Is Fantex safe?

Pros

Cons

Is Fantex Safe or Scam?

Introduction

Fantex is an online trading platform that positions itself within the foreign exchange (forex) market, offering a range of trading instruments including forex pairs, commodities, stocks, and cryptocurrencies. However, potential traders must exercise caution when evaluating such brokers, as the forex market is rife with both legitimate opportunities and fraudulent schemes. Given the high stakes involved, it is crucial for traders to conduct thorough due diligence before committing their funds to any trading platform. This article aims to provide an objective analysis of Fantex's legitimacy, utilizing a comprehensive evaluation framework that considers regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment for forex brokers is vital in determining their credibility and safety for traders. Fantex is operated by Felicity Group Ltd, which is registered in the Commonwealth of Dominica. Unfortunately, Fantex is not regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Dominica | Unverified |

The absence of regulation means that Fantex does not adhere to the stringent operational standards imposed by reputable authorities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This lack of oversight leaves traders vulnerable to potential fraud and financial mismanagement, as there is no governing body to turn to in case of disputes or malpractices. Furthermore, regulatory warnings have been issued against Fantex by various entities, indicating a history of non-compliance and questionable practices. Thus, the question remains: Is Fantex safe? The evidence strongly suggests that it is not.

Company Background Investigation

Fantex's operational history and ownership structure are also critical to assessing its trustworthiness. Established in 2020, Fantex has quickly gained notoriety for its dubious practices. The company is owned by Felicity Group Ltd, which has been linked to multiple other unregulated brokers known for fraudulent activities. The management team behind Fantex is not well-documented, and there is a lack of transparency regarding their professional backgrounds. This obscurity raises further red flags about the company's intentions and operational integrity.

In terms of transparency, Fantex's website offers limited information about its operations, with no clear details on its management team or corporate governance. This lack of disclosure is concerning, as reputable brokers typically provide comprehensive information about their leadership and operational practices. Therefore, when contemplating whether Fantex is safe, the available evidence points to a company that lacks the necessary transparency and accountability expected of a reputable financial service provider.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Fantex claims to provide competitive trading fees and various account types; however, the absence of regulation raises questions about the reliability of these claims. Below is a comparison of Fantex's core trading costs against industry averages:

| Fee Type | Fantex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 0.1 - 1.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5 - 2.0% |

Fantex does not disclose specific details about its spread or commission structure, which is a common practice among unregulated brokers. Additionally, the lack of a demo account further complicates the evaluation of trading conditions, as potential clients cannot test the platform without making a financial commitment. This opacity in fee structure is a significant concern for traders considering whether Fantex is safe, as it suggests a lack of transparency that could lead to unexpected costs.

Customer Fund Security

The safety of client funds is a paramount concern when evaluating any trading platform. Fantex claims to implement measures to protect client funds; however, the absence of regulatory oversight means that these claims cannot be independently verified. Fantex does not provide clear information about fund segregation, investor protection schemes, or negative balance protection policies. This lack of clarity raises serious questions about the safety of deposits held with the broker.

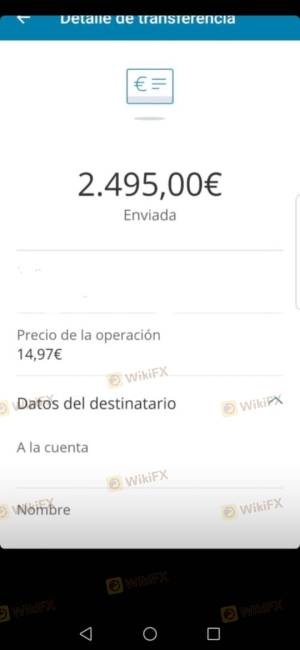

Historically, unregulated brokers like Fantex have been involved in numerous fund security issues, including unauthorized withdrawals and failure to return client funds. Such incidents underscore the risks associated with trading through platforms that lack regulatory oversight. Therefore, when assessing whether Fantex is safe, it is crucial to consider the potential for fund mismanagement and the absence of protective measures.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. A review of user experiences with Fantex reveals a troubling pattern of complaints, primarily centered around withdrawal issues, unresponsive customer support, and difficulties in accessing funds. Below is a summary of the main complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Unresponsive |

| Account Management | High | Non-existent |

Many users have reported being unable to withdraw their funds after making initial deposits, which is a common tactic employed by scam brokers to retain client money. Additionally, the company's response to complaints is often inadequate, with many users reporting that their concerns go unanswered. These issues contribute to the growing sentiment that Fantex is not safe, as traders cannot rely on effective support or resolution of disputes.

Platform and Execution

The trading platform is another critical aspect of any broker's service. Fantex offers a proprietary web-based platform, but there are concerns regarding its performance, stability, and execution quality. Users have reported issues with order execution, including slippage and rejected orders. These problems can significantly impact trading outcomes, especially in a volatile market.

Moreover, the lack of support for well-known trading platforms like MetaTrader 4 (MT4) raises further concerns about the platform's reliability. Traders often prefer established platforms due to their robust features and proven track record. The absence of such options on Fantex's platform may deter experienced traders from engaging with the broker, further questioning whether Fantex is safe for trading.

Risk Assessment

Engaging with unregulated brokers like Fantex inherently comes with a range of risks. Below is a summary of the key risk areas associated with trading through this platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight, high potential for fraud |

| Fund Security Risk | High | Lack of protection measures |

| Execution Risk | Medium | Issues with order fulfillment |

| Customer Service Risk | High | Poor response to complaints |

To mitigate these risks, traders should consider using only regulated brokers with a proven track record of client satisfaction and fund security. It is advisable to conduct thorough research and seek out platforms that offer transparent operations and reliable customer support.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that Fantex is not safe for trading. The lack of regulation, poor customer feedback, and significant concerns regarding fund security and trading conditions raise serious red flags. Traders should exercise extreme caution and consider alternative options that offer better regulatory oversight and customer protection.

For those seeking reliable trading platforms, consider brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers provide a safer trading environment with transparent operations and established customer support systems. Ultimately, conducting thorough research and prioritizing safety will go a long way in ensuring a positive trading experience.

Is Fantex a scam, or is it legit?

The latest exposure and evaluation content of Fantex brokers.

Fantex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fantex latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.