ABET Global 2025 Review: Everything You Need to Know

Executive Summary

ABET Global is a young but innovative forex broker. It has gotten a lot of attention in the trading community since it started. This abet global review shows a company that has achieved good user engagement, with 71% of users giving 5-star ratings, though the feedback stays split with 29% giving 1-star reviews. The broker stands out by offering high leverage ratios up to 1:1000 and many different trading assets including forex, stocks, and cryptocurrencies.

ABET Global is based in Bulgaria and was founded in 2020. It sees itself as a dynamic company in the capital markets, targeting traders who want high leverage chances and varied investment tools. The company's approach mixes technology infrastructure with new financial products, though user experiences change a lot. The broker's business model focuses on CFD and forex trading, giving access to multiple asset classes including indices, precious metals, energy commodities, and digital currencies. Even with the mixed user feedback, the overall satisfaction numbers suggest that ABET Global has successfully attracted traders looking for flexible trading conditions and varied investment opportunities.

Important Notice

Users must check ABET Global's legal status and compliance requirements in their own areas because limited regulatory information is available in current sources. Different regions may have different regulatory frameworks, and traders should make sure the broker operates under proper licensing in their area before doing any trading activities.

This review is put together based on available user feedback and public information to give an objective assessment of user experiences and trading conditions. The evaluation shows current market views and should be considered alongside other research when making trading decisions.

Rating Framework

Broker Overview

ABET Global started in the financial services sector in 2020 as a Bulgaria-based company focused on giving innovative trading products and strong technology infrastructure. The company operates under the full name "Accredited Balanced Exchange Trading" and has placed itself among the young, dynamic, and innovative companies within the capital markets. With a team of 51-200 employees, ABET Global has made itself known as a global broker specializing in CFD and forex trading services for international clients.

The company's business philosophy centers on delivering superior technology infrastructure while keeping an innovative approach to financial product development. According to LinkedIn data, ABET Global has attracted 46 followers and keeps an active presence in the financial services sector. The broker's headquarters in Sofia, Bulgaria, serves as the operational base for its international trading services, though the company's reach extends globally through its online trading platform.

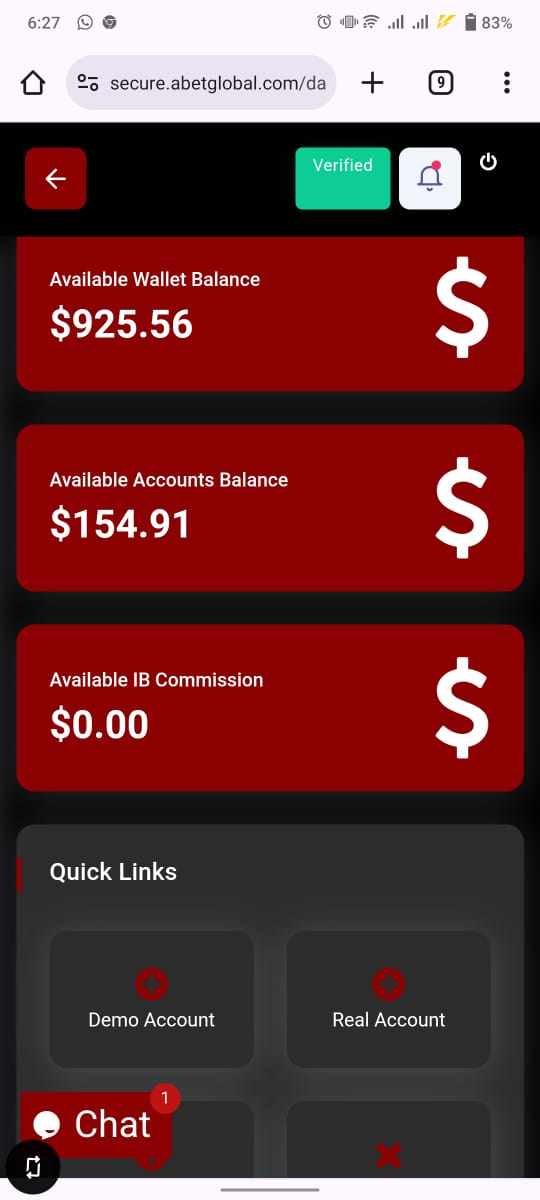

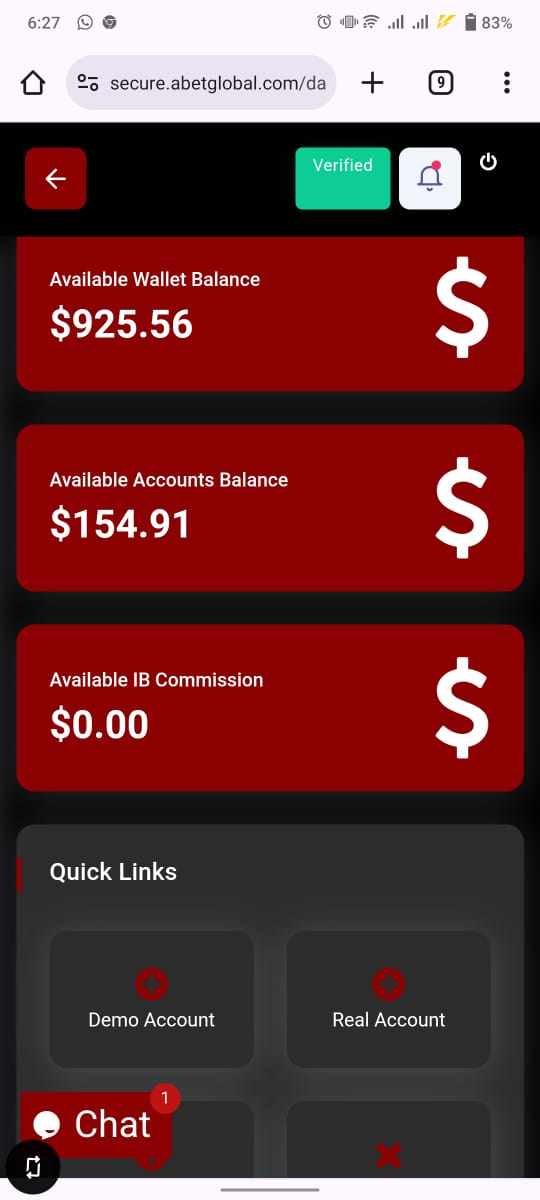

ABET Global operates its own trading platform, giving clients access to a full range of financial instruments. The broker's asset portfolio includes six major categories: foreign exchange pairs, stock indices, individual equity shares, precious metals, cryptocurrency assets, and energy commodities. This abet global review shows that the company has focused on creating a diverse trading environment to fit various investment strategies and risk preferences, though specific regulatory oversight information stays limited in available public sources.

Regulatory Regions: Specific regulatory information is not detailed in available sources, requiring traders to independently verify compliance status in their jurisdictions.

Deposit and Withdrawal Methods: Current available information does not specify the supported payment methods for account funding and withdrawals.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in the available documentation.

Bonus and Promotions: Information regarding promotional offers and bonus structures is not detailed in current sources.

Tradeable Assets: The broker provides access to six major asset categories including foreign exchange pairs, stock indices, individual stocks, precious metals, cryptocurrency instruments, and energy commodities, offering traders diverse investment opportunities across multiple markets.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specified in available sources.

Leverage Ratios: ABET Global offers high leverage options with maximum ratios reaching 1:1000, providing traders with significant capital amplification opportunities.

Platform Options: The company operates its proprietary ABET Global trading platform, though specific features and capabilities require further investigation.

Regional Restrictions: Information about geographical trading restrictions is not detailed in current sources.

Customer Support Languages: Specific language support options are not mentioned in available documentation.

This abet global review highlights the need for potential clients to conduct additional research regarding specific trading conditions and regulatory compliance.

Detailed Rating Analysis

Account Conditions Analysis

ABET Global's account structure presents both opportunities and uncertainties for potential traders. The broker offers attractive leverage ratios up to 1:1000, but the specific details about account types, minimum deposit requirements, and tier-based benefits stay unclear from available sources. This lack of transparency in account specifications may worry traders who prefer detailed information before committing to a trading relationship.

The high leverage offering positions ABET Global competitively within the forex market, particularly appealing to traders seeking capital amplification opportunities. However, the absence of detailed information about account opening procedures, verification requirements, and special account features such as Islamic accounts creates information gaps that potential clients must address through direct broker contact. The account conditions evaluation in this abet global review reflects the broker's apparent focus on providing flexible trading terms, though the limited publicly available information prevents a full assessment of the complete account structure and associated benefits or restrictions.

ABET Global's approach to trading tools and resources shows both strengths and limitations based on available information. The broker's strength lies in its diverse asset portfolio, giving traders access to forex, stocks, indices, precious metals, cryptocurrencies, and energy commodities. This variety allows for portfolio diversification and multiple trading strategies across different market sectors.

However, current sources do not detail specific trading tools, analytical resources, educational materials, or automated trading support that modern traders typically expect from contemporary brokers. The absence of information about research capabilities, market analysis tools, economic calendars, or educational programs represents a significant knowledge gap for potential clients evaluating the broker's comprehensive service offering. The proprietary trading platform mentioned in company information suggests technology focus, though specific platform features, charting capabilities, and analytical tools require further investigation to provide traders with complete service understanding.

Customer Service and Support Analysis

Customer service represents a critical concern area for ABET Global based on available user feedback patterns. The significant disparity in user ratings, with 29% providing 1-star evaluations, suggests inconsistent service delivery that may impact overall client satisfaction. This polarization in feedback indicates potential issues in service quality, response times, or problem resolution effectiveness.

The lack of detailed information about customer support channels, availability hours, response time commitments, and multilingual support capabilities prevents comprehensive service assessment. Modern traders expect multiple communication channels including live chat, email, phone support, and comprehensive FAQ resources, though current sources do not specify ABET Global's support infrastructure. The customer service challenges highlighted in user feedback patterns suggest areas requiring improvement, particularly in consistency of service delivery and client communication effectiveness. Potential clients should carefully evaluate support quality through direct interaction before committing to trading relationships.

Trading Experience Analysis

The trading experience with ABET Global appears generally positive based on overall user satisfaction metrics, with 71% of users providing 5-star ratings. This suggests that when the platform functions effectively, users find the trading environment satisfactory for their needs. The high leverage options and diverse asset portfolio contribute to a flexible trading environment accommodating various strategies.

However, specific information about platform stability, execution speed, order processing quality, and mobile trading capabilities stays limited in available sources. Critical performance metrics such as slippage rates, execution times, server uptime, and platform responsiveness during high-volatility periods are not detailed, preventing comprehensive trading experience evaluation. The abet global review data suggests that successful users appreciate the broker's trading conditions, though the significant percentage of negative feedback indicates potential technical or operational challenges that may affect consistent trading experience delivery across all user segments.

Trust and Reliability Analysis

Trust and reliability represent significant concern areas for ABET Global due to limited regulatory transparency in available sources. The absence of specific regulatory authority oversight information may impact trader confidence regarding fund security, operational compliance, and dispute resolution mechanisms. Modern traders typically expect clear regulatory oversight from recognized financial authorities.

Company transparency about operational procedures, fund segregation policies, investor protection measures, and compliance frameworks appears limited based on current information availability. The lack of detailed regulatory status information may particularly concern traders prioritizing fund safety and regulatory protection in their broker selection process. The trust evaluation reflects the importance of regulatory oversight in forex trading, where fund security and operational transparency significantly impact trader confidence and long-term business relationships.

User Experience Analysis

User experience with ABET Global presents a mixed picture reflecting the polarized feedback patterns observed in rating distributions. The 71% five-star rating percentage indicates that successful users find the overall experience satisfactory, particularly regarding trading conditions and platform accessibility. These positive experiences likely relate to the broker's high leverage offerings and diverse asset availability.

Conversely, the 29% one-star rating percentage suggests significant user experience challenges that may include difficulties with account management, fund operations, customer service interactions, or platform functionality. The absence of detailed information about registration processes, account verification procedures, and fund management workflows prevents comprehensive user experience assessment. The user demographic appears to favor traders seeking high leverage opportunities and diversified investment instruments, though the significant negative feedback percentage indicates potential operational or service delivery issues requiring attention. Prospective clients should carefully evaluate their specific needs against both positive and negative user experience indicators before making trading decisions.

Conclusion

ABET Global presents itself as an emerging forex broker with distinct advantages in high leverage offerings and asset diversification, though significant concerns exist regarding regulatory transparency and service consistency. While 71% of users provide positive feedback, the substantial negative ratings indicate operational challenges requiring careful consideration by potential clients.

The broker appears most suitable for experienced traders seeking high leverage opportunities and diverse asset exposure, provided they can accept the associated risks of limited regulatory transparency. The mixed user feedback patterns suggest that successful trading relationships may depend on individual needs alignment with the broker's specific strengths and limitations. Primary advantages include competitive leverage ratios and comprehensive asset portfolios, while main disadvantages center on limited regulatory information and inconsistent customer service delivery. Potential clients should conduct thorough due diligence and consider direct broker evaluation before making trading commitments.