Is YLL Global safe?

Business

License

Is YLL Global Safe or Scam?

Introduction

YLL Global is an online forex brokerage that has garnered attention for its trading services. Operating within the highly competitive forex market, it presents itself as a platform for traders seeking to engage in currency trading, commodities, and other financial instruments. However, the growth of online trading platforms has also led to an increase in fraudulent schemes, making it imperative for traders to carefully evaluate the legitimacy of brokers like YLL Global. This article aims to investigate whether YLL Global is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this assessment, we analyzed various online reviews, regulatory databases, and user feedback. Our evaluation framework focuses on key indicators of broker reliability, including regulatory compliance, financial transparency, customer service quality, and user experiences.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical factors in determining its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain operational standards and financial practices. Unfortunately, YLL Global operates without any significant regulatory oversight, which raises serious concerns about its safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation from reputable authorities such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) indicates that YLL Global is unregulated. This lack of oversight can expose traders to higher risks, as there are no governing bodies to hold the broker accountable for its practices. Moreover, the lack of transparency regarding its licensing and regulatory compliance is alarming. Traders should be cautious, as many unregulated brokers have been associated with fraudulent activities.

Company Background Investigation

YLL Global Investing Limited, the entity behind YLL Global, has a relatively obscure history. Established in 2021, the company claims to offer a range of trading services, but there is limited information available about its founders or management team. This lack of transparency is a significant red flag.

The management teams experience is vital for a brokerage's credibility. However, YLL Global does not provide any substantial information about its team, which raises questions about their qualifications and expertise in the financial industry.

Furthermore, the company's address in London, as listed in various reviews, does not correlate with a well-known or reputable financial institution. The absence of available media mentions or industry recognition further diminishes its credibility. In summary, the combination of a lack of transparency, limited background information, and an unregulated status leads to concerns about the safety of trading with YLL Global.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its reliability. YLL Global claims to provide competitive spreads and various trading instruments, but the absence of clear and transparent information about its fee structure makes it difficult to assess its true cost of trading.

| Fee Type | YLL Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

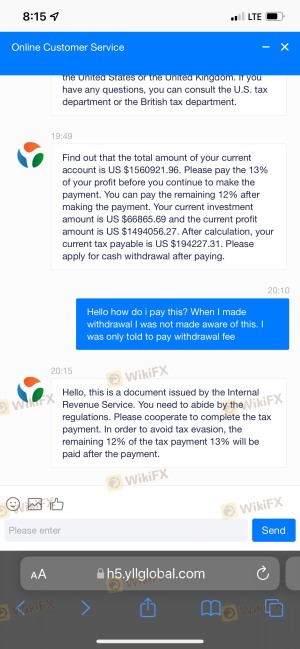

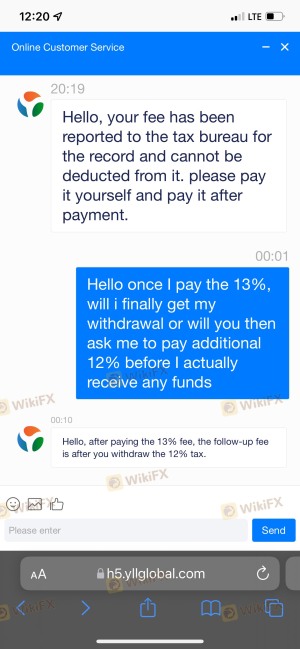

The lack of specific details regarding spreads, commissions, and overnight interest rates is concerning. Many reviews indicate that traders have encountered unexpected fees and difficulties in withdrawing their funds, which is a common tactic employed by fraudulent brokers. The absence of a transparent fee structure can lead to hidden costs that may erode a trader's capital over time.

Customer Fund Security

The security of customer funds is paramount in the forex trading environment. YLL Global's lack of regulatory oversight raises serious concerns about how it manages client funds. The absence of information regarding fund segregation, investor protection, or negative balance protection policies suggests that traders may be at risk if the broker encounters financial difficulties.

Historically, unregulated brokers have faced significant issues with fund security, leading to losses for their clients. The lack of any reported measures to ensure the safety of client funds is a significant red flag. Traders should be particularly cautious when dealing with brokers that do not provide clear information about their fund management practices.

Customer Experience and Complaints

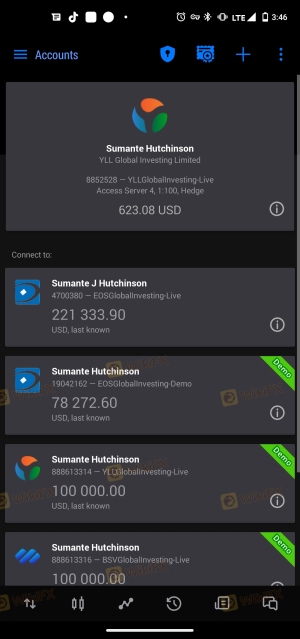

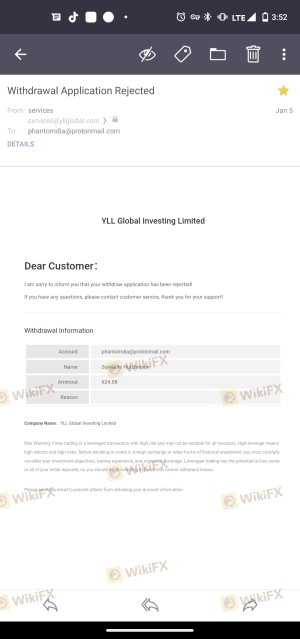

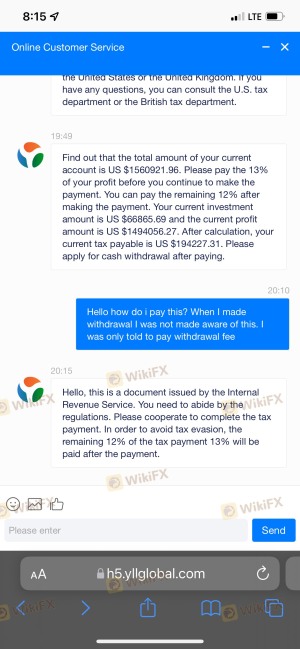

Customer feedback is a crucial indicator of a broker's reliability. In the case of YLL Global, numerous complaints have surfaced online, primarily focusing on withdrawal issues and poor customer service. Many users have reported being unable to withdraw their funds, often citing excuses from the broker about verification processes or additional fees that need to be paid.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

Typical complaints include users being asked to pay fees upfront before they could access their funds, a common tactic used by fraudulent brokers to delay or prevent withdrawals. In one case, a user reported investing a significant amount only to be told they needed to pay additional fees before their withdrawal could be processed. Such experiences contribute to the growing concern that YLL Global may not be a safe trading option.

Platform and Trade Execution

The trading platform's performance is another critical aspect of evaluating a broker. YLL Global claims to offer a user-friendly trading environment; however, user experiences suggest otherwise. Many traders have reported issues with order execution, including slippage and rejected orders.

The quality of order execution is vital for traders, particularly in the fast-paced forex market. If a broker frequently experiences slippage or fails to execute trades promptly, it can lead to significant losses. Concerns about potential platform manipulation have also been raised, further questioning the integrity of YLL Global's trading environment.

Risk Assessment

Engaging with YLL Global presents various risks, primarily due to its unregulated status and negative user feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential loss of funds |

| Operational Risk | Medium | Issues with trade execution |

Given these risks, traders should approach YLL Global with extreme caution. Recommendations for mitigating these risks include conducting thorough research, starting with a minimal investment, and being skeptical of promises of high returns.

Conclusion and Recommendations

In conclusion, YLL Global raises several red flags that suggest it may not be a safe trading option. The lack of regulatory oversight, transparency issues, and numerous customer complaints indicate that traders should exercise caution. While some may still choose to engage with this broker, it is essential to be aware of the potential risks involved.

For traders seeking safer alternatives, it is advisable to consider brokers that are regulated by reputable authorities, have a proven track record of customer satisfaction, and offer transparent trading conditions. Brokers such as Forex.com, OANDA, and IG are examples of established platforms that provide a higher level of security and reliability for traders.

In summary, while the question "Is YLL Global Safe?" may not have a definitive answer, the evidence suggests that traders should be wary and consider more reputable options in the forex market.

Is YLL Global a scam, or is it legit?

The latest exposure and evaluation content of YLL Global brokers.

YLL Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YLL Global latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.