BDG 2025 Review: Everything You Need to Know

Executive Summary

This detailed bdg review looks at a broker that shows a mixed picture in forex trading. BDG has worrying performance numbers that potential traders should think about carefully. The broker has a troubling user rating of 1.29 out of 5, plus 6 documented complaints, which raises big red flags about user happiness and service quality.

BDG does show some good signs in how it operates. The company keeps a 3.8 employee satisfaction score on Glassdoor with an impressive 85% employee recommendation rate, which suggests the workplace is stable and employees are happy. This difference between employee satisfaction and user experience creates an interesting contrast worth looking into.

The broker seems better for people who want stable jobs and career growth in financial services rather than high-risk traders looking for the best trading conditions. The limited information about trading features makes this positioning even clearer. This bdg review will look at all parts of the broker's services to give a complete assessment for potential users.

Important Notice

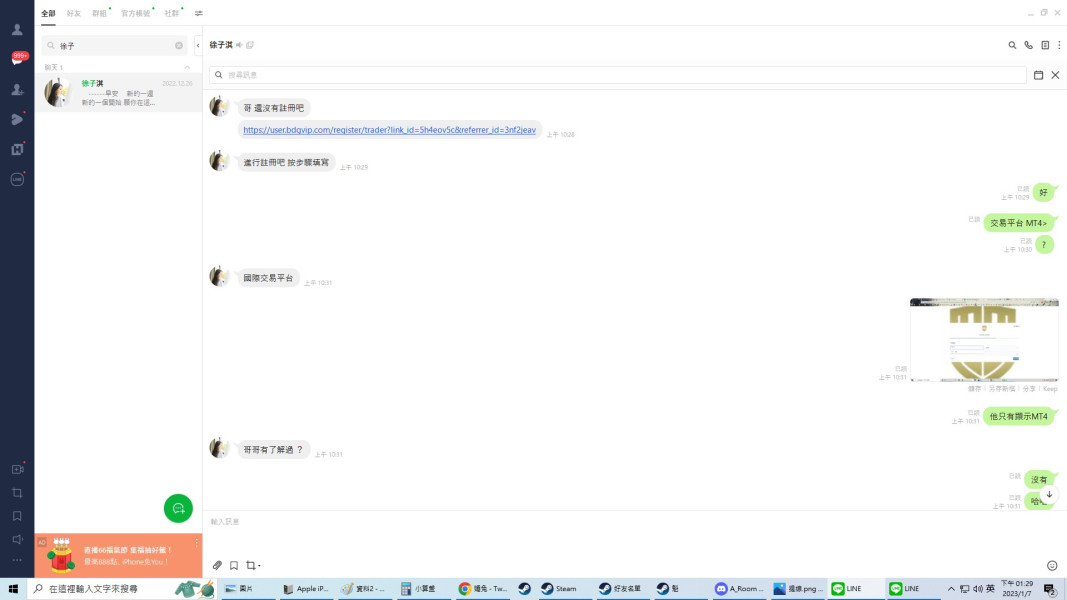

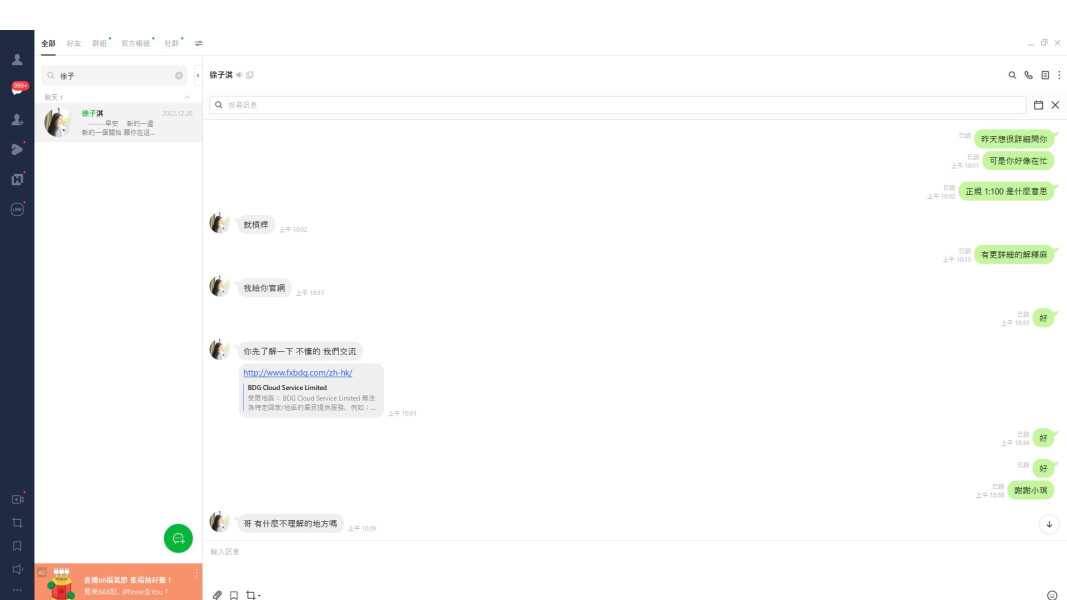

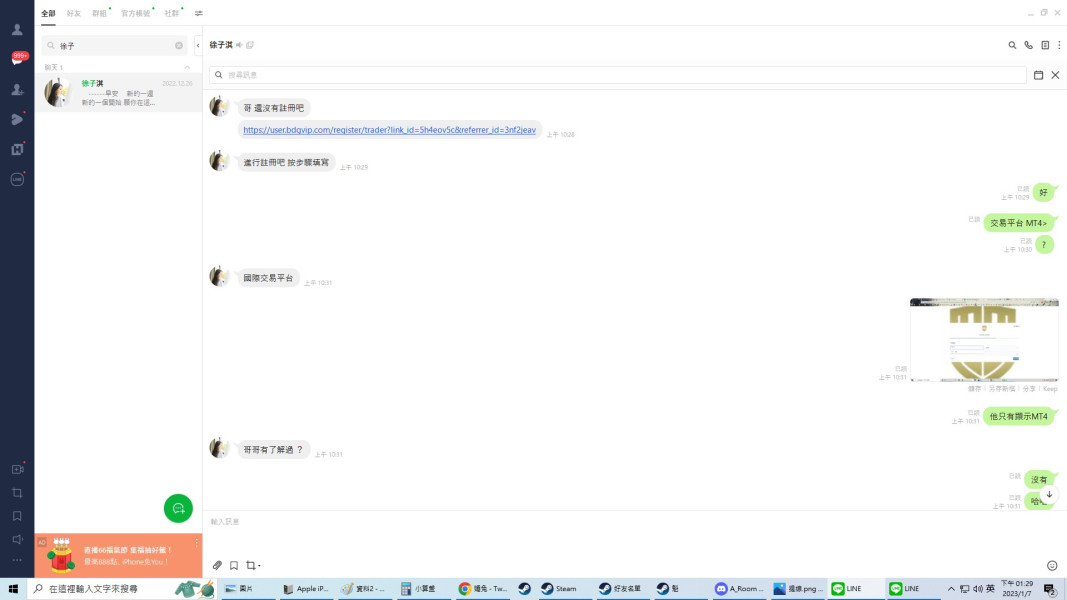

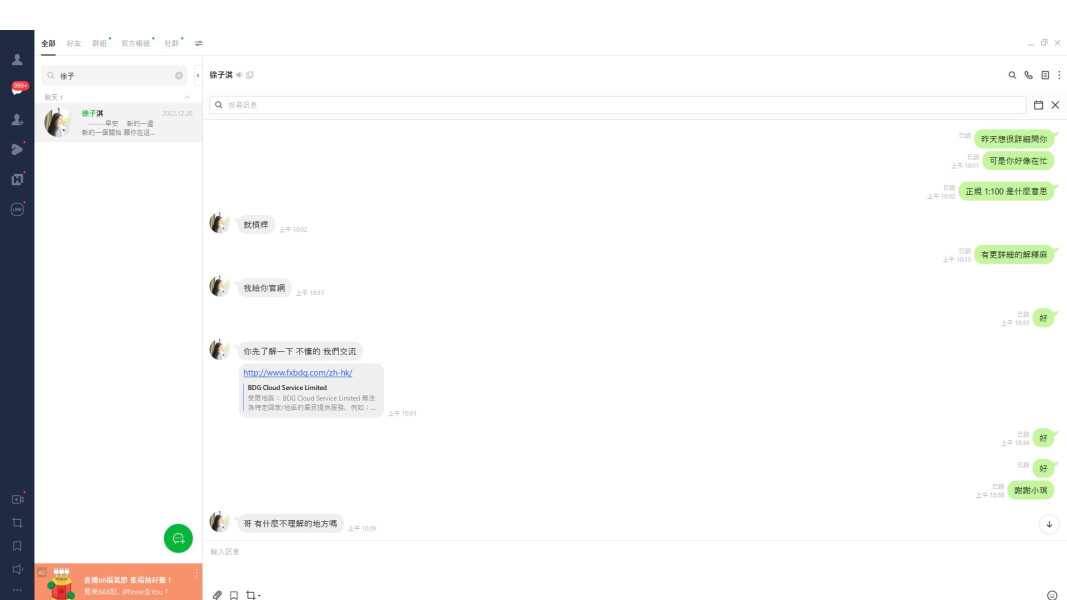

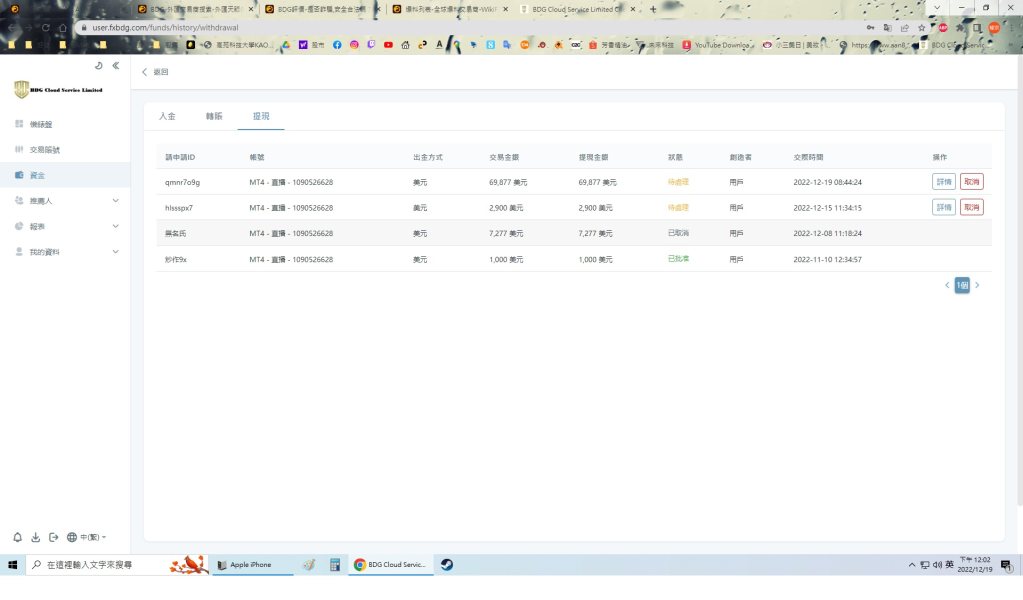

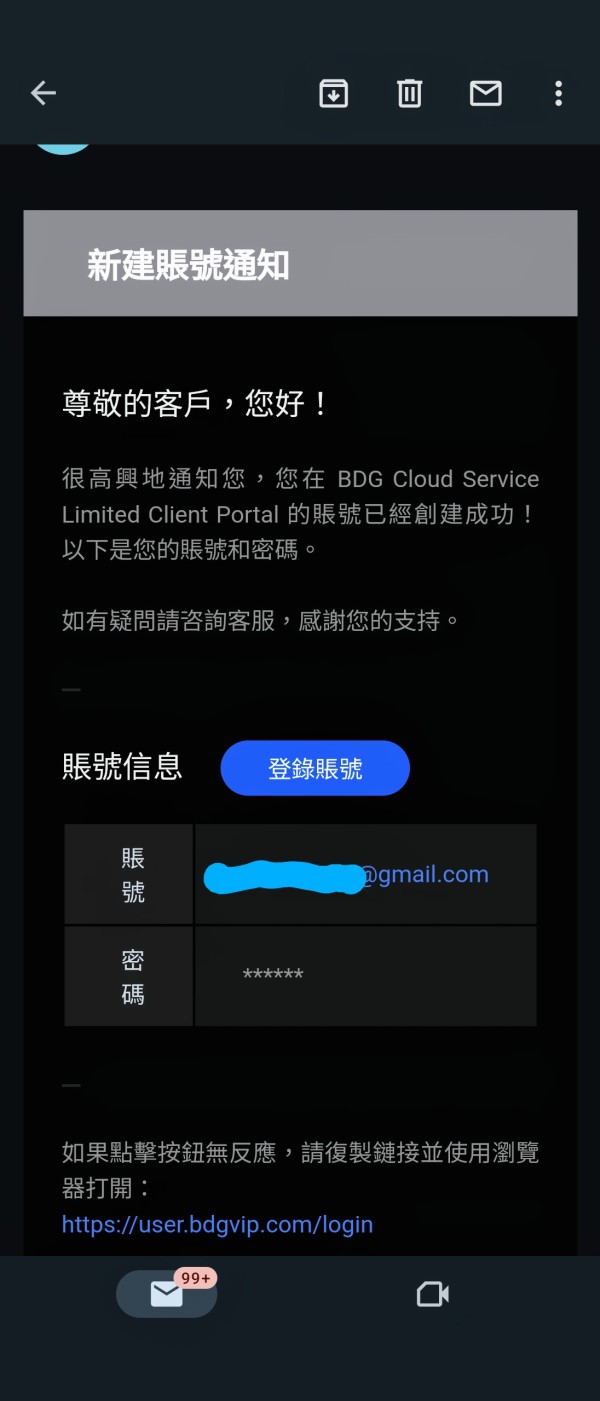

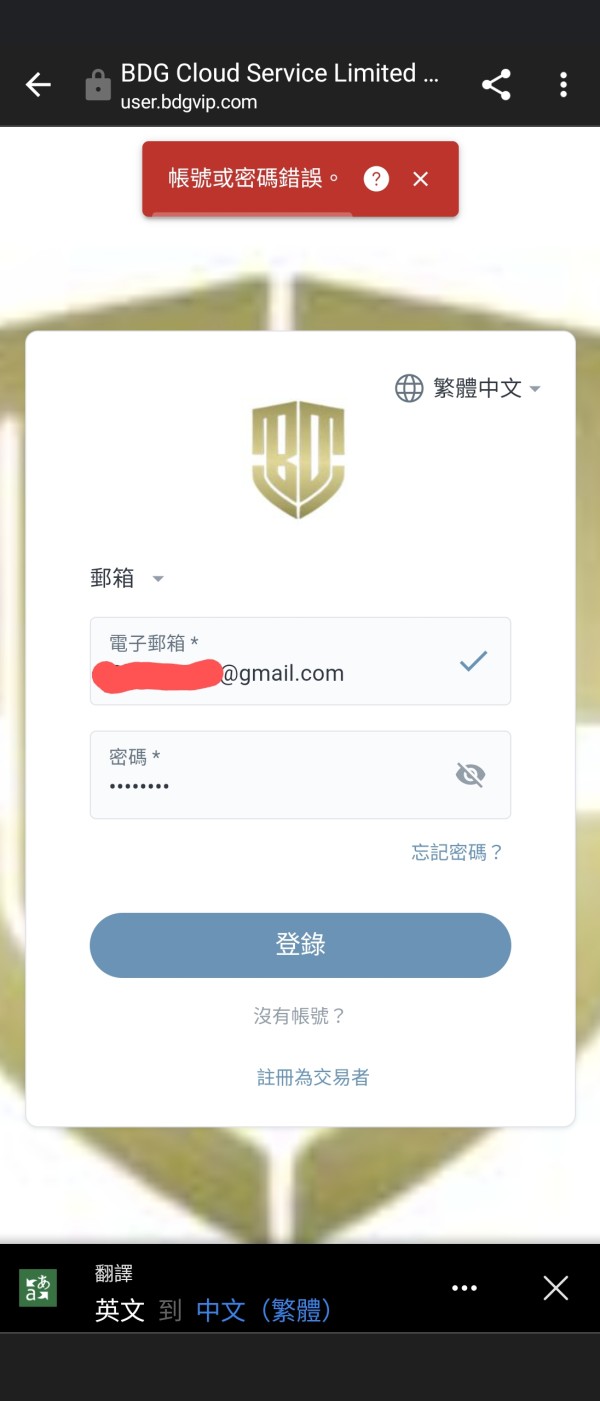

Regional Entity Differences: BDG works through multiple entities with different regulatory frameworks. BDG Cloud Service Limited operates with limited regulatory transparency, while BDG Global Limited benefits from dual regulatory oversight. Potential clients should check which entity they would deal with based on where they live, as regulatory protections and service offerings may differ a lot between these entities.

Review Methodology: This evaluation uses publicly available information, user feedback, and regulatory filings. Some information gaps exist because the company has limited disclosure, and this review may not capture the complete scope of BDG's services. Readers should do additional research and verify current terms and conditions directly with the broker before making any financial commitments.

Rating Framework

Broker Overview

BDG International, Inc. started working in financial services in 1983, marking over four decades in the industry. The company headquarters are in Elgin, Illinois, putting it within the United States regulatory framework. Rather than focusing only on forex trading, BDG International has built its reputation mainly around freight forwarding, customs brokerage, and international trade consulting services. This varied approach to international commerce sets the company apart from traditional forex-focused brokers.

The company's business model centers on helping international trade relationships and providing support for cross-border transactions. This foundation in international commerce gives BDG unique insights into global market movements and currency changes that affect international trade. However, this bdg review must note that the shift from trade services to retail forex brokerage represents a big change in business focus that may impact service quality and specialization.

For regulatory oversight, BDG operates under the supervision of the Belize Financial Commission and the National Futures Association. This dual regulatory framework provides some level of oversight, though the effectiveness and strictness of these regulatory bodies vary considerably. The National Futures Association offers more robust consumer protections for U.S.-based clients, while the Belize Financial Commission provides international regulatory coverage with different standards and enforcement mechanisms.

Regulatory Jurisdictions: BDG maintains regulatory relationships with both the Belize Financial Commission and the National Futures Association. This dual-jurisdiction approach allows the broker to serve both international and U.S.-based clients, though regulatory protections may vary significantly between these frameworks.

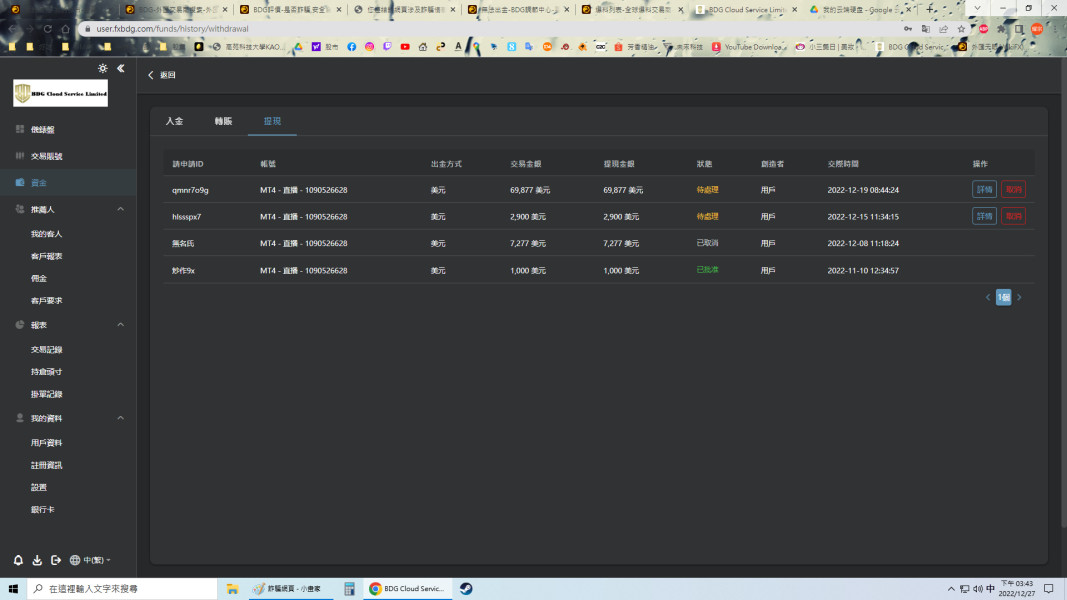

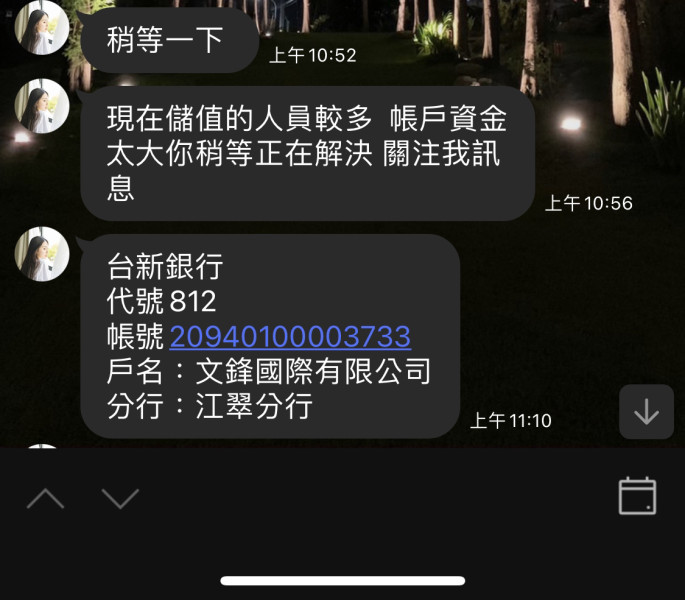

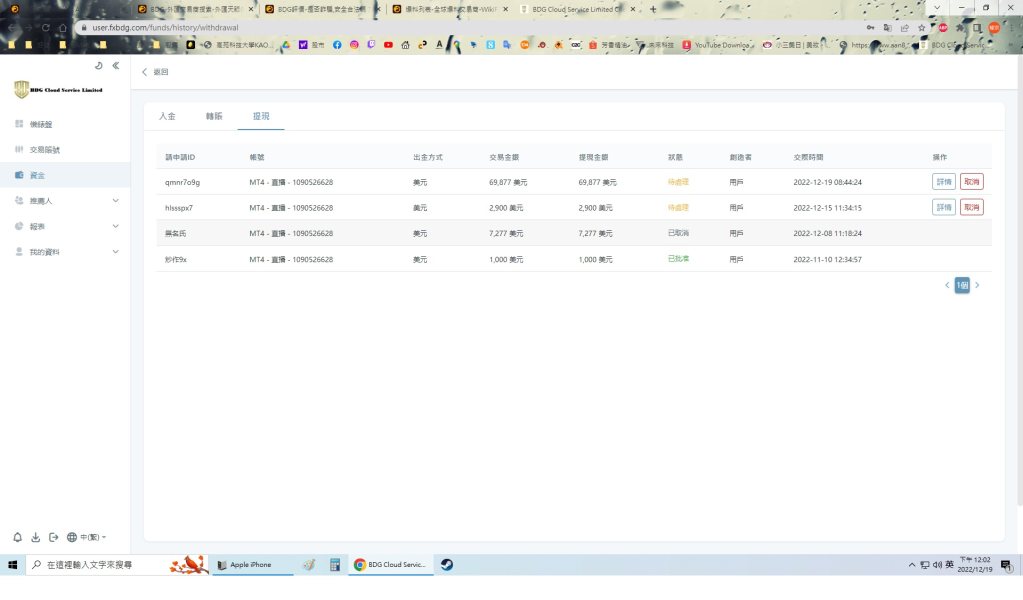

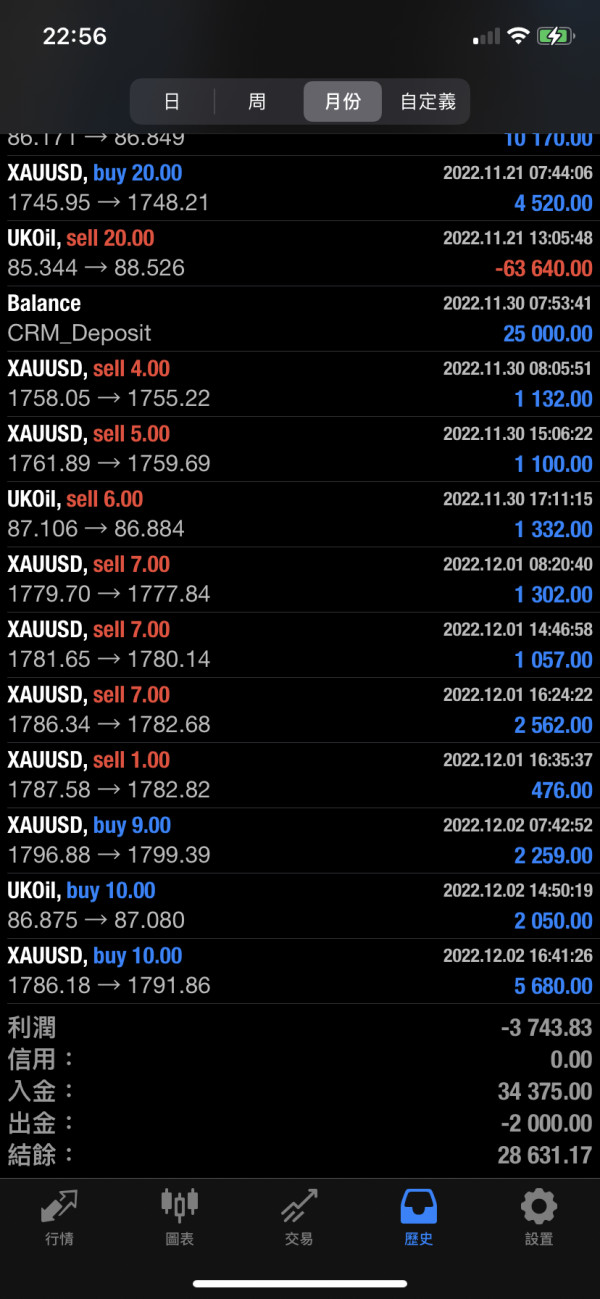

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees is not detailed in available documentation. Potential clients should ask directly about available payment methods and any restrictions that may apply to their region.

Minimum Deposit Requirements: Current minimum deposit thresholds are not specified in accessible broker information. This lack of transparency about entry-level requirements may indicate flexible account opening procedures or simply limited public disclosure.

Bonus and Promotional Offers: No current promotional campaigns or bonus structures are documented in available materials. This absence could suggest either a conservative approach to client acquisition or limited marketing disclosure.

Available Trading Assets: The specific range of tradeable instruments, including forex pairs, commodities, indices, and other financial products, is not fully detailed in current documentation. This bdg review cannot provide specific asset coverage without additional verification.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available. This transparency gap represents a significant concern for cost-conscious traders seeking to understand total trading expenses.

Leverage Ratios: Maximum leverage offerings and any regional restrictions are not specified in current documentation. Leverage policies typically vary based on client location and regulatory requirements.

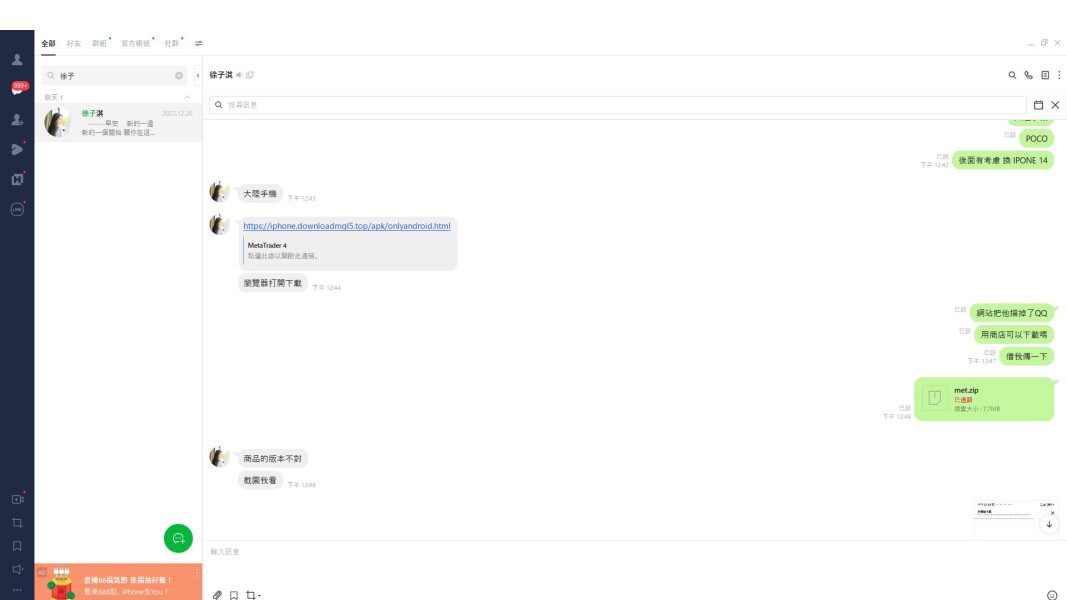

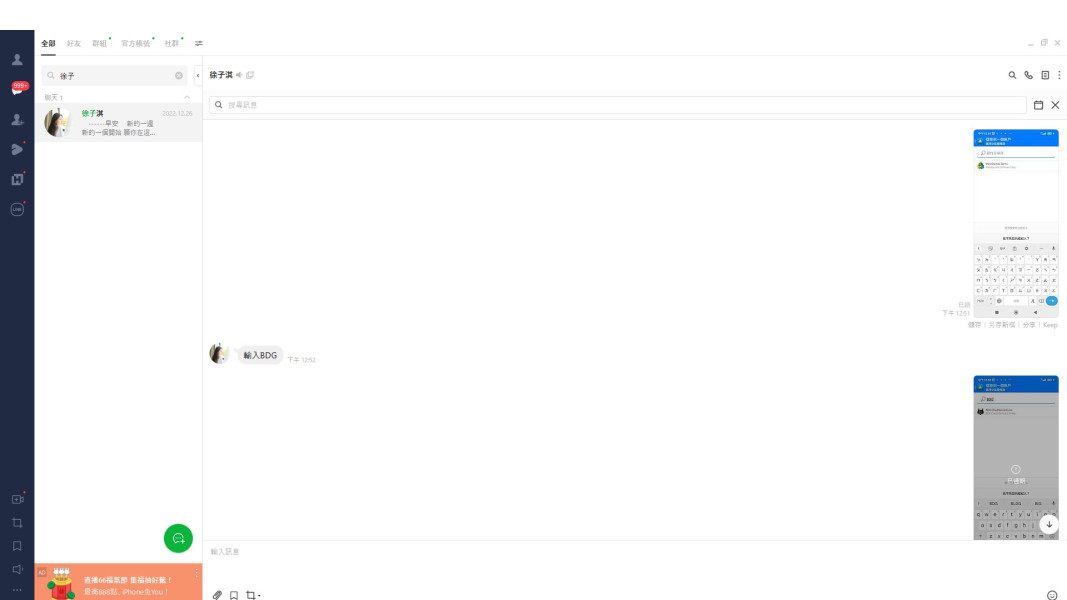

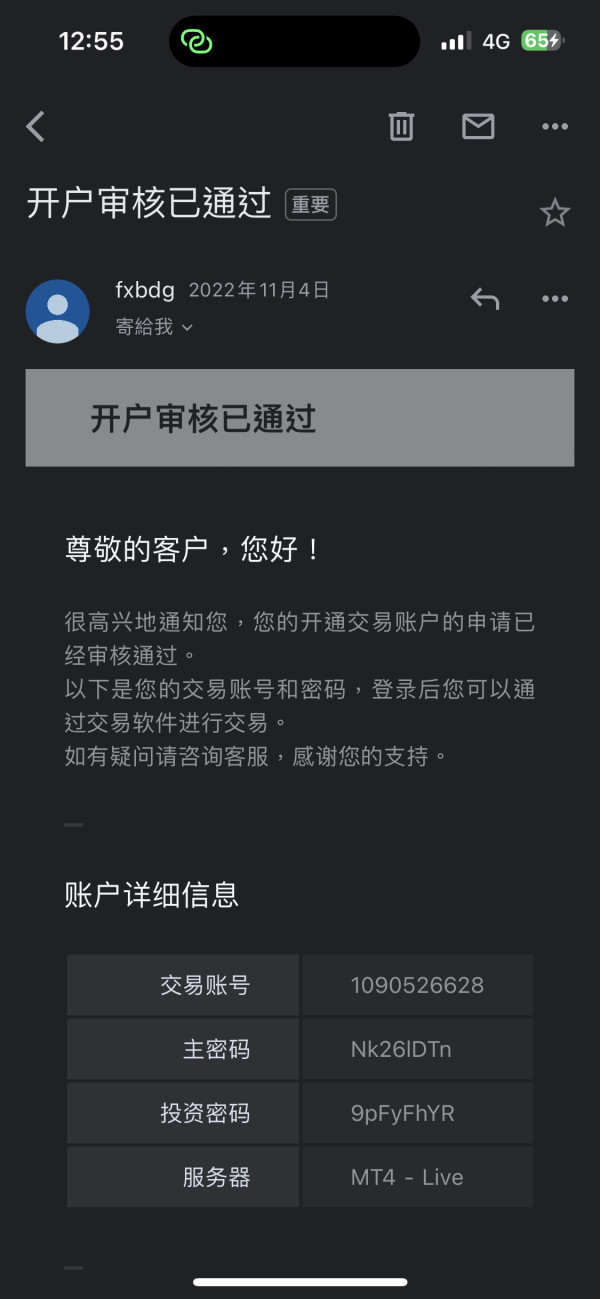

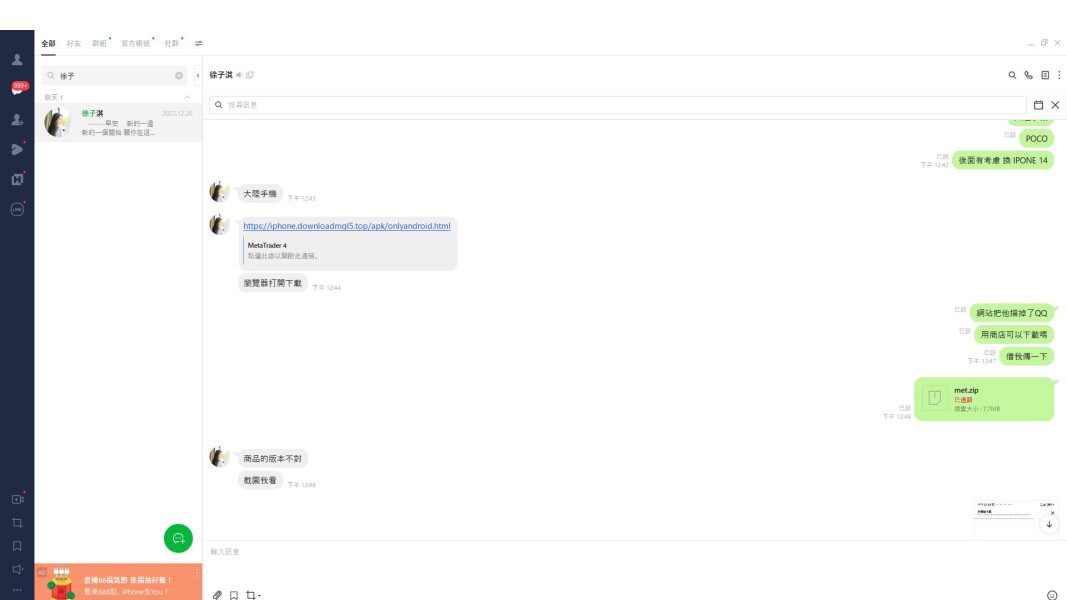

Platform Options: Specific trading platform offerings, including proprietary platforms or third-party solutions like MetaTrader, are not detailed in available information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of BDG's account conditions faces big limitations due to insufficient publicly available information. Without access to detailed account specifications, this bdg review cannot provide thorough analysis of account types, features, or requirements. The lack of transparency about account structures raises concerns about the broker's commitment to clear communication with potential clients.

Traditional forex brokers typically offer multiple account tiers with varying minimum deposits, spread structures, and feature sets. The absence of such detailed information from BDG suggests either limited account variety or poor information disclosure practices. For traders used to comparing specific account features across brokers, this information gap represents a significant disadvantage.

Account opening procedures, verification requirements, and time-to-activation are not documented in available materials. This lack of procedural transparency can create uncertainty for potential clients about the onboarding experience. Most reputable brokers provide clear documentation of their account opening process, required documentation, and expected processing times.

Special account features such as Islamic accounts, managed accounts, or institutional services are not mentioned in current documentation. The absence of information about specialized account types may indicate limited service offerings or simply inadequate marketing communication. Without this information, potential clients cannot assess whether BDG meets their specific account requirements.

The assessment of BDG's trading tools and educational resources encounters substantial information gaps that prevent thorough evaluation. Modern forex brokers typically provide extensive suites of analytical tools, market research, and educational content to support trader development and decision-making processes.

Trading tools such as economic calendars, market sentiment indicators, technical analysis packages, and risk management utilities are not documented in available BDG materials. This absence is particularly concerning given the competitive nature of the forex brokerage industry, where comprehensive tool sets often differentiate superior service providers.

Research and analysis resources, including daily market commentary, weekly outlooks, and fundamental analysis reports, are not mentioned in current documentation. Quality research provision has become a standard expectation among serious traders, and the lack of visible research capabilities may indicate limited analytical support.

Educational resources such as webinars, trading courses, video tutorials, and written guides are not detailed in accessible information. Educational support is particularly important for developing traders, and the absence of documented educational programs may limit BDG's appeal to newer market participants.

Automated trading support, including Expert Advisor compatibility, copy trading services, or algorithmic trading platforms, is not addressed in available materials. As automated trading becomes increasingly popular, the lack of information about these capabilities may indicate limited technological sophistication.

Customer Service and Support Analysis

Customer service evaluation for BDG faces significant constraints due to limited available information about support structures, response times, and service quality metrics. Effective customer support represents a crucial component of successful forex brokerage operations, particularly given the time-sensitive nature of trading activities.

Available communication channels, including phone support, email assistance, live chat functionality, and social media responsiveness, are not thoroughly documented. Most competitive brokers provide multiple contact methods with clearly stated availability hours and expected response times.

Response time commitments and service level agreements are not specified in current documentation. Without established response time expectations, clients cannot assess whether BDG meets industry standards for support responsiveness. Quality customer service typically includes guaranteed response times for different inquiry types.

Service quality metrics, such as first-call resolution rates, customer satisfaction scores, or support ticket escalation procedures, are not publicly available. These metrics help potential clients understand the effectiveness of the support infrastructure and problem-resolution capabilities.

Multilingual support capabilities are not detailed in accessible information. For international brokers serving diverse client bases, language support often determines accessibility and service quality for non-English speaking clients. The absence of language support information may indicate limited international service capabilities.

Trading Experience Analysis

The evaluation of BDG's trading experience faces substantial limitations due to insufficient technical and performance information. Trading experience includes platform stability, execution speed, order management capabilities, and overall technological infrastructure quality.

Platform stability and uptime metrics are not documented in available materials. Reliable platform performance is essential for successful trading operations, particularly during high-volatility market conditions when system stability becomes crucial for protecting trader interests.

Order execution quality, including fill rates, slippage statistics, and execution speed benchmarks, is not specified in current documentation. These metrics directly impact trading profitability and represent key differentiators among forex brokers. Without execution quality data, traders cannot assess BDG's competitive positioning.

Platform functionality completeness, including charting capabilities, order types, risk management tools, and customization options, is not detailed in accessible information. Comprehensive platform functionality supports diverse trading strategies and enhances user experience across different trader skill levels.

Mobile trading experience, including app availability, feature parity with desktop platforms, and mobile-specific optimizations, is not addressed in current documentation. As mobile trading becomes increasingly important, the absence of mobile platform information represents a significant evaluation gap. This bdg review cannot assess mobile trading capabilities without additional information.

Trust and Security Analysis

BDG's trust and security profile presents a mixed picture based on available regulatory information and third-party assessments. The broker operates under dual regulatory oversight from the Belize Financial Commission and the National Futures Association, providing some level of regulatory protection, though the effectiveness varies between these jurisdictions.

The National Futures Association (NFA) provides more robust regulatory oversight for U.S.-based operations, including strict capital requirements, segregated client fund protection, and comprehensive compliance monitoring. However, the Belize Financial Commission operates under different standards that may provide less stringent consumer protections for international clients.

Scam Detector's assessment score of 68 suggests moderate trustworthiness but indicates room for improvement in security and reliability metrics. This score places BDG in a middle-tier category that requires careful evaluation by potential clients, particularly those considering larger account sizes or long-term trading relationships.

Client fund protection measures, including segregated account policies, insurance coverage, and compensation schemes, are not detailed in current documentation. These protections represent crucial safeguards for client capital and should be clearly communicated by reputable brokers.

Company transparency about ownership structure, financial statements, and operational procedures appears limited based on available public information. Enhanced transparency typically builds client confidence and demonstrates commitment to regulatory compliance and ethical business practices.

User Experience Analysis

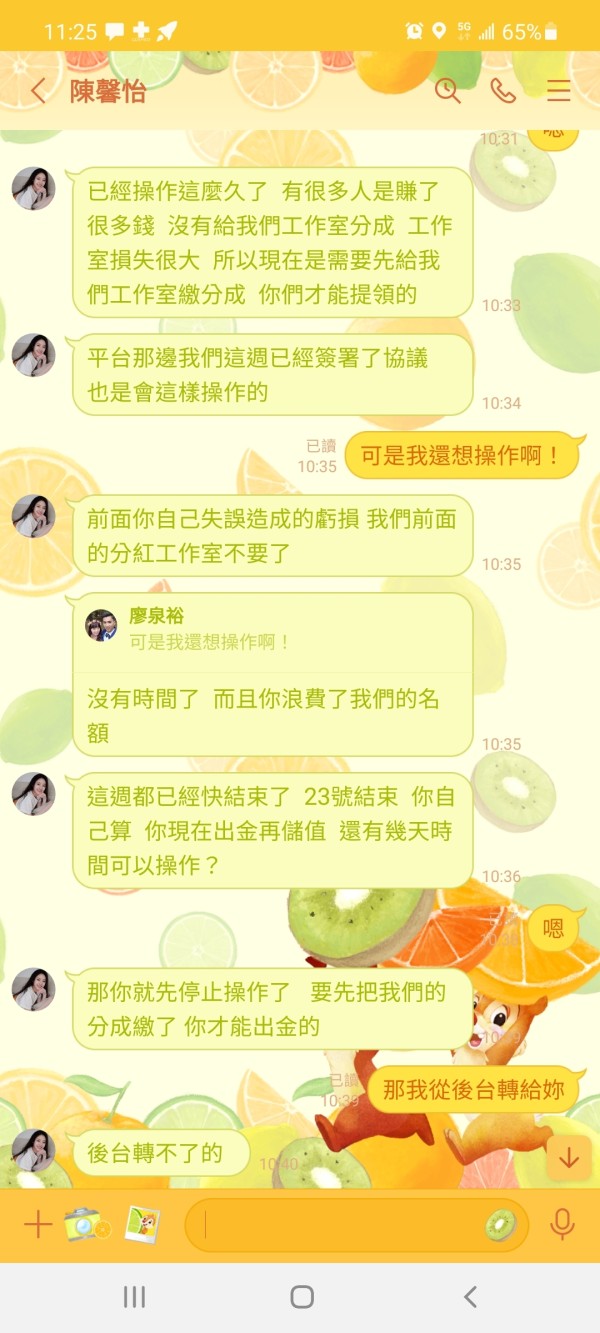

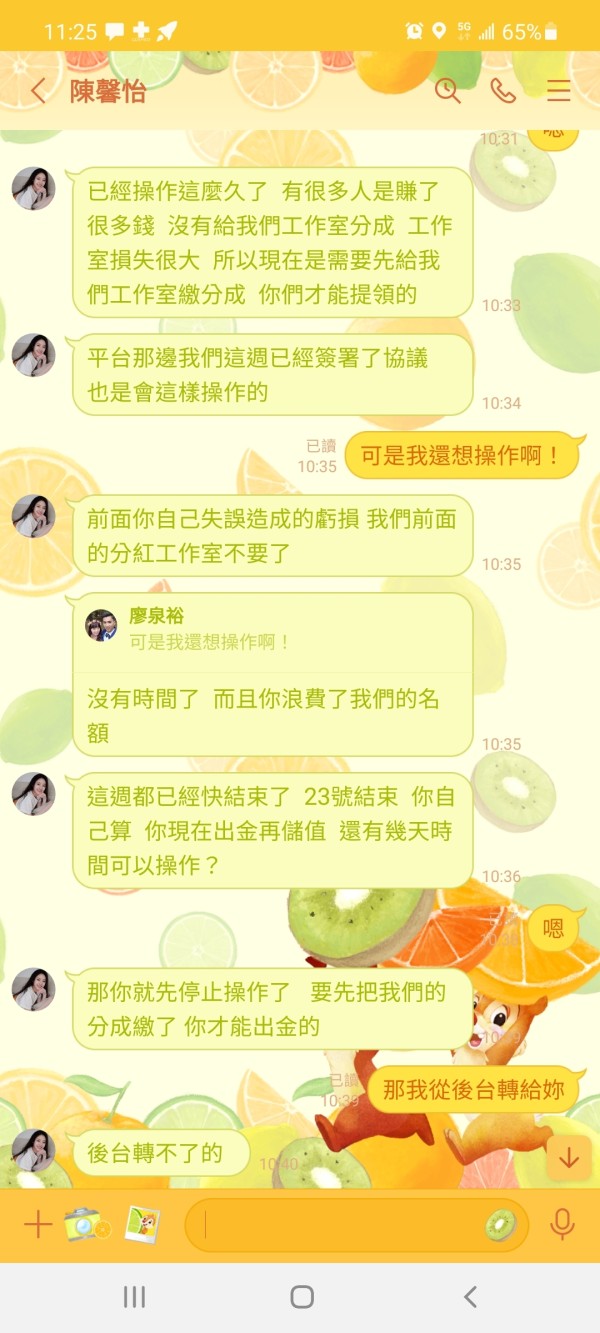

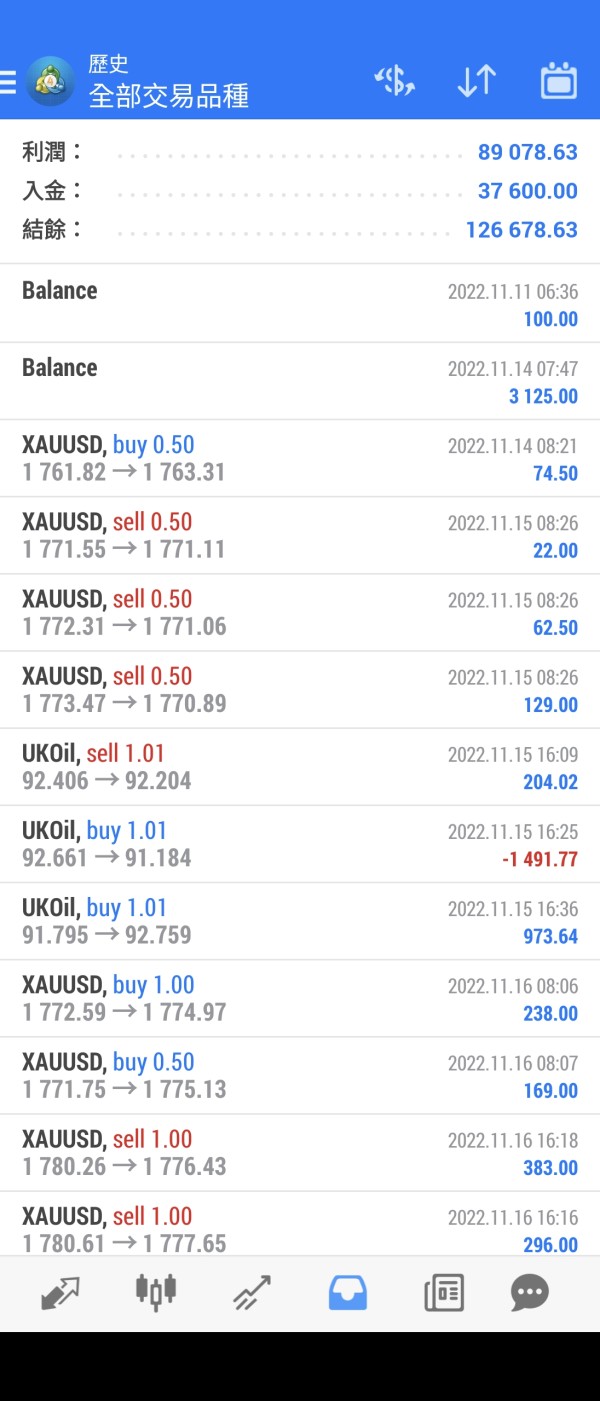

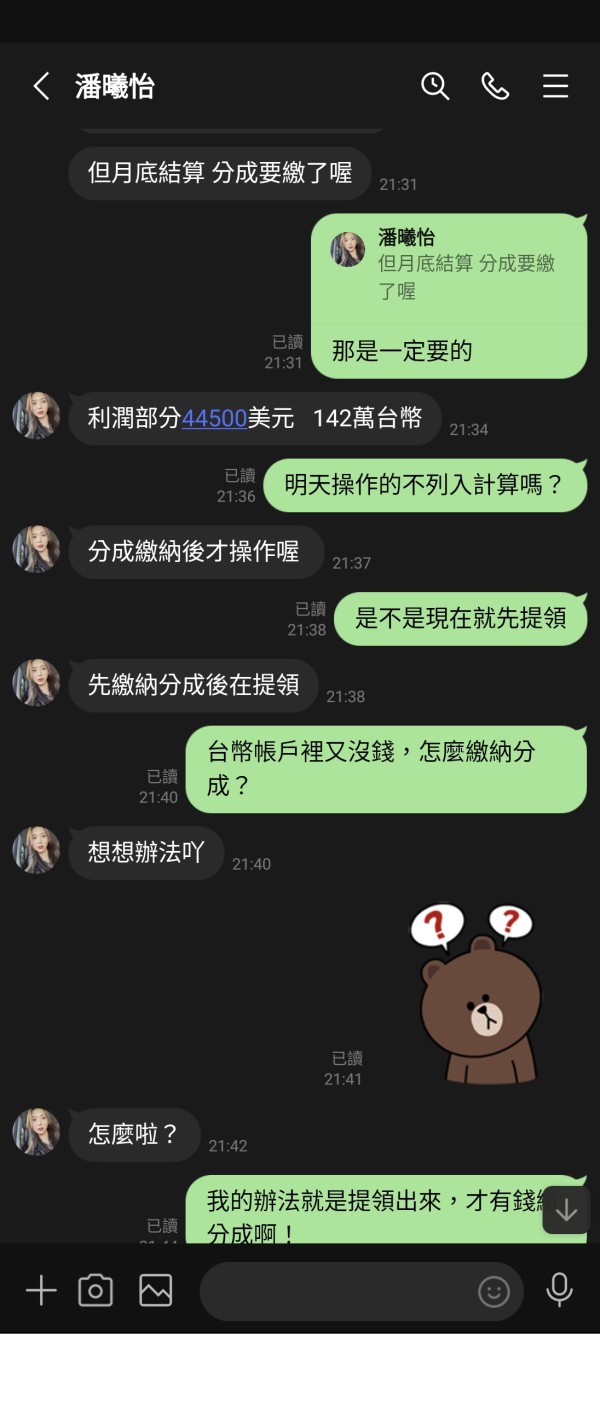

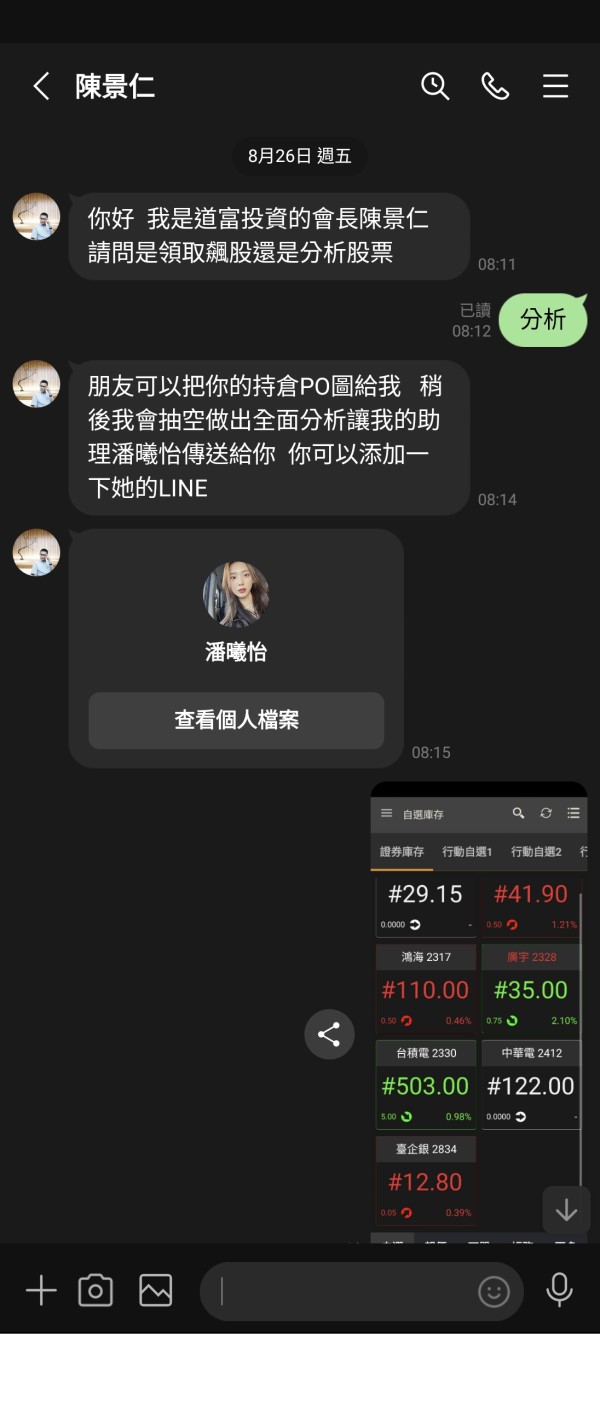

User experience analysis reveals concerning patterns that significantly impact BDG's overall assessment. The documented user rating of 1.29 out of 5 represents exceptionally poor customer satisfaction and suggests widespread dissatisfaction with broker services or experiences.

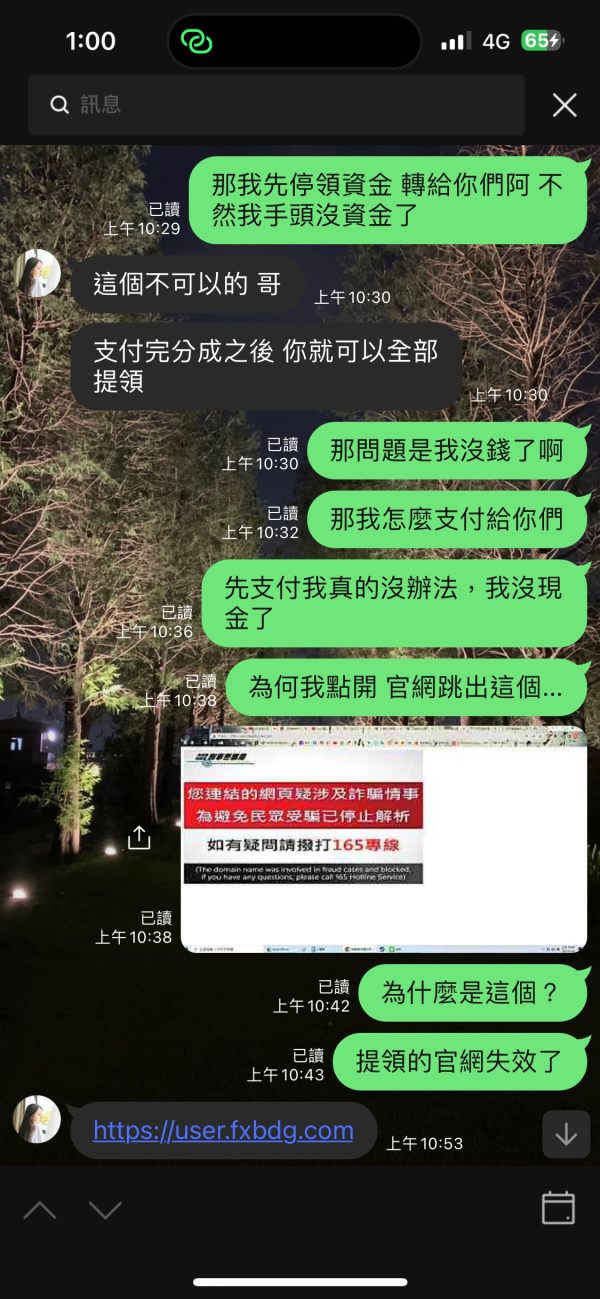

The presence of 6 documented complaints, while not overwhelming in absolute terms, becomes more significant when considered alongside the low user rating. This combination suggests that negative experiences may be more common than positive ones, creating a concerning pattern for potential clients.

Interface design and usability assessments are not available in current documentation, preventing evaluation of platform user-friendliness and accessibility. Modern trading platforms require intuitive design and efficient navigation to support effective trading operations.

Registration and account verification processes are not detailed in accessible information. Smooth onboarding experiences contribute significantly to overall user satisfaction and set expectations for ongoing service quality.

The user demographic appears to align more closely with individuals seeking stable employment opportunities rather than optimal trading conditions. This positioning suggests BDG may be better suited for career-focused individuals rather than active traders seeking competitive trading environments.

Conclusion

This comprehensive bdg review reveals a broker with significant limitations and concerning user feedback patterns that potential clients should carefully consider. BDG's overall performance indicators suggest substantial challenges in user satisfaction and service delivery, as evidenced by the exceptionally low user rating of 1.29 and documented complaint volume.

The broker appears better suited for individuals prioritizing stable employment opportunities and career development within the financial services sector rather than traders seeking optimal trading conditions and competitive service offerings. The positive employee satisfaction metrics (3.8 Glassdoor rating and 85% recommendation rate) contrast sharply with user experience indicators, suggesting internal operational stability that doesn't translate to client satisfaction.

Key advantages include regulatory oversight from established bodies and apparent internal workplace stability. However, significant disadvantages include poor user ratings, limited transparency about trading conditions, and insufficient public information about service offerings. Potential clients should conduct extensive research and consider alternative brokers with stronger user satisfaction records and more transparent service documentation.