Is 24five safe?

Pros

Cons

Is 24five Safe or Scam?

Introduction

In the dynamic world of foreign exchange trading, brokers play a pivotal role in facilitating transactions and providing access to financial markets. One such broker is 24five, a relatively new entrant that claims to offer a comprehensive trading platform for forex, cryptocurrencies, and various financial instruments. However, with the rise of online trading comes the necessity for traders to exercise caution and conduct thorough due diligence before entrusting their funds to any broker. This article aims to evaluate whether 24five is a safe trading option or if it raises red flags indicative of a potential scam. Our investigation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. A regulated broker is subject to oversight by financial authorities, which can provide a layer of protection for traders. In the case of 24five, it operates under the ownership of One World Ltd, which claims to be registered in the Comoros. However, the broker has not provided verifiable information regarding its regulatory status from recognized financial authorities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MISA | T2023314 | Comoros | Unverified |

Despite claiming to be regulated, the lack of a solid regulatory framework raises concerns about the broker's credibility. Operating without a license from a reputable authority means that 24five does not have to adhere to strict financial standards or protect client funds, leaving traders vulnerable to potential fraud. The absence of transparency regarding its regulatory status is a significant red flag that traders should consider when assessing whether 24five is safe.

Company Background Investigation

24five was established in 2015, positioning itself as a global provider of online brokerage services. The company's ownership structure is somewhat opaque, with limited information available about its founders or the management team. The absence of detailed disclosure about the individuals behind the broker raises questions about accountability and transparency.

The management team's professional background is crucial in assessing the broker's reliability. A team composed of experienced professionals with a proven track record in finance and trading would typically inspire greater confidence among potential clients. However, the lack of publicly available information about the management team for 24five makes it challenging to evaluate their qualifications and expertise.

Moreover, the broker's transparency levels appear to be lacking, as it does not provide comprehensive information about its operations, financial standing, or any history of compliance with regulations. This lack of transparency further complicates the assessment of whether 24five is a safe choice for traders.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. 24five promotes itself as having competitive trading conditions, but a closer examination reveals some concerning aspects. The broker's fee structure, including spreads, commissions, and overnight interest rates, is not clearly defined on its website, making it difficult for traders to ascertain the true cost of trading.

| Fee Type | 24five | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | 0.5-2% |

The lack of transparency regarding trading costs can lead to unexpected expenses for traders, further complicating their trading strategies. Additionally, 24five has been reported to employ aggressive sales tactics, which may pressure traders into making larger deposits or trading more frequently than they initially intended. This behavior is often characteristic of brokers that are not genuinely invested in their clients' success and raises questions about whether 24five is safe to trade with.

Client Fund Safety

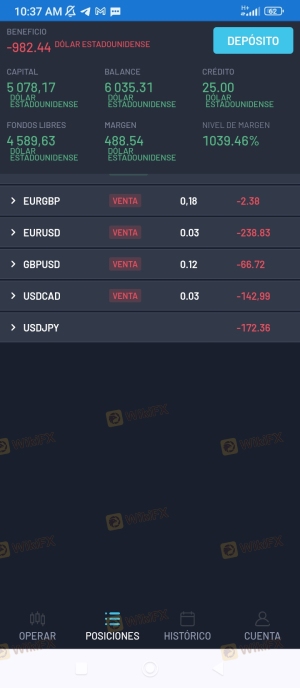

The safety of client funds is paramount in the trading industry. 24five claims to implement measures to safeguard client deposits, such as segregating client funds from the company's operating capital. However, without regulatory oversight, there are no guarantees that these measures are effectively enforced.

Investors should also be wary of the broker's policies regarding investor protection and negative balance protection. In the event of significant market volatility, negative balance protection ensures that clients do not lose more than their deposited amount. However, 24five has not clearly outlined such policies, which could leave traders exposed to potentially devastating losses.

Historical issues regarding fund safety or disputes with clients have not been adequately addressed by 24five, further contributing to concerns about whether 24five is safe for trading. The lack of credible information on fund security measures indicates that traders should approach this broker with caution.

Customer Experience and Complaints

Analyzing customer feedback is crucial in understanding the overall experience with a broker. Reviews of 24five reveal a pattern of negative experiences, with many clients reporting difficulties in withdrawing funds and experiencing aggressive sales tactics. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| High-Pressure Sales Tactics |

Is 24five a scam, or is it legit?

The latest exposure and evaluation content of 24five brokers.

24five Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

24five latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.