Is Xinke Limited safe?

Business

License

Is Xinke Limited Safe or Scam?

Introduction

Xinke Limited is a relatively new player in the forex market, having been established in 2023 and based in Japan. As traders increasingly seek opportunities in the foreign exchange arena, the importance of choosing a reliable broker cannot be overstated. With numerous reports of scams and unregulated entities, traders must carefully assess the credibility and safety of any broker before committing their funds. In this article, we will investigate whether Xinke Limited is a safe option for traders or if it raises red flags that suggest it may be a scam. Our evaluation will be based on a thorough analysis of regulatory status, company background, trading conditions, customer safety, user experiences, and potential risks.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. An unregulated broker poses significant risks to traders, as there is no oversight to ensure compliance with financial standards or protect client funds. Xinke Limited operates without regulation from any major financial authority, which raises concerns about its safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulatory oversight means that traders have limited recourse in case of disputes or fraudulent activities. Although Xinke Limited claims to have an NFA license, there are suspicions that this may be a fraudulent or cloned license. Regulatory bodies are essential for maintaining a fair trading environment, and without them, investors may face increased risks, including potential fraud and manipulation. Therefore, the lack of regulation is a significant concern when evaluating whether Xinke Limited is safe.

Company Background Investigation

Xinke Limited is a relatively new entity in the trading landscape, having been established in 2023. The company's ownership structure remains unclear, with limited information available about its management team. This lack of transparency is concerning, as a reputable brokerage typically provides detailed information about its founders and key personnel.

The absence of a well-defined management structure raises questions about the company's operational integrity and commitment to ethical practices. Moreover, the company's website lacks comprehensive educational resources, which are crucial for traders, especially beginners. The overall transparency and information disclosure level are low, making it difficult for potential clients to gauge the company's reliability.

Trading Conditions Analysis

When assessing a broker's trading conditions, it's essential to consider the overall fee structure and any unusual or problematic policies that may exist. Xinke Limited offers various trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. However, the details regarding spreads, commissions, and other fees are not transparently disclosed.

| Fee Type | Xinke Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-3 pips |

| Commission Structure | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The lack of transparency regarding trading costs can be a significant drawback for traders. While Xinke Limited promotes spreads starting from 0 pips, the absence of detailed information raises questions about the reliability of their pricing model. Additionally, traders should be cautious of potential hidden fees, such as overnight interest fees, deposit and withdrawal fees, and inactivity fees, which can significantly impact overall profitability.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's reliability. Xinke Limited has not provided sufficient information regarding its client fund safety measures. It is unclear whether the broker employs fund segregation practices, which are essential for protecting client funds from operational risks.

Moreover, there is no information available about investor protection schemes or negative balance protection policies, which are crucial for safeguarding traders against significant losses. The lack of historical data regarding any past safety issues or disputes further complicates the assessment of whether Xinke Limited is safe for traders.

Customer Experience and Complaints

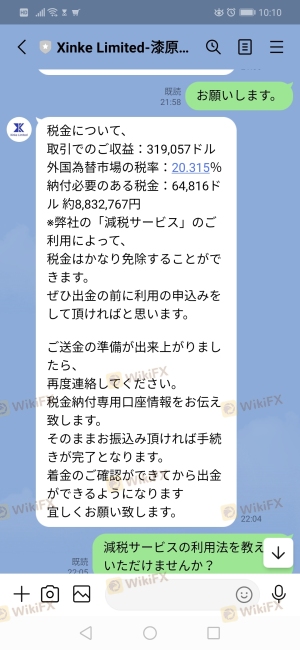

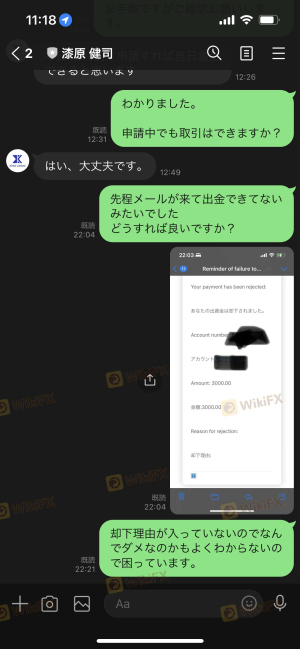

Understanding client feedback and user experiences is vital in determining a broker's reliability. Reports and reviews about Xinke Limited indicate a range of customer experiences, with many users expressing concerns about the responsiveness of customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Slow Customer Support | Medium | Below Average |

| Lack of Transparency | High | Poor |

Common complaints include difficulties in withdrawing funds, which is a significant red flag. Users have reported delays in response times and inadequate assistance from customer support. These patterns suggest that Xinke Limited may not prioritize customer satisfaction, raising further concerns about its legitimacy. Such issues lead to doubts about whether Xinke Limited is a scam or a legitimate broker.

Platform and Execution

The quality of the trading platform and order execution is crucial for traders. Xinke Limited has not disclosed the specifics of its trading platform, which is concerning. The absence of widely recognized platforms like MetaTrader 4 or 5 may limit traders' access to essential tools and features.

Additionally, reports of order execution quality, including slippage and rejection rates, have not been adequately addressed. If traders experience frequent issues with order execution, it could indicate potential manipulation or inefficiencies within the trading environment, further questioning whether Xinke Limited is safe.

Risk Assessment

Using an unregulated broker like Xinke Limited carries inherent risks that traders must understand. The lack of oversight raises concerns about the potential for fraud and manipulation, while the absence of clear information about fees and trading conditions adds to the uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Financial Transparency | High | Lack of information on fees and conditions. |

| Customer Support | Medium | Slow response times may hinder resolution. |

To mitigate these risks, traders should consider opening accounts with regulated brokers that offer clear information about their services. Engaging in thorough research and seeking out alternatives can help protect against potential losses.

Conclusion and Recommendations

In conclusion, the investigation into Xinke Limited raises several concerns about its safety and legitimacy. The lack of regulation, transparency, and customer support issues suggest that this broker may not be a safe choice for traders. The absence of clear information on trading conditions and client fund safety further complicates the assessment.

Based on the evidence, it is reasonable to conclude that Xinke Limited may exhibit characteristics of a scam. Traders, particularly those new to forex trading, should exercise caution and consider seeking alternative brokers that are regulated and have established reputations for reliability and customer service. Recommended alternatives include brokers with strong regulatory oversight and positive user reviews, ensuring a safer trading environment.

Is Xinke Limited a scam, or is it legit?

The latest exposure and evaluation content of Xinke Limited brokers.

Xinke Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Xinke Limited latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.