Regarding the legitimacy of XinHui Global forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is XinHui Global safe?

Business

License

Is XinHui Global markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

HALIFAX INVESTMENT SERVICES PTY LTD

Effective Date:

2003-02-19Email Address of Licensed Institution:

barnett@halifaxonline.com.auSharing Status:

No SharingWebsite of Licensed Institution:

http://www.halifaxonline.com.auExpiration Time:

--Address of Licensed Institution:

'Governor Phillip Tower' Level 49, 1 Farrer Place, SYDNEY NSW 2000Phone Number of Licensed Institution:

0292414321Licensed Institution Certified Documents:

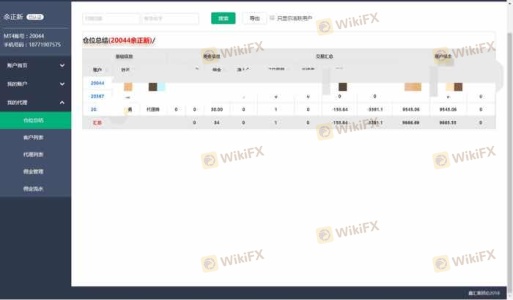

Is Xinhui Global Safe or Scam?

Introduction

Xinhui Global is a forex broker that has positioned itself within the competitive landscape of online trading since its establishment in 2018. Based in the United States, it offers a platform primarily utilizing the widely recognized MetaTrader 4 (MT4) software. As the forex market continues to grow, traders must exercise caution when selecting a broker. The potential for scams is ever-present, making it crucial to evaluate brokers based on regulatory oversight, financial security, and customer feedback. This article investigates whether Xinhui Global can be considered a safe trading option or if it exhibits characteristics commonly associated with scams.

To conduct this evaluation, we utilized a comprehensive approach that included analyzing regulatory information, company background, trading conditions, customer experiences, and risk assessments. By synthesizing findings from multiple credible sources, this article aims to provide a balanced perspective on the safety and legitimacy of Xinhui Global.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy and safety for traders. Xinhui Global claims to operate under the auspices of the Australian Securities and Investments Commission (ASIC). However, it has been flagged as a "clone firm," which indicates that it may be impersonating a legitimate entity to mislead potential clients.

The following table summarizes the key regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 225973 | Australia | Clone Firm Alert |

The importance of regulation cannot be overstated; it provides a layer of protection for traders, ensuring that brokers adhere to established guidelines. In the case of Xinhui Global, the clone firm designation raises significant concerns about the quality of oversight and the broker's compliance history. Traders should be wary of engaging with a broker that lacks proper regulation or operates under dubious claims of legitimacy.

Company Background Investigation

Xinhui Global was established in 2018, and its relatively short history raises questions about its stability and operational transparency. The broker claims to provide services primarily to clients in the United States, yet detailed information about its ownership structure and management team is limited. This lack of transparency can be a red flag for potential investors.

The management teams background is crucial in assessing the broker's reliability. A well-experienced team with a solid track record in the financial sector can significantly enhance a broker's credibility. However, the absence of publicly available information regarding the qualifications and professional backgrounds of Xinhui Global's leadership raises concerns about their capability to manage client funds responsibly.

Trading Conditions Analysis

Xinhui Global offers a variety of trading conditions, but potential clients should be aware of the overall fee structure and any unusual policies that may be in place. Understanding the costs associated with trading is essential for evaluating whether a broker provides a fair trading environment.

| Cost Type | Xinhui Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of clear information regarding spreads, commissions, and overnight interest rates can lead to unexpected costs for traders, which is a common tactic employed by less scrupulous brokers. If Xinhui Global's trading conditions appear overly complicated or opaque, it may indicate a lack of commitment to transparency, increasing the risk for traders.

Client Fund Security

The safety of client funds is a critical aspect of any brokerage. Xinhui Global claims to implement various security measures, including fund segregation and investor protection policies. However, the effectiveness of these measures is contingent upon the broker's regulatory compliance and operational integrity.

In evaluating Xinhui Global's fund security, it is essential to consider whether the broker offers negative balance protection, which can safeguard traders from losing more than their initial investment. Additionally, any historical incidents involving fund security breaches should be taken into account. A broker with a clean record in this regard is generally viewed as safer for trading.

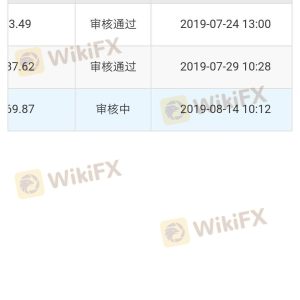

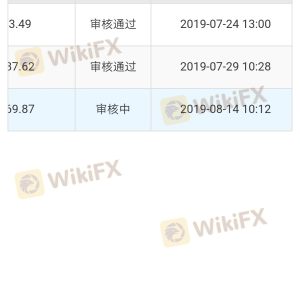

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Xinhui Global has garnered mixed reviews, with some users reporting positive experiences, while others have raised serious complaints regarding withdrawal issues and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Cancellation | High | Poor |

Several complaints highlight a pattern of difficulty in withdrawing funds, a significant warning sign that often indicates a broker may not be operating in good faith. For instance, clients have reported that after generating profits, their accounts were suddenly canceled, and they were unable to access their funds. These issues necessitate careful consideration, as they point to potential operational flaws or even fraudulent behavior.

Platform and Trade Execution

The trading platform's performance is another critical factor in evaluating a broker's reliability. Xinhui Global utilizes the MT4 platform, which is known for its user-friendly interface and extensive features. However, the execution quality, including slippage and rejection rates, must also be assessed.

Traders have reported instances of slippage during volatile market conditions, which can significantly affect trading outcomes. Additionally, any signs of platform manipulation should be scrutinized, as they can lead to a loss of trust and financial losses for traders.

Risk Assessment

Utilizing Xinhui Global carries inherent risks that potential traders must consider. A comprehensive risk assessment can help traders make informed decisions about their investments.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Clone firm status raises concerns. |

| Financial Security Risk | High | Complaints about fund withdrawals. |

| Operational Risk | Medium | Limited transparency and history. |

To mitigate these risks, traders should conduct thorough research before opening an account, including testing the withdrawal process with a small amount of capital. Additionally, seeking out brokers with established reputations and solid regulatory oversight can significantly reduce exposure to fraud.

Conclusion and Recommendations

In conclusion, the evaluation of Xinhui Global raises several concerns regarding its safety and legitimacy. The designation as a clone firm, combined with numerous complaints about withdrawal issues, suggests that potential traders should proceed with caution when considering this broker.

For traders seeking reliable alternatives, it is advisable to explore well-regulated brokers with transparent operations and positive customer feedback. Brokers with solid regulatory backing, such as those regulated by tier-one authorities like the FCA or ASIC, typically offer a safer trading environment.

In summary, while Xinhui Global may present itself as a viable trading option, the risks associated with its operations warrant careful consideration. Is Xinhui Global safe? The evidence suggests that it is prudent for traders to remain vigilant and consider other options to safeguard their investments.

Is XinHui Global a scam, or is it legit?

The latest exposure and evaluation content of XinHui Global brokers.

XinHui Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XinHui Global latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.