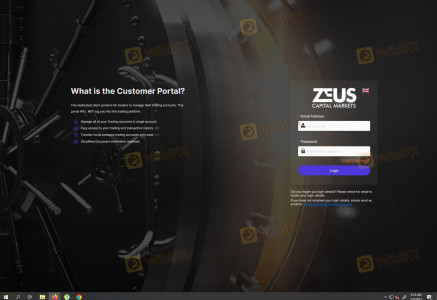

Regarding the legitimacy of Zeus Capital Markets forex brokers, it provides FSCA and WikiBit, .

Is Zeus Capital Markets safe?

Business

License

Is Zeus Capital Markets markets regulated?

The regulatory license is the strongest proof.

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Naqdi Group (PTY) LTD

Effective Date: Change Record

2021-10-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

242 CORLETT DR BRAMLEY JOHANNESBURG 2018Phone Number of Licensed Institution:

97155 1759797Licensed Institution Certified Documents:

Is Zeus Capital Markets a scam, or is it legit?

The latest exposure and evaluation content of Zeus Capital Markets brokers.

Zeus Capital Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Zeus Capital Markets latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.