Is WorldAW safe?

Business

License

Is WorldAW Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, WorldAW has emerged as a broker offering a variety of trading services. It claims to provide access to numerous financial instruments, including currencies, commodities, and cryptocurrencies. However, the legitimacy of WorldAW is a topic of concern among traders and financial regulators alike. As the forex market is rife with potential scams and unregulated brokers, it is crucial for traders to conduct thorough evaluations before entrusting their funds to any trading platform. This article aims to investigate the safety and reliability of WorldAW, utilizing information from various regulatory bodies, customer reviews, and industry standards to provide a comprehensive analysis.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy and the safety of client funds. WorldAW claims to be regulated by several entities, including the Cyprus Securities and Exchange Commission (CySEC), the International Financial Services Commission in Belize, and the Mauritius Financial Services Commission. However, investigations reveal that WorldAW is not licensed by any of these regulators, raising serious questions about its operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | N/A | Cyprus | Not Verified |

| Belize FSC | N/A | Belize | Not Verified |

| Mauritius FSC | N/A | Mauritius | Not Verified |

The lack of proper regulation means that WorldAW does not adhere to the stringent requirements set forth by reputable financial authorities. This absence of oversight is alarming, as it implies that the broker is not obligated to follow standard practices that protect clients, such as segregating client funds and ensuring transparent pricing. Furthermore, the Hong Kong Securities and Futures Commission (SFC) has issued warnings against WorldAW, categorizing it as an unlicensed entity, which solidifies its status as a potentially risky option for traders.

Company Background Investigation

WorldAW presents itself as a reputable broker with a solid foundation, but a closer look reveals a lack of transparency regarding its ownership and operational history. The broker claims to have a presence in Cyprus, but the specific details about its founding and evolution remain ambiguous. The absence of a clear ownership structure raises concerns about accountability and the broker's long-term viability.

The management team behind WorldAW is also shrouded in mystery, with little information available about their professional backgrounds or qualifications. This lack of clarity can be a red flag, as experienced and transparent management is often indicative of a trustworthy brokerage. Moreover, the company's website does not provide adequate disclosures regarding its operations, which is essential for building trust with potential clients.

Trading Conditions Analysis

Understanding the trading conditions offered by WorldAW is vital for assessing its overall value proposition. The broker claims to provide competitive spreads and various account types, but the specifics of these offerings are often vague. Traders are required to make a minimum deposit of $150 to open an account, which is relatively standard in the industry. However, the absence of detailed information about fees and commissions is concerning.

| Fee Type | WorldAW | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding the fee structure could lead to unexpected costs for traders, making it difficult to gauge the true cost of trading with WorldAW. Additionally, the broker's reliance on cryptocurrency transactions for deposits and withdrawals raises further concerns, as these transactions are often irreversible and can complicate the recovery of funds in case of disputes.

Client Funds Security

The safety of client funds is one of the most critical aspects to consider when evaluating a forex broker. WorldAW's claims regarding the security of client funds are not substantiated by any regulatory oversight. The absence of investor protection schemes, such as those provided by regulated brokers, means that clients may be putting their money at significant risk.

Traders need to be aware that without proper regulation, there are no guarantees regarding the segregation of funds or the protection of deposits in the event of the broker's insolvency. Historical issues regarding fund security and previous complaints from users further exacerbate these concerns.

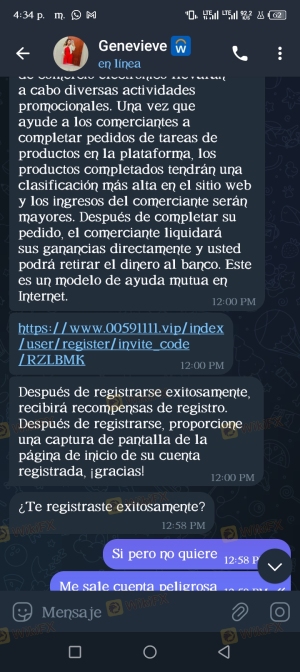

Customer Experience and Complaints

Customer feedback plays an essential role in assessing the reliability of a broker. Reviews and testimonials from users of WorldAW indicate a pattern of dissatisfaction, particularly regarding withdrawal processes and customer support. Many clients have reported difficulties in accessing their funds, which is a significant red flag for any trading platform.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Fair |

Typical cases involve traders who have successfully deposited funds but faced obstacles when attempting to withdraw their earnings. These complaints often highlight a lack of responsiveness from the company's support team, leading to frustration and financial losses for clients.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a positive trading experience. WorldAW offers a proprietary trading platform, which may not have the same level of functionality and reliability as industry-standard platforms like MetaTrader 4 or 5.

Issues such as slippage, order rejections, and execution delays have been reported, which can significantly impact trading outcomes. Furthermore, any signs of potential platform manipulation are concerning, as they indicate a lack of integrity in the broker's operations.

Risk Assessment

Using WorldAW for trading presents several risks that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of investor protection schemes. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders are advised to exercise extreme caution when dealing with WorldAW. It is recommended to start with minimal investments and to thoroughly document all communications and transactions.

Conclusion and Recommendations

In conclusion, the evidence suggests that WorldAW is not a safe trading option. The broker's lack of regulation, transparency issues, and negative customer feedback raise significant concerns about its legitimacy. Traders should be wary of investing their funds with WorldAW, as the potential for loss is high.

For those seeking reliable trading options, it is advisable to consider well-regulated brokers with proven track records. Alternatives may include brokers regulated by top-tier authorities like the FCA, ASIC, or CySEC, which offer greater protection and transparency.

In summary, is WorldAW safe? The consensus is clear: potential traders should approach with caution and consider more reputable alternatives.

Is WorldAW a scam, or is it legit?

The latest exposure and evaluation content of WorldAW brokers.

WorldAW Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WorldAW latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.