BidAsks 2025 Review: Everything You Need to Know

Executive Summary

This bidasks review looks at a forex broker that shows big concerns for traders who might want to use it. The company has very low trust ratings from users. BidAsks gets 0/5 on TrustScore metrics from Bidask Capital Consulting reports. The broker offers things that look good like zero spreads and leverage up to 500:1, but people question if they can be trusted.

The platform wants traders who can handle high risks, especially those who focus on forex trading. BidAsks reports 0ms average trading speed and zero spread costs. This seems perfect for scalpers and high-frequency traders who need fast execution. But the company gives no regulatory information and no clear company details, which creates big red flags for serious investors.

Account types include Pro and Standard options. The broker doesn't tell people about specific features and minimum deposit requirements though. BidAsks lacks transparency about how they operate, customer service, and regulatory compliance, making it wrong for conservative traders who want reliable, regulated trading environments.

Important Disclaimers

Traders must do their own research about compliance with their local financial regulations since clear regulatory information is missing from available sources. This bidasks review uses only public information and user feedback data. Different regions may have different regulatory rules, and potential clients should check if the broker is legal in their location before they start trading.

The evaluation method uses current public information and user reports. This might not show the complete picture of how this broker operates.

Rating Framework

Broker Overview

BidAsks works as a forex broker in a market that gets more competitive every day. Specific details about when the company started and company background information are not easy to find in current documents. The broker's main business focuses on forex trading services for traders who care more about speed and low-cost execution than regulatory certainty and full support services.

The platform's trading system reportedly delivers zero-millisecond average execution speeds. This positions the company as a technology-focused solution for active traders. But the missing detailed platform specifications, asset diversity information, and regulatory oversight details create uncertainty about whether the broker is legitimate and can survive long-term.

Potential clients face big due diligence challenges without clear information about when the company was founded, where headquarters are located, or which regulatory jurisdiction oversees them. The broker's main value seems centered on competitive spreads and high leverage ratios. These benefits must be weighed against big transparency concerns though.

Regulatory Status: Available sources do not name any regulatory authorities that oversee BidAsks operations, which is a big concern for trader protection and fund security.

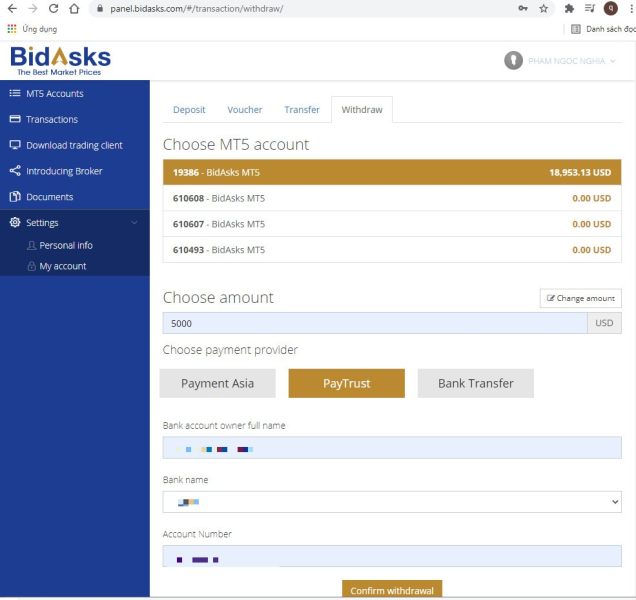

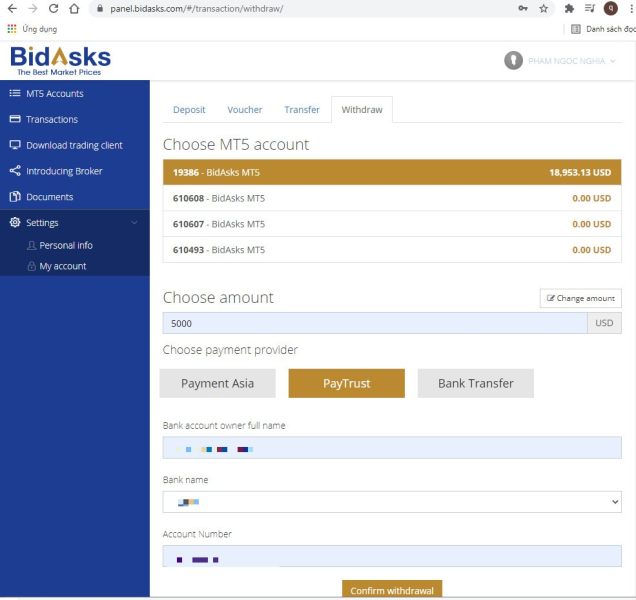

Deposit and Withdrawal Methods: Current information sources do not detail specific payment processing options and procedures. This limits assessment of how easy it is to access funds.

Minimum Deposit Requirements: Entry-level investment thresholds are not specified, preventing accurate evaluation of accessibility for retail traders.

Promotional Offers: Available materials do not document any current bonus or promotional programs.

Tradeable Assets: The broker focuses mainly on forex trading, though the complete range of available currency pairs and additional instruments needs clarification.

Cost Structure: Zero spreads are advertised, though commission structures and other potential fees lack detailed explanation.

Leverage Options: Maximum leverage reaches 500:1, which appeals to traders seeking high capital efficiency but also increases risk exposure significantly.

Platform Technology: Current sources do not comprehensively document specific trading platform details and technological specifications.

Account Conditions Analysis

BidAsks offers Pro and Standard account categories. Available documentation doesn't make clear detailed feature comparisons between these options though. The missing minimum deposit information significantly impacts accessibility assessment for retail traders. Potential clients cannot adequately evaluate how complex the onboarding process is or how much time it requires without transparent account opening procedures.

The lack of specialized account features suggests limited accommodation for diverse trader needs. Examples include Islamic trading accounts for Sharia-compliant trading or institutional-grade services. This bidasks review finds that account condition transparency falls well below industry standards where reputable brokers typically provide comprehensive feature matrices and clear pricing structures.

Standard industry practice includes detailed account tier explanations, deposit requirements, and feature accessibility charts. BidAsks fails to provide such fundamental information, which raises questions about operational transparency and customer-centric service design. The 5/10 rating reflects the presence of multiple account types while penalizing the significant information gaps that prevent informed decision-making.

The evaluation of BidAsks' trading tools and educational resources shows big information deficits that concern serious traders. Available sources document no specific trading tools, analytical resources, or educational materials. Modern forex brokers typically offer comprehensive trading calculators, economic calendars, market analysis, and educational webinars.

Research capabilities appear undefined, with no mention of fundamental or technical analysis resources. Advanced traders rely on sophisticated charting tools, automated trading support, and real-time market data feeds. The absence of such information suggests either limited tool availability or poor marketing communication of existing resources.

Educational support lacks any documentation, which is crucial for developing traders. Reputable brokers invest heavily in trader education through tutorials, market analysis, and strategy guides. The complete absence of educational resource information contributes to the low 3/10 rating in this category.

Algorithmic traders cannot assess platform compatibility with expert advisors or copy trading services without automated trading support details. This information gap significantly limits the broker's appeal to technology-oriented trading strategies.

Customer Service and Support Analysis

Customer service evaluation proves challenging due to complete absence of support infrastructure information. No documentation exists regarding available support channels, whether through live chat, phone support, email ticketing systems, or social media engagement. Response time commitments and service quality standards remain unspecified.

Multi-language support capabilities are undocumented, potentially limiting accessibility for international traders. Operating hours for customer support services lack specification, creating uncertainty about assistance availability during different trading sessions. The 2/10 rating reflects these fundamental service transparency failures.

Professional forex brokers typically maintain 24/5 support during market hours, with multiple communication channels and guaranteed response times. The absence of such basic service information suggests either inadequate customer support infrastructure or poor communication of available services.

Potential clients cannot assess support effectiveness without user feedback regarding service quality or problem resolution case studies. This bidasks review emphasizes that reliable customer service represents a crucial factor in broker selection, particularly for traders requiring technical assistance or account management support.

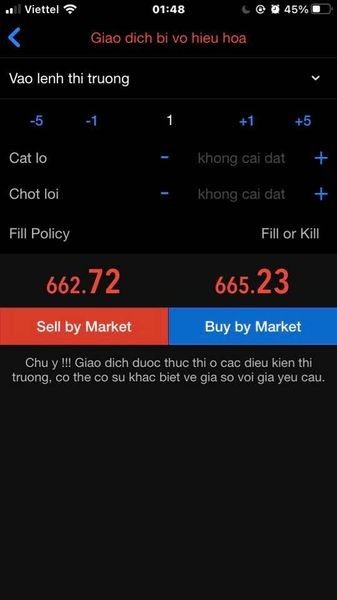

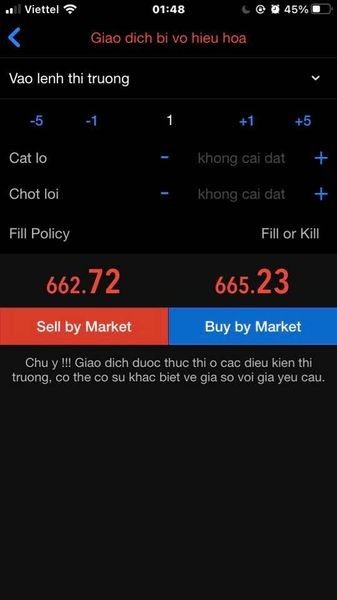

Trading Experience Analysis

BidAsks reports impressive technical performance with 0ms average trading speed. This suggests robust execution infrastructure. This metric appeals to scalpers and high-frequency traders who prioritize minimal latency. However, the absence of slippage data, requote frequency information, and execution quality statistics limits comprehensive trading experience assessment.

Platform stability information remains undocumented, though execution speed suggests potentially solid technical infrastructure. Order execution quality depends on multiple factors beyond speed, including price improvement opportunities, partial fill handling, and rejection rates during volatile market conditions.

Mobile trading experience details are unavailable, despite mobile accessibility being crucial for modern traders. Platform functionality completeness cannot be assessed without specific feature documentation. The 6/10 rating acknowledges excellent execution speed while penalizing the lack of comprehensive trading environment information.

Trading environment stability during news events and market volatility periods requires verification through user experience reports. The bidasks review notes that while speed metrics appear favorable, comprehensive trading experience evaluation requires broader performance data.

Trust and Safety Analysis

Trust assessment reveals serious concerns with BidAsks scoring 0/5 on user trust metrics. This extremely low rating indicates significant user confidence issues that potential clients must carefully consider. Trader protection mechanisms remain unclear without regulatory oversight information.

Fund safety measures lack documentation, including segregated account policies, deposit insurance, and bankruptcy protection procedures. Reputable brokers maintain client funds in segregated accounts with tier-one banks and provide clear fund protection explanations.

Company transparency falls well below industry standards, with limited corporate information, ownership details, or operational history available. The absence of regulatory registration numbers, compliance reports, or third-party audits creates substantial due diligence challenges.

Industry reputation assessment relies heavily on the documented 0/5 trust score, indicating widespread user concern. The broker's credibility remains questionable without positive third-party evaluations or regulatory endorsements. The 1/10 rating reflects these fundamental trust and safety concerns that responsible traders should prioritize in broker selection.

User Experience Analysis

The 0/5 trust rating severely impacts overall user satisfaction assessment, suggesting widespread user dissatisfaction or concern. Interface design and usability information remains unavailable, preventing evaluation of platform user-friendliness and navigation efficiency.

Registration and verification process details are undocumented, though streamlined onboarding represents a crucial user experience factor. Fund operation experiences, including deposit and withdrawal procedures, lack user feedback documentation.

The broker appears targeted toward high-risk tolerance traders willing to prioritize competitive trading conditions over regulatory certainty and comprehensive support services. This narrow user base limits broader market appeal.

Specific user complaints and praise cannot be analyzed without documented user feedback or satisfaction surveys. The 4/10 rating reflects the negative trust indicators while acknowledging that some technical features may appeal to specific trader segments. User experience improvement requires enhanced transparency, regulatory compliance, and comprehensive service documentation.

Conclusion

This bidasks review reveals a forex broker with mixed characteristics that require careful consideration. BidAsks offers potentially attractive trading conditions including zero spreads and high leverage ratios up to 500:1. Significant transparency and trust concerns overshadow these benefits though.

The broker best suits high-risk tolerance forex traders who prioritize competitive execution conditions over regulatory certainty and comprehensive support services. However, the 0/5 user trust rating and absence of regulatory information create substantial risks for most traders.

Primary advantages include competitive spreads and reported fast execution speeds. Major disadvantages encompass poor transparency, lack of regulatory oversight, and extremely low user trust ratings. Conservative traders should consider regulated alternatives with stronger transparency and user satisfaction records.