Asia Pacific Bullion Limited 2025 Review: Everything You Need to Know

Executive Summary

This asia pacific bullion limited review shows major problems with this Hong Kong forex broker that focuses on precious metals trading. Asia Pacific Bullion Limited started on July 14, 2017, and has received many complaints from traders about withdrawal issues and unclear rules. The broker uses the popular MT5 trading platform and works with precious metals markets, but these good points don't make up for serious problems.

The company targets precious metals traders. Our research shows that potential clients should be very careful, especially those who want safe withdrawals and good rules to protect them. User reviews always mention bad withdrawal processes and poor customer support, which makes this broker wrong for traders who want financial safety and good service. The lack of clear rule information makes trust problems worse, putting Asia Pacific Bullion Limited in the high-risk group of forex brokers.

Important Notice

This review uses market information and user feedback from 2025. Potential clients should know that rules may be different in different places, and the company's practices may not follow normal industry standards. Our review method uses user stories, public company information, and industry analysis to give a complete assessment.

Some parts of this review use user experiences and market observations because official rule information is limited. Traders should strongly research on their own and check all information before using this broker.

Rating Framework

Broker Overview

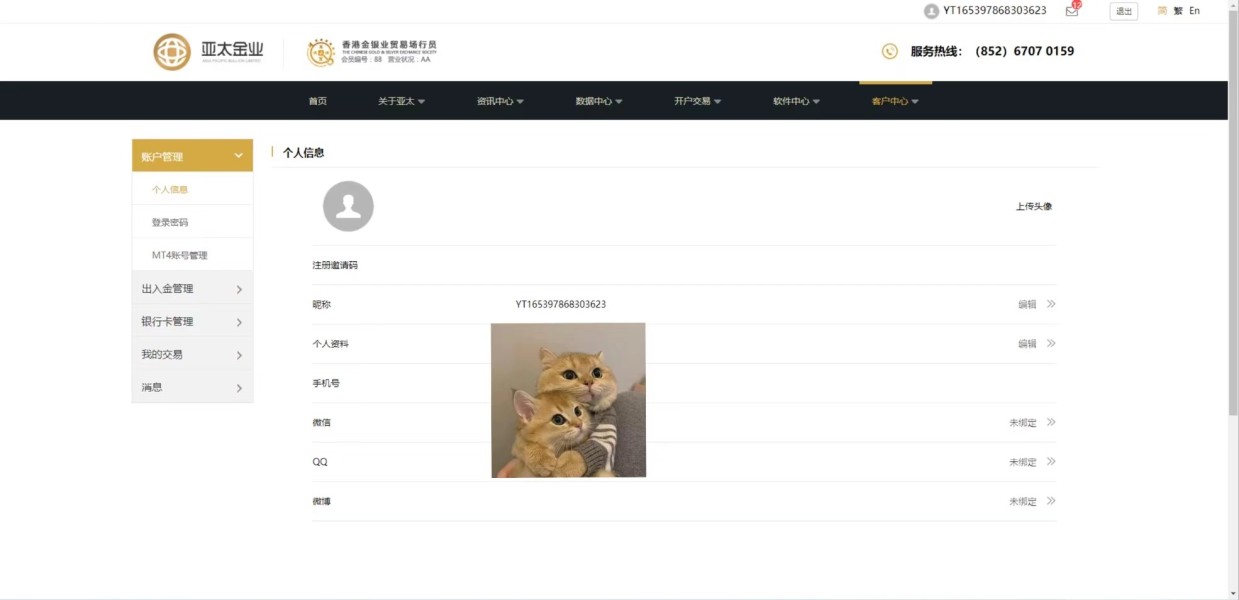

Asia Pacific Bullion Limited started in the forex market on July 14, 2017, with its main office in Hong Kong and a focus on precious metals trading. The company says it is a special precious metals broker that targets traders interested in gold, silver, and other valuable items. Even though it has a specific market area, the broker has had trouble building a good reputation with traders, with many user complaints covering up its special services.

The broker's business plan focuses on giving access to precious metals markets through the MetaTrader 5 platform, which is one of its few good points. However, the company's way of doing business has caused big concerns among traders, especially about managing funds and customer service standards. The lack of complete rule information available to the public makes it harder to judge the broker's credibility, making it difficult for potential clients to check the company's legitimacy and operational standards.

Available information shows that Asia Pacific Bullion Limited works mainly through the MT5 trading platform, though specific details about other platform options are unclear. The broker's asset list focuses heavily on precious metals, which may interest specialized traders but limits variety opportunities for those wanting broader market access. The absence of detailed rule disclosures represents a big red flag for potential clients who want transparency and rule protection.

Regulatory Jurisdiction: Based in Hong Kong, though specific rule oversight details are not clearly shown in available materials, raising concerns about rule compliance and trader protection standards.

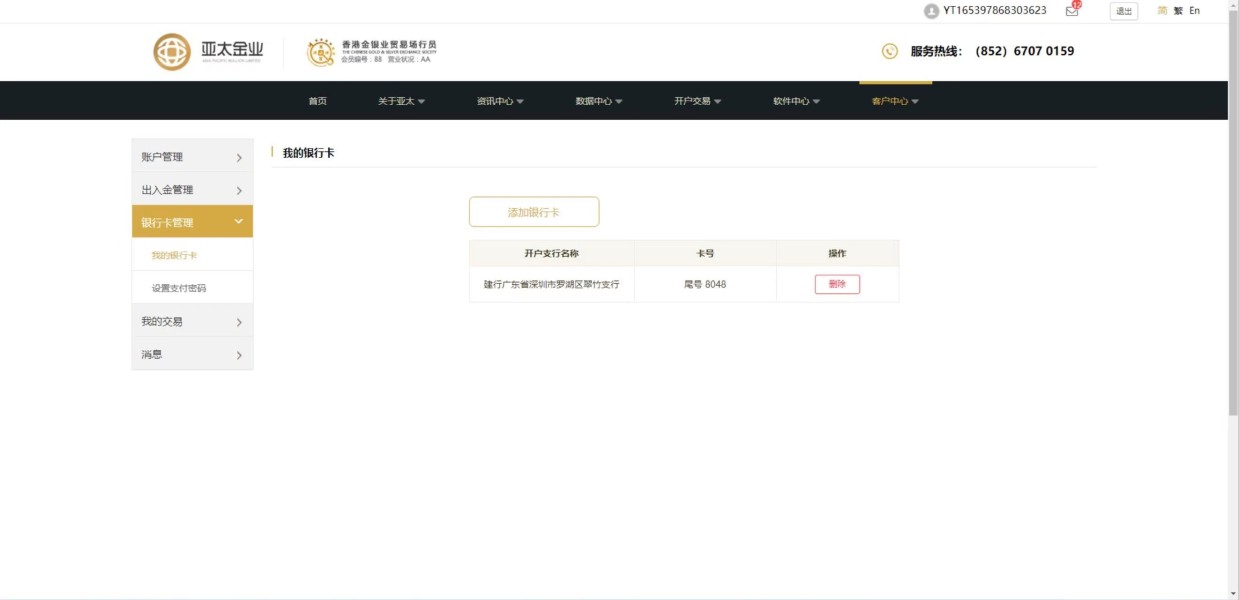

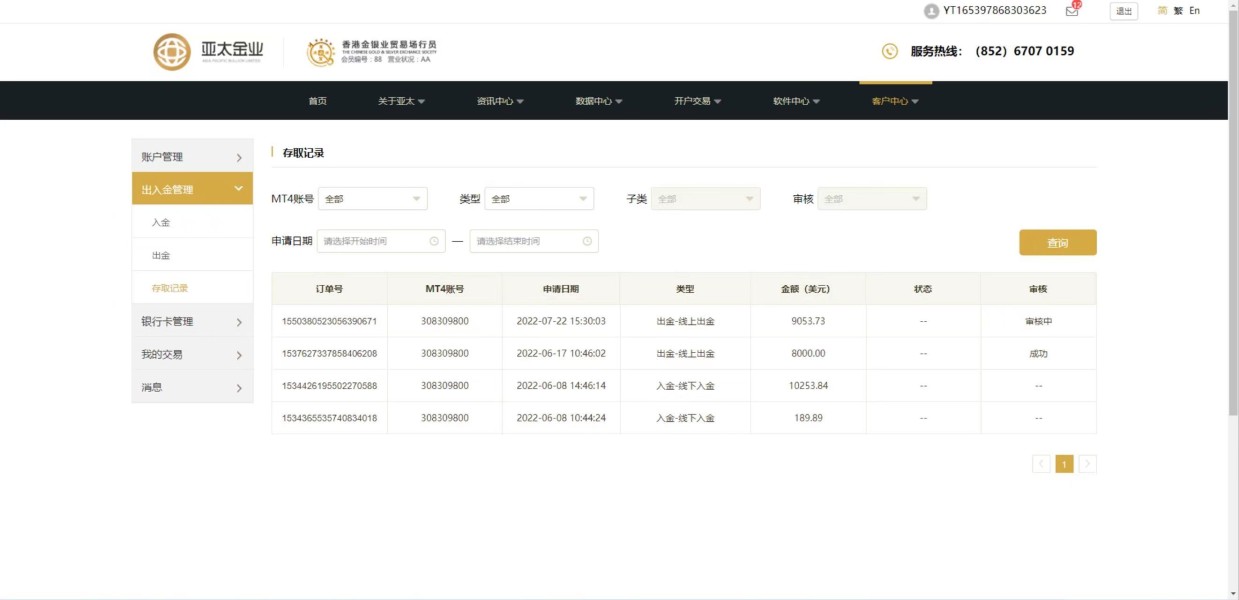

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options is not detailed in accessible sources, which itself represents a transparency concern for potential clients.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account with Asia Pacific Bullion Limited is not specified in available documentation.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in publicly available information, suggesting limited marketing incentives.

Tradeable Assets: The broker specializes primarily in precious metals trading, including gold and silver markets, though the complete range of available instruments requires further clarification.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not readily available, making it difficult for traders to assess the true cost of trading with this broker.

Leverage Options: Specific leverage ratios offered by Asia Pacific Bullion Limited are not detailed in available sources, representing another information gap.

Platform Selection: The broker utilizes the MetaTrader 5 trading platform as its primary trading interface, providing access to advanced charting and analysis tools.

Geographic Restrictions: Information regarding specific geographic limitations or restricted territories is not detailed in accessible materials.

Customer Support Languages: Available customer service languages are not specified in current documentation.

This asia pacific bullion limited review highlights significant information gaps that potential clients should consider when evaluating this broker option.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

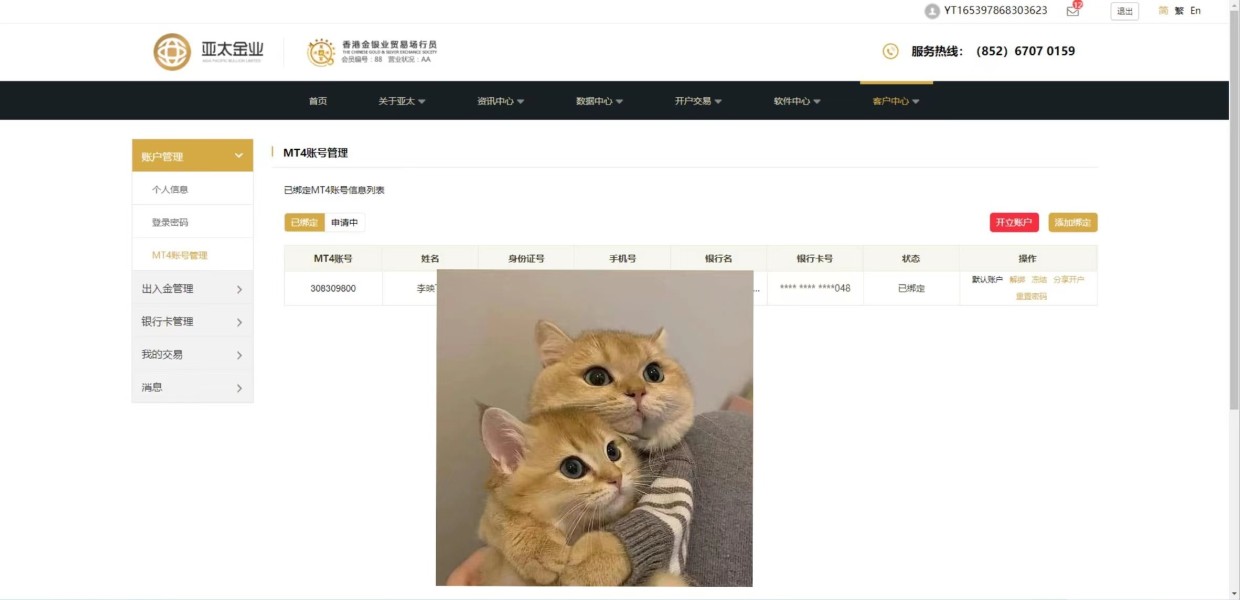

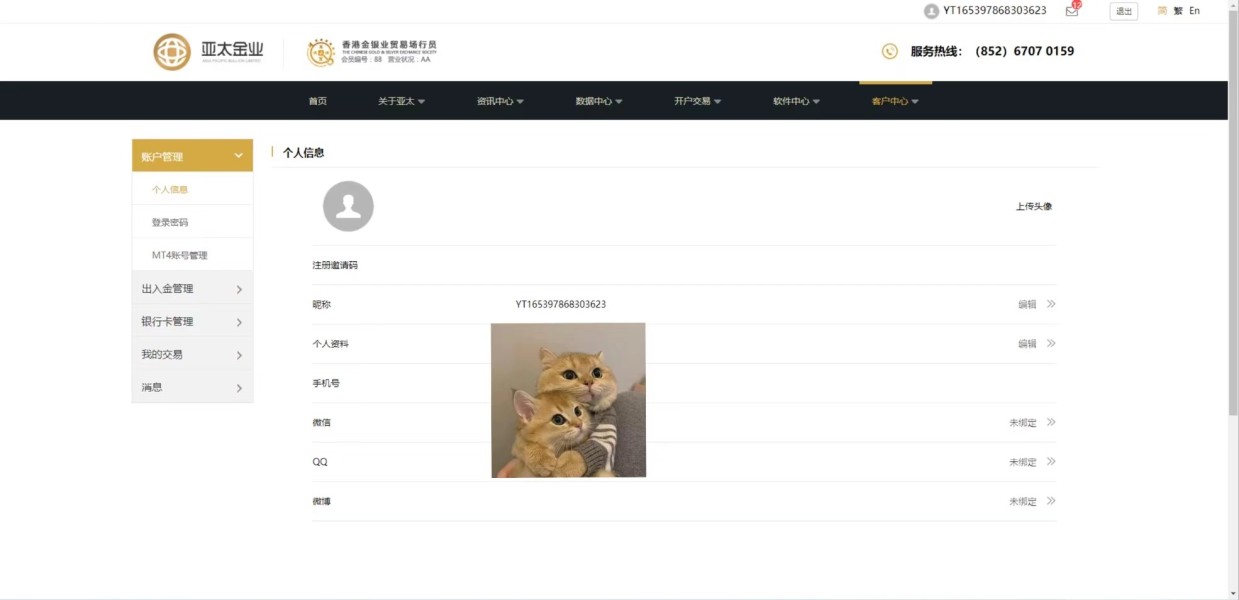

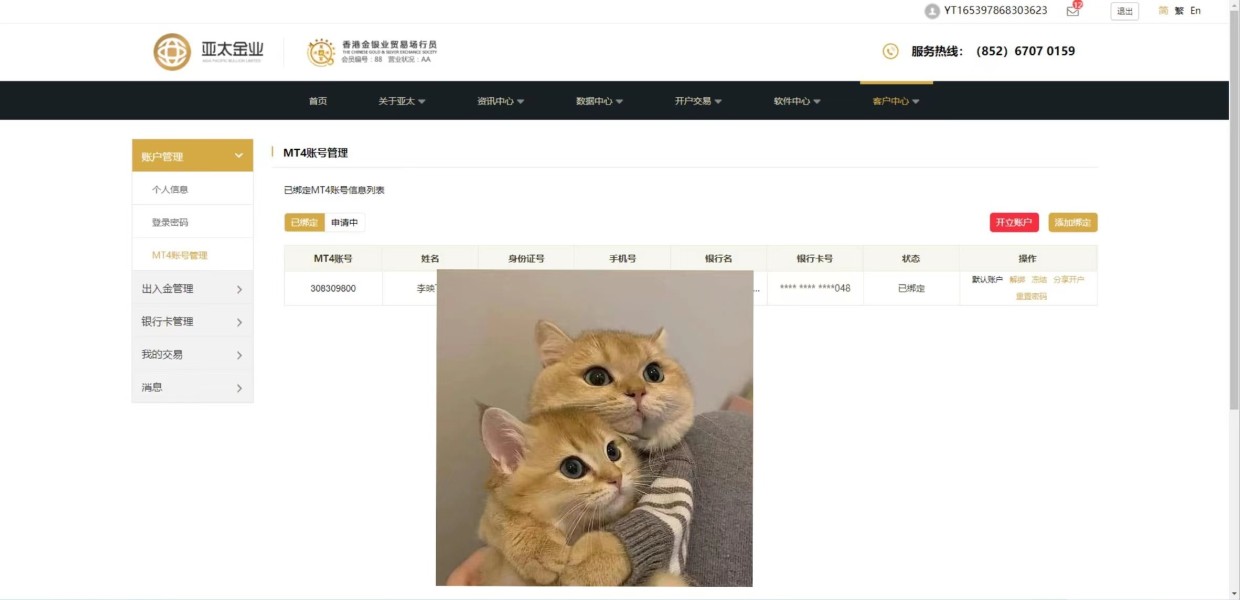

The account conditions offered by Asia Pacific Bullion Limited represent one of the most concerning aspects of this broker's service offering. Available information provides limited details about account types, minimum deposit requirements, or specific account features, which immediately raises transparency concerns. The lack of complete account information makes it extremely difficult for potential traders to make smart decisions about their investment approach.

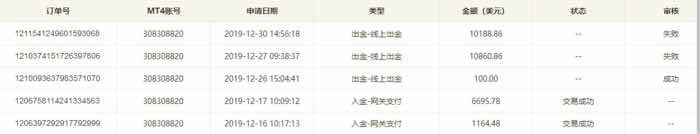

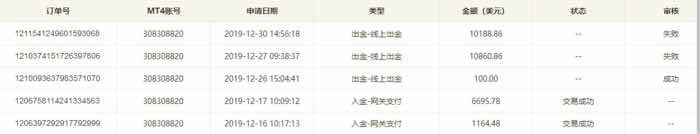

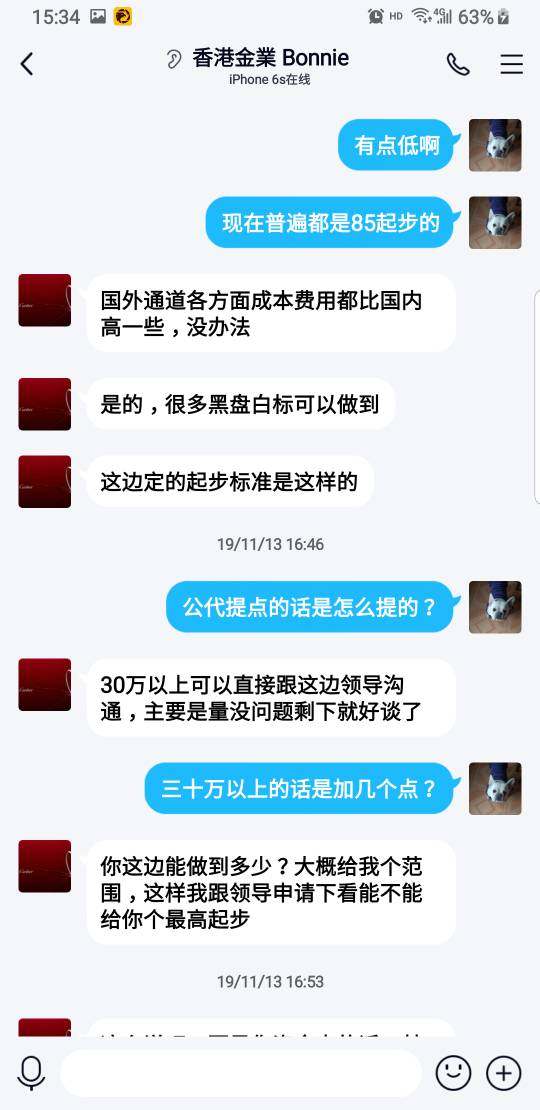

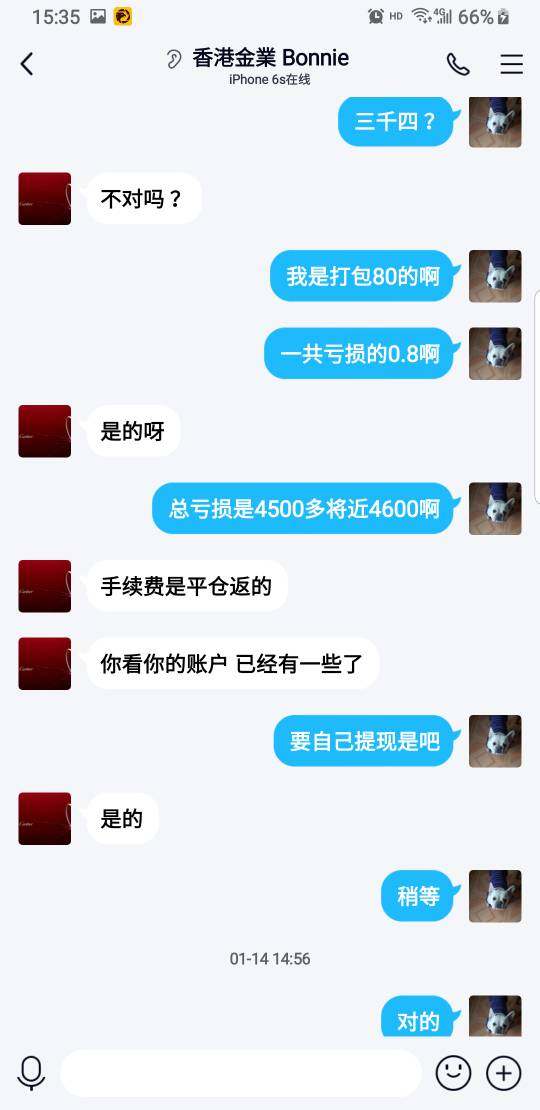

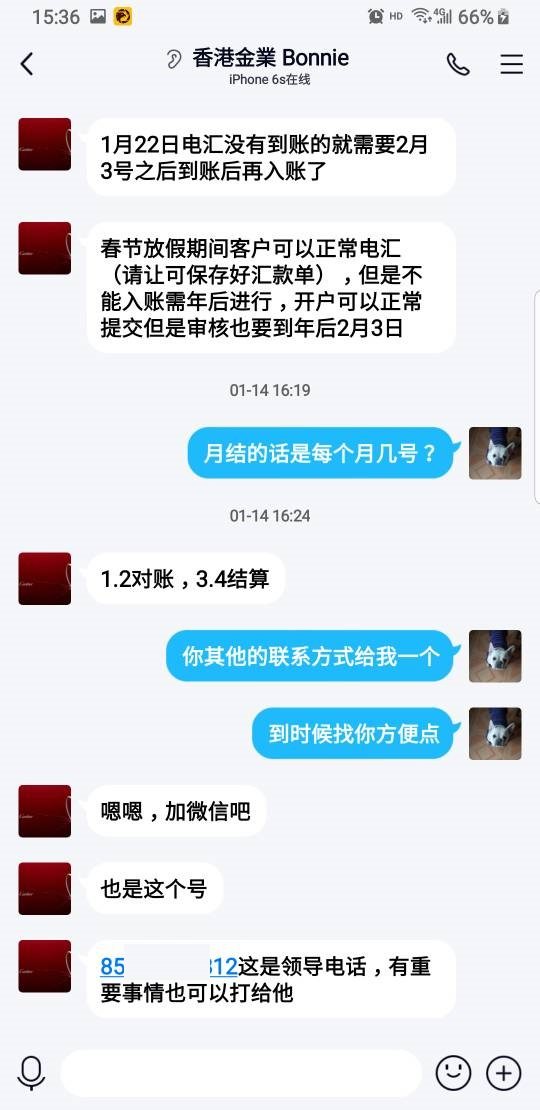

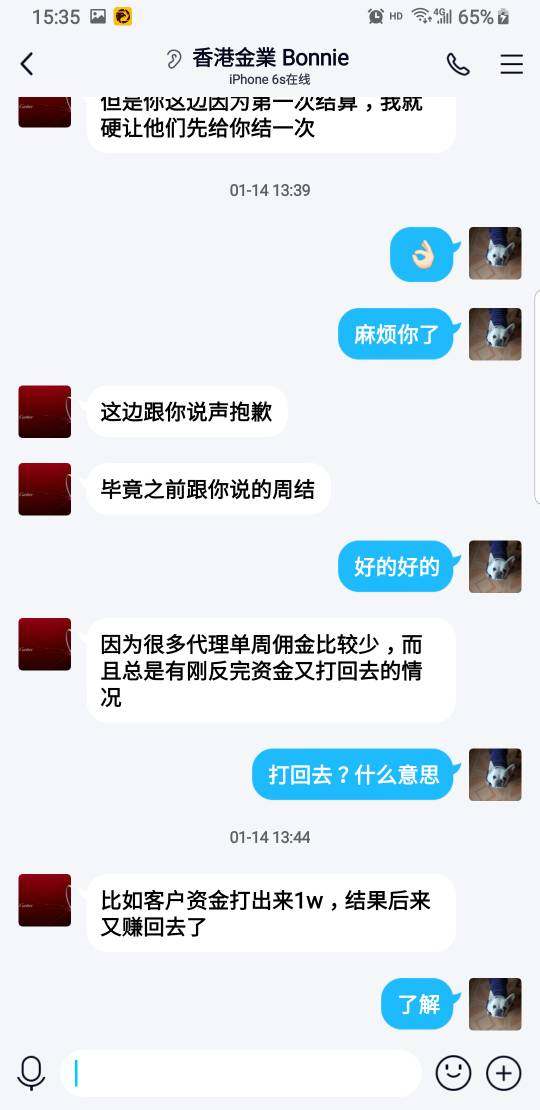

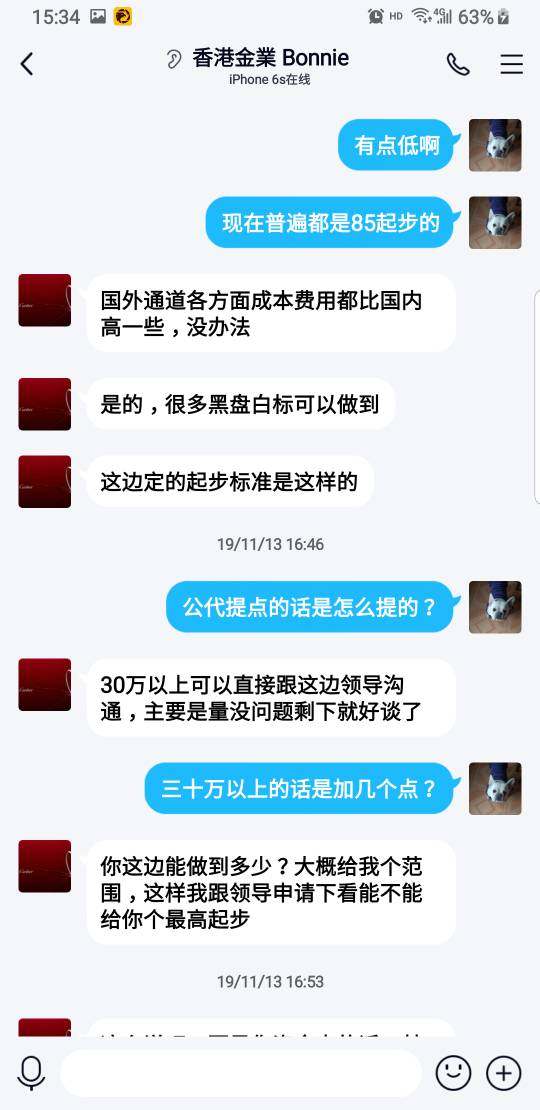

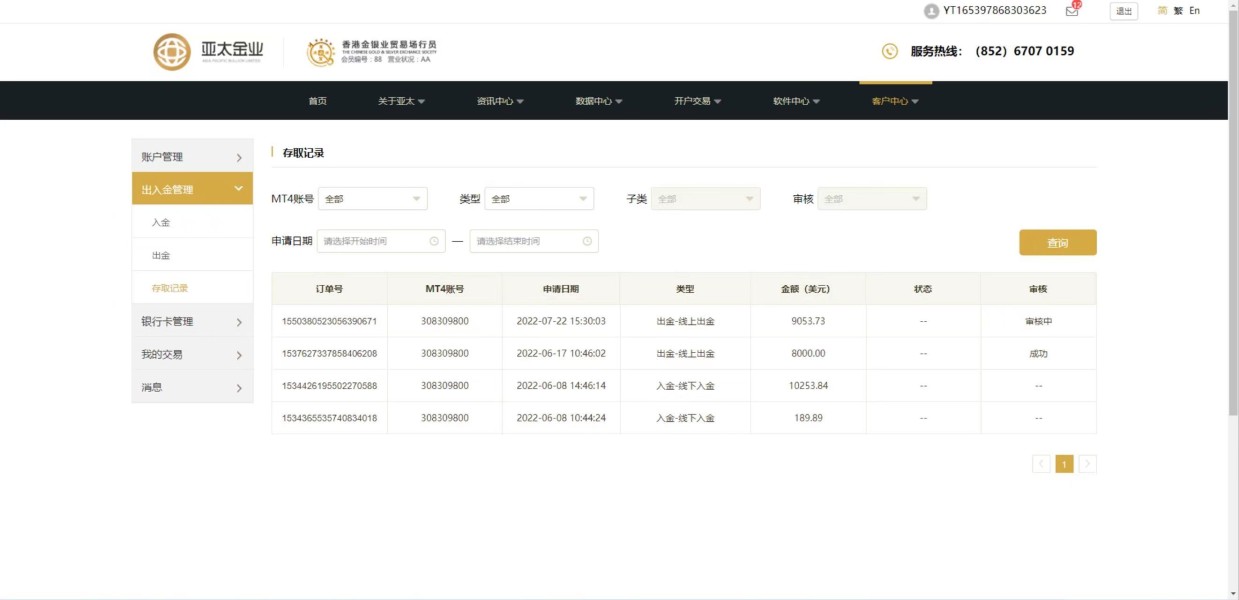

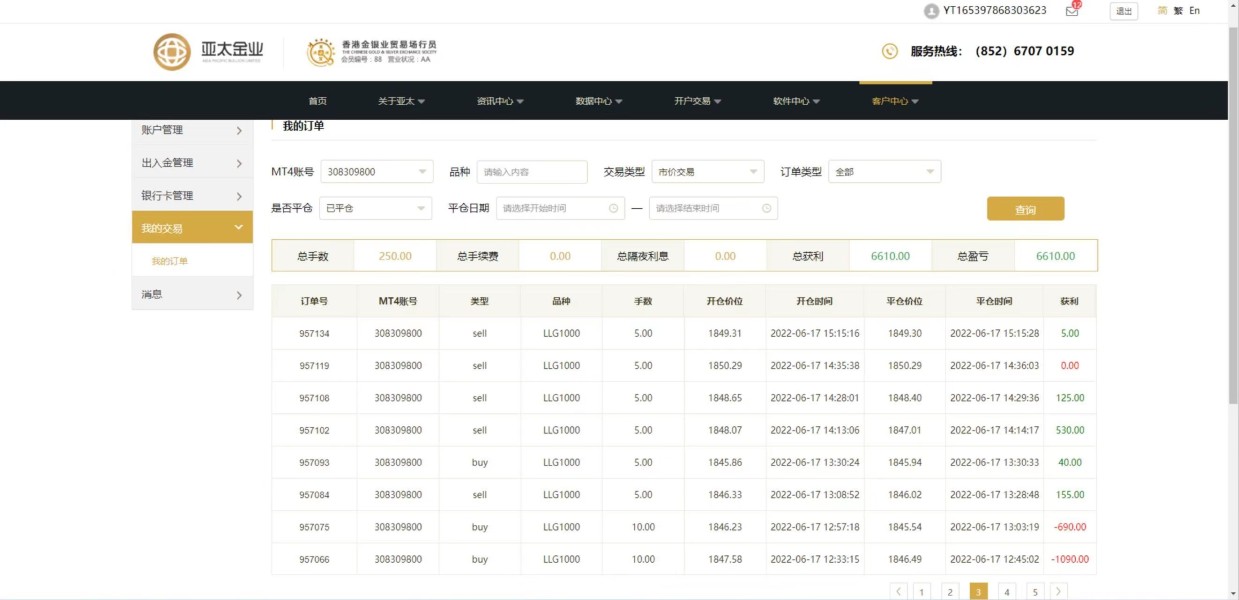

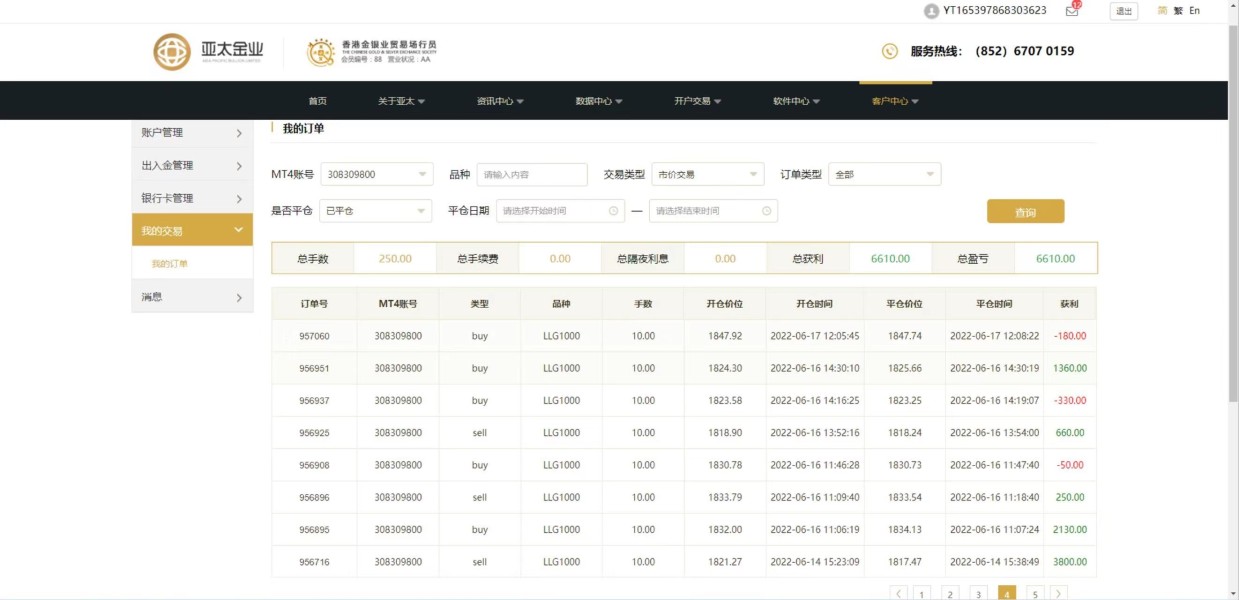

User feedback consistently shows serious problems with account management, especially regarding withdrawal processes. Multiple trader reports suggest that accessing funds after deposit can become problematic, with some users experiencing significant delays or complications when attempting to withdraw their money. This represents a basic breach of trust between broker and client, as reliable fund access is essential for any legitimate trading operation.

The absence of detailed information about special account features, such as Islamic accounts for Muslim traders or VIP accounts for high-volume traders, suggests limited service customization. Professional traders typically require various account options to match their specific trading strategies and religious requirements, making this limitation particularly problematic for serious market participants.

Account opening procedures and verification processes are not clearly outlined in available materials, creating uncertainty about onboarding requirements and timeline expectations. This asia pacific bullion limited review emphasizes that the combination of limited account information and user-reported withdrawal problems makes the account conditions highly unsuitable for most traders.

Asia Pacific Bullion Limited's tools and resources offering presents a mixed picture, with the MetaTrader 5 platform representing the primary positive aspect of their service portfolio. MT5 is widely recognized as a professional-grade trading platform, offering advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. This platform choice demonstrates some commitment to providing traders with industry-standard technology infrastructure.

The broker's focus on precious metals markets could potentially offer focused research and analysis specific to gold, silver, and other commodity markets. However, detailed information about special research resources, market analysis reports, or educational materials is not readily available in accessible sources. This lack of transparency regarding additional tools and resources limits the overall value for traders seeking complete market support.

Educational resources appear to be limited or poorly documented, which represents a significant gap for new traders who require guidance and learning materials. Professional brokers typically provide extensive educational libraries, webinars, and training materials to support trader development, and the absence of such resources suggests a limited commitment to client success.

Automated trading support through MT5 provides some technical capability for computer trading strategies, though specific details about server infrastructure, execution speeds, or additional automation tools are not detailed. The overall tools and resources package, while anchored by a solid trading platform, lacks the complete support structure expected from professional brokerage services.

Customer Service and Support Analysis (Score: 2/10)

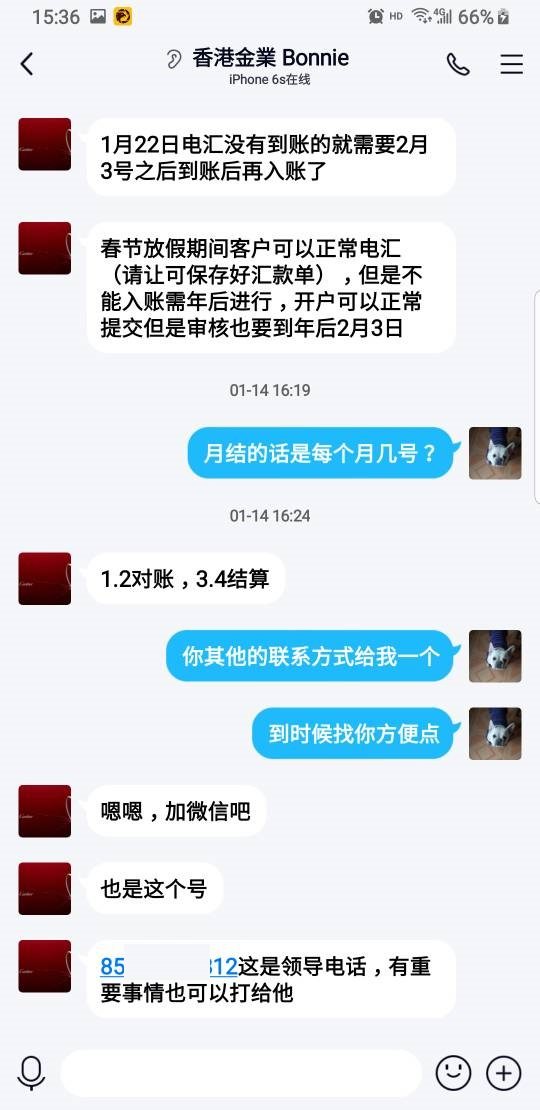

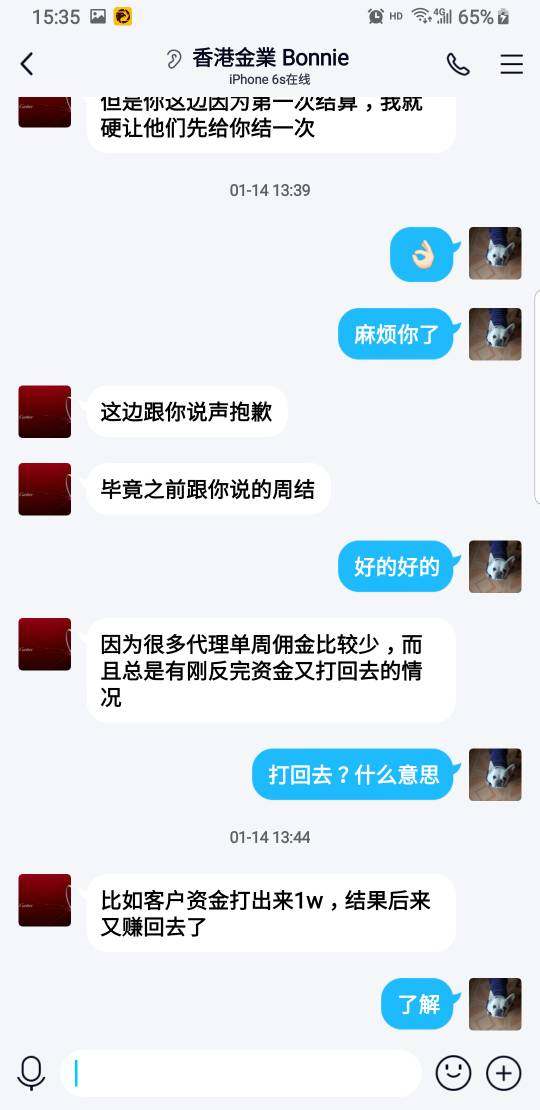

Customer service represents one of the most critically problematic areas for Asia Pacific Bullion Limited, with user feedback consistently highlighting inadequate support quality and responsiveness. Available information suggests that traders experience significant difficulties when attempting to resolve issues, particularly those related to withdrawal requests and account management problems.

Response times appear to be problematic based on user reports, with many traders indicating extended waiting periods for support ticket resolution. In the fast-paced trading environment, delayed customer service can result in missed opportunities and increased frustration, making responsive support essential for broker credibility. The reported lack of timely assistance suggests systematic problems within the customer service infrastructure.

The availability of multiple communication channels, service hours, and multilingual support options is not clearly documented, creating additional barriers for international traders who may require assistance in their native languages. Professional brokers typically offer 24/5 support through various channels including live chat, email, and telephone, with multilingual capabilities to serve diverse client bases.

Problem resolution effectiveness appears particularly weak based on user testimonials, especially regarding withdrawal-related issues. The inability to effectively resolve fund access problems represents a basic failure in customer service standards and raises serious questions about the broker's operational priorities and capabilities. This poor customer service quality significantly undermines trader confidence and operational effectiveness.

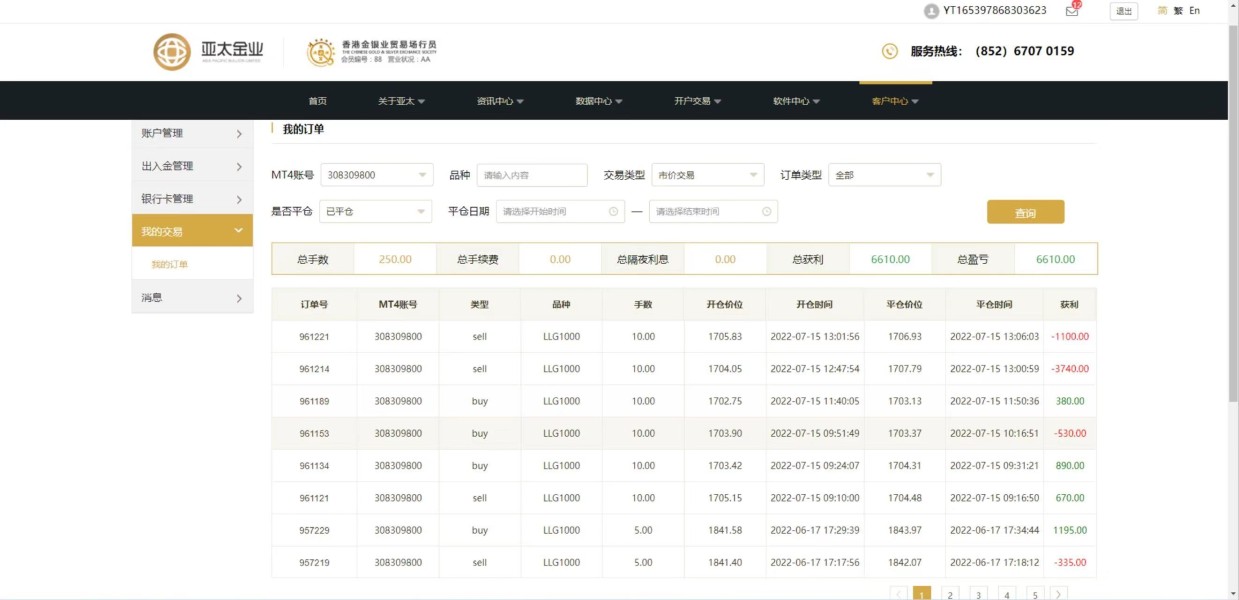

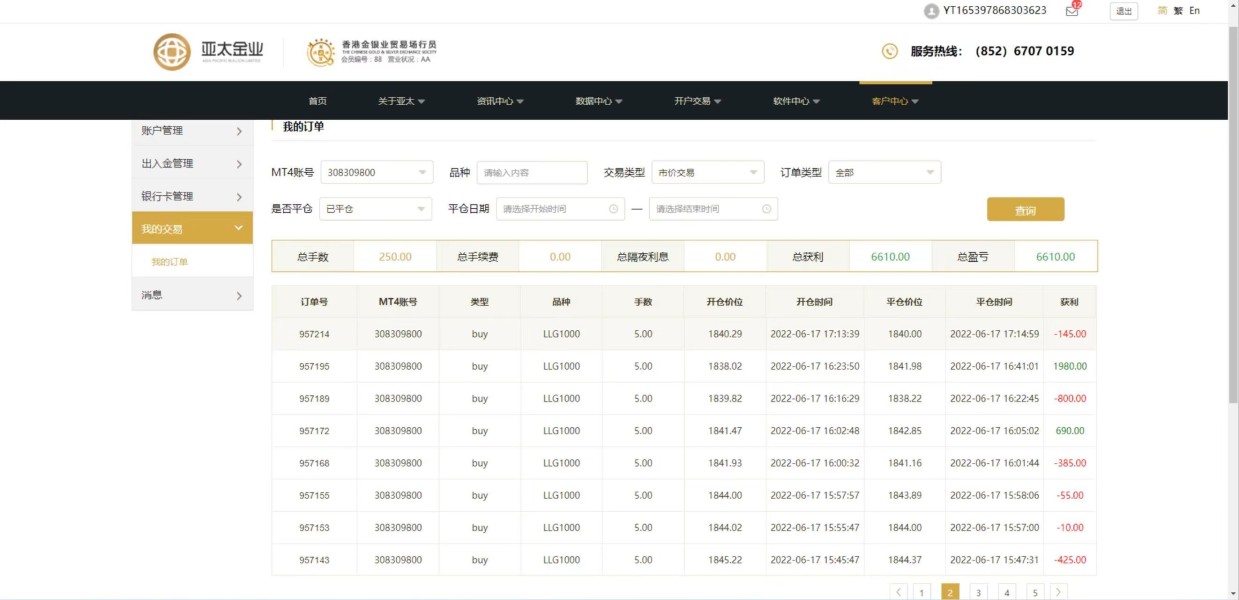

Trading Experience Analysis (Score: 4/10)

The trading experience with Asia Pacific Bullion Limited presents a complex picture, with platform technology providing some positive elements while operational issues create significant concerns. The MetaTrader 5 platform offers professional-grade trading functionality, including advanced order types, comprehensive charting tools, and reliable execution infrastructure when functioning properly.

Platform stability and execution quality reports from users are mixed, with some traders experiencing acceptable performance while others report technical difficulties. The specialized focus on precious metals markets may provide targeted trading opportunities for commodity traders, though this limited asset range restricts portfolio variety options for traders seeking broader market exposure.

Order execution quality and speed details are not completely documented, making it difficult to assess whether the broker provides competitive execution standards. Professional traders require reliable order filling, minimal slippage, and transparent execution policies, and the lack of detailed performance metrics raises questions about execution quality standards.

Mobile trading experience and platform accessibility across different devices are not well-documented, potentially limiting trading flexibility for modern traders who require mobile access. The overall trading experience, while supported by professional platform technology, is undermined by broader operational concerns that affect trader confidence and account management effectiveness.

Trust and Security Analysis (Score: 1/10)

Trust and security represent the most critical weaknesses in Asia Pacific Bullion Limited's service offering, with multiple factors contributing to significant credibility concerns. The absence of clear regulatory oversight information creates immediate transparency issues, as legitimate brokers typically provide detailed regulatory credentials and compliance documentation for client verification.

Fund security measures and client money protection protocols are not clearly outlined in available materials, raising serious questions about asset safety and separation practices. Professional brokers implement strict fund separation, regulatory compliance measures, and insurance protection to safeguard client assets, and the lack of such information represents a major red flag for potential clients.

Company transparency regarding ownership, management, and operational practices appears limited, making it difficult for clients to verify the broker's legitimacy and operational standards. Legitimate financial service providers typically maintain high transparency standards, including detailed company information, regulatory filings, and clear operational policies.

User trust feedback consistently indicates low confidence levels, particularly regarding fund security and withdrawal reliability. The combination of regulatory uncertainty, limited transparency, and negative user experiences creates a trust profile that falls well below industry standards. This asia pacific bullion limited review emphasizes that trust and security concerns make this broker unsuitable for traders prioritizing asset protection and regulatory compliance.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Asia Pacific Bullion Limited appears significantly below industry standards, with multiple aspects of the client experience receiving negative feedback from traders. The combination of withdrawal problems, customer service issues, and transparency concerns creates a user experience that fails to meet basic expectations for professional brokerage services.

Interface design and platform usability benefit from the MT5 platform's professional design, though broader user experience elements including account management, support interactions, and fund operations receive consistently negative feedback. The disconnect between platform quality and operational service creates frustration for users who expect complete professional service.

Registration and verification processes are not clearly documented, potentially creating confusion and delays for new clients attempting to establish accounts. Professional onboarding procedures should be transparent, efficient, and well-documented to ensure smooth client acquisition and account activation processes.

Fund operation experiences represent the most significant user experience problem, with withdrawal difficulties creating stress and uncertainty for traders attempting to access their money. This basic operational failure undermines all other aspects of the user experience and creates an environment unsuitable for serious trading activities.

The user demographic best suited for this broker appears extremely limited given the operational problems and trust concerns. Most professional traders require reliable fund access, regulatory protection, and responsive customer service, making Asia Pacific Bullion Limited unsuitable for the majority of market participants seeking professional brokerage services.

Conclusion

This complete asia pacific bullion limited review reveals a broker with significant operational and trust issues that make it unsuitable for most traders. While the company offers MT5 platform access and specializes in precious metals trading, these limited positive aspects are overwhelmed by serious concerns including withdrawal problems, inadequate customer service, and lack of regulatory transparency.

The broker appears most unsuitable for traders prioritizing fund security, regulatory protection, and reliable customer service. The consistent user feedback regarding withdrawal difficulties and poor support quality creates a risk profile that exceeds acceptable levels for professional trading activities.

Key strengths include MT5 platform access and precious metals specialization, while major weaknesses include withdrawal problems, poor customer service, regulatory uncertainty, and limited transparency. The overall assessment suggests that traders should seek alternative brokers with stronger operational standards and regulatory compliance records.