Regarding the legitimacy of Amillex forex brokers, it provides ASIC, FSC and WikiBit, .

Is Amillex safe?

Software Index

Business

Is Amillex markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

AMILLEX GLOBAL PTY LTD

Effective Date:

2025-05-29Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 16B L 16 2-26 PARK ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

AMILLEX GLOBAL

Effective Date:

2024-06-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Silicon Avenue, 40 cybercity Ebène The Cyberati Lounge, Ground Floor, The Catalyst, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Amillex Safe or a Scam?

Introduction

Amillex is a relatively new player in the forex market, positioning itself as a multi-asset trading platform that offers access to various financial instruments, including forex, commodities, cryptocurrencies, and more. As the forex trading landscape becomes increasingly competitive, traders must carefully evaluate brokers like Amillex to ensure their investments are safe and secure. The importance of due diligence cannot be overstated, as the forex market has seen its share of scams and fraudulent activities. This article will investigate whether Amillex is safe or a potential scam by examining its regulatory status, company background, trading conditions, client fund security measures, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of a forex broker. A regulated broker is typically subject to strict oversight, which can protect traders from fraud and malpractice. Unfortunately, Amillex currently lacks valid regulatory information, raising concerns about its legitimacy in the eyes of potential clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | No valid regulation |

Without a regulatory body overseeing its operations, traders may face significant risks, including potential fraud and lack of recourse in case of disputes. The absence of regulation also suggests that Amillex may not adhere to the industry standards that protect traders' interests. Historically, brokers operating without oversight have been linked to high-risk practices, making it crucial for traders to exercise caution. Thus, when asking, "Is Amillex safe?" the lack of regulation is a red flag that cannot be ignored.

Company Background Investigation

Amillex Global Ltd, the company behind Amillex, is registered in Mauritius and has been operational for about one to two years. The relative youth of the company, combined with its lack of regulatory oversight, raises questions about its stability and long-term viability. The management teams background is not well-documented, which can hinder transparency and trust.

A thorough investigation into the company's ownership structure reveals limited public information, which further complicates the assessment of its credibility. Transparency is a significant factor in evaluating a broker's trustworthiness, and Amillex's lack of information regarding its management and ownership may deter potential clients.

Overall, the limited history and unclear ownership structure contribute to doubts about whether Amillex is a safe trading option. Without a well-established reputation or clear leadership, traders may find it challenging to trust the broker with their funds and personal information.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Amillex claims to offer competitive spreads, leverage options, and various account types, but the absence of regulatory backing raises concerns about the transparency of these claims.

| Fee Type | Amillex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips (Raw Account) | 1-2 pips |

| Commission Model | $3.0 per side (Raw Account) | $5.0 per side |

| Overnight Interest Range | Varies | Varies |

The trading costs associated with Amillex appear competitive, particularly with the low spreads offered on its raw account type. However, traders should be cautious of any hidden fees or unfavorable terms that may not be immediately apparent. For instance, the commission structure may vary significantly based on the account type, which can affect overall trading costs.

The potential for unexpected fees combined with the lack of regulatory oversight makes it crucial for traders to read the fine print and understand the fee structure fully. Therefore, in response to the question, "Is Amillex safe?" the trading conditions may seem appealing, but the underlying risks warrant careful consideration.

Client Fund Security

The safety of client funds is a paramount concern for traders. Amillex claims to prioritize the security of its clients' funds by segregating accounts and implementing various protective measures. Segregated accounts ensure that traders' funds are kept separate from the broker's operational funds, a practice that is essential for safeguarding clients' investments.

Additionally, Amillex mentions that it employs negative balance protection, which means that clients cannot lose more than their initial deposit. This feature is crucial for risk management, especially when trading with leverage. However, the effectiveness of these measures is questionable given the broker's lack of regulatory oversight.

Historically, brokers without regulatory supervision have faced challenges in maintaining client fund security. Therefore, while Amillex presents itself as a safe option, the absence of a regulatory body raises concerns about the reliability and execution of these safety measures. This leads to a critical inquiry: "Is Amillex safe?" The answer remains uncertain due to the lack of verified protective measures.

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reliability. Reviews and testimonials can provide insights into the experiences of real users. However, Amillex does not have a substantial online presence regarding user reviews, which makes it difficult to gauge the overall customer experience.

Common complaints in the forex trading community often revolve around withdrawal issues, unresponsive customer service, and unclear fee structures. If Amillex follows the trend of unregulated brokers, traders may encounter similar challenges when attempting to withdraw funds or resolve disputes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Varies |

| Unresponsive Customer Service | Medium | Varies |

| Fee Transparency | Medium | Varies |

The lack of consistent responses from the company to these complaints can further exacerbate concerns about its reliability. For instance, if a trader experiences withdrawal issues and receives no timely response from customer service, it raises red flags about the broker's commitment to client satisfaction. Thus, when evaluating whether "Is Amillex safe?" it is essential to consider the potential for customer service challenges and the implications for client trust.

Platform and Execution

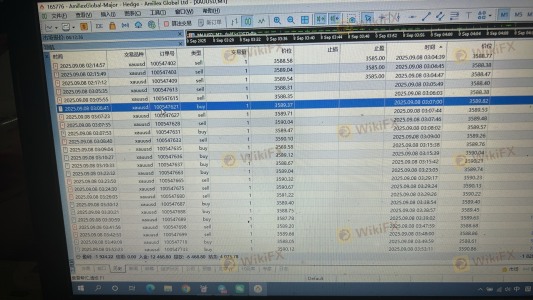

A broker's trading platform is a critical component of the overall trading experience. Amillex offers the MetaTrader 5 platform, which is well-regarded for its advanced features and user-friendly interface. However, the platform's performance, stability, and execution quality are paramount for successful trading.

Traders should be aware of potential issues such as slippage, order rejections, and execution delays, which can significantly impact trading outcomes. If Amillex has a history of poor execution quality or platform instability, it could hinder traders' ability to capitalize on market opportunities effectively.

The absence of verified user experiences regarding platform performance raises concerns about whether Amillex can deliver the promised trading experience. Therefore, when questioning, "Is Amillex safe?" traders should consider the potential risks associated with platform reliability and execution quality.

Risk Assessment

Evaluating the overall risk of using Amillex is crucial for potential clients. The lack of regulation, unclear company background, and mixed reviews contribute to a higher risk profile compared to established brokers.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Security Risk | Medium | Claims of fund segregation, but unverified |

| Customer Service Risk | Medium | Potential for unresponsive support |

| Execution Risk | Medium | Concerns about platform reliability |

To mitigate these risks, traders should conduct thorough research, start with small deposits, and remain vigilant regarding their trading activities. The absence of a regulatory framework makes it even more critical for traders to exercise caution and ensure they understand the potential implications of trading with Amillex.

Conclusion and Recommendations

In conclusion, the investigation into Amillex raises several concerns regarding its safety and legitimacy. The lack of regulatory oversight, combined with limited company transparency and mixed user experiences, suggests that traders should approach this broker with caution. While Amillex may offer competitive trading conditions, the underlying risks associated with its operational practices cannot be overlooked.

For traders seeking a reliable forex broker, it may be prudent to consider alternatives that are well-regulated and have established reputations in the industry. Reputable brokers typically offer robust regulatory protections, transparent fee structures, and reliable customer support.

In summary, when asking, "Is Amillex safe?" the evidence points to a higher level of risk than many traders may be comfortable with. Therefore, potential clients should carefully weigh their options and consider more established brokers to ensure the safety of their investments.

Is Amillex a scam, or is it legit?

The latest exposure and evaluation content of Amillex brokers.

Amillex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Amillex latest industry rating score is 6.90, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.90 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.