Grand Finance 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Grand Finance Group, with a legacy spanning over 35 years in the financial market, positions itself as a reputable brokerage catering to new and inexperienced traders. The firm boasts an extensive array of trading services and financial instruments, making it an appealing selection for individuals who prioritize experience and low trading costs. However, potential investors should tread carefully; allegations of regulatory lapses, trouble with fund withdrawals, and inconsistent customer service have surfaced, casting a shadow over its otherwise promising façade. For novice traders seeking value and access to varied markets, Grand Finance Group may present attractive opportunities, but the lurking risks demand a thorough deliberation.

⚠️ Important Risk Advisory & Verification Steps

Potential Risks:

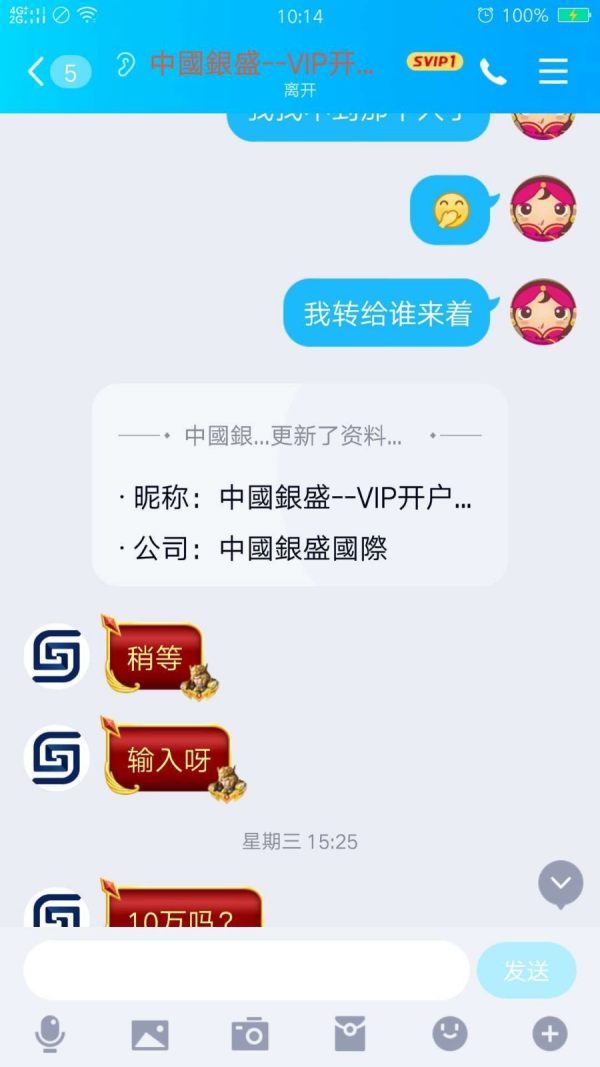

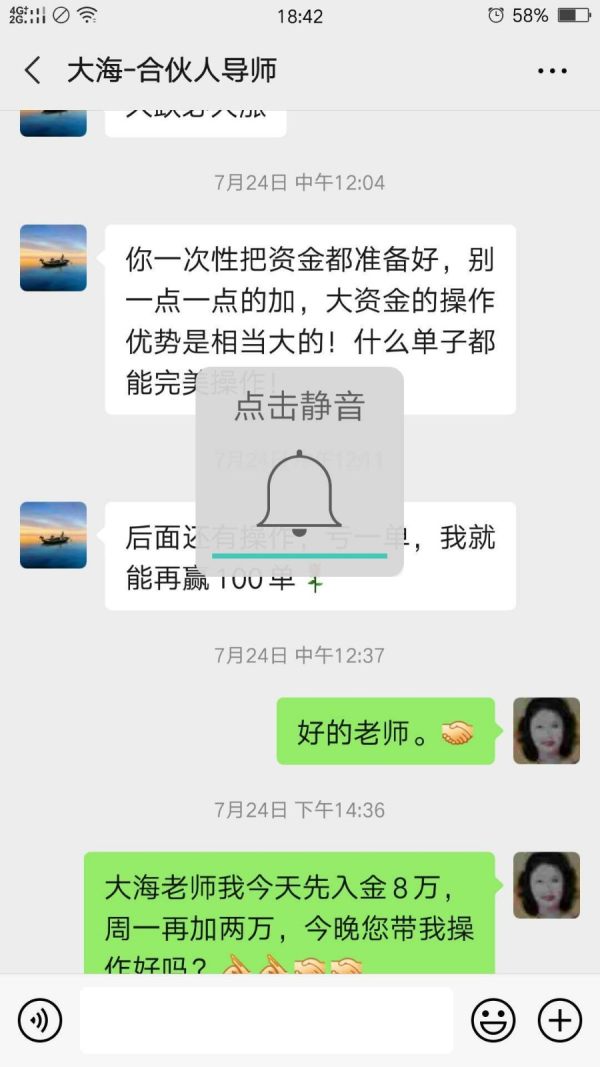

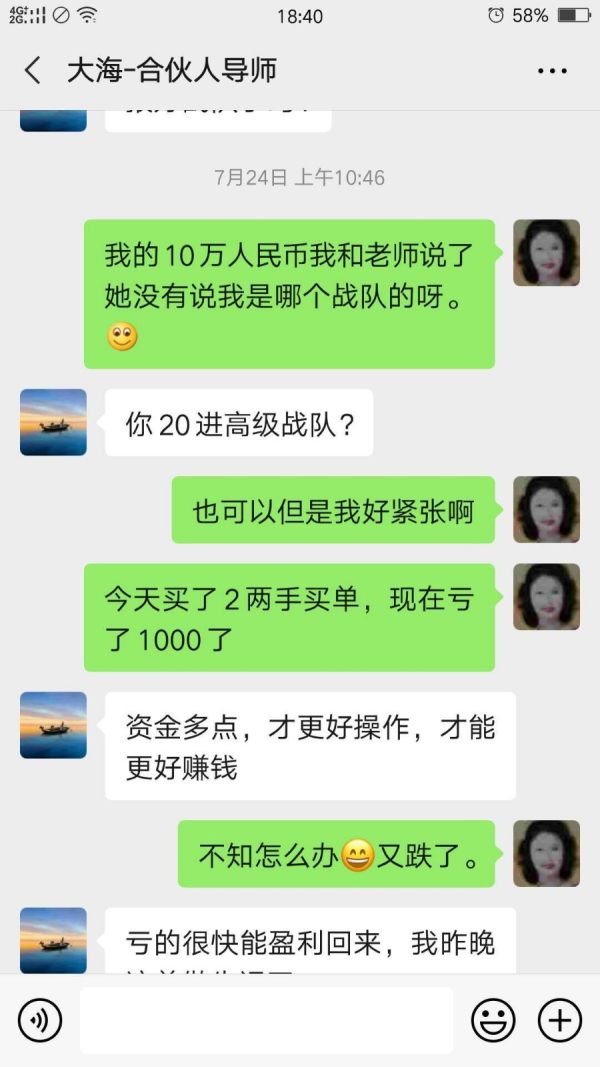

- Regulatory Concerns: Grand Finance operates with a lack of robust regulatory oversight, posing a risk to client investments.

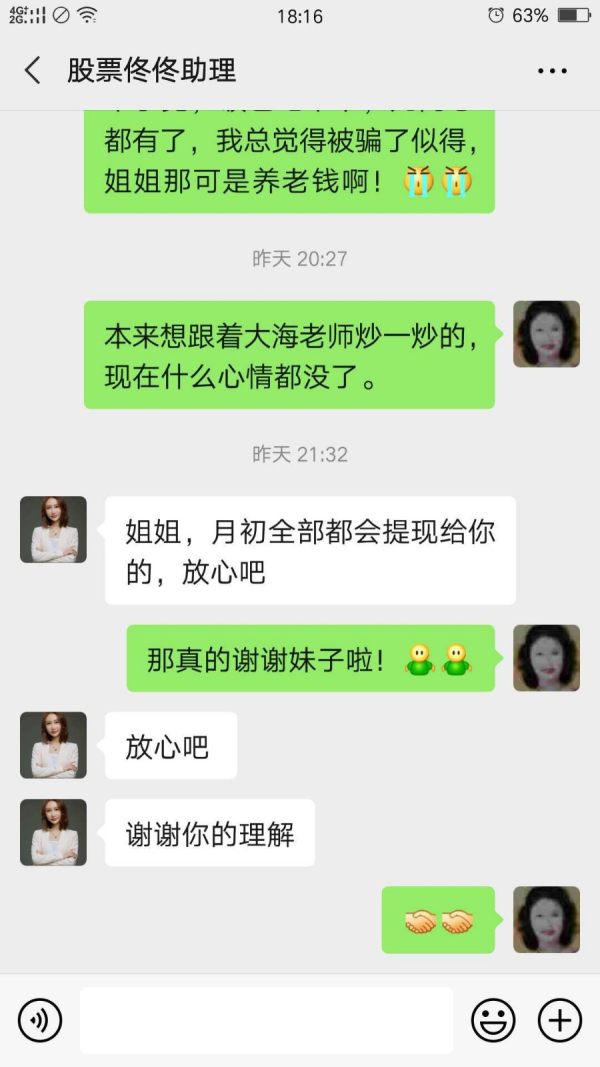

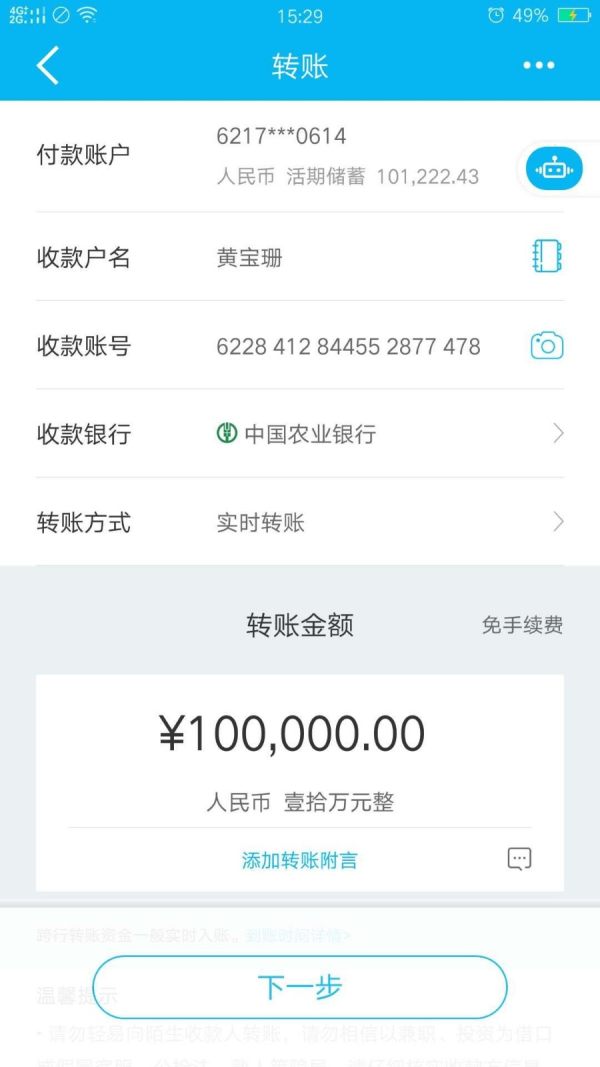

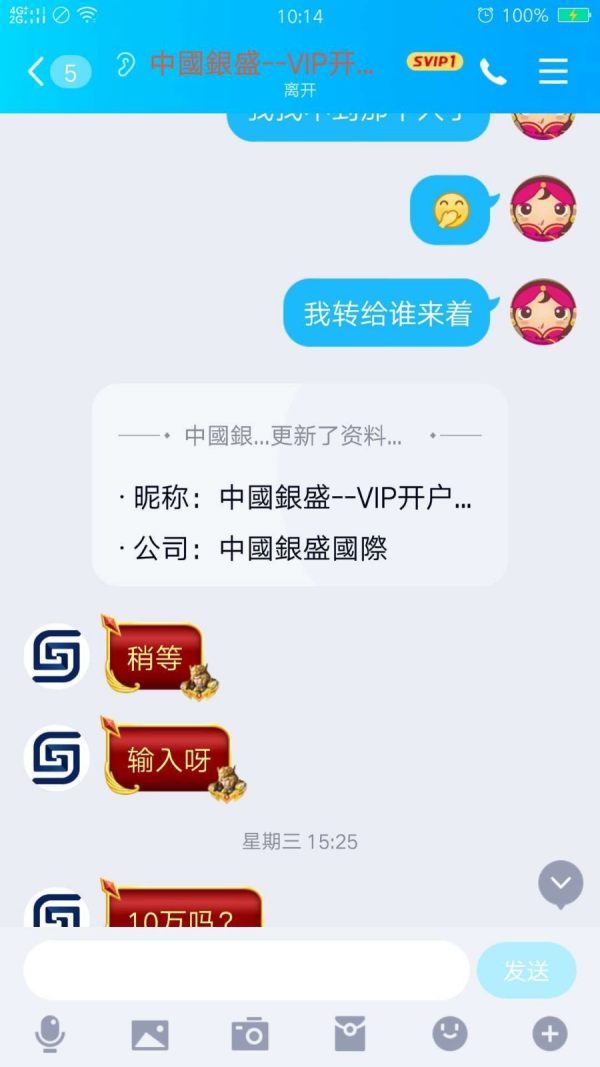

- Withdrawal Challenges: Numerous accounts indicate user experiences facing difficulties in withdrawing their funds.

- Customer Support Concerns: Mixed feedback on the effectiveness and responsiveness of customer service.

Self-Verification Steps:

- Use authoritative regulatory websites like the NFA's BASIC database to check the broker's licensing status.

- Verify the firms provided contact details against independent sources.

- Consult reviews on trusted finance platforms to gauge user sentiments and experiences.

- Assess the broker's website directly for transparency regarding fees and services.

Broker Evaluation Framework

Company Overview

Company Background and Positioning

Established in 1989, Grand Finance Group has its headquarters in Hong Kong and has built a reputation as an experienced player in the trading industry. The company claims regulatory affiliation with the Hong Kong CGSE but faces scrutiny regarding its level of oversight. As such, traders should weigh the companys lengthy existence against the potential risks associated with unregulated operations.

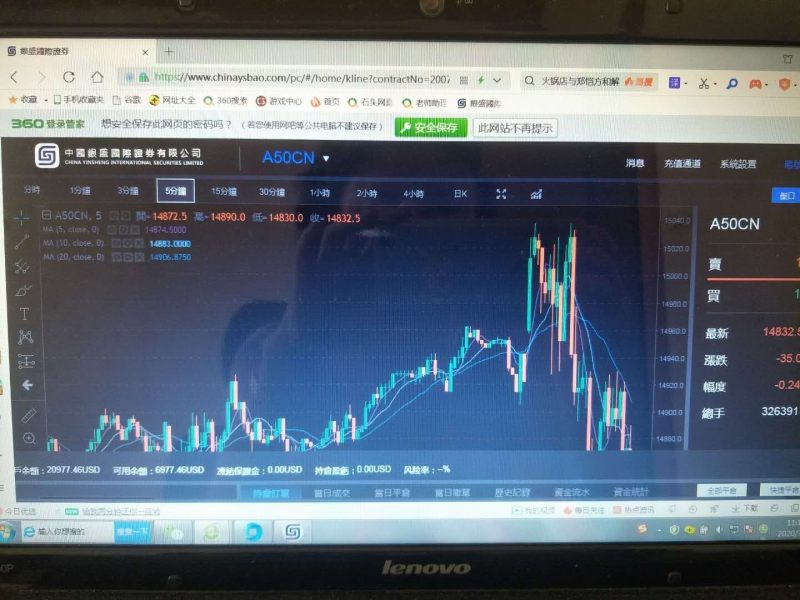

Core Business Overview

Grand Finance Group specializes in offering a variety of trading services encompassing forex, CFDs, commodities, and indices. Traders can access these markets via multiple platforms, although the absence of well-known options such as MT4 or MT5 may deter more experienced users. Grand Finance markets a broad spectrum of financial instruments, but clients should approach with due diligence regarding regulatory compliance.

Quick-Look Details

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Regulatory Information Conflicts

The clarity surrounding Grand Finances regulatory status is clouded. While it claims to be regulated by the CGSE, many reports cite potential issues with unregulated practices. This presents significant risk, leaving clients vulnerable without clear agency oversight.

User Self-Verification Guide

To ascertain the brokers trustworthiness:

- Visit the NFA's BASIC database for licensing information.

- Search for Grand Finance Group‘s registration details to confirm regulatory claims.

- Utilize web resources to probe into the history of user complaints and resolutions.

- Review publicly available financial and operational insights for transparency.

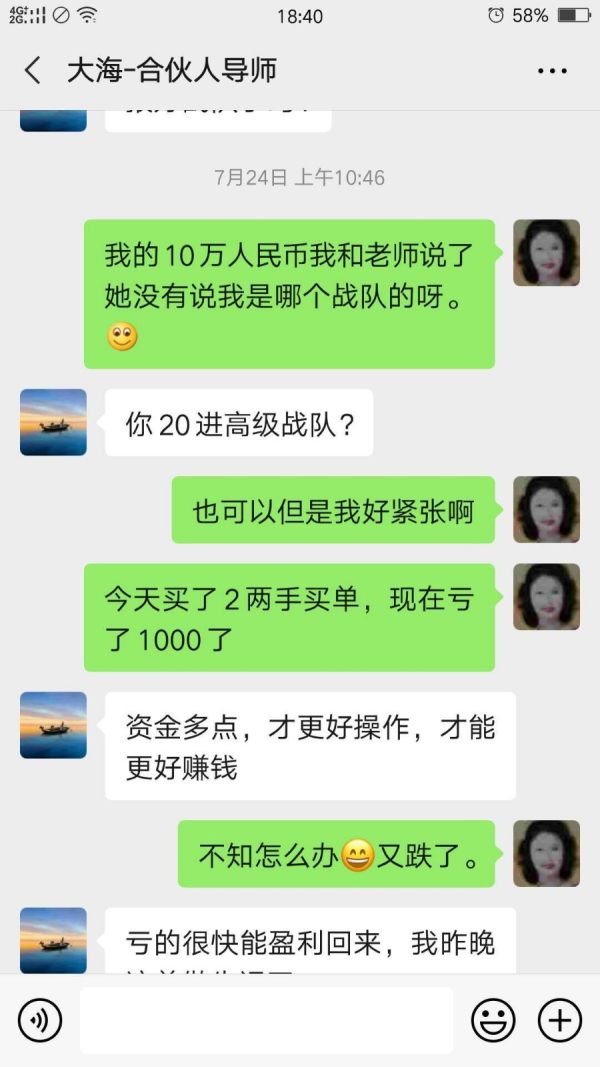

"I’ve struggled to withdraw my funds, and it's left me questioning their legitimacy."

Industry Reputation and Summary

User feedback consistently highlights concerns over withdrawal difficulties, indicating that potential investors must conduct thorough research before engaging with this brokerage.

Trading Costs Analysis

Advantages in Commissions

Grand Finance Group prides itself on a competitive commission structure that appeals to active traders. The absence of trading commissions on selected platforms positions it favorably against its competitors.

The "Traps" of Non-Trading Fees

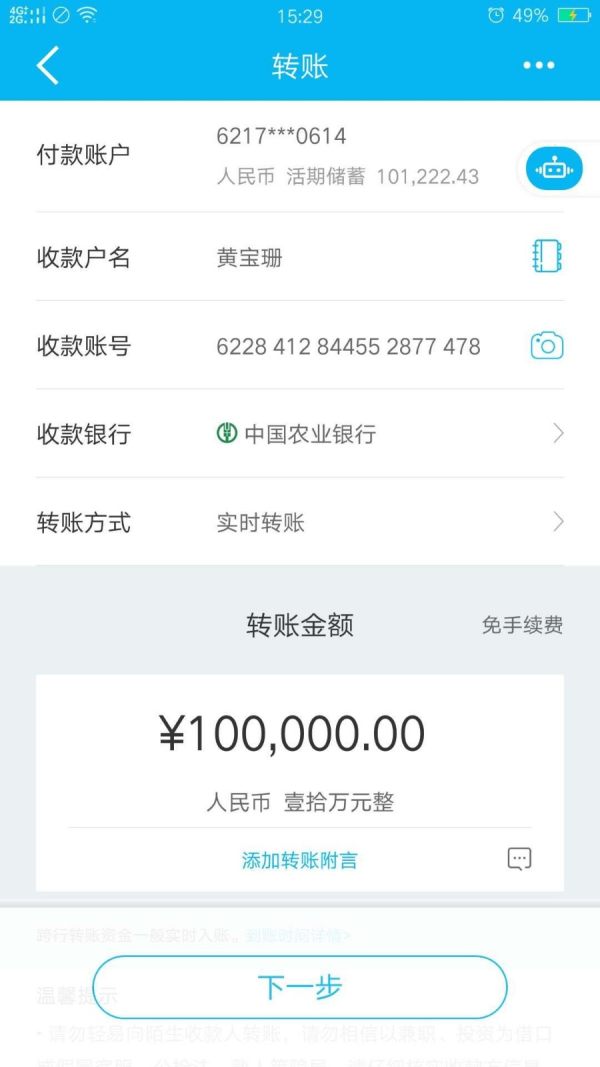

However, unseen pitfalls exist, such as significant withdrawal fees, with reports stipulating fees of $30 or more revealing a concerning practice that can diminish overall investment returns.

"They take $30 every time you try to pull out your money! It's discouraging."

Cost Structure Summary

For new traders enticed by lower commissions, the total cost of trading emerges as a dual-edged sword, suggesting a potential trade-off that experienced traders will notice more acutely.

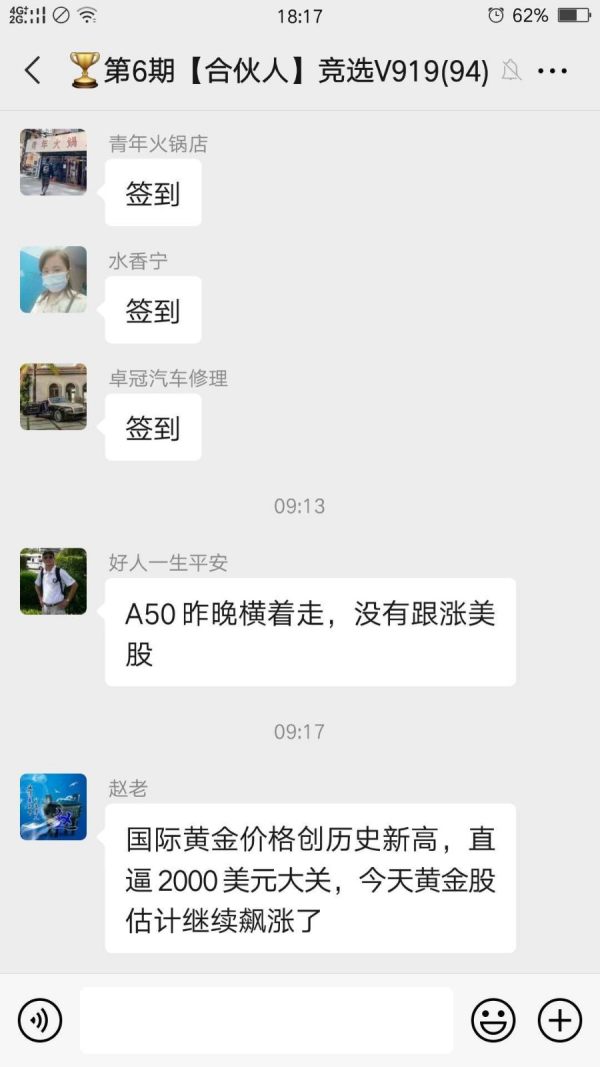

Platform Diversity

Grand Finance offers various platforms, although not utilizing popular trading solutions like MT4 or MT5 limits access to specific tools that many traders find essential. This may result in a user experience that lacks in sophistication, impacting both novice and seasoned traders alike.

Quality of Tools and Resources

Basic charting tools and limited educational materials might impede the development of new traders, whereas more experienced users could find the resources inadequate for sophisticated trading strategies.

Platform Experience Summary

Reviews vary, with some noting that while usability is basic, the interface lacks advanced functionalities users expect from contemporary brokerage platforms.

User Experience Analysis

Overall User Experience

Feedback highlights a mix of ease and frustration in navigating the platform. Beginners might find the interface manageable, but limitations in advanced tools lead to dissatisfaction among more adept traders.

Customer Support Analysis

Support Effectiveness

Reports of poor responsiveness reflect conflicting experiences within customer support. Timeliness and thoroughness in addressing client queries appear to be lacking, creating added frustration among users.

Account Conditions Analysis

Account Structures

Grand Finance offers a simplistic account model lacking the variety required by different trader profiles. The absence of differentiated account types may betray both novice and experienced trader expectations.

Conclusion

Grand Finance Group embodies an intriguing option for new investors, presenting an opportunity to delve into diverse financial markets grounded by experience. However, significant risks pertaining to regulatory concerns, withdrawal issues, and varying customer service levels warrant careful consideration. Potential investors should prioritize rigorous due diligence and self-verification before committing valuable funds to this brokerage. As with any investment, understanding the landscape will remain paramount in navigating opportunities and potential pitfalls alike.