24five Review 1

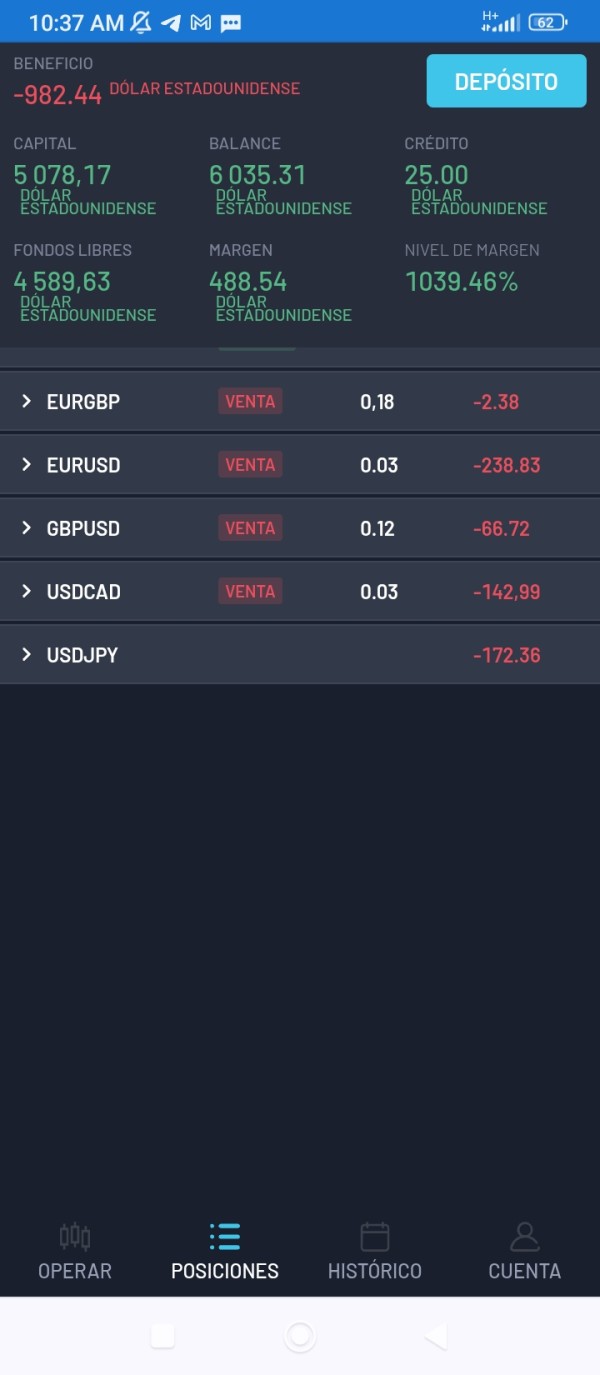

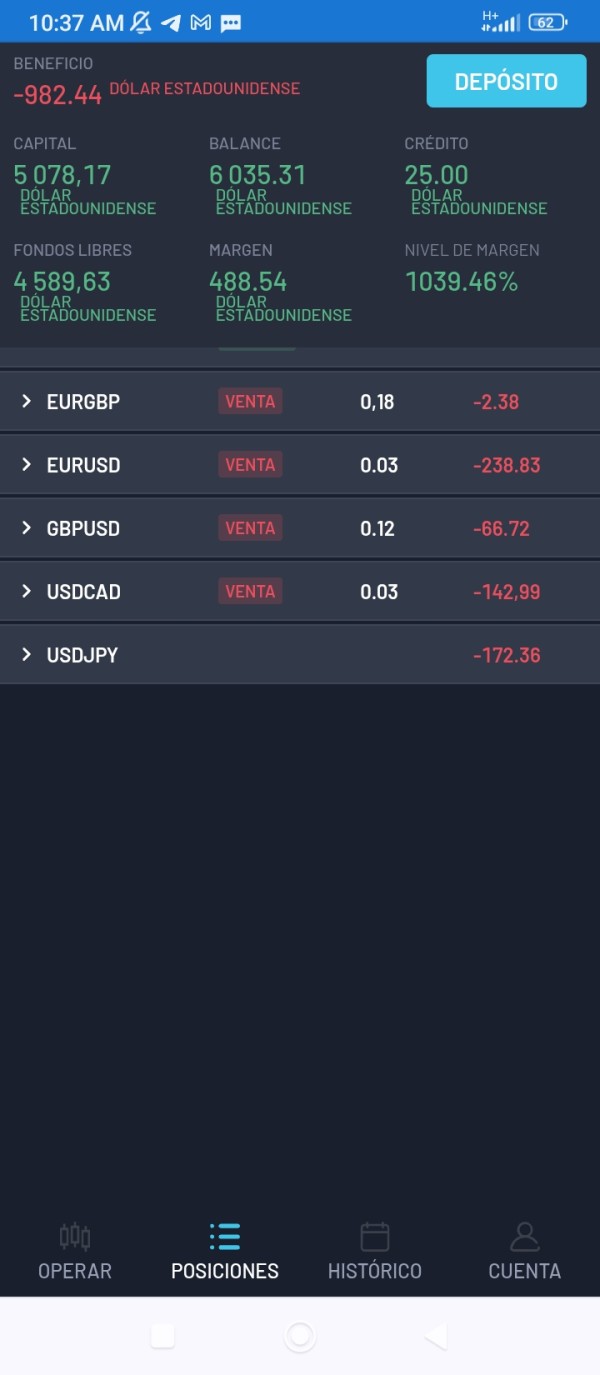

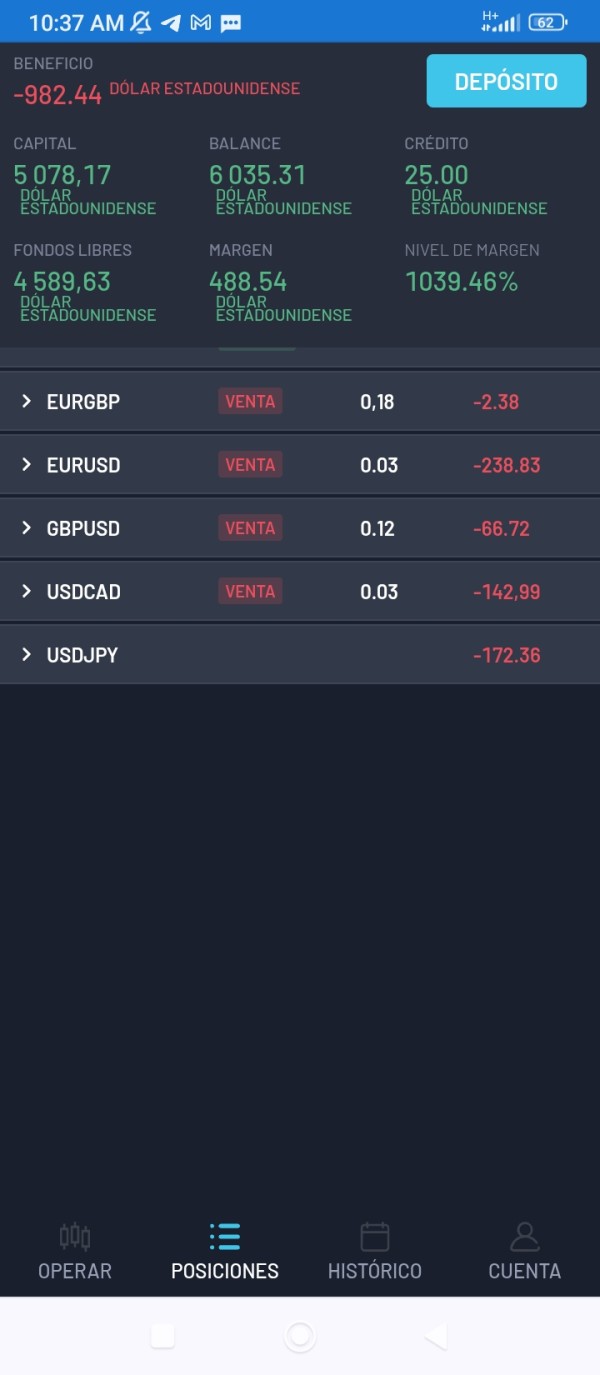

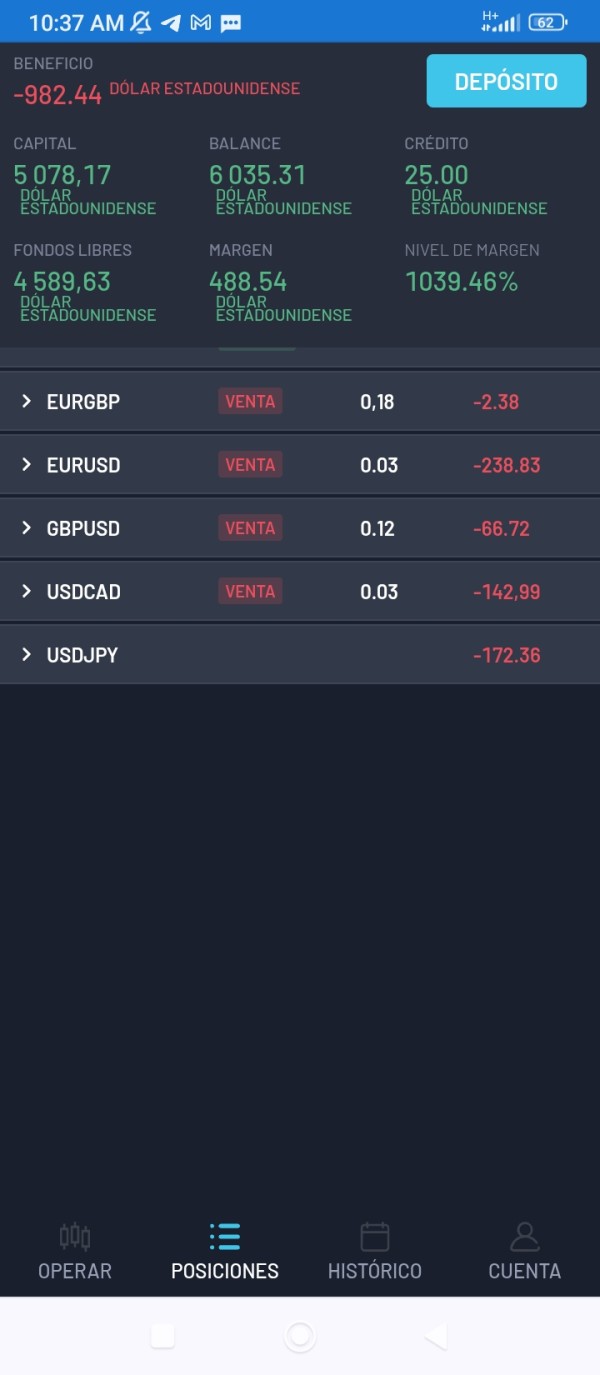

It only takes your money, you can't withdraw it, and its platform is rubbish.

24five Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

It only takes your money, you can't withdraw it, and its platform is rubbish.

This 24five review shows big concerns about this online trading platform. Investors must understand these issues before they think about using this service. Our detailed study of available information and user feedback reveals that 24five has serious red flags. The trading community should pay close attention to these warning signs.

24five works as an online broker that offers various financial tools like CFDs, forex, commodities, indices, futures, stocks, and cryptocurrencies. But the platform has serious trust problems that overshadow what it offers. Many sources point to possible fraud, and users report scam experiences that create immediate safety worries.

The broker does not share clear regulatory information, which is a critical weakness. Regulatory oversight protects traders and is essential in this industry. 24five claims to provide diverse trading opportunities, but it lacks clear licensing details and faces scam allegations. This creates a very risky environment for potential investors.

Our analysis strongly recommends against using this platform because of documented safety concerns and poor regulatory transparency. The trading community deserves better protection and clearer regulatory frameworks than what 24five currently provides.

This review uses available information from multiple sources including user feedback and industry reports. Investors should know that 24five's registration details and regulatory status are unclear. This significantly affects the reliability of any services offered.

The lack of complete regulatory information and documented user concerns about possible fraud focus this evaluation on available data. We highlight areas where critical information is missing. Our assessment method puts trader safety and regulatory compliance first as basic criteria for broker evaluation.

| Evaluation Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 2/10 | Poor |

| Tools and Resources | 5/10 | Average |

| Customer Service and Support | 3/10 | Poor |

| Trading Experience | 4/10 | Below Average |

| Trustworthiness | 1/10 | Very Poor |

| User Experience | 3/10 | Poor |

| Overall Rating | 3.0/10 | Poor |

24five entered the online trading market in 2015. The company positioned itself as a complete financial services provider. It operates through internet-based platforms and offers access to multiple financial markets through one interface. However, the broker's operational transparency and regulatory compliance remain subjects of significant concern within the trading community.

The platform's business model centers on providing online trading access to various asset classes. These include traditional forex pairs, contract for differences, commodities, stock indices, futures contracts, individual stocks, and cryptocurrency instruments. This diverse offering initially appears attractive to traders seeking portfolio diversification opportunities across multiple markets.

Despite the broad range of available instruments, 24five's fundamental credibility issues overshadow its product diversity. The absence of clear regulatory oversight and documented user complaints about potential fraud create substantial barriers to confident platform engagement. This 24five review emphasizes that product variety cannot compensate for fundamental trust and safety problems.

The broker's operational structure lacks the transparency expected from legitimate financial service providers. This is particularly true regarding licensing, regulatory compliance, and client fund protection measures that form the foundation of trustworthy brokerage operations.

Regulatory Jurisdiction: Available information does not specify clear regulatory oversight or licensing details. This represents a significant transparency deficit that impacts trader confidence and legal protection.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees remains unavailable in current documentation. This limits traders' ability to assess operational convenience.

Minimum Deposit Requirements: The platform's minimum deposit thresholds are not specified in available materials. This prevents potential users from understanding entry-level investment requirements.

Bonus and Promotions: Current documentation does not detail any promotional offers, welcome bonuses, or incentive programs. These might be available to new or existing clients.

Tradeable Assets: 24five offers access to CFDs, forex currency pairs, commodities, stock indices, futures contracts, individual stocks, and cryptocurrency instruments. This provides broad market exposure opportunities.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs remains undisclosed. This creates uncertainty about the true cost of trading through this platform.

Leverage Ratios: Available documentation does not specify maximum leverage ratios. These would be available for different asset classes or account types.

Platform Options: Details about trading platform software are not clearly specified in current materials. This includes whether they use proprietary or third-party solutions like MetaTrader.

Geographic Restrictions: Information about restricted jurisdictions or regional limitations is not detailed in available documentation.

Customer Service Languages: Supported languages for customer service communications are not specified in current materials.

This 24five review highlights significant information gaps. Legitimate brokers typically address these transparently for potential clients.

The account conditions offered by 24five present substantial concerns for potential traders. Available information lacks essential details about account types, tier structures, and specific benefits linked to different account levels. This opacity prevents traders from making informed decisions about which account might suit their trading goals and capital requirements.

Minimum deposit requirements remain unspecified across available documentation. This creates uncertainty about entry barriers for new traders. Legitimate brokers typically provide clear information about deposit thresholds, account features, and progression pathways between different account tiers.

The account opening process lacks detailed explanation. This includes verification requirements, documentation needs, and timeline expectations. This absence of procedural clarity raises questions about operational efficiency and regulatory compliance standards.

Special account features such as Islamic accounts, professional trader classifications, or institutional arrangements are not addressed in available materials. These omissions suggest limited accommodation for diverse trader needs and regulatory requirements across different jurisdictions.

The overall lack of transparency regarding account conditions significantly impacts this 24five review assessment. Clear account information represents a fundamental expectation for legitimate brokerage operations.

24five's trading tools and resources present a mixed picture of capabilities and limitations. The platform offers access to various financial instruments across multiple asset classes. This suggests some level of tool diversity for portfolio construction and trading strategy implementation.

However, specific information about analytical tools, charting capabilities, technical indicators, and market research resources remains largely unspecified. Modern traders expect comprehensive analytical capabilities including advanced charting packages, economic calendars, market news feeds, and technical analysis tools.

Educational resources are crucial for trader development and platform familiarization, but they are not detailed in available documentation. Quality brokers typically provide educational materials, webinars, tutorials, and market analysis to support client success and platform engagement.

Automated trading support is not addressed in current materials. This includes expert advisor compatibility, algorithmic trading capabilities, and API access. These features have become increasingly important for sophisticated trading strategies and portfolio management approaches.

The absence of detailed tool specifications limits traders' ability to assess whether the platform can support their analytical needs. It also prevents evaluation of trading methodology effectiveness.

Customer service capabilities represent a critical weakness in 24five's operational framework. Available information does not specify support channels, availability hours, or response time commitments. Traders cannot know what to expect when requiring assistance.

Communication methods such as live chat, telephone support, email ticketing systems, or dedicated account management are not clearly outlined. This lack of clarity creates uncertainty about problem resolution processes and ongoing support quality.

Response time expectations and service level commitments remain unspecified. This prevents traders from understanding what support standards they can reasonably expect. Quality brokers typically provide clear service level agreements and response time commitments.

Multilingual support capabilities are not detailed. This potentially limits accessibility for international traders who may require assistance in their native languages. Global brokers typically accommodate diverse linguistic needs through comprehensive support teams.

The absence of documented positive customer service experiences creates concern. Combined with reported negative user feedback, this suggests significant deficiencies in support quality and problem resolution capabilities.

The trading experience offered by 24five faces substantial limitations due to insufficient information about platform capabilities and performance characteristics. Platform stability, execution speed, and order processing efficiency remain unspecified in available documentation.

Order execution quality lacks detailed specification. This includes slippage rates, rejection frequencies, and processing speeds during various market conditions. These factors significantly impact trading outcomes and overall user satisfaction.

Platform functionality completeness is not comprehensively detailed. This includes advanced order types, risk management tools, and trading automation features. Modern traders expect sophisticated platform capabilities that support diverse trading strategies and risk management approaches.

Mobile trading experience has become essential for contemporary trading activities. It lacks detailed description regarding app functionality, feature parity with desktop platforms, and user interface quality.

The trading environment's overall quality remains uncertain due to limited user feedback and absence of detailed platform specifications. This makes it difficult for this 24five review to provide definitive assessments of trading experience quality.

Trustworthiness represents 24five's most significant deficiency. Multiple factors contribute to serious credibility concerns. The absence of clear regulatory licensing information creates fundamental questions about legal compliance and operational legitimacy.

Client fund protection measures are not specified in available documentation. This includes segregated account arrangements, deposit insurance, and regulatory oversight mechanisms. These protections form the foundation of trustworthy brokerage operations.

Company transparency regarding ownership structure, financial backing, and operational history remains limited. Legitimate brokers typically provide comprehensive company information and regulatory compliance details.

Industry reputation and third-party validations are notably absent. Available feedback indicates potential fraudulent activities and user complaints about platform reliability and safety.

The presence of scam allegations and negative user experiences creates substantial trust barriers. Potential investors must carefully consider these before engaging with this platform.

User experience assessment reveals significant challenges based on available feedback and operational transparency issues. Overall user satisfaction appears compromised by trust concerns and operational uncertainties.

Platform interface design and usability information remains limited. This prevents assessment of navigation efficiency, feature accessibility, and overall user-friendliness. Modern trading platforms require intuitive design and efficient workflow management.

Registration and verification processes lack detailed explanation. This creates uncertainty about onboarding efficiency and compliance requirements. Streamlined account setup represents a basic expectation for contemporary brokerage services.

Fund management experiences are not well-documented. This includes deposit processing, withdrawal efficiency, and account management capabilities. Limited understanding of operational convenience results.

Documented user complaints and negative feedback suggest significant experience deficiencies. These impact overall platform satisfaction and recommend caution for potential users.

This comprehensive 24five review reveals substantial concerns that strongly advise against platform engagement. The combination of regulatory transparency deficiencies, documented scam allegations, and operational opacity creates an environment of significant risk for potential investors.

While 24five offers diverse financial instruments across multiple asset classes, these product offerings cannot compensate for fundamental trust and safety deficiencies. The absence of clear regulatory oversight and documented negative user experiences represent critical barriers to confident platform engagement.

No trader profile can be safely recommended for this platform given the documented safety concerns and regulatory uncertainties. The trading community deserves transparent, regulated, and trustworthy brokerage services that 24five currently fails to demonstrate.

Potential investors should prioritize platforms with clear regulatory licensing, transparent operational practices, and positive user feedback. These factors are essential when selecting brokerage services for trading activities.

FX Broker Capital Trading Markets Review