Is VS FX safe?

Business

License

Is VS FX A Scam?

Introduction

VS FX is a forex broker that has positioned itself within the competitive landscape of online trading. As an entity in the foreign exchange market, it claims to offer a range of trading services, including access to various currency pairs, commodities, and indices. However, the rise of numerous unregulated brokers has made it imperative for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex trading environment can be fraught with risks, and understanding the legitimacy of a broker is crucial. This article aims to provide a comprehensive analysis of VS FX, examining its regulatory status, company background, trading conditions, client safety measures, and customer feedback. The evaluation is based on a review of multiple online sources, user experiences, and regulatory databases.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most significant factors that determine its legitimacy. A broker that operates under the oversight of a recognized financial authority is typically seen as more trustworthy. In the case of VS FX, the broker claims to be licensed, but a deeper investigation reveals inconsistencies in its regulatory claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001289584 | Australia | Revoked |

As indicated in the table, VS FX was previously regulated by the Australian Securities and Investments Commission (ASIC), but its license has since been revoked. This revocation raises serious concerns regarding the broker's operational legitimacy and adherence to regulatory standards. The absence of valid regulation suggests that traders may be exposed to higher risks, as there are no formal mechanisms in place to protect their interests. The lack of oversight from a reputable authority is a significant red flag, prompting potential clients to reconsider their engagement with this broker.

Company Background Investigation

A thorough examination of the company behind VS FX reveals a somewhat obscure operational history. Established relatively recently, the broker operates under the name VS FX Financial Limited, registered in the United Kingdom. However, details about its ownership structure and management team remain limited.

The absence of transparency regarding the company's leadership raises questions about its accountability and operational integrity. A robust management team with relevant industry experience is essential for ensuring that a broker adheres to best practices and maintains a client-centric approach. Unfortunately, the lack of information about the team behind VS FX indicates potential risks associated with the broker's operations.

Furthermore, the company's communication and information disclosure practices have been criticized. Traders looking for clear and accessible information about their broker's operations, policies, and practices may find VS FX lacking. This opacity can lead to misunderstandings and potential financial losses, as clients may not be fully aware of the risks involved in trading with an unregulated broker.

Trading Conditions Analysis

When evaluating a forex broker, it is crucial to analyze its trading conditions, including fees, spreads, and commissions. VS FX presents a competitive trading environment in terms of the range of instruments offered, but the overall fee structure raises concerns.

| Fee Type | VS FX | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.5 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | -1.5% to 1.5% | -1.0% to 2.0% |

The table illustrates that VS FX offers relatively low spreads, which may initially appear attractive to traders. However, the variable commission model can lead to unexpected costs, making it difficult for traders to predict their overall trading expenses. Additionally, the overnight interest rates charged by VS FX are competitive but warrant caution, as they can significantly impact profitability, especially for traders holding positions overnight.

One of the more troubling aspects of VS FX's fee structure is the potential for hidden fees or unusual withdrawal conditions. Reports from users indicate that many have encountered difficulties when attempting to withdraw funds, often citing vague explanations and prolonged delays. Such practices are indicative of a broker that may not have the best interests of its clients at heart, further supporting the assertion that IS VS FX safe is a critical question for potential traders.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. A responsible broker should implement robust measures to safeguard client deposits and ensure transparency in its operations. In the case of VS FX, the broker's lack of regulatory oversight raises significant concerns regarding client fund safety.

VS FX does not appear to offer adequate protection measures, such as segregated accounts for client funds or investor compensation schemes. Segregating client funds is a best practice that protects traders in the event of a broker's insolvency. Without such measures, traders risk losing their investments if the broker encounters financial difficulties. Additionally, the absence of a negative balance protection policy means that traders could potentially lose more than their initial deposits, further exacerbating the risks associated with trading with VS FX.

Historically, there have been reports of clients struggling to access their funds, with many alleging that the broker has engaged in practices that delay or prevent withdrawals. Such issues not only highlight the potential risks of trading with VS FX but also raise questions about the broker's overall integrity and commitment to client satisfaction.

Customer Experience and Complaints

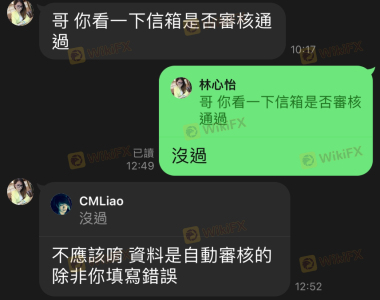

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of VS FX, numerous user reviews and complaints suggest a pattern of dissatisfaction among clients. Common complaints include difficulties with withdrawals, lack of responsive customer support, and unclear communication regarding trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Average |

| Transparency Concerns | High | Poor |

The table outlines the primary complaints associated with VS FX, with withdrawal issues being the most severe. Many clients report being unable to withdraw their funds, often citing vague explanations from customer support. This lack of responsiveness and transparency can lead to frustration and mistrust among traders, reinforcing the perception that IS VS FX safe is a legitimate concern.

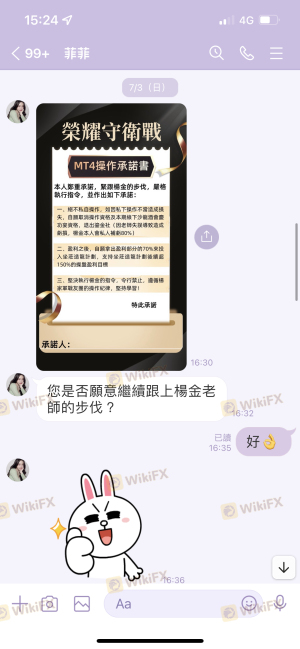

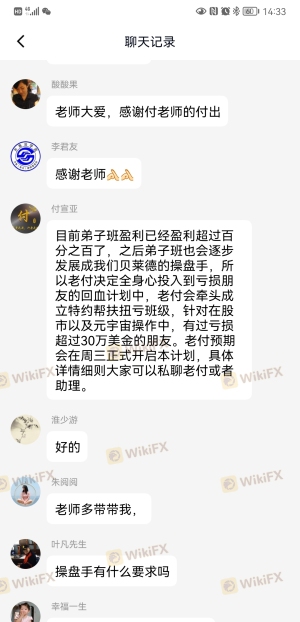

Two typical case studies illustrate the challenges faced by clients. In one instance, a trader deposited funds and successfully executed trades but encountered significant delays when attempting to withdraw profits. The broker's customer support provided minimal assistance, leading the trader to question the legitimacy of the operation. In another case, a client reported being pressured into making additional deposits under the guise of covering withdrawal fees, raising concerns about potential scams.

Platform and Trade Execution

The trading platform's performance is crucial for a smooth trading experience. VS FX utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, user experiences with the platform have been mixed.

Traders have reported issues with order execution quality, including slippage and rejected orders. These problems can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. Additionally, concerns about potential platform manipulation have surfaced, with some clients alleging that the broker's execution practices may not be in their best interest.

The overall performance and stability of the trading platform are essential for maintaining trader confidence. If a broker fails to provide a reliable trading environment, it may lead to increased risk and financial losses for clients. Therefore, potential traders should carefully consider the execution quality when evaluating whether IS VS FX safe is a question they can confidently answer.

Risk Assessment

Engaging with any forex broker carries inherent risks, and VS FX is no exception. The broker's lack of regulation, combined with numerous client complaints and concerns regarding fund safety, presents a high-risk profile for potential traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation in place. |

| Fund Safety Risk | High | Lack of segregation and negative balance protection. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

The table summarizes the key risk areas associated with trading with VS FX. Regulatory risk is particularly concerning, given the broker's revoked license and the absence of oversight from reputable authorities. Additionally, the lack of adequate fund safety measures and poor customer service further exacerbate the risks involved.

To mitigate these risks, traders should consider the following recommendations:

- Conduct thorough research: Always investigate a broker's regulatory status, client reviews, and overall reputation before opening an account.

- Start with a demo account: Utilize demo accounts to familiarize yourself with the trading platform and assess its performance without risking real money.

- Limit initial deposits: If you choose to trade with VS FX, consider starting with a small amount to minimize potential losses while gauging the broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that VS FX presents several red flags that warrant caution. The lack of valid regulation, poor customer feedback, and issues surrounding fund safety raise significant concerns about the broker's legitimacy. Therefore, the question of IS VS FX safe leans towards a negative response, as potential traders may expose themselves to undue risks by engaging with this broker.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with a proven track record of client satisfaction and transparent operations. Brokers regulated by reputable authorities such as the FCA, ASIC, or NFA typically provide a safer trading environment. Always prioritize due diligence and ensure that the broker you choose aligns with your trading goals and risk tolerance.

Is VS FX a scam, or is it legit?

The latest exposure and evaluation content of VS FX brokers.

VS FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VS FX latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.