Amillex 2025 Review: Everything You Need to Know

Summary

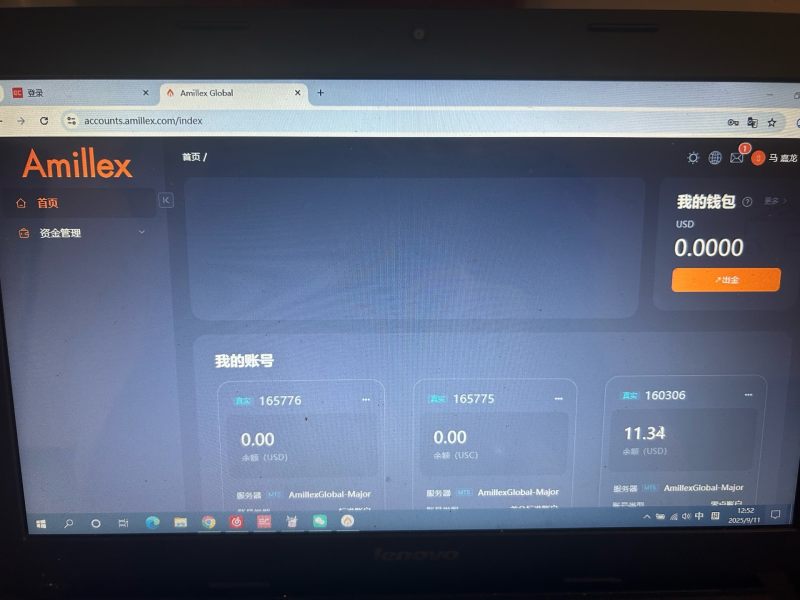

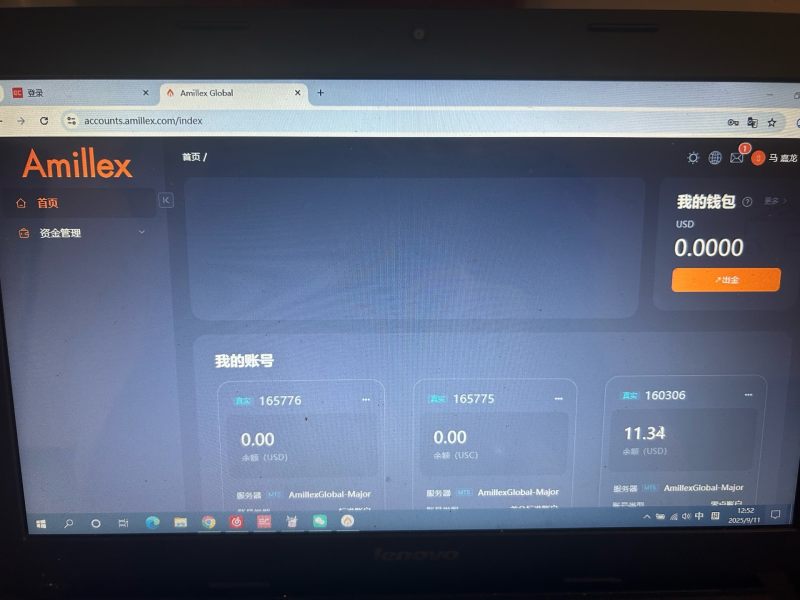

This Amillex review shows serious problems with a trading company. Many traders have raised red flags about this broker based on user feedback and market data. Amillex gets an overall rating of 2 out of 10, which means there are big concerns about whether it's real and reliable. The platform says it's a multi-asset trading broker that offers stocks, digital assets, and CFDs. Their headquarters are supposedly in Sydney. However, many sources have found problems with the broker's credibility, and some reviews call it a scam outright. The main customers seem to be traders who want different investment options across many asset types. Even though Amillex claims to provide complete trading services, the lack of clear regulatory information and mostly negative user reviews suggest big risks for potential clients. This evaluation is especially worrying for traders who care about safety and regulatory compliance when choosing their broker.

Important Notice

This review uses information from various sources including user feedback, market analysis, and public company information. Readers should know that regulatory requirements and broker operations can be very different across different countries. The lack of clear regulatory information for Amillex creates more concerns about following local financial regulations. All assessments in this review reflect the current available information and should be considered along with independent research. Potential clients should strongly verify all broker claims independently and talk with financial advisors before making any investment decisions. The trading industry changes rapidly, and broker conditions may evolve over time.

Rating Framework

Broker Overview

Amillex says it's a multi-asset trading platform based in Sydney, Australia, though specific details about when it started remain unclear from available sources. The company claims to offer complete trading services across multiple asset classes, trying to be a destination for traders who want different investment opportunities. According to available information, Amillex works as a brokerage firm that provides access to stocks, digital assets, and CFD trading, though the specific details of their business model and how they operate are not well documented in public sources.

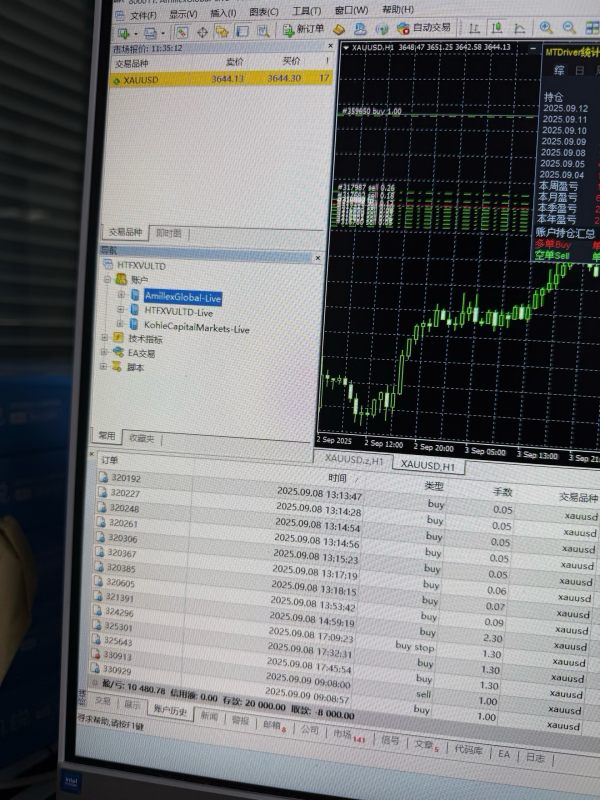

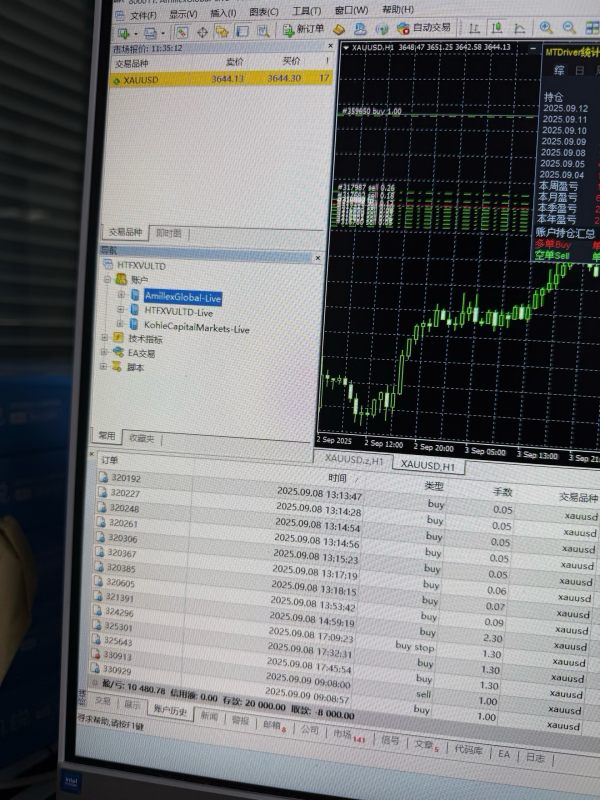

The broker's market position suggests an attempt to attract traders interested in modern, multi-asset trading environments. However, the lack of detailed company background information, including founding dates and executive leadership details, raises questions about transparency. WikiStock reports show that Amillex may have connections to Mauritius with a relatively short operational history of 1-2 years, though this information needs verification. The absence of complete corporate disclosure and limited public information about the company's operational history adds to the overall concerns about the broker's legitimacy and long-term viability in the competitive forex and CFD trading market.

Regulatory Status: Available sources do not mention specific regulatory information for Amillex, which is a big concern for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in the available source materials, leaving potential clients without clear guidance on funding procedures.

Minimum Deposit Requirements: The minimum deposit requirements for opening accounts with Amillex are not specified in the available documentation.

Bonus and Promotions: Information about promotional offers, welcome bonuses, or ongoing promotional campaigns is not mentioned in the available sources.

Tradeable Assets: According to available information, Amillex offers trading in stocks, digital assets, and CFDs, suggesting a multi-asset approach to trading services.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not provided in the available source materials, making it difficult to assess the broker's competitiveness.

Leverage Ratios: Specific leverage offerings and maximum leverage ratios are not mentioned in the available documentation.

Platform Options: The specific trading platforms offered by Amillex are not detailed in the available source materials.

Geographic Restrictions: Information about regional restrictions or availability limitations is not mentioned in the available sources.

Customer Support Languages: Available language options for customer support are not specified in the source materials.

This Amillex review highlights the significant information gaps that potential clients face when evaluating this broker, which itself raises concerns about transparency and regulatory compliance.

Account Conditions Analysis

The evaluation of Amillex's account conditions faces big limitations due to the lack of detailed information available in public sources. Traditional broker reviews typically examine multiple account types, ranging from basic retail accounts to premium or professional trading accounts, but such details are missing from available Amillex documentation. The absence of clear account tier structures, minimum deposit requirements, and associated benefits represents a significant transparency issue that potential clients should consider carefully.

Most reputable brokers provide complete account opening procedures, clearly defined documentation requirements, and transparent fee structures for different account levels. However, the available information about Amillex does not include these crucial details, making it impossible to assess whether the broker offers competitive account conditions compared to industry standards. The lack of information about special account types, such as Islamic accounts for Sharia-compliant trading or demo accounts for practice trading, further adds to concerns about the broker's service comprehensiveness.

Additionally, the absence of detailed information about account funding requirements, maintenance fees, or inactivity charges prevents potential clients from making informed decisions about the true cost of maintaining an account with Amillex. This Amillex review must note that reputable brokers typically provide extensive documentation about account terms and conditions, and the lack of such information raises questions about operational transparency and client protection measures.

The assessment of trading tools and resources offered by Amillex encounters significant challenges due to limited available information about the broker's platform capabilities and analytical offerings. Professional trading environments typically provide complete charting tools, technical analysis indicators, economic calendars, and market research resources, but specific details about Amillex's tool suite are not documented in available sources.

Modern traders expect access to advanced analytical tools, real-time market data, and educational resources to support their trading decisions. However, the available information does not specify whether Amillex provides fundamental analysis reports, technical analysis tools, or automated trading capabilities such as Expert Advisors or copy trading systems. The absence of detailed information about research resources, market commentary, or educational materials raises questions about the broker's commitment to supporting trader development and informed decision-making.

Furthermore, the lack of information about third-party tool integration, API access for algorithmic trading, or mobile trading capabilities suggests potential limitations in the broker's technological offerings. Reputable brokers typically highlight their technological advantages and tool offerings as key differentiators, and the absence of such information in Amillex's available documentation represents a significant gap in transparency that potential clients should consider when evaluating the broker's suitability for their trading needs.

Customer Service and Support Analysis

The evaluation of Amillex's customer service capabilities faces big constraints due to the absence of detailed information about support channels, response times, and service quality in available sources. Effective customer support represents a crucial component of broker selection, particularly for traders who may require assistance with technical issues, account management, or trading-related inquiries.

Professional brokers typically offer multiple communication channels including live chat, email support, telephone assistance, and complete FAQ sections. However, the available information about Amillex does not specify which support channels are available, their operational hours, or the languages in which support is provided. This lack of transparency about customer service capabilities raises concerns about the broker's ability to provide timely and effective assistance when clients encounter issues.

The absence of information about support quality, average response times, or customer satisfaction metrics prevents potential clients from assessing whether Amillex can meet their service expectations. Additionally, the lack of details about account management support, technical assistance capabilities, or dispute resolution procedures represents significant gaps in service transparency. Given the negative user ratings and scam allegations mentioned in various sources, the absence of clear customer service information becomes even more concerning for potential clients who may need reliable support channels to address any issues that arise during their trading experience.

Trading Experience Analysis

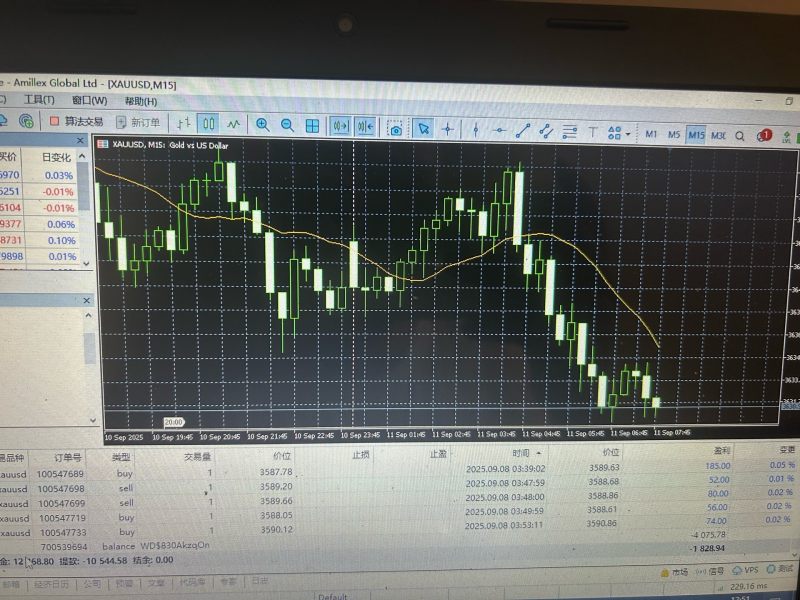

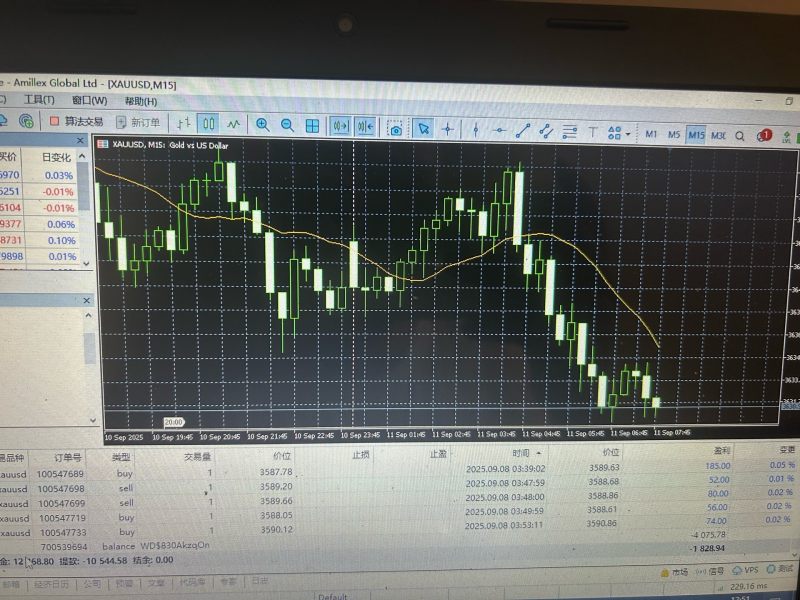

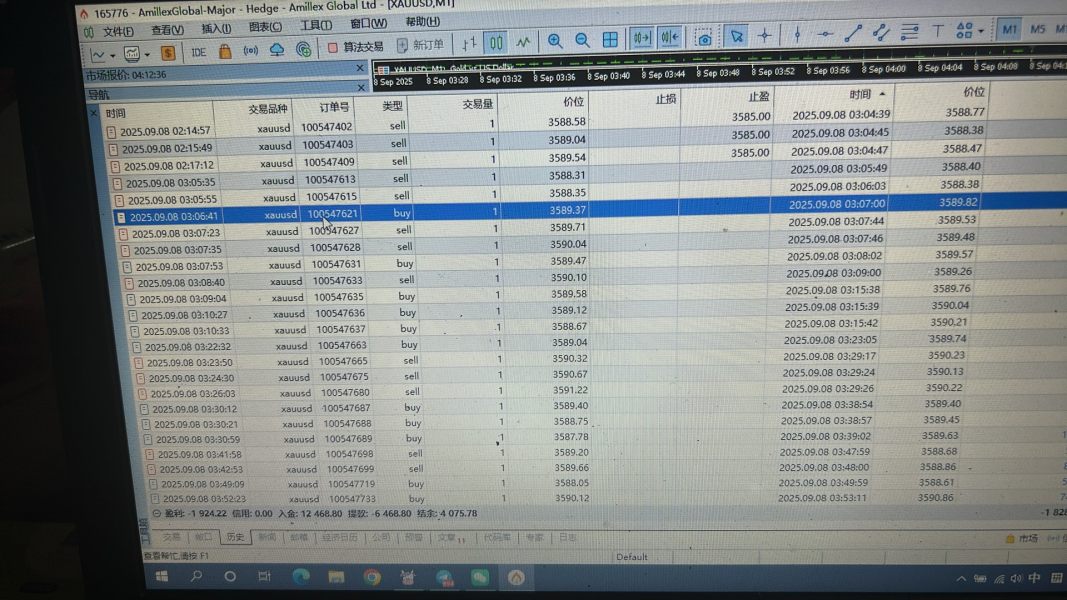

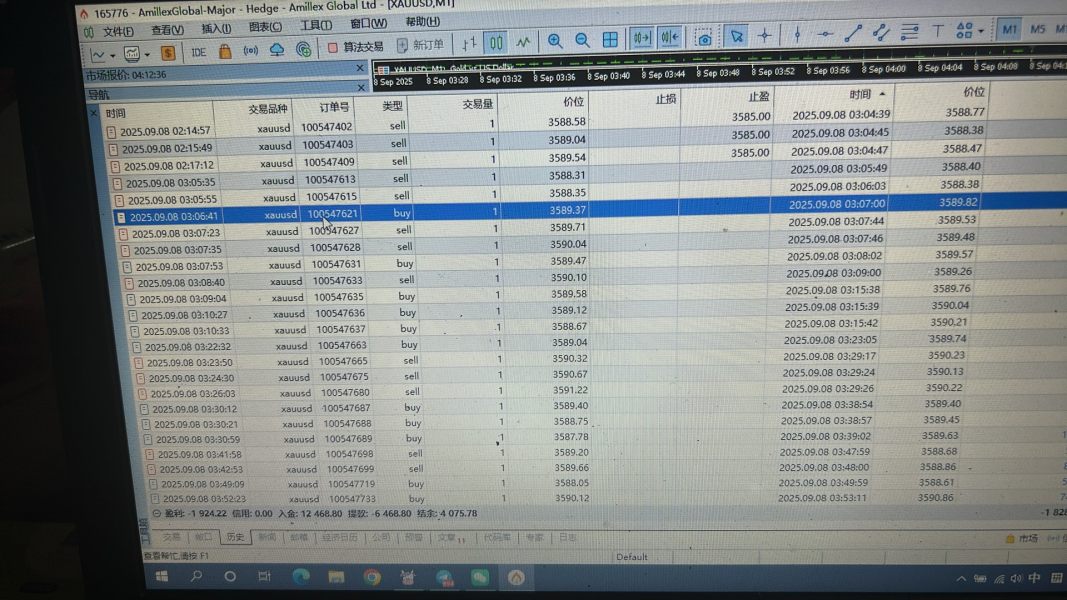

The assessment of trading experience with Amillex encounters significant limitations due to insufficient detailed information about platform performance, execution quality, and overall user interface design. Trading experience includes multiple factors including platform stability, order execution speed, price accuracy, and the overall usability of trading interfaces, but complete data about these aspects is not available in the source materials.

Professional trading platforms typically provide fast order execution, minimal slippage, competitive spreads, and stable connectivity during various market conditions. However, the available information does not include specific performance metrics, execution statistics, or user feedback about platform reliability during high-volatility periods. The absence of detailed trading condition information prevents potential clients from understanding what to expect regarding execution quality and platform performance.

Mobile trading capabilities have become increasingly important for modern traders, but information about Amillex's mobile platform features, functionality, and performance is not documented in available sources. Additionally, the lack of details about platform customization options, advanced order types, or risk management tools raises questions about the sophistication of the trading environment. The user rating of 2 out of 10 suggests significant dissatisfaction with the overall service, though specific trading experience feedback is not detailed in the available sources. This Amillex review must emphasize that the lack of complete trading experience information, combined with negative user ratings, raises big concerns about platform quality and reliability.

Trust and Reliability Analysis

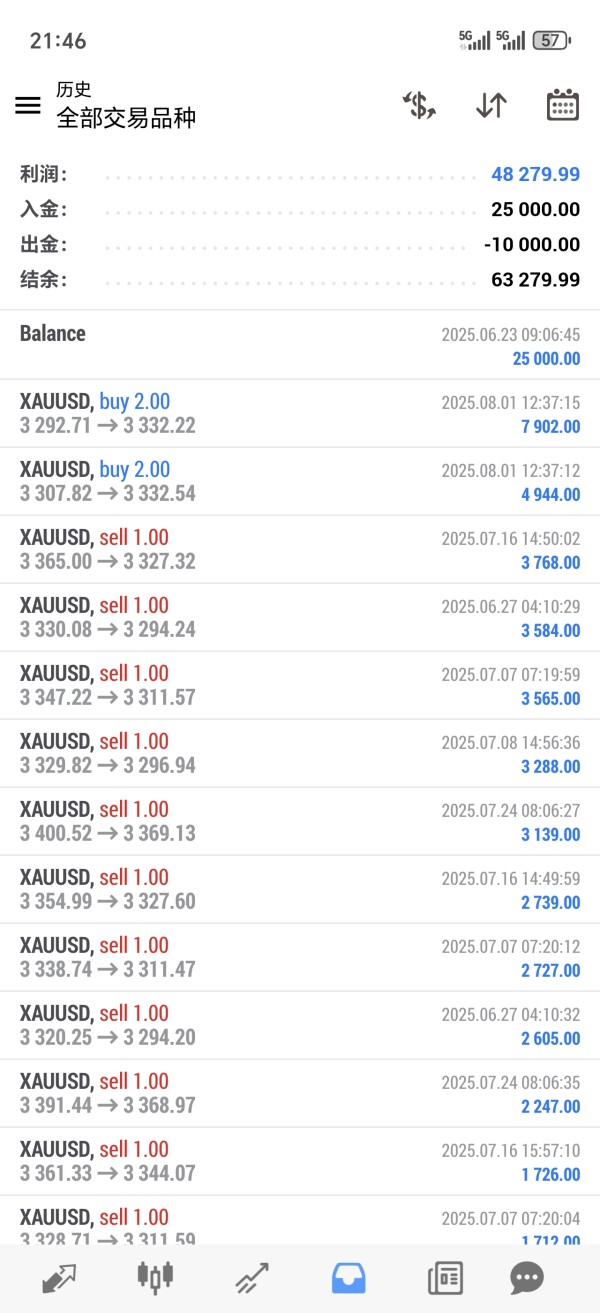

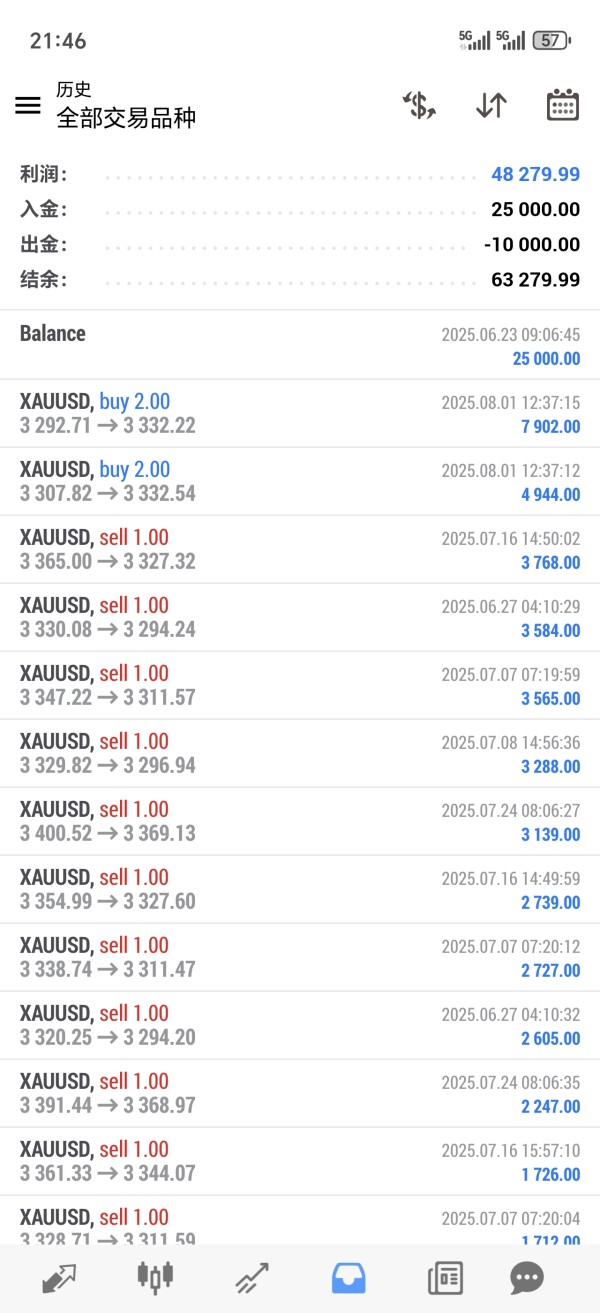

The trust and reliability assessment of Amillex reveals serious concerns that potential clients should carefully consider before engaging with this broker. The most significant red flag is the overall user rating of 2 out of 10, which shows widespread dissatisfaction and raises questions about the broker's legitimacy and operational quality. Multiple sources have raised concerns about Amillex's credibility, with some reviews explicitly questioning whether the broker represents a scam operation.

The absence of clear regulatory information represents a fundamental trust issue in the forex and CFD trading industry. Reputable brokers typically hold licenses from recognized financial authorities such as the FCA, ASIC, CySEC, or other established regulatory bodies, and prominently display their regulatory status. The lack of transparent regulatory disclosure for Amillex raises serious questions about client fund protection, dispute resolution mechanisms, and adherence to industry standards.

Furthermore, the limited operational history mentioned in some sources combined with the negative user feedback creates additional concerns about the broker's track record and long-term viability. The forex industry has unfortunately seen numerous instances of fraudulent operations that initially appear legitimate but ultimately fail to protect client interests. The combination of poor user ratings, regulatory uncertainty, and limited operational transparency suggests significant risks for potential clients considering Amillex as their trading partner.

User Experience Analysis

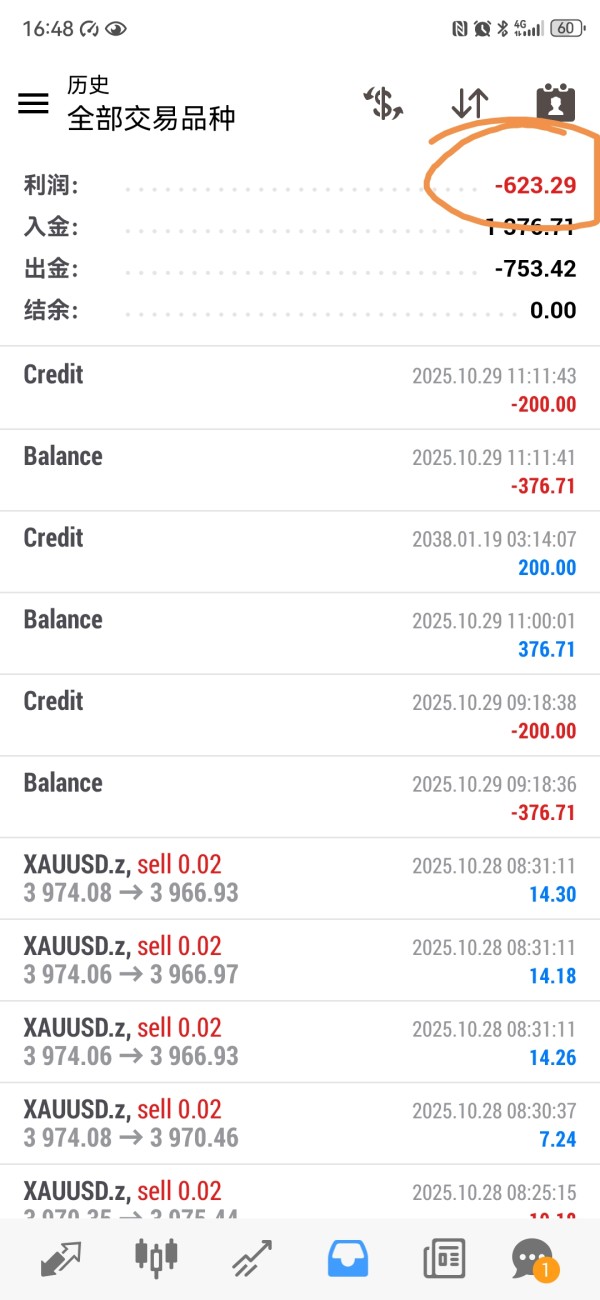

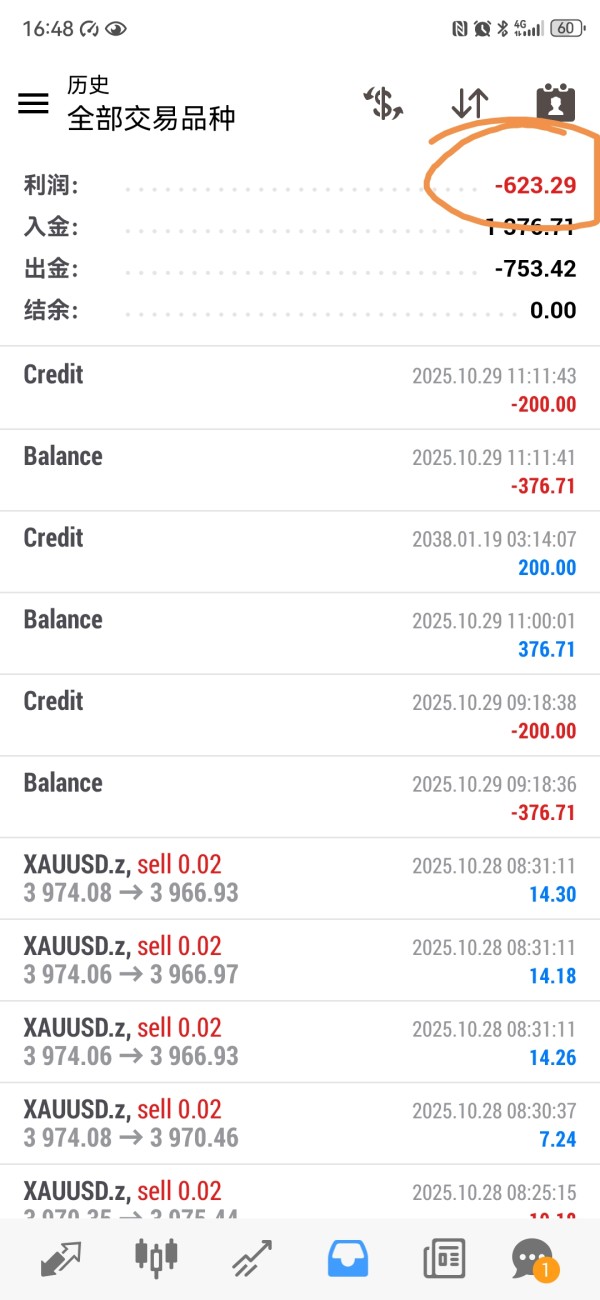

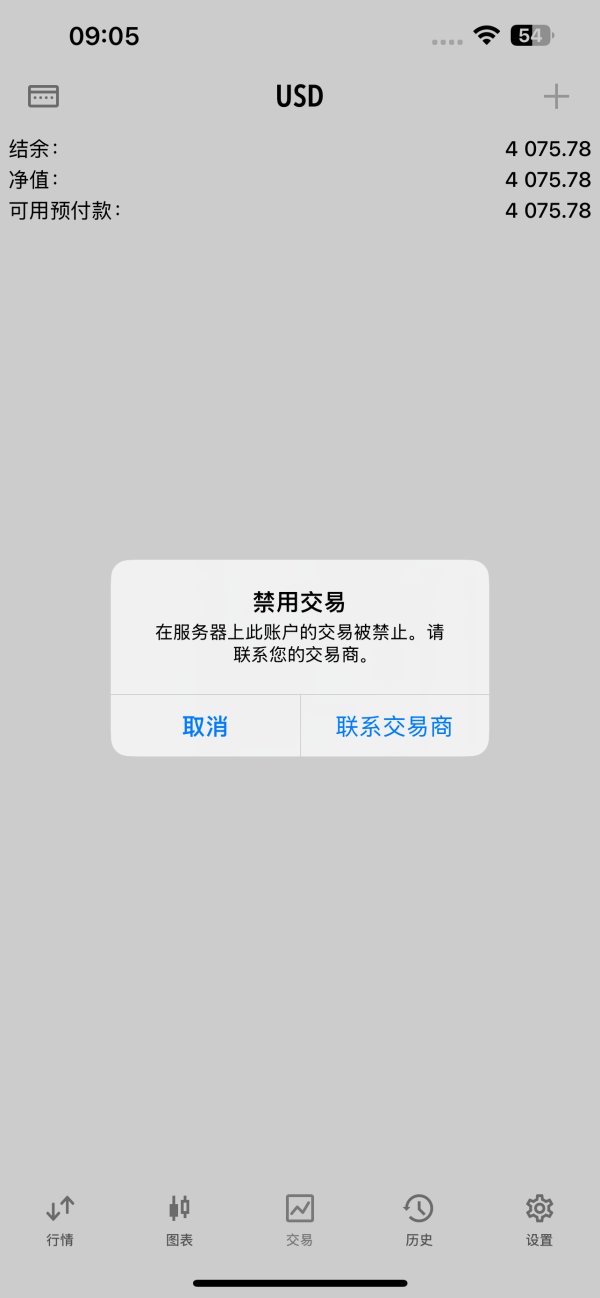

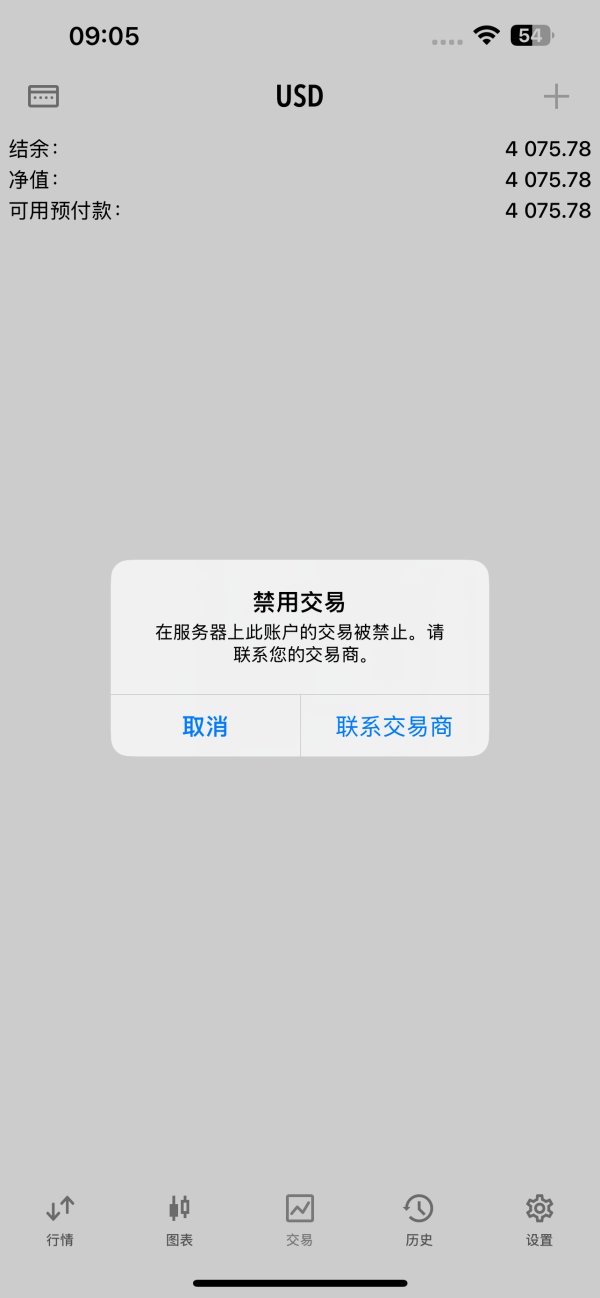

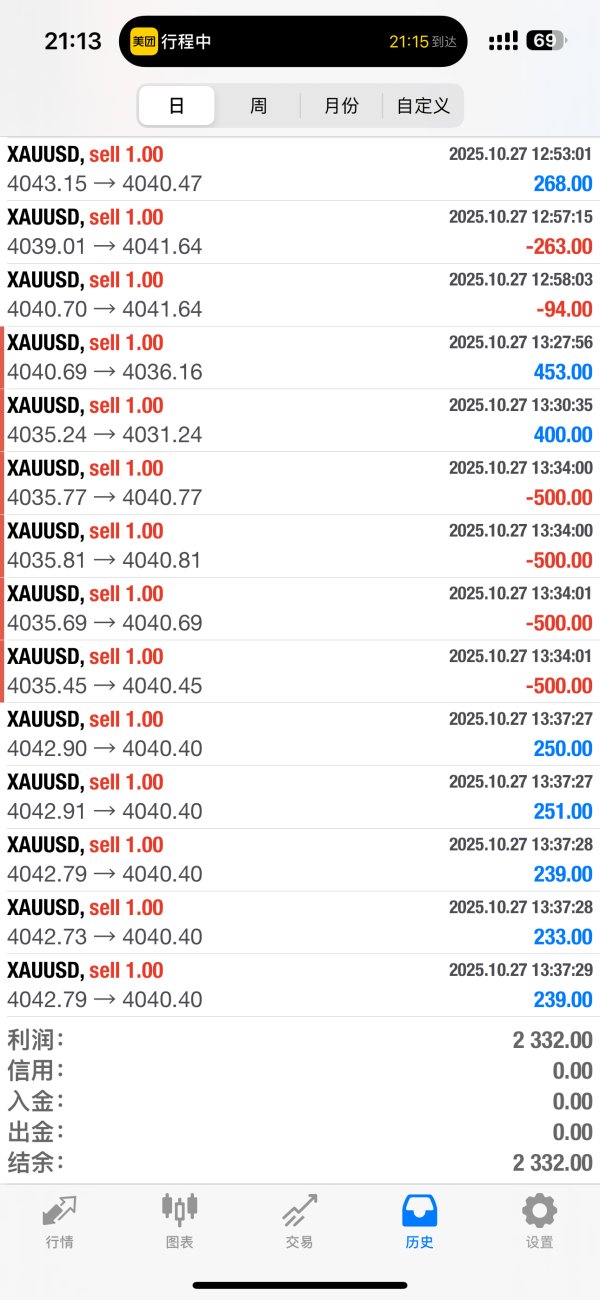

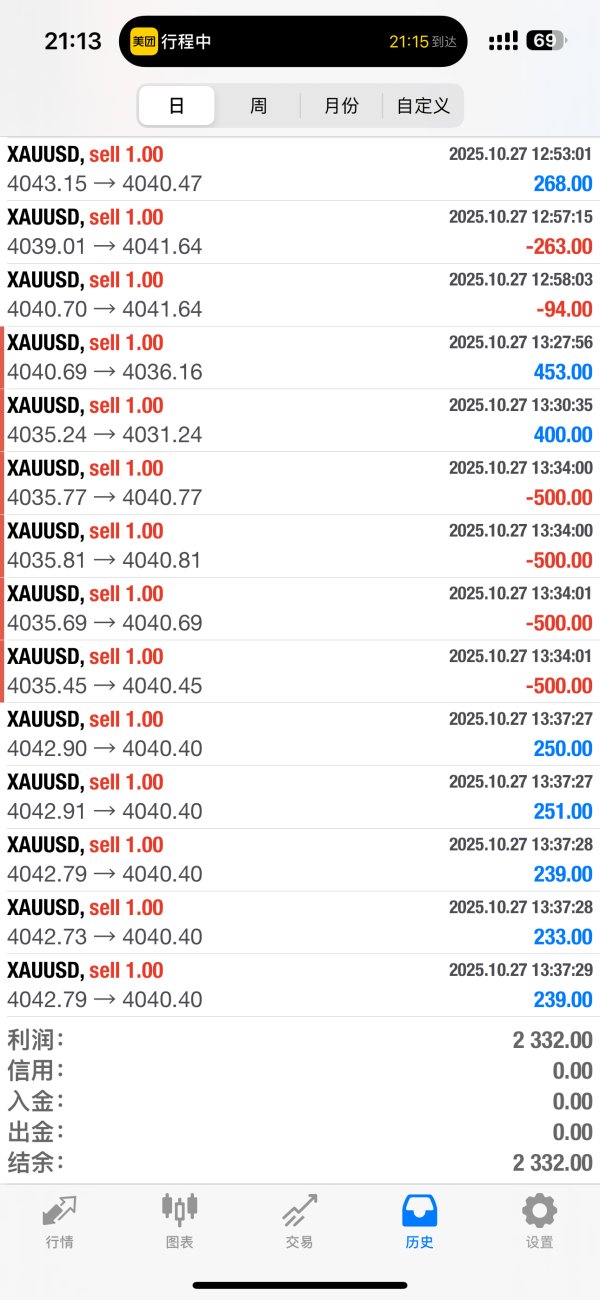

The user experience evaluation for Amillex presents a concerning picture based on the available feedback and rating information. With an overall user rating of 2 out of 10, the broker clearly fails to meet basic user expectations across multiple service dimensions. This extremely low rating suggests widespread dissatisfaction among users who have attempted to engage with the platform's services.

User experience includes various elements including account opening procedures, platform navigation, customer service interactions, and overall satisfaction with trading conditions. While specific user interface details are not provided in the available sources, the poor overall rating shows significant deficiencies in one or more of these critical areas. The fact that some reviews have raised questions about the broker's legitimacy and reliability suggests that users may have encountered serious issues beyond typical service complaints.

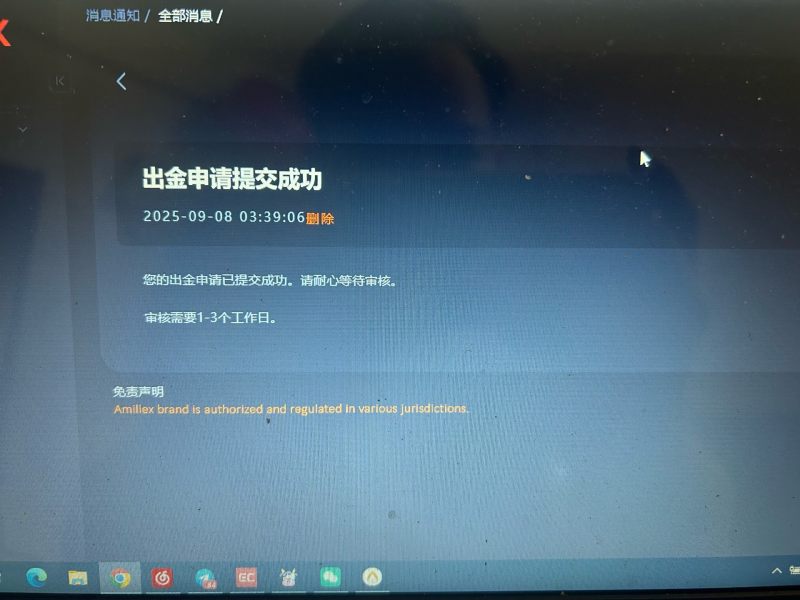

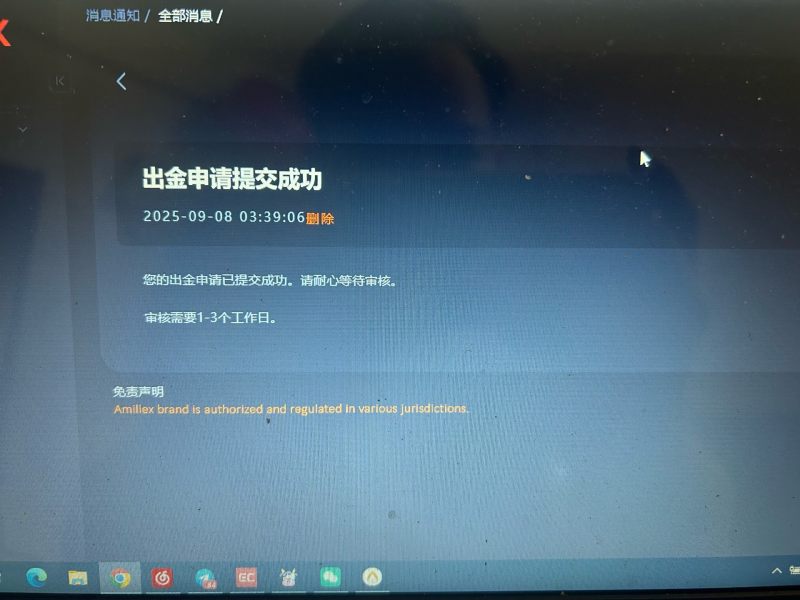

The presence of scam allegations in user reviews represents the most serious form of negative user experience, showing potential issues with fund security, withdrawal processes, or deceptive business practices. Such allegations, combined with the extremely low user rating, suggest that potential clients should exercise extreme caution when considering Amillex as a trading partner. The absence of positive user testimonials or success stories in the available sources further reinforces concerns about the broker's ability to provide satisfactory trading experiences.

Conclusion

This Amillex review reveals significant concerns that potential clients should carefully consider before engaging with this broker. The combination of an extremely low user rating of 2 out of 10, allegations of questionable legitimacy, and the absence of clear regulatory information creates a risk profile that is unsuitable for most traders. While Amillex claims to offer multi-asset trading opportunities across stocks, digital assets, and CFDs, the lack of transparency about operational details, trading conditions, and regulatory compliance raises serious red flags. The broker is particularly unsuitable for risk-averse traders who prioritize regulatory protection and proven track records. Based on the available evidence, potential clients are strongly advised to consider alternative brokers with established reputations, clear regulatory oversight, and positive user feedback before making any trading decisions.