rating of 3 out of 5 stars suggests moderate satisfaction levels. Only 45% of employees would recommend the company to friends, indicating room for improvement in overall user and employee experience.

The institutional focus of BTIG's services means that user experience would primarily relate to professional clients rather than retail users. The reviewed materials did not include interface design and ease of use details, making it difficult to assess the technical user experience aspects.

This btig review suggests that while BTIG maintains industry recognition for specific services, the overall user experience may benefit from enhancement, given the moderate employee recommendation rate and overall satisfaction scores. The 45% positive outlook among employees indicates mixed confidence in the company's direction and user experience improvements.

Conclusion

BTIG presents itself as a globally recognized institutional financial services firm with notable industry achievements, including recognition as Hedgeweek's Best Prime Broker. However, this review reveals limited publicly available information about specific trading conditions, regulatory details, and client-facing services that would typically inform retail trader decisions.

The firm appears best suited for institutional investors and high-net-worth clients seeking sophisticated financial services across global markets. BTIG's strengths include industry recognition, global operational presence, and comprehensive institutional service offerings. However, the moderate employee satisfaction ratings and lack of detailed service information represent areas where transparency and experience could be enhanced.

Potential clients should conduct thorough due diligence regarding regulatory status, service availability, and specific terms in their jurisdiction before engaging with BTIG's services.